Vietnam Battery Industry Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD2113

November 2024

99

About the Report

Vietnam Battery Market Overview

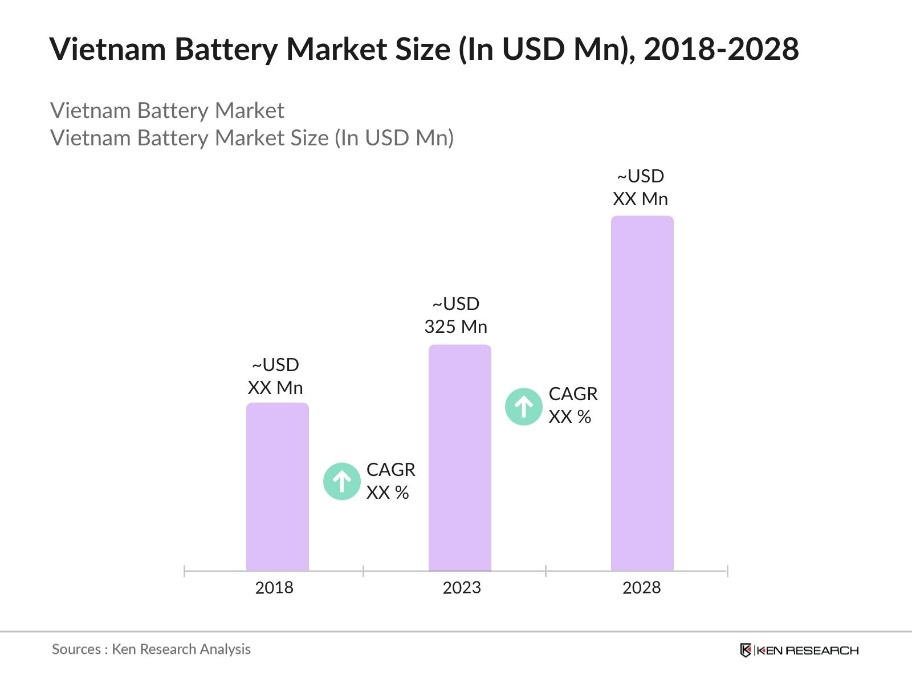

- The Vietnam Battery Market was valued at USD 325 million in 2023, driven by increasing demand for electric vehicles (EVs), renewable energy storage systems, and growing industrial and consumer electronics sectors. The market comprises various segments, including lithium-ion, lead-acid, nickel-metal hydride, and solid-state batteries, serving diverse applications across automotive, industrial, and consumer electronics.

- Key players in the Vietnam Battery Market include VinFast Battery, Panasonic Vietnam, Toshiba Battery Vietnam, and BYD Vietnam. These companies maintain a strong market presence through continuous innovation, strategic partnerships, and investments in manufacturing capacities to meet the rising demand for battery products across the region.

- Major regions such as Ho Chi Minh City, Hanoi, and Bac Ninh dominate the market due to their industrial base, proximity to key battery manufacturing facilities, and growing adoption of electric vehicles and renewable energy solutions.

- In 2023, VinFast Battery announced plans to increase production capacity for lithium-ion batteries in its Hai Phong facility to support the growing EV market in Vietnam and Southeast Asia. This expansion aligns with Vietnams strategy to reduce dependency on imported battery technologies and establish itself as a key player in the global energy storage market.

