USA Wheelchair Market Outlook to 2030

Region:North America

Author(s):Shubham

Product Code:KROD5279

October 2024

85

About the Report

USA Wheelchair Market Overview

- The USA wheelchair market is valued at USD 1.5 billion, driven by rising demand for mobility aids among an aging population, as well as increased awareness and adoption of assistive technologies. The development of advanced wheelchairs, such as powered and smart wheelchairs, has further fueled this market growth. Government programs aimed at improving accessibility for people with disabilities, coupled with advancements in healthcare infrastructure, have significantly contributed to market expansion.

- Major cities such as New York, Los Angeles, and Chicago play a dominant role in the USA wheelchair market. These cities have a large concentration of senior citizens, high healthcare spending, and numerous rehabilitation centers, making them key hubs for wheelchair demand. Additionally, healthcare facilities in these urban areas tend to invest more in advanced mobility solutions, contributing to the higher adoption of premium wheelchairs in these regions.

- The Americans with Disabilities Act (ADA) plays a crucial role in shaping the U.S. wheelchair market, ensuring that individuals with mobility impairments have access to public spaces and transportation. As of 2024, the ADA mandates strict design standards for mobility aids, including wheelchairs, in public and private facilities. Compliance with ADA regulations is essential for manufacturers and healthcare providers, with penalties for non-compliance ranging from fines to litigation. The ADAs influence extends to the design of wheelchair-accessible infrastructure, which has been integrated into urban planning projects nationwide.

