Vietnam Baby Food Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD11241

December 2024

92

About the Report

Vietnam Baby Food Market Overview

- The Vietnam Baby Food Market is valued at USD 1.9 billion, based on a five-year historical analysis. This growth is primarily driven by the increase in birth rates, rising disposable incomes, and heightened awareness among Vietnamese parents about child nutrition and health. Consumers are particularly interested in organic and fortified products, contributing to the market's expansion as parents become more health-conscious and seek nutritious and convenient options.

- Urban centers such as Ho Chi Minh City and Hanoi lead the market due to their high population density, greater disposable incomes, and consumer preference for premium baby food products. In these cities, parents are more inclined to invest in high-quality, branded baby food products, including organic and fortified options, driving the markets dominance in these regions.

- The Vietnamese government allocated nearly 900 billion VND in 2024 for subsidized nutrition programs aimed at reducing malnutrition in infants. These programs include distributing free or low-cost baby food items in economically disadvantaged areas.

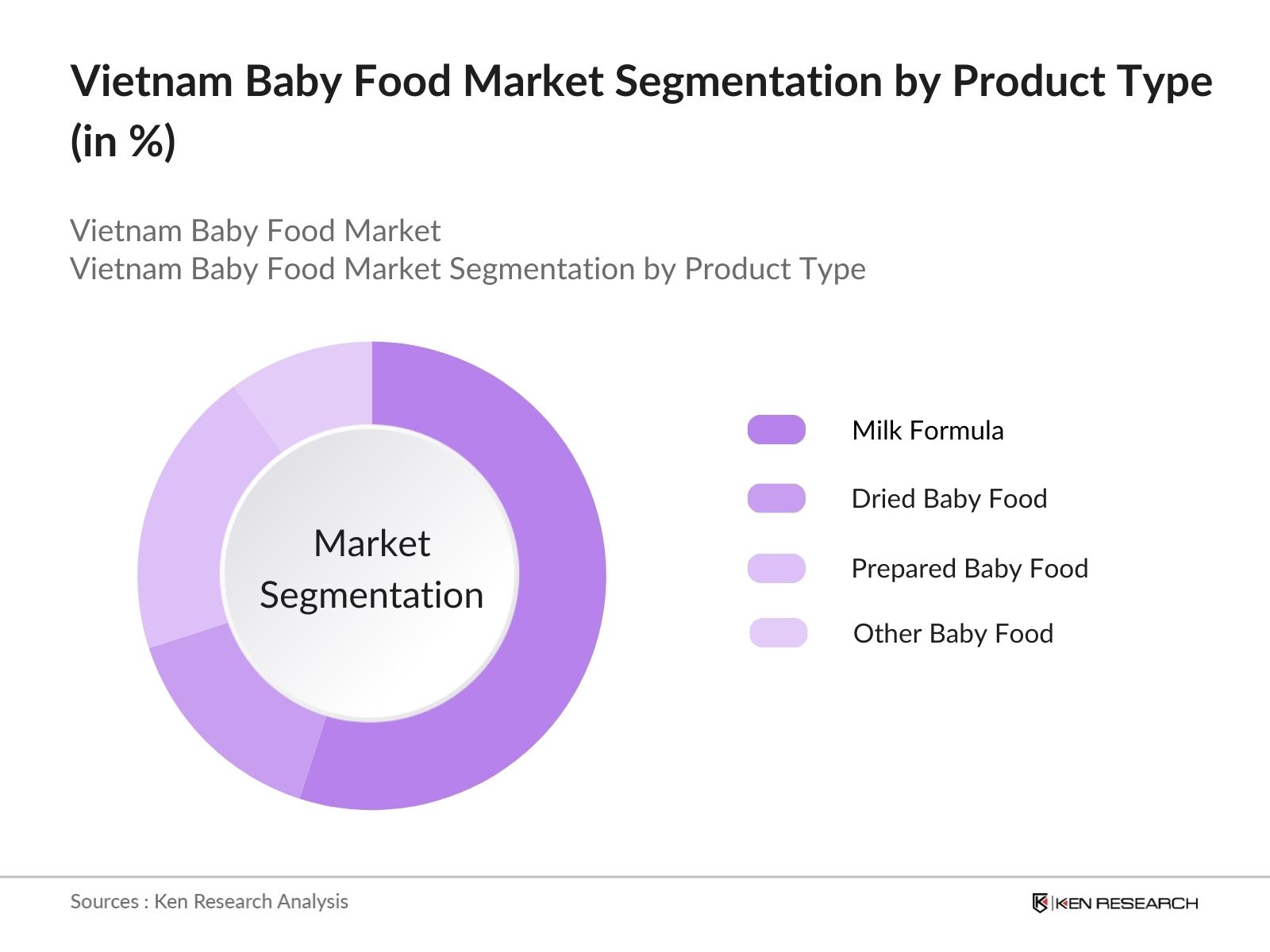

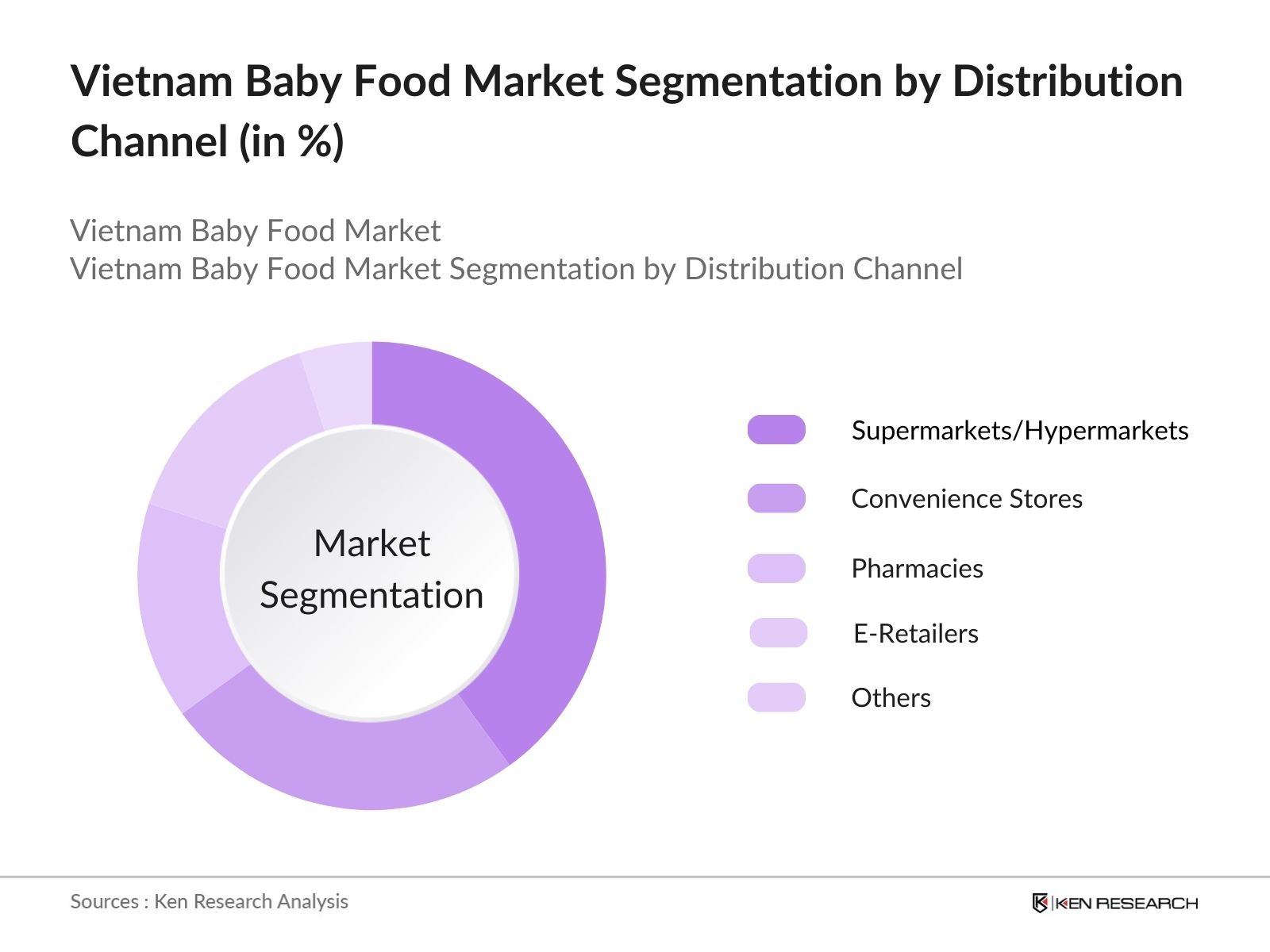

Vietnam Baby Food Market Segmentation

By Product Type: The market is segmented by product type into milk formula, dried baby food, prepared baby food, and other baby foods. Milk formula holds a dominant market share under this segmentation, attributed to its essential role as a supplement for mothers unable to breastfeed or those seeking additional nutrition for their infants. This demand is supported by the high nutritional value of milk formulas and the influence of well-established brands that offer a wide range of products tailored to different infant stages and health needs.

