Vietnam Cigarettes Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7754

November 2024

82

About the Report

Vietnam Cigarettes Market Overview

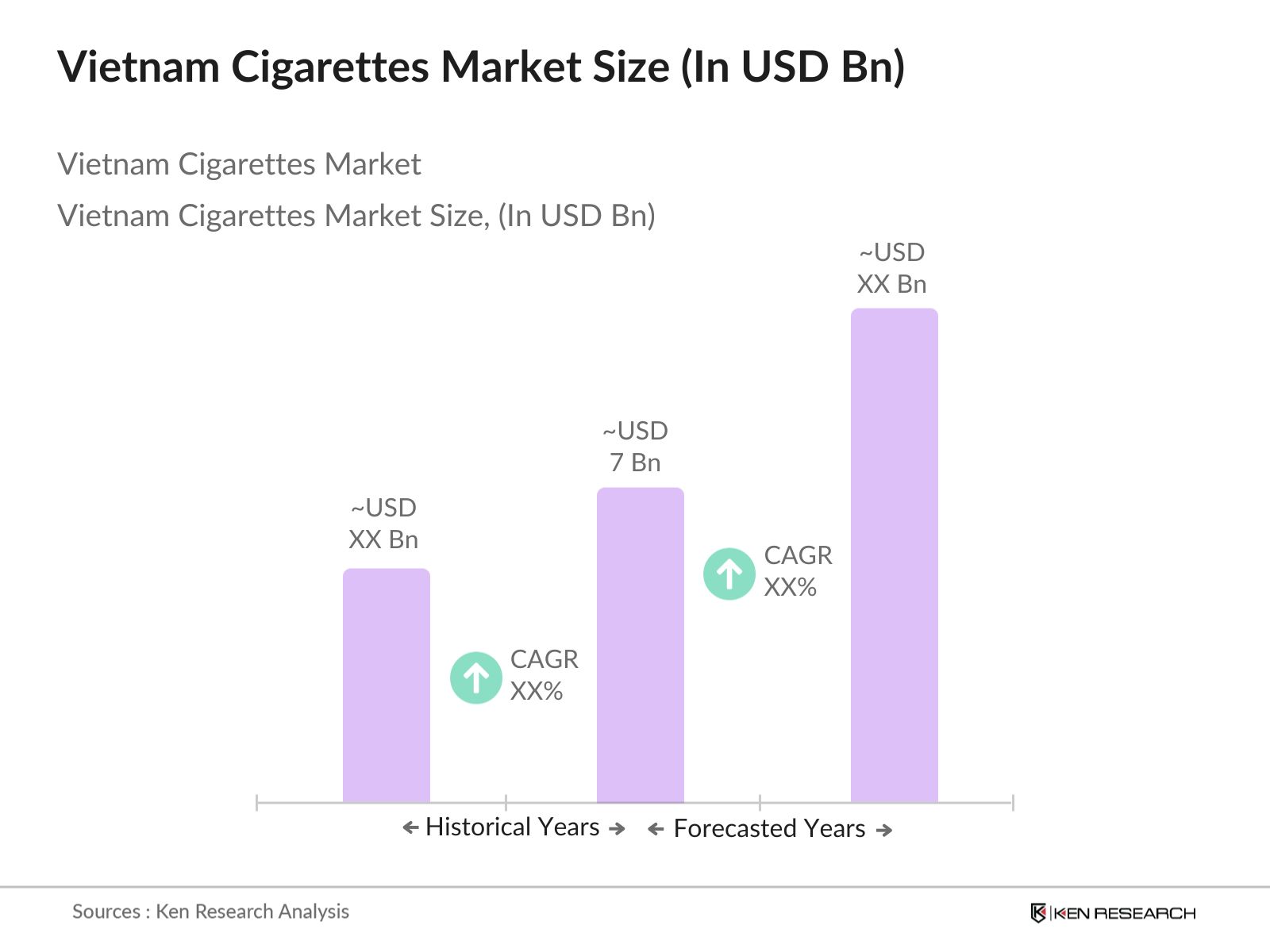

- The Vietnam Cigarettes market is valued at USD 7 billion, based on a five-year historical analysis. The market is driven by rising disposable incomes, cultural acceptance of smoking, and the increasing availability of both traditional and alternative tobacco products, such as e-cigarettes. Growth in retail channels, particularly in urban and rural areas, has further contributed to the markets expansion by providing easy access to a wide variety of cigarette brands.

