Vietnam 1,4 Butanediol Derivatives Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD8454

November 2024

94

About the Report

Vietnam 1,4 Butanediol Derivatives Market Overview

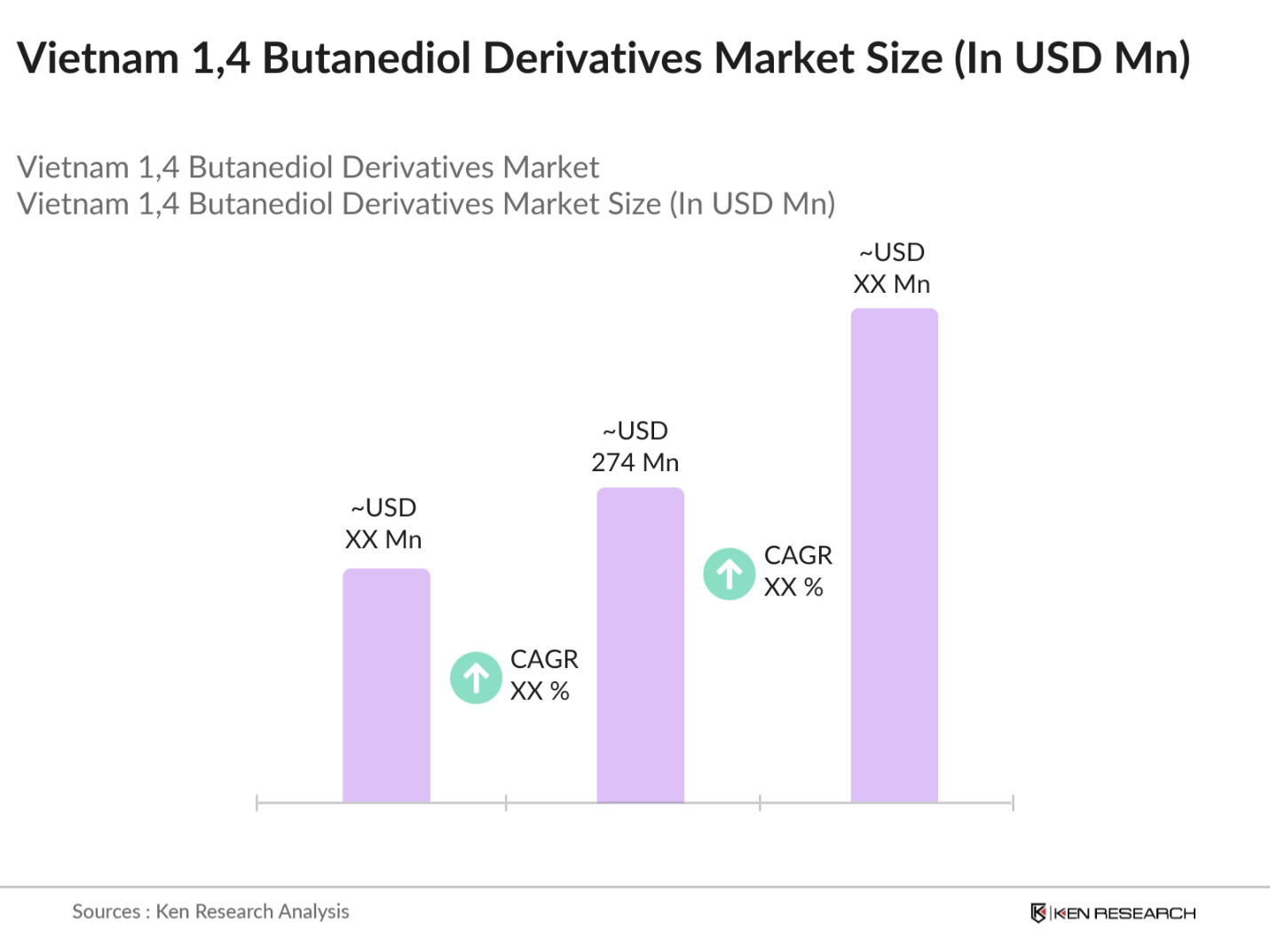

- The Vietnam 1,4 Butanediol Derivatives market is valued at USD 274 million, based on a five-year historical analysis. Growth in this market is driven by rising demand in the automotive and textile sectors, where 1,4 Butanediol derivatives are essential for producing high-performance materials and durable fibers. Additionally, government policies encouraging sustainable manufacturing practices are further boosting adoption, with bio-based derivatives emerging as a focal point across industries. This market highlights Vietnams expanding industrial landscape and the strategic role of 1,4 Butanediol derivatives in facilitating production efficiency and quality.

- The market sees substantial activity in southern Vietnam, primarily due to its concentration of industrial hubs. Cities like Ho Chi Minh and Binh Duong, known for their advanced infrastructure and favorable business environment, lead in production and demand for 1,4 Butanediol derivatives. This dominance is attributed to established manufacturing sectors, strong logistical connectivity, and proximity to export facilities, positioning these cities as focal points for local and international businesses.

- Vietnams environmental regulations for chemical manufacturing, updated in 2023, mandate stricter pollution controls. Compliance has led to a 5% increase in operational costs for chemical firms due to investments in eco-friendly equipment and waste management systems. Penalties for non-compliance, averaging 500 million VND per incident, underscore the importance of meeting environmental standards in chemical production, particularly in derivatives like 1,4 Butanediol.

