USA Yogurt and Probiotic Drink Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD5833

December 2024

98

About the Report

USA Yogurt and Probiotic Drink Market Overview

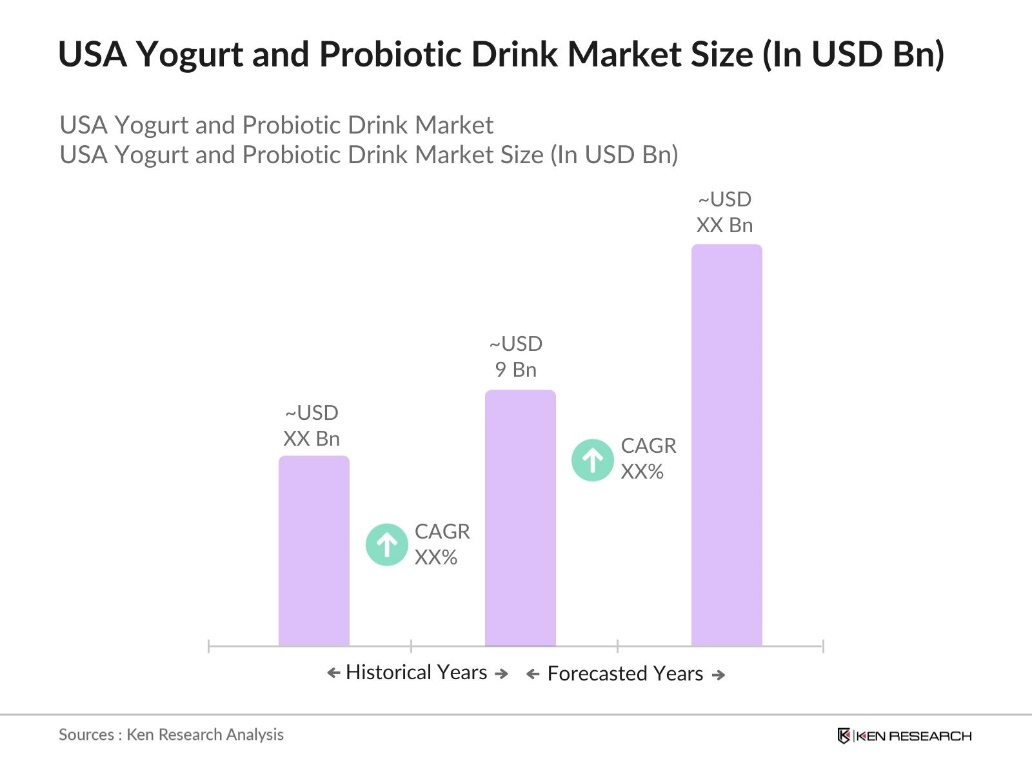

- The USA Yogurt and Probiotic Drink Market is valued at USD 9 billion based on a five-year historical analysis. The market is driven by rising health consciousness among consumers, emphasizing digestive health benefits and the demand for functional foods. Factors such as increasing awareness of the gut microbiome's impact on overall health and the incorporation of probiotics into daily diets are critical drivers, supported by robust product innovation by major brands.

- The market dominance is particularly notable in states like California and New York, where health and wellness trends are more pronounced, coupled with a high concentration of health-conscious consumers. These states benefit from strong distribution networks, a higher prevalence of organic food retail chains, and significant urban populations, contributing to the markets leadership.

- The U.S. government introduced the Food Labeling Act of 2023 to enhance transparency and accountability in product labeling. This legislation mandates standardized phrases for quality and discard dates"BEST If Used By" and "USE By," respectivelyto provide consumers with clear information about product freshness and safety. The act also aims to reduce food waste by relaxing certain state restrictions on the sale or donation of past-date foods.