By Distribution Channel: The market is further segmented by distribution channel into supermarkets/hypermarkets, convenience stores, pharmacies, e-retailers, and others. Supermarkets and hypermarkets lead this segmentation due to the convenience they offer in terms of location, the variety of baby food options available, and regular promotions that attract price-sensitive consumers. Their expansive reach across urban areas also plays a key role, ensuring consistent availability of products.

Vietnam Baby Food Market Competitive Landscape

The market is primarily driven by both domestic and international companies, including players like Vinamilk and global brands such as Nestl and Abbott Laboratories. This consolidation reflects the market's competitive landscape, where prominent brands compete on quality, brand loyalty, and innovation.

Vietnam Baby Food Market Analysis

Market Growth Drivers

- Increasing Birth Rate in Vietnam: Vietnam's birth rate remains stable, with approximately 1.5 million births in 2024. The consistent number of new births directly correlates with rising demand for baby food products as parents seek convenient and nutritious options to support early childhood development.

- Government Promotion of Maternal and Child Health: The Vietnamese government has allocated over 1.2 trillion VND in 2024 to maternal and child health programs. These initiatives, including subsidized healthcare for infants, indirectly promote awareness and consumption of baby food products, as they educate parents on the importance of proper infant nutrition.

- Growing Working Parent Demographic: Vietnam's labor force includes around 25 million women, with a substantial proportion balancing careers and childcare responsibilities. The demand for convenient, pre-prepared baby food products is surging as working parents look for time-saving, nutritionally adequate feeding solutions.

Market Challenges

- Health Concerns Over Processed Baby Food Ingredients: Parents are increasingly cautious about preservatives and artificial ingredients in baby foods, particularly following a government report identifying trace chemicals in imported products. These health concerns impact brand trust and slow the adoption of certain baby food products in Vietnam.

