USA Wooden Fence Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4228

November 2024

97

About the Report

USA Wooden Fence Market Overview

- The USA wooden fence market is currently valued at USD 2.7 billion, driven by strong demand from residential, agricultural, and commercial sectors. A growing emphasis on home improvement projects, coupled with increasing housing developments, has propelled the market. The rise of eco-friendly initiatives has also contributed to the increased demand for sustainable wooden materials in fencing, further driving the market. Moreover, with growing urbanization, the need for privacy and security in both residential and commercial properties continues to expand in the market. Data from sources such as the U.S. Census Bureau and home improvement reports substantiate these developments.

- The dominant regions in the USA wooden fence market include California, Texas, and Florida. These states exhibit high demand due to their large population size, housing boom, and extensive agricultural land requiring fencing solutions. California sees growth due to its focus on eco-friendly construction, while Texas and Florida benefit from vast rural areas that require fencing for agricultural purposes. Additionally, these states are also supported by strong construction sectors, driving consistent demand for wooden fencing solutions.

- The U.S. government enforces environmental protection regulations that impact the sourcing of wood for fences. The Lacey Act, amended in 2008, prohibits the importation of illegally sourced wood products, ensuring that wood used in U.S. fencing projects is sustainably harvested. The U.S. Fish and Wildlife Service, which oversees the Lacey Act, reported that over $1.5 million worth of illegal wood imports were seized in 2022. These regulations promote the use of eco-certified wood, which is essential for maintaining the environmental sustainability of the wooden fence market.