USA Wheelchair Market Segmentation

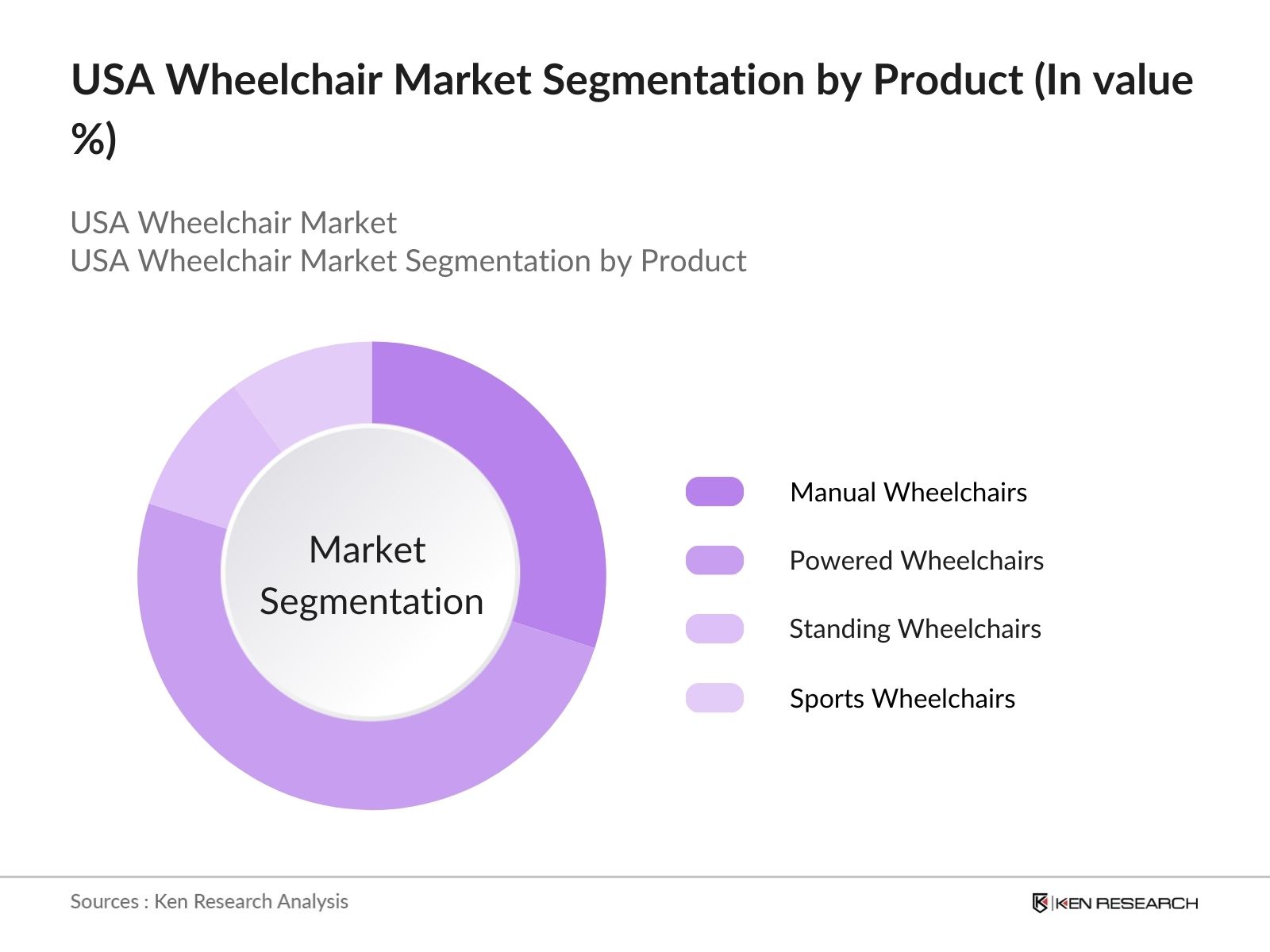

- By Product Type: The market is segmented by product type into manual wheelchairs, powered wheelchairs, standing wheelchairs, and sports wheelchairs. Powered wheelchairs have captured the dominant market share in 2023 due to their ease of use and the increasing adoption of advanced technologies such as smart mobility features. Consumers with severe mobility impairments and those seeking enhanced independence prefer powered wheelchairs. The availability of various customization options for powered wheelchairs also boosts their demand in hospitals and home care settings.

