Vietnam Cards and Payments Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD3566

November 2024

93

About the Report

Vietnam Cards and Payments Market Overview

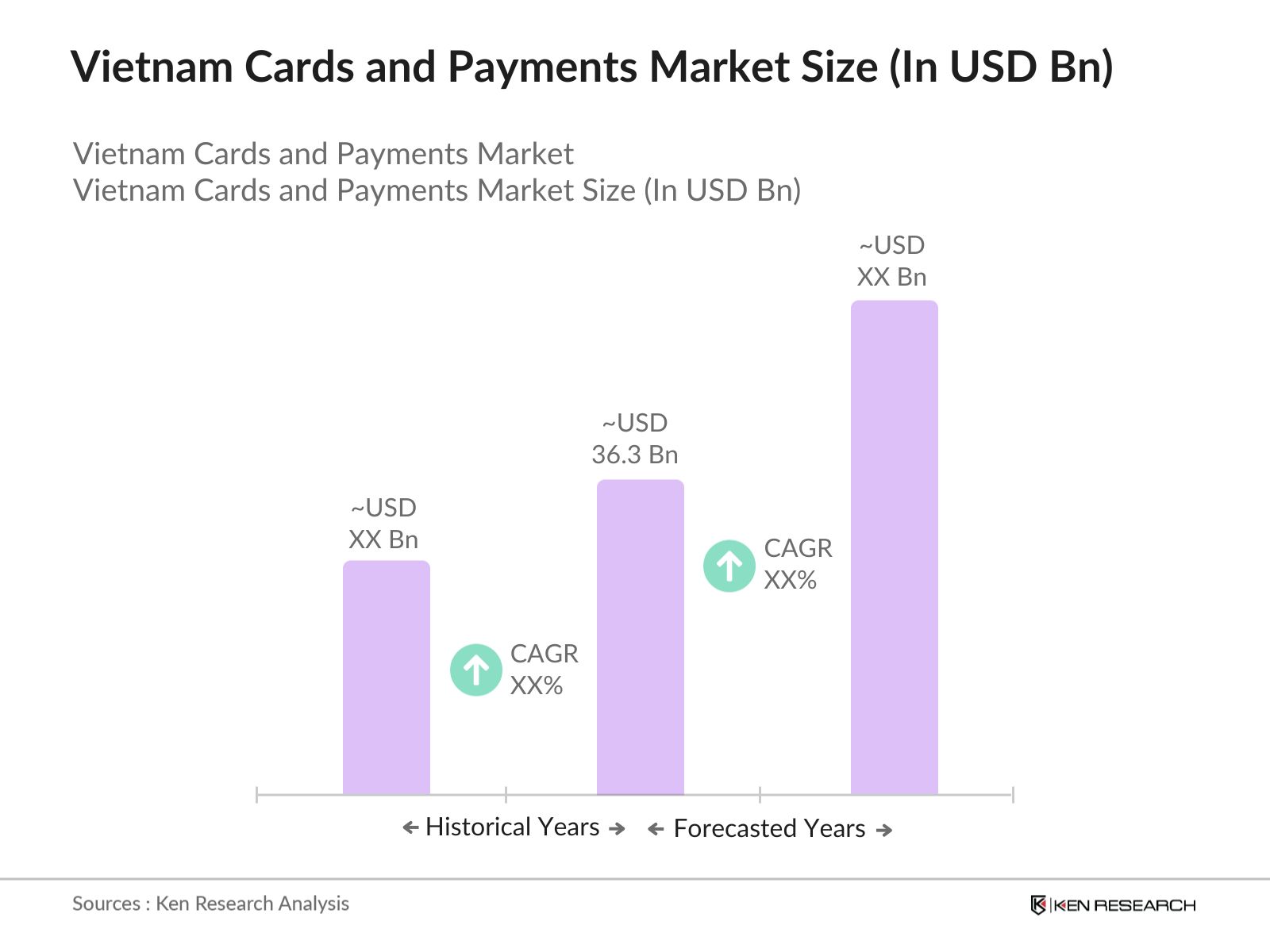

- The Vietnam Cards and Payments Market is valued at USD 36.3 billion, based on a five-year historical analysis. This market is primarily driven by increasing smartphone penetration, the rise of digital payments, and the rapid expansion of e-commerce platforms. The governments efforts to push financial inclusion, combined with technological advancements in payment infrastructure, are also contributing to the market's growth. Traditional banking cards, along with the integration of mobile wallets, are pivotal in driving transaction volumes, enhancing the overall value of the market.

