Vietnam Automotive Aftermarket Service Market Outlook to 2028

Driven by increasing car ownership, urbanization and growing middle class

Region:Asia

Author(s):Navya and Rajat

Product Code:KR1453

October 2024

63

About the Report

Vietnam Automotive Aftermarket Service Market Overview:

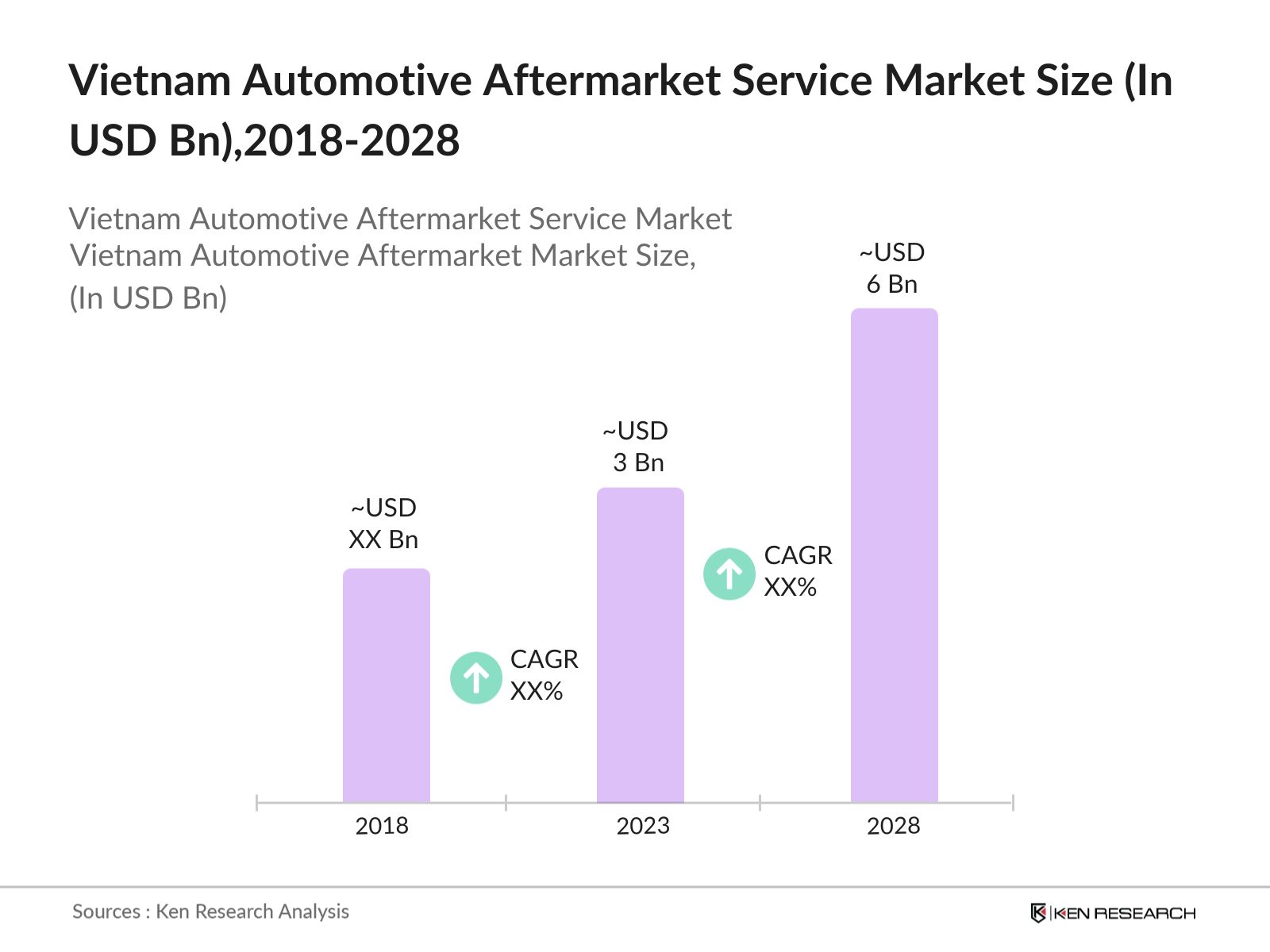

- Vietnam Automotive Aftermarket Service Market was valued at USD 3 Bn in 2023, driven by increasing awareness of regular maintenance, rising disposable income and a growing middle class. The expansion of e-commerce platforms for auto parts and services has also contributed to the market's steady growth.