Vietnam Battery Market Segmentation

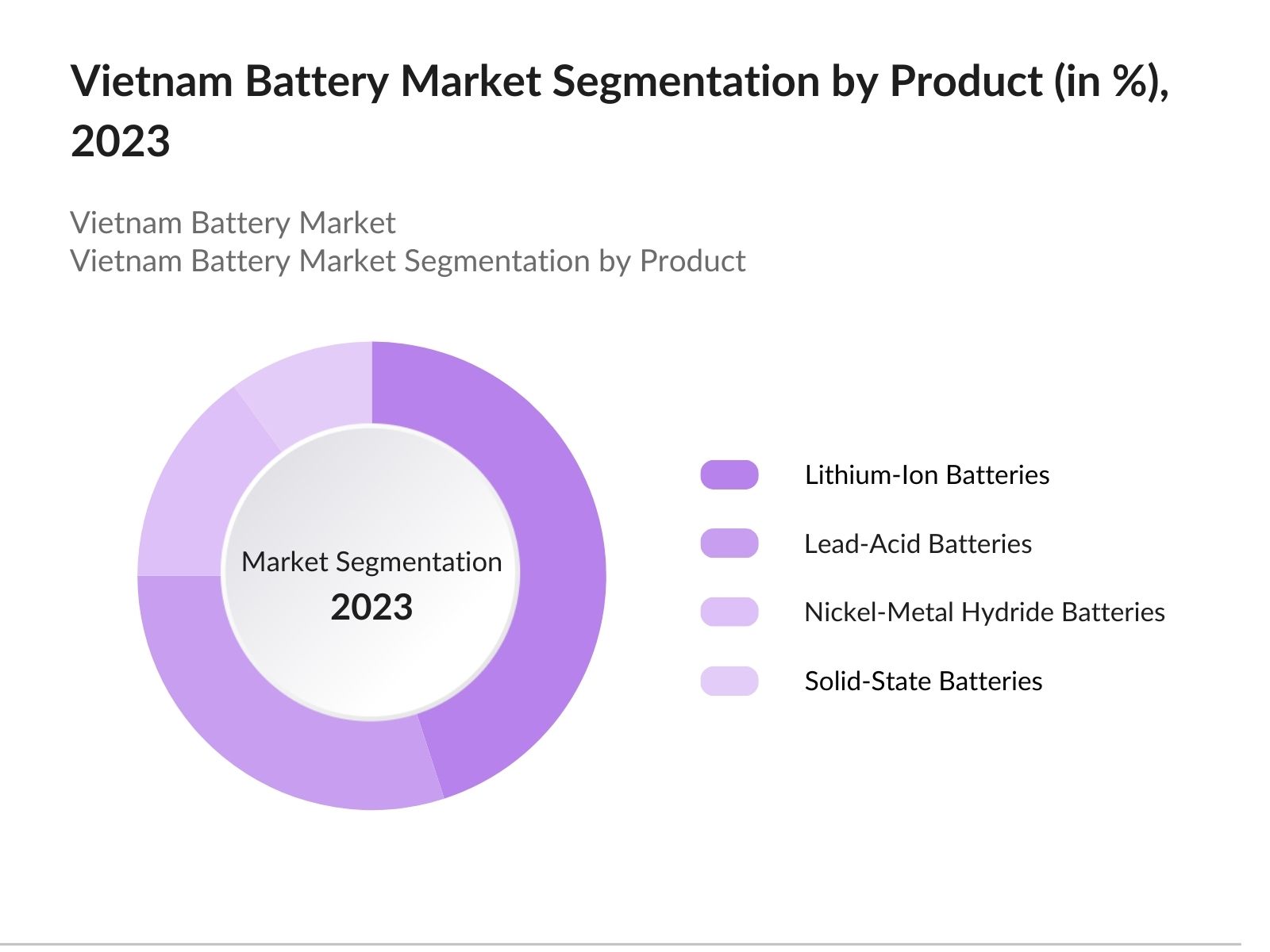

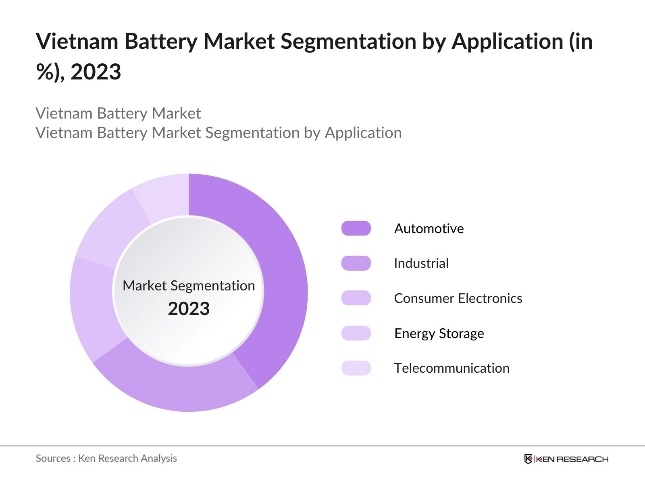

The Vietnam Battery Market is segmented by product type, application, and region.

By Product Type: The market is segmented into Lithium-Ion, Lead-Acid, Nickel-Metal Hydride, and Solid-State Batteries. In 2023, lithium-ion batteries held the dominant market share due to their widespread use in electric vehicles (EVs) and renewable energy storage systems. Key players in this segment include VinFast Battery and Panasonic Vietnam, offering advanced battery solutions for automotive and industrial applications.

By Application: The market is categorized by application into Automotive, Industrial, Consumer Electronics, Energy Storage, and Telecommunication. Automotive applications led the market in 2023, driven by the increasing production and adoption of electric vehicles. The industrial sector is also gaining traction due to the demand for backup power and energy storage solutions.