- Price Sensitivity Among Consumers: Approximately 60% of Vietnam's population has a monthly income below 8 million VND. This significant proportion of price-sensitive consumers often restricts their purchases to staple foods, affecting the demand for baby food products, particularly premium brands.

Vietnam Baby Food Market Future Outlook

Over the next five years, the Vietnam Baby Food industry is expected to witness substantial growth due to the rising awareness around child nutrition, continued innovation in product offerings, and expansion into online retail channels.

Future Market Opportunities

- Increased Investment in Organic Baby Foods: Over the next five years, Vietnamese baby food companies are expected to invest heavily in organic and non-GMO product lines. Organic baby food consumption is projected to reach 4 million households by 2029, as health-conscious parents prioritize safe and natural options.

- Growth of Subscription-Based Baby Food Services: Subscription-based baby food services are anticipated to grow, catering to busy, urban parents seeking convenience. The number of households subscribing to monthly baby food deliveries is expected to reach 500,000 by 2029.

Scope of the Report

|

Product Type |

Milk Formula |

|

Distribution Channel |

Supermarkets/Hypermarkets |

|

Age Group |

0-6 Months |

|

Ingredient Type |

Organic |

|

Region |

Northern Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Manufacturers and Suppliers (Baby Food Production Units)

Retailers (Supermarkets, Hypermarkets, E-Retailers)

Distributors (Wholesalers and Local Distributors)

Government and Regulatory Bodies (Vietnam Ministry of Health, Ministry of Industry and Trade)

Healthcare Providers (Pediatricians, Child Health Clinics)

Investor and Venture Capitalist Firms (Local and Global VC Firms)

Marketing and Advertising Agencies

Consumer Advocacy Groups

Companies

Players Mentioned in the Report:

Vinamilk

Abbott Laboratories

Nestl Vietnam Ltd.

