Vietnam Construction Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD1922

October 2024

100

About the Report

Vietnam Construction Market Overview

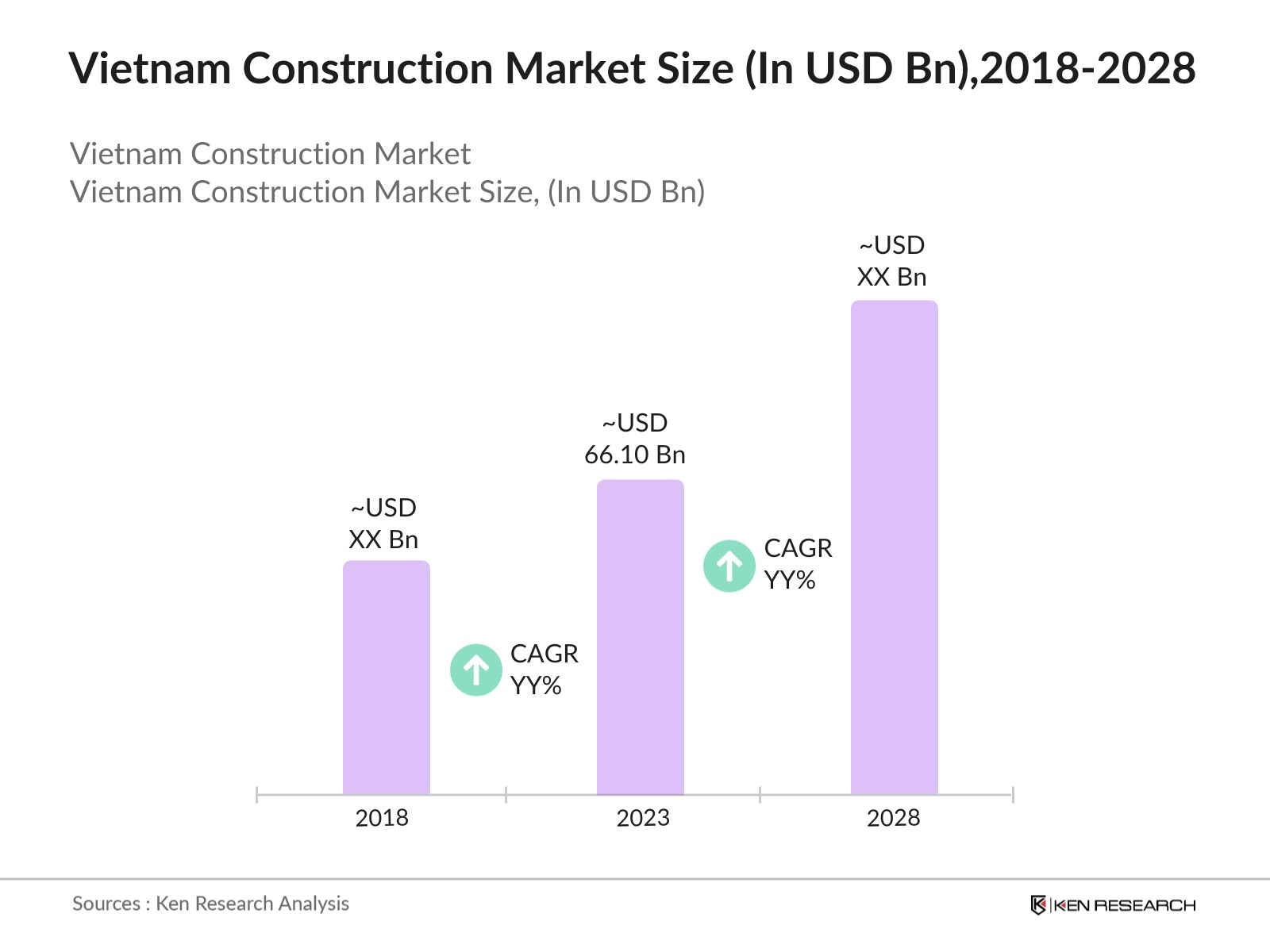

- The Vietnam Construction Market size was USD 66.10 billion in 2023, driven by rapid urbanization and substantial government investment in infrastructure projects such as transportation networks and industrial zones. This growth is supported by strong demand across residential, industrial, and commercial construction sectors.

