Vietnam Amusement Parks Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD9562

November 2024

82

About the Report

Vietnam Amusement Parks Market Overview

- The Vietnam Amusement Parks market is valued at USD 425 million, based on a five-year historical analysis. This market is driven primarily by the rise in domestic tourism, increasing disposable incomes among the middle-class population, and government initiatives promoting local tourism. Moreover, Vietnam's rapidly urbanizing cities and expanding infrastructure have created opportunities for new amusement parks and expansions in existing ones.

- Dominant regions in Vietnams amusement park market include Ho Chi Minh City and Hanoi. These cities dominate due to their large population density, increasing number of tourists, and well-established infrastructure that supports high footfall in amusement and theme parks. Proximity to international airports, higher average household incomes, and investments in tourism-oriented projects further enhance their leadership in the market.

- The Vietnamese government has implemented stringent health and safety regulations to ensure the wellbeing of amusement park visitors. The Ministry of Culture, Sports, and Tourism requires annual safety inspections for all rides, with non-compliance resulting in fines of up to USD 4,063.39 In 2024, over 90% of amusement parks in Vietnam passed these inspections, demonstrating the effectiveness of the regulatory framework. These standards include structural integrity tests, regular maintenance checks, and emergency response preparedness, ensuring a safe environment for millions of visitors annually.

