Vietnam 5G Infrastructure Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD3653

October 2024

95

About the Report

Vietnam 5G Infrastructure Market Overview

- The Vietnam 5G infrastructure market is valued at USD 822 million, based on a five-year historical analysis. This market has seen substantial growth due to the government's ambitious initiatives for digital transformation, investments in advanced technologies, and the rising demand for high-speed, reliable internet connectivity.

- The most dominant cities in the market are Ho Chi Minh City and Hanoi. These cities lead the market due to their dense urban populations, high concentration of industries, and status as economic hubs. These metropolitan areas are also the primary targets for initial 5G rollouts, as they have significant demand for advanced connectivity, making them key contributors to the market's early adoption.

- Vietnam's National Digital Transformation Programme aims to elevate its digital economy to$52 billionby2025, growing at29%annually. The government plans to achieve99%5G coverage by2030and enhance digital services across sectors, targeting60%of businesses in industrial zones to adopt digital platforms by this year.

Vietnam 5G Infrastructure Market Segmentation

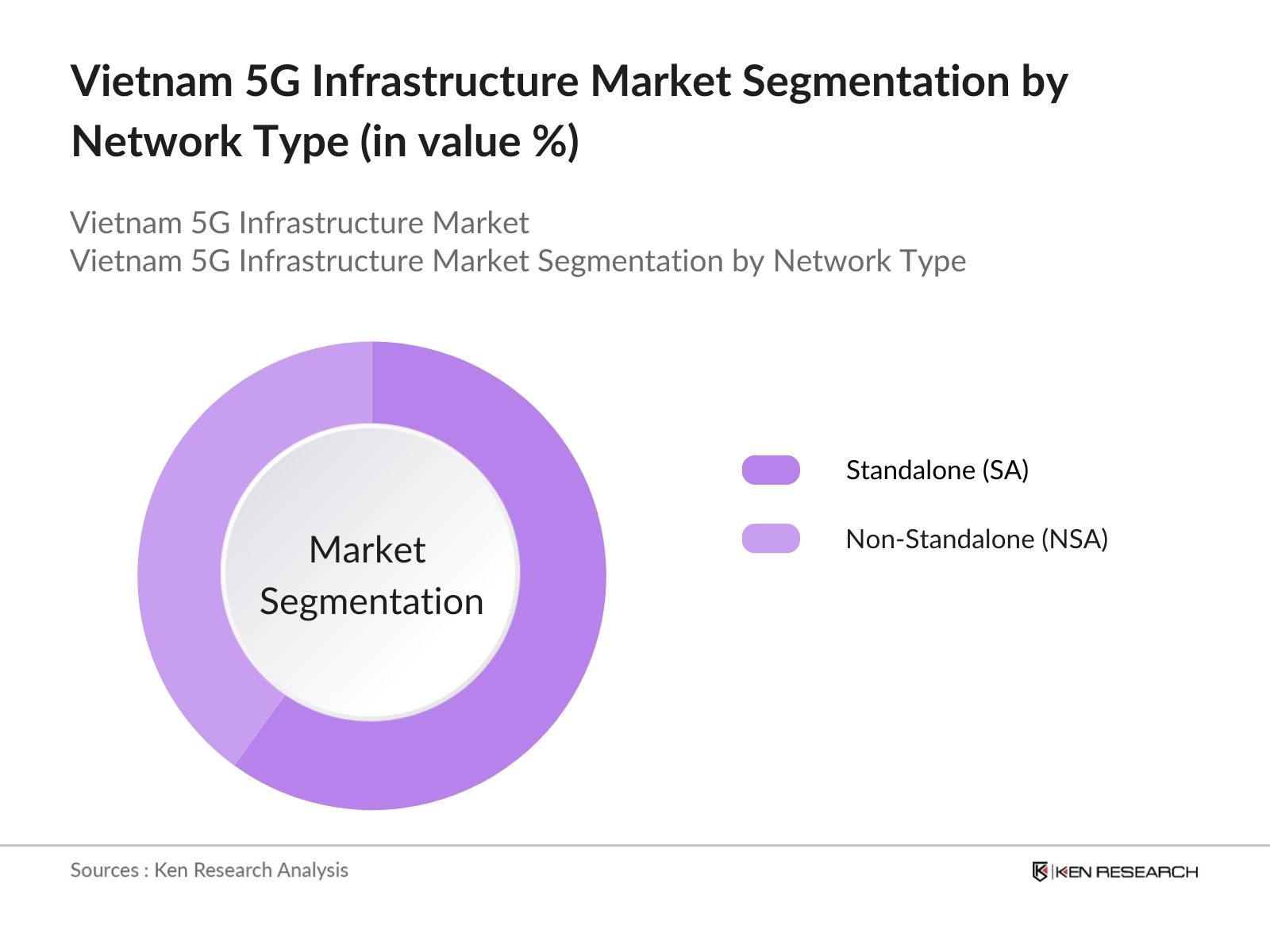

By Network Type: The market is segmented by network type into Standalone (SA) Networks and Non-Standalone (NSA) Networks. Standalone networks hold the dominant market share in this segmentation due to their ability to offer a fully independent 5G infrastructure, which enables higher speeds and lower latency.

