Vietnam Construction Equipment Rental Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2827

November 2024

83

About the Report

Vietnam Construction Equipment Rental Market Overview

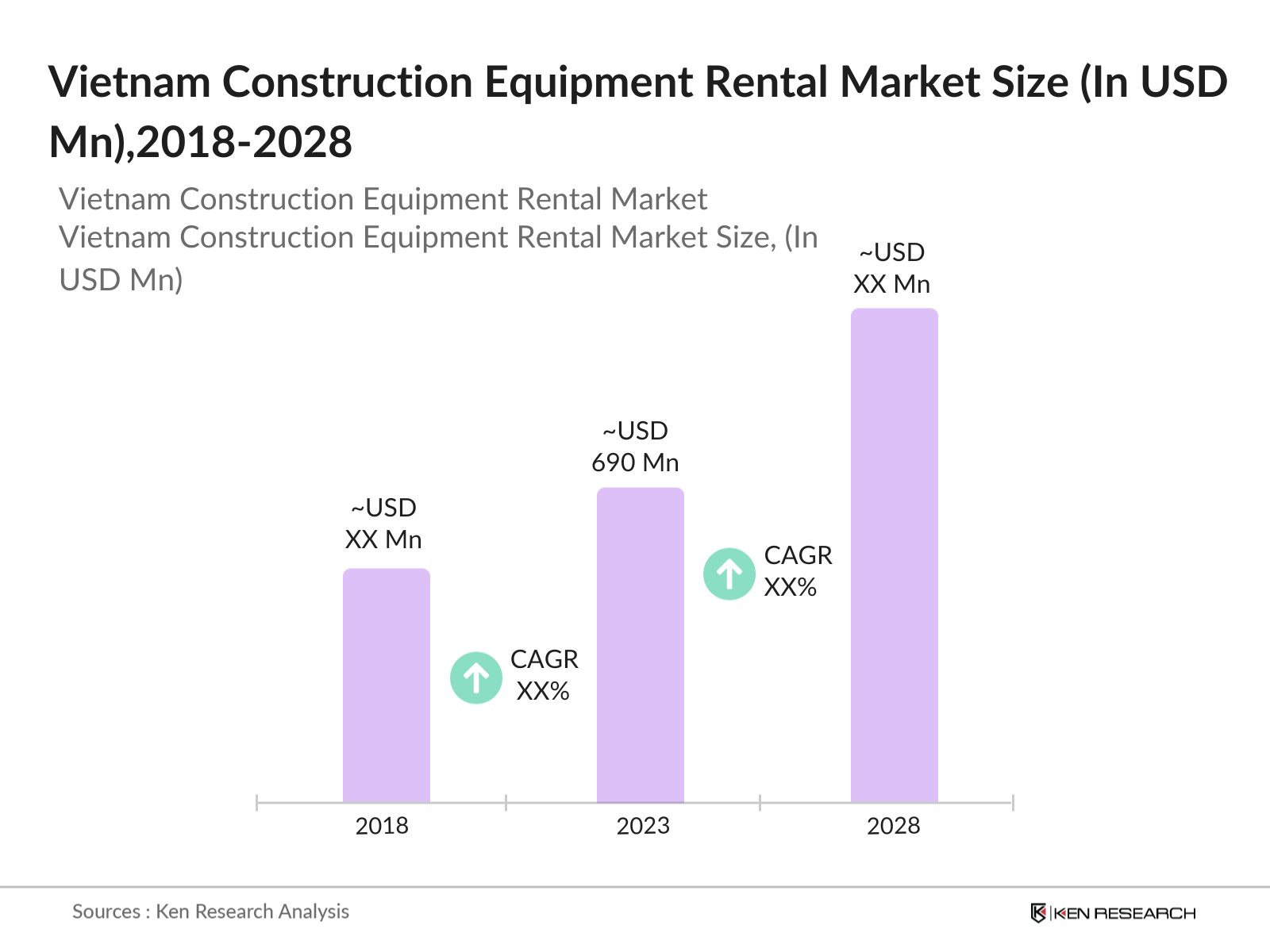

- The Vietnam Construction Equipment Rental Market was valued at USD 690 million in 2023, driven by increasing infrastructure projects, rapid urbanization, and growing demand for cost-effective construction solutions. The market is segmented into heavy equipment, material handling, and earthmoving machinery, with earthmoving machinery being the most dominant due to its versatility and wide usage across various construction projects.