Vietnam Amusement Parks Market Segmentation

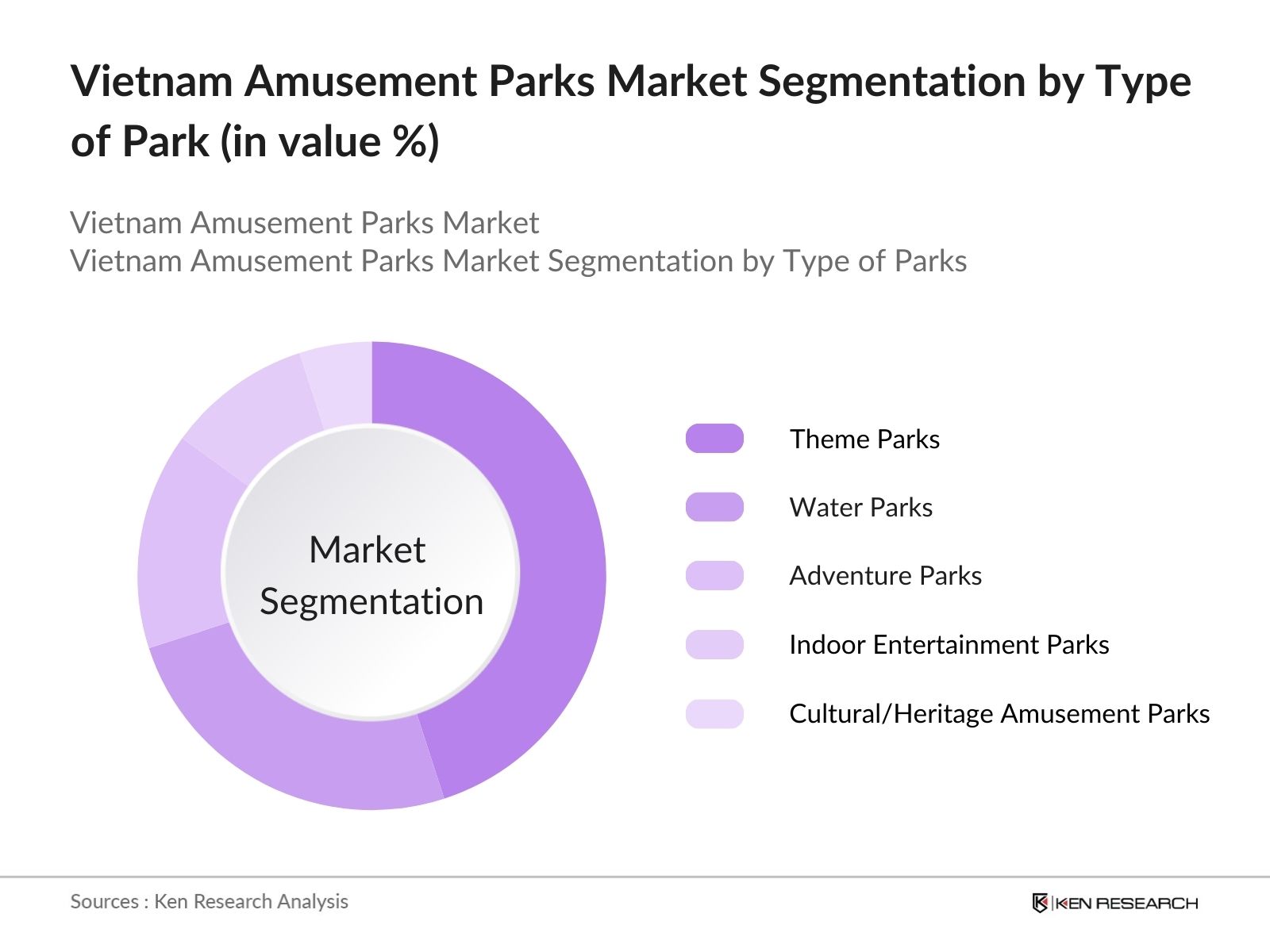

By Type of Park: Vietnams amusement park market is segmented by park type into theme parks, water parks, adventure parks, indoor entertainment parks, and cultural/heritage amusement parks. Theme parks hold a dominant market share within this segment due to their ability to offer a combination of entertainment, educational experiences, and immersive attractions that cater to a wide demographic, including families and tourists. The continued investments in innovative rides, international partnerships, and unique thematic zones allow theme parks to stand out. They have also been able to capitalize on Vietnams growing tourism industry.

