Vietnam Bread & Cereal Products Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD11157

December 2024

86

About the Report

Vietnam Bread & Cereal Products Market Overview

- The Vietnam Bread & Cereal Products market is valued at USD 16.1 billion, with its growth driven by rising consumer interest in convenient, ready-to-eat food options and healthier bread and cereal alternatives. The market has seen significant growth due to the increasing urban population's demand for diverse breakfast and snacking options, along with a notable shift toward organic and whole-grain products.

- Dominant regions in Vietnam's bread and cereal market include urban centers like Ho Chi Minh City and Hanoi. These cities have high populations, greater access to modern retail channels, and higher consumer purchasing power, making them hubs for premium and diverse food products. Additionally, these cities host a range of global and local players, creating a competitive environment that drives product quality, variety, and innovation in bread and cereal offerings.

- The Vietnamese government has introduced subsidies aimed at encouraging local wheat cultivation to reduce dependency on imports. In 2024, the Ministry of Agriculture allocated $100 million to support domestic wheat farming, which aims to meet at least 10% of the countrys wheat demand by 2026. This initiative is expected to stabilize production costs for bread and cereal manufacturers in the coming years.

Vietnam Bread & Cereal Products Market Segmentation

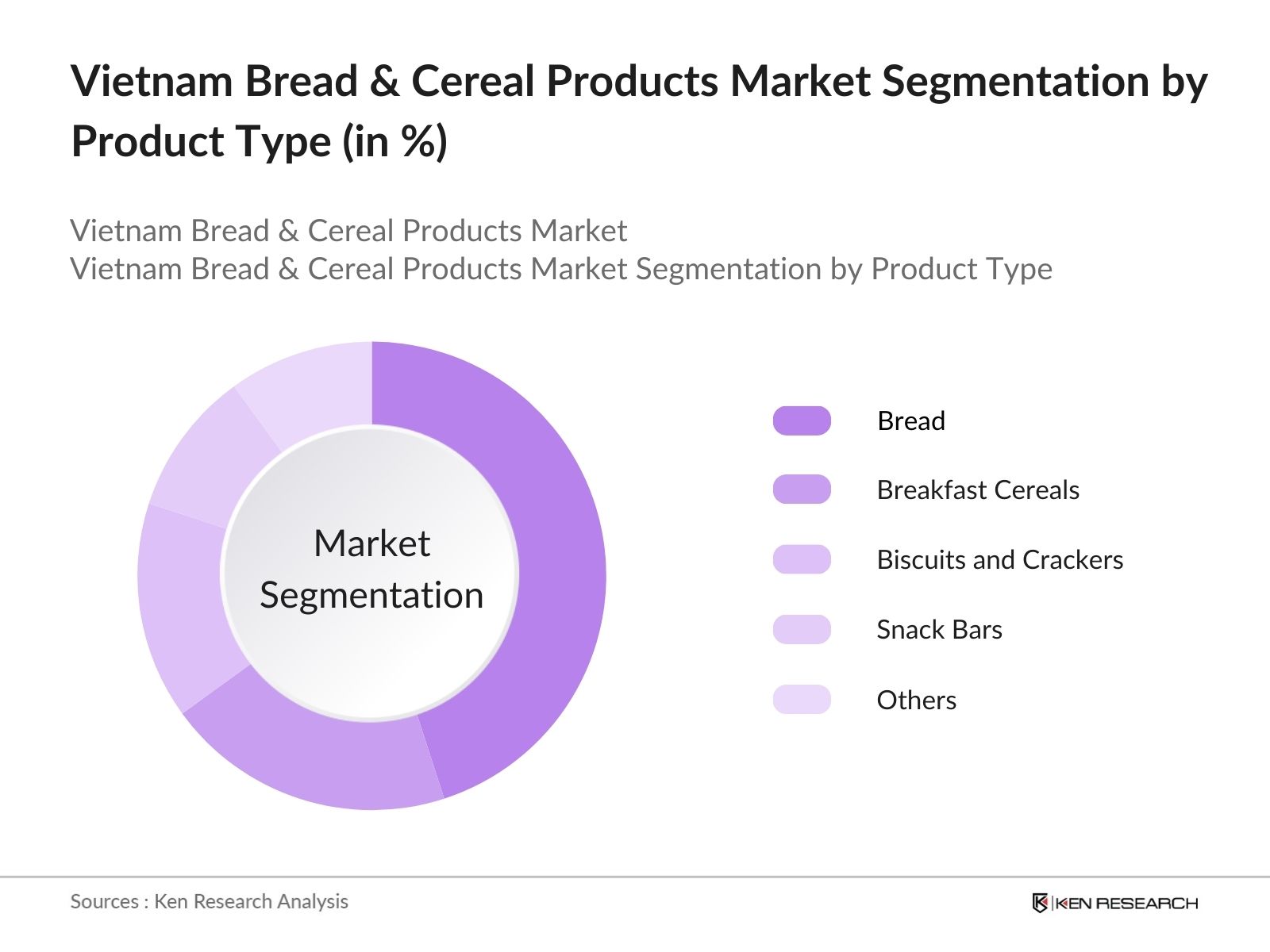

By Product Type: The market is segmented by product type into bread, breakfast cereals, biscuits and crackers, snack bars, and other niche products. Bread holds a dominant position within this segment, largely because of its role as a staple food item and its widespread acceptance across various consumer demographics. Vietnamese consumers favor bread products due to their affordability, versatility, and convenience, making it an essential part of daily meals. Additionally, artisanal and bakery brands contribute to this segment's growth by offering unique flavors, textures, and healthy alternatives like whole-grain and gluten-free options.

