Vietnam Cooking and Edible Oils Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD9617

November 2024

87

About the Report

Vietnam Cooking and Edible Oils Market Overview

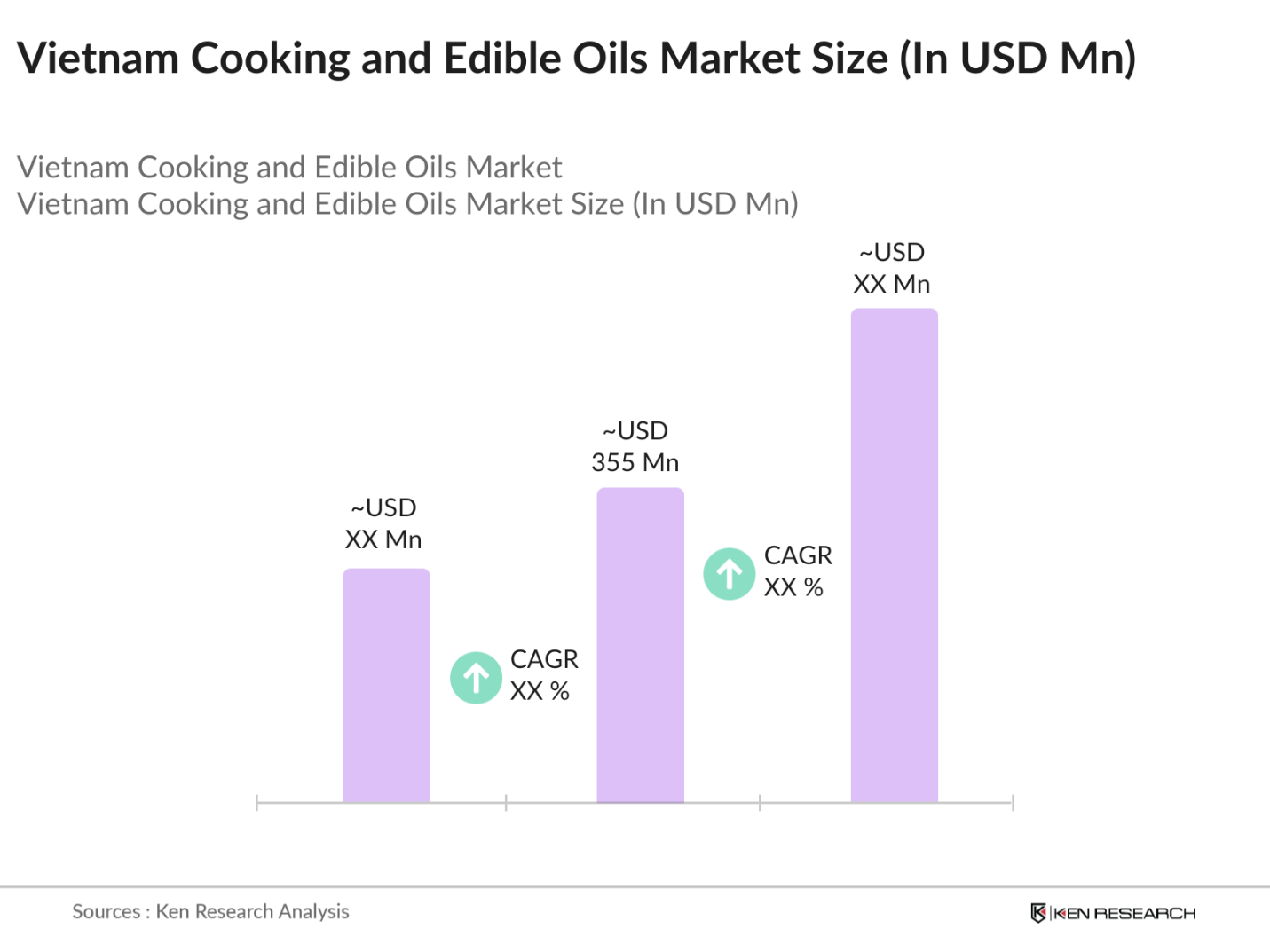

- The Vietnam Cooking and Edible Oils market is valued at USD 355 million, based on a five-year historical analysis. This market is primarily driven by increasing consumer health awareness and a shift toward oils with heart health benefits, such as sunflower and olive oils. With rising disposable incomes and urbanization, the demand for healthier, premium edible oils has gained traction, supported by a growing presence of organized retail channels and easy accessibility to a range of cooking oils, from locally produced options to high-quality imports.

- Major urban centers such as Ho Chi Minh City and Hanoi lead the market in demand for cooking oils. These areas benefit from high consumer purchasing power, diverse culinary cultures, and an expanding presence of supermarkets and hypermarkets, which facilitate the easy availability of various cooking oil products, from locally produced oils to imported specialty varieties.

- As part of its commitment to sustainable growth, the Vietnamese government imposes environmental standards on agricultural and processing practices. Edible oil producers are encouraged to reduce emissions and waste throughout the supply chain, aligning with the national green growth policy and international sustainability frameworks. Non-compliance with these standards can lead to fines and restrict market entry.