- Hanoi and Ho Chi Minh City dominate the Vietnam cigarettes market due to their large populations and concentration of retail outlets. These cities are central economic hubs, which has led to a higher rate of cigarette consumption. Additionally, their urbanization and higher disposable incomes contribute to the strong demand for premium cigarette brands. The presence of a robust retail and distribution infrastructure further solidifies the dominance of these cities in the market.

- Vietnam imposes a heavy tax burden on tobacco products, with an excise tax of 75% on retail prices and a 10% VAT. This taxation is part of the government's strategy to reduce smoking rates while generating significant revenue. In 2023, tobacco taxes contributed VND 15 trillion to the state budget, reflecting the high tax regime's impact on both prices and consumption.

Vietnam Cigarettes Market Segmentation

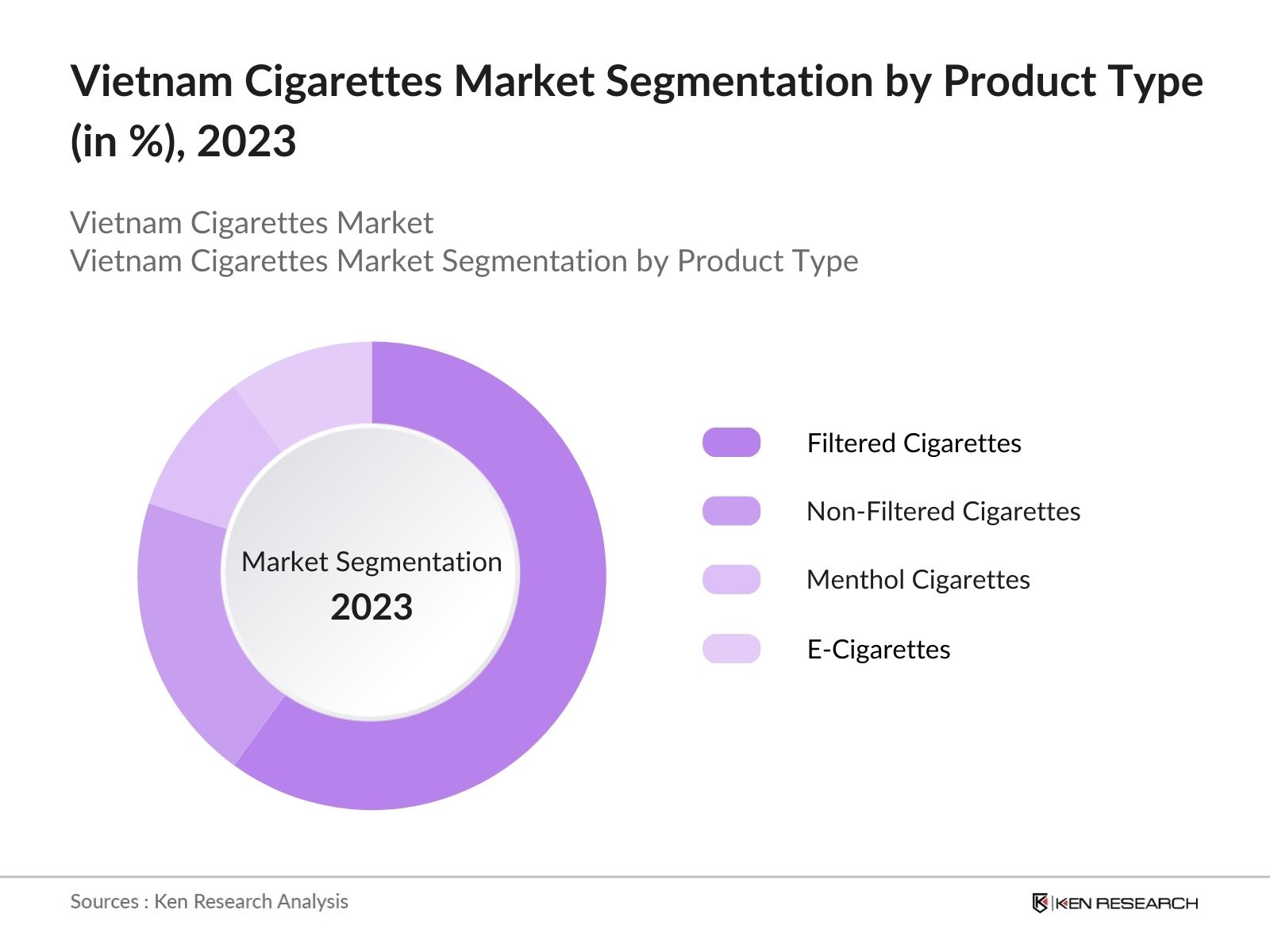

By Product Type: The Vietnam Cigarettes market is segmented by product type into filtered cigarettes, non-filtered cigarettes, menthol cigarettes, and e-cigarettes. Filtered cigarettes hold a dominant market share due to their widespread availability and consumer preference for smoother smoking experiences. The perception that filtered cigarettes are less harmful compared to non-filtered ones has contributed to their popularity, especially among younger consumers.