USA Wooden Fence Market Segmentation

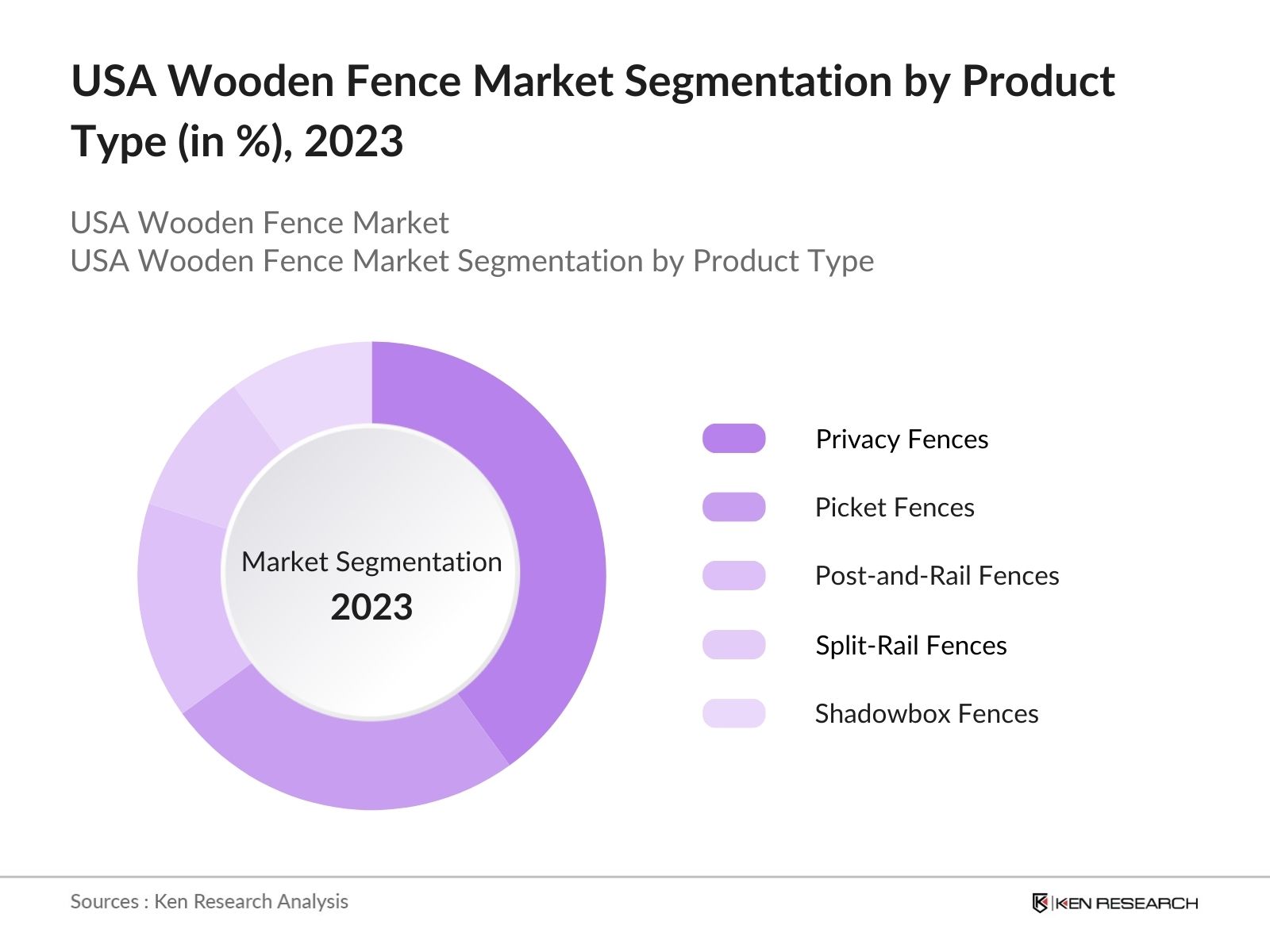

By Product Type: The market is segmented by product type into privacy fences, picket fences, post-and-rail fences, split-rail fences, and shadowbox fences. Among these, privacy fences dominate the market share due to their widespread use in residential areas, where homeowners value the added security and seclusion they offer. Privacy fences also provide a noise barrier and protection from external views, making them a popular choice in urbanized areas. Additionally, customization options and eco-friendly materials are driving growth in this segment.