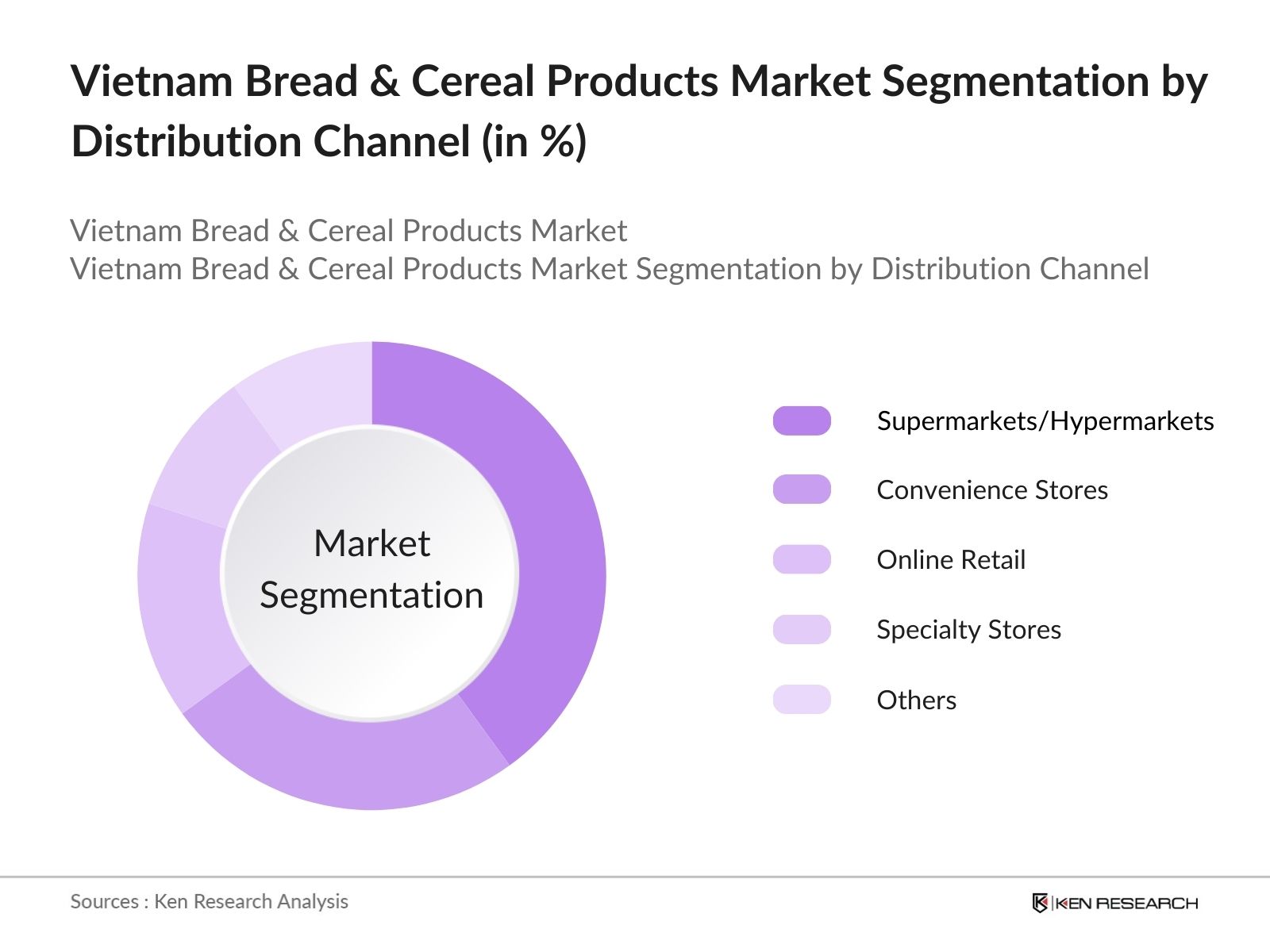

By Distribution Channel: The distribution channel for bread and cereal products in Vietnam comprises supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and other channels. Supermarkets and hypermarkets dominate this segment, thanks to their extensive presence in urban areas and their ability to offer a wide range of local and international brands. These retail formats cater to the demand for both affordability and premium-quality products. Convenience stores and online retail are also gaining traction, especially in metropolitan areas where consumers prioritize convenience and quick access.

Vietnam Bread & Cereal Products Market Competitive Landscape

The market is dominated by a mix of local and international companies that focus on innovation, product quality, and expanding distribution channels. Major companies in the market invest in product development to meet the evolving health and taste preferences of Vietnamese consumers, leading to a highly competitive landscape.

Vietnam Bread & Cereal Products Market Analysis

Market Growth Drivers

- Rising Health Awareness and Demand for Nutritional Products: With an increase in health awareness among Vietnamese consumers, the demand for bread and cereal products fortified with vitamins, minerals, and whole grains is growing rapidly. In 2024, nearly 15 million Vietnamese consumers are seeking healthier food options, prompting bread and cereal manufacturers to introduce nutrient-rich and fiber-packed products.

- Increasing Urban Population and Shift in Consumption Patterns: Vietnams urban population has seen a steady increase, with an estimated 46 million people living in urban areas in 2024. The urban demographic has shown a strong inclination toward convenient, ready-to-eat products, leading to a surge in the popularity of pre-packaged bread and cereal products.