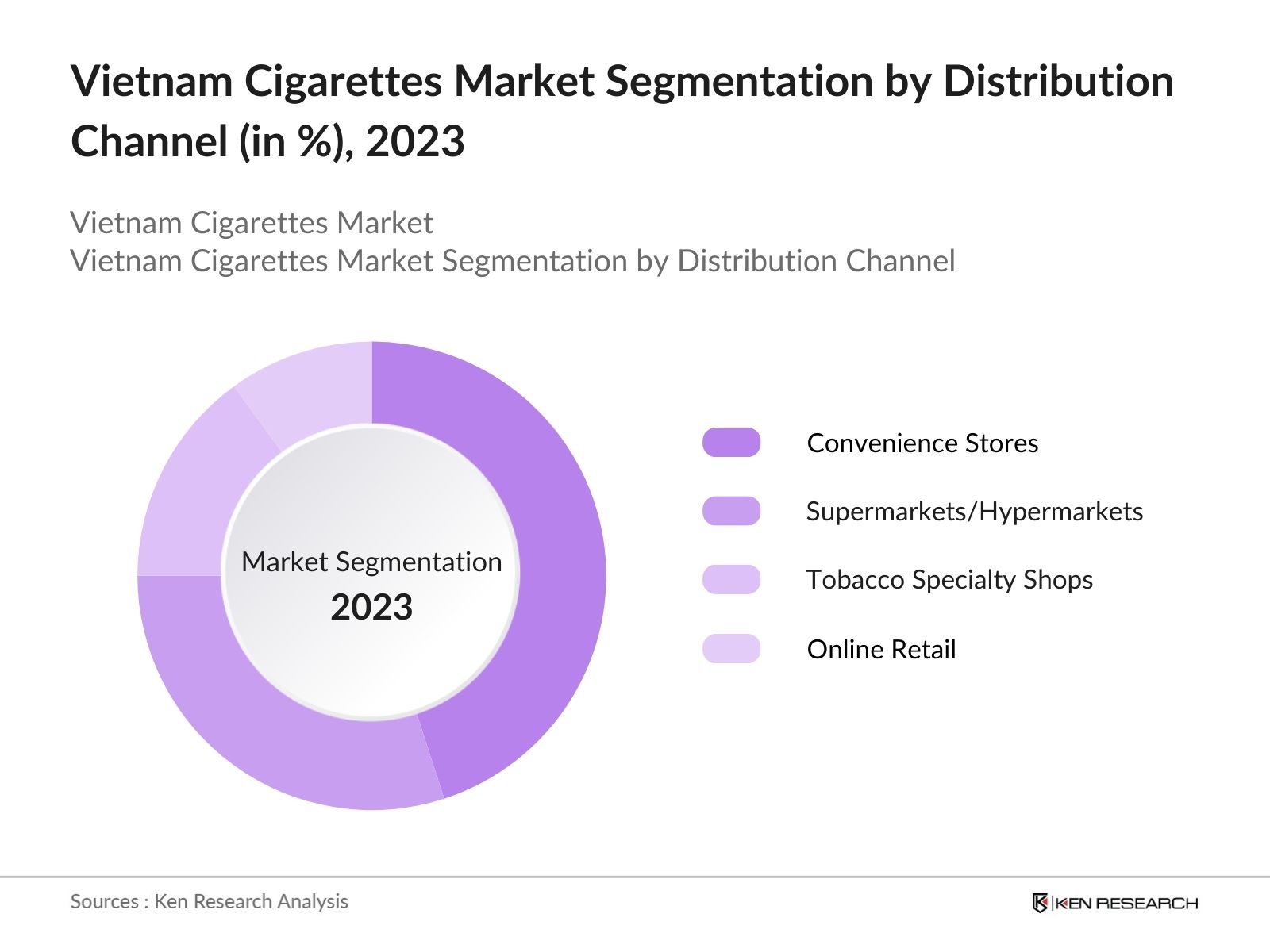

By Distribution Channel: The Vietnam Cigarettes market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, and tobacco specialty shops. Convenience stores are the leading distribution channel, primarily due to their ubiquity and ease of access. Smokers tend to prefer convenience stores for purchasing cigarettes as these outlets offer a quick and reliable way to obtain their preferred brands at all hours, with many stores operating 24/7 in urban areas.

Vietnam Cigarettes Market Competitive Landscape

The Vietnam Cigarettes market is dominated by a mix of local and international players, with Vietnam National Tobacco Corporation (Vinataba) maintaining a leading position. Global giants like British American Tobacco and Philip Morris International are also significant contributors to the market, offering both mass-market and premium products.

Vietnam Cigarettes Industry Analysis

Growth Drivers

- Rising Disposable Income: Vietnam's per capita income has been rising steadily, reaching approximately $4,100 in 2023, driven by strong economic growth. The expansion of the middle class has increased the disposable income available for non-essential items, including cigarettes. The World Bank reports that GDP per capita has seen consistent growth, from $2,740 in 2018 to $4,100 in 2023. This rise in disposable income enables more consumers, especially in urban areas, to purchase premium tobacco products.