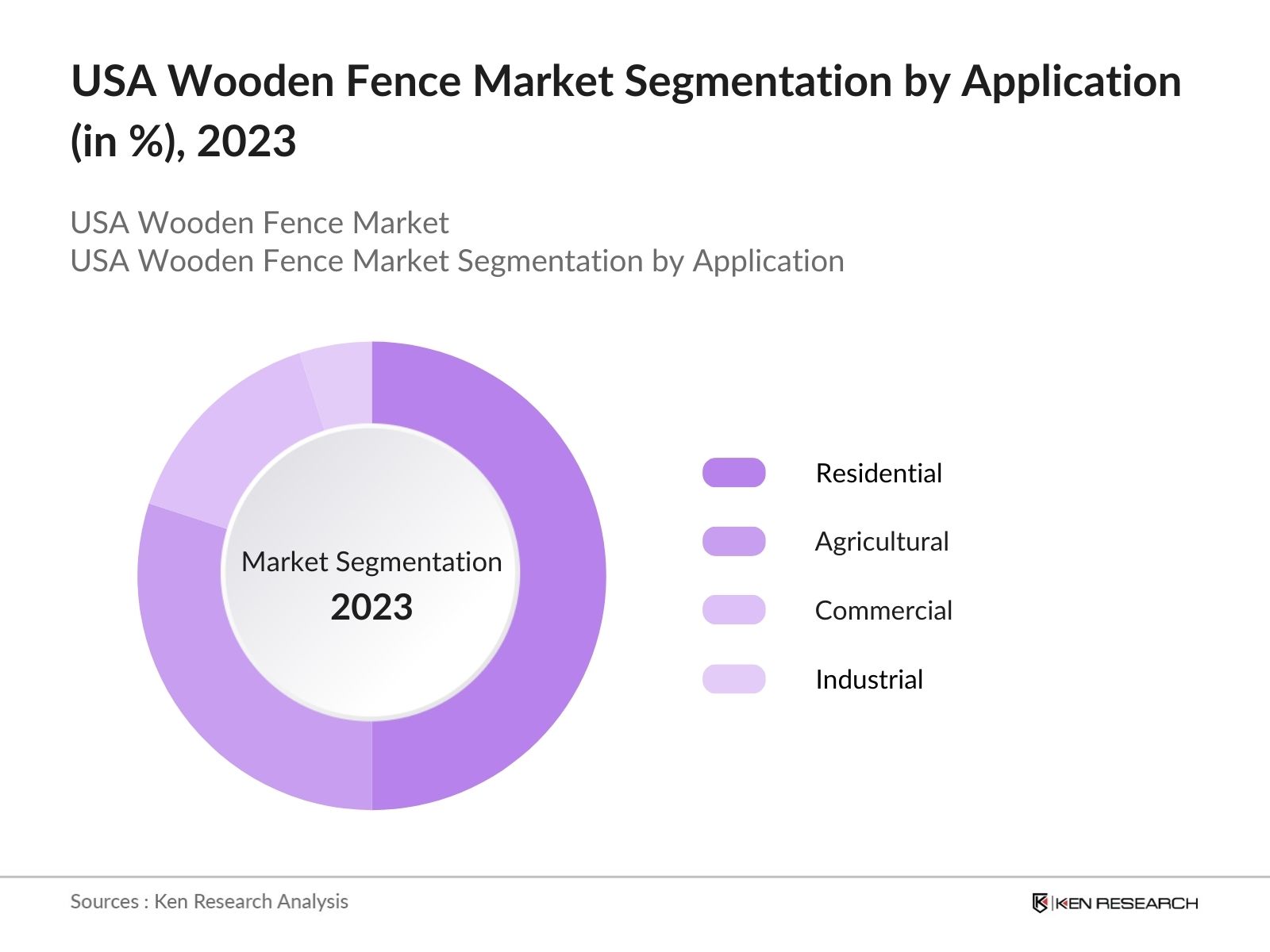

By Application: The market is further segmented by application into residential, agricultural, commercial, and industrial segments. The residential segment commands the largest market share due to increasing urbanization and a growing focus on home renovation projects. Homeowners frequently opt for wooden fencing for its aesthetic appeal, durability, and ability to enhance property value. The demand for residential fences continues to rise in suburban areas, where large outdoor spaces are common.

USA Wooden Fence Market Competitive Landscape

The USA wooden fence market is dominated by key players that offer a wide range of products and services tailored to various sectors. These companies maintain their competitive edge by investing in sustainable wood sourcing, advanced wood treatment technologies, and strong distribution networks across the United States. The market is moderately consolidated, with both large and small manufacturers competing in terms of quality, durability, and customer service. These companies have a significant influence on market trends and pricing, setting the tone for product innovation and customization.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Annual Revenue (USD) |

Market Specialization |

Material Sourcing |

Sustainability Certifications |

Geographical Presence |

R&D Investment |

|---|---|---|---|---|---|---|---|---|---|

|

YellaWood |

1970 |

Alabama, USA |

|||||||

|

Universal Forest Products |

1955 |

Michigan, USA |

|||||||

|

Lowes Companies Inc. |

1946 |

North Carolina, USA |

|||||||

|

Seegars Fence Company |

1949 |

North Carolina, USA |

|||||||

|

Alta Forest Products |

1960 |

Washington, USA |

USA Wooden Fence Industry Analysis

Growth Drivers

- Increasing Housing Developments: The expansion of the housing sector in the U.S. is a key driver for the wooden fence market, with residential construction continuing at a robust pace. In 2023, the U.S. Census Bureau reported that 1.4 million new housing units were built, reflecting an increased demand for fencing as homeowners look for both privacy and aesthetic improvements. The housing market contributes to the growth of wooden fencing, particularly in suburban and rural areas where large property boundaries require durable fencing solutions. Residential properties in states like Texas and Florida have seen significant wooden fence installations due to population growth.

- Rising Preference for Aesthetic Appeal in Landscaping: The trend of home renovations is fueling the demand for wooden fences due to their natural aesthetic appeal. According to the Joint Center for Housing Studies of Harvard University, homeowners in the U.S. spent approximately $433 billion on home renovations in 2022, including landscaping improvements such as fencing. Wooden fences offer versatility in design, which appeals to homeowners who seek to enhance their outdoor spaces. This growing preference for aesthetic enhancements in landscaping directly correlates with an increased demand for premium wooden materials like cedar and redwood.

- Expanding Agricultural Sector: The agricultural sector, accounting for over 893 million acres of farmland in the U.S. in 2023, has increased its demand for durable boundary fencing to secure livestock and crops. Wooden fences are often used in rural and farm settings due to their strength and traditional appeal. The U.S. Department of Agriculture (USDA) supports these developments with initiatives such as the Conservation Reserve Program (CRP), encouraging the use of sustainable fencing to protect farmlands and maintain ecological balance. Wooden fences are favored over metal and vinyl options for larger farm properties due to their natural fit in agricultural environments.

Market Challenges

- High Maintenance Costs: Wooden fences, despite their appeal, are prone to damage from environmental factors such as rot, termites, and moisture, increasing maintenance costs. According to the National Pest Management Association (NPMA), U.S. homeowners spend around $5 billion annually on termite damage repairs, and a significant portion of this affects wooden structures like fences. Wooden fences also require regular staining or painting, which adds to the upkeep expenses. These maintenance needs can discourage some property owners from choosing wood over lower-maintenance alternatives like vinyl or metal fencing.