- Key cities that dominate the Vietnam Cards and Payments Market include Ho Chi Minh City and Hanoi. These urban centers lead due to their high concentration of financial institutions, tech-savvy populations, and well-developed digital infrastructure. The availability of robust banking services, coupled with higher disposable incomes in these regions, propels the widespread adoption of card-based and digital payments. Additionally, the high demand for online shopping and modern retail formats is more pronounced in these metropolitan areas, further boosting card transactions.

- The Vietnamese government continues to promote a cashless economy as part of its "Digital Transformation Strategy 2025." By 2023, cashless transactions accounted for 40% of all financial transactions, as reported by the Ministry of Planning and Investment. The government has introduced tax incentives for businesses adopting digital payment systems and implemented consumer education programs to drive widespread usage of electronic payments across all sectors of the economy.

Vietnam Cards and Payments Market Segmentation

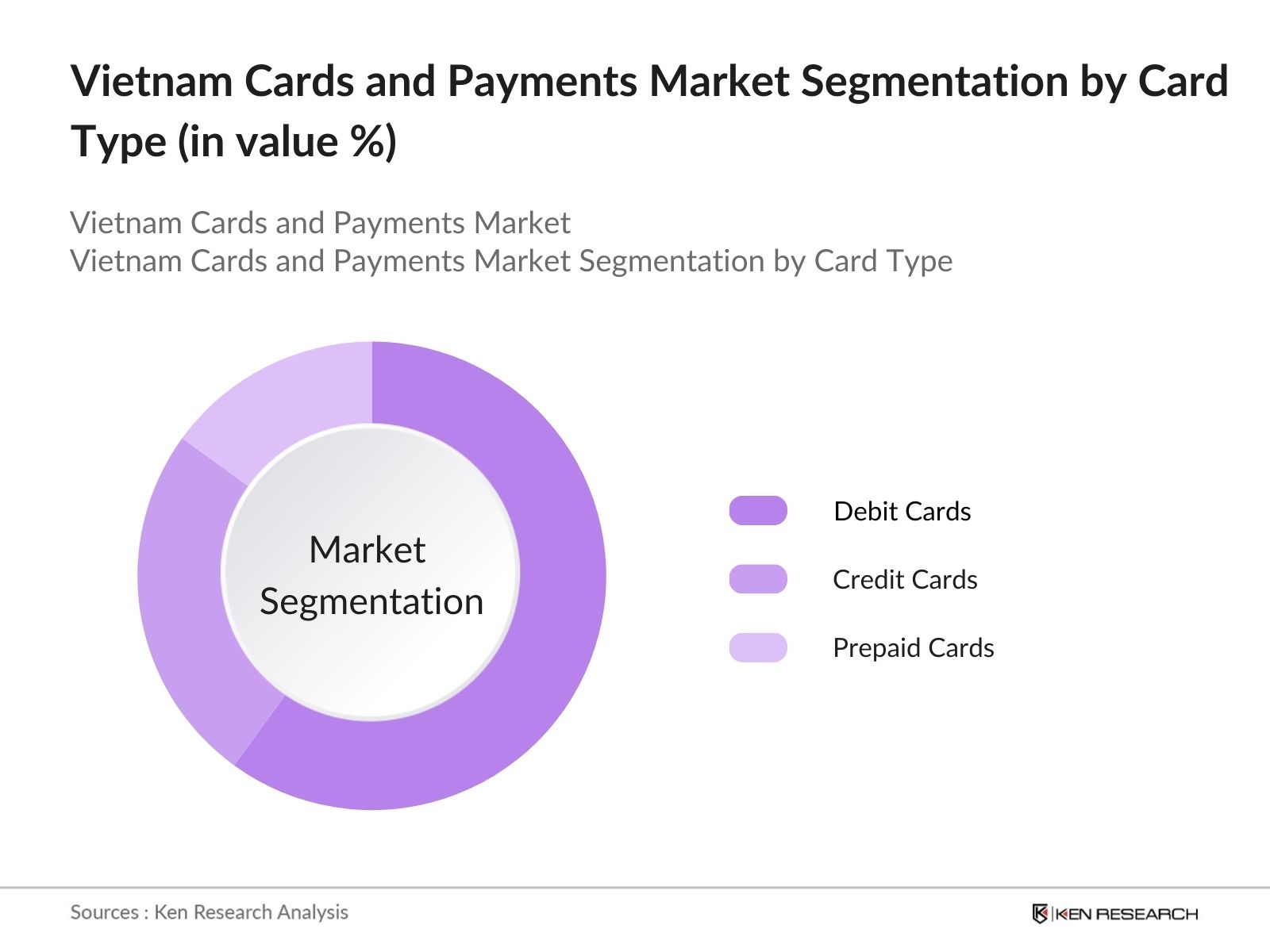

- By Card Type: The Vietnam Cards and Payments Market is segmented by card type into debit cards, credit cards, and prepaid cards. Debit cards currently dominate the market under the card type segmentation due to their deep integration with consumers' existing bank accounts. As Vietnamese consumers increasingly shift towards digital transactions, the convenience and security of debit cards, backed by strong banking networks, make them the preferred payment tool for daily transactions. Additionally, many employers and government programs issue debit cards, further cementing their dominance in this segment.

