Vietnam Aluminium Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD4041

December 2024

86

About the Report

Vietnam Aluminium Market Overview

- The Vietnam Aluminium Market is valued at USD 4.2 billion, based on a five-year historical analysis. This market is primarily driven by the countrys rapid industrialization, increasing infrastructure development, and the rising adoption of aluminium in key sectors such as automotive, construction, and packaging. The need for lightweight and high-strength materials in manufacturing and transportation is further enhancing the demand for aluminium products. Additionally, the growing export activities, supported by Vietnam's strategic location and access to regional trade agreements, contribute to the markets expansion.

- The dominant regions in the Vietnamese aluminium market are Ho Chi Minh City and Hanoi, which lead due to their industrial capacities, infrastructure development, and strategic location advantages. These cities host the majority of the countrys industrial parks and have easy access to ports, making them ideal for manufacturing and exporting aluminium products. Their growing automotive and construction sectors further amplify the demand for aluminium, solidifying their positions as key markets.

- The Vietnamese government has implemented several regulations to promote sustainable aluminium production and ensure compliance with environmental standards. Trade policies, such as import duties and export incentives, have been aligned to support the growth of domestic production. Additionally, government initiatives aimed at boosting public and private investment in industrial infrastructure will further support the aluminium market's expansion.

Vietnam Aluminium Market Segmentation

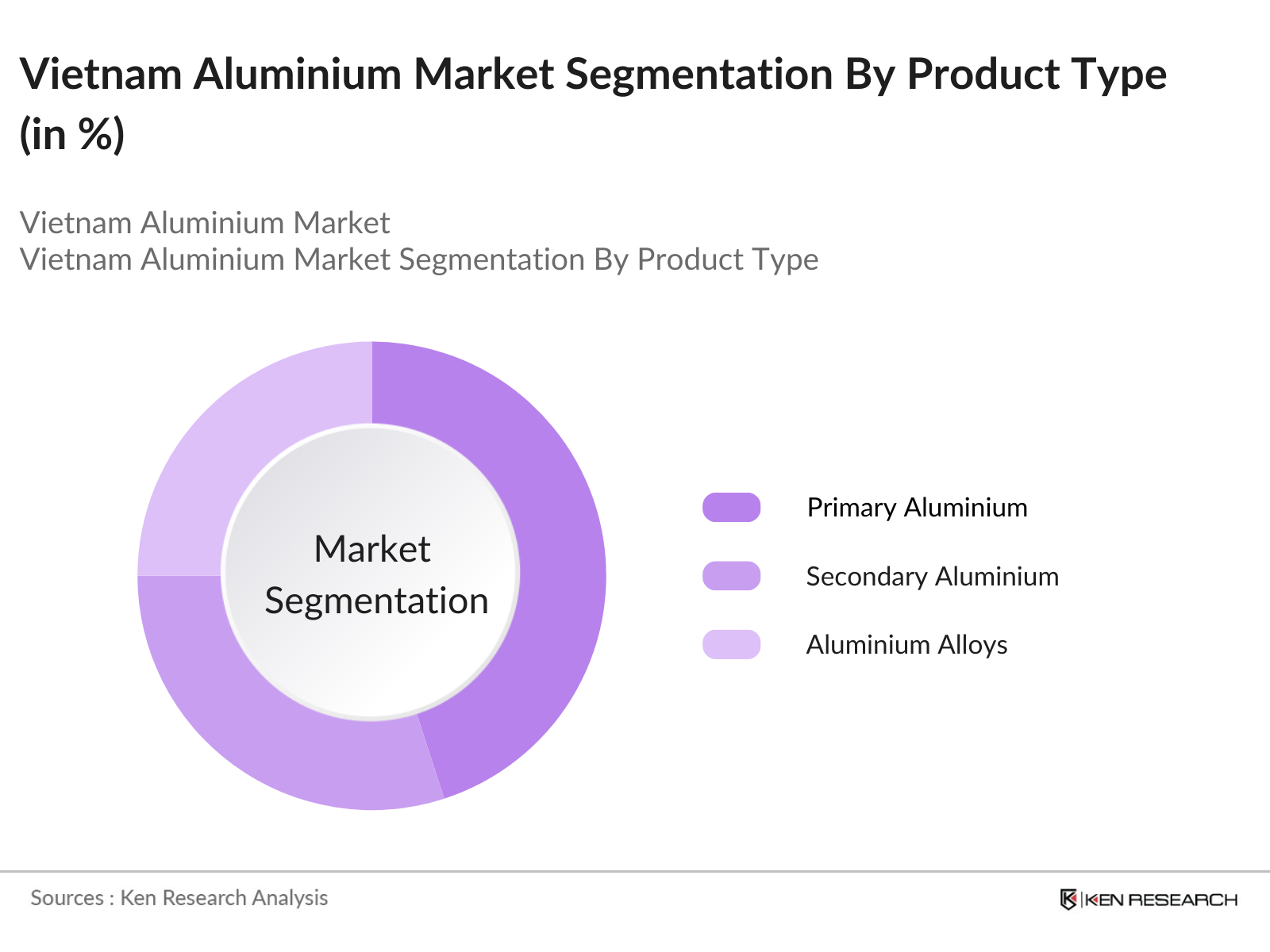

By Product Type: Vietnam's aluminium market is segmented by product type into primary aluminium, secondary aluminium, and aluminium alloys. Primary aluminium currently holds a dominant market share due to its high purity and demand in critical applications such as transportation and construction. The lightweight nature and superior mechanical properties of primary aluminium make it the preferred choice for manufacturing components in the automotive and aerospace sectors, driving its dominance in the Vietnamese market.