USA Yogurt and Probiotic Drink Market Segmentation

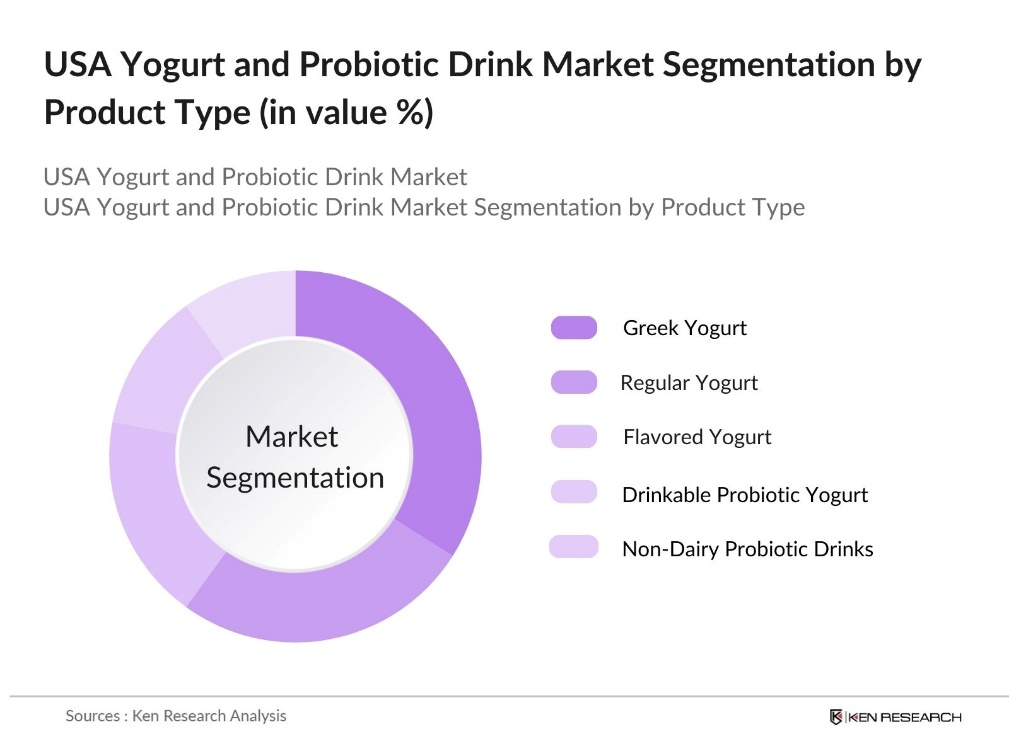

By Product Type: The market is segmented by product type into Greek yogurt, regular yogurt, flavored yogurt, drinkable probiotic yogurt, and non-dairy probiotic drinks. Greek yogurt holds the dominant market share within this segment due to its high protein content, creamy texture, and consumer preference for nutritious, satiating products. The continued focus on healthy lifestyles and the integration of high-protein diets have bolstered the segment's leadership.

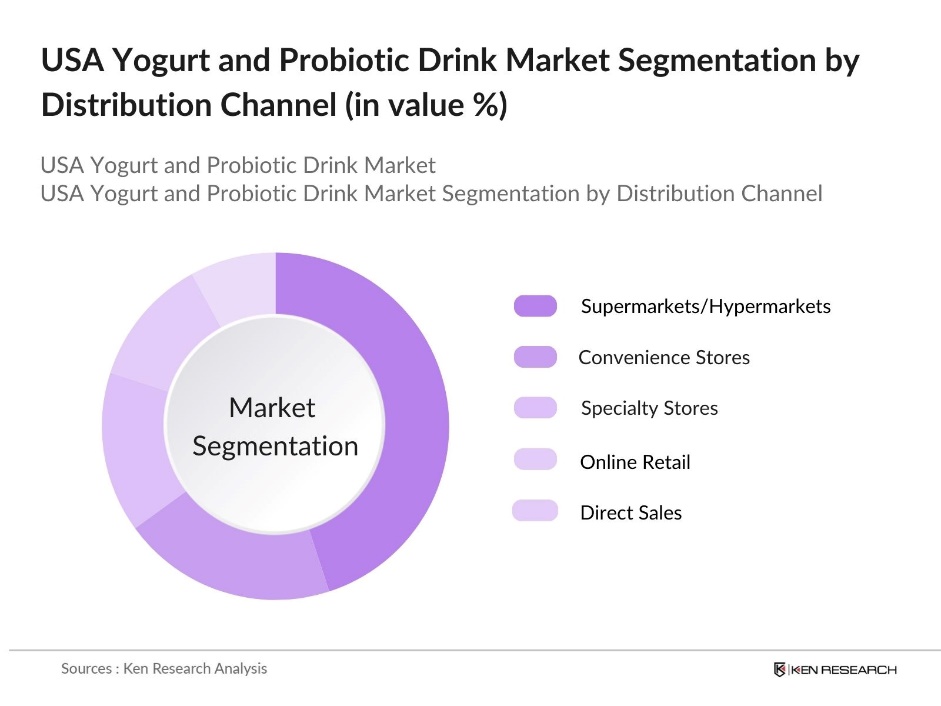

By Distribution Channel: The market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and direct sales. Supermarkets and hypermarkets dominate the distribution channel segment due to their extensive reach, diverse product availability, and strategic partnerships with leading yogurt brands, enabling customers easy access to a variety of products.