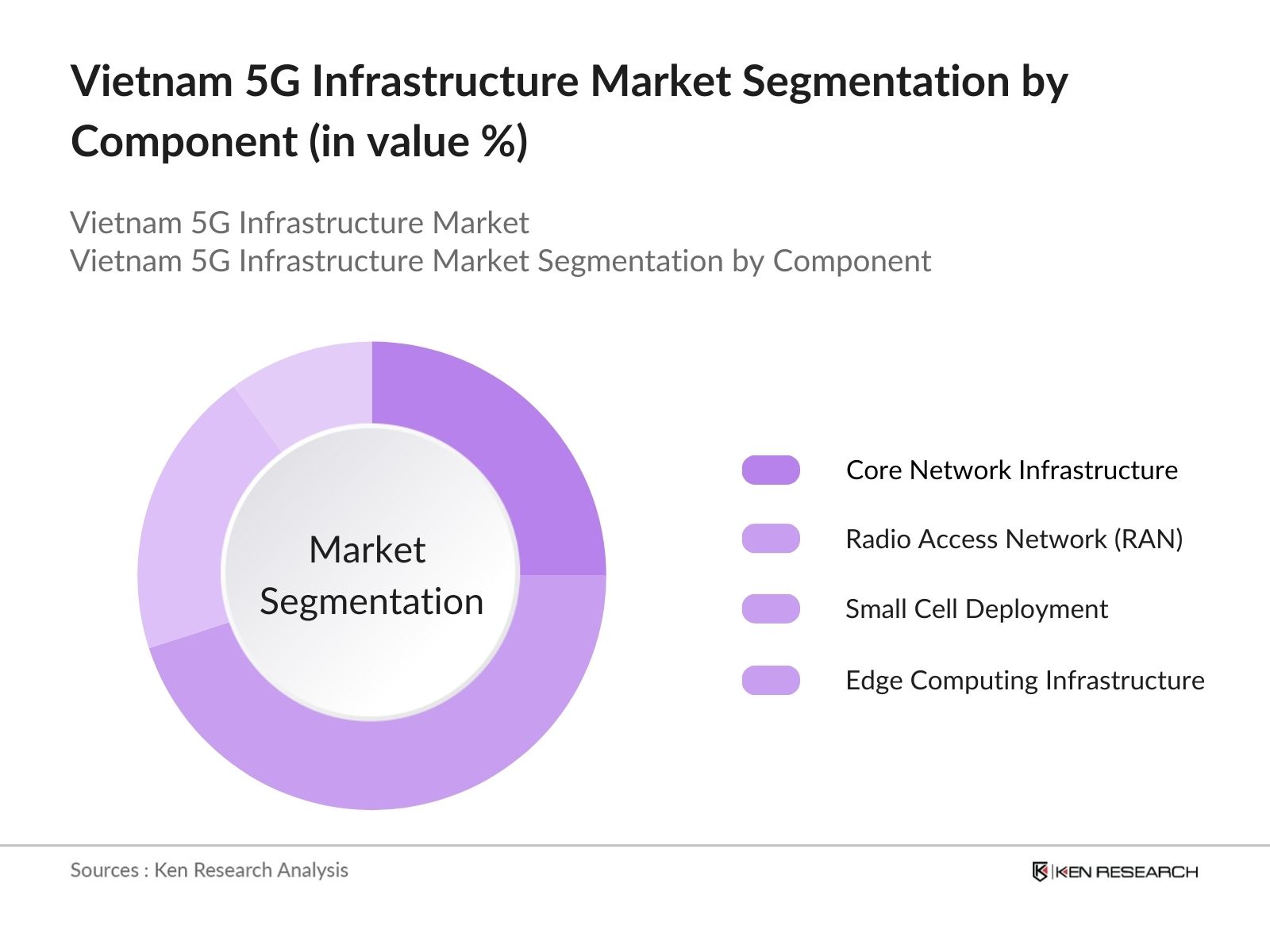

By Component: The market is further segmented by component into Core Network Infrastructure, Radio Access Network (RAN), Small Cell Deployment, and Edge Computing Infrastructure. Radio Access Network (RAN) holds a dominant share in this segment, largely due to its critical role in expanding coverage and enabling faster data transmission.

Vietnam 5G Infrastructure Market Competitive Landscape

The market is dominated by a mix of local and international players, each contributing to the growth and expansion of 5G technology. These companies are heavily involved in network deployment, research, and development of 5G solutions, as well as partnerships with local government bodies and industries to drive adoption.

|

Company Name |

Establishment Year |

Headquarters |

Market Revenue |

Partnerships |

5G Trials |

Investment in R&D |

Spectrum Ownership |

Network Deployment Capacity |

|

Viettel Group |

1989 |

Hanoi, Vietnam |

||||||

|

VNPT (Vietnam Posts and Telecommunications Group) |

1946 |

Hanoi, Vietnam |

||||||

|

FPT Telecom |

1997 |

Hanoi, Vietnam |

||||||

|

Ericsson Vietnam |

1876 |

Stockholm, Sweden |

||||||

|

Nokia Vietnam |

1865 |

Espoo, Finland |

Vietnam 5G Infrastructure Market Analysis

Market Growth Drivers

- Government Investment in Telecom Infrastructure: The Vietnamese government has committed resources towards the development of 5G infrastructure as part of its national digital transformation strategy. In 2024, the government allocated approximately $500 million to upgrade telecommunications networks, focusing on 5G deployment in key urban centers and industrial zones. These investments are expected to accelerate the rollout of 5G services, making Vietnam one of the regional leaders in advanced telecommunications.

- Rapid Manufacturing Growth: Vietnam's manufacturing sector is a key growth driver, contributing over20%to the GDP. In 2023, it attracted$23.5 billionin foreign direct investment, accounting for64.2%of total FDI. This sectors growth is driving the need for advanced connectivity solutions like 5G to enhance automation, supply chain management, and real-time data analysis. Industries such as automotive, electronics, and textiles rely heavily on smart manufacturing systems that require low-latency, high-speed networks, making 5G critical for operational efficiency.