- Major players in the market include Vinhomes, Hoa Binh Construction Group, Coteccons Construction JSC, Delta Construction Group, and FLC Group. These companies lead due to their extensive portfolios in residential and commercial projects, robust partnerships with foreign investors, and their strategic role in key infrastructure developments across Vietnam.

- In 2022, Vinhomes launched a major urban development project named Vinhomes Ocean Park 2, covering 1,200 hectares with an investment of VND 80 trillion (USD 3.5 billion). This project is set to expand the housing and infrastructure in Hanoi, catering to the growing urban population.

- Ho Chi Minh City and Hanoi are the dominant regions for construction activities, driven by their role as economic hubs and the epicenter of infrastructure projects. These cities benefit from government-backed initiatives and foreign direct investments. Ho Chi Minh City, in particular, is experiencing a surge in industrial and residential construction due to the expansion of industrial parks and its proximity to major logistics networks.

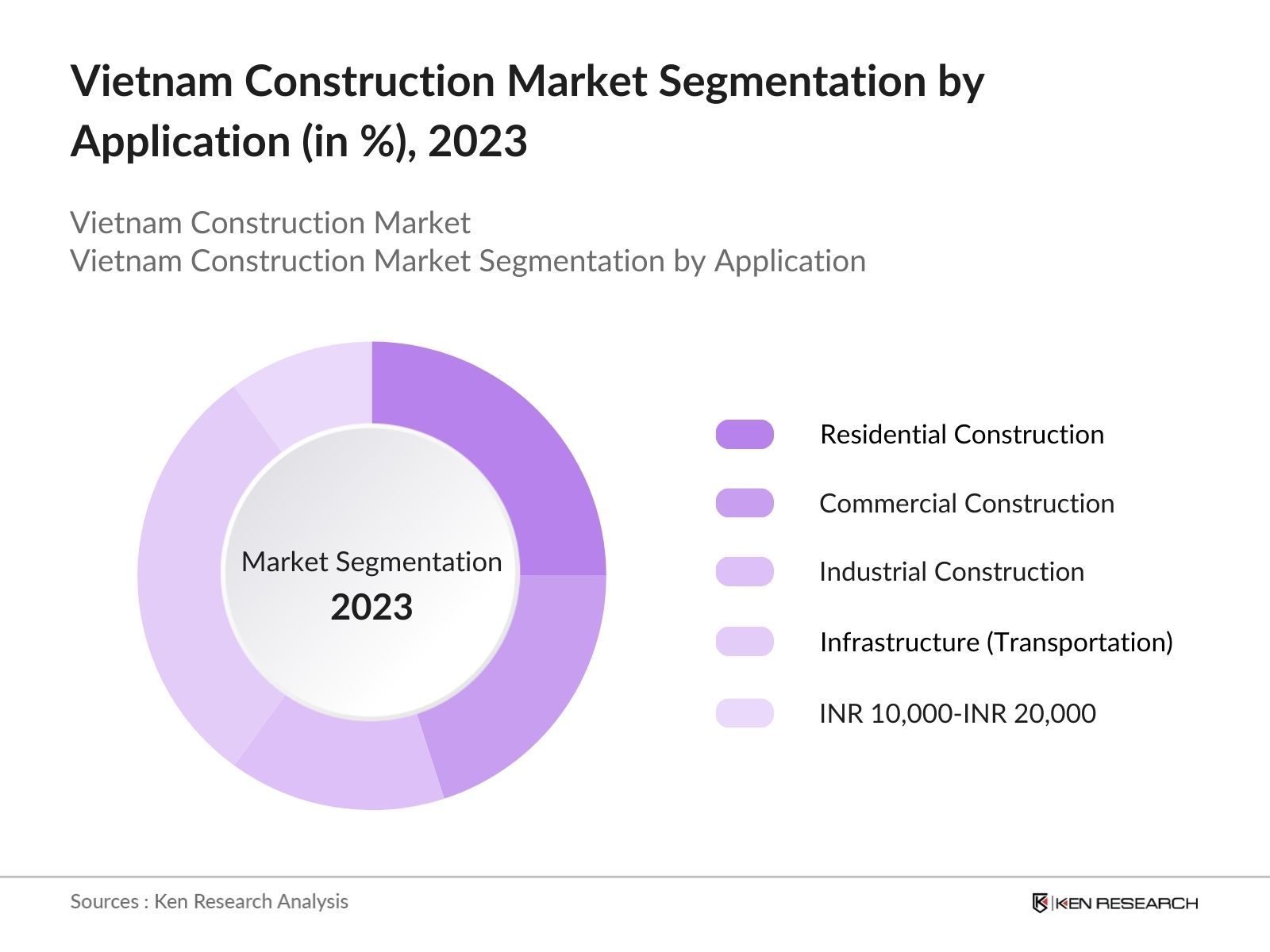

Vietnam Construction Market Segmentation

The market is segmented into various factors like application, end-user, and region.