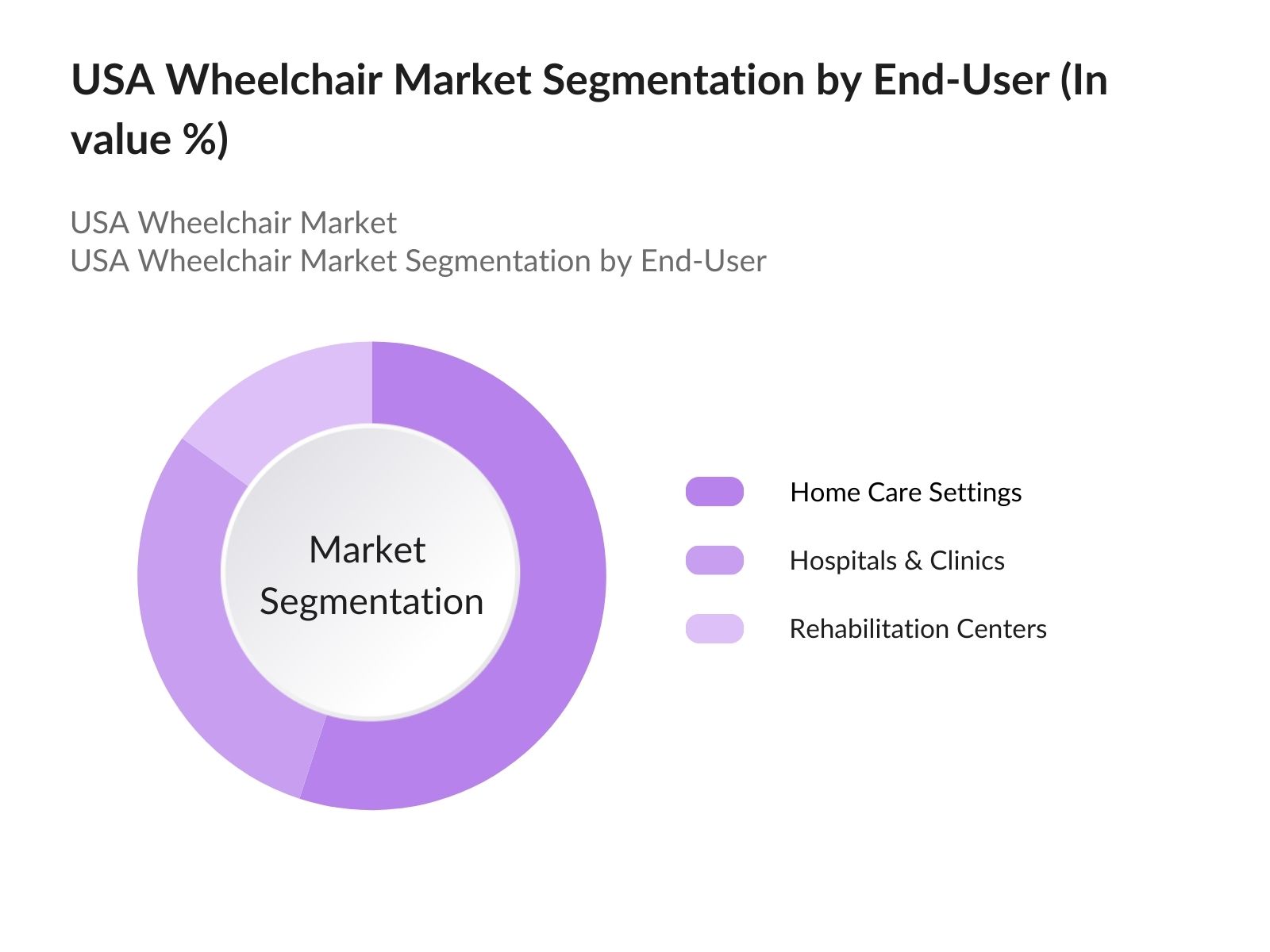

- By End-User: The USA wheelchair market is also segmented by end-user into home care settings, hospitals & clinics, and rehabilitation centers. Home care settings represent the largest end-user segment in 2023. The growing trend of home healthcare, driven by the aging populations preference for aging in place, has significantly boosted demand for wheelchairs in this category. Hospitals and clinics also contribute a substantial portion of the market due to the frequent need for mobility solutions in patient care and post-surgery rehabilitation.

