USA Wellness & Fitness Products Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD7051

December 2024

96

About the Report

USA Wellness & Fitness Products Market Overview

- The USA Wellness & Fitness Products Market, valued at USD 29 billion, reflects strong consumer interest in personal health and well-being, propelled by an emphasis on preventive health measures, increased physical activity, and heightened awareness about mental well-being. Driven largely by advancements in wearable technology, digital health platforms, and fitness products, the market continues to expand.

- Key regions in the U.S., such as California, Texas, and New York, dominate the wellness and fitness products market. Their dominance is attributed to high consumer spending power, a population of health-conscious individuals, and substantial investments in health and wellness infrastructure. These states offer a robust ecosystem that supports both local and international brands through an advanced retail network and wide-ranging distribution channels.

- The federal government has introduced tax deductions for expenses related to preventative health and wellness, benefiting consumers purchasing fitness equipment and wellness supplements. According to the IRS, this has led to a notable increase in filings for deductions related to wellness expenditures, indirectly boosting market demand.

USA Wellness & Fitness Products Market Segmentation

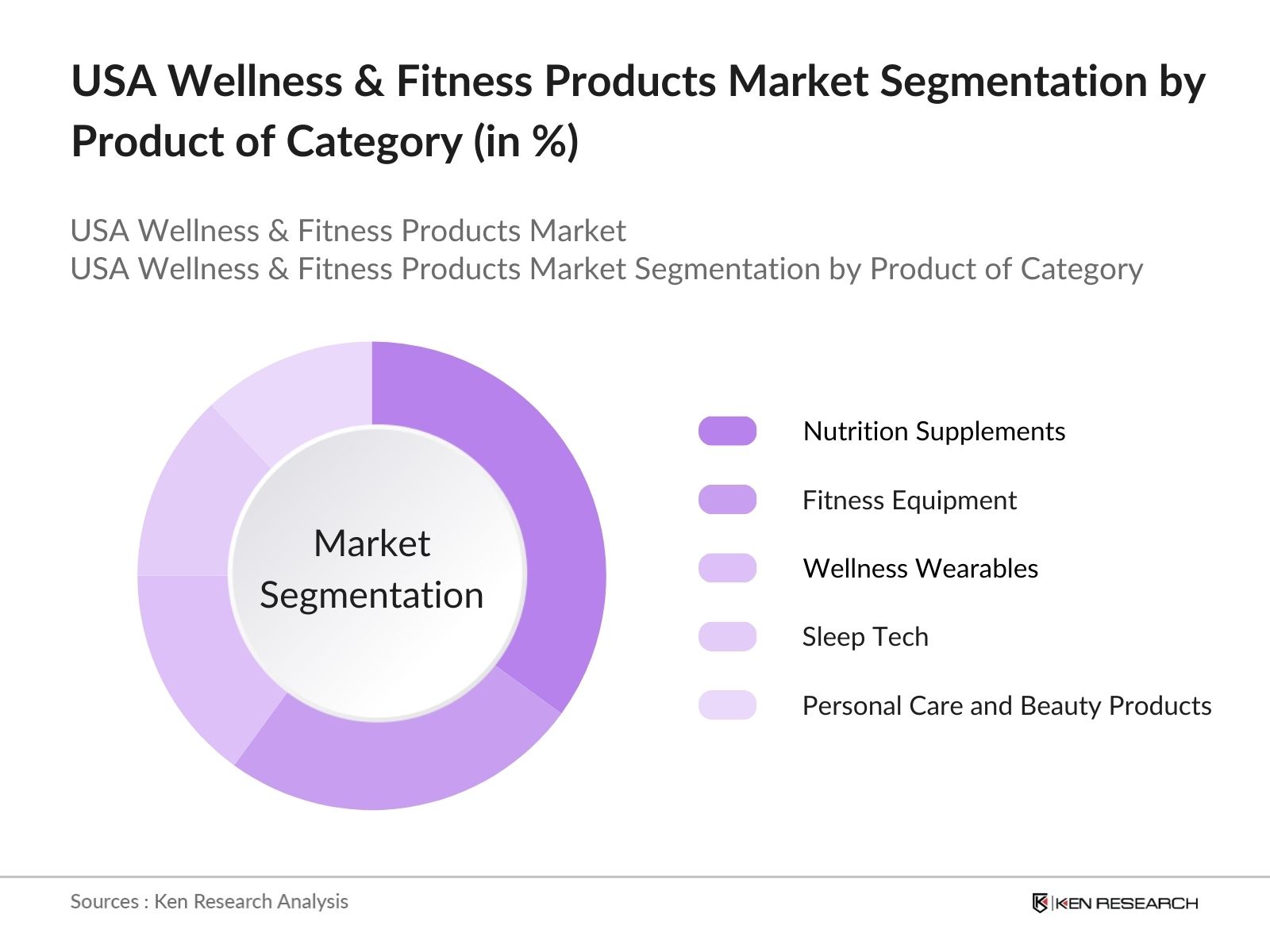

By Product Category: The market is segmented by product category, including Nutrition Supplements, Fitness Equipment, Wellness Wearables, Sleep Tech, and Personal Care and Beauty Products. Among these, Nutrition Supplements hold a dominant market share due to an increasing focus on dietary supplements, immune boosters, and protein intake. These products have become a staple for consumers prioritizing health and fitness routines, with brands like GNC, Abbott, and Amway leading the segment.