- Major players in the Vietnam Construction Equipment Rental Market include Doosan Infracore, Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, and Liebherr Group. These companies are recognized for their broad equipment offerings, strong service networks, and reliability in construction operations. Caterpillar leads the market with a significant share in the heavy machinery segment, known for its durability and fuel efficiency.

- The construction boom in Vietnam is concentrated in urban centers like Ho Chi Minh City and Hanoi, where infrastructure and real estate developments are driving the demand for rental equipment. The governments emphasis on infrastructure modernization, particularly in transportation and energy sectors, has further bolstered the market.

- In 2023, Komatsu introduced a new range of hybrid excavators in Vietnam, aimed at reducing fuel consumption and carbon emissions. This aligns with the growing trend toward eco-friendly construction practices in the country, reflecting broader global trends in the construction industry.

Vietnam Construction Equipment Rental Market Segmentation

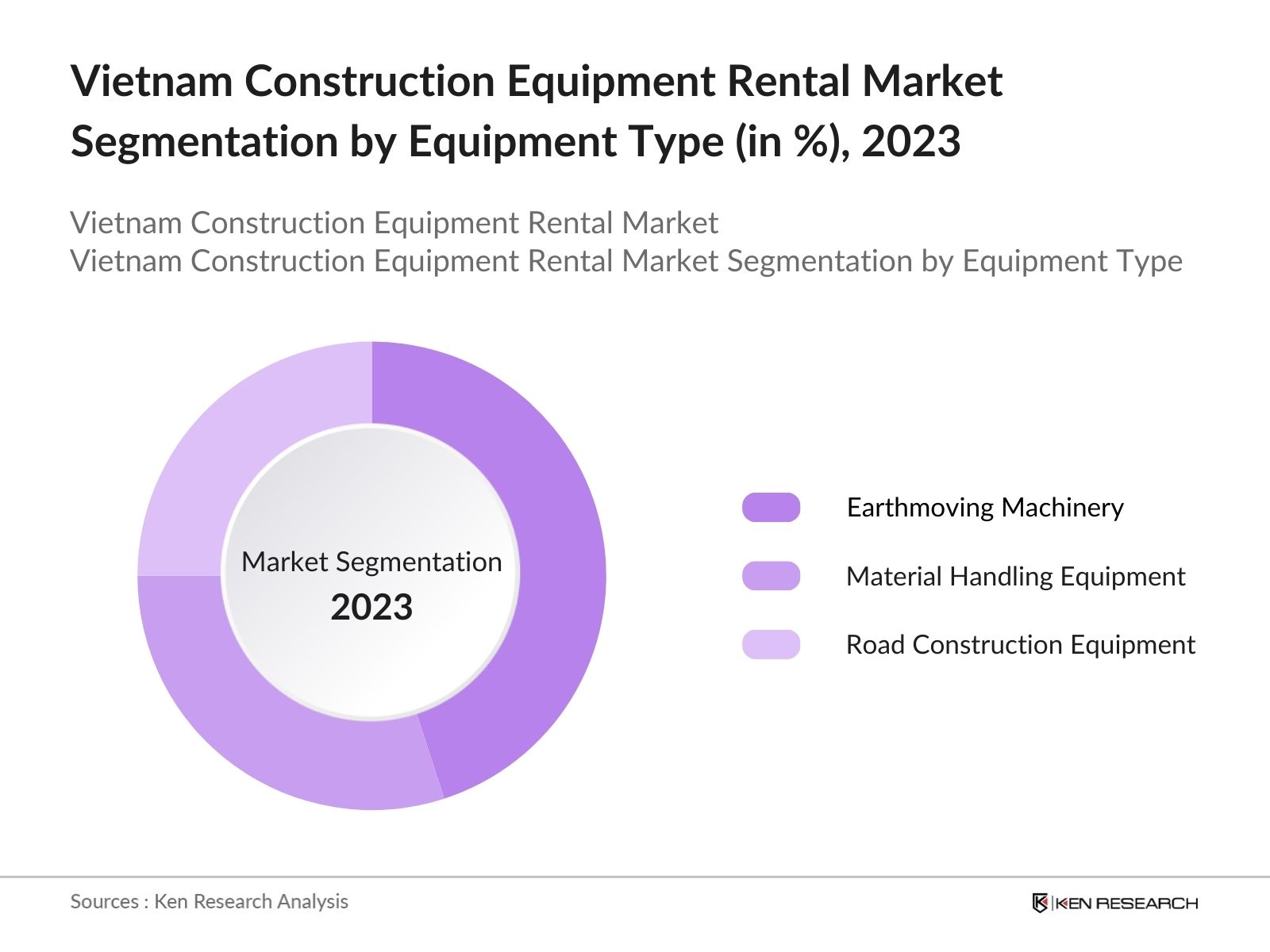

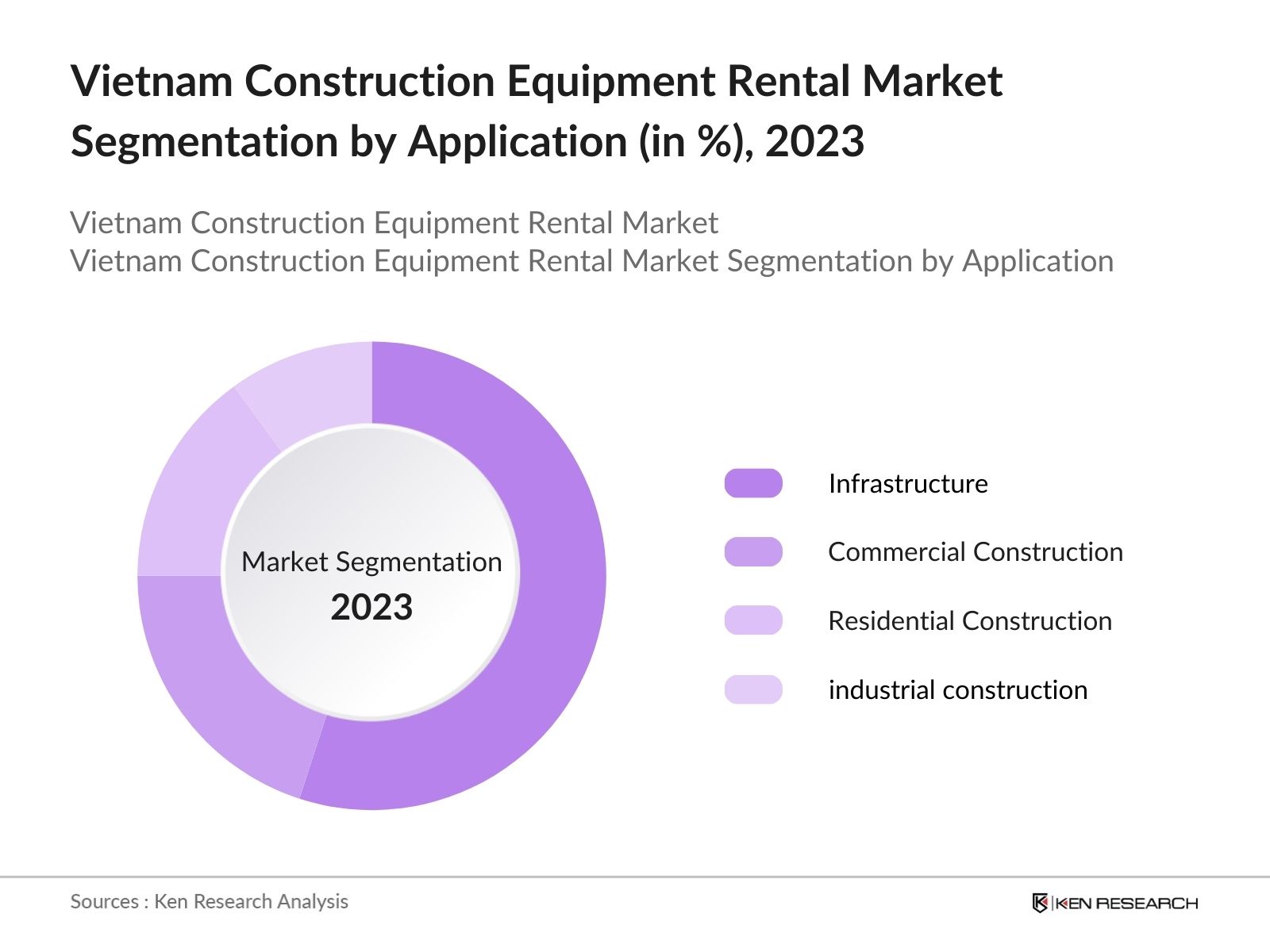

The Vietnam Construction Equipment Rental Market can be segmented by equipment type, application, and region:

- By Equipment Type: The market is segmented into earthmoving machinery, material handling equipment, and road construction equipment. In 2023, earthmoving machinery dominates the market due to its widespread use in large-scale infrastructure projects, such as roads and bridges. However, material handling equipment is gaining traction in industrial applications and warehousing, driven by Vietnams expanding logistics sector.

- By Application: The market is segmented by application into infrastructure, commercial, residential, and industrial construction. Infrastructure leads the market, accounting for a significant share due to ongoing government projects in transportation and energy sectors. Commercial and residential construction are also growing segments, driven by urbanization and increased demand for real estate development.

- By Region: The market is segmented into North, East, West and South. In 2023, South leads the market due to significant construction activities in Ho Chi Minh City and the Mekong Delta region. Northern Vietnam, particularly Hanoi, is also a growing market, supported by infrastructure development and industrial projects.

Vietnam Construction Equipment Rental Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Doosan Infracore |

1937 |

Seoul, South Korea |

|

Caterpillar Inc. |

1925 |

Illinois, USA |

|

Komatsu Ltd. |

1921 |

Tokyo, Japan |

|

Hitachi Construction |

1970 |

Tokyo, Japan |

|

Liebherr Group |

1949 |

Bulle, Switzerland |

- Caterpillar Inc.: In 2023, Caterpillar expanded its rental services in Vietnam with the introduction of a new range of fuel-efficient backhoes and loaders designed for urban construction projects. This expansion is aimed at strengthening its foothold in the market, where demand for versatile, eco-friendly equipment is rising. The company also offers maintenance services as part of its rental agreements, enhancing customer satisfaction and reducing downtime.

- Komatsu Ltd.: In 2024, Komatsu introduced hybrid excavators designed to lower fuel consumption and operational costs. This new line targets contractors working on long-term infrastructure projects, where cost efficiency is a key concern. The hybrid technology aligns with Vietnams growing focus on sustainability in the construction sector.

Vietnam Construction Equipment Rental Market Analysis

Market Growth Drivers:

- Government Infrastructure Projects: Vietnams government has allocated USD 25 billion for infrastructure development, with key projects in transportation, energy, and urban development. These initiatives are driving demand for rental equipment, as contractors seek to minimize capital expenditure while accessing high-quality machinery.

- Urbanization and Industrialization: The rapid urbanization of cities like Hanoi and Ho Chi Minh City, along with growing industrialization in peripheral regions, is fueling the demand for construction equipment rental. Ho Chi Minh City alone is seeing significant land development, with multiple large-scale projects currently underway.