Vietnam 1,4 Butanediol Derivatives Market Segmentation

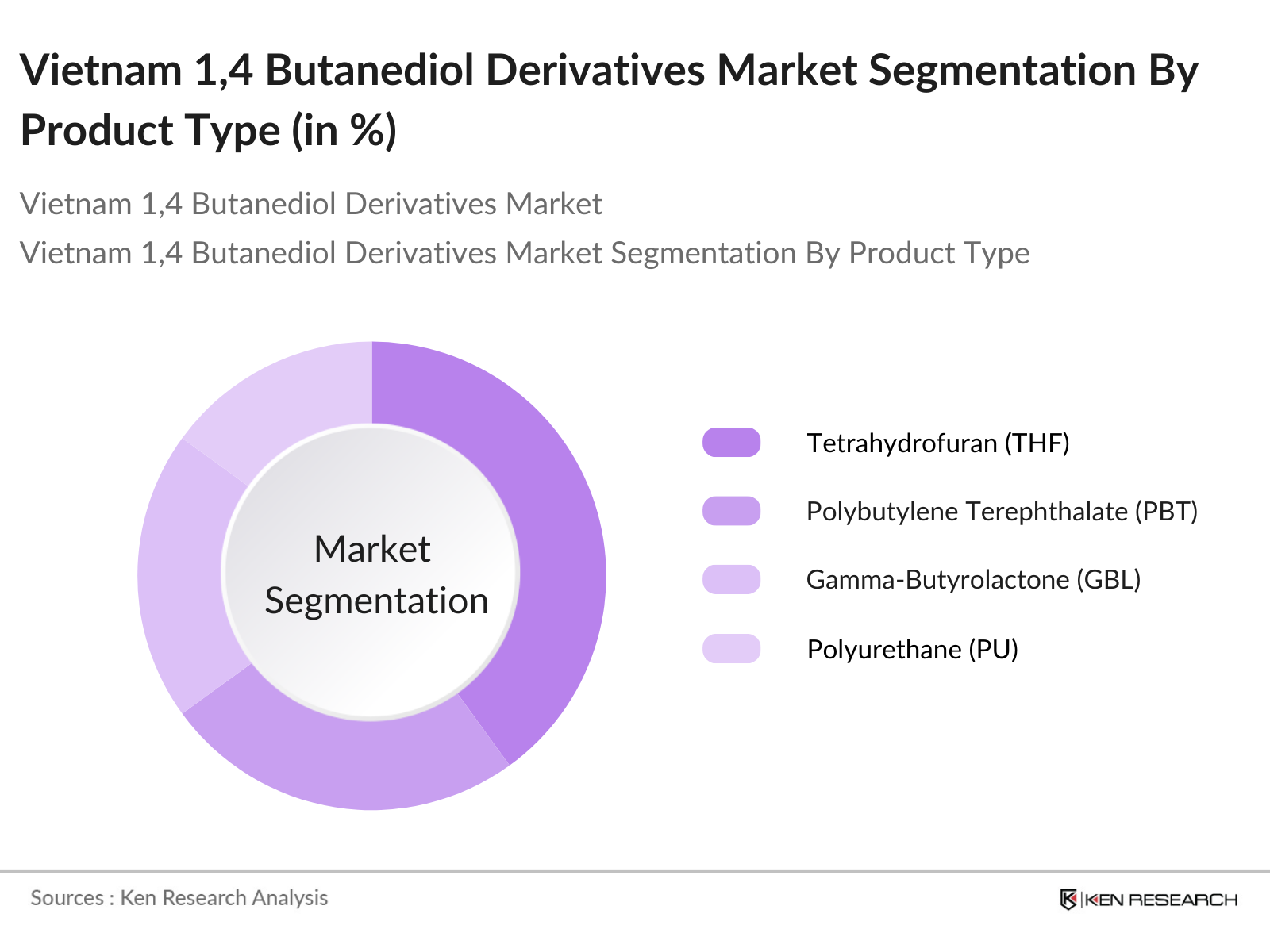

By Product Type: The market is segmented by product type into Tetrahydrofuran (THF), Polybutylene Terephthalate (PBT), Gamma-Butyrolactone (GBL), and Polyurethane (PU). Currently, Tetrahydrofuran (THF) holds the dominant market share within this segment, largely due to its extensive application in the production of spandex fibers, which are highly sought in the textile industry.

