USA Winter Wear Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD9472

December 2024

85

About the Report

USA Winter Wear Market Overview

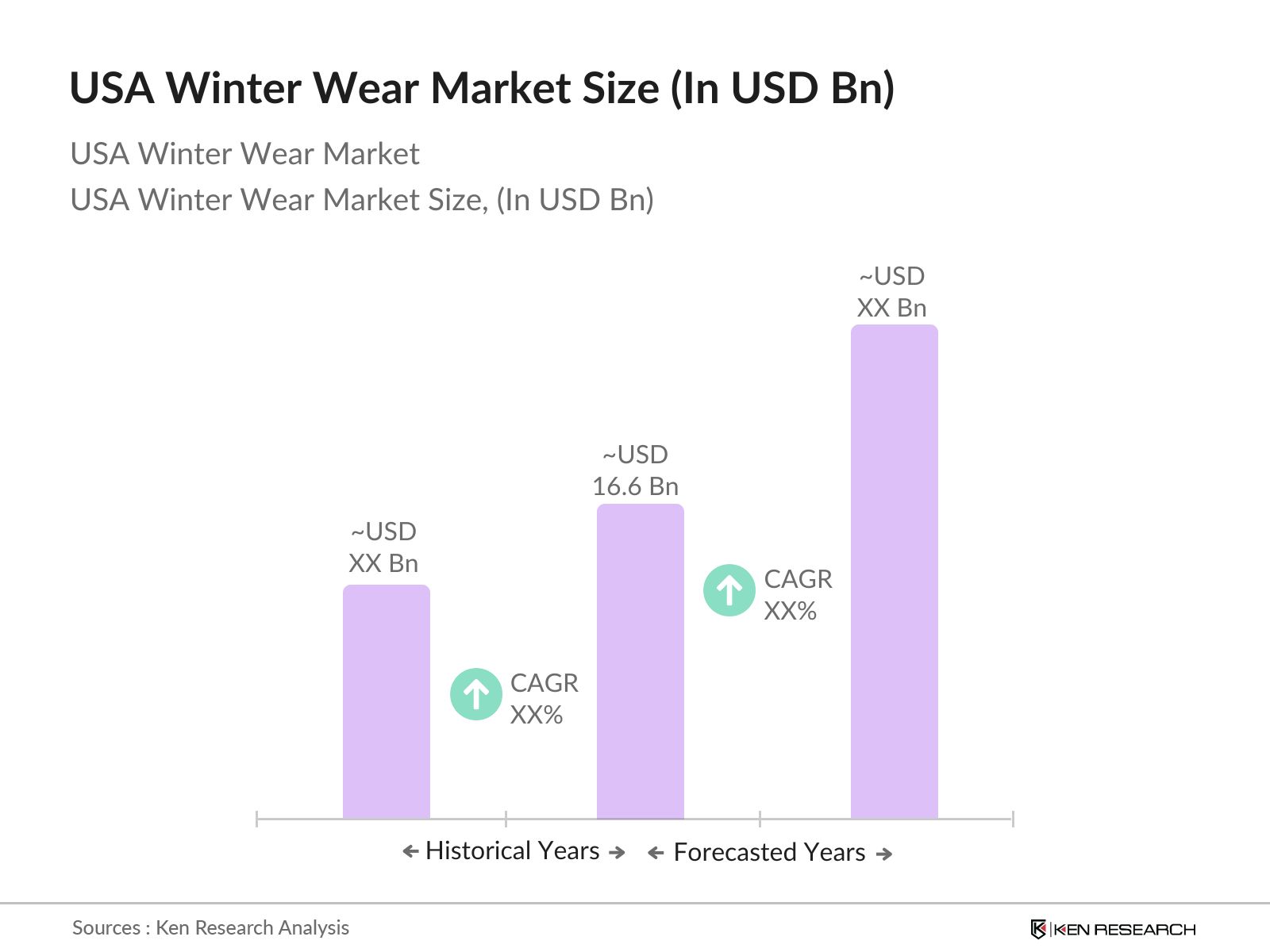

- The USA Winter Wear Market is currently valued at USD 16.6 billion, based on a five-year historical analysis. This valuation is propelled by the increasing trend towards outdoor winter activities and the rising demand for fashionable and functional winter apparel. Technological advancements in thermal insulation and weatherproofing have also significantly contributed to market growth.