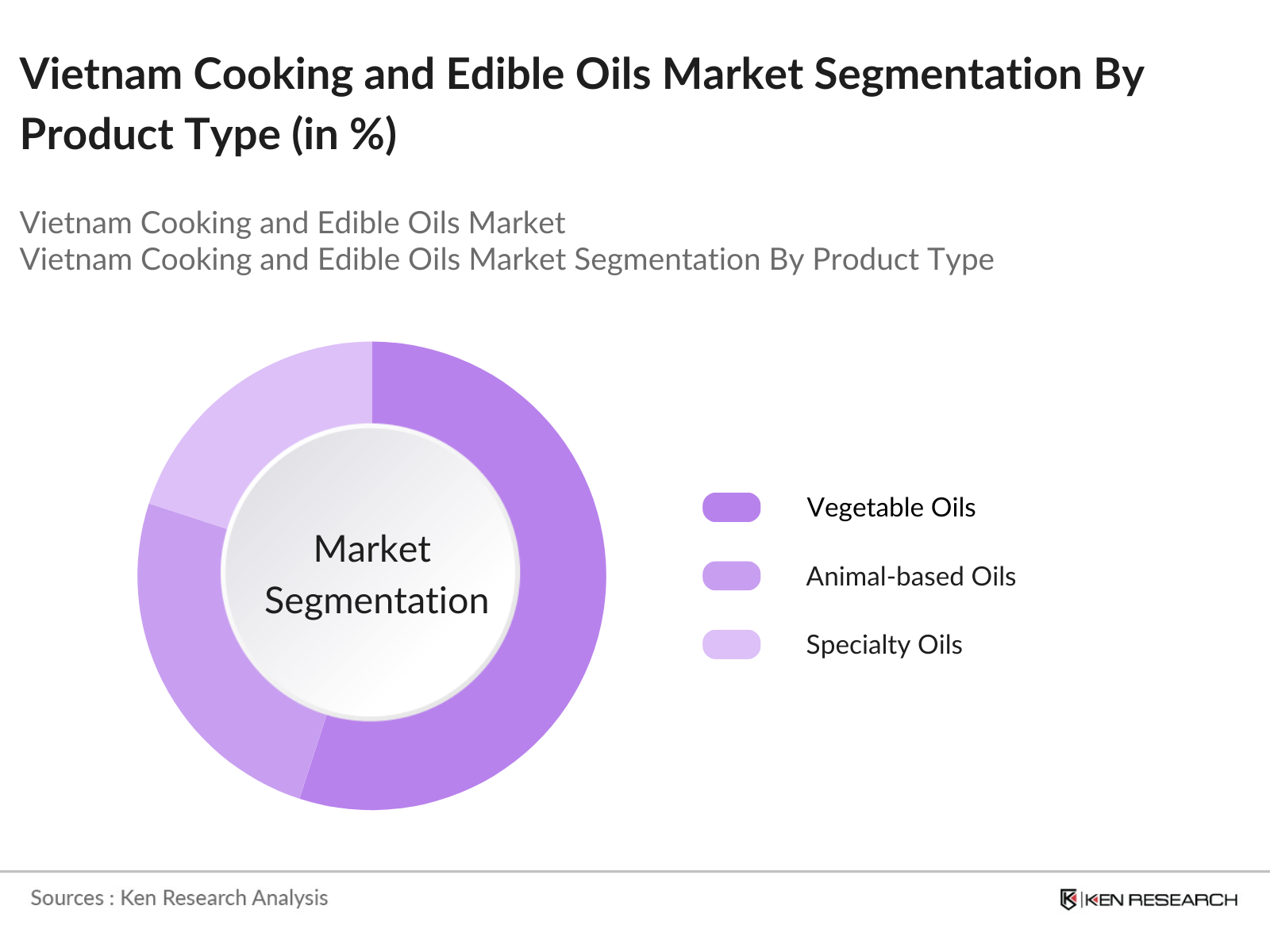

Vietnam Cooking and Edible Oils Market Segmentation

By Product Type: The Vietnam Cooking and Edible Oils market is segmented by product type into Vegetable Oils, Animal-based Oils, and Specialty Oils. Recently, Vegetable Oils have held a dominant market share in Vietnam due to their affordability, wide application in local cuisine, and increasing demand for healthier, plant-based options. Brands like Cai Lan and Tuong An have gained strong consumer loyalty, contributing to the dominance of this segment.

