Vietnam Cable Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD8554

December 2024

99

About the Report

Vietnam Cable Market Overview

- The Vietnam cable market is valued at USD 1.3 billion, primarily driven by the rapid expansion of infrastructure, industrialization, and the telecommunications industry. The markets growth is fueled by government investment in power and data transmission infrastructure, aligning with Vietnams digitalization goals. With increasing demand for high-quality cables in sectors such as energy, telecommunications, and construction, the cable market has become a critical component of Vietnam's industrial and economic development.

- Major cities such as Ho Chi Minh City and Hanoi are primary demand centers for cables in Vietnam. Ho Chi Minh City, as a major industrial hub, drives demand through numerous infrastructure projects, while Hanoi's extensive development in telecommunications and power grids strengthens its cable market position. These cities' economic growth and dense industrial zones make them dominant players in the cable market.

- Vietnam has established stringent national standards for cable manufacturing to ensure product quality and safety. The Ministry of Industry and Trade enforces these standards, mandating quality checks for all imported and domestically produced cables. In 2023, the government introduced new technical requirements for cables used in high-voltage applications, enhancing safety and reliability, especially in industrial settings. These regulations drive manufacturers to comply with high-quality standards, improving the competitiveness and quality of cables in the domestic market.

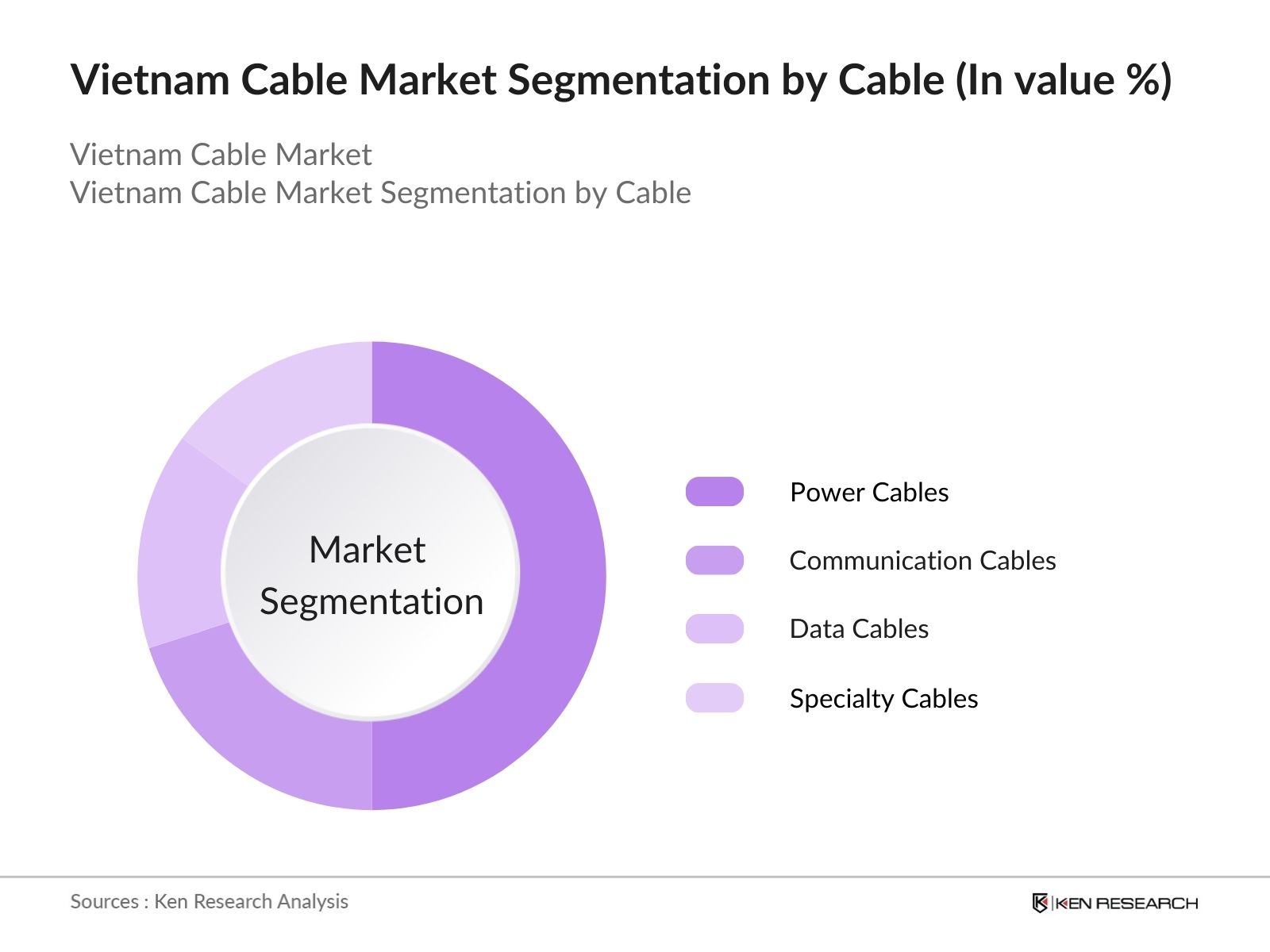

Vietnam Cable Market Segmentation

- By Cable Type: The market is segmented by cable type into power cables, communication cables, data cables, and specialty cables. Power cables hold a dominant market share within this segmentation due to their extensive usage in industrial projects and power transmission systems. The demand for high-capacity power cables continues to grow as Vietnam enhances its energy infrastructure, including renewable energy projects, which require reliable transmission solutions.