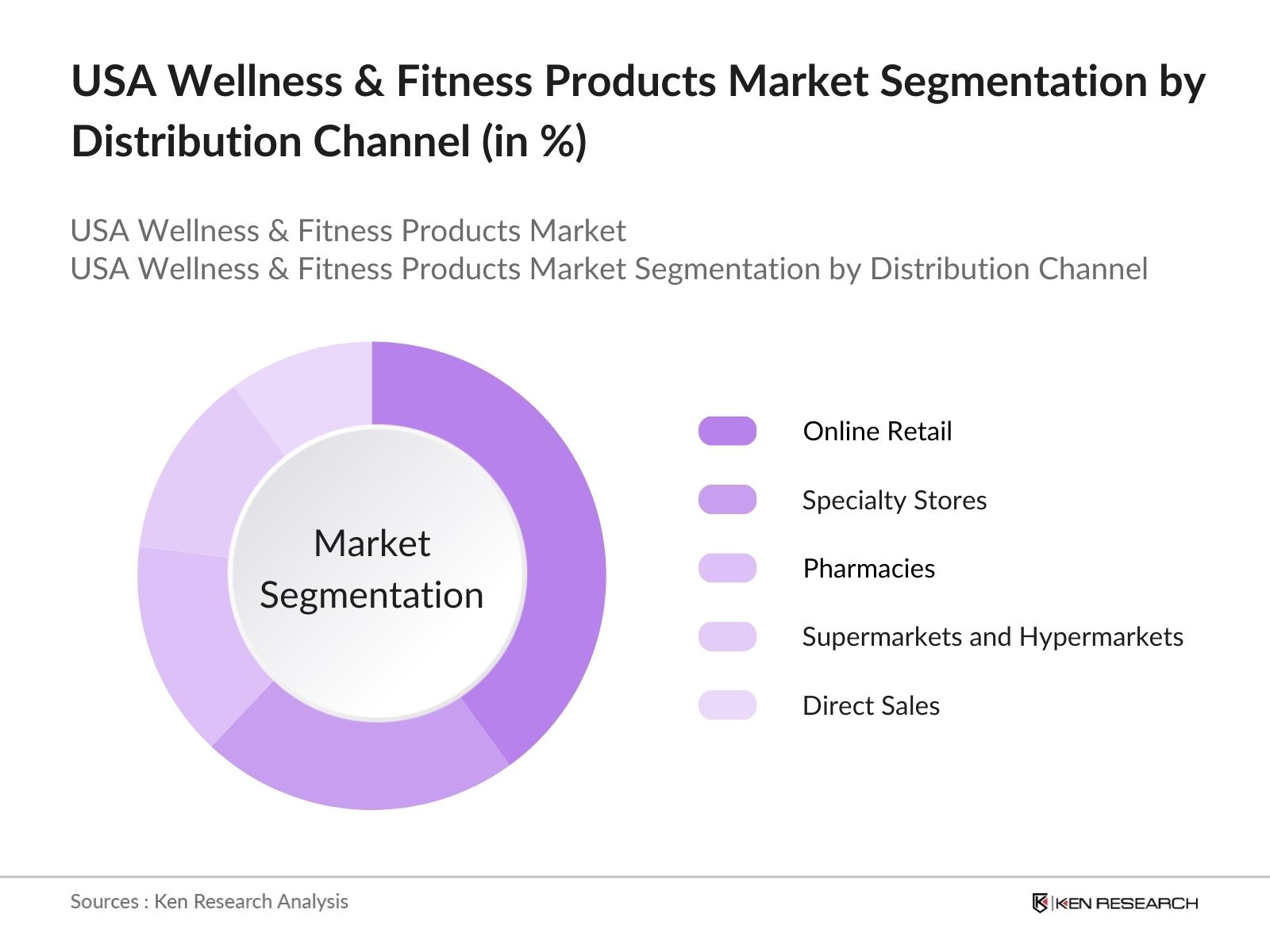

By Distribution Channel: The market is segmented by distribution channels, including Online Retail, Specialty Stores, Pharmacies, Supermarkets and Hypermarkets, and Direct Sales. Online retail has gained significant traction, driven by the convenience of digital shopping and the availability of direct-to-consumer platforms, making it the leading distribution channel. Major online platforms like Amazon and Walmart offer a vast selection of wellness and fitness products, contributing to this segment's dominance.

USA Wellness & Fitness Products Market Competitive Landscape

The market is dominated by several key players who drive growth through innovation, strong branding, and expansive distribution. The market's competitive landscape is characterized by established brands such as Procter & Gamble, Abbott Laboratories, and Apple Inc., which leverage product innovation and consumer trust to maintain their market positions.

USA Wellness & Fitness Products Market Analysis

Market Growth Drivers

- Increased Demand for Mental Health and Wellness Products: The emphasis on mental health in the U.S. has driven the demand for wellness products, including supplements, sleep aids, and mindfulness tools. With over 45 million adults experiencing mental health concerns annually, theres been a significant rise in sales of products supporting mental well-being. The U.S. Health and Human Services (HHS) reports a rise in mental health awareness programs, leading to higher public spending on wellness products to cater to these needs.

- Growth in At-Home Fitness Solutions: Around 63% of Americans are now opting for at-home fitness solutions, driving demand for fitness equipment and virtual training programs. Data from the American Time Use Survey indicates that individuals in major cities, including New York and Los Angeles, spend more time in home-based fitness, with over 20 million households investing in gym equipment and virtual subscriptions, boosting the fitness products market.

- Increased Focus on Organic and Plant-Based Wellness Products: As consumers become more health-conscious, the demand for organic and plant-based wellness products has surged, with around 30 million people actively seeking plant-based supplements and protein products. The USDAs recent analysis indicates a consistent increase in organic product availability across major U.S. stores, directly influencing sales in wellness stores.

Market Challenges

- High Costs of Premium Wellness Products: A study by the Bureau of Economic Analysis highlights that wellness products are often priced 30-40% higher than regular health products. With rising costs of ingredients like organic herbs and natural compounds, many wellness products remain inaccessible to lower-income groups, limiting the market growth potential within this demographic.