- Market is dominated by several key players including Kia, Hyundai, Mazda and Vinfast. These companies have established strong networks of service centers across the country and continue to expand their product and service offerings to cater to the rising demand for automotive maintenance and repair services.

- In 2024, Ford Vietnam was awarded the First-Class Order of Labor by the Vietnamese State. This recognition highlights the company's 28-year commitment to Vietnam and its substantial contributions to the local economy, including an investment of $208 million and the creation of over 5,000 jobs.

- Ho Chi Minh City and Hanoi are the dominant cities in Vietnam's automotive aftermarket service market. Ho Chi Minh City is the largest market due to its dense population and high vehicle ownership rates. The rapid urbanization, high concentration of automotive service centers, and the presence of major automotive companies in these cities contribute to their dominance in the market.

Vietnam Automotive Aftermarket Service Market Segmentation:

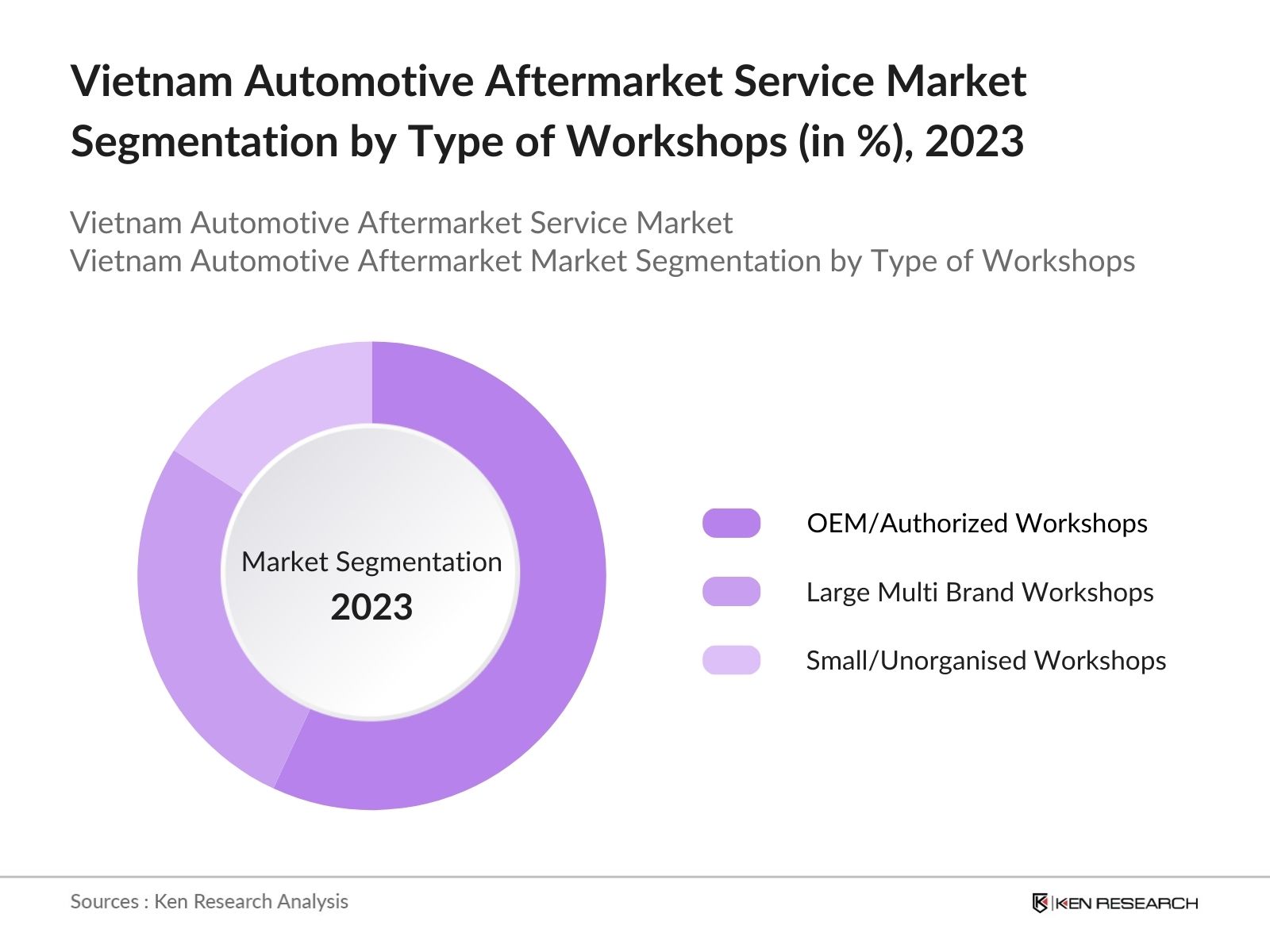

By Type of Workshops: Vietnam automotive aftermarket service market is segmented by workshop type into OEM/Authorized Workshops, Large Multi-Brand Workshops and Small /Unorganized Workshops. In 2023, OEM/Authorized Workshops has dominated the market driven by their advanced diagnostic tools, skilled technicians, and strong brand reputation, which attracted a higher number of customers seeking reliable and quality services.

