USA Welding Consumables Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8743

December 2024

85

About the Report

USA Welding Consumables Market Overview

- The USA Welding Consumables Market is valued at USD 3 billion, based on an analysis of historical market trends. The market is driven by a growing demand for welding materials in key industries such as construction, automotive, and oil & gas. Infrastructure development projects, especially those related to energy and utilities, have led to an increased consumption of welding consumables.

- The dominant regions in the USA welding consumables market include Texas, California, and Ohio. Texas, being a hub for oil and gas operations, drives demand for welding materials used in pipeline construction and maintenance. California and Ohio are home to numerous automotive and manufacturing facilities, leading to high consumption of welding consumables. The dominance of these regions is due to their industrial base and demand for specialized welding technologies.

- The U.S. Environmental Protection Agency (EPA) regulates air quality and hazardous waste associated with welding processes. In 2023, the EPA strengthened its regulations on emissions from industrial welding operations, particularly targeting volatile organic compounds (VOCs) and particulate matter. These regulations compel welding companies to adopt consumables that emit fewer hazardous materials, such as low-fume welding rods and fluxes.

USA Welding Consumables Market Segmentation

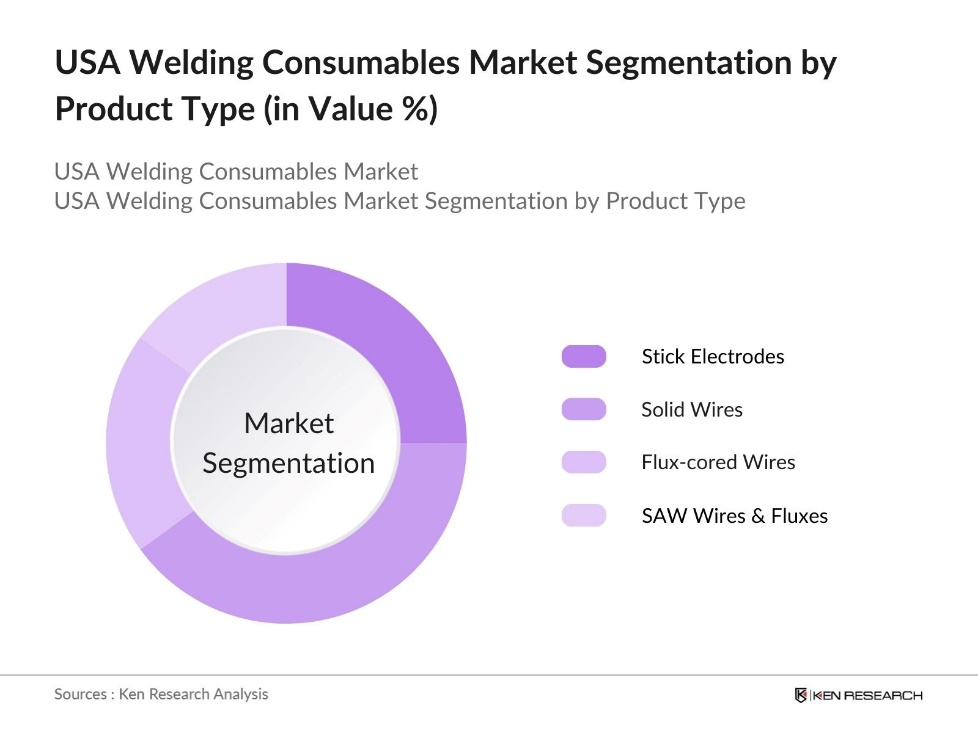

By Product Type: The market is segmented by product type into stick electrodes, solid wires, flux-cored wires, and SAW wires & fluxes. Recently, solid wires have had a dominant market share due to their widespread use in gas metal arc welding (GMAW) processes, especially in the automotive and construction sectors. Solid wires offer higher efficiency, better control, and faster welding speed, making them more favorable compared to other types. Their flexibility in use across various applications also gives them a competitive advantage.