- Urbanization and Changing Lifestyle: Vietnam has experienced rapid urbanization, with over 38% of its population living in urban areas by 2023, up from 34% in 2015. The World Bank estimates that Vietnams urban population has reached approximately 38.6 million in 2023. As more people move to cities, they are exposed to different lifestyles, including higher smoking rates, particularly among young adults. This shift contributes to increasing cigarette consumption as urbanization alters social norms and access to tobacco products.

- Increase in Youth Population: Vietnam's youth population (aged 15-24) stands at around 13.7 million in 2024, representing a significant portion of the total population. This demographic is often targeted by tobacco companies, leading to increased cigarette consumption. Young adults, particularly males, have higher smoking rates compared to older generations. The National Institute of Statistics shows that this age group forms nearly 14% of the population, making it a crucial driver for tobacco sales in Vietnam.

Market Challenges

- Government Regulations on Tobacco Advertising (Law No. 09/2012/QH13): Vietnams Law No. 09/2012/QH13, which came into effect in 2013, strictly prohibits advertising tobacco products in all forms. This regulatory landscape creates challenges for tobacco companies in reaching consumers, particularly in the youth demographic. Despite these regulations, the consumption of tobacco persists, but companies are restricted in their marketing efforts, leading to reliance on indirect methods, such as point-of-sale promotions.