USA Yogurt and Probiotic Drink Market Competitive Landscape

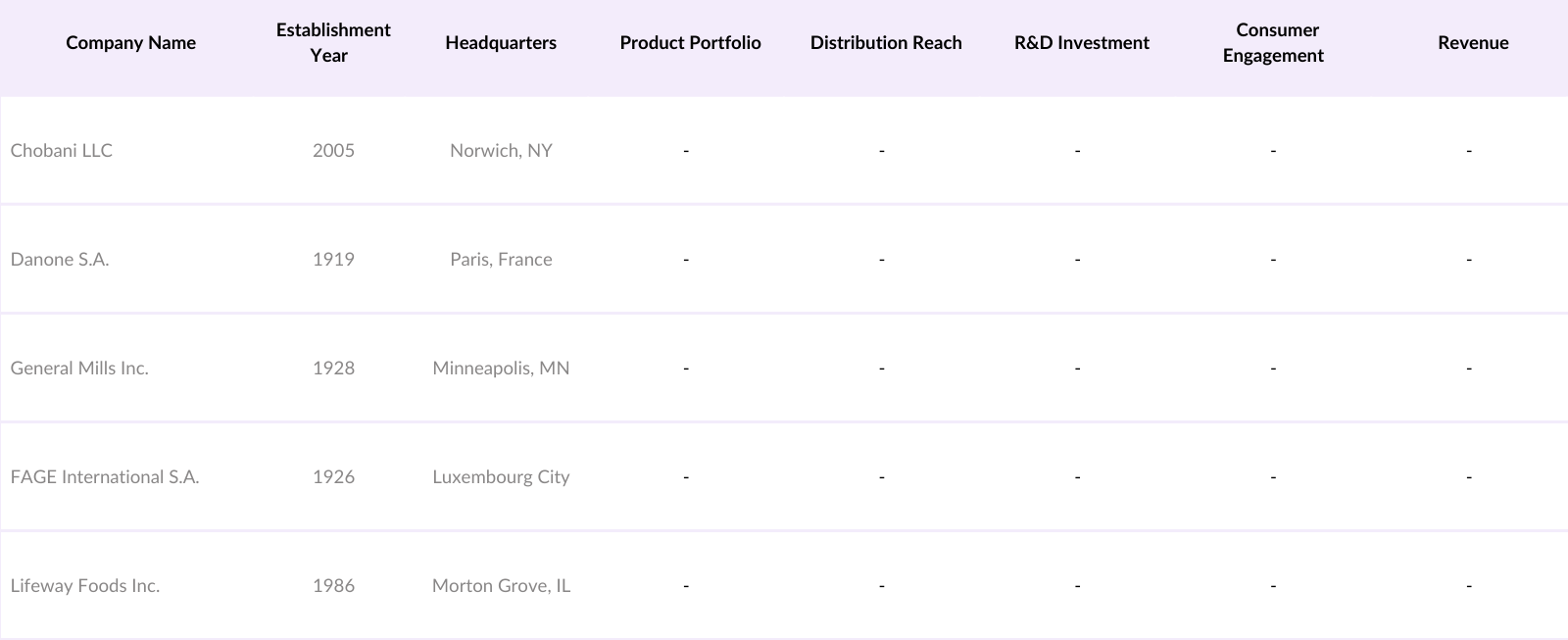

The USA Yogurt and Probiotic Drink market is dominated by key players that lead in terms of innovation, distribution, and brand loyalty. This consolidation highlights the significant influence of well-established brands.

USA Yogurt and Probiotic Drink Industry Analysis

Growth Drivers

- Increasing Consumer Health Awareness: Consumer health awareness has surged in the USA, driven by an increase in lifestyle-related illnesses. According to the CDC, over 34.2 million adults in the country were diagnosed with diabetes as of 2022. This trend has motivated consumers to adopt healthier dietary habits, including yogurt and probiotic drinks known for their gut health benefits. The rise in health-conscious decisions is catalyzing demand for these functional products, highlighting the relevance of nutrient-dense, probiotic-enriched foods in daily diets.

- Rise in Probiotic Benefits Awareness: Awareness of the health benefits of probiotics has grown substantially due to their impact on digestive health and immunity. The National Center of Biotechnology Information (NCBI) estimates that around 11% of the U.S. population suffers from chronic digestive diseases, with this rate increasing to 35% among individuals aged 65 and older. Government-backed health campaigns have emphasized the advantages of probiotics, bolstering their consumption.