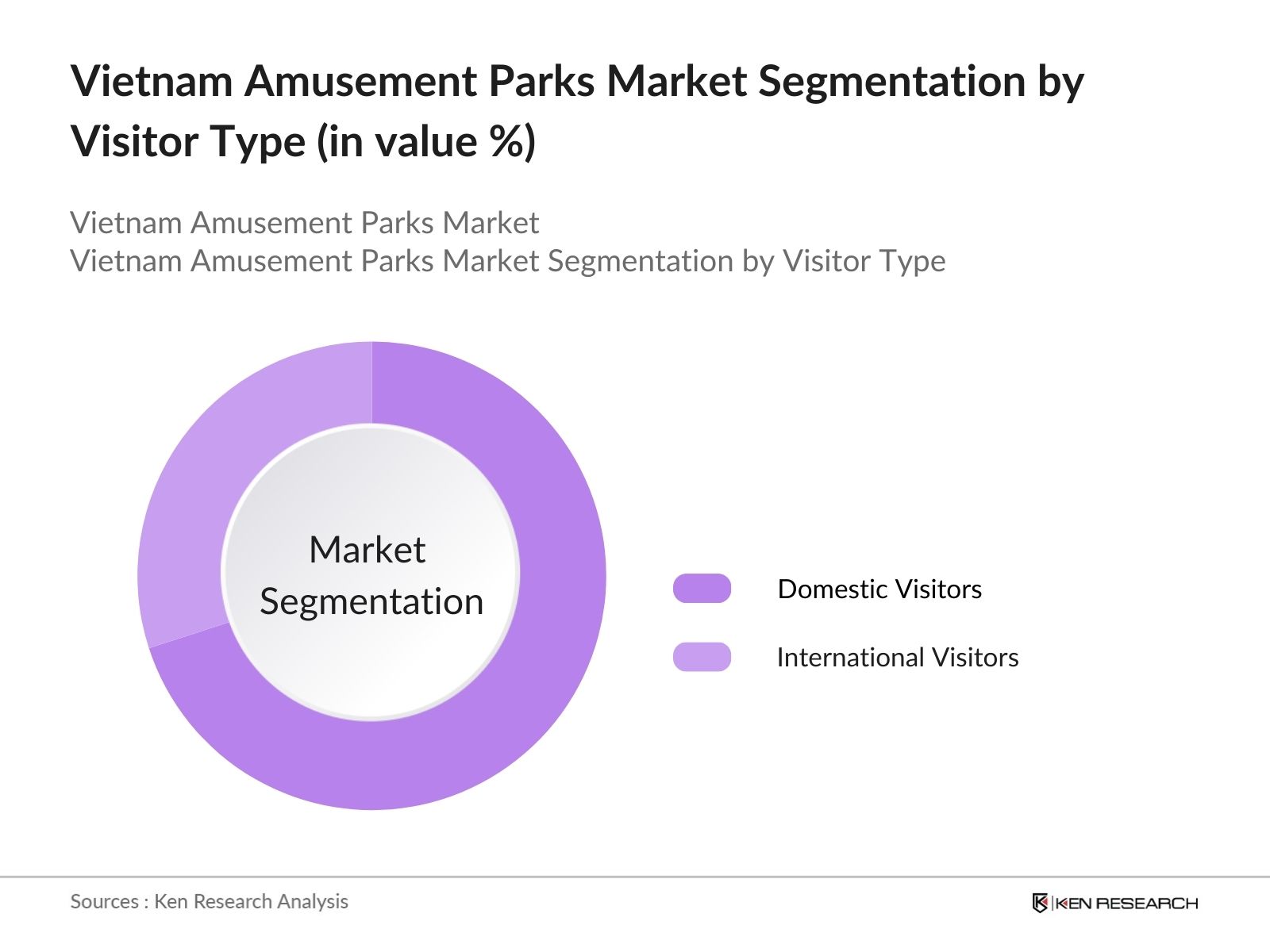

By Visitor Type: The market is also segmented by visitor type into domestic visitors and international visitors. Domestic visitors dominate this segment, making up the largest share of the market. This dominance is due to increasing urbanization, rising middle-class incomes, and the Vietnamese government's push for local tourism campaigns. The demand for leisure activities, particularly among families during national holidays and school vacations, heavily drives domestic visitor traffic. Moreover, the proximity of amusement parks to urban centers like Ho Chi Minh City and Hanoi makes them accessible and affordable for the local population.

By Visitor Type: The market is also segmented by visitor type into domestic visitors and international visitors. Domestic visitors dominate this segment, making up the largest share of the market. This dominance is due to increasing urbanization, rising middle-class incomes, and the Vietnamese government's push for local tourism campaigns. The demand for leisure activities, particularly among families during national holidays and school vacations, heavily drives domestic visitor traffic. Moreover, the proximity of amusement parks to urban centers like Ho Chi Minh City and Hanoi makes them accessible and affordable for the local population.

Vietnam Amusement Parks Market Competitive Landscape

Vietnam Amusement Parks Market Competitive Landscape

The Vietnam amusement parks market is dominated by a mix of local and international players, each bringing its unique value proposition. Local brands such as Vinpearl Land have established a strong presence with large-scale parks that cater to both domestic and international audiences. International players are entering the market through partnerships, mergers, or collaborations with Vietnamese operators. Consolidation among major players allows them to leverage economies of scale and offer competitive pricing.

|

Company |

Established Year |

Headquarters |

Number of Parks |

Annual Visitors (Mn) |

Revenue (USD Mn) |

Number of Employees |

Partnerships |

New Attractions per Year |

Government Ties |

|

Vinpearl Land |

2006 |

Nha Trang, Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

Sun World |

2011 |

Quang Ninh, Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

Dam Sen Park |

1976 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

|

Suoi Tien Park |

1995 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

|

Asia Park Danang |

2014 |

Da Nang, Vietnam |

- |

- |

- |

- |

- |

- |

- |

Vietnam Amusement Parks Market Analysis

Growth Drivers

- Domestic Tourism Surge: Vietnam's domestic tourism is expected to see significant growth in 2024, driven by a projected increase in visitor count, reaching 100 million domestic trips by the end of the year, as per the Vietnam National Administration of Tourism (VNAT). The increase in disposable income and improved infrastructure across major cities has played a pivotal role in boosting domestic tourism, directly impacting amusement park attendance.

- Rising Disposable Income: Per capita income in Vietnam is projected to rise to USD 4,700 in 2024, facilitating higher spending on leisure and entertainment, according to World Bank data. This increasing income is expected to drive growth in leisure spending, with amusement park visitors spending an average of USD 300 per visit, reflecting a significant shift towards premium experiences. This trend is further supported by an expanding middle class, with 30 million people now able to afford frequent entertainment visits, a key contributor to the market's growth.

- Increasing Urbanization: Vietnam's urban population is growing rapidly, expected to reach 46 million in 2024, with cities like Hanoi and Ho Chi Minh City driving this growth. Urban density near amusement parks has increased the proximity of residents to leisure destinations, making them more accessible. This urbanization has provided a 15% boost in visitor numbers year-over-year in cities with major parks, as parks are more likely to be near residential areas.

Challenges

- High Maintenance Costs: Costs associated with safety checks, equipment upkeep, and infrastructure repair have increased due to aging rides and equipment in older parks. This expense has become a significant challenge, reducing net profit margins, especially in smaller, independently-owned parks. Larger parks, such as Vinpearl Land, have managed these costs better through efficient management but still allocate significant funds towards park upkeep.