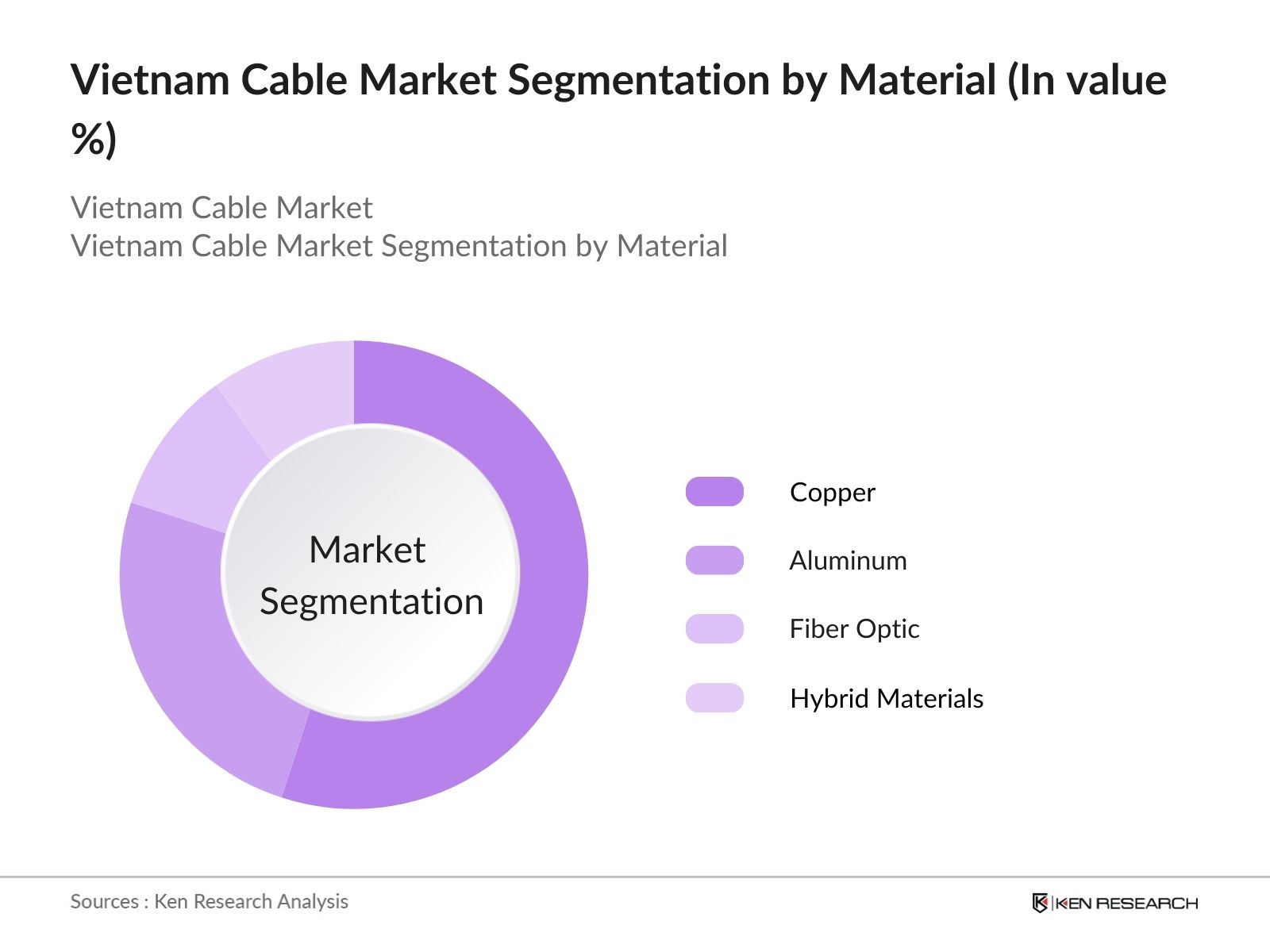

- By Material Type: The market is further segmented by material type into copper, aluminum, fiber optic, and hybrid materials. Copper cables dominate this segment due to their high conductivity, durability, and widespread application in power and telecommunications infrastructure. With Vietnams focus on enhancing connectivity and power reliability, copper cables remain a preferred choice for their efficiency and compatibility with various industrial and utility applications.

Vietnam Cable Market Competitive Landscape

The Vietnam cable market is highly competitive, with both international and domestic players striving to capture market share through quality, technological advancements, and distribution reach. Leading companies invest heavily in R&D and employ advanced manufacturing processes to maintain their competitive edge.

The Vietnam cable market is led by major companies such as LS Cable & System, Prysmian Group, and Nexans S.A., whose large-scale production capabilities and regional influence place them at the forefront of the industry. These companies, along with local leaders, shape the market landscape through strategic initiatives and strong customer relations.

Vietnam Cable Market Analysis

Growth Drivers

- Expanding Infrastructure Projects: Vietnams government is investing significantly in urban infrastructure projects, allocating nearly USD 150 billion toward infrastructure upgrades and new developments from 2022 to 2025, as reported by the Ministry of Planning and Investment. This funding supports initiatives such as smart cities in key regions, including Ho Chi Minh City and Hanoi. These projects require advanced cable