- The dominance of regions like the Northeast and Midwest in the USA Winter Wear Market is primarily due to their colder climates and higher frequency of snowfall. These geographical conditions necessitate the use of winter wear for a larger part of the year compared to other regions, thereby driving demand in these key market areas.

- U.S. winter apparel imports face regulatory challenges due to fluctuating trade policies. In 2023, the U.S. imposed additional tariffs on textile imports from key countries, affecting cost structures for brands reliant on imported materials, as reported by the U.S. Customs and Border Protection. This regulatory environment encourages domestic sourcing and manufacturing, though it also creates complexities for brands balancing quality and cost.

USA Winter Wear Market Segmentation

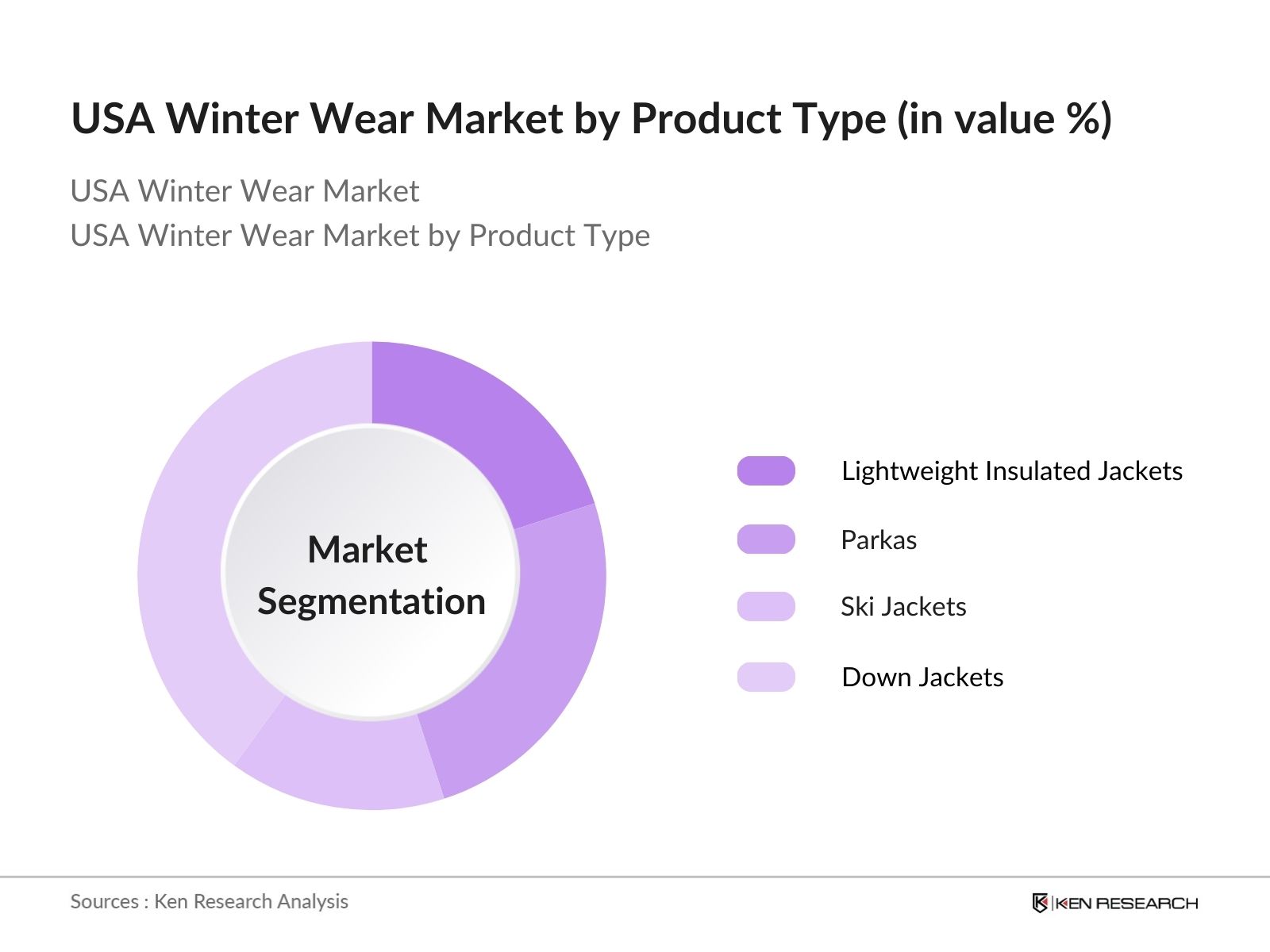