By Application: The market is segmented by application into residential, commercial, industrial, infrastructure (transportation), and energy and utilities. In 2023, infrastructure held the dominant market share due to massive investments in transportation projects such as highways, airports, and metro systems, driven by the governments push to modernize Vietnams urban infrastructure.

By End-User: The market is segmented by end-user into residential, commercial, industrial, and government sectors. In 2023, the residential sector dominated the market, driven by a growing urban population and high demand for affordable housing. Government-backed housing projects and urban development initiatives, such as the Social Housing Scheme.

By Region: The market is segmented by region into North, East, West, and South. In 2023, Southern region dominated the market due to its status as an economic hub, attracting substantial foreign direct investment (FDI) in industrial and infrastructure projects. The regions proximity to major ports and logistics networks, coupled with ongoing industrial zone developments, has made it a focal point for construction activities, contributing to its market dominance.

Vietnam Construction Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Vinhomes |

2008 |

Hanoi, Vietnam |

|

Coteccons Construction JSC |

2004 |

Ho Chi Minh City, Vietnam |

|

Hoa Binh Construction Group |

1987 |

Ho Chi Minh City, Vietnam |

|

Delta Construction Group |

1993 |

Ho Chi Minh City, Vietnam |

|

FLC Group |

2001 |

Hanoi, Vietnam |

- Hoa Binh Construction Group: In February 2024, Hoa Binh Construction Group secured a USD 72 million contract to build 3,400 apartments in Kenya, marking its entry into the African market. This project, aimed at constructing housing for police, military, and students, is part of a larger potential deal worth USD 163.6 million for social housing projects in Kenya

- Coteccons Construction JSC: In 2024, a consortium led by Covestcons Co. Ltd, a subsidiary of Coteccons, bid for a VND 10.66 trillion (USD 418.8 million) residential-commercial project in Long An Province. The project spans 85.19 hectares and is expected to accommodate 4,800 residents, with construction set to begin in 2024 and complete by 2029.

Vietnam Construction Market Analysis

Market Growth Drivers

- Urbanization and Infrastructure Expansion: Vietnam's infrastructure investment is a key growth driver, with the government allocating6% of GDPsignificantly higher than the2.3%average in the region. To sustain economic growth, the country requires$25-30 billionannually, yet the national budget can only cover$15-18 billion, necessitating increased private investment to bridge the$10-15 billiongap.

- Foreign Direct Investment (FDI) Surge: In 2022, Vietnam attracted USD 27.72 billion in FDI, with a significant portion channeled into the construction sector. This influx of foreign capital is directed toward large-scale infrastructure and residential projects, driving market growth.

- Growth in Industrial Zones: The expansion of industrial parks and manufacturing hubs, particularly in Southern Vietnam, has spurred a surge in construction activities. Long An Province is set to accommodate new industrial zones, supporting both residential and commercial construction to meet the needs of growing industries.

Market Challenges

- Rising Material Costs: The construction industry in Vietnam faces rising costs for raw materials, such as cement and steel, due to global supply chain disruptions. In 2023, the price of steel rose by 30%, putting pressure on developers and contractors to manage costs effectively.

- Labor Shortages: Vietnam's construction sector is grappling with a skilled labor shortage, exacerbated by the post-pandemic economic recovery. The lack of qualified workers has led to project delays and increased labor costs, slowing down the pace of ongoing construction activities.

Government Initiatives

- Transport Infrastructure Development Plan (2021-2025): In 2021, Vietnam launched its USD 65 billion Transport Infrastructure Master Plan, aiming to build 5,000 km of new expressways and high-speed railways by 2030. Key projects include the Long Thanh International Airport and Lach Huyen Port expansions, designed to enhance cargo and passenger transport capacity nationwide.

Vietnam Construction Market Future Outlook

The Vietnam construction market is including strong growth over the next five years, driven by infrastructure development, foreign investments, and urbanization. The governments long-term infrastructure initiatives will continue to fuel demand across various construction segments.