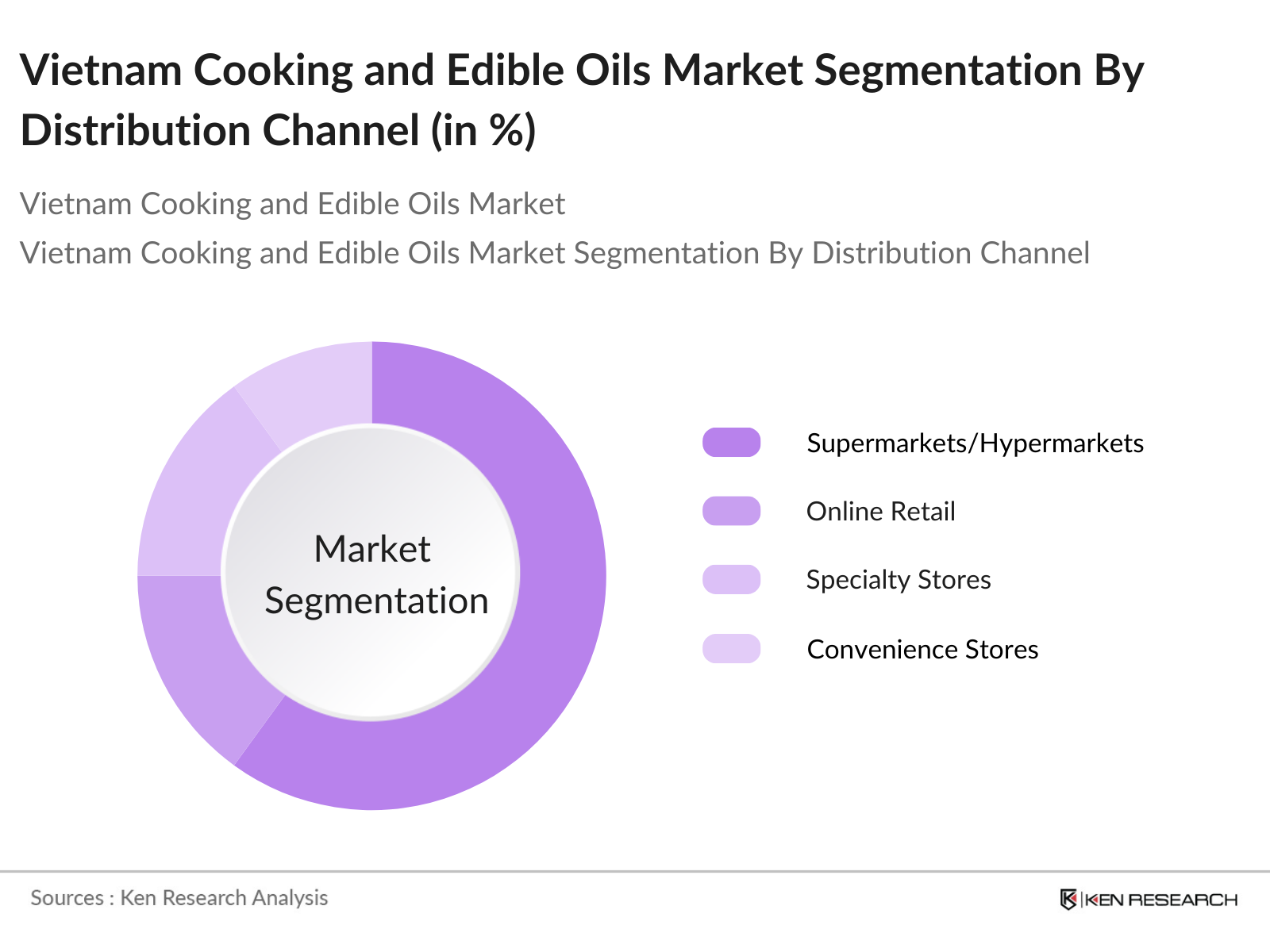

By Distribution Channel: The market is segmented by distribution channel into Supermarkets/Hypermarkets, Online Retail, Specialty Stores, and Convenience Stores. Supermarkets/Hypermarkets dominate distribution due to their widespread presence and comprehensive product variety, making it easier for consumers to compare and select from a range of oils. Major retail chains such as VinMart and Co.opmart provide a one-stop shopping experience, reinforcing their leading role in this segment.