systems to support high-density urban demands, which directly drives the cable market. As a result, the demand for durable and efficient cable solutions in Vietnam's urban areas is increasing, bolstering growth in both fiber and high-voltage power cables to handle expanded energy needs.

- Rising Demand in Telecommunications: Vietnam's telecommunications sector continues to expand, with Vietnam Posts and Telecommunications Group (VNPT) reporting a notable year-on-year increase in fiber optic installations to meet the escalating demand for high-speed internet across urban and rural areas. The government-backed National Digital Transformation Program, aimed at 100% digital inclusion, has led to extensive deployment of fiber optics. This surge in telecommunication infrastructure has necessitated substantial investment in fiber cables, positioning Vietnam as one of Southeast Asias fastest-growing fiber optic markets, supporting digital infrastructure to accommodate its expanding internet user base, which reached 72 million in 2023.

- Industrial Growth and Energy Demand: Vietnams rapid industrial growth, especially in sectors like manufacturing, has increased the demand for reliable power infrastructure, spurring the need for advanced cable systems. The Ministry of Industry and Trade reports that Vietnam's industrial electricity consumption reached 130 billion kWh in 2023, a 5% increase from the previous year, primarily driven by factories in industrial zones across the North and South. As industries modernize, high-performance cables are essential to maintaining power stability, meeting increased operational demands, and supporting the country's position as a global manufacturing hub.