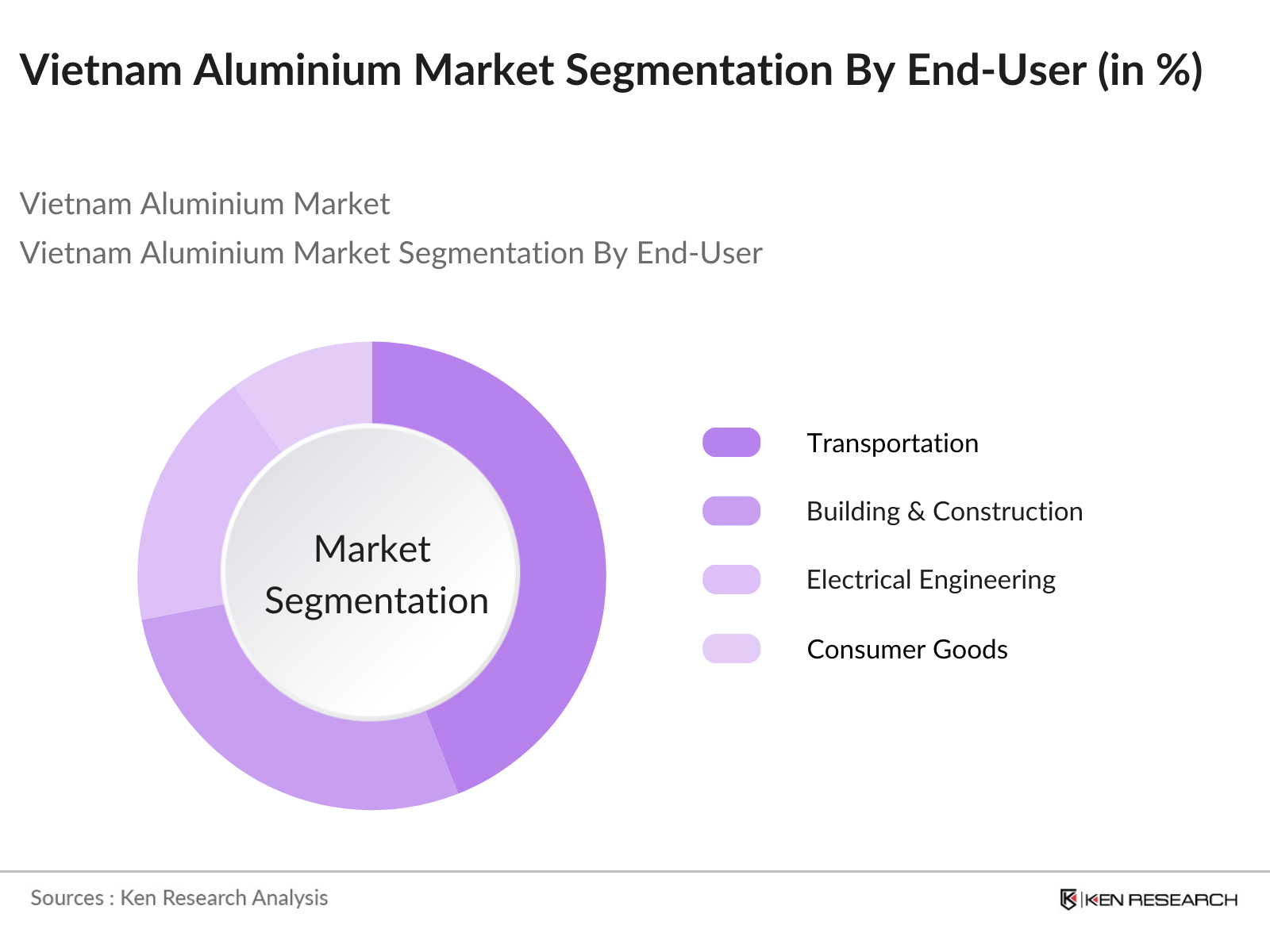

By End-Use Industry: Vietnam's aluminium market is also segmented by end-use industries, including transportation, building & construction, electrical engineering, consumer goods, and machinery & equipment. The transportation segment has a significant market share owing to the rising demand for lightweight materials in the automotive sector, which improves fuel efficiency and reduces emissions. Additionally, the rapid growth in Vietnam's electric vehicle (EV) market further accelerates the adoption of aluminium due to its use in EV battery components and body structures.