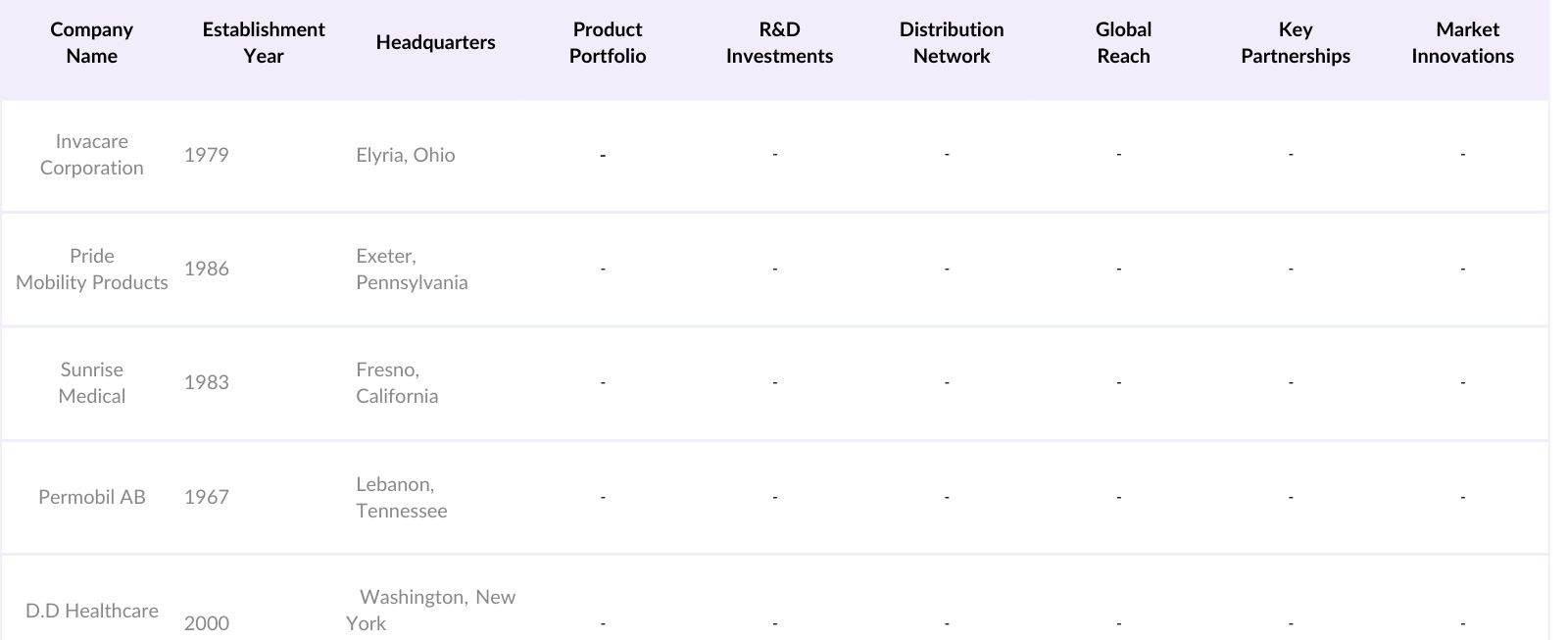

USA Wheelchair Market Competitive Landscape

The USA wheelchair market is highly competitive, with major domestic and international players shaping the landscape. Established companies dominate the market through continuous innovation, product diversification, and expanding partnerships with healthcare providers.

USA Wheelchair Market Analysis

Growth Drivers

- Increasing demand for mobility aids due to ageing population: As of 2024, the U.S. Census Bureau reports that over 54 million Americans are aged 65 and older, and the demand for mobility aids, such as wheelchairs, is rapidly growing among this demographic. The aging population is more prone to mobility-related issues, with millions of seniors reporting difficulty walking or climbing stairs. This demographic shift has led to a surge in the need for mobility aids, with wheelchair purchases steadily increasing annually among this group, driven by both health and lifestyle needs.

- Rise in healthcare infrastructure investment: The U.S. healthcare sector continues to experience substantial investment, with over USD 4.3 trillion spent in 2023 alone, and a portion of this investment is aimed at enhancing accessibility to mobility aids, including wheelchairs. Federal funding of healthcare infrastructure improvements, including hospitals and long-term care facilities, has resulted in higher demand for wheelchairs as part of integrated care services. Medicare and Medicaid together are expected to spend over USD 1.5 trillion in 2024, ensuring greater access to essential mobility equipment for patients in need

- Government funding for disability assistance: In 2024, the U.S. government continues to prioritize disability assistance, allocating over USD 14.2 billion in federal funding for programs that enhance accessibility for disabled individuals, including mobility devices like wheelchairs. Government initiatives such as Medicaid, which provides funding for mobility aids, are helping bridge the gap in accessibility. Furthermore, the U.S. Department of Veterans Affairs has contributed USD 104 billion to veteran healthcare services, which includes the provision of wheelchairs and other mobility aids. These programs directly impact the market for wheelchairs by increasing their availability to individuals reliant on government-funded healthcare.

Market Challenges

- High Costs of Advanced Wheelchairs: The high cost of advanced mobility devices remains a significant challenge in the U.S. wheelchair market. Powered wheelchairs, especially those with advanced features such as stronger motors and integrated technology, are often prohibitively expensive for many individuals. Without comprehensive insurance coverage, the cost of these devices presents a financial burden. Government programs, such as Medicare, help to alleviate some of these costs, but patients still face substantial out-of-pocket expenses. This financial strain limits the accessibility of advanced mobility devices, particularly for individuals without sufficient financial resources.

- Limited insurance coverage for powered wheelchairs: Insurance coverage for powered wheelchairs is often restricted, with Medicare covering only a portion of the approved cost. Patients are frequently left to cover the remaining amount, which can still be a significant expense. Additionally, commercial insurance policies tend to have stringent eligibility requirements for powered wheelchair coverage, leaving many individuals underinsured. As a result, a large portion of those who need powered mobility aids are unable to obtain them due to limited insurance support, making affordability a major barrier to access.

