USA Yeast Extracts Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD6519

December 2024

88

About the Report

USA Yeast Extracts Market Overview

- The USA Yeast Extracts Market is valued at USD 1.4 billion, supported by a five-year historical analysis. This market size is primarily driven by the increasing demand for natural flavor enhancers in food and beverages, particularly as consumers move away from synthetic additives like MSG. The growing trend for clean-label products has pushed manufacturers to incorporate yeast extracts as natural flavor enhancers and nutritional fortifiers in processed food products.

- The market sees dominance from key metropolitan areas such as New York, Chicago, and Los Angeles, driven by the high demand for processed foods and functional ingredients in these regions. These cities are hubs for major food and beverage manufacturing, which increasingly rely on yeast extracts as clean-label substitutes to cater to health-conscious consumers. Additionally, the significant presence of pharmaceutical and biotechnology companies in these cities further enhances demand for yeast extracts in clinical nutrition and drug formulation.

- The FDA's voluntary sodium reduction guidelines, updated in 2024, aim to lower sodium intake in processed foods. This government initiative is driving food manufacturers to explore alternatives such as yeast extracts, which can enhance flavor while reducing sodium content. As a result, manufacturers are expected to increase the incorporation of yeast extracts in over 50,000 food product lines to meet these guidelines.

USA Yeast Extracts Market Segmentation

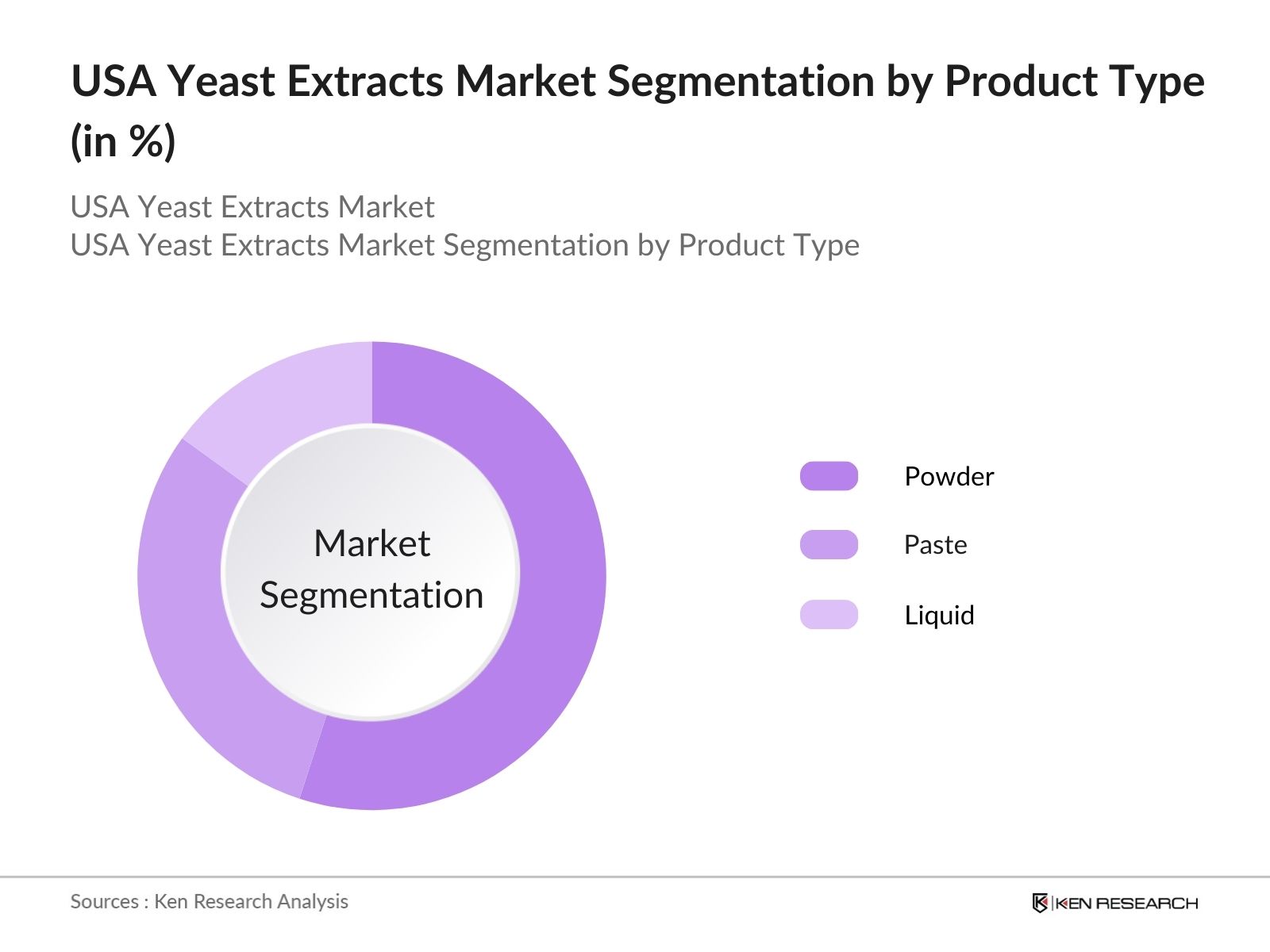

By Product Type: The market is segmented by product type into powder, paste, and liquid. Recently, powder yeast extracts have dominated market share due to their convenience in handling and widespread application across multiple industries. Powdered forms are widely used as flavor enhancers in the food and beverage industry, owing to their ease of incorporation and storage. Additionally, their longer shelf life compared to liquid forms adds to their preference among manufacturers.