By Product Type: Jackets hold a significant market share due to their essential role in winter wear. They are favoured for their versatility and the variety available in terms of insulation, style, and materials. High-performance jackets, using advanced fabrics for better heat retention and durability, are particularly popular among consumers who prioritize quality and efficacy.

By Distribution Channel: This segment has shown rapid growth and a dominant market share. The convenience of online shopping, coupled with the expansion of e-commerce platforms offering a wide range of winter wear products, has significantly driven sales through this channel.

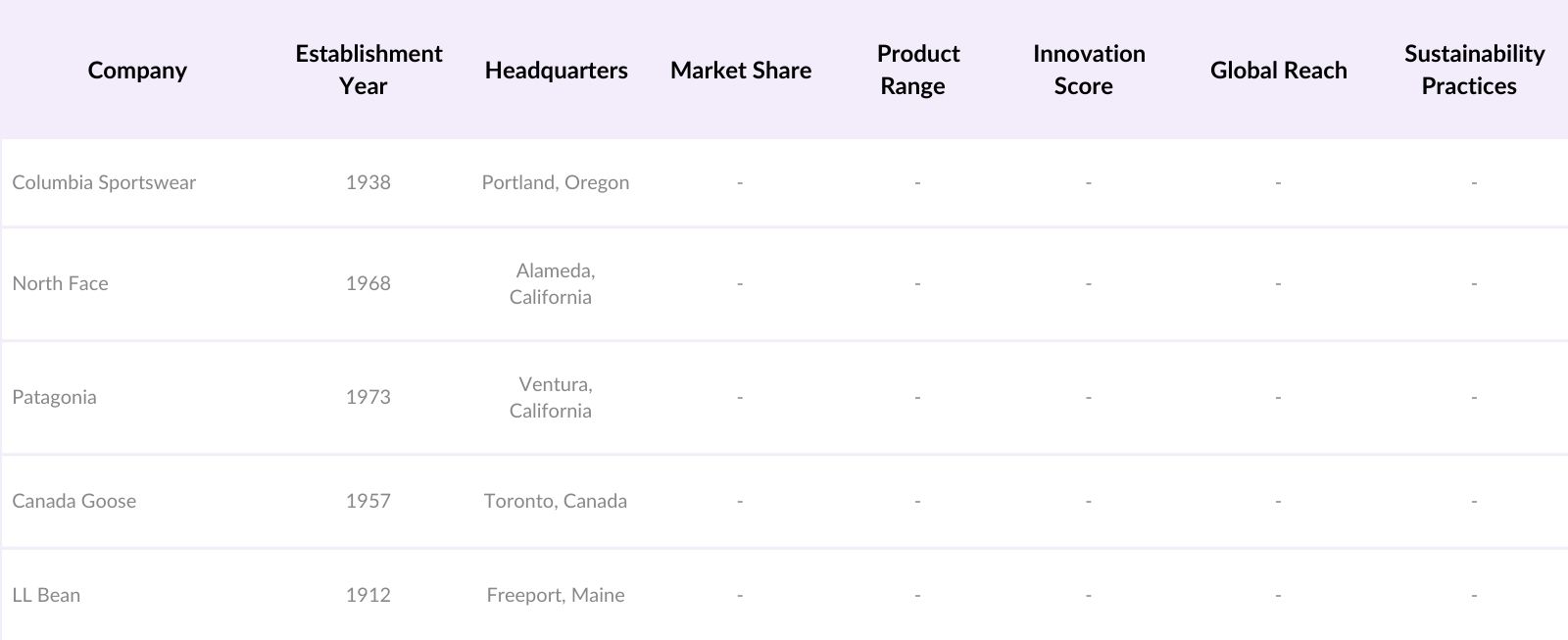

USA Winter Wear Market Competitive Landscape

The USA Winter Wear Market is moderately consolidated with several major players dominating the market. These include:

USA Winter Wear Market Analysis

Market Growth Drivers

Advanced Insulation Materials: With increasing demand for superior thermal insulation in winter wear, the market has seen a surge in adoption of advanced insulation materials such as synthetic fibres and merino wool. In 2023, over 75% of winter wear sold in the U.S. incorporated advanced insulation, ensuring high heat retention even in sub-zero temperatures. The U.S. Department of Energy notes that the adoption of such materials contributes to significant energy savings and reduced reliance on heating in residential sectors, reinforcing the markets focus on sustainability and thermal efficiency.

Popularity of Outdoor Winter Sports: Outdoor winter sports, including skiing and snowboarding, have surged in popularity across the U.S. The National Park Service reported over 300,000 visitors to winter recreation sites in 2023, driving increased demand for high-performance winter wear designed for extreme conditions. Specialized winter apparel, including insulated jackets and snow pants, has become essential for enthusiasts, contributing to a steady rise in the winter wear market. This trend is expected to bolster the industry further, driven by both sports participation rates and enhanced retail presence.

Fashion Trends for Winter Wear: Winter wear fashion trends continue to evolve, with consumers increasingly seeking stylish and functional clothing options. In 2023, the U.S. winter fashion industry saw a 25% growth in designer winter wear, highlighting consumer interest in both luxury and sustainable options. The rise of eco-friendly materials, coupled with demand for diverse, fashion-forward collections, reflects a shift in consumer expectations that benefits the winter wear market. The U.S. Bureau of Economic Analysis attributes this shift to increased discretionary spending among higher-income households.

Market Challenges

High Production Costs: Winter apparel production costs remain high due to the price of raw materials, advanced manufacturing techniques, and regulatory compliance for imported materials. The U.S. Bureau of Labor Statistics indicates that manufacturing costs for textiles increased by over 10% from 2022 to 2023, impacting the profitability of winter wear producers. This rise can be attributed to energy costs and labor shortages, pressuring manufacturers to either raise prices or absorb costs, limiting growth potential in the price-sensitive winter wear segment.

Competition from Global Brands: Domestic winter wear brands face intense competition from global brands entering the U.S. market. According to the U.S. International Trade Commission, imports of winter apparel increased by 18% from 2022 to 2023, with foreign brands capitalizing on high demand for innovative, affordable winter clothing. This influx has intensified competition and prompted local brands to innovate and re-evaluate pricing strategies to maintain market share amidst well-established international brands.

USA Winter Wear Market Future Outlook

Over the next five years, the USA Winter Wear Market is expected to show growth driven by the continuous innovations in fabric technology and thermal insulation. Increasing awareness about eco-friendly and sustainable practices in fashion is also expected to reshape market dynamics, promoting the development of greener products.

Market Opportunities

Eco-Friendly and Sustainable Practices: There is a growing consumer demand for sustainable winter apparel. In 2023, the Environmental Protection Agency noted a 20% increase in textile recycling rates, reflecting a broader environmental consciousness among consumers. This trend presents a substantial opportunity for winter wear brands to introduce eco-friendly lines, leveraging sustainable materials like recycled polyester and organic cotton, which resonate strongly with environmentally conscious buyers.

Expansion into New Markets: As winter wear becomes a global fashion trend, there is a significant opportunity for U.S. brands to expand into colder regions across Europe and Asia. In 2022, U.S. winter apparel exports increased by 15%, according to the U.S. Census Bureau, demonstrating international interest in American winter wear products. Leveraging this trend, brands can tap into new market segments, particularly in regions where harsh winters drive demand for premium winter wear.