USA Wheelchair Market Future Outlook

The USA wheelchair market is projected to experience continued growth, driven by increasing demand for home healthcare services, advancements in wheelchair technologies, and rising awareness about assistive devices. Manufacturers are expected to focus on the development of lightweight, foldable, and smart wheelchairs to cater to evolving consumer preferences. Additionally, government support for improving accessibility for disabled individuals will continue to play a crucial role in market expansion.

Future Market Opportunities

- Growing demand for home healthcare and mobility aids: The home healthcare sector is experiencing substantial growth, with the U.S. government investing USD 150 billion in next 10 years to expand home-based care services. This rise in home care has led to increased demand for mobility aids, including wheelchairs, as more individuals seek to manage disabilities from the comfort of their homes. The U.S. Department of Health and Human Services predicts that a substantial number of Americans will rely on home healthcare services by the end of 2024, driving demand for adaptable and easy-to-use mobility devices.

- Integration of telehealth with wheelchair technologies: Telehealth services are increasingly being integrated with wheelchair technologies to provide real-time health monitoring and consultations for wheelchair users. By 2024, telehealth programs are expected to serve over 60 million Americans, many of whom rely on mobility aids. Wheelchairs equipped with sensors and health monitoring systems can transmit data directly to healthcare providers, enhancing the quality of care and reducing the need for in-person visits. This trend is supported by the federal investment in telehealth infrastructure in 2023, driving innovation in connected mobility devices.

Scope of the Report

|

Product Type |

Manual Wheelchairs Powered Wheelchairs Standing Wheelchairs Sports Wheelchairs |

|

End-User |

Home Care Settings Hospitals & Clinics Rehabilitation Centers |

|

Distribution Channel |

Online Platforms Retail Stores Specialized Medical Equipment Stores |

|

Technology |

Basic Manual Technology Electrically Powered Technology AI-enabled/Smart Wheelchairs |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Wheelchair Manufacturers

Healthcare Equipment Distributors

Home Care Service Providers

Hospitals & Rehabilitation Centers

Government and Regulatory Bodies (FDA, U.S. Department of Health & Human Services)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Healthcare Insurance Providers

Companies

Players Mentioned in the Report

Invacare Corporation

Pride Mobility Products Corp.

Sunrise Medical

Drive DeVilbiss Healthcare

Permobil AB

Hoveround Corporation

Ottobock Healthcare

Medline Industries, Inc.

Karman Healthcare

MEYRA GmbH

GF Health Products

Invamed Group

KD Smart Chair

Drive Medical

Quickie Wheelchairs

Table of Contents

1. USA Wheelchair Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Wheelchair Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Wheelchair Market Analysis

3.1 Growth Drivers (Government Policies, Technological Innovations, Aging Population, Healthcare Access Expansion)

3.1.1 Government funding for disability assistance

3.1.2 Increasing demand for mobility aids due to aging population

3.1.3 Technological advancements in smart wheelchairs

3.1.4 Rise in healthcare infrastructure investment

3.2 Market Challenges (Cost, Insurance Coverage, Supply Chain, Maintenance Services)

3.2.1 High cost of advanced mobility devices

3.2.2 Limited insurance coverage for powered wheelchairs

3.2.3 Supply chain constraints in critical components

3.2.4 Availability of skilled maintenance services

3.3 Opportunities (Home Care Expansion, Telehealth Integration, Customization Trends, Assistive Technology Penetration)

3.3.1 Growing demand for home healthcare and mobility aids

3.3.2 Integration of telehealth with wheelchair technologies

3.3.3 Customization of wheelchair products for specific disabilities

3.3.4 Increasing focus on assistive technologies for mobility

3.4 Trends (Sustainability, IoT-enabled Devices, Foldable & Lightweight Wheelchairs, Inclusion in Sports)

3.4.1 Sustainable materials in wheelchair manufacturing

3.4.2 IoT integration in wheelchair functions and tracking

3.4.3 Lightweight and foldable wheelchairs gaining popularity

3.4.4 Increased participation of people with disabilities in sports events

3.5 Government Regulation (FDA Approvals, Disability Acts, Healthcare Standards, Import Tariffs)

3.5.1 FDA medical device classification and compliance

3.5.2 U.S. Disability Acts and wheelchair standards

3.5.3 Healthcare reforms supporting mobility devices

3.5.4 Import/export regulations on mobility equipment

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Suppliers, Distributors, Healthcare Providers)