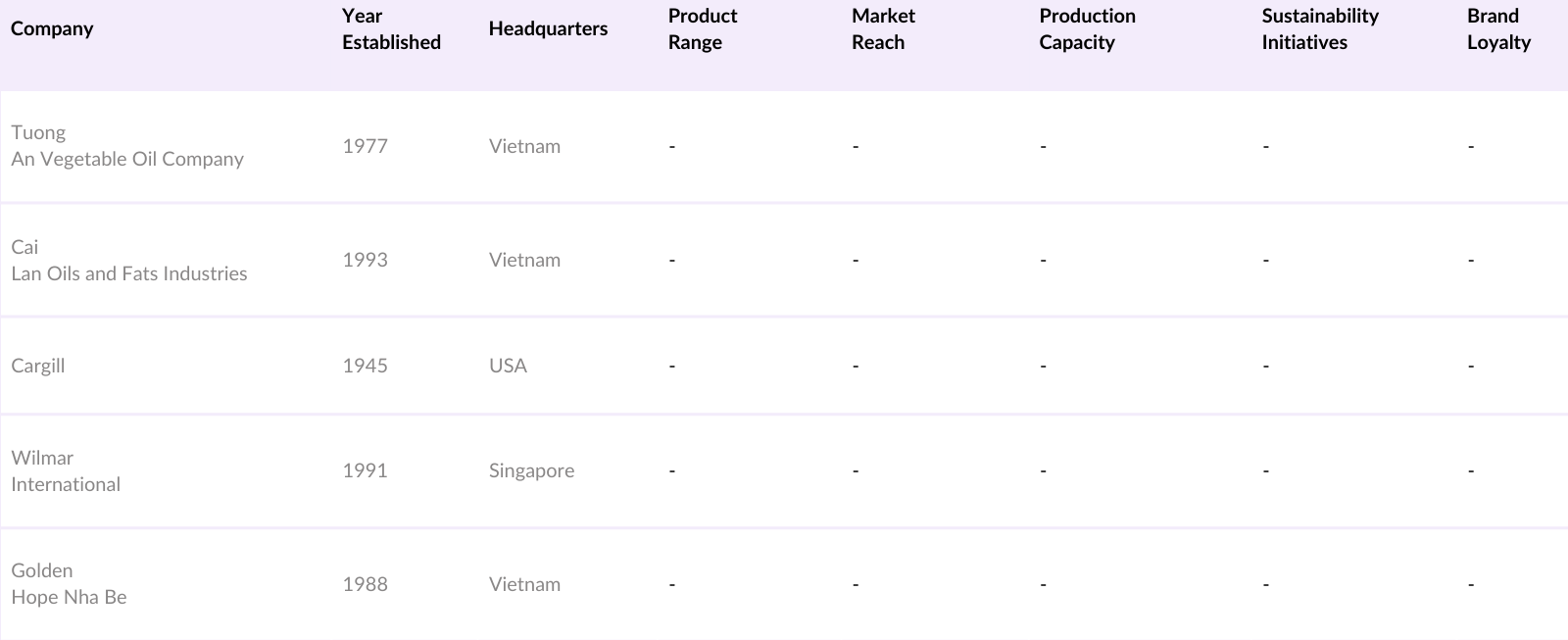

Vietnam Cooking and Edible Oils Market Competitive Landscape

The Vietnam Cooking and Edible Oils market is influenced by several key players, including local companies like Tuong An Vegetable Oil Company and Cai Lan Oils and Fats Industries, alongside international players such as Cargill and Wilmar International. These companies benefit from strong distribution networks and established brand equity, making it challenging for new entrants to penetrate the market significantly.

Vietnam Cooking and Edible Oils Industry Analysis

Growth Drivers

- Increasing Urbanization and Disposable Income: Vietnam's urban population is experiencing rapid growth, reaching around 37 million residents in urban areas by 2024, facilitated by extensive migration from rural zones. The rising urban density, especially in cities like Hanoi and Ho Chi Minh City, is driving consumer spending across various product categories, including cooking and edible oils. This urbanization is coupled with a GDP per capita increase, projected to exceed USD 4,300 by 2024, boosting disposable incomes and encouraging demand for diverse consumer goods, including premium cooking oils that appeal to the middle-class demographic.