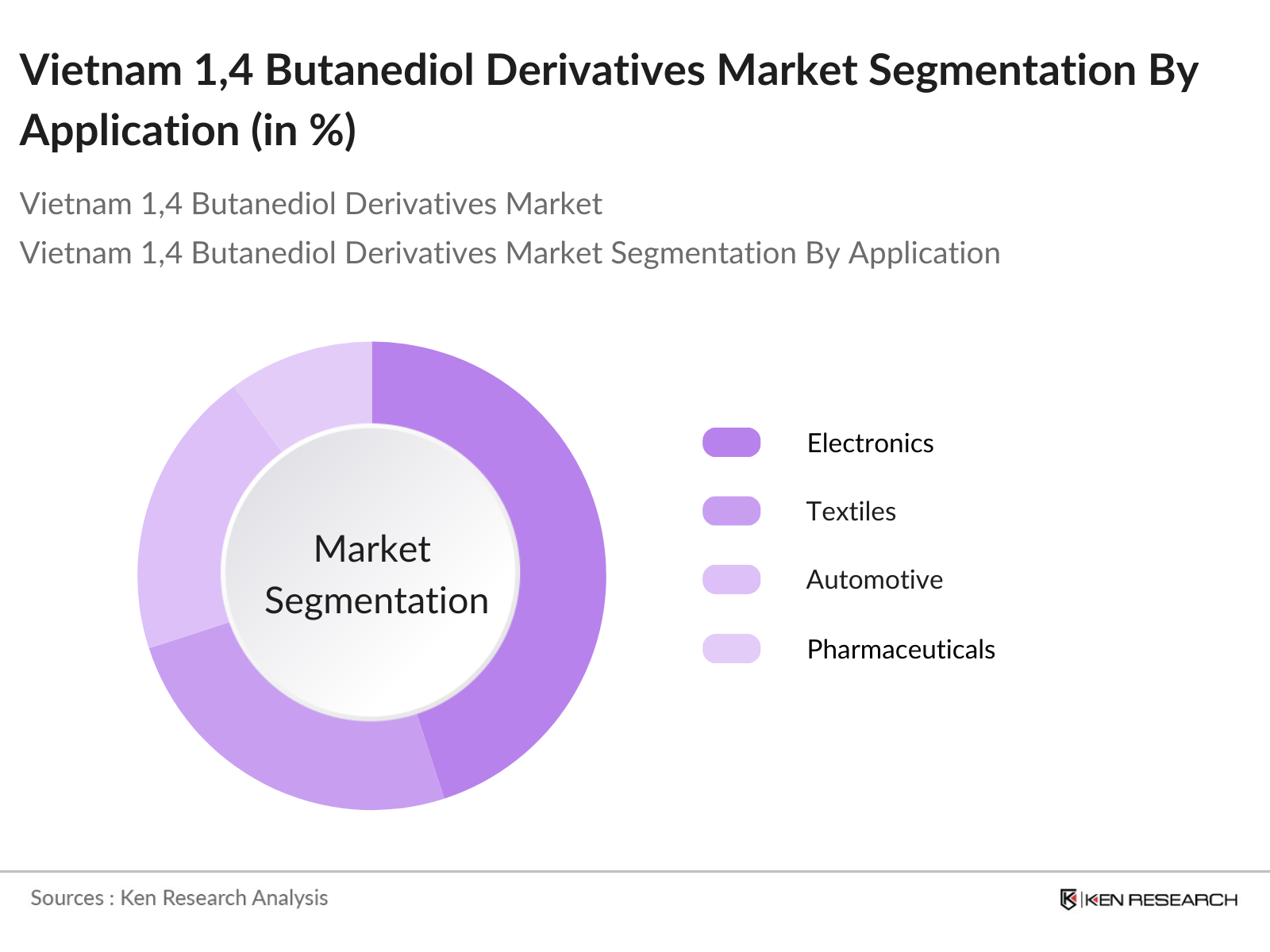

By Application: The market segmentation by application includes Electronics, Textiles, Automotive, Pharmaceuticals, and Industrial Cleaners. Within this category, the Electronics segment commands the highest market share. This dominance is due to the expanding electronics industry in Vietnam, where 1,4 Butanediol derivatives are integral to the production of durable plastic components.

Vietnam 1,4 Butanediol Derivatives Market Competitive Landscape

The Vietnam 1,4 Butanediol Derivatives market is dominated by prominent global and regional players such as BASF SE, Mitsubishi Chemical, and Huntsman Corporation. These companies have substantial influence over the market due to their established distribution channels, advanced production technology, and strong investment in research and development for high-quality derivatives.

Vietnam 1,4 Butanediol Derivatives Industry Analysis

Growth Drivers

- Increasing Demand in Manufacturing Sector: The manufacturing sector in Vietnam has seen significant growth, supported by a 6.2% increase in industrial production as of 2023, driven by the governments strategic focus on expanding domestic production. The 1,4 Butanediol derivatives market benefits directly, as these derivatives are essential in producing solvents, plastics, and adhesives, materials essential for manufacturing growth. For instance, Vietnams polymer production output increased by over 3 million metric tons in 2022, with over 15% of production requiring 1,4 Butanediol-based derivatives.

- Shift Toward Sustainable Production: Vietnams National Green Growth Strategy emphasizes sustainable production, resulting in an increasing shift toward eco-friendly chemicals such as 1,4 Butanediol-based derivatives. These derivatives contribute to reducing environmental impact by facilitating sustainable production in applications like biodegradable plastics. Data from 2023 indicates that Vietnams push for green production processes has led to a 4.8% increase in demand for bio-based chemicals within the last year.

- Government Subsidies and Incentives: To support the local chemical industry, the Vietnamese government offers subsidies and tax incentives for companies investing in advanced production facilities. In 2023, the government allocated over 1.5 trillion VND (approximately $63 million) to support sustainable manufacturing practices, indirectly benefiting the 1,4 Butanediol derivatives market. This support aims to reduce the reliance on imports and strengthen domestic production capabilities, aligning with Vietnams goal to have 70% self-sufficiency in key chemical sectors by 2025.