3.8 Porters Five Forces Analysis (Competitive Rivalry, Threat of Substitutes, Supplier Power, Buyer Power, New Entrants)

3.9 Competition Ecosystem (Wheelchair Manufacturers, Distributors, Assistive Technology Integrators)

4. USA Wheelchair Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Manual Wheelchairs

4.1.2 Powered Wheelchairs

4.1.3 Standing Wheelchairs

4.1.4 Sports Wheelchairs

4.2 By End-User (In Value %)

4.2.1 Home Care Settings

4.2.2 Hospitals & Clinics

4.2.3 Rehabilitation Centers

4.3 By Distribution Channel (In Value %)

4.3.1 Online Platforms

4.3.2 Retail Stores

4.3.3 Specialized Medical Equipment Stores

4.4 By Technology (In Value %)

4.4.1 Basic Manual Technology

4.4.2 Electrically Powered Technology

4.4.3 AI-enabled/Smart Wheelchairs

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Wheelchair Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Invacare Corporation

5.1.2 Pride Mobility Products Corp.

5.1.3 Sunrise Medical

5.1.4 Drive DeVilbiss Healthcare

5.1.5 Permobil AB

5.1.6 Hoveround Corporation

5.1.7 Ottobock Healthcare

5.1.8 Medline Industries, Inc.

5.1.9 Karman Healthcare

5.1.10 MEYRA GmbH

5.1.11 GF Health Products

5.1.12 Invamed Group

5.1.13 KD Smart Chair

5.1.14 Drive Medical

5.1.15 Quickie Wheelchairs

5.2 Cross Comparison Parameters (Product Portfolio, Revenue, Distribution Channels, Key Patents, R&D Investments, Market Share, Geographical Reach, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. USA Wheelchair Market Regulatory Framework

6.1 FDA Compliance

6.2 Certification and Labeling Requirements

6.3 Import/Export Regulations

6.4 Reimbursement Policies

7. USA Wheelchair Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Wheelchair Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. USA Wheelchair Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Analysis

9.3 Market Entry Strategies

9.4 Partnerships and Collaborations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying key market drivers, challenges, and opportunities by mapping the entire ecosystem of the USA wheelchair market. Extensive desk research, using proprietary databases and industry reports, helped in understanding the key factors that influence the market dynamics.

Step 2: Market Analysis and Construction

This phase focused on collecting historical data to analyze the markets performance over the past five years. Metrics such as wheelchair adoption rates, market revenue generation, and technological advancements were used to assess the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including wheelchair manufacturers and healthcare providers, were conducted to validate the assumptions made during the research. These consultations provided valuable insights into the operational challenges and future trends.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the research findings and preparing the final report. This phase included validating the data obtained through primary research with the help of industry experts to ensure accuracy and reliability.

Frequently Asked Questions

01. How big is the USA Wheelchair Market?

The USA wheelchair market is valued at USD 1.5 billion, driven by the increasing demand for mobility aids among the elderly population and advancements in wheelchair technology.

02. What are the challenges in the USA Wheelchair Market?

The major challenges in the USA wheelchair market include the high costs associated with powered and smart wheelchairs and supply chain disruptions, which affect the availability of critical components.

03. Who are the key players in the USA Wheelchair Market?

Key players in the USA wheelchair market include Invacare Corporation, Pride Mobility Products Corp., Sunrise Medical, Permobil AB, and Drive DeVilbiss Healthcare, among others.

04. What are the growth drivers of the USA Wheelchair Market?

The USA wheelchair market is driven by advancements in wheelchair technology, including smart mobility features, and government initiatives aimed at improving accessibility for people with disabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.