USA Wires and Cables Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD10694

December 2024

89

About the Report

USA Wires and Cables Market Overview

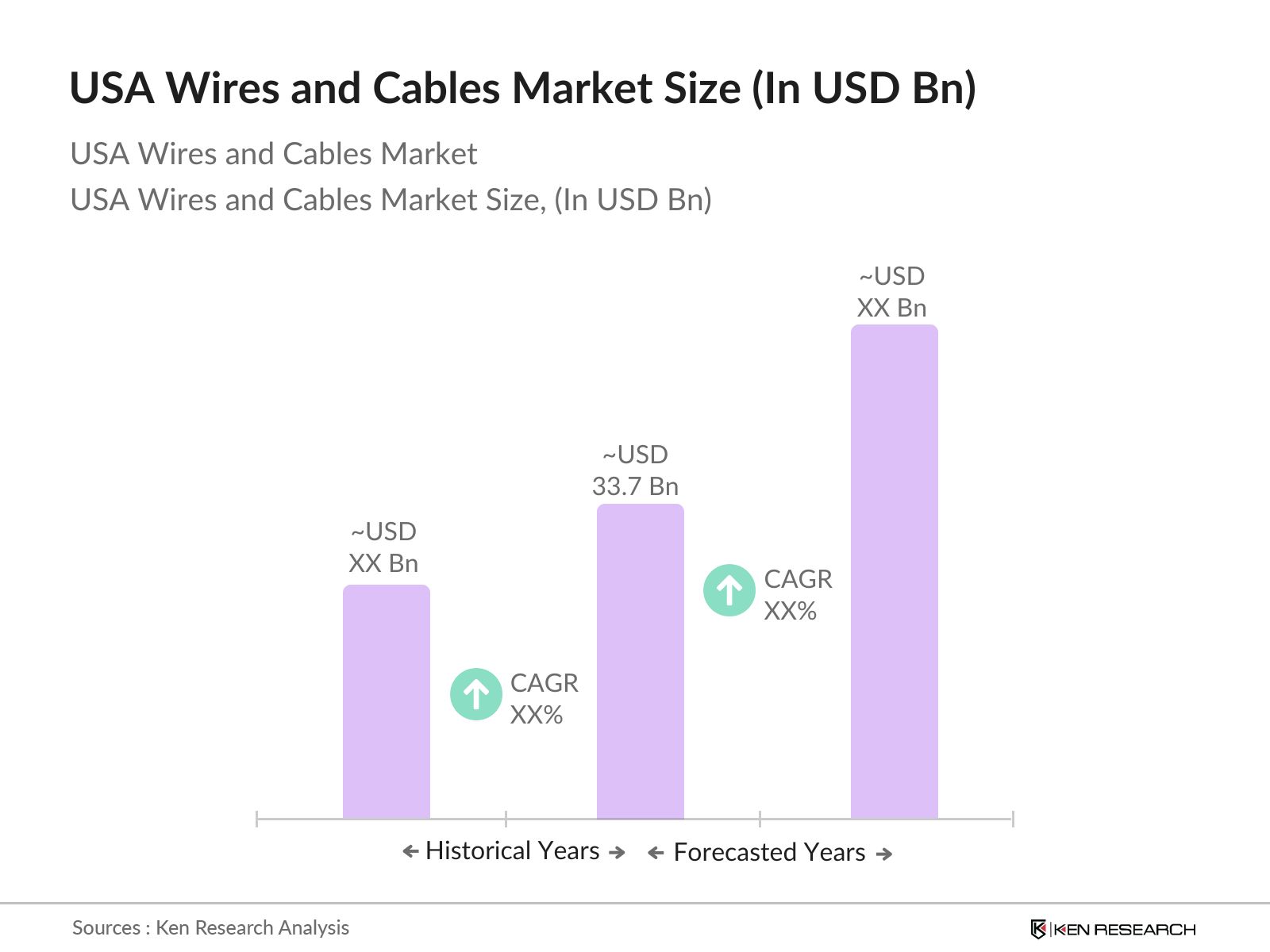

- The USA wires and cables market is valued at USD 33.7 billion, based on a comprehensive analysis of historical data. This substantial market size is propelled by infrastructure development, the integration of renewable energy sources, and technological advancements in various sectors. The ongoing modernization of power grids and the expansion of data centers further contribute to the robust demand for wires and cables.

- The market is predominantly driven by key regions such as the Northeast, Midwest, South, and West of the United States. Extensive industrial activities, urbanization, and substantial investments in infrastructure projects characterize these areas. The concentration of manufacturing hubs and technological centers in these regions influences the demand for wires and cables, establishing them as dominant players in the market.