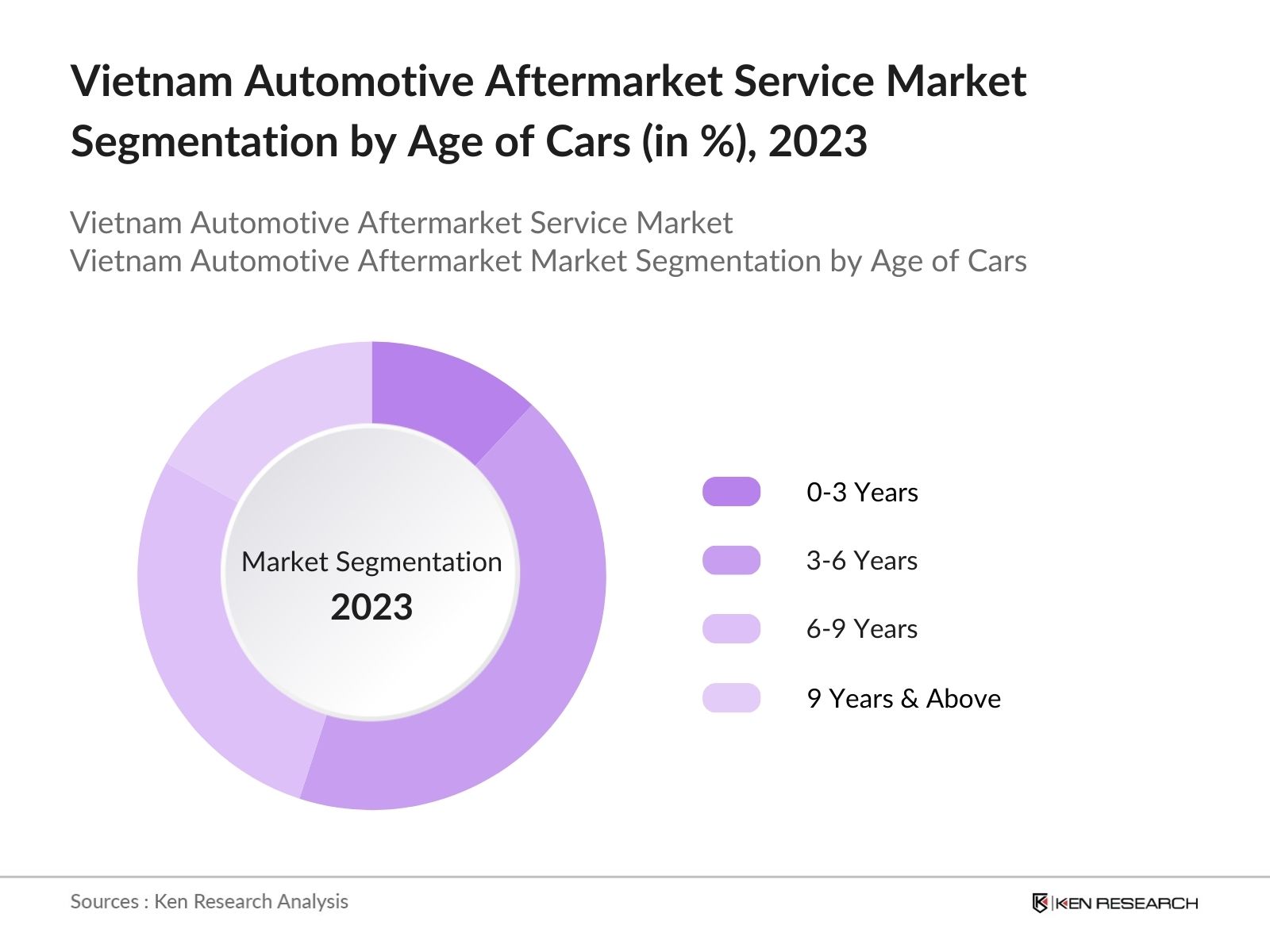

By Age of Cars: Vietnam automotive aftermarket service market is segmented by age of cars into 0-3 Years, 3-6 Years, 6-9 Years and 9 Years and above. In 2023, 3-6 Years old cars have dominated the market due to the increasing need for regular maintenance and part replacements as these vehicles approach mid-life, making them more frequent visitors to service workshops.

By Region: Vietnam automotive aftermarket service market is segmented by region into North, Central & South. In 2023, North region have dominated the market benefiting from its higher concentration of urban centers, leading to a larger vehicle population and greater demand for aftermarket services. The region's well-established infrastructure and presence of key automotive hubs also contributed to its leading position in the market.

Vietnam Automotive Aftermarket Service Industry Analysis:

Vietnam Automotive Aftermarket Service Market Growth Drivers:

- Increasing Vehicle Ownership: In 2023, the total automobile sales in Vietnam dropped by approximately 20.6% to 404,294 units, which includes both locally produced and imported vehicles. This increase is particularly noticeable in major cities like Ho Chi Minh City and Hanoi where the vehicle density is the highest in the country.

- Expansion of E-commerce Platforms: By 2022, the number of e-commerce users reached 48.5 million. This growth is fueled by the increasing adoption of digital shopping, particularly in urban areas, where consumers prefer the convenience of ordering parts online and having them delivered or installed at their convenience.

- Government Support for Electric Vehicles (EVs): Vietnams government has set an ambitious target for increasing the adoption of electric vehicles (EVs) by offering incentives like 0% registration fee for battery electric vehicles for three years starting from March 1, 2022. This rise in EV adoption is driving the need for specialized aftermarket services, such as battery replacement, electric motor servicing, and software updates.

Vietnam Automotive Aftermarket Service Market Challenges:

- High Overhead Cost: Vietnamese Original Equipment Manufacturers (OEMs) face significant overhead costs, primarily due to their reliance on imported genuine components and spare parts, which increases operational expenses by 15% to 20%. Additionally, these OEMs must make substantial investments in marketing and customer relationship management to maintain their market share, further contributing to the overall cost burden in the competitive landscape.

- Quality and Reliability Perception: Vietnamese OEMs incur high overhead costs, with operational expenses rising by 15% to 20% due to reliance on imported components. To retain market share, they also invest heavily in marketing and customer relationship management, further adding to their financial burden in an increasingly competitive environment.