- Increasing Demand for Data-Intensive Applications: The growing adoption of data-intensive applications such as augmented reality (AR), virtual reality (VR), and online gaming is driving the demand for faster and more reliable internet. By 2023, Vietnam had over 68 million internet users, many of whom are transitioning to 5G to support bandwidth-heavy applications. These applications require high-speed, low-latency networks, which 5G provides, enabling real-time interactions and improved user experiences.

Market Challenges

- Limited Spectrum Availability: Vietnam faces challenges with limited spectrum allocation, which is crucial for the deployment of 5G networks. As of 2023, the country had not yet fully allocated its 5G spectrum bands, delaying the process of network expansion. Spectrum auctions are expected to take place in 2024, but the delay has slowed down progress, limiting telecom operators' ability to provide consistent and widespread 5G services.

- High Deployment Costs: Deploying 5G infrastructure in Vietnam comes with substantial financial hurdles. The cost of installing 5G base stations across the country is estimated at $2 billion, which poses a challenge, particularly for smaller telecom operators. The high cost of network equipment, along with the need for a large number of base stations to ensure reliable coverage, is creating barriers to nationwide deployment.

Vietnam 5G Infrastructure Market Future Outlook

Over the next five years, the Vietnam 5G infrastructure industry is expected to demonstrate growth, driven by government support, technological advancements, and increasing demand for high-speed, low-latency communication. The country's focus on becoming a digital economy, combined with strategic investments in industries such as IoT, smart cities, and manufacturing, will fuel the rapid expansion of 5G networks across the region.