Future Market Trends

- Expansion of Green and Sustainable Buildings: With increasing environmental awareness and global sustainability trends, Vietnam's construction industry is expected to adopt more green building certifications and eco-friendly materials. By 2028, the demand for LEED-certified buildings is projected to grow significantly, especially in commercial and industrial construction, driven by both government regulations and investor preference.

- Growth in Urban Infrastructure Development: Vietnams focus on urban infrastructure is set to accelerate, particularly with the governments Transport Infrastructure Master Plan. By 2028, ongoing projects such as Long Thanh International Airport and new expressway developments are expected to enhance connectivity, driving more construction activities in the residential and commercial sectors.

Scope of the Report

|

By Application |

Residential Construction Commercial Construction Industrial Construction Infrastructure (Transportation) Energy & Utilities |

|

By End-User |

Residential Sector Commercial Sector Industrial Sector Government Sector |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Infrastructure Development Companies

Government Regulatory Bodies (e.g., Ministry of Construction)

Investment Firms

Foreign Direct Investors (FDI) in Construction

Engineering and Consulting Firms

Banks and Financial Institutions

Construction Companies

Venture Capitalist

Companies

Players Mentioned in the Report:

Vinhomes

Coteccons Construction JSC

Hoa Binh Construction Group

Delta Construction Group

FLC Group

Phuc Khang Corporation

Novaland Group

Taseco Construction JSC

Dat Xanh Group

Nam Long Investment Corporation

Vinaconex Corporation

Hung Thinh Corporation

Sacomreal

Sun Group

Kusto Group

Table of Contents

1. Vietnam Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Construction Market Size (in USD), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Construction Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Infrastructure Expansion

3.1.2. Foreign Direct Investment Surge

3.1.3. Growth in Industrial Zones

3.2. Restraints

3.2.1. Rising Material Costs

3.2.2. Labor Shortages

3.3. Opportunities

3.3.1. Green and Sustainable Buildings

3.3.2. Expansion of Industrial Zones

3.4. Trends

3.4.1. Adoption of Smart Construction Technologies

3.4.2. Increasing Demand for Residential Projects

3.5. Government Initiatives

3.5.1. Transport Infrastructure Development Plan (2021-2025)

3.5.2. National Housing Strategy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Vietnam Construction Market Segmentation, 2023

4.1. By Application (in Value%)

4.1.1. Residential Construction

4.1.2. Commercial Construction

4.1.3. Industrial Construction

4.1.4. Infrastructure (Transportation)

4.1.5. Energy & Utilities

4.2. By End-User Industry (in Value%)

4.2.1. Residential Sector

4.2.2. Commercial Sector

4.2.3. Industrial Sector

4.2.4. Government Sector

4.3. By Region (in Value%)

4.3.1. North Vietnam

4.3.2. Central Vietnam

4.3.3. South Vietnam

5. Vietnam Construction Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Vinhomes

5.1.2. Coteccons Construction JSC

5.1.3. Hoa Binh Construction Group

5.1.4. Delta Construction Group

5.1.5. FLC Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Vietnam Construction Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Foreign Direct Investments (FDI)

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Vietnam Construction Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Vietnam Construction Market Future Size (in USD), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Vietnam Construction Market Future Segmentation, 2028

9.1. By Application (in Value%)

9.2. By End-User Industry (in Value%)

9.3. By Region (in Value%)

10. Vietnam Construction Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step:1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Construction Market Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output

Our team will approach multiple construction industries and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such chemical companies.

Frequently Asked Questions

01 How big is the Vietnam Construction Market?

The Vietnam Construction Market size was USD 66.10 billion in 2023, driven by rapid urbanization and substantial government investment in infrastructure projects such as transportation networks and industrial zones.

02 What are the challenges in the Vietnam Construction Market?

Major challenges in the Vietnam Construction Market include rising material costs, skilled labor shortages, and supply chain disruptions, which can impact project timelines and costs.

03 Who are the major players in the Vietnam Construction Market?

Major players in the Vietnam Construction Market include Vinhomes, Coteccons Construction JSC, Hoa Binh Construction Group, Delta Construction Group, and FLC Group.

04 What are the main growth drivers of the Vietnam Construction Market?

Key drivers of the Vietnam Construction Market include rapid urbanization, foreign direct investments (FDI) in infrastructure, and the expansion of industrial zones across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.