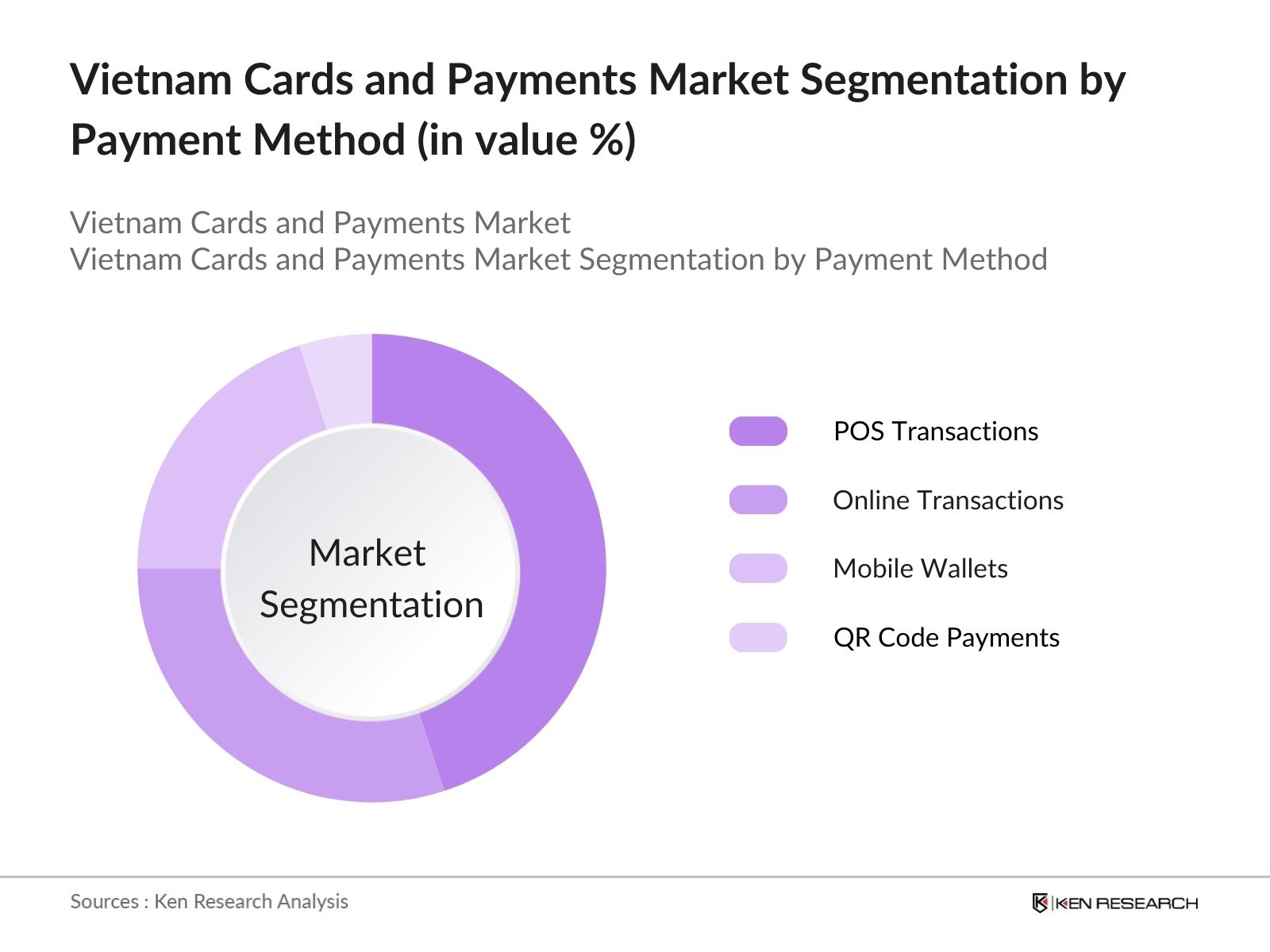

- By Payment Method: In terms of payment method, the Vietnam Cards and Payments Market is segmented into POS transactions, online transactions, mobile wallets, and QR code payments. POS transactions have a dominant market share under this segmentation due to the rapid expansion of modern retail and the increasing number of POS terminals across urban and suburban regions. The availability of quick and secure transaction processing, combined with consumers' growing preference for contactless payments at physical retail locations, further enhances POS transactions' lead in the market.

Vietnam Cards and Payments Market Competitive Landscape

The Vietnam Cards and Payments Market is shaped by a mix of domestic and international players, with banks, fintech companies, and payment processors playing a pivotal role. The market is competitive, with both traditional financial institutions and digital payment providers vying for a share. Key players such as Vietcombank and BIDV dominate due to their extensive branch networks and customer bases. Fintech players like MoMo Wallet are also making inroads, particularly in mobile and contactless payments, leveraging user-friendly digital platforms to attract younger, tech-savvy consumers.

|

Company |

Establishment Year |

Headquarters |

No. of Cards Issued |

Revenue (USD bn) |

Number of POS Terminals |

Partnerships |

Mobile App Downloads |

Branch Network |

Digital Wallet Transactions |

|

Vietcombank |

1963 |

Hanoi |

- |

- |

- |

- |

- |

- |

- |

|

BIDV |

1957 |

Hanoi |

- |

- |

- |

- |

- |

- |

- |

|

Techcombank |

1993 |

Hanoi |

- |

- |

- |

- |

- |

- |

- |

|

MoMo Wallet |

2007 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

|

Timo Digital Bank |