- Seasonal Fluctuations: Visitor numbers in Vietnams amusement parks fluctuate significantly by season, with a 30% drop in attendance during the rainy season (June-August), according to the Vietnam Meteorological and Hydrological Administration. Parks like Sun World Ba Na Hills experience peak visitor counts in spring and summer holidays, while monsoon seasons deter tourists, impacting revenue generation.

Vietnam Amusement Parks Market Future Outlook

Vietnam amusement parks market is expected to exhibit substantial growth, driven by the government's continued investments in tourism infrastructure, increased disposable incomes, and a surge in both domestic and international tourism. As the middle class continues to expand, leisure spending is forecasted to rise, further contributing to the demand for amusement parks and entertainment venues.

Market Opportunities

- Investment in Themed Attractions: Vietnams amusement parks are seeing growing investment in themed attractions, with an average of five new attractions added annually across major parks like VinWonders and Sun World Ba Na Hills. These investments are often funded through joint ventures with international companies, capitalizing on the global trend of immersive, theme-based entertainment. Themed attractions, particularly those based on popular media franchises, are a key growth area.

- Public-Private Partnerships for New Developments: Public-private partnerships (PPP) are playing a critical role in the development of new amusement parks in Vietnam. In 2024, the government allocated USD 80 million towards tourism infrastructure projects, including amusement park developments. These partnerships provide park operators with funding and incentives to expand their offerings, such as infrastructure subsidies for transportation links to parks.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Type of Park |

Theme Parks Water Parks Adventure Parks Indoor Entertainment Parks Cultural/Heritage Amusement Parks |

|

By Age Group |

Children (1-12) Teenagers (13-18) Young Adults (19-30) Families |

|

By Visitor Type |

Domestic Visitors International Visitors |

|

By Revenue Model |

Ticket Sales Sponsorships & Advertisements Food & Beverage Sales Merchandise & Souvenirs |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Amusement Park Operators and Developers

Local Tourism Boards

Real Estate Developers and Property Managers

Hospitality and Hotel Chains

Event Management Companies

Amusement and Theme Park Equipment Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam National Administration of Tourism, Ministry of Culture, Sports and Tourism)

Companies

Players Mentioned in the Report

Vinpearl Land

Sun World

Dam Sen Park

Suoi Tien Park

Asia Park Danang

WaterWorld Ho Chi Minh City

Tiniworld

Ho May Park

Dai Nam Wonderland

Fantasy Park Ba Na Hills

Table of Contents

1. Vietnam Amusement Parks Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Annual Visits, Ticket Revenue)

1.4 Market Segmentation Overview

2. Vietnam Amusement Parks Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis (Visitor Footfall, Revenue per Visitor)

2.3 Key Market Developments and Milestones

3. Vietnam Amusement Parks Market Analysis

3.1 Growth Drivers

3.1.1 Domestic Tourism Surge (Visitor Count, Spending Power)

3.1.2 Rising Disposable Income (Per Capita Leisure Spending)

3.1.3 Increasing Urbanization (Urban Population Density, Proximity to Parks)

3.1.4 Expanding Middle-Class Population (Leisure Time Availability)

3.2 Market Challenges

3.2.1 High Maintenance Costs (Maintenance Expenditure as % of Revenue)

3.2.2 Seasonal Fluctuations (Seasonal Visitor Trends)

3.2.3 Regulatory Challenges (Licensing, Safety Standards)

3.2.4 Competition from Emerging Digital Entertainment (Virtual Entertainment Usage)

3.3 Opportunities

3.3.1 Investment in Themed Attractions (New Attractions per Year)

3.3.2 Public-Private Partnerships for New Developments (Government Funding Opportunities)

3.3.3 Expansion of Integrated Resorts (Resort Capacity, Amusement Park Adjacency)

3.3.4 Growth in International Tourism (Tourist Visits by Region)

3.4 Trends

3.4.1 Sustainability Initiatives (Energy-Efficient Ride Systems)

3.4.2 Technology Integration (Augmented Reality in Parks, Contactless Payments)

3.4.3 Health & Safety Protocol Enhancements (Safety Investment per Visitor)

3.4.4 VIP Experiences and Premium Services (Revenue from VIP Packages)

3.5 Government Regulations

3.5.1 Health and Safety Regulations (Government Safety Compliance Standards)

3.5.2 Environmental Impact Regulations (Carbon Emission Limits for Parks)

3.5.3 Investment Incentives for New Parks (Tax Breaks, Infrastructure Subsidies)

3.5.4 Zoning Laws (Land Use Regulations for Amusement Parks)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Vietnam Amusement Parks Market Segmentation