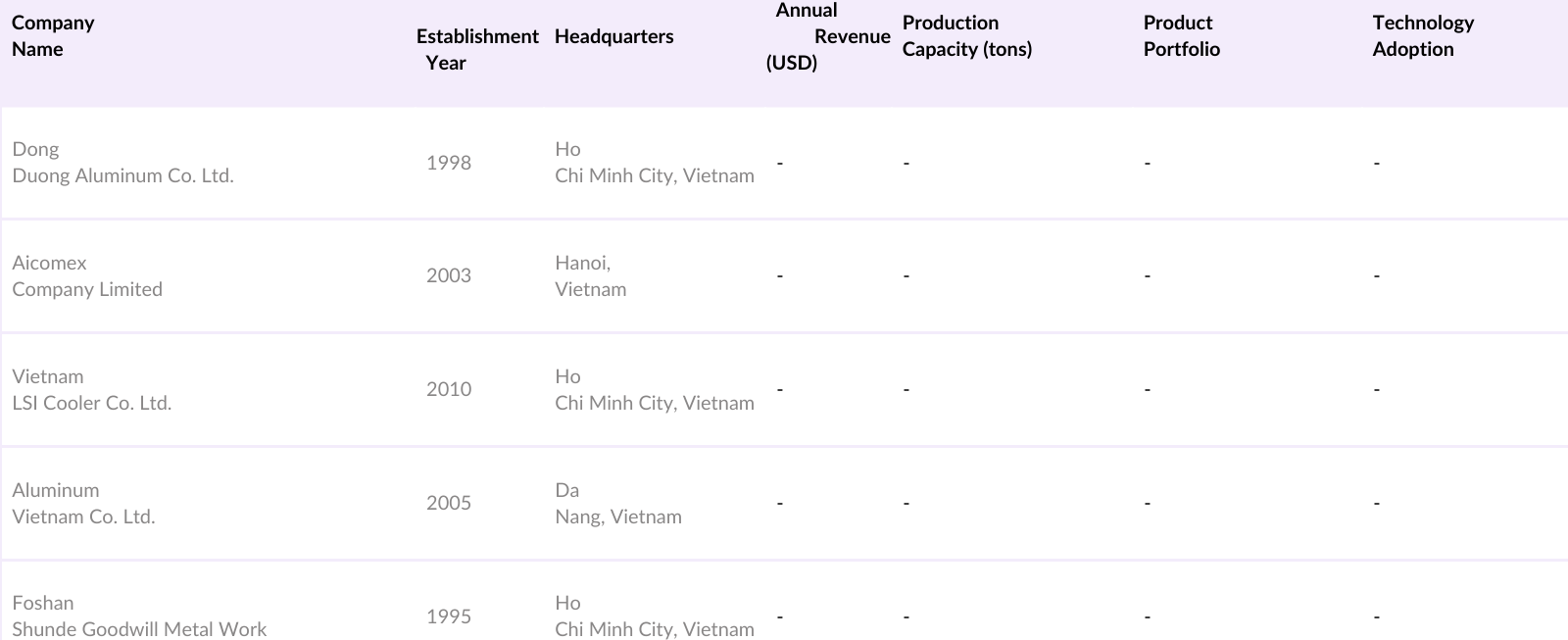

Vietnam Aluminium Market Competitive Landscape

The Vietnam aluminium market is dominated by a few key players who have established strong supply chains, production capacities, and technological capabilities. The competition is characterized by a mix of local and international firms, each focusing on specific segments of the aluminium value chain. The market is dominated by a few prominent players such as Dong Duong Aluminum Company Limited, Aicomex Company Limited, and Foshan Shunde Goodwill Metal Work, along with several smaller companies.

Vietnam Aluminium Industry Analysis

Growth Drivers

- Industrial Growth and Urbanization: The Vietnamese aluminium market is supported by strong industrial growth, with GDP expanding at 6.1% in 2024. This growth is propelled by the country's efforts to become a leading manufacturing hub in Southeast Asia. Industrial production has been boosted by the ongoing urbanization, as Vietnam's urban population is expected to reach over 38 million by the end of 2024, contributing significantly to infrastructure development and increased demand for aluminium products for construction and transport sectors.

- Rise in Automotive and Construction Sectors: The construction sector in Vietnam has seen significant growth, particularly in major urban areas like Hanoi and Ho Chi Minh City, due to infrastructure investment and the governments housing policies. Meanwhile, the automotive sector is gaining momentum, with over 500,000 vehicles produced in 2023. The increasing need for lightweight materials in automotive manufacturing to enhance fuel efficiency has driven up the demand for aluminium, which is now widely used in vehicle frames and components.

- Demand for Sustainable and Recyclable Materials: The shift towards sustainable development has made aluminium a preferred material due to its recyclability. Vietnams focus on sustainable growth aligns with global trends, where approximately 75% of all aluminium ever produced is still in use today. This trend is driven by regulations promoting green construction and eco-friendly practices. The use of recycled aluminium in various sectors has minimized environmental impact and reduced costs for manufacturers.

Market Challenges

- High Initial Capital Costs: Setting up aluminium production facilities in Vietnam requires substantial capital investments. This is a major barrier for new entrants. Initial costs for a medium-scale aluminium plant are estimated at USD 200 million, making it challenging for smaller players to compete with established firms. Moreover, ongoing investments are needed for technology upgrades to comply with environmental standards, which further add to operational expenses.

- Environmental Concerns and Regulatory Compliance: The aluminium industry faces significant environmental regulations due to its high energy consumption and CO2 emissions. To address these concerns, Vietnam has been tightening regulations, requiring firms to adopt cleaner production technologies and reduce greenhouse gas emissions. Compliance with these regulations increases operational costs, making it difficult for companies to maintain competitiveness.