2016 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

Vietnam Cards and Payments Market Analysis

Vietnam Cards and Payments Market Growth Drivers

- Rising Digital Transactions: Digital transactions in Vietnam have surged, driven by increased internet penetration and government initiatives for cashless payments. In 2022, the State Bank of Vietnam reported that over 1.2 billion digital transactions were processed, highlighting the growing shift towards cashless payments. This trend is supported by Vietnam's internet penetration rate, which reached over 73 million users in 2023, and the rise in online payments for e-commerce and utilities.

- Increasing Smartphone Penetration: Vietnam's growing smartphone penetration, which reached 83 million active mobile connections in 2023 according to the Ministry of Information and Communications, is a critical driver of the cards and payments market. The high rate of mobile usage has facilitated access to mobile banking and digital wallets, encouraging the adoption of electronic payments, especially in urban areas. Financial institutions are increasingly developing mobile-first solutions to tap into this expanding user base.

- Expanding E-commerce Market: The e-commerce market in Vietnam is growing rapidly, with revenue reaching $16.4 billion in 2022, according to the Ministry of Industry and Trade. This growth has spurred the demand for card-based and digital payment solutions, as consumers increasingly opt for online purchases. By 2023, e-commerce accounted for over 7% of total retail sales in Vietnam, indicating a robust transition towards online shopping. The availability of multiple payment gateways has further boosted the cards and payments ecosystem, with more merchants integrating digital wallets and payment cards for seamless transactions.

