Vietnam Breakfast Cereals Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3262

November 2024

97

About the Report

Vietnam Breakfast Cereal Market Overview

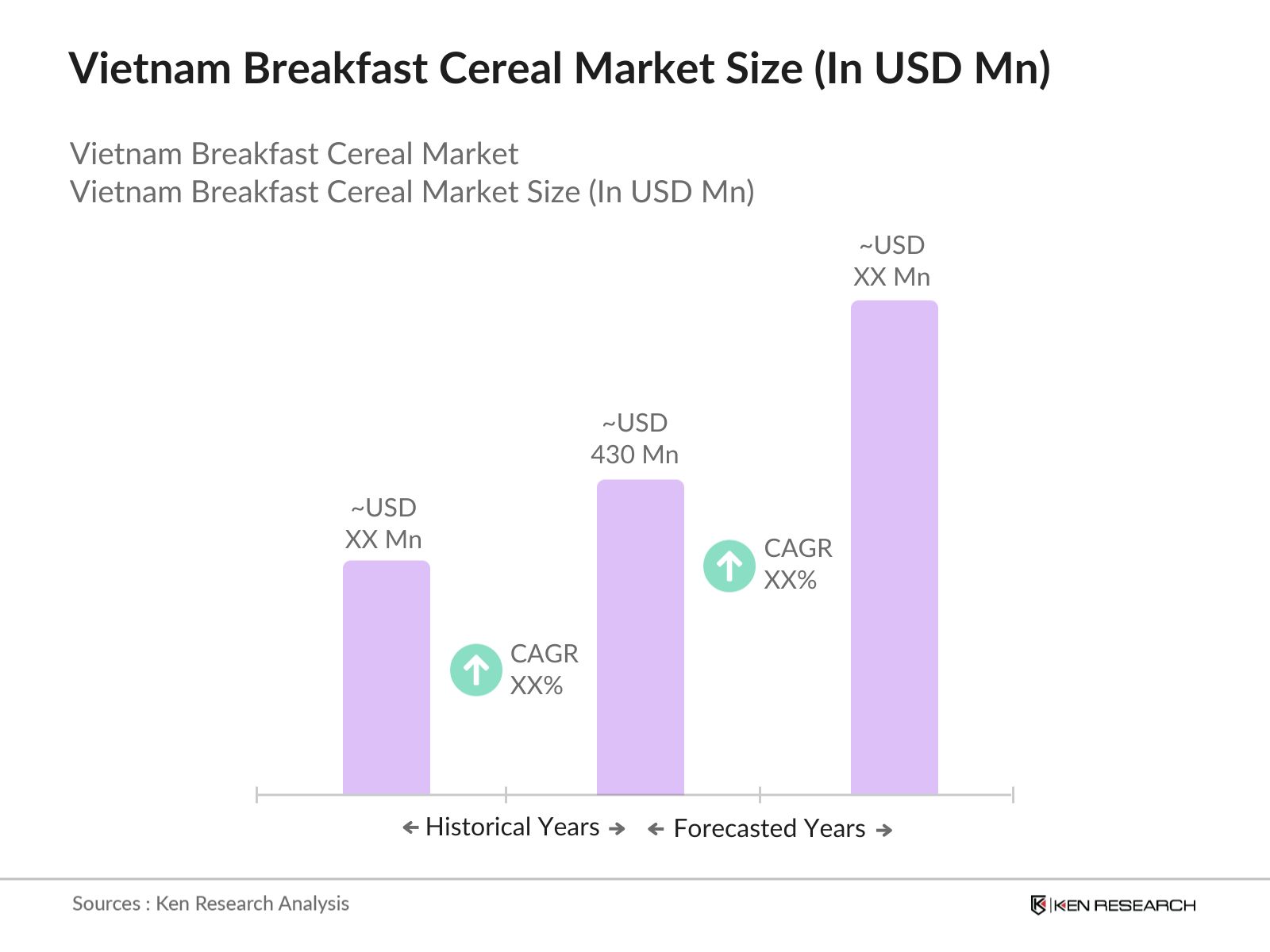

- The Vietnam Breakfast Cereal Market has seen significant growth over the past few years reaching a market size of USD 430 Mn, driven by changing consumer preferences and the increasing influence of Western food trends. The market is characterized by a rising demand for convenient, ready-to-eat food options, especially among the urban population. As Vietnam's economy continues to grow, and the middle class expands, consumers are increasingly seeking healthier and time-efficient meal options, including breakfast cereals. Key factors influencing this market include urbanization, an increase in disposable incomes, and greater awareness of health and nutrition.