- Availability of Low-Cost Alternatives: The market for wooden fences faces competition from low-cost alternatives such as vinyl and chain link fences. These materials offer longer durability and minimal maintenance compared to wood, making them attractive options for cost-conscious homeowners. The U.S. vinyl fence industry has seen consistent growth, with the American Fence Association estimating that vinyl fence installations have increased by 25% over the past three years. Vinyls resistance to weathering and ease of installation further challenges the wooden fence market, especially in urban areas where long-term durability is prioritized.

USA Wooden Fence Market Future Outlook

Over the next five years, the USA wooden fence market is expected to experience steady growth driven by several factors. Increased investments in residential construction, along with growing consumer interest in sustainable materials, will continue to propel the market. Technological advancements in wood treatment methods, which increase the lifespan and durability of wooden fences, are also anticipated to further support market expansion. The rise in urbanization, coupled with the trend of home renovation projects, will likely increase the demand for wooden fencing across both residential and commercial sectors.

Future Market Opportunities

- Increased Adoption of Customizable Fencing Solutions: There is a rising demand for customizable fencing solutions, as homeowners seek unique designs to reflect personal aesthetics. Wooden fences offer significant customization potential, including different styles, finishes, and colors. According to a report by the National Association of Home Builders (NAHB), 67% of new homeowners in 2022 opted for custom home features, including fencing. This trend toward customization creates opportunities for growth within the wooden fence market, particularly in high-income residential areas where homeowners are willing to invest in personalized fence designs.

- Government Incentives for Sustainable Construction Materials: Government incentives aimed at promoting sustainable construction practices offer a notable opportunity for the wooden fence market. Federal and state-level programs encourage the use of eco-friendly materials by providing tax breaks for sustainable construction. In 2023, the U.S. Green Building Council reported that homeowners who used FSC-certified wood for their building projects, including fencing, could receive tax credits under various state sustainability programs. These incentives make it more affordable for homeowners to opt for sustainable wood, boosting demand for eco-certified wooden fences.

Scope of the Report

|

By Product Type |

Privacy Fences Picket Fences Post-and-Rail Fences Split-Rail Fences Shadowbox Fences |

|

By Material Type |

Cedar Redwood Pine Pressure-Treated Wood Composite Wood |

|

By Application |

Residential Commercial Agricultural Industrial |

|

By Distribution Channel |

Offline (Home Improvement Stores, Specialty Retailers) Online (E-commerce Platforms) |

|

By Region |

Northeast Midwest Southern Western |

Products

Key Target Audience

Investments and venture capitalist firms

Government and regulatory bodies (U.S. Environmental Protection Agency, U.S. Department of Agriculture)

Residential and commercial property developers

Agricultural landowners

Construction and fencing contractors

Banks and Financial Institutes

Manufacturers of wooden fencing materials

Home improvement retailers

Sustainability advocacy organizations

Companies

Major Players

YellaWood

Universal Forest Products

Lowes Companies Inc.

Seegars Fence Company

Alta Forest Products

Home Depot

CertainTeed

Viking Fence

ActiveYards

Superior Fence & Rail

United States Fence Inc.

Red Cedar Fence Company

Nationwide Fence Supply

United Fence Company

Midwest Fence Company

Table of Contents

USA Wooden Fence Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Materials Used in Wooden Fencing (Lumber, Cedar, Redwood, Pine, Pressure-Treated Wood)

1.4. Market Segmentation Overview

USA Wooden Fence Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Wooden Fence Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Housing Developments (Residential Construction Rates)

3.1.2. Rising Preference for Aesthetic Appeal in Landscaping (Home Renovation Projects)

3.1.3. Expanding Agricultural Sector (Farm Boundary Fencing Needs)

3.1.4. Sustainability Preferences (Eco-friendly Materials in Wooden Fencing)

3.2. Market Challenges

3.2.1. High Maintenance Costs (Wooden Fences Vulnerability to Rot and Termites)

3.2.2. Availability of Low-Cost Alternatives (Vinyl, Chain Link, Metal Fences)

3.2.3. Deforestation Concerns (Supply of Sustainable Wood)

3.2.4. Labor Shortage in the Construction Industry

3.3. Opportunities

3.3.1. Increased Adoption of Customizable Fencing Solutions (Customization Options for Homeowners)

3.3.2. Government Incentives for Sustainable Construction Materials (Tax Breaks for Sustainable Wood)

3.3.3. Innovations in Wood Treatment Technologies (Improved Durability)

3.4. Trends

3.4.1. Rising Use of Eco-Certified Wood Products (FSC and PEFC Certified Materials)

3.4.2. Shift Towards DIY Installation Kits (Ease of Use for Homeowners)

3.4.3. Increased Demand for Privacy and Security Features in Residential Areas

3.5. Government Regulation

3.5.1. Building Codes for Fencing (State and Federal Zoning Regulations)

3.5.2. Environmental Protection Regulations (Sustainable Wood Sourcing)

3.5.3. Property Boundary Laws (Legal Guidelines for Fence Installation)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Retailers, Builders, Property Developers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