By Region: The market is segmented into North, East, West & South. South region, particularly Ho Chi Minh City and Binh Duong, dominates the market in 2023 due to the presence of major battery manufacturing hubs and extensive industrial activities. Northern Vietnam, including Hanoi and Hai Phong, is also a key region for battery manufacturing and EV adoption.

Vietnam Battery Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

VinFast Battery |

2019 |

Hai Phong |

|

Panasonic Vietnam |

1971 |

Hanoi |

|

BYD Vietnam |

2020 |

Bac Ninh |

|

Toshiba Battery Vietnam |

1999 |

Ho Chi Minh City |

|

GS Yuasa Vietnam |

1996 |

Binh Duong |

- Panasonic Vietnam: In September 2023, Panasonic Appliances Vietnam received an USD 18 million investment certificate from Hung Yen province, which is aimed at expanding its manufacturing capabilities. This investment reflects Panasonic's commitment to enhancing its production capacity in Vietnam, particularly in the context of increasing demand for batteries and energy solutions.

- BYD Vietnam: On July 18, 2023, BYD officially introduced its electric vehicle (EV) brand in Vietnam, unveiling three key models: the BYD SEAL, BYD DOLPHIN, and BYD ATTO 3. This launch marks BYD's strategic entry into the Vietnamese market, which it considers a high-potential opportunity for growth in the EV sector.

Vietnam Battery Market Analysis

Growth Drivers

- Electric Vehicle Adoption Surge: The surge in electric vehicle (EV) adoption is one of the primary drivers for the Vietnam battery market. As of 2023, the Vietnamese government implemented its EV Development Plan, which aims to have 1 million electric vehicles on the roads by 2028. Sales of electric vehicles reached 18,000 units in 2023, supported by government incentives such as tax breaks for EV manufacturers and consumers. This shift in the automotive industry boosts the demand for lithium-ion batteries, which are critical for EV production.

- Renewable Energy Expansion: Vietnam's commitment to renewable energy is driving battery demand, particularly for energy storage solutions. The governments Green Energy Transition Program, launched in 2022, aims to generate 21% of the country's electricity from renewable sources by 2030. As solar and wind energy projects grow, energy storage systems, mainly lithium-ion batteries, are crucial for stabilizing the grid. By 2023, Vietnam had over 16 GW of installed solar capacity, and the government is expected to invest USD 5 billion by 2025 to enhance energy storage solutions to complement its renewable energy goals.

- Industrialization and Infrastructure Growth: Vietnams fast-paced industrialization, coupled with the government's focus on expanding industrial zones, is fueling demand for backup power and energy storage solutions. In 2023, the Vietnamese government reported that industrial activities accounted for one third of the countrys total electricity consumption, prompting industries to invest in battery-based energy storage systems to ensure uninterrupted power supply during grid outages.

Challenges

- Supply Chain Vulnerabilities: The Vietnam battery industry faces challenges due to its dependency on imported raw materials like lithium and cobalt, which are essential for battery production. The country's reliance on imports from countries such as China and Australia has exposed the market to supply chain disruptions. Geopolitical tensions and global shipping delays have further complicated the situation, leading to higher production costs and extended lead times.

- Environmental Impact of Battery Disposal: Battery disposal, particularly of lead-acid batteries, presents environmental challenges in Vietnam. Without a comprehensive recycling infrastructure, improper disposal practices have contributed to soil and water contamination in various regions. The accumulation of discarded batteries has raised concerns over environmental health and sustainability.

Government Initiatives

- National EV Development Plan (2023-2028): The Vietnamese governments National EV Development Plan aims to boost electric vehicle adoption and domestic battery production. By offering tax incentives and subsidies to manufacturers like VinFast and Panasonic, the plan targets 500,000 electric vehicles by 2025 and 1 million electric vehicles by 2028.

- Green Energy Transition Program: Launched in 2022, Vietnams Green Energy Transition Program focuses on increasing the countrys reliance on renewable energy, particularly solar and wind power, and promoting the development of energy storage systems. The government has set a target to achieve 21% renewable energy contribution to the national grid by 2030.

Vietnam Battery Market Future Outlook

The Vietnam Battery Market is expected to grow remarkably in the forecasted period, driven by the rising demand for electric vehicles, renewable energy storage, and industrial backup power solutions.

Future Market Trends

- Adoption of Solid-State Batteries: By 2028, solid-state battery technology is expected to gain prominence in Vietnam due to its higher energy density and safety compared to traditional lithium-ion batteries. Major manufacturers, including VinFast and Panasonic, have started investing in solid-state battery research and development.

- Expansion of Battery Recycling Capabilities: To address environmental concerns and reduce dependency on imported raw materials, Vietnam is expected to invest heavily in large-scale battery recycling facilities by 2028. The governments strategy focuses on reclaiming valuable materials like lithium, cobalt, and lead from used batteries, particularly from electric vehicles and industrial applications.