- The major metropolitan areas like Ho Chi Minh City and Hanoi are the primary consumers of breakfast cereals, where the working population is adopting faster and more convenient breakfast options. Additionally, the younger generation, influenced by global food trends and a busy lifestyle, is contributing to the increasing demand for ready-to-eat cereal products.

- The Vietnam Food Administration (VFA) imposes strict food safety standards on imported and domestically produced breakfast cereals to ensure consumer health and safety. Under the 2024 regulatory framework, all cereal products must comply with VFA's guidelines on food additives, labeling, and contamination limits. The increasing focus on food safety has led to more rigorous inspections and certification processes for cereal manufacturers, which are necessary for market entry.

Vietnam Breakfast Cereal Market Segmentation

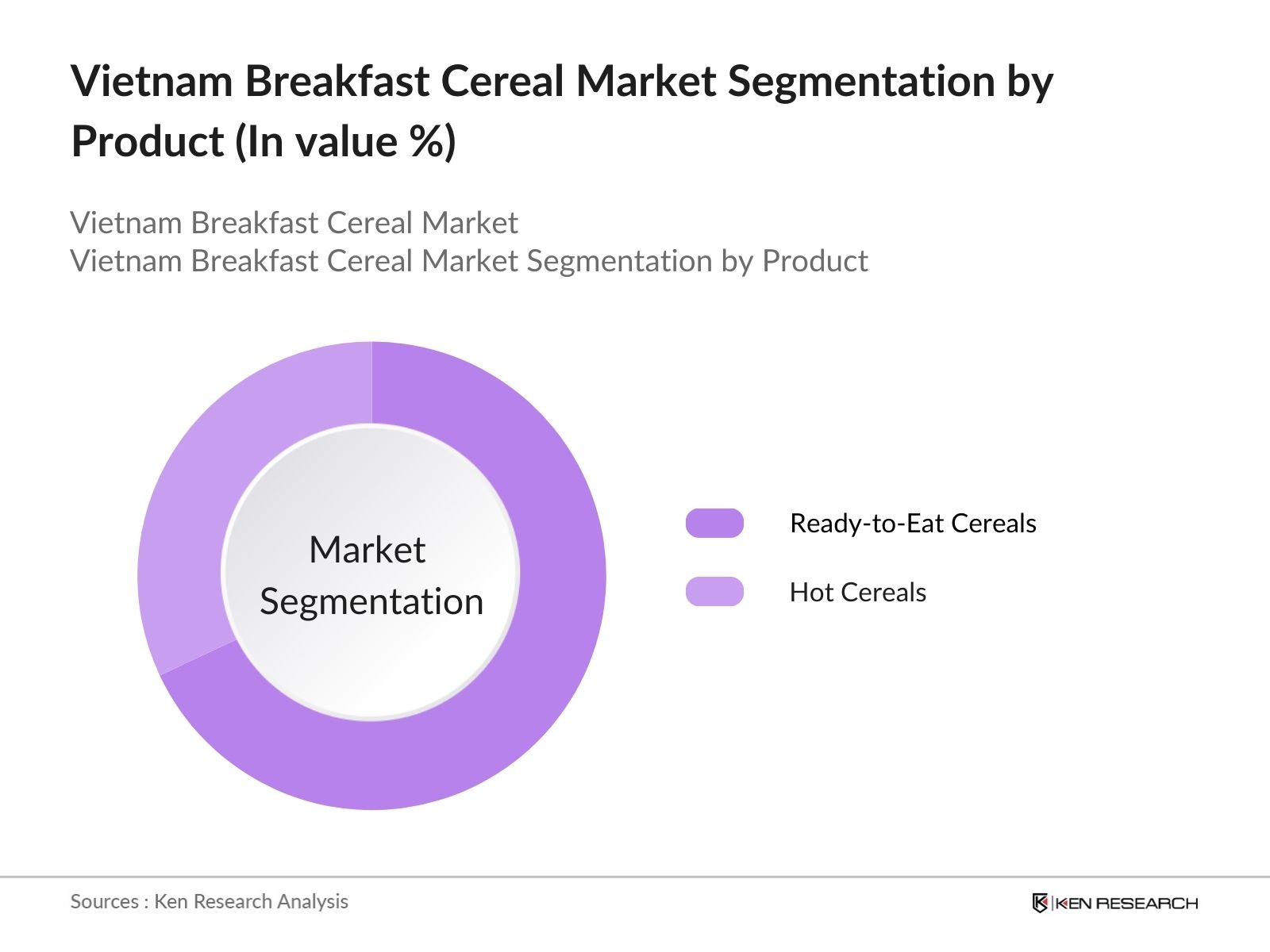

- By Product Type: The market is segmented by product type into ready-to-eat cereals and hot cereals. Ready-to-eat cereals, such as cornflakes, muesli, and puffed cereals, dominate the market due to their convenience and appeal to both children and adults. This segment benefits from the fast-paced lifestyles of urban consumers who prefer quick breakfast solutions that do not require cooking. Brands like Nestl and Kelloggs have established strong brand recognition, and their products are widely available in supermarkets and hypermarkets, contributing to this segments dominance.

