Vietnam Clinical Laboratories Market Outlook to 2028

Driven by Private Hospitals driving the future of Healthcare and Clinical Tests in Vietnam

Region:Asia

Author(s):Aditya Konnur

Product Code:KR1452

October 2024

95

About the Report

Vietnam Clinical Laboratories Market Overview:

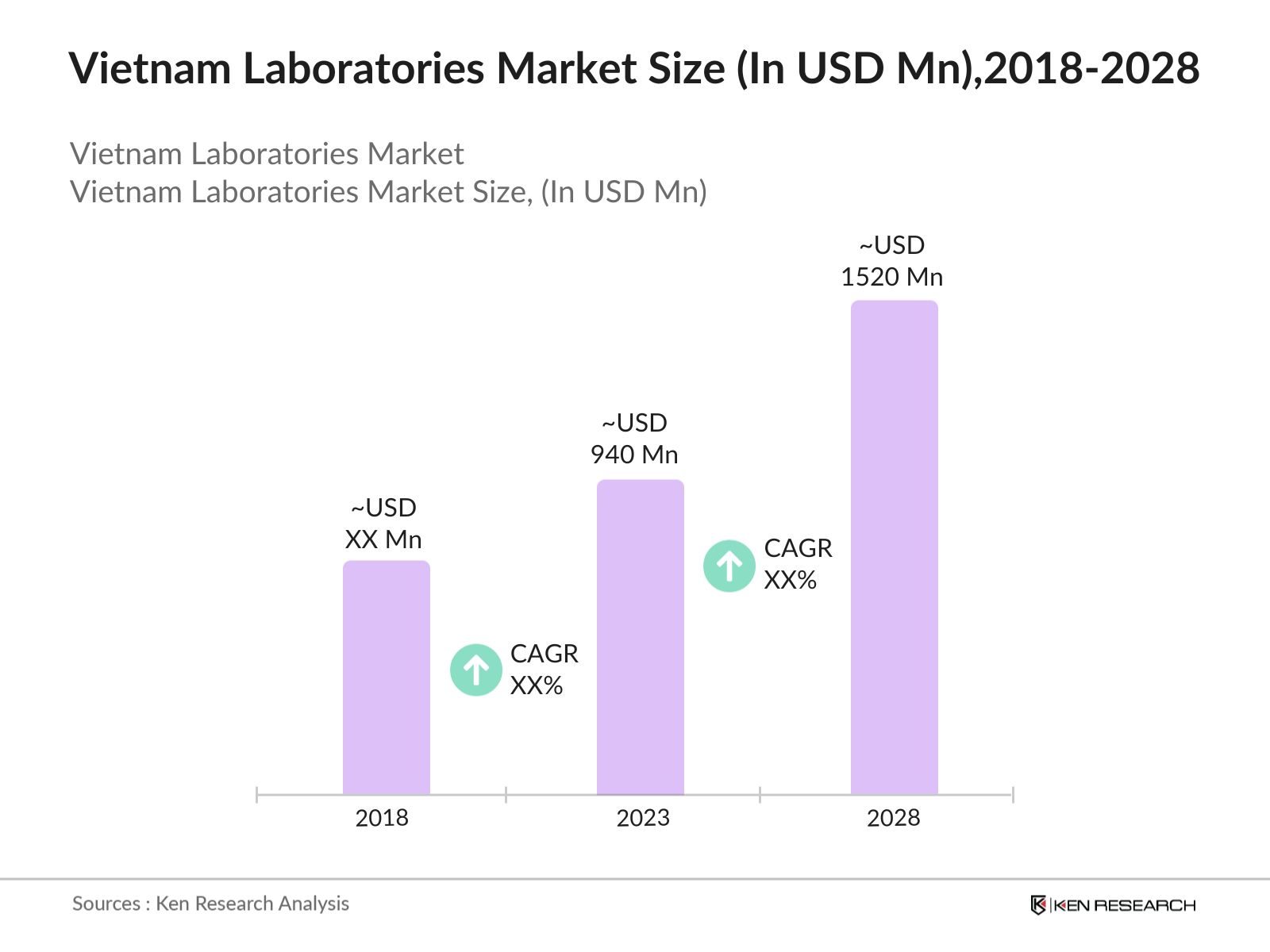

- In 2023, Vietnam Clinical Laboratories Market was valued at USD 940 Mn driven by Private Hospitals stimulating the future of Healthcare and Clinical Tests in Vietnam, growth in non-communicable diseases and chronic diseases, Increasing focus on preventive medicine, and Technological Advancements.