- Rising Health Awareness and Anti-Smoking Campaigns: The Ministry of Health in Vietnam has been actively running anti-smoking campaigns, with public health spending focused on reducing smoking rates. As of 2023, nearly 10% of the Ministry's public health budget is allocated toward anti-smoking efforts, which include education and awareness campaigns. Increased awareness of the health risks associated with smoking has contributed to a decline in smoking rates, particularly among older adults, challenging market growth.

Vietnam Cigarettes Market Future Outlook

Over the next five years, the Vietnam Cigarettes market is expected to experience moderate growth driven by ongoing demand for premium products and e-cigarettes. While traditional cigarette consumption is expected to remain stable, newer trends such as reduced-risk products (RRPs) and nicotine pouches will likely see increased adoption. The Vietnamese government's evolving regulatory policies and taxation structures may also play a significant role in shaping market trends.

Market Opportunities

- Premiumization and Growth of Specialty Cigarette Products: As consumer preferences shift towards premium products, the demand for high-quality tobacco items is rising. In 2023, premium cigarettes accounted for nearly 15% of total sales, driven by consumers seeking higher-quality experiences. The trend towards premiumization is particularly prevalent in urban areas where disposable incomes are higher. The expansion of luxury tobacco products, including specialty blends and limited-edition items, presents a significant opportunity for growth.

- Innovation in E-Cigarettes and Reduced Harm Products: E-cigarettes and other reduced-harm products have gained popularity in Vietnam, especially among younger consumers. The Vietnam Tobacco Association reported that e-cigarette sales increased by 20% between 2021 and 2023. These products are viewed as safer alternatives to traditional cigarettes and present an opportunity for the market to expand into new consumer segments. Regulatory discussions surrounding these products are ongoing, but innovation in this space is likely to continue driving market opportunities.

Scope of the Report

By Product Type |

Filtered Cigarettes Non-Filtered Cigarettes Menthol Cigarettes E-Cigarettes |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Tobacco Specialty Shops |

|

By End User |

Youth (18-24 years) Adult (25-50 years) Senior (50+ years) |

|

By Pricing Tier |

Premium Cigarettes Mid-Range Cigarettes Low-Cost Cigarettes |

|

Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Tobacco Manufacturers

Retailers and Distributors

Tobacco Farmers and Cooperatives

Government and Regulatory Bodies (Vietnam Ministry of Health, Vietnam National Tobacco Administration)

Investors and Venture Capital Firms

E-Cigarette and Vaping Product Companies

Packaging and Labeling Companies

Public Health Organizations

Companies

Players Mentioned in the Report

Vietnam National Tobacco Corporation (Vinataba)

British American Tobacco

Philip Morris International

Japan Tobacco International

Imperial Brands

Saigon Tobacco Company

Dong Nai Tobacco Company

Khatoco

KT&G Corporation

ITC Ltd.

Table of Contents

1. Vietnam Cigarettes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Cigarettes Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Cigarettes Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Urbanization and Changing Lifestyle

3.1.3. Increase in Youth Population

3.1.4. Growth in Tobacco Retail Channels

3.2. Market Challenges

3.2.1. Government Regulations on Tobacco Advertising (Law No. 09/2012/QH13)

3.2.2. Rising Health Awareness and Anti-Smoking Campaigns

3.2.3. Counterfeit Cigarettes and Illicit Trade

3.3. Opportunities

3.3.1. Premiumization and Growth of Specialty Cigarette Products

3.3.2. Innovation in E-Cigarettes and Reduced Harm Products

3.3.3. Export Potential to Neighboring Countries

3.4. Trends

3.4.1. Shift from Traditional Cigarettes to E-Cigarettes

3.4.2. Rising Popularity of Menthol and Flavored Cigarettes

3.4.3. Increase in Online Sales Channels

3.5. Government Regulation

3.5.1. Taxation Policy (Excise Tax, VAT)

3.5.2. Packaging and Labeling Restrictions (Plain Packaging Laws)

3.5.3. Anti-Smoking Laws (Smoking Bans in Public Spaces)

3.5.4. Control of Tobacco Harm Reduction Strategies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Tobacco Farmers, Retailers, Manufacturers)