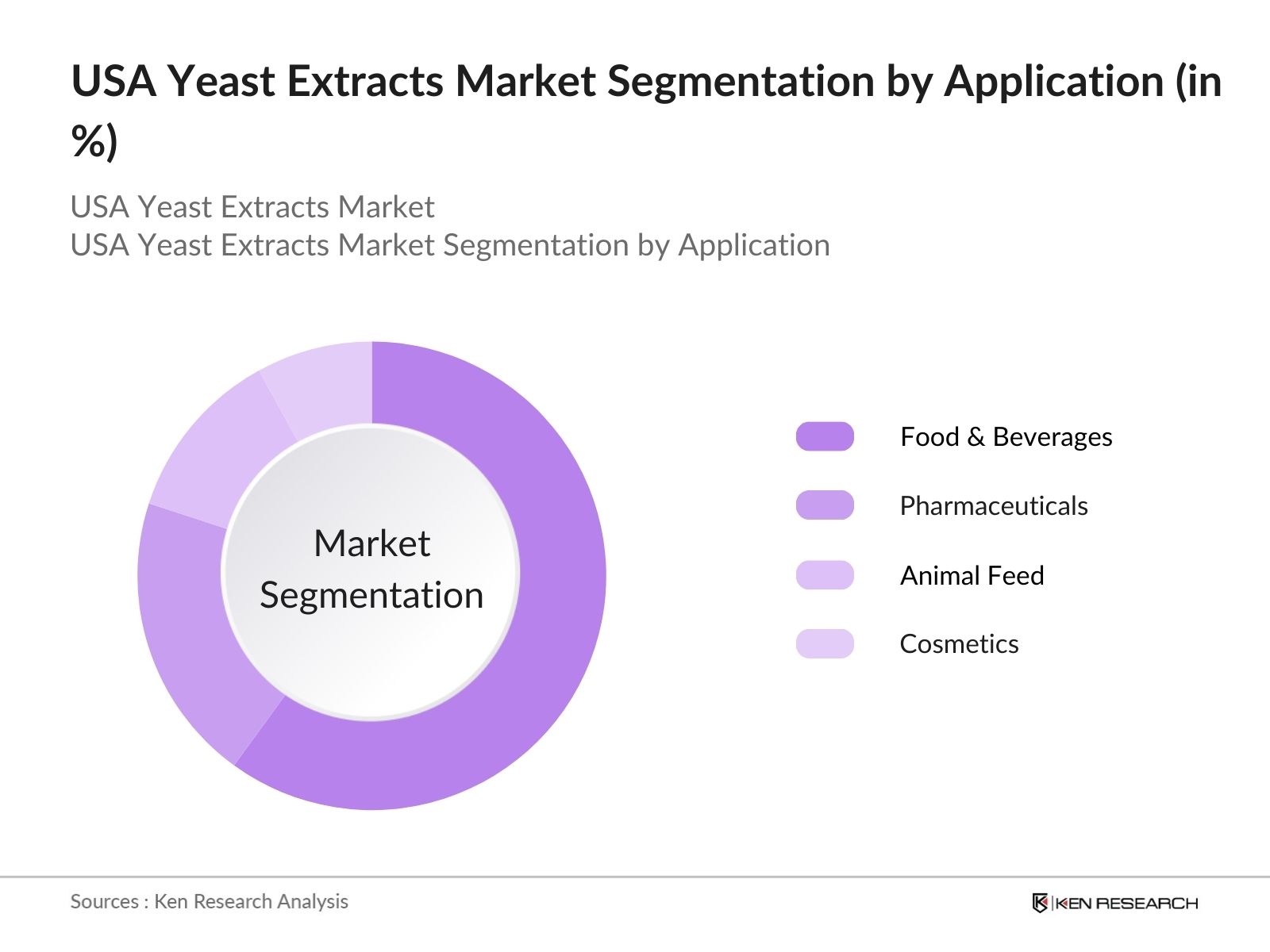

By Application: In terms of application, the market is segmented into food and beverages, pharmaceuticals, animal feed, and cosmetics. The food and beverages sector holds the largest share due to the rising demand for savory snacks, soups, and sauces, where yeast extracts are widely used as natural flavor enhancers. The bakery industry, in particular, has been increasingly adopting yeast extracts to enhance the flavor and nutritional content of products.

USA Yeast Extracts Market Competitive Landscape

The market is characterized by a mix of established multinational corporations and a few smaller players, with major companies focusing on product innovation, strategic acquisitions, and expanding their reach through distribution channels.

USA Yeast Extracts Market Analysis

Market Growth Drivers

- Rising Demand for Clean Label Ingredients: The increasing consumer shift towards clean-label products is driving the demand for yeast extracts in the USA. According to the 2024 macroeconomic indicators, health-conscious consumers are leaning toward natural flavor enhancers like yeast extracts, avoiding artificial additives. This trend is fueled by the rise of organic and non-GMO food products, which has grown by over 600 million new product introductions in 2023 alone.

- Growth of the Plant-based Food Industry: The plant-based food industry is driving demand for yeast extracts, which are increasingly used in vegan and vegetarian products. As plant-based diets gain popularity, manufacturers are leveraging yeast extracts to enhance the umami flavors in plant-based meats and dairy alternatives.

- Expansion in Processed Food Manufacturing: With processed food sales reaching $4.6 billion in 2023 in the USA, yeast extracts have become a key ingredient due to their ability to reduce sodium and enhance flavor without chemical additives. The expansion of the processed food sector, driven by busy lifestyles and convenience-seeking consumers, is boosting the demand for natural flavor enhancers.

Market Challenges