Scope of the Report

|

By Product |

Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride Batteries Solid-State Batteries |

|

By Application |

Automotive Industrial Consumer Electronics Energy Storage Telecommunication |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Battery Manufacturers

Electric Vehicle (EV) Manufacturers

Renewable Energy Providers

Telecommunication Companies

Industrial Automation Firms

Consumer Electronics Firms

Energy Storage Providers

Government and Regulatory Bodies (Ministry of Industry and Trade)

Investors and Venture Capitalists

Banks and Financial Institute

Automotive OEMs

Electricity Grid Operators

Energy Service Companies (ESCOs)

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

VinFast Battery

Panasonic Vietnam

Toshiba Battery Vietnam

BYD Vietnam

GS Yuasa Vietnam

Hitachi Chemical Vietnam

Exide Technologies Vietnam

Saft Vietnam

Leoch Battery Vietnam

Vision Battery Vietnam

Samsung SDI Vietnam

LG Chem Vietnam

Varta Vietnam

TDK Vietnam

FDK Vietnam

Table of Contents

1. Vietnam Battery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. Vietnam Battery Market Size (in USD Mn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam Battery Market Analysis

3.1 Growth Drivers

3.1.1 Electric Vehicle Adoption Surge

3.1.2 Renewable Energy Expansion

3.1.3 Industrialization and Infrastructure Growth

3.2 Challenges

3.2.1 Supply Chain Vulnerabilities

3.2.2 Environmental Impact of Battery Disposal

3.2.3 High Production Costs

3.3 Opportunities

3.3.1 Expansion of Energy Storage Solutions

3.3.2 Government Incentives for Battery Production

3.3.3 Growing Demand for Battery Recycling

3.4 Trends

3.4.1 Expansion of Lithium-Ion Battery Production

3.4.2 Development of Energy Storage Systems

3.4.3 Investment in Battery Recycling

3.5 Government Initiatives

3.5.1 National EV Development Plan (2023-2028)

3.5.2 Green Energy Transition Program

3.5.3 Circular Economy Action Plan

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. Vietnam Battery Market Segmentation, 2023

4.1 By Product Type (in Value %)

4.1.1 Lithium-Ion Batteries

4.1.2 Lead-Acid Batteries

4.1.3 Nickel-Metal Hydride Batteries

4.1.4 Solid-State Batteries

4.2 By Application (in Value %)

4.2.1 Automotive

4.2.2 Industrial

4.2.3 Consumer Electronics

4.2.4 Energy Storage

4.2.5 Telecommunication

4.3 By Region (in Value %)

4.3.1 North

4.3.2 East

4.3.3 South

4.3.4 West

5. Vietnam Battery Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 VinFast Battery

5.1.2 Panasonic Vietnam

5.1.3 BYD Vietnam

5.1.4 Toshiba Battery Vietnam

5.1.5 GS Yuasa Vietnam

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Vietnam Battery Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. Vietnam Battery Market Regulatory Framework

7.1 National Policies and Guidelines

7.2 Compliance Requirements and Certification Processes

7.3 International Trade Agreements and Tariffs

8. Vietnam Battery Market Future Outlook (in USD Mn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. Vietnam Battery Future Market Segmentation, 2028

9.1 By Product Type (in Value %)

9.2 By Application (in Value %)

9.3 By Region (in Value %)

10. Vietnam Battery Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building

Collating statistics on Vietnam battery market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam battery market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential battery companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from battery companies.

Frequently Asked Questions

01 How big is the Vietnam Battery Market?

The Vietnam Battery Market was valued at USD 325 million in 2023, driven by the increasing demand for electric vehicles (EVs), renewable energy storage systems, and growth in industrial and consumer electronics sectors.

02 What are the challenges in the Vietnam Battery Market?

Challenges in the Vietnam Battery Market include supply chain vulnerabilities due to reliance on imported raw materials, environmental concerns related to battery disposal, and high production costs. These issues are exacerbated by global shipping delays and regulatory challenges around battery recycling.

03 Who are the major players in the Vietnam Battery Market?

Key players in the Vietnam Battery Market include VinFast Battery, Panasonic Vietnam, Toshiba Battery Vietnam, and BYD Vietnam. These companies lead the market through continuous innovation, strategic partnerships, and large-scale investments in manufacturing capacity.

04 What are the growth drivers of the Vietnam Battery Market?

The Vietnam Battery Market is driven by factors such as the surge in electric vehicle adoption, government initiatives promoting renewable energy expansion, and industrial growth, particularly in energy storage and backup power solutions for manufacturing facilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.