Market Challenges

- Volatile Raw Material Prices: Global fluctuations in oil prices, rising by 7% in early 2023, have impacted the costs of raw materials crucial to producing 1,4 Butanediol. Since derivatives are often synthesized from petrochemical-based feedstocks, such price volatility creates unpredictable shifts in production costs for Vietnamese manufacturers. In addition, Vietnam imports around 60% of these raw materials, exposing the market to foreign exchange fluctuations, which rose by 4% against the USD in the first quarter of 2023, adding financial pressure.

- Regulatory Compliance Constraints: The Vietnamese government has introduced stricter chemical handling regulations, with the Ministry of Industry and Trade implementing new standards in late 2023 to ensure environmental and worker safety. Compliance has resulted in an increase in regulatory costs for manufacturers by 12%, creating financial burdens for smaller companies that struggle to afford safety upgrades. Additionally, penalties for non-compliance, averaging 200 million VND per violation, underscore the financial impact of adhering to these standards.

Vietnam 1,4 Butanediol Derivatives Market Future Outlook

Over the next five years, the Vietnam 1,4 Butanediol Derivatives market is projected to witness substantial growth. Key drivers include the expansion of the manufacturing sector, which demands high-quality derivatives, alongside advancements in bio-based alternatives. As more industries shift towards sustainable practices, demand for eco-friendly derivatives will likely increase, positioning the market for robust expansion.

Market Opportunities

- Expansion in Bio-based Derivatives: Vietnams strategic shift towards renewable resources has catalyzed a demand for bio-based 1,4 Butanediol derivatives, driven by rising consumer interest in green products. This demand grew by 6% year-over-year in 2023, with companies in the chemical sector increasingly investing in bio-based alternatives that meet eco-friendly regulations. Such expansions are projected to enhance Vietnam's export capability for bio-based chemicals, supporting Vietnams export growth targets of reaching 20 billion USD in green exports by 2025.

- R&D in High-Purity Grades: Vietnams focus on high-tech chemical production has led to increased research and development in high-purity 1,4 Butanediol derivatives, used in applications such as pharmaceuticals and high-performance polymers. The governments R&D incentives, worth over 500 billion VND in 2023, support firms investing in purity enhancement technologies. This trend aligns with rising global demand for quality-controlled chemical products, creating export opportunities for Vietnamese companies developing high-grade derivatives.

Scope of the Report

|

Product Type |

Tetrahydrofuran (THF) |

|

Application |

Electronics |

|

End-User |

Manufacturers |

|

Production Method |

Reppe Process |

|

Region |

Northern Vietnam |

Products

Key Target Audience

Chemical Manufacturers

End-User Industries (Automotive, Electronics)

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade)

Industrial Cleaners Producers

Automotive Component Manufacturers

Investment and Venture Capitalist Firms

Local Distribution Companies

Export and Import Agencies

Companies

Players Mentioned in the Report

BASF SE

Mitsubishi Chemical Corporation

Huntsman Corporation

LyondellBasell Industries

Toray Industries

Nan Ya Plastics Corporation

Ashland Global Holdings Inc.

SK Global Chemical Co., Ltd.

Sipchem

Dow Inc.

Table of Contents

1. Vietnam 1,4 Butanediol Derivatives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam 1,4 Butanediol Derivatives Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam 1,4 Butanediol Derivatives Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Manufacturing Sector

3.1.2. Shift Toward Sustainable Production

3.1.3. Government Subsidies and Incentives

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. Regulatory Compliance Constraints

3.2.3. Market Saturation in Key End-Use Sectors

3.3. Opportunities

3.3.1. Expansion in Bio-based Derivatives

3.3.2. R&D in High-Purity Grades

3.3.3. Growing Focus on Green Chemistry

3.4. Trends

3.4.1. Shift Toward Low-Emission Processes

3.4.2. Advancements in Catalyst Technologies

3.4.3. Integration with Circular Economy Practices

3.5. Regulatory Framework

3.5.1. Environmental Compliance

3.5.2. Safety Standards for Chemical Handling

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Vietnam 1,4 Butanediol Derivatives Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Tetrahydrofuran (THF)