- Growth in Retail Infrastructure: Vietnam's retail sector, especially modern trade channels such as supermarkets and hypermarkets, has expanded significantly, reaching over 1,200 supermarkets and 300 hypermarkets in 2024. The increasing availability of bread and cereal products across these outlets has made these products more accessible to a broader range of consumers.

Market Challenges

- Lack of Standardization in Quality and Labeling: The absence of standardized regulations on quality and labeling within the bread and cereal segment poses a challenge to consumers and producers alike. Reports indicate that inconsistencies in labeling have led to consumer mistrust, with 500 reported complaints in 2023 regarding misleading nutritional claims.

- Growing Competition from International Brands: The presence of international bread and cereal brands in Vietnams market has intensified, with imports of baked goods reaching approximately $250 million in 2024. Local manufacturers struggle to compete against these established brands, which have superior resources for advertising and distribution.

Vietnam Bread & Cereal Products Market Future Outlook

The Vietnam Bread & Cereal Products industry is expected to witness sustained growth, fueled by a combination of urbanization, evolving consumer preferences, and increased disposable incomes.

Future Market Opportunities

- Increase in Organic Bread and Cereal Products: Over the next five years, consumer demand for organic bread and cereals is expected to grow as health awareness continues to rise. Organic product sales in Vietnam are projected to increase, reaching up to 5 million units annually by 2028, supported by government certifications and the rising number of organic food stores.

- Adoption of Sustainable Packaging: Bread and cereal manufacturers will increasingly adopt sustainable packaging materials, such as biodegradable wraps and recyclable boxes, to meet consumer preferences for eco-friendly options. By 2028, it is estimated that 70% of bread and cereal products will utilize environmentally friendly packaging, aligning with global sustainability goals and attracting eco-conscious consumers.