Challenges

- High Competition and Price Sensitivity: Vietnams cable market faces intense competition from both domestic and international players, leading to significant price sensitivity. Local manufacturers often struggle to maintain profitability amidst rising operational costs. Competitive pricing pressures impact their ability to invest in technological advancements, challenging companies to balance cost efficiency with quality standards. This price-driven dynamic influences the market structure, pushing companies to innovate and optimize operations while facing tight margins.

- Volatile Raw Material Prices: The fluctuating prices of essential raw materials, particularly copper and aluminum, directly affect cable production costs in Vietnam. Global supply chain disruptions contribute to these price fluctuations, impacting the profitability of cable manufacturers who rely heavily on imported materials. The instability in raw material costs often results in increased production expenses that are ultimately passed on to end customers, creating further challenges within the market.

Vietnam Cable Market Future Outlook

The Vietnam cable market is set for robust growth, supported by government policies to improve energy infrastructure, expand telecommunications, and promote sustainable development. Over the next five years, the adoption of advanced cable technologies, such as fiber optics for data transmission and high-voltage cables for power infrastructure, is expected to drive market expansion. The emphasis on renewable energy and smart city projects will further strengthen demand, presenting opportunities for market players to innovate and expand.

Future Market Opportunities

- Adoption of Advanced Cable Technologies: Vietnams shift toward advanced cable technologies, including high-voltage and fiber-optic cables, supports the countrys increasing energy and telecommunications demands. In 2023, the Ministry of Science and Technology recorded a substantial increase in high-performance cable imports to meet infrastructure upgrades and digital network expansions. The deployment of these technologies aligns with government initiatives to modernize national infrastructure, making Vietnam a promising market for technologically advanced cable solutions that cater to the high-speed data and energy transmission requirements of both urban and rural areas.

- Expansion in Rural Electrification: Vietnam has committed to achieving universal electricity access, with the government aiming to provide power to 99.7% of rural households by the end of 2024. This expansion in rural electrification, which saw a $1.2 billion investment in rural grid infrastructure by 2023, demands extensive use of cables for power distribution. According to the Ministry of Industry and Trade, over 10,000 kilometers of cable have been installed in rural areas, marking substantial growth in the demand for transmission cables, with rural infrastructure upgrades supporting increased access and energy reliability.

Scope of the Report

|

By Cable Type |

Power Cables Communication Cables Data Cables Specialty Cables |

|

By Material Type |

Copper Aluminum Fiber Optic |

|

By Voltage Type |

Low Voltage Medium Voltage High Voltage |

|

By End-Use Industry |

Construction Power Generation and Transmission Telecommunications Automotive |

|

By Region |

Northern Central Southern |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade, Vietnam Electricity)

Renewable Energy Companies

Telecommunications Providers

Power Distribution Companies

Industrial Construction Firms

Cable Manufacturers and Suppliers

Companies

Players Mentioned in the Report

LS Cable & System Ltd.

Prysmian Group

Nexans S.A.

Fujikura Ltd.

Southwire Company

ZTT Group

Furukawa Electric Co., Ltd.

Hengtong Group

Jiangnan Group Limited

KEI Industries Limited

Belden Inc.

Encore Wire Corporation

Tratos Ltd.

Leoni AG

Sumitomo Electric Industries, Ltd.

Table of Contents

1. Vietnam Cable Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Vietnam Cable Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam Cable Market Dynamics