USA Wooden Fence Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Privacy Fences

4.1.2. Picket Fences

4.1.3. Post-and-Rail Fences

4.1.4. Split-Rail Fences

4.1.5. Shadowbox Fences

4.2. By Material Type (In Value %)

4.2.1. Cedar

4.2.2. Redwood

4.2.3. Pine

4.2.4. Pressure-Treated Wood

4.2.5. Composite Wood

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Agricultural

4.3.4. Industrial

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Home Improvement Stores, Specialty Retailers)

4.4.2. Online (E-commerce Platforms)

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. Southern

4.5.4. Western

USA Wooden Fence Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ActiveYards

5.1.2. Seegars Fence Company

5.1.3. CertainTeed

5.1.4. Long Fence

5.1.5. Superior Fence & Rail

5.1.6. Home Depot

5.1.7. Lowes Companies Inc.

5.1.8. Viking Fence

5.1.9. YellaWood

5.1.10. Nationwide Fence Supply

5.1.11. Viking Fence Company

5.1.12. Red Cedar Fence Company

5.1.13. Universal Forest Products

5.1.14. United States Fence Inc.

5.1.15. Alta Forest Products

5.2. Cross Comparison Parameters (Number of Employees, Revenue, Headquarters, Market Share, Supply Chain Strength, Product Range, Certifications, Material Sourcing)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants for Sustainability

5.8. Venture Capital and Private Equity Funding

USA Wooden Fence Market Regulatory Framework

6.1. Environmental Regulations for Wood Procurement

6.2. Construction Zoning Laws and Permits

6.3. Occupational Safety Standards for Fence Installation

USA Wooden Fence Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

USA Wooden Fence Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

USA Wooden Fence Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the key stakeholders in the USA Wooden Fence Market, including manufacturers, suppliers, retailers, and end-users. Extensive desk research is conducted to gather relevant industry-level information from credible sources such as industry reports, government publications, and proprietary databases.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to understand market trends and dynamics. The analysis covers market penetration, sales volume, and material preferences. Data on wood procurement, supply chain dynamics, and customer preferences is also assessed to provide a comprehensive market overview.

Step 3: Hypothesis Validation and Expert Consultation

To validate the collected data, in-depth interviews with industry experts, including fence manufacturers and suppliers, are conducted. These consultations provide real-time insights into market dynamics, product innovations, and consumer preferences. These discussions help in refining the research findings.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data to provide a complete and accurate analysis of the USA Wooden Fence Market. This involves collaboration with manufacturers to cross-verify product segmentation, pricing strategies, and distribution channels. The synthesis ensures that the final output is both comprehensive and validated.

Frequently Asked Questions

01. How big is the USA Wooden Fence Market?

The USA wooden fence market is valued at USD 2.7 billion, driven by strong demand from residential and agricultural sectors, as well as the growing emphasis on sustainable materials for construction.

02. What are the challenges in the USA Wooden Fence Market?

Challenges in the USA wooden fence market include the high maintenance costs of wooden fences, competition from low-cost alternatives like vinyl and metal, and concerns over deforestation and sustainable wood sourcing.

03. Who are the major players in the USA Wooden Fence Market?

Key players in the USA wooden fence market include YellaWood, Universal Forest Products, Lowes Companies Inc., Seegars Fence Company, and Alta Forest Products. These companies dominate the market due to their extensive distribution networks, product variety, and commitment to sustainability.

04. What are the growth drivers of the USA Wooden Fence Market?

The USA wooden fence market is driven by factors such as increased residential construction, demand for privacy and security solutions in urban areas, and the growing popularity of home improvement projects. Additionally, the use of eco-certified wood products is contributing to market growth.

05. Which product type dominates the USA Wooden Fence Market?

Privacy fences dominate the USA wooden fence market due to their widespread use in residential areas. They offer homeowners enhanced security, privacy, and aesthetic appeal, making them a popular choice in both suburban and urban locations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.