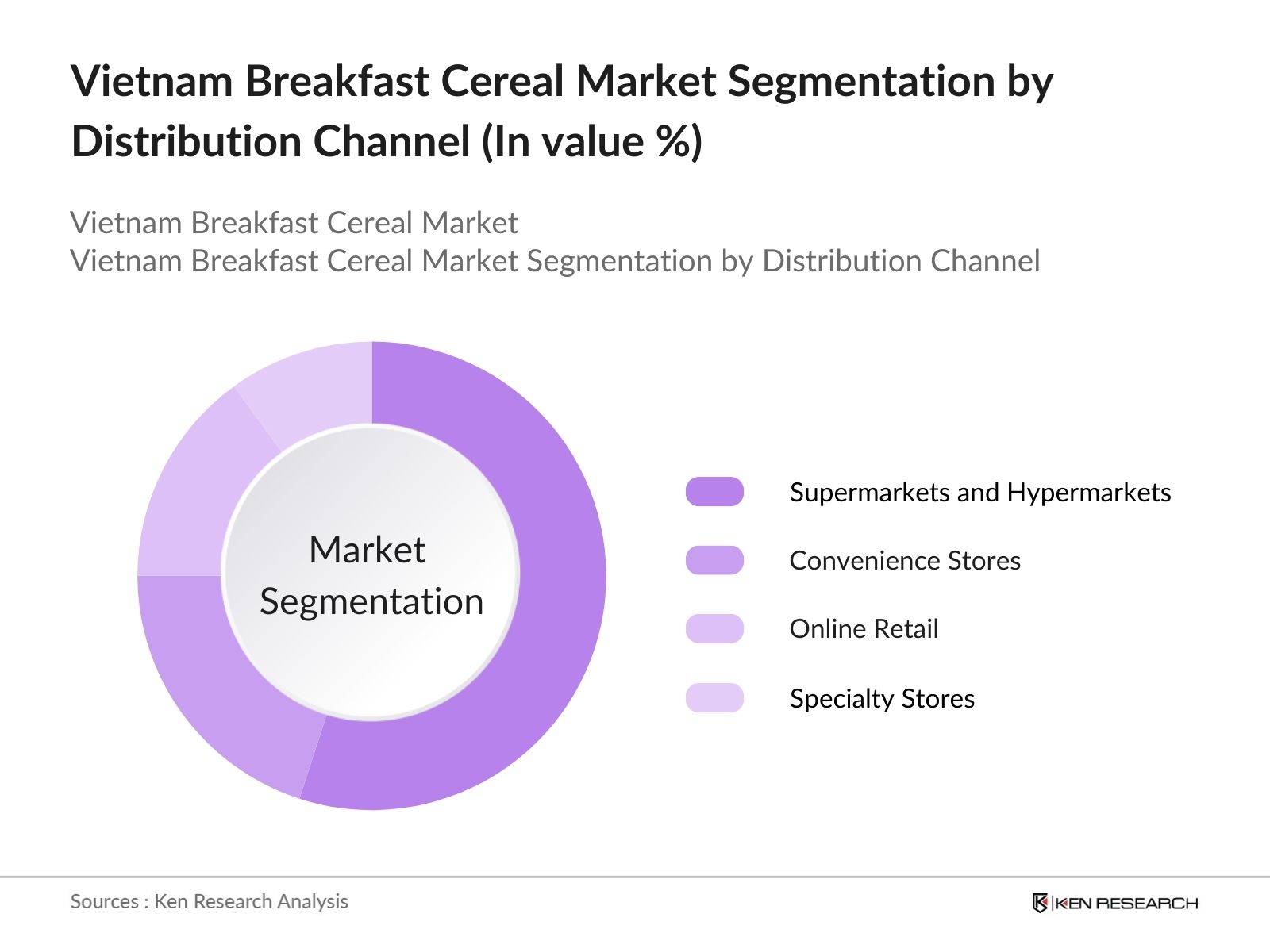

- By Distribution Channel: The market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. Supermarkets and hypermarkets account for the largest share of sales due to the availability of a wide range of products and attractive promotions. Online retail is witnessing significant growth, driven by increasing internet penetration and the convenience of home delivery, particularly in urban areas.

Vietnam Breakfast Cereal Market Competitive Landscape

The Vietnam Breakfast Cereal Market is competitive, with both local and international brands competing for market share. Major international players like Nestl, Kelloggs, and PepsiCo dominate the market, particularly in the premium segment, while local brands are focusing on affordable options tailored to the tastes of Vietnamese consumers.

Companies are increasingly investing in product innovation, introducing healthier options such as cereals fortified with vitamins and minerals, low-sugar varieties, and organic options. The competition is also heating up in terms of distribution, with many companies partnering with e-commerce platforms to capture the growing online consumer base.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Range |

R&D Investments |

Market Presence |

Distribution Network |

Strategic Initiatives |

|

Nestl |

1867 |

Vevey, Switzerland |

||||||

|

Kelloggs |

1906 |

Battle Creek, USA |

||||||

|

PepsiCo (Quaker) |

1965 |

New York, USA |