- Supply Chain Constraints Affecting Product Availability: Wellness product manufacturers rely heavily on international suppliers for ingredients, especially from Asia. Reports from U.S. Customs indicate that logistical delays have impacted the availability of popular products, causing inventory shortages and price fluctuations, particularly in urban areas where demand is high.

USA Wellness & Fitness Products Market Future Outlook

Over the next five years, the USA Wellness & Fitness Products industry is poised for growth, driven by advancements in wearable technology, personalized nutrition, and the rising popularity of holistic wellness practices.

Future Market Opportunities

- Expansion of Corporate Wellness Programs with Advanced Product Offerings: By 2028, corporate wellness programs are likely to include advanced fitness and wellness products as employee benefits, such as biofeedback devices and mental health apps. This will lead to higher procurement of wellness products from corporate sectors, with corporate investments potentially increasing by several billion dollars.

- Growth in Demand for Personalized Wellness Solutions: The demand for personalized wellness solutions, including customized supplements and health tracking, will continue to rise. This trend is expected to attract over 10 million new consumers by 2029, as more wellness brands adopt AI-driven personalization in products, reshaping consumer expectations of wellness products.

Scope of the Report

|

Product Category |

Nutrition Supplements Fitness Equipment Wellness Wearables Sleep Tech Personal Care and Beauty Products |

|

Function |

Weight Management Immune Support Mental Wellbeing Anti-aging Fitness Tracking |

|

Distribution Channel |

Online Retail Specialty Stores Pharmacies Supermarkets and Hypermarkets Direct Sales |

|

Consumer Demographics |

Age Group (Millennials, Gen Z, Baby Boomers) Income Group (High-Income, Middle-Income, Low-Income) |

|

Region |

North-East West Mid-West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Consumer Product Manufacturers

Online Retail Platforms

Venture Capital Firms and Investors

Government and Regulatory Bodies (e.g., FDA, NIH)

Banks and Financial Institution

Private Equity Firms

Healthcare and Wellness Technology Providers

Companies

Players Mentioned in the Report:

Procter & Gamble

Abbott Laboratories

Apple Inc.

Nestle Health Science

General Nutrition Centers Inc.

Arbonne International

Fitbit Inc.

Amway Corp.

The Kraft Heinz Company

GlaxoSmithKline (GSK)

Table of Contents

1. USA Wellness & Fitness Products Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Drivers and Inhibitors

1.4 Market Segmentation Overview

2. USA Wellness & Fitness Products Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Wellness & Fitness Products Market Analysis