- The National Electrical Code (NEC) establishes crucial standards for electrical installations in the U.S. In 2022, the NEC underwent revisions to enhance safety and efficiency in wiring systems, affecting all manufacturers and contractors in the industry. Compliance with these updated standards is essential to avoid penalties and ensure consumer safety. The NECs influence extends to the types of wires and cables used in various applications, emphasizing the need for manufacturers to adapt their products accordingly to meet evolving regulatory requirements.

USA Wires and Cables Market Segmentation

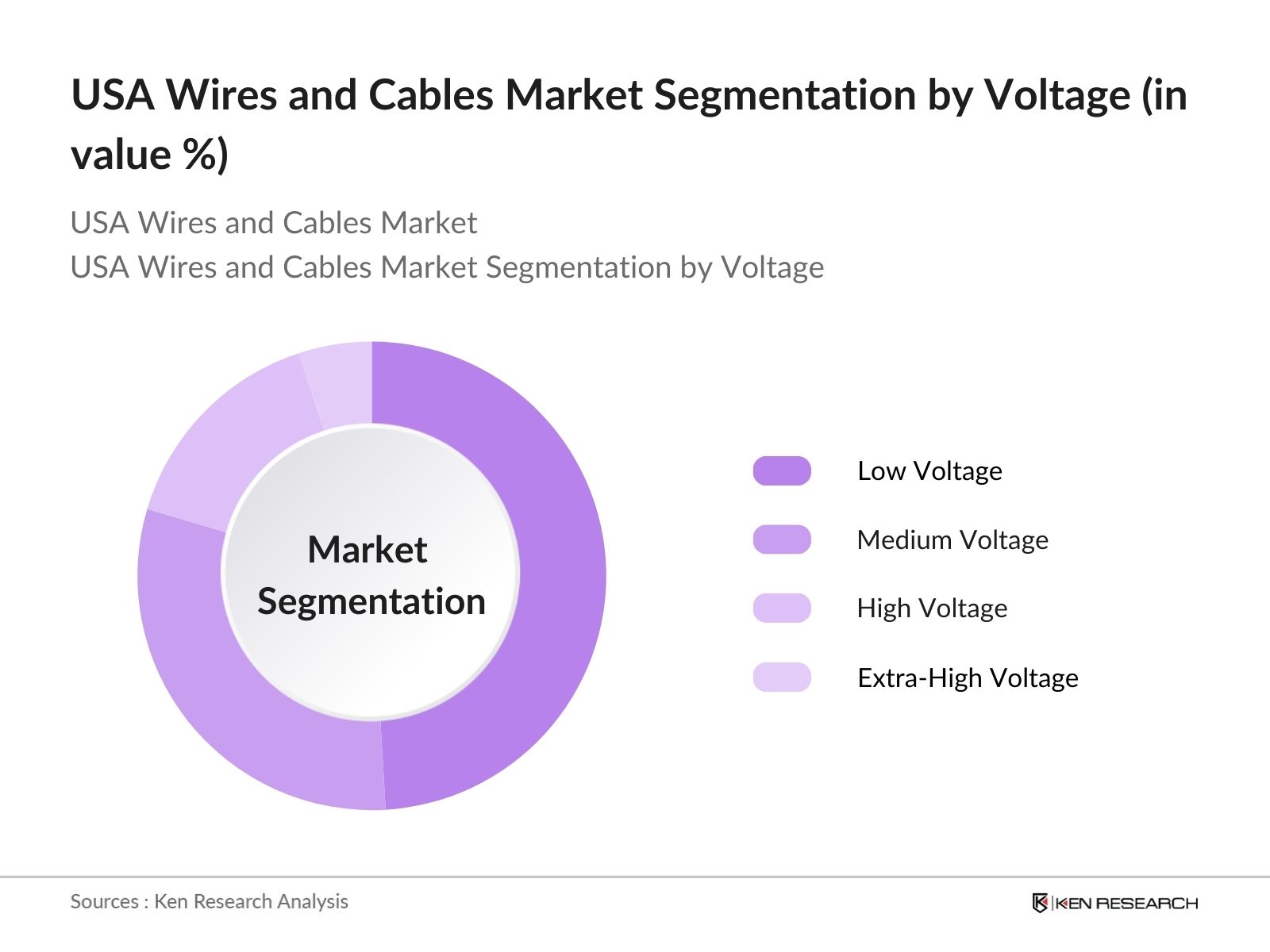

- By Voltage: The U.S. wires and cables market is segmented by voltage into low, medium, high, and extra-high voltage categories. The low voltage segment holds a dominant market share, driven by its extensive application in residential, commercial, and industrial sectors. The widespread use of low voltage cables in everyday electrical systems and their adaptability to various applications contribute to their leading position in the market.