||||||

|

Vinamilk |

1976 |

Ho Chi Minh City, VN |

||||||

|

General Mills |

1928 |

Minneapolis, USA |

Vietnam Breakfast Cereal Market Analysis

Growth Drivers

- Increasing Urbanization: Vietnams urban population has been steadily rising, with the World Bank reporting 40.98 million people living in urban areas as of 2024. This increase in urbanization has led to shifts in lifestyle, where busy schedules encourage consumers to opt for quick, convenient breakfast options like cereals. The growing urban middle class, combined with improved infrastructure in cities like Hanoi and Ho Chi Minh City, is fostering greater demand for ready-to-eat breakfast cereals. Urban regions are seeing more supermarkets and convenience stores, which further boosts the market penetration of cereals.

- Shift to Healthy Eating Habits: Vietnams consumers are increasingly focusing on healthier eating habits, with a growing preference for products that are perceived as healthy, including breakfast cereals. According to the Vietnam Ministry of Health, chronic diseases related to diet, such as diabetes and hypertension, have prompted consumers to make healthier food choices. Cereal brands capitalizing on the demand for whole grains, fiber-enriched, and low-sugar variants are seeing an uptake in urban centers. This shift to healthy eating has been encouraged by national awareness campaigns promoting balanced diets, further driving demand for nutrient-rich breakfast cereals.