3.1 Growth Drivers

3.1.1 Expanding Infrastructure Projects (e.g., urbanization, smart city initiatives)

3.1.2 Rising Demand in Telecommunications (fiber optic installations)

3.1.3 Industrial Growth and Energy Demand

3.1.4 Government Initiatives in Renewable Energy

3.2 Market Challenges

3.2.1 High Competition and Price Sensitivity

3.2.2 Volatile Raw Material Prices

3.2.3 Technical and Operational Complexities

3.3 Opportunities

3.3.1 Adoption of Advanced Cable Technologies (e.g., high voltage, fiber optics)

3.3.2 Expansion in Rural Electrification

3.3.3 Demand for Electric Vehicles Infrastructure

3.4 Trends

3.4.1 Integration of Smart Cables (IoT-enabled monitoring)

3.4.2 Use of Sustainable Cable Materials

3.4.3 Miniaturization in Cable Design

3.5 Government Regulations

3.5.1 National Standards for Cable Manufacturing

3.5.2 Environmental and Safety Regulations

3.5.3 Energy-Efficiency Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Analysis

4. Vietnam Cable Market Segmentation

4.1 By Cable Type (In Value %)

4.1.1 Power Cables

4.1.2 Communication Cables

4.1.3 Data Cables

4.1.4 Specialty Cables

4.2 By Material Type (In Value %)

4.2.1 Copper

4.2.2 Aluminum

4.2.3 Fiber Optic

4.3 By Voltage Type (In Value %)

4.3.1 Low Voltage

4.3.2 Medium Voltage

4.3.3 High Voltage

4.4 By End-Use Industry (In Value %)

4.4.1 Construction

4.4.2 Power Generation and Transmission

4.4.3 Telecommunications

4.4.4 Automotive

4.5 By Region (In Value %)

4.5.1 Northern

4.5.2 Central

4.5.3 Southern

5. Vietnam Cable Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 LS Cable & System Ltd.

5.1.2 Prysmian Group

5.1.3 Nexans S.A.

5.1.4 Sumitomo Electric Industries, Ltd.

5.1.5 Southwire Company

5.1.6 Fujikura Ltd.

5.1.7 Furukawa Electric Co., Ltd.

5.1.8 Belden Inc.

5.1.9 ZTT Group

5.1.10 KEI Industries Limited

5.1.11 Jiangnan Group Limited

5.1.12 Encore Wire Corporation

5.1.13 Hengtong Group Co., Ltd.

5.1.14 Leoni AG

5.1.15 Tratos Ltd.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Specialization, Geographic Reach, R&D Investment, Key Clients)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Vietnam Cable Market Regulatory Framework

6.1 Manufacturing Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Vietnam Cable Market Future Projections (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth

8. Vietnam Cable Market Segmentation

8.1 By Cable Type (In Value %)

8.2 By Material Type (In Value %)

8.3 By Voltage Type (In Value %)

8.4 By End-Use Industry (In Value %)

8.5 By Region (In Value %)

9. Vietnam Cable Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Target Customer Cohort Analysis

8.3 Market Entry Strategies

8.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves identifying critical factors influencing the Vietnam Cable Market, including market size, industry drivers, and regulatory frameworks. Desk research and proprietary databases provide insights into the ecosystem, which helps define the variables for analysis.

Step 2: Market Analysis and Data Compilation

Historical data on market penetration and revenue trends are analyzed to construct a reliable data set. This includes the assessment of growth rates across different market segments, supported by industry statistics.

Step 3: Hypothesis Development and Validation

Market hypotheses are developed based on initial findings and validated through consultations with industry experts. These expert insights provide operational and strategic perspectives that refine the research outcomes.

Step 4: Data Synthesis and Finalization

The final data compilation involves aggregating findings from primary and secondary sources. This ensures a well-rounded view of the market, and the data is verified to maintain accuracy and relevance for stakeholders.

Frequently Asked Questions

01. How big is the Vietnam Cable Market?

The Vietnam Cable Market is valued at USD 1.3 billion, supported by government infrastructure investments and the growth of the telecommunications and industrial sectors.

02. What are the main growth drivers in the Vietnam Cable Market?

Key drivers in the Vietnam Cable Market include infrastructure development, increased industrialization, and expansion in telecommunications, all of which fuel demand for high-quality power and data cables.

03. Which companies dominate the Vietnam Cable Market?

Major players in the Vietnam Cable Market include LS Cable & System, Prysmian Group, Nexans S.A., and Fujikura Ltd., each holding significant market share due to extensive product portfolios and strong market presence.

04. What challenges does the Vietnam Cable Market face?

Challenges in the Vietnam Cable Market include high raw material costs and environmental regulations, which increase operational expenses and require investment in sustainable production methods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.