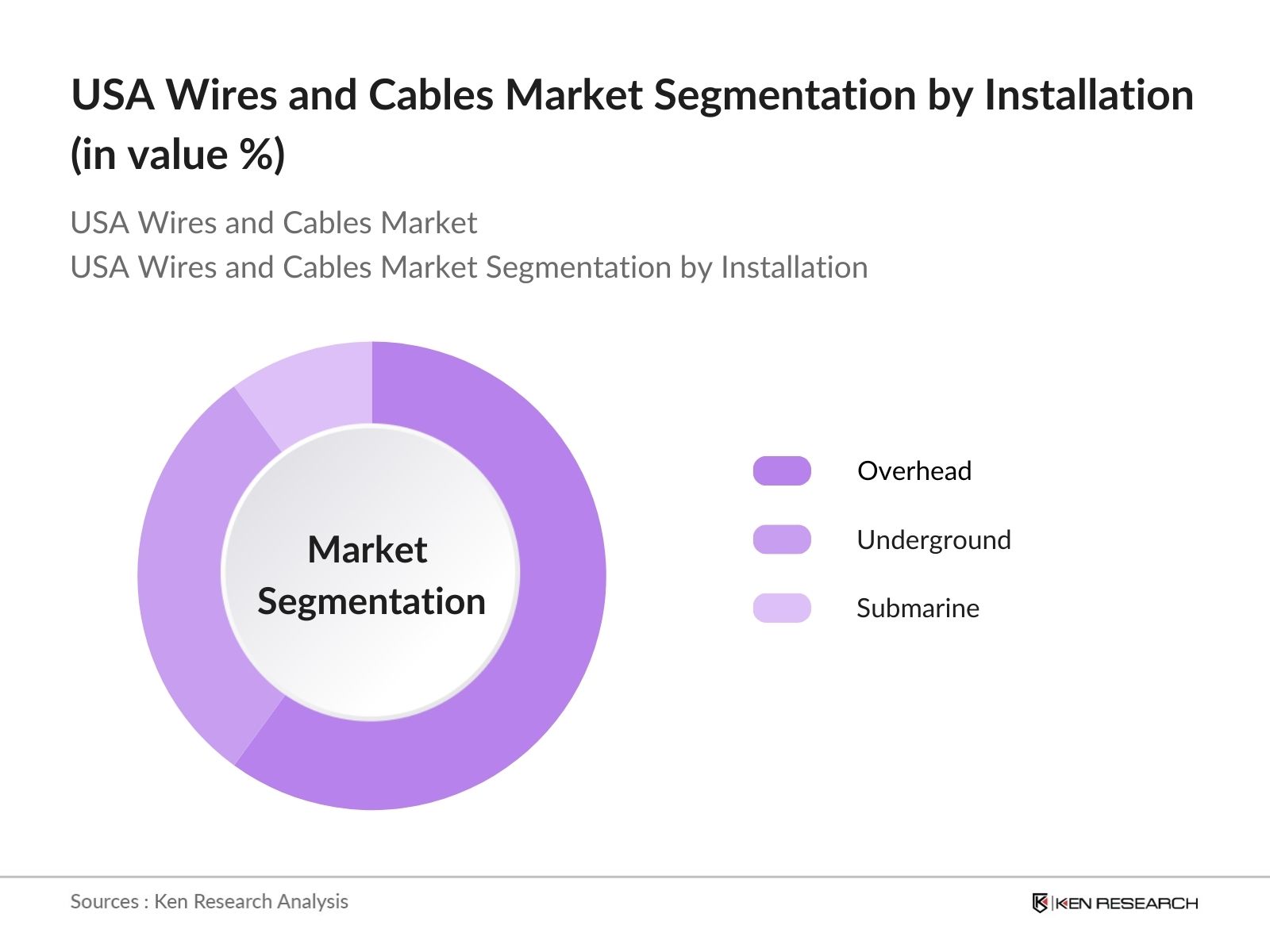

- By Installation: The installation segment comprises overhead, underground, and submarine cables. Overhead cables dominate this segment, primarily due to their cost-effectiveness and ease of installation, especially in rural and less densely populated areas. Economic considerations and the existing infrastructure setup influence the preference for overhead installations in these regions.