- Price Volatility of Raw Materials: The cost of molasses, a key raw material in yeast extract production, has shown fluctuations, impacting overall production costs. In 2024, the average price of molasses increased by $200 per ton due to supply chain disruptions, affecting the pricing strategies of yeast extract manufacturers.

- Strict Regulatory Environment: Stringent food safety regulations imposed by the FDA and USDA pose challenges to yeast extract producers. In 2024, new labeling laws were introduced that require clearer ingredient listings on food packaging, which can increase compliance costs for manufacturers.

USA Yeast Extracts Market Future Outlook

Over the next five years, the USA yeast extracts industry is expected to show steady growth, driven by rising demand for clean-label food ingredients, consumer inclination toward plant-based diets, and the growing popularity of functional foods and nutraceuticals.

Future Market Opportunities

- Increased Adoption in Low-Sodium Foods: In the next five years, the market is expected to see a rise in adoption across low-sodium food products, driven by FDA guidelines and consumer health awareness. By 2028, yeast extracts are forecasted to be used in over 75,000 new low-sodium product formulations in the USA, addressing growing concerns over high-sodium diets.

- Growth in Plant-based Food Applications: The demand for yeast extracts in the plant-based food sector will continue to grow, with an estimated 250,000 tons of yeast extracts being incorporated into plant-based meat and dairy alternatives by 2029. This trend will be fueled by the increasing consumer shift toward vegan and vegetarian diets and the ongoing innovations in plant-based food manufacturing.

Scope of the Report

|

Product Type |

Powder Paste Liquid |

|

Application |

Food & Beverages Pharmaceuticals Animal Feed Cosmetics |

|

Source |

Baker's Yeast Brewers Yeast Torula Yeast |

|

Form |

Powder Liquid |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food and Beverage Manufacturers

Nutraceutical Companies

Pharmaceutical Manufacturers

Cosmetics Manufacturers

Animal Feed Producers

Government Regulatory Bodies (e.g., FDA, USDA)

Investor and Venture Capitalist Firms

Biotech and Fermentation Companies

Companies

Players Mentioned in the Report:

Kerry Group

Lallemand Inc.

Lesaffre Group

Angel Yeast Co. Ltd.