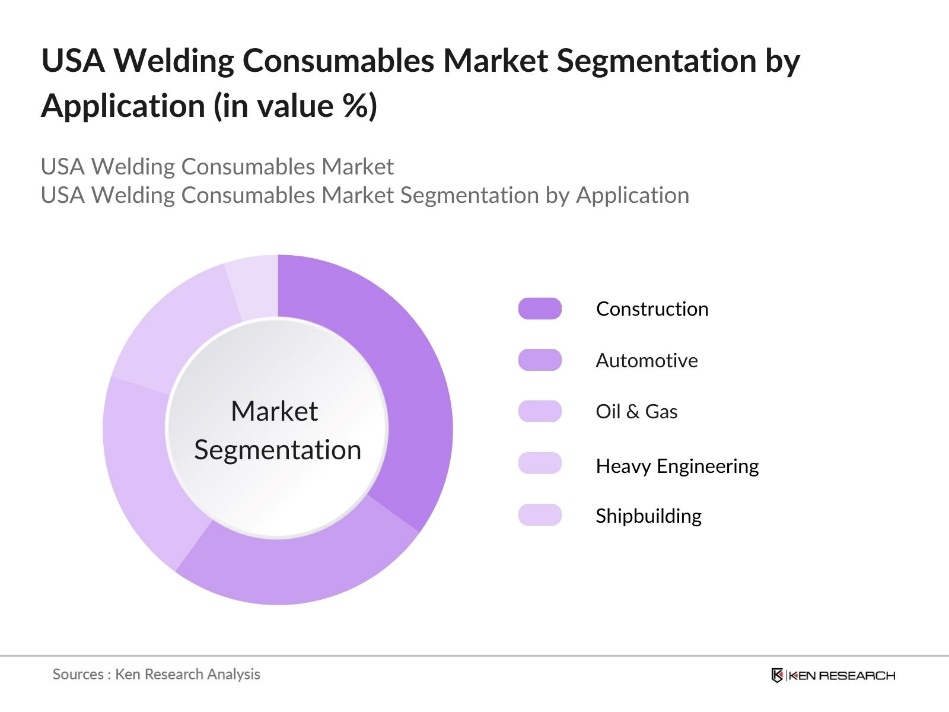

By Application: The market is segmented by application into construction, automotive, oil & gas, heavy engineering, and shipbuilding. Among these, the construction sector holds the largest market share. The continued growth in residential, commercial, and industrial construction projects has driven demand for welding consumables. In particular, the construction of bridges, highways, and renewable energy plants requires extensive welding work, especially in structural steel fabrication, which boosts the use of welding consumables.