Vietnam Cards and Payments Market Challenges

- Cybersecurity and Fraud Concerns: Vietnam's growing reliance on digital payments has heightened cybersecurity risks. In 2022, the Ministry of Information and Communications reported over 3,500 cyberattacks targeting financial systems, underlining the vulnerability of the payments infrastructure. Fraudulent activities, including phishing and unauthorized transactions, remain a generic concern for consumers and financial institutions. As the volume of online transactions increases, securing payment gateways and protecting consumer data are critical challenges for the market.

- Lack of Infrastructure in Rural Areas: While urban centers in Vietnam have adopted digital payments at a faster pace, rural areas still face infrastructural challenges. In 2023, only 45% of rural households had reliable access to internet and banking services, according to the General Statistics Office of Vietnam. The lack of digital infrastructure and financial literacy in these regions limits the adoption of cards and digital payments. Government efforts are ongoing to extend 4G/5G coverage and increase banking penetration in remote areas to bridge this gap.

Vietnam Cards and Payments Market Future Outlook

The Vietnam Cards and Payments Market is expected to witness growth over the next five years, driven by increasing adoption of digital payment methods, further expansion of e-commerce, and continuous improvements in financial technology. The governments ambition to create a cashless economy and the introduction of innovative payment solutions, such as mobile wallets and QR codes, will propel the market forward. Additionally, the entry of global payment platforms and strategic partnerships between banks and fintech players will further diversify the payment ecosystem, catering to a wider range of consumer needs.

Vietnam Cards and Payments Market Opportunities

- Emergence of Digital Wallets and FinTech Solutions: The rise of fintech solutions has created opportunities for the cards and payments market. In 2023, the Vietnamese government issued 40 licenses to fintech companies specializing in digital payments, according to the State Bank of Vietnam. Digital wallets like Momo and ZaloPay have become increasingly popular, with over 50 million users between them, driving alternative payment methods. Fintechs are capitalizing on this trend by partnering with banks and telecom companies to expand financial services across underserved regions.

- Cross-border Payments: Vietnam's international trade volumes have grown substantially, creating a demand for efficient cross-border payment solutions. In 2023, the General Department of Vietnam Customs reported total exports valued at $371.5 billion. This rise in trade has led to increased demand for secure and cost-effective cross-border payment systems, particularly for SMEs engaged in e-commerce. Fintech companies are collaborating with banks to streamline international transactions, which present opportunities for growth in the payments sector.

Scope of the Report

|

By Card Type |

Debit Cards Credit Cards Prepaid Cards |

|

By Payment Method |

POS Transactions Online Transactions Mobile Wallets QR Code Payments |

|

By End-User Industry |

Retail E-commerce Hospitality Transportation |

|

By Card Issuer |

Domestic Banks International Banks NBFCs |

|

By Region |

Ho Chi Minh City Hanoi Da Nang Rural Vietnam |

Products

Key Target Audience

Banks and Financial Institutions

Payment Processors

Mobile Wallet Providers

E-commerce Platforms

Retailers and Merchants

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (National Payment Corporation of Vietnam, State Bank of Vietnam)

POS Terminal Manufacturers

Companies

Major Players in the Vietnam Cards and Payments Market

Vietcombank

BIDV

Techcombank

MoMo Wallet

Timo Digital Bank

Agribank

VPBank

Sacombank

Mastercard

Visa

ZaloPay

ShopeePay

Citibank

Standard Chartered

VIB Bank

Table of Contents

1. Vietnam Cards and Payments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Cards and Payments Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Cards and Payments Market Analysis

3.1. Growth Drivers

3.1.1. Rising Digital Transactions

3.1.2. Increasing Smartphone Penetration

3.1.3. Government Push for Financial Inclusion (Government Regulations)

3.1.4. Expanding E-commerce Market

3.2. Market Challenges

3.2.1. Cybersecurity and Fraud Concerns

3.2.2. Lack of Infrastructure in Rural Areas

3.2.3. Consumer Trust Issues

3.3. Opportunities

3.3.1. Emergence of Digital Wallets and FinTech Solutions

3.3.2. Cross-border Payments

3.3.3. Strategic Partnerships with Fintech Companies

3.4. Trends

3.4.1. Contactless Payment Adoption

3.4.2. Buy Now, Pay Later (BNPL) Services

3.4.3. Mobile Payments Domination

3.4.4. Increasing Consumer Awareness of Digital Banking

3.5. Government Regulations

3.5.1. National Payments Corporation of Vietnam (NPCV) Initiatives

3.5.2. Regulatory Push for Cashless Economy

3.5.3. Digital Transformation Policies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Consumers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Vietnam Cards and Payments Market Segmentation