FrieslandCampina Dutch Lady Vietnam

Mead Johnson Nutrition Vietnam

Danone Vietnam Company Ltd.

Nutifood

Hipp

Bibica

DFB Hanco Nutrition

Table of Contents

1. Vietnam Baby Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Baby Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Baby Food Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Increasing Urbanization

3.1.3. Growing Health Awareness

3.1.4. Expanding Middle-Class Population

3.2. Market Challenges

3.2.1. High Competition from Local Brands

3.2.2. Regulatory Compliance

3.2.3. Supply Chain Constraints

3.3. Opportunities

3.3.1. Expansion into Rural Areas

3.3.2. Introduction of Organic Products

3.3.3. E-commerce Growth

3.4. Trends

3.4.1. Demand for Organic and Natural Products

3.4.2. Fortified and Functional Foods

3.4.3. Convenience Packaging

3.5. Government Regulations

3.5.1. Food Safety Standards

3.5.2. Import Tariffs and Duties

3.5.3. Labeling Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Vietnam Baby Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Milk Formula

4.1.2. Dried Baby Food

4.1.3. Prepared Baby Food

4.1.4. Other Baby Food

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Pharmacies

4.2.4. E-retailers

4.2.5. Others

4.3. By Age Group (In Value %)

4.3.1. 0-6 Months

4.3.2. 6-12 Months

4.3.3. 12-24 Months

4.3.4. 24-36 Months

4.4. By Ingredient Type (In Value %)

4.4.1. Organic

4.4.2. Conventional

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Baby Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vinamilk

5.1.2. Abbott Laboratories

5.1.3. Nestl Vietnam Ltd.

5.1.4. FrieslandCampina Dutch Lady Vietnam

5.1.5. Mead Johnson Nutrition Vietnam

5.1.6. Danone Vietnam Company Ltd.

5.1.7. Nutifood

5.1.8. Hipp

5.1.9. Bibica

5.1.10. DFB Hanco Nutrition

5.1.11. Heinz

5.1.12. Lactalis International

5.1.13. Saigon Food

5.1.14. TUV Corp

5.1.15. Cay Thi

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Distribution Network, Pricing Strategy, Marketing Initiatives, R&D Investment, Financial Performance, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Vietnam Baby Food Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam Baby Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Baby Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Age Group (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Baby Food Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved mapping the Vietnam Baby Food Market, which included assessing all primary stakeholders. Comprehensive desk research was conducted using proprietary databases and publicly available data to understand and define crucial market variables.

Step 2: Market Analysis and Construction

In this phase, historical market data for Vietnam Baby Food was analyzed to assess trends in consumption, sales channels, and consumer demographics. Data analysis helped determine key market drivers and revenue potential in various regions.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market growth and trends were validated through in-depth interviews with industry experts and stakeholders from leading baby food companies. Their feedback provided insights into the markets operational and financial dimensions, which enriched the analysis.

Step 4: Research Synthesis and Final Output

Finally, the insights gained were synthesized to produce a well-rounded, accurate report that reflects both quantitative and qualitative aspects of the Vietnam Baby Food Market. This final stage also involved validating the research findings with available market reports to ensure data integrity.

Frequently Asked Questions

01. How big is the Vietnam Baby Food Market?

The Vietnam Baby Food Market was valued at USD 1.9 billion, primarily driven by increased awareness about child health and nutrition.

02. What are the challenges in the Vietnam Baby Food Market?

Key challenges in the Vietnam Baby Food Market include regulatory hurdles, competition from local brands, and price sensitivity among consumers in rural areas, which impact market expansion.

03. Who are the major players in the Vietnam Baby Food Market?

The Vietnam Baby Food Market includes Vinamilk, Abbott Laboratories, Nestl Vietnam Ltd., and FrieslandCampina, among others, known for their extensive distribution networks and high-quality product offerings.

04. What factors are driving growth in the Vietnam Baby Food Market?

Growth in the Vietnam Baby Food Market is propelled by factors such as rising disposable incomes, health-conscious parenting, and the increasing urban population, which boosts demand for premium baby food products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.