Future Market Opportunities

- Expansion into Rural Areas: Over the next five years, Vietnams 5G infrastructure is expected to expand into rural areas. The governments Rural Connectivity Initiative will drive this growth, with plans to cover over 80% of rural households by 2029. This expansion will be supported by additional investment in base stations and fiber optic cables, providing high-speed internet access to underserved regions.

- Integration with Smart City Projects: Vietnams ongoing smart city initiatives, including those in Hanoi and Ho Chi Minh City, will heavily rely on 5G infrastructure over the next five years. By 2029, more than 25 cities in Vietnam are expected to implement smart traffic management, environmental monitoring, and public safety systems, all powered by 5G technology. These projects will be crucial in managing urbanization and improving the quality of life for residents, positioning Vietnam as a leader in smart city development within Southeast Asia.

Scope of the Report

|

Network Type |

Standalone (SA) Networks |

|

Non-Standalone (NSA) Networks |

|

|

Component |

Core Network Infrastructure |

|

Radio Access Network (RAN) |

|

|

Small Cell Deployment |

|

|

Edge Computing Infrastructure |

|

|

Deployment Model |

Public 5G Networks |

|

Private 5G Networks |

|

|

Hybrid Networks |

|

|

Application |

Enhanced Mobile Broadband (eMBB) |

|

Massive Machine Type Communications (mMTC) |

|

|

Ultra-Reliable Low Latency Communications (uRLLC) |

|

|

Region |

North |

|

West |

|

|

East |

|

|

South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecom Operators and Network Providers

Equipment Manufacturers

Government and Regulatory Bodies (Ministry of Information and Communications, Telecommunications Regulatory Authority of Vietnam)

Investments and Venture Capitalist Firms

IT and Software Solution Providers

Internet Service Providers

Large Enterprises (Manufacturing, Healthcare, Retail)

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Viettel Group

VNPT (Vietnam Posts and Telecommunications Group)

FPT Telecom

Ericsson Vietnam

Nokia Vietnam

Huawei Vietnam

ZTE Corporation

Samsung Networks

Qualcomm Technologies

Cisco Systems Vietnam

NEC Corporation

MobiFone Corporation

VinGroup

Rakuten Mobile

Intel Corporation

Table of Contents

1. Vietnam 5G Infrastructure Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Vietnam 5G Infrastructure Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam 5G Infrastructure Market Analysis

3.1 Growth Drivers (Network Expansion, Digital Transformation, Telecom Investments, Government Policies)

3.1.1 Governments Digital Transformation Strategy

3.1.2 Telecom Investments in 5G Networks

3.1.3 Demand for High-Speed Connectivity

3.1.4 Enterprise Adoption in Manufacturing and IoT

3.2 Market Challenges (Infrastructure Costs, Regulatory Delays, Fiber Optic Connectivity)

3.2.1 High Capital Expenditure

3.2.2 Delays in Spectrum Allocation

3.2.3 Limited Fiber Optic Network Penetration

3.2.4 Regulatory and Licensing Hurdles

3.3 Opportunities (Private 5G Networks, Smart City Projects, Industry 4.0)

3.3.1 Growth of Smart City Initiatives

3.3.2 Emergence of Industry 4.0 Solutions

3.3.3 Expansion of Private 5G Networks

3.3.4 Cloud Integration for Telecom Services

3.4 Trends (Edge Computing, Network Virtualization, Open RAN, Spectrum Sharing)

3.4.1 Adoption of Edge Computing

3.4.2 Rise in Network Virtualization (NFV and SDN)

3.4.3 Deployment of Open Radio Access Networks (Open RAN)

3.4.4 Spectrum Sharing Strategies

3.5 Government Regulations (Telecom Regulatory Authority, 5G Spectrum Allocation, Licensing Guidelines)

3.5.1 5G Spectrum Auction Policies

3.5.2 Government Mandates on Telecom Infrastructure

3.5.3 Public-Private Partnerships (PPP)

3.5.4 National 5G Roadmap and Timelines

3.6 SWOT Analysis

3.7 Stake Ecosystem (Telecom Operators, Infrastructure Providers, Government Bodies)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Vietnam 5G Infrastructure Market Segmentation