- Rising Health Awareness and Demand for Edible Oils: In Vietnam, awareness about health-oriented products is on the rise, with a growing demand for oils labeled as organic or low in cholesterol. This shift reflects changing dietary habits influenced by urban lifestyles and an increased prevalence of non-communicable diseases. Reports show that the number of lifestyle-related conditions in urban areas has surged, which further incentivizes co health-optimized oils. The government and local agencies are promoting awareness on healthier food choices, aligning with global health trends.

- Expansion of Organized Retail and E-Commerce Channels: Organized retail and digital commerce have seen substantial growth in Vietnam. By 2024, the countrys e-commerce sector is estimated to encompass over 60 million internet users, increasing consumer access to a variety of cooking oils. This expansion is bolstered by high ration rates and the rise of digital payment options, which improve market accessibility for rural and urban consumers alike. Organized retail continues to attract foreign investment, facilitating the availability and affordability of quality edible oils.

Market Challenges

- High Import Dependency for Raw Materials: Vietnam heavily relies on imported oilseeds, with imports reaching $1.6 billion in 2023. This dependency increases vulnerability to global price fluctuations. As oilseed production in Southeast Asia faces challenges from environmental factors, Vietnams supply chain remains exposed to potential disruptions, affecting production consistency and pricing in the domestic market.