Scope of the Report

|

Product Type |

Bread Breakfast Cereals Biscuits and Crackers Snack Bars Others |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

|

Price Range |

Premium Mid-Range Economy |

|

Consumer Demographics |

Urban Consumers Rural Consumers |

|

Region |

North Vietnam Central Vietnam South Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Trade, Vietnam Food Administration)

Bread and Cereal Product Manufacturers

Distributors and Wholesalers

Retail Chains and Supermarket Operators

E-commerce Platforms

Food & Beverage Packaging Companies

Private Equity Firms

Companies

ABC Bakery

Mondelez International

Kinh Do

Calbee

Nestle

Orion Corporation

Huu Nghi Food Joint Stock Company

Quang Minh Bakery

VinaOne

Frito-Lay

Table of Contents

1. Vietnam Bread & Cereal Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Bread & Cereal Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Bread & Cereal Products Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Urbanization and Lifestyle Changes

3.1.3. Increasing Demand for Convenience Foods

3.1.4. Growing Disposable Income

3.2. Market Challenges

3.2.1. Competition from Local Bakeries and Small Brands

3.2.2. Price Sensitivity of Consumers

3.2.3. Supply Chain and Logistics Constraints

3.3. Opportunities

3.3.1. Expansion into Rural Markets

3.3.2. Development of Organic & Healthy Variants

3.3.3. Investment in Innovative Packaging Solutions

3.4. Trends

3.4.1. Preference for Whole Grains and Multigrain Products

3.4.2. Demand for On-the-Go Snacking Products

3.4.3. Integration of Technology in Production

3.5. Government Regulations

3.5.1. Food Safety and Quality Standards

3.5.2. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. Vietnam Bread & Cereal Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bread

4.1.2. Breakfast Cereals

4.1.3. Biscuits and Crackers

4.1.4. Snack Bars

4.1.5. Others (include market-specific items)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.2.5. Others

4.3. By Price Range (In Value %)

4.3.1. Premium

4.3.2. Mid-Range

4.3.3. Economy

4.4. By Consumer Demographics (In Value %)

4.4.1. Urban Consumers

4.4.2. Rural Consumers

4.5. By Region (In Value %)

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam Bread & Cereal Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Company A

5.1.2. Company B

5.1.3. Company C

(List up to 15 major competitors)

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Innovation Level, Price Positioning, Regional Presence, Brand Loyalty, Production Capacity, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures & Partnerships

6. Vietnam Bread & Cereal Products Market Regulatory Framework

6.1. Food Safety Standards

6.2. Labeling Requirements

6.3. Import and Export Guidelines

7. Vietnam Bread & Cereal Products Future Market Size (In USD Bn)

7.1. Projected Market Size

7.2. Key Factors Driving Future Market Growth

8. Vietnam Bread & Cereal Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Price Range (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

9. Vietnam Bread & Cereal Products Market Analysts Recommendations

9.1. Market Penetration Strategies

9.2. Product Differentiation Strategies

9.3. Digital Marketing Insights

9.4. Expansion into Untapped Markets

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem, including all stakeholders within the Vietnam Bread & Cereal Products market. This step relies on desk research and databases to gather in-depth market information. The goal is to identify critical variables affecting the market, such as consumer preferences, retail channels, and product types.

Step 2: Market Analysis and Data Collection

In this phase, we analyze historical data and assess trends in product consumption, revenue generation, and distribution network. This analysis provides insights into market penetration, consumer preferences, and the performance of various product categories.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts, manufacturers, and distributors. These consultations provide valuable insights and operational data that support and refine the initial research findings.

Step 4: Data Synthesis and Final Output

The final stage involves synthesizing all data to produce a comprehensive market analysis. Direct engagement with manufacturers allows for verification and enhancement of data accuracy, ensuring a well-rounded and validated report.

Frequently Asked Questions

01. How big is the Vietnam Bread & Cereal Products Market?

The Vietnam Bread & Cereal Products Market is valued at USD 16.1 billion, primarily driven by urbanization, rising disposable incomes, and increasing consumer demand for convenient and healthy food options.

02. What are the challenges in the Vietnam Bread & Cereal Products Market?

Challenges in the Vietnam Bread & Cereal Products Market include high competition from local bakeries, price sensitivity among consumers, and logistical hurdles in reaching rural areas. Additionally, fluctuations in raw material costs can impact profitability for manufacturers.

03. Who are the major players in the Vietnam Bread & Cereal Products Market?

Key players in the Vietnam Bread & Cereal Products Market include ABC Bakery, Mondelez International, Kinh Do, Calbee, and Nestle. These companies dominate due to their strong distribution networks, brand loyalty, and commitment to innovation.

04. What drives the growth of the Vietnam Bread & Cereal Products Market?

Growth in the Vietnam Bread & Cereal Products Market is driven by the demand for convenient food options, the expansion of modern retail formats, and consumer interest in health-oriented products like whole-grain bread and organic cereals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.