- Cost Efficiency and Flexibility: Renting construction equipment offers cost savings, with rental rates often being half or less than the cost of purchasing new equipment. Contractors can rent specific equipment for project phases ranging from one week to several months, depending on the scale of the work.

Market Challenges:

- Equipment Maintenance and Downtime: Ensuring timely maintenance and minimizing equipment downtime can be challenging for rental companies. Downtime impacts project timelines and can result in increased costs for contractors, making reliable service a critical factor for market success.

- Regulatory Constraints: The construction sector in Vietnam is subject to strict regulations regarding safety standards and equipment certifications. Complying with these regulations can increase operational costs for rental companies and limit the availability of certain equipment types.

- Growing Competition: The market is becoming increasingly competitive, with both domestic and international players vying for market share. This competition drives down rental rates, making it more challenging for smaller companies to compete on price while maintaining service quality.

Government Initiatives

- Vietnam Infrastructure Development Plan: The Vietnamese government has allocated over USD 25 billion for infrastructure development between 2021 and 2025. The Vietnamese government plans to invest significantly in infrastructure, with total state funding for projects during this period estimated to be around USD 124.8 billion, which includes USD 65.2 billion from the central budget and USD 59.56 billion from local budgets. Key projects include highways, metro systems, and energy plants, which will require significant use of construction equipment.

- Green Building Certification Program: Vietnam has introduced incentives for contractors and developers to adopt green building practices, which include using energy-efficient and low-emission machinery. This aligns with global sustainability goals and creates opportunities for rental companies to offer eco-friendly equipment options to meet the rising demand.

Vietnam Construction Equipment Rental Market Future Market Outlook

The Vietnam Construction Equipment Rental Market is expected to continue growing, driven by ongoing infrastructure projects, increasing urbanization, and a shift towards sustainable construction practices.

Future Market Trends:

- Eco-friendly Equipment: The demand for energy-efficient and low-emission construction equipment is expected to grow as Vietnam adopts more stringent environmental regulations. Hybrid and electric machinery will become more common in rental fleets, driven by the need to reduce the environmental impact of construction activities.

- Growth of Smart Construction Equipment: The adoption of smart construction equipment, integrated with GPS and IoT technologies, will increase in Vietnam. This trend is driven by the need for greater precision and efficiency in large-scale projects, where real-time monitoring of equipment can improve productivity and safety.

Scope of the Report

|

By Region |

West East North South |

|

By Equipment Type |

Earthmoving Machinery Material Handling Road Construction Equipment |

|

By Rental Type |

Short-term Long-term |

|

By Application |

Infrastructure Commercial Residential Industrial |

Products

Key Target Audience

Banks and Financial Institutions

Construction Companies

Real Estate Developers

Government and Regulatory Bodies (VSQI, MONRE, Vietnam Register)

Rental Service Providers

Industrial Developers

Infrastructure Development Firms

Logistics and Warehousing Companies

Investment Firms and Venture Capitalists

Equipment Manufacturers

Construction Equipment Suppliers

Project Management Firms

Sustainability Consultants

Urban Planning Agencies

Transport and Infrastructure Authorities

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Doosan Infracore

Caterpillar Inc.

Komatsu Ltd.

Hitachi Construction

Liebherr Group

Volvo Construction Equipment

Hyundai Heavy Industries

JCB

XCMG Group

SANY Heavy Equipment

Zoomlion Heavy Industry

Kubota Corporation

Manitou Group

Terex Corporation

Sumitomo Construction Machinery

Table of Contents

1. Vietnam Construction Equipment Rental Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Construction Equipment Rental Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Construction Equipment Rental Market Analysis