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes (Nicotine Patches, Gums, Vaping Products)

3.8.5. Industry Rivalry

4. Vietnam Cigarettes Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Filtered Cigarettes

4.1.2. Non-Filtered Cigarettes

4.1.3. Menthol Cigarettes

4.1.4. E-Cigarettes

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Tobacco Specialty Shops

4.3. By End User (In Value %)

4.3.1. Youth (18-24 years)

4.3.2. Adult (25-50 years)

4.3.3. Senior (50+ years)

4.4. By Region (In Value %)

4.4.1. Northern Vietnam

4.4.2. Central Vietnam

4.4.3. Southern Vietnam

4.5. By Pricing Tier (In Value %)

4.5.1. Premium Cigarettes

4.5.2. Mid-Range Cigarettes

4.5.3. Low-Cost Cigarettes

5. Vietnam Cigarettes Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vietnam National Tobacco Corporation (Vinataba)

5.1.2. British American Tobacco (BAT)

5.1.3. Philip Morris International

5.1.4. Japan Tobacco International (JTI)

5.1.5. Imperial Brands

5.1.6. ITC Ltd.

5.1.7. China National Tobacco Corporation

5.1.8. Godfrey Phillips India

5.1.9. KT&G Corporation

5.1.10. Altria Group

5.1.11. Reynolds American Inc.

5.1.12. VINA Tobacco

5.1.13. Saigon Tobacco Company

5.1.14. Dong Nai Tobacco Company

5.1.15. Khatoco

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Market Share, Product Portfolio, Innovation Rate, Geographical Presence, Inception Year, Headquarters)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Cigarettes Market Regulatory Framework

6.1. Tobacco Control Law

6.2. Advertising and Marketing Restrictions

6.3. Taxation Policies (Excise Tax, VAT)

6.4. Import and Export Regulations

7. Vietnam Cigarettes Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Cigarettes Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End User (In Value %)

8.4. By Region (In Value %)

8.5. By Pricing Tier (In Value %)

9. Vietnam Cigarettes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with a comprehensive mapping of all stakeholders in the Vietnam Cigarettes Market, from tobacco farmers to retailers. Using secondary data sources, we identify crucial market variables such as production output, consumer preferences, and sales channels, which directly influence market behavior.

Step 2: Market Analysis and Construction

Historical data is analyzed to assess the penetration of different product types and distribution channels. We focus on year-on-year revenue generation across various segments, analyzing both rural and urban areas to understand the overall market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through a series of interviews to validate market hypotheses. These experts provide first-hand insights into market trends, competitive strategies, and consumer behaviors, helping to refine our market projections.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized into actionable insights, which are validated through direct feedback from cigarette manufacturers and distributors. The bottom-up approach ensures the accuracy of our projections, which are cross-verified with market data and expert input.

Frequently Asked Questions

01. How big is the Vietnam Cigarettes Market?

The Vietnam Cigarettes market is valued at USD 7 billion, based on a five-year historical analysis. The market is driven by rising disposable incomes, cultural acceptance of smoking, and the increasing availability of both traditional and alternative tobacco products, such as e-cigarettes.

02. What are the challenges in the Vietnam Cigarettes Market?

Challenges include stringent government regulations on advertising, increasing health awareness among consumers, and the proliferation of illicit and counterfeit cigarettes.

03. Who are the major players in the Vietnam Cigarettes Market?

Major players include Vietnam National Tobacco Corporation (Vinataba), British American Tobacco, Philip Morris International, Japan Tobacco International, and Imperial Brands. These companies have a strong market presence due to established distribution networks and brand loyalty.

04. What are the growth drivers of the Vietnam Cigarettes Market?

Key growth drivers include rising disposable incomes, urbanization, and the increasing availability of premium and specialty tobacco products. Additionally, innovation in e-cigarettes and reduced-harm products is attracting a younger demographic.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.