DSM

Leiber GmbH

BioOrigin

Titan Biotech

AB Mauri North America

Ohly GmbH

Table of Contents

1. USA Yeast Extracts Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Yeast Extracts Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Yeast Extracts Market Analysis

3.1 Growth Drivers (Demand for Clean-Label Ingredients, Consumer Health Trends, Food Safety Regulations, and Sustainability Focus)

3.2 Market Challenges (Price Volatility of Raw Materials, Supply Chain Disruptions, and Stringent FDA Regulations)

3.3 Opportunities (Increasing Demand for Functional Foods, Expansion into Alternative Protein Segments, and Collaborations with Biotech Firms)

3.4 Trends (Adoption of Yeast Extracts as MSG Substitutes, Plant-Based Food Applications, Use in Nutraceuticals, and Eco-Friendly Production Techniques)

3.5 Government Regulations (FDA Guidelines on Yeast Extract Usage, Labeling Requirements, and Import/Export Standards)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem (Strategic Collaborations, R&D Investments, and New Product Launches)

4. USA Yeast Extracts Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Powder

4.1.2 Paste

4.1.3 Liquid

4.2 By Application (In Value %)

4.2.1 Food and Beverages (Savory Snacks, Bakery, Dairy, Meat & Poultry Products, Sauces & Soups)

4.2.2 Pharmaceuticals (Nutritional Supplements, Immunity Boosters)

4.2.3 Animal Feed (Nutritional Additives, Palatability Enhancers)

4.2.4 Cosmetics (Skin Care, Hair Health Products)

4.3 By Source (In Value %)

4.3.1 Bakers Yeast

4.3.2 Brewers Yeast

4.3.3 Torula Yeast

4.4 By Form (In Value %)

4.4.1 Powder

4.4.2 Liquid

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Yeast Extracts Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Kerry Group

5.1.2 Lallemand Inc.

5.1.3 Lesaffre Group

5.1.4 Angel Yeast Co. Ltd.

5.1.5 DSM

5.1.6 Leiber GmbH

5.1.7 BioOrigin

5.1.8 Titan Biotech

5.1.9 AB Mauri North America

5.1.10 Ohly GmbH

5.1.11 Fuji Foods Corporation

5.1.12 Halcyon Proteins

5.1.13 Synergy Flavors

5.1.14 Alltech

5.1.15 Sensient Technologies

5.2 Cross Comparison Parameters (Product Portfolio, Headquarters, R&D Focus, Distribution Channels, Certifications, Partnerships, Revenue, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Equity, Government Grants, Venture Capital)

6. USA Yeast Extracts Market Regulatory Framework

6.1 FDA Guidelines

6.2 Compliance and Certification Requirements

6.3 Environmental Standards for Yeast Extract Production

7. USA Yeast Extracts Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Yeast Extracts Future Market Segmentation

8.1 By Product Type

8.2 By Application

8.3 By Source

8.4 By Form

8.5 By Region

9. USA Yeast Extracts Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation and Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves identifying critical variables that influence the USA Yeast Extracts Market, such as product demand in various industries, technological advancements, and regulatory influences. Extensive secondary research is conducted, drawing data from government publications, industry databases, and company reports.

Step 2: Market Analysis and Construction

We analyze historical data from trusted sources to assess market trends, segment penetration, and the ratio of product sales. This helps determine the accuracy of market forecasts and ensures the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through direct interviews with industry professionals, providing insights into operational strategies, pricing trends, and competitive dynamics. These consultations help corroborate market data.

Step 4: Research Synthesis and Final Output

Finally, a detailed synthesis of all research findings is performed, including input from key stakeholders. The data is aggregated to provide an accurate and validated analysis of the USA Yeast Extracts Market.

Frequently Asked Questions

01. How big is the USA Yeast Extracts Market?

The USA Yeast Extracts Market was valued at USD 1.4 billion, with growth driven by consumer demand for clean-label ingredients and functional foods.

02. What are the key challenges in the USA Yeast Extracts Market?

Challenges in the USA Yeast Extracts Market include fluctuating raw material prices, regulatory restrictions by the FDA, and the competition from synthetic flavor enhancers.

03. Who are the major players in the USA Yeast Extracts Market?

Key players in the USA Yeast Extracts Market include Kerry Group, Lallemand Inc., Lesaffre Group, Angel Yeast Co. Ltd., and DSM.

04. What are the growth drivers of the USA Yeast Extracts Market?

Growth in the USA Yeast Extracts Market is driven by increasing consumer awareness of clean-label foods, rising demand for natural flavor enhancers, and advancements in biotechnology.

05. What industries utilize yeast extracts the most in the USA?

Yeast extracts are predominantly used in the food and beverage industry, followed by pharmaceuticals, animal feed, and cosmetics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.