Vietnam Aluminium Market Future Outlook

Over the next few years, the Vietnam aluminium market is expected to show significant growth driven by continued industrialization, increasing investments in the automotive and construction sectors, and a shift towards the use of lightweight and high-strength aluminium alloys. The government's focus on promoting electric vehicles and the development of smart cities will further catalyze demand for aluminium. The ongoing expansion of industrial capacities and the implementation of environmental regulations will reshape the landscape of the market, leading to more innovation and sustainable growth.

Market Opportunities

- Expansion in the Electrical and Electronics Sector: Vietnams electronics sector, valued at over USD 100 billion in 2023, has been a key driver for aluminium demand. Aluminiums superior conductivity and corrosion resistance make it an ideal material for electrical applications, including cables and heat sinks. With increasing foreign direct investment (FDI) in Vietnams electronics sector, the demand for aluminium is set to grow, creating opportunities for manufacturers to cater to this sector.

- Technological Advancements in Manufacturing Processes: Technological innovations such as automated casting and rolling processes have increased production efficiency and reduced waste in the aluminium manufacturing process. This has lowered operational costs and improved the quality of final products. These advancements make Vietnam an attractive destination for aluminium production, especially as it seeks to strengthen its position in the global supply chain.

Scope of the Report

|

Series |

Series 1 Series 2 Series 3 Series 4 Series 5 Series 6 Series 7 Series 8 |

|

Processing Method |

Rod & Bar Flat Rolled Casting Extrusions Forgings Pigments & Powder |

|

End Use Industry |

Transportation Building & Construction Electrical Engineering Consumer Goods Machinery & Equipment |

|

Product Type |

Primary Aluminium Secondary Aluminium Alloys |

|

Region |

North Vietnam Central Vietnam South Vietnam |

Products

Key Target Audience

Automobile Manufacturers

Construction and Real Estate Companies

Electrical Equipment Manufacturers

Consumer Goods Manufacturers

Machinery and Equipment Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade, General Department of Vietnam Customs)

Packaging Industry Players

Companies

Players Mentioned in the Report

Dong Duong Aluminum Company Limited

Aicomex Company Limited

Vietnam LSI Cooler Company Limited

Aluminum Vietnam Company Limited

Foshan Shunde Goodwill Metal Work

Alcoa Corporation

Century Aluminum Co.

Hindalco Industries Ltd.

China Zhongwang Holdings Ltd.

Emirates Global Aluminium PJSC

Table of Contents

1. Vietnam Aluminium Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Aluminium Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Market Share Analysis by Series (Series 1-8)

2.3. Market Share Analysis by Processing Method (Rod & Bar, Flat Rolled, Casting, Extrusions, Forgings, Pigments & Powder)

2.4. Market Share Analysis by End Use Industry (Transportation, Building & Construction, Electrical Engineering, Consumer Goods, Machinery & Equipment, Foil & Packaging)

2.5. Year-On-Year Growth Analysis

3. Vietnam Aluminium Market Analysis

3.1. Market Growth Drivers

3.1.1. Industrial Growth and Urbanization

3.1.2. Rise in Automotive and Construction Sectors

3.1.3. Demand for Sustainable and Recyclable Materials

3.2. Market Challenges

3.2.1. High Initial Capital Costs

3.2.2. Environmental Concerns and Regulatory Compliance

3.2.3. Competition from Alternative Materials

3.3. Opportunities

3.3.1. Expansion in the Electrical and Electronics Sector

3.3.2. Technological Advancements in Manufacturing Processes

3.3.3. Export Potential in ASEAN and Global Markets

3.4. Trends

3.4.1. Shift Towards Lightweight and High-Strength Aluminium Alloys

3.4.2. Integration of Advanced Manufacturing Technologies

3.4.3. Increased Application of Aluminium in Renewable Energy Solutions

3.5. Government Regulation (Impact of Trade Policies, Environmental Regulations, and Industry Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem Analysis