3.1 Growth Drivers

3.1.1 Market Penetration Rates

3.1.2 Digital Integration

3.1.3 Consumer Preference Shifts

3.1.4 Strategic Alliances

3.2 Market Challenges

3.2.1 Pricing Pressures

3.2.2 Supply Chain Complexities

3.2.3 Regulatory Constraints

3.2.4 Consumer Skepticism

3.3 Opportunities

3.3.1 Gen-AI-Driven Personalization

3.3.2 Corporate Wellness Growth

3.3.3 Wearable Tech Expansion

3.3.4 Niche Product Growth

3.4 Trends

3.4.1 Shift Toward Clinical Validation

3.4.2 Rise of Wearables

3.4.3 Increasing Demand for Personalization

3.4.4 Wellness-Driven Lifestyle Choices

3.5 Government Regulations

3.5.1 FDA Compliance

3.5.2 Health Product Certifications

3.5.3 Dietary Supplement Regulations

3.5.4 Consumer Safety Standards

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competition Ecosystem

4. USA Wellness & Fitness Products Market Segmentation

4.1 By Product Category (In Value %)

4.1.1 Nutrition Supplements

4.1.2 Fitness Equipment

4.1.3 Wellness Wearables

4.1.4 Sleep Tech

4.1.5 Personal Care and Beauty Products

4.2 By Function (In Value %)

4.2.1 Weight Management

4.2.2 Immune Support

4.2.3 Mental Wellbeing

4.2.4 Anti-aging

4.2.5 Fitness Tracking

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Specialty Stores

4.3.3 Pharmacies

4.3.4 Supermarkets and Hypermarkets

4.3.5 Direct Sales

4.4 By Consumer Demographics (In Value %)

4.4.1 Age Group (Millennials, Gen Z, Baby Boomers)

4.4.2 Income Group (High-Income, Middle-Income, Low-Income)

4.5 By Region (In Value %)

4.5.1 North-East

4.5.2 West

4.5.3 Mid-West

4.5.4 South

5. USA Wellness & Fitness Products Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Procter & Gamble

5.1.2 Nestle Health Science

5.1.3 General Nutrition Centers Inc.

5.1.4 Pfizer Inc.

5.1.5 PROVANT Health Solutions Inc.

5.1.6 Abbott Laboratories

5.1.7 Arbonne International

5.1.8 The Kraft Heinz Company

5.1.9 GlaxoSmithKline (GSK)

5.1.10 Walgreens Co.

5.1.11 Bayer AG

5.1.12 Amway Corp.

5.1.13 Herbalife Nutrition Ltd.

5.1.14 Fitbit Inc.

5.1.15 Apple Inc.

5.2 Cross-Comparison Parameters

5.2.1 Product Innovation

5.2.2 Market Reach

5.2.3 Customer Retention

5.2.4 Revenue Growth

5.2.5 R&D Investment

5.2.6 Supply Chain Networks

5.2.7 Brand Loyalty

5.2.8 Consumer Satisfaction

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Private Equity Investments

5.6.2 Government Grants

5.6.3 Venture Capital Funding

6. USA Wellness & Fitness Products Market Regulatory Framework

6.1 Product Certification Standards

6.2 Compliance Requirements for Wellness Products

6.3 Labeling and Health Claims Regulations

6.4 Import and Export Regulations

7. USA Wellness & Fitness Products Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Wellness & Fitness Products Future Market Segmentation

8.1 By Product Category

8.2 By Function

8.3 By Distribution Channel

8.4 By Consumer Demographics

8.5 By Region

9. USA Wellness & Fitness Products Market Analysts’ Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Target Customer Analysis

9.3 Recommended Marketing Strategies

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the USA Wellness & Fitness Products market, examining primary stakeholders and gathering comprehensive industry-level information from secondary and proprietary databases. Key variables such as consumer behavior and market growth drivers are identified.

Step 2: Market Analysis and Construction

In this stage, historical data on the wellness and fitness products market is analyzed, focusing on product penetration rates, distribution channel efficiency, and revenue trends. Market segmentation analysis ensures accurate data representation.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are developed and validated through direct interviews with industry experts, which helps refine and substantiate the research findings.

Step 4: Research Synthesis and Final Output

This step involves a thorough synthesis of data, validated through direct industry feedback, to present an accurate and comprehensive analysis of the USA Wellness & Fitness Products market.

Frequently Asked Questions

1. How big is the USA Wellness & Fitness Products Market?

The USA Wellness & Fitness Products Market is valued at USD 29 billion, driven by consumer preferences for preventive healthcare, fitness technologies, and nutritional supplements.

2. What are the main challenges in the USA Wellness & Fitness Products Market?

Key challenges in the USA Wellness & Fitness Products Market include rising regulatory scrutiny, competitive pricing pressures, and the need for continual innovation to meet evolving consumer demands.

3. Who are the major players in the USA Wellness & Fitness Products Market?

Prominent players in the USA Wellness & Fitness Products Market include Procter & Gamble, Abbott Laboratories, Apple Inc., Nestle Health Science, and General Nutrition Centers, with robust market reach and innovative product lines.

4. What drives growth in the USA Wellness & Fitness Products Market?

Growth in the USA Wellness & Fitness Products Market is driven by consumer focus on health, advancements in fitness and sleep tech, and the rise of digital health platforms facilitating personalized wellness experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.