- Dietary Shifts Toward Protein-Rich Products: Shifts in consumer dietary preferences toward high-protein foods are driving demand for yogurt and probiotic drinks. Updated dietary guidelines encourage increased protein intake for improved health, making protein-enriched probiotic yogurt particularly appealing. This trend has led manufacturers to introduce protein-rich probiotic drinks and dairy-based yogurts that align with evolving dietary preferences.

Market Challenges

- Regulatory Compliance and Labeling Requirements: The USA's FDA enforces strict regulations on labeling and health claims for probiotic products. Compliance with these standards can be challenging for manufacturers due to the complex documentation and procedures involved. Additionally, increased scrutiny from the Federal Trade Commission (FTC) on product claims emphasizes the need for substantiated evidence, adding further complexity for probiotic and yogurt producers.

- Fluctuations in Raw Material Costs: The cost of milk, a key raw material for yogurt, has experienced fluctuations due to disruptions in the global supply chain. Factors such as geopolitical issues and weather patterns affecting agriculture contribute to these variations, impacting production costs for yogurt manufacturers. This volatility in raw material pricing creates financial challenges for producers, affecting profitability and influencing pricing strategies in the market.

USA Yogurt and Probiotic Drink Market Future Outlook

The USA Yogurt and Probiotic Drink market is set to experience continuous growth due to increasing consumer awareness about the benefits of probiotics, coupled with evolving dietary preferences prioritizing gut health. The expansion of plant-based and non-dairy probiotic products is expected to further fuel market diversification and attract a broader range of consumers looking for dairy-free alternatives.

Market Opportunities

- Innovative Product Flavors and Formulations: There are significant opportunities in the market to develop unique product flavors and formulations that cater to evolving consumer tastes. Younger consumers are particularly open to experimenting with new flavors, making product diversification appealing. Brands that introduce innovative combinations, such as probiotics with immune-supporting vitamins, are well-positioned to attract this demographic. Additionally, incorporating vitamins and minerals into products aligns with current health trends, enhancing appeal through multifunctional food solutions.

- Expansion into Untapped Regional Markets: Expanding into less saturated regions within the USA offers growth potential for yogurt and probiotic drink brands. Southern and midwestern states, for example, are showing growing interest in health-focused products but remain relatively underserved by these brands. Targeted marketing efforts and regional partnerships can help bridge this gap, increasing market reach and visibility in these secondary markets.

Scope of the Report

|

Product Type |

Greek Yogurt Regular Yogurt Flavored Yogurt Drinkable Probiotic Yogurt Non-Dairy Probiotic Drinks |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail Direct Sales |

|

Packaging Type |

Plastic Bottles Glass Bottles Tetra Packs Pouches |

|

Consumer Segment |

Children Adults Seniors |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Yogurt and Probiotic Product Manufacturers

Health and Wellness Industry

Nutritional Product Manufactures

Health and Wellness Industry

Government and Regulatory Bodies (e.g., FDA, USDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Chobani LLC

Danone S.A.

General Mills Inc.

FAGE International S.A.

Lifeway Foods Inc.

Stonyfield Farm Inc.

The Icelandic Milk and Skyr Corp. (Siggi's)

GoodBelly Probiotics

Yakult Honsha Co., Ltd.

Maple Hill Creamery LLC

Table of Contents

1. USA Yogurt and Probiotic Drink Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. USA Yogurt and Probiotic Drink Market Size (In USD Mn)

2.1. Historical Market Size Analysis

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Yogurt and Probiotic Drink Market Analysis