4.1 By Network Type (In Value %)

4.1.1 Standalone (SA) Networks

4.1.2 Non-Standalone (NSA) Networks

4.2 By Component (In Value %)

4.2.1 Core Network Infrastructure

4.2.2 Radio Access Network (RAN)

4.2.3 Small Cell Deployment

4.2.4 Edge Computing Infrastructure

4.3 By Deployment Model (In Value %)

4.3.1 Public 5G Networks

4.3.2 Private 5G Networks

4.3.3 Hybrid Networks

4.4 By Application (In Value %)

4.4.1 Enhanced Mobile Broadband (eMBB)

4.4.2 Massive Machine Type Communications (mMTC)

4.4.3 Ultra-Reliable Low Latency Communications (uRLLC)

4.5 By Region (In Value %)

4.5.1 North

4.5.2 West

4.5.3 South

4.5.4 East

5. Vietnam 5G Infrastructure Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Viettel Group

5.1.2 VNPT (Vietnam Posts and Telecommunications Group)

5.1.3 FPT Telecom

5.1.4 Ericsson Vietnam

5.1.5 Nokia Vietnam

5.1.6 Huawei Vietnam

5.1.7 ZTE Corporation

5.1.8 Samsung Networks

5.1.9 Qualcomm Technologies

5.1.10 Cisco Systems Vietnam

5.1.11 NEC Corporation

5.1.12 MobiFone Corporation

5.1.13 VinGroup

5.1.14 Rakuten Mobile

5.1.15 Intel Corporation

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, 5G Network Trials, Deployment Capacity, Partnerships, Spectrum Ownership, Investment in R&D)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. Vietnam 5G Infrastructure Market Regulatory Framework

6.1 Telecommunications Law

6.2 Compliance Requirements

6.3 Licensing Processes

6.4 Spectrum Allocation Guidelines

7. Vietnam 5G Infrastructure Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Vietnam 5G Infrastructure Future Market Segmentation

8.1 By Network Type (In Value %)

8.2 By Component (In Value %)

8.3 By Deployment Model (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Vietnam 5G Infrastructure Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of our research process involved constructing an ecosystem map of the Vietnam 5G Infrastructure Market. We conducted extensive desk research, using secondary and proprietary databases to gather detailed information on key variables that influence market dynamics, such as network deployment, technology advancements, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data on the markets infrastructure development. We evaluated key metrics, including network coverage expansion, government policies, and consumer demand trends. This step helped ensure the accuracy of our market revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate our hypotheses, we conducted interviews with industry experts and stakeholders through computer-assisted telephone interviews (CATI). These consultations provided insights into industry operations, 5G trials, and upcoming network deployments, helping refine the market data.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesized the data obtained from telecom operators and technology providers. We integrated this data with our bottom-up analysis, creating a comprehensive report on the Vietnam 5G infrastructure market. This step ensures a well-rounded, validated report backed by real-world data and expert opinion.

Frequently Asked Questions

1. How big is the Vietnam 5G Infrastructure Market?

The Vietnam 5G Infrastructure Market is valued at USD 822 million, driven by extensive telecom investments, government support, and increasing demand for high-speed internet connectivity.

2. What are the challenges in the Vietnam 5G Infrastructure Market?

Challenges in the Vietnam 5G Infrastructure Market include high capital expenditures, regulatory hurdles in spectrum allocation, and limited fiber optic network penetration, which may slow down the full-scale deployment of 5G.

3. Who are the major players in the Vietnam 5G Infrastructure Market?

Key players in the Vietnam 5G Infrastructure Market include Viettel Group, VNPT, FPT Telecom, Ericsson Vietnam, and Nokia Vietnam, all of which are heavily invested in building the country's 5G infrastructure.

4. What are the growth drivers of the Vietnam 5G Infrastructure Market?

The Vietnam 5G Infrastructure Market is driven by factors such as government initiatives for digital transformation, rising industrial adoption of IoT, and the growing demand for high-speed, low-latency communication in urban areas.

5. What opportunities exist in the Vietnam 5G Infrastructure Market?

Opportunities in the Vietnam 5G Infrastructure Market lie in the expansion of private 5G networks for industrial use, the integration of edge computing, and the development of smart city projects. These factors are expected to boost market growth in the coming years.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.