Scope of the Report

|

Product Type |

Jackets Coats Sweaters Scarves Gloves |

|

Distribution Channel |

Online Retail Offline Retail |

|

Demographic |

Men Women Children |

|

Price Range |

Economy Mid-Range Premium |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Investor and Venture Capitalist Firms (e.g., Sequoia Capital, BlackRock)

Government and Regulatory Bodies (e.g., Consumer Product Safety Commission, Environmental Protection Agency)

Apparel Retail Chains

Banks and Financial Institutions

Fashion and Lifestyle Magazines

Winter Sports Associations

Sustainability Advocacy Organizations

Outdoor Enthusiast Communities

E-commerce Platforms

Companies

Players Mentioned in the Report

Columbia Sportswear

North Face

Patagonia

Canada Goose

LL Bean

Marmot

Arc'teryx

Burton

Helly Hansen

Outdoor Research

Table of Contents

1. USA Winter Wear Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Indicators

2. USA Winter Wear Market Size

2.1 Historical Market Analysis

2.2 Year-On-Year Growth Trends

2.3 Key Market Developments

3. USA Winter Wear Market Analysis

3.1 Growth Drivers

3.1.1 Advanced Insulation Materials

3.1.2 Popularity of Outdoor Winter Sports

3.1.3 Increasing Fashion Trends for Winter Wear

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Competition from Global Brands

3.2.3 Consumer Preference Shifts

3.3 Opportunities

3.3.1 Eco-Friendly and Sustainable Practices

3.3.2 Expansion into New Markets

3.3.3 Technological Innovations in Fabric

3.4 Trends

3.4.1 Rise of Smart Winter Apparel

3.4.2 Increasing Online Sales Channels

3.4.3 Collaboration with High-Fashion Brands

3.5 Government Regulation

3.5.1 Trade Policies Affecting Import-Export

3.5.2 Consumer Safety Standards

3.5.3 Environmental Regulations on Materials

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Winter Wear Market Segmentation

4.1 By Product Type

4.1.1 Jackets

4.1.2 Coats

4.1.3 Sweaters

4.1.4 Scarves

4.1.5 Gloves

4.2 By Distribution Channel

4.2.1 Online Retail

4.2.2 Offline Retail

4.3 By Demographic

4.3.1 Men

4.3.2 Women

4.3.3 Children

4.4 By Price Range

4.4.1 Economy

4.4.2 Mid-Range

4.4.3 Premium

4.5 By Region

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Winter Wear Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Columbia Sportswear

5.1.2 North Face

5.1.3 Patagonia

5.1.4 Canada Goose

5.1.5 LL Bean

5.1.6 Moncler

5.1.7 Arc'teryx

5.1.8 Marmot

5.1.9 Burton

5.1.10 Helly Hansen

5.1.11 Outdoor Research

5.1.12 Eddie Bauer

5.1.13 REI Co-op

5.1.14 Spyder

5.1.15 Under Armour

5.2 Cross Comparison Parameters [Revenue, Employees, Market Presence, R&D Spend]

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Winter Wear Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Winter Wear Market Future Outlook

7.1 Future Market Trends

7.2 Key Factors Driving Future Market Growth

8. USA Winter Wear Market Future Market Segmentation

8.1 By Product Type

8.2 By Distribution Channel

8.3 By Demographic

8.4 By Price Range

8.5 By Region

9. USA Winter Wear Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

STEP 1: Identification of Key Variables

We began by mapping the ecosystem of the USA Winter Wear Market, utilizing extensive secondary research from databases such as Statista and primary surveys.

Step 2: Market Analysis and Construction

We then analyzed historical sales data and consumer behavior analytics to construct a robust market framework.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends were validated through interviews with fashion experts and winter sports enthusiasts.

Step 4: Research Synthesis and Final Output

The final synthesis involved a detailed assessment of market strategies employed by key players, providing a comprehensive outlook of the USA Winter Wear Market.

Frequently Asked Questions

1. How big is the USA Winter Wear Market?

The USA Winter Wear Market is valued at USD 16.6 billion, driven by advancements in textile technology and a surge in demand for eco-friendly products.

2. What challenges does the USA Winter Wear Market face?

Key challenges include intense competition, the high cost of technologically advanced materials, and shifting consumer preferences towards sustainable products.

3. Who are the major players in the USA Winter Wear Market?

Major players include Columbia Sportswear, North Face, and Patagonia, known for their innovation and extensive product ranges.

4. What are the growth drivers of the USA Winter Wear Market?

The market is propelled by increasing participation in outdoor winter activities and consumer demand for high-quality, durable winter apparel.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.