- The market is dominated by key players such as Dai Hoc Y Duoc Hospital, Thong Nhat Hospital and Cho Ray Hospital, FV Hospital, and Hanoi French Hospital. These players have established a strong presence through extensive networks of clinical laboratories, offering a wide range of diagnostic services.

- Under a three-year Memorandum of Understanding (MoU) spanning from 2018 to 2020, Philips made a significant contribution to the healthcare infrastructure of Thanh Vu Medic General Hospital in Vietnam by providing state-of-the-art medical equipment. This collaboration was part of a broader initiative to elevate the hospital's diagnostic capabilities and healthcare standards to international levels.

- Ho Chi Minh City and Hanoi dominate the Vietnam Clinical Laboratories Market due to their advanced healthcare infrastructure and higher concentration of private healthcare providers. Ho Chi Minh City, being the economic hub, attracts a large number of patients from across the country and neighboring regions, making it the leading market for clinical laboratory services.

Vietnam Clinical Laboratories Market Segmentation

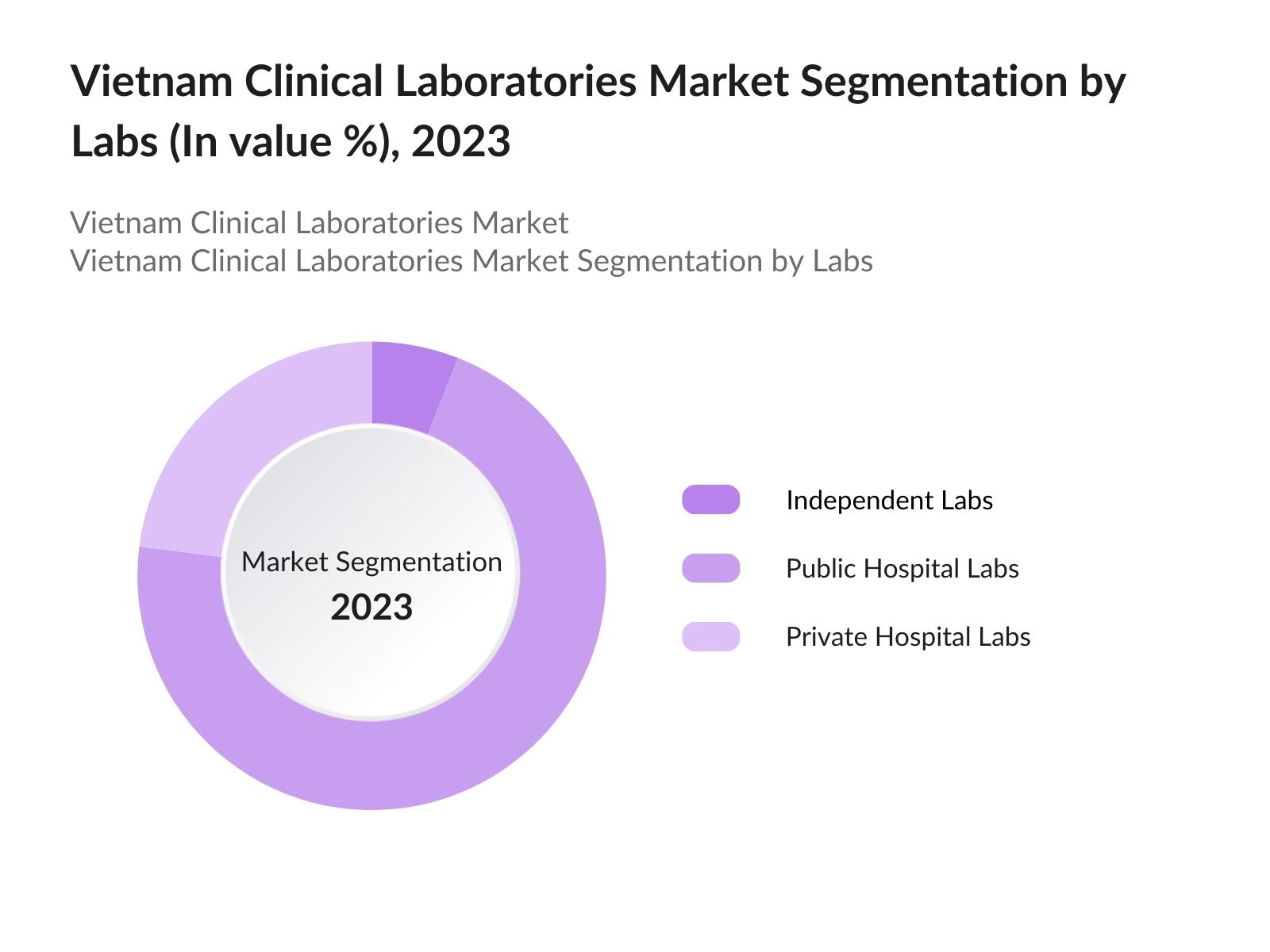

- By Type of Labs: Vietnam's Clinical Laboratories Market is segmented by type of labs into Independent Labs, Public Hospital Labs, and Private Hospital Labs. In 2023, Public Hospital Labs dominate the market share within this segmentation. The dominance of public hospital labs is driven by their widespread presence across the country, especially in rural and underserved regions. These labs are often government-funded, ensuring affordability and accessibility for a large portion of the population.