USA Wires and Cables Market Competitive Landscape

The U.S. wires and cables market is characterized by the presence of several key players, including:

USA Wires and Cables Market Analysis

Market Growth Drivers

- Infrastructure Development: The U.S. government has committed to investing $1.2 trillion in infrastructure improvements under the Infrastructure Investment and Jobs Act, which aims to enhance roads, bridges, and power systems. This substantial investment is expected to lead to increased demand for wires and cables used in construction and modernization projects. Additionally, the American Society of Civil Engineers (ASCE) reported that in 2022, approximately 42% of the nations roads were in poor condition, necessitating urgent infrastructure upgrades, which further drives the market for cables in road and construction applications.

- Renewable Energy Integration: In 2022, renewable energy sources accounted for 23% of the total electricity generation in the U.S., with projections indicating growth in this sector. The U.S. Department of Energy reported that solar and wind energy production has doubled since 2020, leading to increased demand for wires and cables required for renewable energy installations and connections. Furthermore, the Biden administrations goal to achieve 100% clean energy by 2035 bolsters the necessity for an extensive network of cables to support the transition to renewable energy sources.

- Technological Advancements: Technological advancements in manufacturing processes and materials have led to the development of advanced wires and cables that offer better performance and durability. In 2022, the introduction of smart wiring solutions has gained momentum, particularly in residential and commercial buildings. The U.S. National Institute of Standards and Technology (NIST) emphasized that investments in advanced manufacturing technologies can enhance production efficiency, contributing to a projected increase in the quality and variety of cables available in the market. The adoption of such technologies is pivotal in meeting the growing demands of high-performance electrical systems.

Market Challenges

- Fluctuating Raw Material Prices: The volatility of raw material prices, particularly copper and aluminum, presents a major challenge to the wires and cables market. As of 2022, the price of copper has seen fluctuations ranging from $4.00 to $4.80 per pound, impacting production costs for manufacturers. The U.S. Geological Survey noted that these fluctuations can lead to unpredictable cost structures, affecting profitability and pricing strategies within the market. This instability is exacerbated by global supply chain issues, necessitating companies to adapt their procurement and pricing strategies accordingly to mitigate risks associated with raw material procurement.

- Supply Chain Disruptions: Supply chain disruptions have significantly impacted the availability of wires and cables, particularly during the COVID-19 pandemic. The National Association of Manufacturers reported that over 70% of manufacturers faced supply chain issues in 2022, leading to delays in production and increased lead times for cables. This disruption is largely attributed to logistical challenges, labor shortages, and global trade tensions. As manufacturers seek to stabilize their supply chains, the challenges posed by these disruptions may limit their ability to meet growing demand in the market.

USA Wires and Cables Market Future Outlook

Over the next five years, the U.S. wires and cables market is expected to experience growth, driven by continuous infrastructure development, advancements in renewable energy integration, and increasing demand for high-performance cables in sectors such as telecommunications and automotive. The ongoing modernization of power grids and the expansion of data centers are anticipated to further propel the demand for wires and cables.

Market Opportunities

- Expansion of Smart Grids: The push towards smart grid technology offers a significant opportunity for the wires and cables market. The U.S. government has allocated over $7 billion for smart grid projects, which aim to enhance the reliability and efficiency of electricity distribution. As of 2022, nearly 25% of the U.S. power grid has been modernized, and continued investments are expected to drive further growth. This modernization requires advanced wiring systems capable of supporting increased data transmission and integration with renewable energy sources, presenting a lucrative opportunity for manufacturers in the cables sector.

- Electric Vehicle Adoption: The rising adoption of electric vehicles (EVs) is driving the demand for specialized cables needed for charging infrastructure. In 2022, sales of electric vehicles increased to over 600,000 units, reflecting a growing consumer shift towards sustainable transportation. The U.S. Department of Transportation projects the establishment of 500,000 EV charging stations across the nation, requiring substantial wiring and cabling solutions. As the EV market continues to expand, so does the demand for high-quality wires and cables capable of supporting the electrical needs of these vehicles.