USA Welding Consumables Market Competitive Landscape

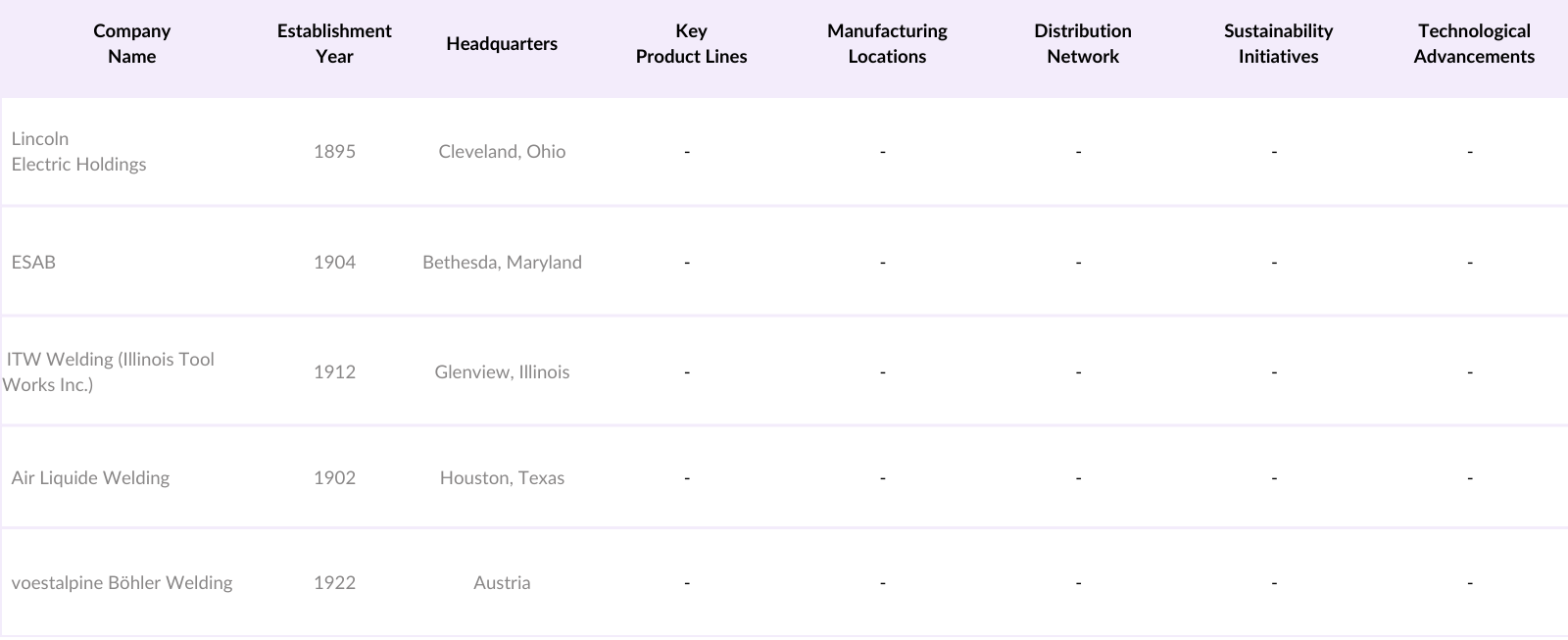

The USA Welding Consumables Market is characterized by the presence of major global players who are continuously investing in research and development to bring advanced products to the market. Companies like Lincoln Electric Holdings, ESAB, and ITW Welding dominate the market with their extensive distribution networks and a focus on technological innovations, such as automation in welding processes. The competitive landscape is marked by product differentiation, strategic collaborations, and mergers & acquisitions.

USA Welding Consumables Industry Analysis

Growth Drivers

- Infrastructure Development (e.g., Transportation, Energy, and Utilities): The USA welding consumables market is heavily driven by large-scale infrastructure development projects across sectors like transportation, energy, and utilities. In 2022, the U.S. Department of Transportation (USDOT) was part of a broader initiative under the Bipartisan Infrastructure Law, which authorized a total of $550 billion in new federal investment over five years (2022-2026) for infrastructure projects, including roads, bridges, and mass transit. Similarly, energy infrastructure investments continue with major projects in pipeline construction and renewable energy plants, especially in states like Texas and California.

- Increasing Automotive : The automotive industry is a key driver of demand for welding consumables due to the extensive use of metals in vehicle manufacturing. North American automotive production, which includes the U.S., reached approximately 15.6 million units in 2023, reflecting a 9.6% increase from the previous year. This surge in automotive manufacturing requires a variety of welding techniques, including arc welding and laser welding, particularly in the production of vehicle frames, battery packs, and chassis.

- Advancements in Metal Fabrication Technologies: Advancements in metal fabrication technologies, especially automation and robotics, have significantly improved welding processes by enhancing precision, efficiency, and weld quality. These systems are increasingly adopted in industries like aerospace and defense, driving the demand for specialized welding consumables such as electrodes and wires. Additionally, the rise of additive manufacturing, which relies on advanced welding for metal deposition, further boosts the need for these technologies.

Market Challenges

- Fluctuations in Raw Material Prices (Steel, Nickel): Volatility in raw material prices, particularly steel and nickel, presents ongoing challenges for the welding consumables market. Price fluctuations are driven by factors such as supply chain disruptions and geopolitical issues, impacting the cost structure for manufacturers. This instability often results in higher production costs, which can reduce profit margins for companies that rely on these essential materials in welding processes.