- Price Fluctuations and Volatile Supply Chains: The global edible oil market volatility has increased, particularly due to supply chain disruptions from key oil-producing countries. Vietnams inflation rate, forecasted at around 4.5% in 2024, is partly driven by food and commodity prices, including cooking oils. High inflation impacts consumer affordability and increases pressure on manufacturers to manage cost fluctuations without passing them entirely to consumers.

Vietnam Cooking and Edible Oils Market Future Outlook

Over the next five years, the Vietnam Cooking and Edible Oils market is projected to grow significantly due to rising health consciousness, increasing demand for premium oils, and the expansion of distribution networks, particularly in rural areas. Government support for sustainable production practices and the rising influence of e-commerce will further drive market growth.

Market Opportunities

- Growing Trend for Health-Optimized Oils (Enriched Oils, Blends): Health-optimized oils are increasingly popular, with a significant market shift toward oils fortified with vitamins and omega-3 fatty acids. Demand for blended oils, which offer varied nutritional benefits, is growing as consumers prioritize dietary health. This trend is supported by government dietary guidelines promoting nutrient-dense foods, creating opportunities for brands to introduce premium products.

- Expansion into Rural Markets and Smaller Cities: While urban centers have traditionally driven the demand, rural areas represent a burgeoning market due to increased disposable incomes and government programs aimed at rural development. The Ministry of Agricultures rural modernization plan has improved infrastructure in rural areas, making it easier for brands to reach new consumers through both traditional retail and mobile commerce platforms.

Scope of the Report

|

By Product Type |

Vegetable Oils Animal-based Oils Specialty Oils |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores |

|

By Packaging Type |

Bottles Sachets Bulk Packaging |

|

By End-User |

Households Food Services Industrial |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Food and Beverage Manufacturers

Cooking Oil Producers

Supermarkets and Hypermarkets

Specialty and Health Food Stores

Restaurant Chains and Foodservice Providers

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development, Ministry of Health)

Investments and Venture Capitalist Firms

Private Label and Retail Brand Developers

Companies

Players Mentioned in the Report

Wilmar International Ltd.

Cargill Vietnam Co., Ltd.

Marico Vietnam Co., Ltd.

Golden Hope Nha Be

Cai Lan Oils and Fats Industries Company

Tuong An Vegetable Oil Company

Kido Group Corporation

Calofic (Cai Lan Oils & Fats Industries Co.)

Lam Soon Vietnam Co., Ltd.

Sao Mai Group

Table of Contents

1. Vietnam Cooking and Edible Oils Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate Analysis

1.4. Market Segmentation Overview

2. Vietnam Cooking and Edible Oils Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Trends

2.3. Key Market Developments and Milestones

3. Vietnam Cooking and Edible Oils Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Disposable Income

3.1.2. Rising Health Awareness and Demand for Edible Oils (Organic, Low Cholesterol, etc.)

3.1.3. Expansion of Organized Retail and E-Commerce Channels

3.1.4. Impact of Government Initiatives on Sustainable Oil Production

3.2. Market Challenges

3.2.1. High Import Dependency for Raw Materials

3.2.2. Price Fluctuations and Volatile Supply Chains

3.2.3. Competition with Domestic and International Brands

3.2.4. Regulatory Constraints on Oil Composition and Packaging

3.3. Opportunities

3.3.1. Growing Trend for Health-Optimized Oils (Enriched Oils, Blends)

3.3.2. Expansion into Rural Markets and Smaller Cities

3.3.3. Innovations in Oil Processing and Product Packaging

3.4. Trends

3.4.1. Shift Toward Organic and Non-GMO Cooking Oils

3.4.2. Premiumization of Oil Products for Quality-Conscious Consumers

3.4.3. Use of Sustainable Packaging in Oil Distribution

3.5. Government Regulation

3.5.1. Food Safety and Quality Standards

3.5.2. Labeling and Nutritional Information Compliance

3.5.3. Import Tariffs and Duty Regulations

3.5.4. Environmental Standards for Oil Production

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Cooking and Edible Oils Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vegetable Oils (Palm, Soybean, Coconut)