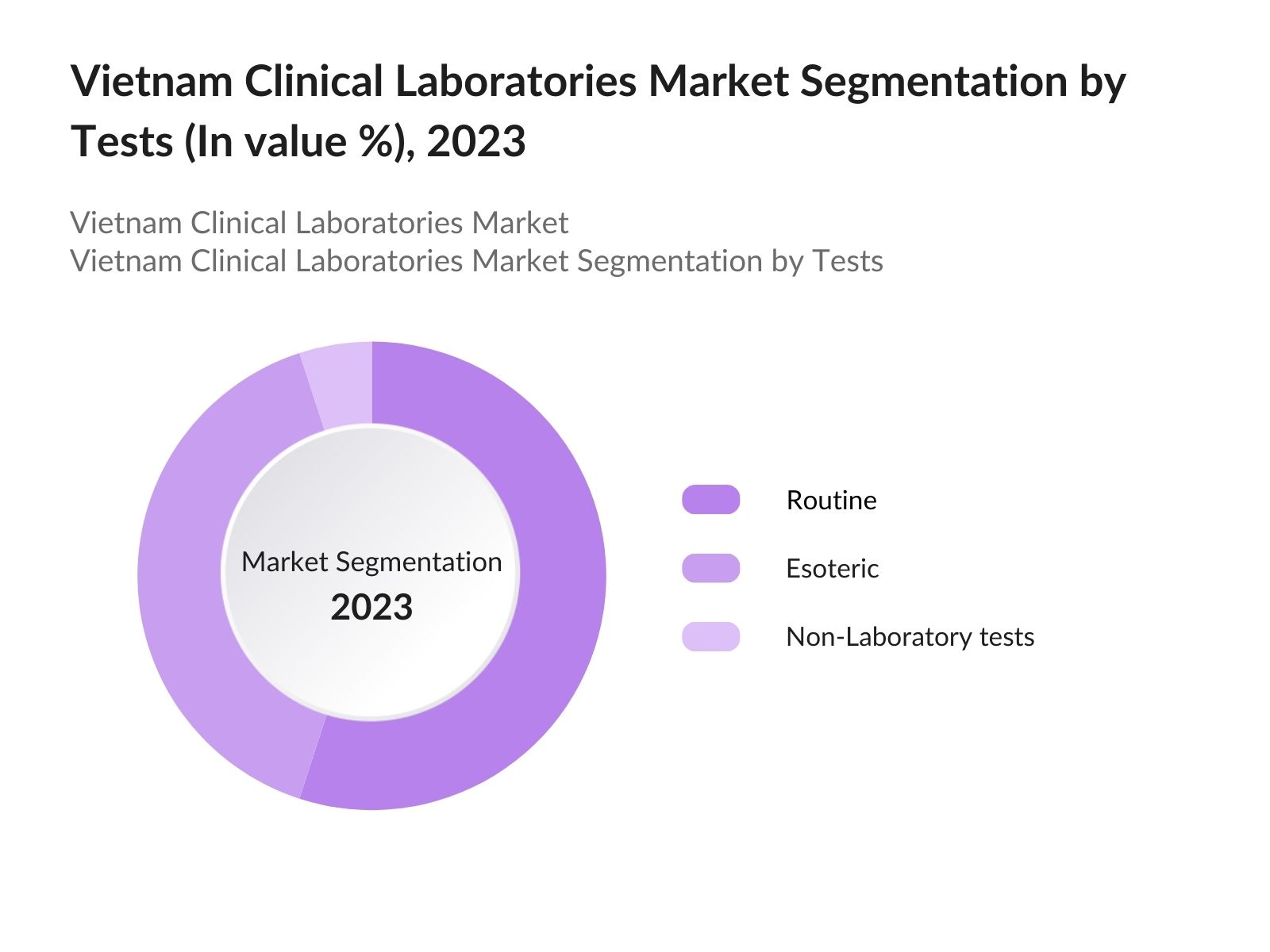

- By Type of Tests: The Vietnam Clinical Laboratories Market is segmented by the type of tests into Routine, Esoteric, and Non-Laboratory tests. In 2023, non-laboratory tests hold the dominant market share. The dominance of this segment is attributed to the increasing demand for point-of-care testing (POCT) and home-based diagnostics, which are categorized under non-laboratory tests. These tests offer convenience and rapid results, making them particularly appealing in urban areas where patients seek quick and accessible healthcare solutions without the need for traditional laboratory settings.

- By Region: The Vietnam Clinical Laboratories Market is segmented by region into North Northwest, Northeast, Red River Delta, North Central, South Central Coast, Central Highlands, Southeast, and Mekong River Delta. In 2023, the Southeast region dominates the market share within this segmentation. The dominance of the Southeast region, particularly Ho Chi Minh City, is due to its advanced healthcare infrastructure, higher concentration of clinical laboratories, and the presence of top-tier hospitals.

Vietnam Clinical Laboratories Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Cho Ray Hospital |

1900 |

Ho Chi Minh City, Vietnam |

|

Dai Hc Y Dc Hospital |

1947 |

Ho Chi Minh City, Vietnam |

|

Thong Nhat Hospital |

1975 |

Ho Chi Minh City, Vietnam |

|

Hoan My Medical Corporation |

1997 |

Ho Chi Minh City, Vietnam |

|

MEDLATEC General Hospital |

1996 |

Hanoi, Vietnam |