3.1. Growth Drivers (e.g., Health Consciousness, Demand for Functional Beverages)

3.1.1. Increasing Consumer Health Awareness

3.1.2. Rise in Probiotic Benefits Awareness

3.1.3. Dietary Shifts Toward Protein-rich Products

3.1.4. Growing Popularity of Gut Health Solutions

3.2. Market Challenges (e.g., High Production Costs, Regulatory Compliance)

3.2.1. Regulatory Compliance and Labeling Requirements

3.2.2. Fluctuations in Raw Material Costs

3.2.3. Competition from Plant-based Alternatives

3.2.4. Distribution Channel Challenges

3.3. Opportunities (e.g., Innovations, Expanding Distribution Networks)

3.3.1. Innovative Product Flavors and Formulations

3.3.2. Expansion into Untapped Regional Markets

3.3.3. Strategic Partnerships with Retailers

3.4. Trends (e.g., Organic and Non-Dairy Variants, Packaging Innovations)

3.4.1. Growing Demand for Organic Yogurt

3.4.2. Increasing Availability of Plant-based Probiotic Drinks

3.4.3. Sustainable Packaging Solutions

3.5. Regulatory Framework (e.g., FDA Regulations, Labeling Guidelines)

3.5.1. Federal Regulations on Probiotic Claims

3.5.2. Nutritional Labeling Compliance

3.5.3. State-specific Requirements

3.5.4. Import Tariffs and Trade Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem Overview

4. USA Yogurt and Probiotic Drink Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Greek Yogurt

4.1.2. Regular Yogurt

4.1.3. Flavored Yogurt

4.1.4. Drinkable Probiotic Yogurt

4.1.5. Non-Dairy Probiotic Drinks

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Specialty Stores

4.2.4. Online Retail

4.2.5. Direct Sales

4.3. By Packaging Type (In Value %)

4.3.1. Plastic Bottles

4.3.2. Glass Bottles

4.3.3. Tetra Packs

4.3.4. Pouches

4.4. By Consumer Segment (In Value %)

4.4.1. Children

4.4.2. Adults

4.4.3. Seniors

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Yogurt and Probiotic Drink Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Chobani LLC

5.1.2. Danone S.A.

5.1.3. General Mills Inc. (Yoplait)

5.1.4. FAGE International S.A.

5.1.5. Stonyfield Farm Inc.

5.1.6. Lifeway Foods Inc.

5.1.7. The Icelandic Milk and Skyr Corp. (Siggi's)

5.1.8. GoodBelly Probiotics

5.1.9. Yakult Honsha Co., Ltd.

5.1.10. Maple Hill Creamery LLC

5.1.11. Clover Sonoma

5.1.12. Horizon Organic

5.1.13. Califia Farms

5.1.14. GTs Living Foods

5.1.15. Nancys Probiotic Foods

5.2. Cross Comparison Parameters (Product Portfolio, Distribution Reach, Revenue, R&D Investment, Sustainability Initiatives, Brand Value, Market Penetration, Consumer Engagement)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Government Grants and Support

5.8. Private Equity and Venture Capital Involvement

6. USA Yogurt and Probiotic Drink Market Regulatory Framework

6.1. Federal Food Safety Regulations

6.2. Probiotic Health Claims Standards

6.3. Import and Export Policies

6.4. FDA and USDA Compliance

8. USA Yogurt and Probiotic Drink Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Consumer Segment (In Value %)

8.5. By Region (In Value %)

9. USA Yogurt and Probiotic Drink Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing and Branding Initiatives

9.4. White Space and Growth Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping the industry ecosystem, identifying major stakeholders, and analyzing market data through robust desk research. Comprehensive databases were used to gather insights on distribution channels, product type trends, and consumer behavior.

Step 2: Market Analysis and Construction

Historical data analysis was conducted to evaluate market penetration, segment trends, and revenue generation. This included an assessment of the balance between product types and the dominant distribution channels, supplemented by revenue data.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics were verified through consultations with industry experts and stakeholders using computer-assisted telephone interviews (CATIs). These engagements ensured the alignment of primary data with industry trends and operational insights.

Step 4: Research Synthesis and Final Output

In-depth discussions with market leaders provided detailed insights into product launches, sales performance, and consumer preferences. This bottom-up approach helped corroborate data accuracy, ensuring a validated and comprehensive market analysis.

Frequently Asked Questions

01 How big is the USA Yogurt and Probiotic Drink Market?

The USA Yogurt and Probiotic Drink market was valued at USD 9 billion, driven by increasing consumer demand for digestive health solutions and functional beverages.

02 What are the main challenges in the USA Yogurt and Probiotic Drink Market?

Challenges in USA Yogurt and Probiotic Drink market include high production and distribution costs, regulatory compliance related to health claims, and competition from plant-based alternatives.

03 Who are the major players in the USA Yogurt and Probiotic Drink Market?

Key players in USA Yogurt and Probiotic Drink market include Chobani LLC, Danone S.A., General Mills Inc., FAGE International S.A., and Lifeway Foods Inc., known for their extensive product ranges and distribution networks.

04 What are the growth drivers of the USA Yogurt and Probiotic Drink Market?

The USA Yogurt and Probiotic Drink market is driven by rising health consciousness, innovation in product flavors and formats, and increased awareness about the benefits of probiotics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.