- Shortage of Skilled Welders: The shortage of skilled welders is a significant issue in the welding industry. An aging workforce and limited training opportunities for new workers have exacerbated the labor gap, particularly in sectors like construction and shipbuilding. The lack of qualified welders often delays projects and forces companies to turn to automated welding technologies as a solution to compensate for the skills shortage.

USA Welding Consumables Market Future Outlook

Over the next several years, the USA Welding Consumables Market is expected to see moderate growth, driven by infrastructure development initiatives, technological advancements in welding processes, and the rising demand from the automotive and energy sectors. The increasing use of automation in welding, along with the need for high-strength materials, will further propel the market forward. Additionally, the introduction of green welding technologies to meet environmental standards is likely to open up new opportunities for market players.

Market Opportunities

- Growing Offshore Oil & Gas Projects: The offshore oil and gas sector offers substantial opportunities for the welding consumables market. These projects require extensive welding for the construction and maintenance of pipelines, rigs, and subsea equipment. Due to the harsh conditions in offshore environments, there is a growing demand for high-performance consumables, such as corrosion-resistant welding materials, which are essential for ensuring the durability and safety of these structures.

- Adoption of Automated Welding Systems: The increasing adoption of automated welding systems across industries, particularly automotive and aerospace, is boosting demand for welding consumables. Automated systems improve efficiency and precision, requiring advanced consumables like flux-cored wires and robotic welding torches. These systems are critical in large-scale industrial operations where consistent and high-quality welds are essential for maintaining product integrity and meeting safety standards.

Scope of the Report

|

Product Type |

Stick Electrode Solid Wires Flux-cored Wires SAW Wires & Fluxes |

|

Application |

Construction Automotive Oil & Gas Heavy Engineering Shipbuilding |

|

Technology |

SMAW GMAW GTAW FCAW |

|

End-User |

Automotive & Transportation Building & Construction Power Generation Aerospace & Defense Marine |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive & Transportation Companies

Construction Firms

Oil & Gas Companies

Power Generation Companies

Aerospace & Defense Manufacturers

Government and Regulatory Bodies (OSHA, EPA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Lincoln Electric Holdings, Inc.

ESAB

ITW Welding (Illinois Tool Works Inc.)

Air Liquide Welding

voestalpine Bhler Welding

Hyundai Welding Co. Ltd.

The Linde Group

Kiswel Inc.

Ador Welding Limited

Sandvik Materials Technology

Table of Contents

1. USA Welding Consumables Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Product Types, Applications, Technology, End-Users, Regions)

1.3. Market Growth Rate (Analysis by Volume & Value)

1.4. Market Segmentation Overview

2. USA Welding Consumables Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (By Product Type and Application)

2.3. Key Market Developments and Milestones

3. USA Welding Consumables Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development Projects (e.g., Transportation, Energy, and Utilities)

3.1.2. Increasing Automotive Production

3.1.3. Advancements in Metal Fabrication Technologies

3.1.4. Rising Demand for Lightweight Vehicles

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices (Steel, Nickel)

3.2.2. Shortage of Skilled Welders

3.2.3. Environmental Regulations on Fumes and Waste Materials

3.3. Opportunities

3.3.1. Growing Offshore Oil & Gas Projects

3.3.2. Adoption of Automated Welding Systems

3.3.3. Demand for High-Strength Steel in Construction

3.4. Trends

3.4.1. Growing Adoption of Robotics in Welding

3.4.2. Shift Towards Flux-cored Arc Welding (FCAW) in Shipbuilding

3.4.3. Development of Environmentally Friendly Welding Consumables

3.5. Regulatory Landscape

3.5.1. OSHA (Occupational Safety and Health Administration) Guidelines

3.5.2. EPA (Environmental Protection Agency) Regulations

3.5.3. Certification Standards (AWS - American Welding Society)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Welding Consumables Manufacturers, Distributors, End-Users)