- Hoan My Medical Corporation: In 2023, Hoan My established the Hoan My Academy to enhance clinical outcomes and treatment effectiveness. The academy collaborates with international organizations, such as South Korea's Asan Medical Center, to provide advanced training for medical staff in sub-specialties like oncology.Additionally, partnerships with medical device companies like GE Healthcare support the integration of new technologies and training initiatives.

- MEDLATEC General Hospital: In 2024, MEDLATEC General Hospital has partnered with Hoa Binh Provincial General Hospital to enhance healthcare services in Hoa Binh province. This collaboration aims to improve laboratory testing capabilities and provide timely diagnostic services to residents. The partnership reflects MEDLATEC's commitment to expanding its reach and ensuring high-quality healthcare access for the local population through advanced medical technology and expertise.

Vietnam Clinical Laboratories Market Analysis

Growth Drivers

- Growth in Non-Communicable Diseases and Chronic Diseases: The Vietnam Clinical Laboratories Market is significantly driven by the rising prevalence of non-communicable diseases (NCDs) and chronic conditions. According to the Ministry of Health, Vietnam reported over 3.5 million new cases of non-communicable diseases, such as cardiovascular diseases, diabetes, and cancer, in 2023. This surge is largely attributed to lifestyle changes, urbanization, and an aging population. As these conditions require regular monitoring and early detection, the demand for routine and specialized diagnostic tests has increased exponentially.