Scope of the Report

| By Voltage |

Low Voltage Medium Voltage High Voltage Extra-High Voltage |

| By Installation |

Overhead Underground Submarine |

| By End-User |

Aerospace & Defense Construction (Residential, Commercial) IT & Telecommunication Power Transmission & Distribution Oil & Gas Consumer Electronics Manufacturing Automotive Others |

| By Material |

Copper Aluminum Others |

| By Region |

Northeast Midwest South West |

Products

Key Target Audience

Investors and venture capital firms

Government and regulatory bodies (e.g., Federal Energy Regulatory Commission)

Utility companies

Construction and infrastructure firms

Renewable energy companies

Telecommunications providers

Automotive manufacturers

Data center operators

Companies

Players Mentioned in the Report

Southwire Company, LLC

TE Connectivity Ltd.

Amphenol Corporation

Prysmian Group

Nexans S.A.

Belden Inc.

General Cable Corporation

Encore Wire Corporation

LS Cable & System Ltd.

Sumitomo Electric Industries, Ltd.

Table of Contents

1. U.S. Wires and Cables Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Wires and Cables Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Wires and Cables Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development

3.1.2. Renewable Energy Integration

3.1.3. Technological Advancements

3.1.4. Government Initiatives

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Supply Chain Disruptions

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Expansion of Smart Grids

3.3.2. Electric Vehicle Adoption

3.3.3. Data Center Proliferation

3.4. Trends

3.4.1. Shift Towards High-Voltage Cables

3.4.2. Emphasis on Sustainability

3.4.3. Adoption of Fire-Resistant Cables

3.5. Government Regulations

3.5.1. National Electrical Code (NEC) Standards

3.5.2. Federal Energy Regulatory Commission (FERC) Guidelines

3.5.3. Environmental Protection Agency (EPA) Directives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. U.S. Wires and Cables Market Segmentation

4.1. By Voltage (In Value %)

4.1.1. Low Voltage

4.1.2. Medium Voltage

4.1.3. High Voltage

4.1.4. Extra-High Voltage

4.2. By Installation (In Value %)

4.2.1. Overhead

4.2.2. Underground

4.2.3. Submarine

4.3. By End-User (In Value %)

4.3.1. Aerospace & Defense

4.3.2. Construction

4.3.2.1. Residential

4.3.2.2. Commercial

4.3.3. IT & Telecommunication

4.3.4. Power Transmission & Distribution

4.3.5. Oil & Gas

4.3.6. Consumer Electronics

4.3.7. Manufacturing

4.3.8. Automotive

4.3.9. Others

4.4. By Material (In Value %)

4.4.1. Copper

4.4.2. Aluminum

4.4.3. Others

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Wires and Cables Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Southwire Company, LLC

5.1.2. TE Connectivity Ltd.

5.1.3. Amphenol Corporation

5.1.4. Prysmian Group

5.1.5. Nexans S.A.

5.1.6. Belden Inc.

5.1.7. General Cable Corporation

5.1.8. Encore Wire Corporation

5.1.9. LS Cable & System Ltd.

5.1.10. Sumitomo Electric Industries, Ltd.

5.1.11. Furukawa Electric Co., Ltd.

5.1.12. Leviton Manufacturing Co., Inc.

5.1.13. CommScope Holding Company, Inc.

5.1.14. Corning Incorporated

5.1.15. Superior Essex Inc.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, R&D Investment, Strategic Initiatives, Employee Strength, Year Established)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. U.S. Wires and Cables Market Regulatory Framework

6.1. Compliance Requirements

6.2. Certification Processes

6.3. Environmental Standards

7. U.S. Wires and Cables Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Wires and Cables Future Market Segmentation

8.1. By Voltage (In Value %)

8.2. By Installation (In Value %)

8.3. By End-User (In Value %)

8.4. By Material (In Value %)

8.5. By Region (In Value %)

9. U.S. Wires and Cables Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. wires and cables market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the U.S. wires and cables market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple wire and cable manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the U.S. wires and cables market.

Frequently Asked Questions

1. How big is the U.S. Wires and Cables Market?

The U.S. wires and cables market is valued at USD 33.7 billion, primarily driven by infrastructure advancements, renewable energy adoption, and growing data center investments.

2. What are the primary growth drivers of the U.S. Wires and Cables Market?

Major growth drivers include infrastructure development, technological innovation, renewable energy integration, and government support for modernizing the power grid.

3. Who are the key players in the U.S. Wires and Cables Market?

The market is dominated by companies such as Southwire Company, LLC, TE Connectivity Ltd., Prysmian Group, Nexans S.A., and Amphenol Corporation, which benefit from established market presence, broad product portfolios, and strategic initiatives.

4. What challenges are impacting the U.S. Wires and Cables Market?

Key challenges include fluctuating raw material costs, regulatory compliance issues, and supply chain disruptions, which affect manufacturing and distribution efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.