3.8. Porters Five Forces Analysis

3.8.1. Supplier Power (Raw Material Price Volatility)

3.8.2. Buyer Power (Influence of Large OEMs and Contractors)

3.8.3. Competitive Rivalry (Fragmented Market Landscape)

3.9. Competitive Landscape

4. USA Welding Consumables Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Stick Electrodes

4.1.2. Solid Wires

4.1.3. Flux-cored Wires

4.1.4. SAW Wires & Fluxes

4.2. By Application (In Value %)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Oil & Gas

4.2.4. Heavy Engineering

4.2.5. Shipbuilding

4.3. By Technology (In Value %)

4.3.1. Shielded Metal Arc Welding (SMAW)

4.3.2. Gas Metal Arc Welding (GMAW)

4.3.3. Gas Tungsten Arc Welding (GTAW)

4.3.4. Flux-cored Arc Welding (FCAW)

4.4. By End-User (In Value %)

4.4.1. Automotive & Transportation

4.4.2. Building & Construction

4.4.3. Power Generation

4.4.4. Aerospace & Defense

4.4.5. Marine

5. USA Welding Consumables Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lincoln Electric Holdings, Inc.

5.1.2. ESAB

5.1.3. ITW Welding (Illinois Tool Works Inc.)

5.1.4. Air Liquide Welding

5.1.5. voestalpine Bhler Welding

5.1.6. Hyundai Welding Co. Ltd.

5.1.7. The Linde Group

5.1.8. Kiswel Inc.

5.1.9. Ador Welding Limited

5.1.10. Sandvik Materials Technology

5.1.11. EWM AG

5.1.12. Fronius International GmbH

5.1.13. Miller Electric Mfg. LLC

5.1.14. Kobe Steel, Ltd.

5.1.15. Welding Alloys Group

5.2. Cross Comparison Parameters (Product Offerings, Market Presence, Strategic Alliances, R&D Investments, Revenue, Market Share, Manufacturing Capabilities, Sustainability Initiatives)

5.3. Market Share Analysis (By Company, Product Type, and Application)

5.4. Strategic Initiatives

5.4.1. Product Launches

5.4.2. Collaborations & Partnerships

5.4.3. Geographic Expansions

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

6. USA Welding Consumables Market Regulatory Framework

6.1. Industry Standards and Certifications (AWS, ASME, ISO)

6.2. Compliance Requirements (OSHA, EPA)

6.3. Trade Tariffs and Duties (Impact on Imports/Exports)

7. USA Welding Consumables Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Welding Consumables Future Market Segmentation

8.1. By Product Type

8.2. By Application

8.3. By Technology

8.4. By End-User

8.5. By Region

9. USA Welding Consumables Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (By Application and Technology)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began with a thorough analysis of key stakeholders in the USA Welding Consumables Market. Primary sources included databases such as the American Welding Society (AWS) and government statistics. The aim was to map out critical variables such as product demand, application sectors, and technological trends.

Step 2: Market Analysis and Construction

Historical data on the market were gathered to analyze product penetration and application distribution. This data provided a foundation for estimating the market size and share of individual segments. Performance metrics like production efficiency and sales revenue were also scrutinized.

Step 3: Hypothesis Validation and Expert Consultation

We engaged in consultations with industry experts through Computer Assisted Telephone Interviews (CATIs). Insights from welding manufacturers and distributors were gathered to validate market trends, especially concerning product innovations and sectoral demand.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the data and feedback from industry consultations. The resulting report was then cross-verified with both government databases and proprietary market data to ensure accuracy and reliability of the market projections and trends.

Frequently Asked Questions

01. How big is the USA Welding Consumables Market?

The USA Welding Consumables Market is valued at USD 3 billion, driven by demand from sectors like construction, automotive, and oil & gas.

02. What are the key challenges in the USA Welding Consumables Market?

Challenges in USA Welding Consumables Market include fluctuations in raw material prices, a shortage of skilled welders, and stringent environmental regulations concerning emissions and waste disposal.

03. Who are the major players in the USA Welding Consumables Market?

Major players in USA Welding Consumables Market include Lincoln Electric Holdings, ESAB, ITW Welding, Air Liquide Welding, and voestalpine Bhler Welding, among others.

04. What are the main growth drivers of the USA Welding Consumables Market?

The USA Welding Consumables Market is driven by growth in the construction and automotive sectors, technological advancements in welding processes, and increasing demand for lightweight, durable materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.