- Increasing Focus on Preventive Medicine: There is a growing emphasis on preventive medicine in Vietnam, which is significantly boosting the clinical laboratories market. Preventive healthcare aims to detect and address health issues before they develop into serious conditions, thereby reducing the overall healthcare burden. In 2023, the Vietnamese government launched several public health campaigns focusing on the importance of regular health check-ups and screenings, particularly for at-risk populations. This initiative has led to a substantial increase in the number of routine tests conducted in clinical laboratories.

- Advancements in diagnostics Tools: Technological advancements in diagnostic tools and laboratory equipment are another major growth driver for the Vietnam Clinical Laboratories Market. The adoption of cutting-edge technologies, such as automated laboratory systems, molecular diagnostics, and AI-powered diagnostic tools, has revolutionized the way clinical laboratories operate. In 2023, several major hospitals and independent laboratories in Vietnam invested in state-of-the-art diagnostic technologies, enabling them to offer more accurate, faster, and comprehensive testing services.

Challenges

- No Commercialization of Clinical Labs: The lack of commercialization in the clinical laboratories market in Vietnam presents a significant challenge to the sector's growth. Unlike other healthcare markets where private entities play a major role, Vietnam's clinical labs remain largely under government control, with limited involvement from private players. This absence of commercialization restricts the ability of labs to innovate, expand, and compete on a broader scale.

- Large Dependence on Focus Cities: Vietnam's clinical laboratories market is heavily dependent on a few key cities, such as Ho Chi Minh City and Hanoi, where the majority of advanced healthcare infrastructure is concentrated. This regional focus creates significant disparities in access to quality diagnostic services across the country. While urban centres benefit from state-of-the-art laboratories and a wide range of diagnostic options, rural and less developed areas often face limited access to such services.

Government Initiatives

- National Health Insurance Program Expansion: In 2023, the Vietnamese government expanded the National Health Insurance Program to cover a broader range of diagnostic services, including advanced laboratory tests. As of early 2024, over 93.3 million people are insured, exceeding the government's target This initiative aims to make healthcare more accessible to the population, particularly in underserved regions.

- Incentives for Private Sector Investment: To encourage private investment in the healthcare sector, the government introduced a series of incentives in 2024, including tax breaks and subsidies for the establishment of new clinical laboratories. This policy aims to address the shortage of diagnostic facilities in rural areas and to enhance the overall capacity of the healthcare system.

Vietnam Clinical Laboratories Market Future Outlook:

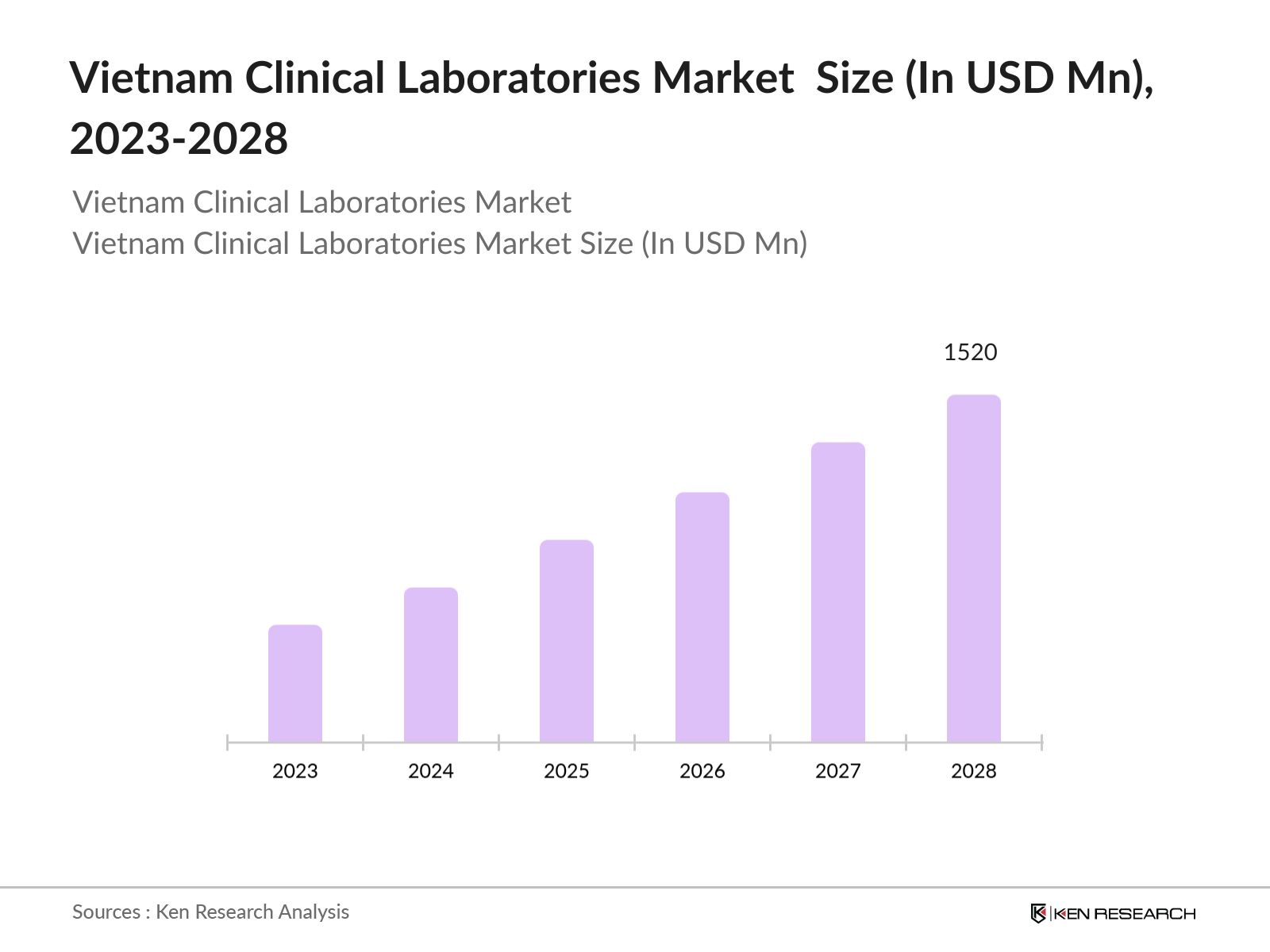

The Vietnam Clinical Laboratories market is poised for remarkable growth, the market is expected to reach USD 1520 Mn by 2028, driven by rise in communicable and non-communicable diseases, increasing penetration of private health insurance, and change in consumption habits.

Future Trends

- Rise in Communicable and Non-Communicable Diseases: Over the next five years, the Vietnam Clinical Laboratories Market is expected to be significantly influenced by the continued rise in both communicable and non-communicable diseases. The increasing prevalence of infectious diseases such as dengue fever, tuberculosis, and emerging viral infections will drive the demand for rapid and accurate diagnostics. Simultaneously, the growing burden of non-communicable diseases (NCDs) like diabetes, cardiovascular diseases, and cancer will further escalate the need for regular monitoring and advanced diagnostic services.

- Increasing Penetration of Private Health Insurance: The penetration of private health insurance is anticipated to grow substantially in Vietnam, shaping the clinical laboratories market by 2028. As more individuals opt for private health insurance plans, there will be an increase in demand for high-quality diagnostic services, which are often covered by these plans. Private insurers tend to partner with top-tier hospitals and laboratories, ensuring their clients have access to comprehensive diagnostic tests.

Scope of the Report

|

By Type of Labs |

Independent Labs Public Hospital Labs Private Hospital Labs |

|

By Type of Tests on the Basis of Number of Tests Conducted |

Pathology Tests X-Ray Ultrasounds CT-scan |

|

By End-User |

Corporate Clients Walk-Ins Doctor Referrals Online Referrals |

|

By Payor |

Out-of-Pocket Corporate Insurance Private Insurance Government Insurance |

|

By Patient Age |

0-20 years 20-40 years 40-60 years Above 60 years |

|

By Region |

Northwest Northeast Red River Delta North Central South Central Coast Central Highlands SouthEast Mekong River Delta |

Products

Key Target Audience:

Healthcare Providers

Medical Equipment Manufacturers

Diagnostic Service Providers

Government and Regulatory Bodies

Health Insurance Companies

Pharmaceuticals and Biotechnology Companies

Hospitals and Clinics

Government and Regulatory Bodies (Ministry of Health, General Department of Preventive Medicine)

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Cho Ray Hospital

Dai Hc Y Dc Hospital

Thong Nhat Hospital

Hoan My Medical Corporation

MEDLATEC General Hospital

Vinmec International Hospital

FV Hospital

Hanoi French Hospital

Cho Ray Hospital

Bach Mai Hospital

Viet Duc University Hospital

Phuoc An Clinic

Saigon Clinic

Tan Tao University Hospital

Nhi Dong 1 Hospital

Table of Contents

1. Executive Summary

1.1 Executive Summary: Vietnam Clinical Laboratories Market

2. Country Overview: Vietnam

2.1 Overview of Vietnam

2.2 Population Analysis for Vietnam

2.3 Healthcare Analysis for Vietnam

2.4 Health Insurance (Public, Private) Coverage in Vietnam

2.5 Diseases Overview in Vietnam

3. Market Overview of Clinical Laboratories Market in Vietnam

3.1 Cross Comparison of Clinical Laboratories Market in Vietnam with Other Countries

3.2 Ecosystem of Clinical Laboratories Market in Vietnam

3.3 Evolution of Independent Clinical Laboratories Market in Vietnam

3.4 Value Chain of Clinical Laboratories Market in Vietnam

4. Market Size of Clinical Laboratories Market in Vietnam

4.1 Market Size of Clinical Laboratories Industry in the Vietnam on the basis of Revenue, 2018-2023

5. Market Segmentation of Clinical Laboratories Market in Vietnam, 2023

5.1 Segmentation by Type of Labs (Public Hospital Labs, Private Hospital Labs, Independent Lab chains)

5.2 Segmentation by Number of Independent Labs (Organized, Unorganized)

5.3 Segmentation by Type of Tests (Pathology, X-ray, Ultrasound, CT-scan)

5.4 Segmentation by End-User (Corporate Clients, Walk-Ins, Doctor Referrals, Online Referrals) and by Private Hospital Labs (In-House Labs, Third Party Tie-ups)

5.5 Segmentation by Type of Tests (Routine, Esoteric, Non-Laboratory) and By Payor (Out-of-Pocket, Corporate Insurance, Private Insurance, Government Insurance)

5.6 Segmentation by Routine Tests (CBC, A1C, Basic Metabolic Panel, Others) and By Esoteric Tests (Oncology, Endocrine, Infectious Disease, Allergic Disease, Others)

5.7 Segmentation by Customer Age (0-20 years, 20-40 years, 40-60 years, above 60 years)

5.8 By Region (NorthWest, NorthEast, Red River Delta, North Central, South-Central Coast, Central Highlands, SouthEast, Mekong River Delta)

6. Industry Analysis

6.1 Trends and Developments in Vietnam Clinical Laboratories Market

6.2 Next Generation Laboratory Technology Trends

6.3 Key Challenges in Vietnam Clinical Laboratories Market

6.4 SWOT Analysis: Vietnam Clinical Laboratories Market

6.5 Growth Drivers of Vietnam Clinical Laboratories Market

6.6 Impact of Covid-19 on Vietnam Clinical Laboratories Market

6.7 Global Landscape: Increasing Adoption of Digital Pathology

6.8 Dynamics of Vietnam Tele-Pathology Market

6.9 Regulations around Digital Healthcare in Vietnam

7. Competition Analysis

7.1 Market Share of Major Players in Vietnam Clinical Laboratories Market

7.2 Market Positioning Analysis of Vietnam Clinical Laboratories Market

7.3 Gartners Magic Quadrant of Vietnam Clinical Laboratories Market

7.4 Company Profile of Major Private Organized Diagnostics Labs in Vietnam (Company Overview, Regions,Third Party Tie-Ups,Vintage, Number of Labs and Branches, Number of Tests Conducted, Best Selling Tests, Revenues in USD (2021) & Partnership Highlights