Vietnam Automotive Aftermarket Service Market Government Initiatives

- Collaboration with International Firms: The Ministry of Industry and Trade (MoIT) is upgrading two technical centers in the North and South to support industrial growth. These centers work with international companies, including Toyota, to identify and develop potential suppliers for their value chains, fostering stronger collaboration between local and global firms, thereby enhancing Vietnam's industrial capabilities and competitiveness in the global market.

- Supporting Industry Development Programme: The Vietnam governments Supporting Industry Development Programme (until 2025) helps Vietnamese enterprises adopt modern standards and systems to boost domestic production in key sectors like automobiles. The government aims for supporting industry products to meet 70% of local demand by 2030, with expectations that around 2,000 companies will be capable of supplying directly to multinational corporations by that time.

Vietnam Automotive Aftermarket Service Competitive Landscape:

|

Company |

Vintage |

No. of Service Centers |

Services Offered |

|

Kia |

2007 |

104 |

Periodic Maintenance Repair Service |

|

Hyundai |

2011 |

93 |

Periodic Maintenance Repair Service Spare Parts Accessories |

|

Toyota |

1995 |

86 |

Periodic Maintenance Repair Service Car Beauty Care Service |

|

Mazda |

2011 |

52 |

Periodic Maintenance Repair Service |

|

Ford |

1995 |

49 |

Periodic Maintenance Repair Service |

|

Suzuki |

1995 |

40 |

Periodic Maintenance Maintenance Inspection Repair Service |

- VF3 by Vinfast: In 2024, VinFast has officially launched the VF 3, a mini electric SUV, in Vietnam, with a starting price of $9,200. This vehicle is designed to cater to the mass market, aiming to become a popular choice among consumers in Vietnam and potentially other Asian markets.

- Hyundai IONIQ 5: In 2023, Hyundai began local production of the IONIQ 5 to expand in Vietnam's electric vehicle market and is assembled locally, aiming to cater to the growing demand for electric vehicles in the region. By producing the IONIQ 5 domestically, Hyundai aims to reduce costs and improve supply chain efficiency, which is crucial for capturing market share in the rapidly evolving EV landscape.

Vietnam Automotive Aftermarket Service Future Market Outlook:

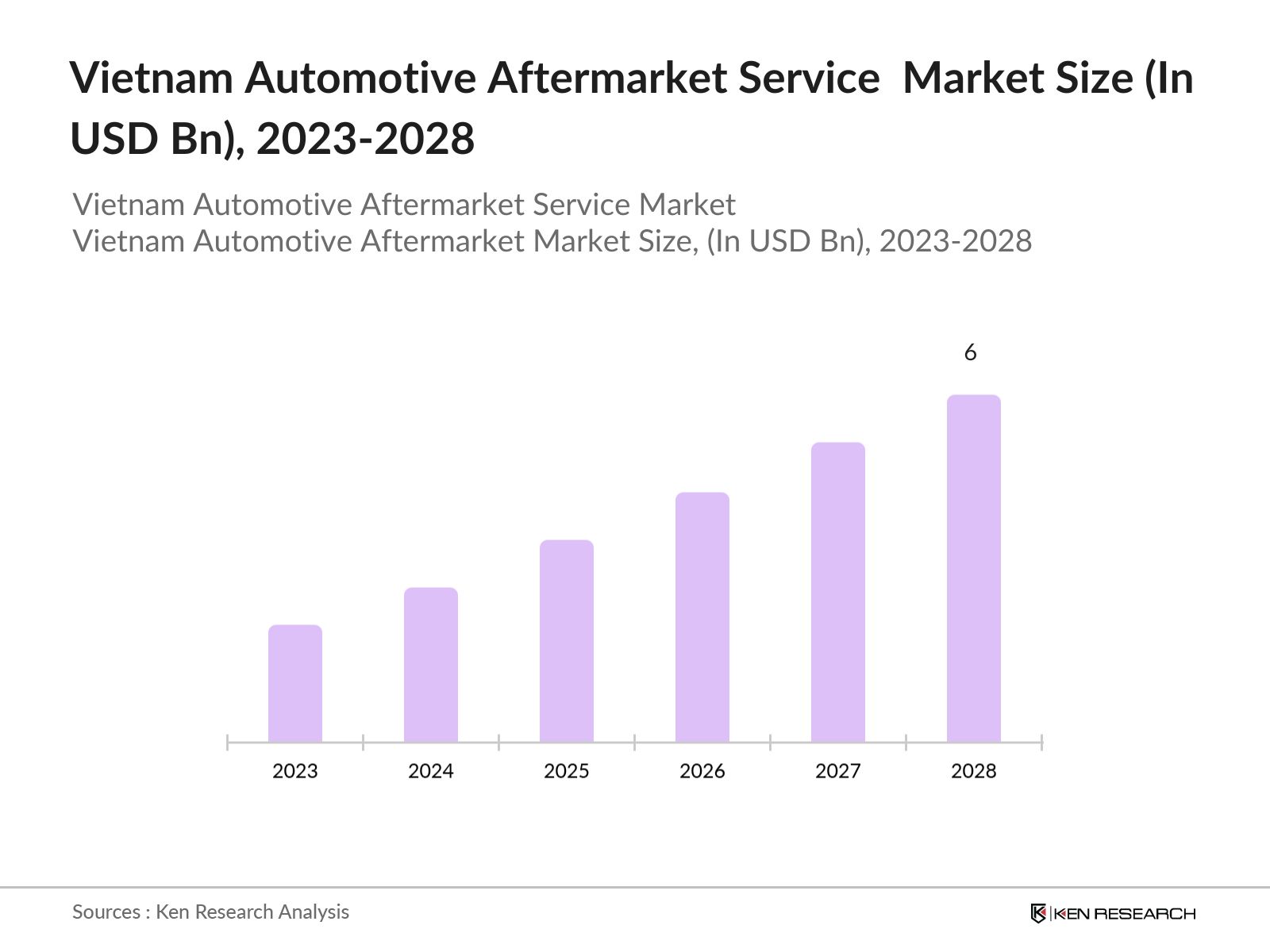

Vietnam Automotive Aftermarket Service market is poised for significant growth as the market is expected to reach USD 6 Bn in 2028, driven by the rising adoption of electric vehicles (EVs) and the governments ongoing initiatives to promote sustainable automotive practices.

Future Market Trends:

- Growth of Electric Vehicle Aftermarket Services: In the coming years, the aftermarket service sector in Vietnam will increasingly cater to the growing population of electric vehicles. As EV adoption accelerates, the market will see a rise in dedicated EV service centers equipped with advanced diagnostic tools and trained technicians.

- Digitalization of Automotive Services: The digitalization trend in Vietnams automotive aftermarket will gain momentum, with more service providers adopting online platforms for service booking, diagnostics, and customer engagement. The integration of AI and IoT in service operations will enhance efficiency, reduce service times, and improve customer satisfaction.

Scope of the Report

|

By Type of Workshops |

OEM/Authorized Workshops Large Multi-Brand Workshops Small /Unorganized Workshops |

|

By Type of Service |

Maintenance Car Care Accident Repair |

|

By Age of Car |

0-3 Years 3-6 Years 6-9 Years 9 Years & Above |

|

By Type of Vehicles |

SUV/MPV Sedan Compact SUV Hatchback Others |

|

By Booking Mode |

Offline Online |

|

By Region |

North Central South |

Products

Key Target Audience:

Automotive Manufacturers

Vehicle Owners and Fleet Operators

E-commerce Platforms for Auto Parts

Aftermarket Service Companies

Insurance Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Transport, Vietnam Register)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Kia