4.1. By Card Type (In Value %)4.1.1. Debit Cards

4.1.2. Credit Cards

4.1.3. Prepaid Cards

4.2. By Payment Method (In Value %)4.2.1. POS Transactions

4.2.2. Online Transactions

4.2.3. Mobile Wallets

4.2.4. QR Code Payments

4.3. By End-User Industry (In Value %)4.3.1. Retail

4.3.2. E-commerce

4.3.3. Hospitality

4.3.4. Transportation

4.4. By Card Issuer (In Value %)4.4.1. Domestic Banks

4.4.2. International Banks

4.4.3. Non-Banking Financial Companies (NBFCs)

4.5. By Region (In Value %)4.5.1. Ho Chi Minh City

4.5.2. Hanoi

4.5.3. Da Nang

4.5.4. Rural Vietnam

5. Vietnam Cards and Payments Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Vietcombank

5.1.2. BIDV

5.1.3. Techcombank

5.1.4. MB Bank

5.1.5. VPBank

5.1.6. Timo Digital Bank

5.1.7. Agribank

5.1.8. Sacombank

5.1.9. Citibank

5.1.10. Standard Chartered

5.1.11. Mastercard

5.1.12. Visa

5.1.13. MoMo Wallet

5.1.14. ZaloPay

5.1.15. ShopeePay

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Cards Issued, Payment Volume, Merchant Partners, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Funding

5.8. Private Equity and Venture Capital Investments

6. Vietnam Cards and Payments Market Regulatory Framework

6.1. Payment Licensing Requirements

6.2. Regulations on Cross-border Payments

6.3. Anti-Money Laundering (AML) Compliance

6.4. Data Privacy and Cybersecurity Standards

7. Vietnam Cards and Payments Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Cards and Payments Future Market Segmentation

8.1. By Card Type (In Value %)

8.2. By Payment Method (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Card Issuer (In Value %)

8.5. By Region (In Value %)

9. Vietnam Cards and Payments Market Analysts Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Consumer Segmentation and Behavioral Analysis

9.3. Marketing and Product Development Strategies

9.4. White Space Opportunities Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by mapping out the key stakeholders within the Vietnam Cards and Payments Market. Extensive desk research is conducted using secondary sources such as industry reports, news articles, and proprietary databases to gather key data points that influence market dynamics, including transaction volumes, payment preferences, and the regulatory landscape.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical market data to assess the growth of card payments, mobile wallets, and other payment methods in Vietnam. Factors such as transaction volumes across different payment methods and the number of active cardholders are thoroughly evaluated to understand the markets structure.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts and practitioners are conducted to validate key market hypotheses. These consultations provide insights into emerging trends, the adoption rate of digital payments, and how regulatory policies are impacting market players.

Step 4: Research Synthesis and Final Output

The final step includes synthesizing all gathered data to develop a comprehensive report on the Vietnam Cards and Payments Market. This phase also involves direct engagement with key market players to verify data accuracy, ensuring that all market statistics and projections are validated.

Frequently Asked Questions

01. How big is the Vietnam Cards and Payments Market?

The Vietnam Cards and Payments Market is valued at USD 36.3 billion, driven by the increasing adoption of digital payment methods and the growth of e-commerce platforms.

02. What are the challenges in the Vietnam Cards and Payments Market?

Challenges include cybersecurity risks, consumer trust issues, and the lack of payment infrastructure in rural areas. Additionally, there is a growing need for improved regulatory compliance to ensure secure transactions.

03. Who are the major players in the Vietnam Cards and Payments Market?

Key players include Vietcombank, BIDV, Techcombank, MoMo Wallet, and Timo Digital Bank. These companies have a influence due to their extensive branch networks, partnerships, and technological innovations.

04. What are the growth drivers of the Vietnam Cards and Payments Market?

Growth is propelled by increased smartphone penetration, government support for financial inclusion, and the expansion of e-commerce. Furthermore, innovations such as contactless payments and mobile wallets are gaining traction among consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.