7.5 Pricing Analysis

7.6 Market Entry Strategies Adopted by Multilateral Players

7.7 Key Partnerships and Collaborations

7.8 Overview of MEDLATECs Strategic Partnerships

7.9 Digital Adoption Case Studies in Vietnam Clinical Laboratories Market

7.10 Case Study: Market Entry and Expansion of Hoan My Medical Group

8. Future Outlook and Projections, 2023-2028

8.1 Future Market Size of Clinical Laboratories Market in Vietnam on the basis of Revenue, 2023-2028

8.2 Future Market Segmentation by Type of Labs (Public Hospital Labs, Private Hospital Labs, Independent Lab chains)

8.3 Future Market Segmentation by Number of Independent Labs (Organized, Unorganized) and By Private Hospital Labs (In-House Labs, Third Party Tie-ups)

8.4 Future Market Segmentation by Payor (Out-of-Pocket, Corporate Insurance, Private Insurance, Government Health Insurance) and By End-User (Corporate Clients, Walk-Ins, Doctor Referrals, Online Referrals)

8.5 Future Market Segmentation by Type of Tests (Routine, Esoteric, Non-Laboratory), By Routine Tests (CBC, A1C, Basic Metabolic Panel, Others) and By Esoteric Tests (Oncology, Endocrine, Infectious Disease, Allergic Disease, Others)

8.6 Future Market Segmentation by Region (Northwest, Northeast, Red River Delta, North Central, South-Central Coast, Central Highlands, Southeast, Mekong River Delta) and By Customer Age (0-20 years, 20-40 years, 40-60 years, above 60 years)

9. Analyst Recommendations

9.1 Key Market Entry Routes

9.2 Legal Framework for Market Entry

9.3 Desired Product and Service Offerings

9.4 Operational and Marketing Strategies

9.5 Industry Whitespaces and Shortcomings

9.6 Growth Opportunities: Specialized Testing

9.7 Growth Opportunities: Optimizing the Lab Operations

9.8 Growth Opportunities: Digital Transformation

9.9 Future Roadmap for Market Entry

10. Industry Speaks

10.1 Interview with Thin Nht (Ron), Commercial Finance Analyst at Diag Laboratories

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Clinical Laboratories in Vietnam:

Exhaustive research done to identify the list of Clinical Laboratories companies which have a presence in the Vietnam.

Step 2: Secondary Research on Clinical Laboratories Industry:

Exhaustive secondary research done on the Clinical Laboratories industry. Gathered information on the Clinical Laboratories industry from several industry articles, company websites, blogs, industry reports.

Step 3: Interviews with Key Industry Executives:

Conducted interviews with the management of the Clinical Laboratories companies (Managing Partner, C-level executives, Business Development head, Category Manager, Operations Manager & others).

Step 4: Data Validation through Mystery Calls:

To validate the data points gathered from the interviews, our team then did mystery calling to the stakeholders in the Clinical Laboratories Industry and verified revenues for major companies. The team also tried to understand their operating and financial indicators including revenue, business models, geographical presence, focus areas, business verticals, and services offered among others.

Frequently Asked Questions

01 How big is the Vietnam Clinical Laboratories Market?

The Vietnam Clinical Laboratories Market was valued at approximately USD 940 Mn in 2023, driven by the rising prevalence of chronic diseases, government healthcare initiatives, and the increasing demand for advanced diagnostic services.

02 What are the challenges in the Vietnam Clinical Laboratories Market?

Challenges in Vietnam Clinical Laboratories market include a shortage of skilled laboratory technicians, limited commercialization, and heavy reliance on major cities like Ho Chi Minh City and Hanoi, which create disparities in access to diagnostic services across the country.

03 Who are the major players in the Vietnam Clinical Laboratories Market?

Key players in the Vietnam Clinical Laboratories market include Cho Ray Hospital, Hoan My Medical Corporation, Vinmec International Hospital, MEDLATEC General Hospital, and FV Hospital, which dominate due to their advanced facilities, extensive service offerings, and strong market presence.

04 What are the growth drivers of the Vietnam Clinical Laboratories Market?

The Vietnam Clinical Laboratories market is driven by the rising prevalence of non-communicable diseases, increasing focus on preventive medicine, and technological advancements in diagnostic tools and laboratory equipment, which enhance service quality and accessibility.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.