Hyundai

Toyota

Mazda

Vinfast

Ford

Honda

Mitsubishi

Suzuki

Table of Contents

1. Executive Summary

1.1 Executive Summary: Vietnam Automotive Aftermarket Service

2. Market Overview and Genesis of Vietnam Automotive Aftermarket Services

2.1 Market Overview of Vietnam Automotive Industry

2.2 Ecosystem of Vietnam Automotive Aftermarket Services

2.3 Value Chain Analysis of Vietnam Automotive Aftermarket Services

2.4 Operating Model for OEM Workshops in Vietnam

2.5 Operating Model for Multi Brand Workshops in Vietnam

3. Market Sizing of Vietnam Automotive Aftermarket Services

3.1 Passenger Car Sales and Car Parc in Vietnam, 2019 - 2023

3.2 Market Size Analysis of Vietnam Automotive Aftermarket Services, 2019 - 2023

3.3 Market Size Analysis of Vietnam Automotive Aftermarket Services, 2023 – 2028

4. Market Segmentation of Vietnam Automotive Aftermarket Services

4.1 Market Segment Analysis: By Type of Workshops, 2023-2028

4.2 Market Segment Analysis: By Type of Services for OEMs and Multi Brand Operators, 2023-2028

4.3 Market Segment Analysis: By Age of Car, 2023-2028

4.4 Market Segment Analysis: By Type of Vehicles Serviced, 2023-2028

4.5 Market Segment Analysis: By Booking Mode, 2023-2028

4.6 Market Segment Analysis: By Region, 2023-2028

5. Purchasing Behavior Analysis Basis Product Category

5.1 Purchasing Behavior Analysis for OEMs in 2023

5.2 Purchasing Behavior Analysis for Multi Brand Operators in 2023

6. Industry Analysis

6.1 Trends and Development in Vietnam Automotive Aftermarket Services

6.2 Pain Points of OEM and Multi Brand Operators in Vietnam’s Aftermarket Industry

6.3 Opportunities for OEM and Multi Brand Operators in Vietnam’s Aftermarket Industry

6.4 Porter Five Forces Analysis: Automotive Aftermarket Service Industry in Vietnam

6.5 Government Regulations and Initiatives in Vietnam Automotive Aftermarket Services

6.6 Key Decision-Making Parameters for Automobile Servicing: OEM and Multi Brand Vehicle Servicing Companies

6.7 Technology Platforms used by OEM and Multi Brand Vehicle Servicing Companies

6.8 Impact of Covid on Vietnam Automotive Aftermarket Service

7. Competition Analysis

7.1 Competition Overview in Vietnam Automotive Aftermarket Service Industry

7.2 Competition in Vietnam OEM Automotive Aftermarket Service Industry

7.3 Competition in Vietnam Multi Brand Automotive Aftermarket Service Industry

8. Analyst Recommendations

8.1 Prioritization between MBOs and OEMs based on product category and decision factors

8.2 Supply Chain Strategies

8.3 Sales Strategies

8.4 Case Study

9. Research Methodology

9.1 Market Definitions and Abbreviations

9.2 Market Sizing Approach

9.3 Consolidated Research Approach

9.4 Sample Size Inclusion

9.5 Limitation and Future Conclusions

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Automotive Aftermarket Service Market over the years, penetration of marketplaces and service providers ratio to compute finance disbursed for Vietnam Automotive Aftermarket Service Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach Automotive Aftermarket Service providers and understand nature of services segments and product, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Automotive Aftermarket Service Providers.

Frequently Asked Questions

01 How big is Vietnam Automotive Aftermarket Service Market?

Vietnam Automotive Aftermarket Service Market was valued at USD 3 Bn in 2023, driven by increasing awareness of regular maintenance, rising disposable income and a growing middle class.

02 What are the Key Factors Driving the Vietnam Automotive Aftermarket Service Market?

Growth drivers include the rising disposable income, urbanization and increasing vehicle ownership. This increase is particularly noticeable in major cities like Ho Chi Minh City and Hanoi where the vehicle density is the highest in the country.

03 Who are the Major Players in the Vietnam Automotive Aftermarket Service Market?

Vietnam Automotive Aftermarket Service Market is dominated by several key players including Kia, Hyundai, Mazda and Vinfast. These companies have established strong networks of service centers across the country and continue to expand their product and service offerings

04 What is the Future of Vietnam Automotive Aftermarket Service Market?

Vietnam Automotive Aftermarket Service market is expected to reach USD 6 Bn in 2028, driven by the rising adoption of electric vehicles (EVs) and the governments ongoing initiatives to promote sustainable automotive practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.