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Aluminium Market Segmentation

4.1. By Series

4.1.1. Series 1

4.1.2. Series 2

4.1.3. Series 3

4.1.4. Series 4

4.1.5. Series 5

4.1.6. Series 6

4.1.7. Series 7

4.1.8. Series 8

4.2. By Processing Method

4.2.1. Rod & Bar

4.2.2. Flat Rolled

4.2.3. Casting

4.2.4. Extrusions

4.2.5. Forgings

4.2.6. Pigments & Powder

4.3. By End Use Industry

4.3.1. Transportation

4.3.2. Building & Construction

4.3.3. Electrical Engineering

4.3.4. Consumer Goods

4.3.5. Machinery & Equipment

4.4. By Product Type

4.4.1. Primary Aluminium

4.4.2. Secondary Aluminium

4.4.3. Alloys

4.5. By Region

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam Aluminium Market Competitive Analysis

5.1. Profiles of Key Competitors

5.1.1. Dong Duong Aluminum Company Limited

5.1.2. Aicomex Company Limited

5.1.3. Qingdao Zhongwangsanchang Aluminum Industry Co., Ltd

5.1.4. Vietnam LSI Cooler Company Limited

5.1.5. Aluminum Vietnam Company Limited

5.1.6. Foshan Shunde Goodwill Metal Work Co., Ltd

5.1.7. Kama Vina Joint Stock Company

5.1.8. Alcoa Corporation

5.1.9. Century Aluminum Co.

5.1.10. Hindalco Industries Ltd.

5.1.11. China Zhongwang Holdings Ltd.

5.1.12. Emirates Global Aluminium PJSC

5.1.13. Jindal Aluminium Ltd.

5.1.14. Norsk Hydro ASA

5.1.15. Rio Tinto Ltd.

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Technological Capabilities, Market Share, Cost Structure, Supply Chain Efficiency, Regional Presence, Product Portfolio)

5.3. Strategic Initiatives (Mergers, Acquisitions, Partnerships, Collaborations)

5.4. Investment Analysis

5.5. Government Grants and Incentives

5.6. Venture Capital Funding

5.7. Private Equity Investments

6. Vietnam Aluminium Market Regulatory Framework

6.1. Environmental Regulations

6.2. Compliance Requirements for Aluminium Products

6.3. Industry Standards and Certifications

6.4. Trade Tariffs and Import/Export Restrictions

7. Vietnam Aluminium Future Market Size (In USD Billion)

7.1. Market Projections by Series

7.2. Market Projections by Processing Method

7.3. Market Projections by End Use Industry

8. Vietnam Aluminium Market Segmentation

8.1. By Series

8.2. By Processing Method

8.3. By End Use Industry

8.4. By Product Type

8.5. By Region

9. Vietnam Aluminium Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Strategic Recommendations

9.3. White Space Opportunity Analysis

9.4. Market Expansion Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Aluminium Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam Aluminium Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aluminium manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Aluminium Market.

Frequently Asked Questions

1. How big is the Vietnam Aluminium Market?

The Vietnam Aluminium Market is valued at USD 4.2 billion, based on a five-year historical analysis. This market is primarily driven by the countrys rapid industrialization, increasing infrastructure development, and the rising adoption of aluminium in key sectors such as automotive, construction, and packaging.

2. What are the main challenges in the Vietnam Aluminium Market?

The main challenges include high initial capital costs, environmental concerns, and competition from alternative materials such as steel and plastics.

3. Who are the major players in the Vietnam Aluminium Market?

Key players in the market include Dong Duong Aluminum Company Limited, Aicomex Company Limited, and Foshan Shunde Goodwill Metal Work, among others.

4. What are the growth drivers of the Vietnam Aluminium Market?

The market is propelled by rapid industrialization, a surge in infrastructure development, and increasing applications in the automotive sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.