3.1. Growth Drivers

3.1.1. Government Infrastructure Projects

3.1.2. Urbanization

3.1.3. Industrialization

3.2. Restraints

3.2.1. Equipment Maintenance

3.2.2. Regulatory Constraints

3.2.3. Growing Competition

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Sustainable Construction

3.3.3. Green Building Practices

3.4. Trends

3.4.1. Adoption of Smart Construction Equipment

3.4.2. Eco-Friendly Equipment

3.4.3. Increased Demand for Hybrid Equipment

3.5. Government Regulation

3.5.1. Vietnam Infrastructure Development Plan

3.5.2. Green Building Certification Program

3.5.3. Sustainability Incentives

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Vietnam Construction Equipment Rental Market Segmentation, 2023

4.1. By Equipment Type (in Value %)

4.1.1. Earthmoving Machinery

4.1.2. Material Handling Equipment

4.1.3. Road Construction Equipment

4.2. By Application (in Value %)

4.2.1. Infrastructure

4.2.2. Commercial

4.2.3. Residential

4.2.4. Industrial

4.3. By Rental Type (in Value %)

4.3.1. Short-term Rentals

4.3.2. Long-term Rentals

4.4. By Region (in Value %)

4.4.1. North

4.4.2. Central

4.4.3. South

5. Vietnam Construction Equipment Rental Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Doosan Infracore

5.1.2. Caterpillar Inc.

5.1.3. Komatsu Ltd.

5.1.4. Hitachi Construction

5.1.5. Liebherr Group

5.1.6. Volvo Construction Equipment

5.1.7. Hyundai Heavy Industries

5.1.8. JCB

5.1.9. XCMG Group

5.1.10. SANY Heavy Equipment

5.1.11. Zoomlion Heavy Industry

5.1.12. Kubota Corporation

5.1.13. Manitou Group

5.1.14. Terex Corporation

5.1.15. Sumitomo Construction Machinery

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Vietnam Construction Equipment Rental Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Vietnam Construction Equipment Rental Market Regulatory Framework

7.1. Equipment Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Vietnam Construction Equipment Rental Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Vietnam Construction Equipment Rental Future Market Segmentation, 2028

9.1. By Equipment Type (in Value %)

9.2. By Application (in Value %)

9.3. By Rental Type (in Value %)

9.4. By Region (in Value %)

10. Vietnam Construction Equipment Rental Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and rental equipment trends. We also assess regulatory impacts and market dynamics specific to the Vietnam construction equipment rental market.

Step 2: Market Building

We collect historical data on market size, growth rates, and equipment segmentation (earthmoving machinery, material handling, and road construction equipment). Additionally, we analyze market share and revenue generated by leading brands, emerging trends in sustainable construction, and customer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading construction companies, equipment rental providers, and regulatory bodies. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as rental pricing strategies, supply chain management, and contractor purchasing patterns.

Step 4: Research Output

Our team interacts with equipment rental providers, construction firms, and project managers to understand the dynamics of market segments, evolving preferences for equipment types, and key construction projects. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the Vietnam Construction Equipment Rental Market?

In 2023, the Vietnam Construction Equipment Rental Market was valued at USD 690 million. The market's growth is driven by increasing infrastructure development, rapid urbanization, and the demand for cost-effective construction solutions.

02. What are the challenges in the Vietnam Construction Equipment Rental Market?

Challenges in the Vietnam Construction Equipment Rental Market include equipment maintenance and downtime, regulatory compliance for safety standards, and increasing competition among rental companies. Rising operational costs and price pressures are also significant concerns.

03. Who are the major players in the Vietnam Construction Equipment Rental Market?

Major players in the Vietnam Construction Equipment Rental Market include Doosan Infracore, Caterpillar Inc., Komatsu Ltd., Hitachi Construction, and Liebherr Group. These companies dominate the market with strong equipment portfolios and extensive service networks.

04. What are the growth drivers of the Vietnam Construction Equipment Rental Market?

Key growth drivers include government-led infrastructure projects, rapid urbanization in major cities, and the cost-efficiency of renting construction equipment. Additionally, the increasing focus on sustainable construction practices is creating demand for eco-friendly equipment options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.