- Rise in Disposable Income (Urban Consumers): Disposable income among Vietnams urban population continues to grow, with annual average income levels rising to USD 4,013 per capita as of 2024, according to the World Bank. This increase in income has led to higher consumer spending on convenience foods, including breakfast cereals. As urban consumers prioritize ease and health benefits, they are more inclined to purchase higher-quality breakfast products, boosting the market demand. The increase in disposable income also correlates with an improved standard of living, supporting the growth of the breakfast cereal sector

Market Challenges

- High Reliance on Imported Products: Vietnams breakfast cereal market heavily depends on imported products, with over 80% of cereals sold in the country sourced internationally, according to the General Department of Vietnam Customs. This reliance on imports subjects the market to fluctuations in international supply chains, affecting product availability and prices. Global logistics disruptions, such as those seen during the COVID-19 pandemic, have also exacerbated challenges in maintaining steady cereal supplies, making it difficult for domestic consumers to access consistent product varieties.

- Limited Domestic Production: Domestic production of breakfast cereals in Vietnam remains limited, with most brands relying on imported raw materials or finished products. The lack of a well-established local manufacturing base increases dependency on foreign companies, limiting product customization and innovation specific to Vietnamese preferences. Furthermore, high production costs and limited agricultural resources for specific grains make it challenging to scale local cereal production. As a result, Vietnams breakfast cereal market remains vulnerable to external factors such as global trade policies and currency fluctuations.

Vietnam Breakfast Cereal Market Future Outlook

The Vietnam Breakfast Cereal Market is projected to grow steadily, driven by increasing urbanization, rising disposable incomes, and the growing influence of Western eating habits. As consumer preferences continue to shift towards convenient and healthy food options, the demand for breakfast cereals is expected to rise.

Future Market Opportunities

- Innovation in Localized Flavors: There is growing demand for breakfast cereals tailored to local tastes, with potential for the development of products that incorporate flavors unique to Vietnam, such as coconut, pandan, or jackfruit. As of 2024, local food producers are increasingly experimenting with these regional flavors to cater to domestic consumers. By offering unique products that resonate with local palates, cereal brands can differentiate themselves in the highly competitive market and tap into a broader customer base. This innovation presents an opportunity to blend traditional tastes with modern convenience.

- Growing Demand for Organic Cereals: Consumer demand for organic products is rising in Vietnam as awareness around health and environmental sustainability grows. According to a 2024 report from the Vietnam Organic Agriculture Association, organic food sales in the country have seen a sharp increase, driven by a young, health-conscious population. Organic breakfast cereals, in particular, are witnessing a surge in demand as consumers seek pesticide-free, non-GMO products. This shift provides an opportunity for brands to expand their product lines to include organic offerings, capitalizing on the trend toward clean-label food products.

Scope of the Report

|

By Product |

Ready-to-Eat Cereals Hot Cereals |

|

By Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By Age Group |

Children Adults |

|

By Price Segment |

Premium Mid-range Economy |

|

By Ingredient Type |

Grain-Based Cereals Fruit and Nut-Infused Cereals Organic Cereals |

Products

Key Target Audience

Breakfast Cereal Manufacturers

Supermarket Chains and Hypermarkets

Convenience Store Operators

E-commerce Platforms

Government and Regulatory Bodies (Ministry of Industry and Trade, Ministry of Agriculture and Rural Development)

Investors and Venture Capitalist Firms

Food Safety and Quality Control Agencies

Health-Conscious Consumer Groups

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Nestl S.A.

Kelloggs

PepsiCo (Quaker Oats)

General Mills

Weetabix Food Company

Post Holdings, Inc.

Vinamilk

Calbee

Sanitarium Health Food Company

Mondelez International

Bobs Red Mill Natural Foods

Marico Vietnam

Organiclife Vietnam

Dongsuh Foods

Alpen Food Company

Table of Contents

01 Vietnam Breakfast Cereal Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02 Vietnam Breakfast Cereal Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03 Vietnam Breakfast Cereal Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization

3.1.2. Shift to Healthy Eating Habits

3.1.3. Rise in Disposable Income (urban consumers)

3.1.4. Expansion of E-commerce Channels

3.2. Market Challenges

3.2.1. High Reliance on Imports

3.2.2. Competition from Traditional Breakfast Options

3.2.3. Limited Domestic Production

3.3. Opportunities

3.3.1. Innovation in Localized Flavors

3.3.2. Growing Demand for Organic Cereals

3.3.3. Expansion of Distribution Networks in Rural Areas

3.4. Trends

3.4.1. Increasing Popularity of Low-Sugar and Gluten-Free Products

3.4.2. Rise in Premium Cereals Targeting Health-Conscious Consumers

3.4.3. Emergence of Plant-Based Cereal Products

3.5. Government Regulation

3.5.1. Food Safety Standards (Vietnam Food Administration)

3.5.2. Import Tariff Regulations on Processed Foods

3.5.3. National Campaigns for Healthy Eating Habits

04 Vietnam Breakfast Cereal Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ready-to-Eat Cereals

4.1.2. Hot Cereals

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Age Group (In Value %)

4.3.1. Children

4.3.2. Adults

4.4. By Price Segment (In Value %)

4.4.1. Premium

4.4.2. Mid-range

4.4.3. Economy

4.5. By Ingredient Type (In Value %)

4.5.1. Grain-Based Cereals

4.5.2. Fruit and Nut-Infused Cereals

4.5.3. Organic Cereals

05 Vietnam Breakfast Cereal Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl S.A.

5.1.2. Kelloggs

5.1.3. PepsiCo (Quaker Oats)

5.1.4. General Mills

5.1.5. Weetabix Food Company

5.1.6. Post Holdings, Inc.

5.1.7. Vinamilk

5.1.8. Calbee

5.1.9. Sanitarium Health Food Company

5.1.10. Mondelez International

5.1.11. Bobs Red Mill Natural Foods

5.1.12. Marico Vietnam

5.1.13. Organiclife Vietnam

5.1.14. Dongsuh Foods

5.1.15. Alpen Food Company

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Inception Year, Headquarters, Product Portfolio, Market Share, R&D Investments, Distribution Networks)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

06 Vietnam Breakfast Cereal Market Regulatory Framework

6.1. Import Regulations and Tariff Policies

6.2. Food Safety and Quality Standards (Vietnam Food Administration)

6.3. Certification and Labeling Requirements

07 Vietnam Breakfast Cereal Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08 Vietnam Breakfast Cereal Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Price Segment (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Age Group (In Value %)

09 Vietnam Breakfast Cereal Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of the Vietnam Breakfast Cereal Market, identifying major stakeholders, and conducting extensive desk research to gather comprehensive industry-level information. Key variables include product types, distribution channels, and market growth drivers.

Step 2: Market Analysis and Construction

This phase focuses on gathering historical data regarding the Vietnam Breakfast Cereal Market, including market size, product penetration, and revenue analysis. The data is validated through secondary research and confirmed using proprietary databases and public records from credible government bodies.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed in the earlier phases are validated through consultations with industry experts using structured interviews. These consultations ensure accurate data collection and provide key insights into operational and financial trends within the market.

Step 4: Research Synthesis and Final Output

The final phase consolidates findings from all previous steps, verifying the data through additional primary research methods. The output is a comprehensive, accurate report on the Vietnam Breakfast Cereal Market, tailored for business professionals.

Frequently Asked Questions

01 How big is the Vietnam Breakfast Cereal Market?

The Vietnam Breakfast Cereal Market is valued at USD 430 million, driven by increasing urbanization, changing consumer preferences, and a growing demand for convenient food options.

02 What are the major challenges in the Vietnam Breakfast Cereal Market?

Challenges include reliance on imported cereals, competition from traditional breakfast options, and the relatively limited local production of breakfast cereals. These factors impact both market growth and product pricing.

03 Who are the major players in the Vietnam Breakfast Cereal Market?

Major players include Nestl, Kelloggs, PepsiCo, Vinamilk, and General Mills, all of whom dominate the market due to their strong distribution networks, product innovation, and brand recognition.

04 What drives growth in the Vietnam Breakfast Cereal Market?

Key growth drivers include the rise of the middle-class population, urbanization, and increasing health awareness. The demand for ready-to-eat cereals has grown, especially among health-conscious consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.