4.1.2. Polybutylene Terephthalate (PBT)

4.1.3. Gamma-Butyrolactone (GBL)

4.1.4. Polyurethane (PU)

4.2. By Application (in Value %)

4.2.1. Electronics

4.2.2. Textiles

4.2.3. Automotive

4.2.4. Pharmaceuticals

4.2.5. Industrial Cleaners

4.3. By End-User (in Value %)

4.3.1. Manufacturers

4.3.2. Distributors

4.3.3. Research Institutions

4.4. By Production Method (in Value %)

4.4.1. Reppe Process

4.4.2. Davy Process

4.4.3. Propylene Oxide Process

4.5. By Region (in Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam 1,4 Butanediol Derivatives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Dow Inc.

5.1.3. Mitsubishi Chemical Corporation

5.1.4. LyondellBasell Industries

5.1.5. Nan Ya Plastics Corporation

5.1.6. Ashland Global Holdings Inc.

5.1.7. Toray Industries, Inc.

5.1.8. Sipchem (Saudi International Petrochemical Company)

5.1.9. Shandong Sanyi Technology Co., Ltd.

5.1.10. Dairen Chemical Corporation

5.1.11. Markor Chemical Group Co., Ltd.

5.1.12. SK Global Chemical Co., Ltd.

5.1.13. Xinjiang Blue Ridge Tunhe Energy Co., Ltd.

5.1.14. Sinopec Shanghai Petrochemical Co., Ltd.

5.1.15. Huntsman Corporation

5.2. Cross-Comparison Parameters (Headquarters Location, Revenue, Number of Production Facilities, Product Portfolio Depth, R&D Investment, Product Certification, Market Share, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam 1,4 Butanediol Derivatives Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam 1,4 Butanediol Derivatives Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam 1,4 Butanediol Derivatives Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Application (in Value %)

8.3. By End-User (in Value %)

8.4. By Production Method (in Value %)

8.5. By Region (in Value %)

9. Vietnam 1,4 Butanediol Derivatives Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step focuses on mapping out an extensive ecosystem covering major stakeholders within the Vietnam 1,4 Butanediol Derivatives market. This is accomplished through comprehensive desk research and proprietary databases, aiming to capture all critical variables that impact market growth.

Step 2: Market Analysis and Construction

In this stage, we conduct a detailed analysis of historical data related to the Vietnam market, with a focus on production volumes, application-specific demand, and competitive positioning. This phase is essential for constructing reliable revenue estimates and understanding market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formulated based on initial data, then validated through direct consultations with industry experts, including key manufacturers and distributors. These interactions provide valuable industry insights, aiding in fine-tuning the data and verifying market trends.

Step 4: Research Synthesis and Final Output

The final stage involves integrating insights from various sources to create a comprehensive market analysis. This includes cross-verifying statistics and conducting interviews to ensure accuracy, producing a validated report tailored for business professionals.

Frequently Asked Questions

01. How big is the Vietnam 1,4 Butanediol Derivatives Market?

The Vietnam 1,4 Butanediol Derivatives market is valued at USD 274 million, based on a five-year historical analysis. Growth in this market is driven by rising demand in the automotive and textile sectors, where 1,4 Butanediol derivatives are essential for producing high-performance materials and durable fibers.

02. What challenges exist in the Vietnam 1,4 Butanediol Derivatives Market?

Challenges include volatile prices of raw materials, regulatory hurdles, and competition from alternative chemical compounds. These factors can impact production costs and profitability for manufacturers.

03. Who are the major players in the Vietnam 1,4 Butanediol Derivatives Market?

Leading players include BASF SE, Mitsubishi Chemical, Huntsman Corporation, and Toray Industries, all of which have a significant influence in the market due to their extensive product portfolios and regional presence.

04. What are the primary growth drivers in the Vietnam 1,4 Butanediol Derivatives Market?

Growth is driven by increasing demand in the automotive and electronics industries, along with government initiatives supporting local manufacturing and environmental sustainability in the production processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.