4.1.2. Animal-based Oils (Fish Oil, Lard)

4.1.3. Specialty Oils (Olive, Avocado, Flaxseed)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Retail

4.2.3. Specialty Stores

4.2.4. Convenience Stores

4.3. By Packaging Type (In Value %)

4.3.1. Bottles

4.3.2. Sachets

4.3.3. Bulk Packaging

4.4. By End-User (In Value %)

4.4.1. Households

4.4.2. Food Services (Restaurants, Caterers)

4.4.3. Industrial (Food Processing Units)

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Cooking and Edible Oils Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Wilmar International Ltd.

5.1.2. Cargill Vietnam Co., Ltd.

5.1.3. Marico Vietnam Co., Ltd.

5.1.4. Golden Hope Nha Be

5.1.5. Cai Lan Oils and Fats Industries Company

5.1.6. Tuong An Vegetable Oil Company

5.1.7. Kido Group Corporation

5.1.8. Calofic (Cai Lan Oils & Fats Industries Co.)

5.1.9. Lam Soon Vietnam Co., Ltd.

5.1.10. Sao Mai Group

5.1.11. Musim Mas Group

5.1.12. Sime Darby Oils

5.1.13. Agrocorp International

5.1.14. Vietnam Vegetable Oils Industry Corporation (Vocarimex)

5.1.15. Agro Tech Foods Ltd.

5.2 Cross Comparison Parameters (Revenue, Distribution Reach, Product Portfolio Depth, Sustainability Initiatives, Market Share, Production Capacity, Technology Use, Employee Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Cooking and Edible Oils Market Regulatory Framework

6.1. Food Safety Regulations

6.2. Import and Export Guidelines

6.3. Packaging and Labeling Standards

6.4. Health Certifications and Compliance

7. Vietnam Cooking and Edible Oils Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Drivers for Future Market Growth

8. Vietnam Cooking and Edible Oils Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Cooking and Edible Oils Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Marketing Strategies for Growth

9.4. White Space Analysis for Product Innovation

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves building an ecosystem map covering all major players within the Vietnam Cooking and Edible Oils market, using in-depth desk research and proprietary databases to define influential market variables.

Step 2: Market Analysis and Construction

Historical data on market size, consumption patterns, and revenue generation are collected to build a comprehensive market model. Service quality statistics are evaluated to verify reliability and ensure accurate revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through computer-assisted interviews with industry experts, providing critical insights into operational and financial aspects to refine the market data.

Step 4: Research Synthesis and Final Output

In the final stage, data from multiple oil producers is consolidated to understand product segmentation, consumer behavior, and market trends. This synthesis ensures an accurate, validated analysis of the Vietnam Cooking and Edible Oils market.

Frequently Asked Questions

1. How big is the Vietnam Cooking and Edible Oils Market?

The Vietnam Cooking and Edible Oils market is valued at USD 355 million, based on a five-year historical analysis. This market is primarily driven by increasing consumer health awareness and a shift toward oils with heart health benefits, such as sunflower and olive oils.

2. What are the key challenges in the Vietnam Cooking and Edible Oils Market?

Major challenges include high dependency on imported raw materials, fluctuating prices, and regulatory requirements on oil quality, which complicate supply chain management and production stability.

3. Who are the major players in the Vietnam Cooking and Edible Oils Market?

Key players include Tuong An Vegetable Oil Company, Cargill Vietnam, and Wilmar International, which dominate due to their extensive distribution networks and strong consumer loyalty.

4. What are the growth drivers of the Vietnam Cooking and Edible Oils Market?

Growth is primarily driven by rising health consciousness, the popularity of specialty oils, and the expansion of retail channels, especially in rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.