4.1 By Type of Park (In Value %)

4.1.1 Theme Parks

4.1.2 Water Parks

4.1.3 Adventure Parks

4.1.4 Indoor Entertainment Parks

4.1.5 Cultural/Heritage Amusement Parks

4.2 By Age Group (In Value %)

4.2.1 Children (Aged 1-12)

4.2.2 Teenagers (Aged 13-18)

4.2.3 Young Adults (Aged 19-30)

4.2.4 Families

4.3 By Visitor Type (In Value %)

4.3.1 Domestic Visitors

4.3.2 International Visitors

4.4 By Revenue Model (In Value %)

4.4.1 Ticket Sales

4.4.2 Sponsorships & Advertisements

4.4.3 Food & Beverage Sales

4.4.4 Merchandise & Souvenirs

4.5 By Region (In Value %)

4.5.1 Northern Vietnam

4.5.2 Central Vietnam

4.5.3 Southern Vietnam

5. Vietnam Amusement Parks Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Vinpearl Land

5.1.2 Sun World

5.1.3 Dam Sen Park

5.1.4 Suoi Tien Park

5.1.5 Fantasy Park Ba Na Hills

5.1.6 Asia Park Danang

5.1.7 Ho May Park

5.1.8 Dai Nam Wonderland

5.1.9 WaterWorld Ho Chi Minh City

5.1.10 Tiniworld

5.2 Cross Comparison Parameters (Number of Visitors, Revenue, Park Area, Number of Attractions, Number of Employees, Operational Hours, Inception Year, Expansion Plans)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Vietnam Amusement Parks Market Regulatory Framework

6.1 Amusement Park Licensing Regulations

6.2 Safety and Operational Compliance Requirements

6.3 Environmental and Energy Standards for Parks

6.4 Taxation and Incentive Policies for Park Operators

7. Vietnam Amusement Parks Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Vietnam Amusement Parks Future Market Segmentation

8.1 By Type of Park (In Value %)

8.2 By Age Group (In Value %)

8.3 By Visitor Type (In Value %)

8.4 By Revenue Model (In Value %)

8.5 By Region (In Value %)

9. Vietnam Amusement Parks Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Visitor Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the key stakeholders within the Vietnam Amusement Parks Market. This was achieved through extensive desk research using a mix of secondary sources such as government reports, proprietary databases, and tourism sector publications. The goal was to identify critical variables like visitor demographics, park types, and revenue sources.

Step 2: Market Analysis and Construction

In this phase, historical data from amusement park operators was collected and analyzed. This included visitor attendance, revenue per park, and seasonal fluctuations. The analysis allowed for the construction of a comprehensive overview of the market's performance and its key revenue drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through consultations with industry experts. Using a combination of telephone and in-person interviews, insights were gathered from operators, real estate developers, and government officials to corroborate the market trends and challenges identified through desk research.

Step 4: Research Synthesis and Final Output

This phase involved engaging directly with amusement park operators and suppliers to obtain detailed data on revenue generation, visitor satisfaction, and new attraction development. The result was a validated, data-driven report with accurate estimates of market size, segmentation, and competitive landscape.

Frequently Asked Questions

01. How big is the Vietnam Amusement Parks Market?

The Vietnam Amusement Parks market is valued at USD 425 million, driven by domestic tourism growth, rising middle-class disposable incomes, and government tourism initiatives.

02. What are the challenges in the Vietnam Amusement Parks Market?

Challenges in Vietnam Amusement Parks market include high maintenance costs, regulatory hurdles around safety and licensing, and competition from emerging digital entertainment platforms such as VR and gaming.

03. Who are the major players in the Vietnam Amusement Parks Market?

Key players in Vietnam Amusement Parks market include Vinpearl Land, Sun World, Dam Sen Park, Suoi Tien Park, and Asia Park Danang, who dominate due to their large-scale operations and strategic locations in key urban centers.

04. What are the growth drivers of the Vietnam Amusement Parks Market?

Key growth drivers in Vietnam Amusement Parks market include increasing urbanization, a rising middle-class population with greater disposable income, and government initiatives that promote tourism and family-oriented entertainment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.