Vietnam Corporate Training Market Outlook to 2028

Driven by Government Initiatives, Global Market Integration, and Technological Advancement across Industries

Region:Asia

Author(s):Mukul, Grantha and Kartik

Product Code:KR1384

September 2023

36

About the Report

Market Overview:

A moderately fragmented market with immense growth potential the corporate training market in Vietnam is highly competitive, with numerous players offering learning & development services. The emergence of a Blended Learning Approach and Customized Training Courses is set to change the dynamics of Vietnam’s Corporate Training Market.

The total addressable market in Vietnam for has been expanding. Govt. takes initiatives to boost vocational training. Demand grows for tailored soft skills and leadership training. Financial constraints impede investment in training, especially for Small and Medium Enterprises. Inefficiency of classroom-based training methods. Vietnam Corporate training industry is catered by the domestic and international players such as Pace, E&G, CTS Corporate Training Solutions are amongst the top players in the industry.

Vietnam Corporate Training Market Analysis

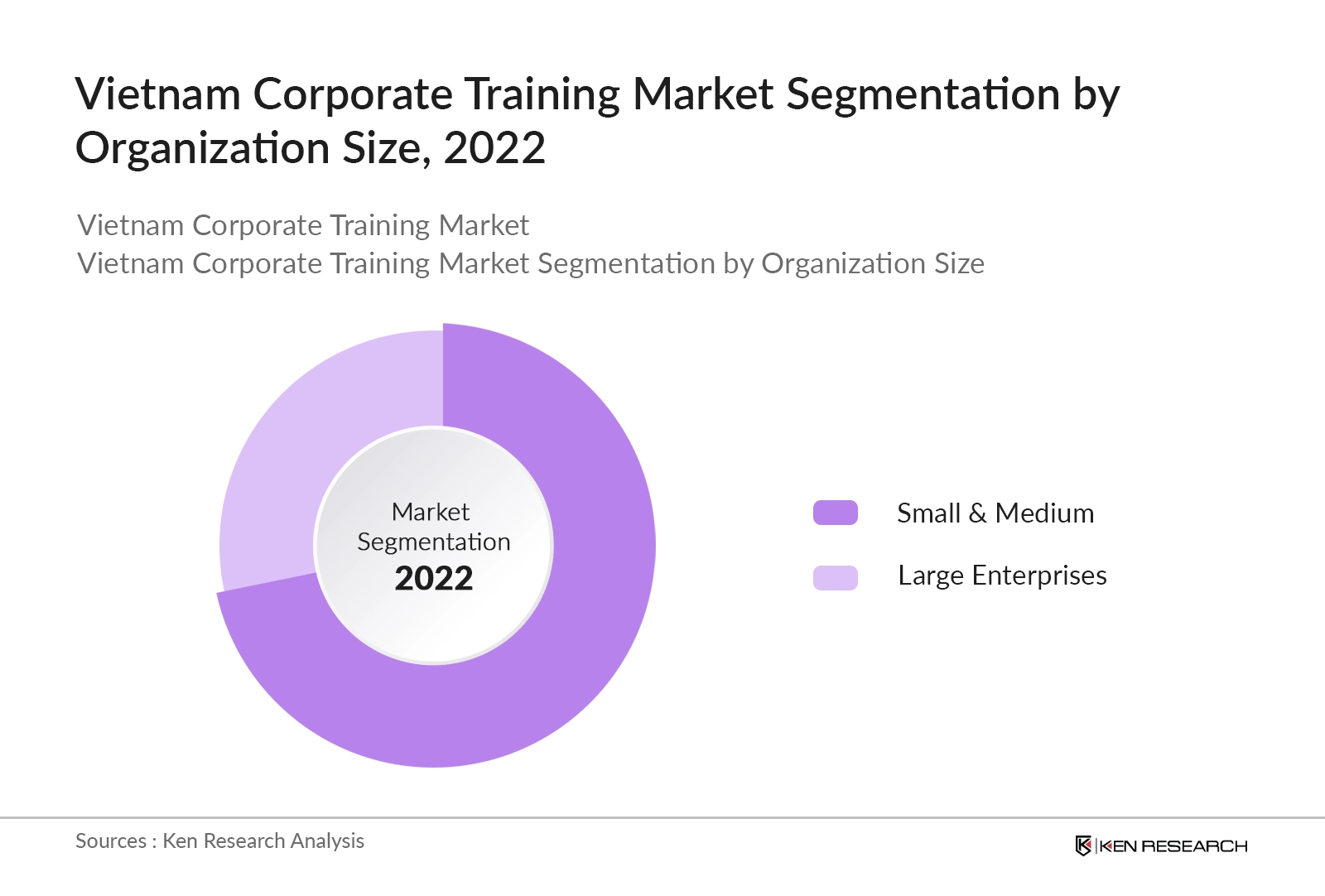

- Small and Medium Companies of Vietnam, of which Manufacturing and Financial Services industry dominate the market for Vietnam Corporate Training Market

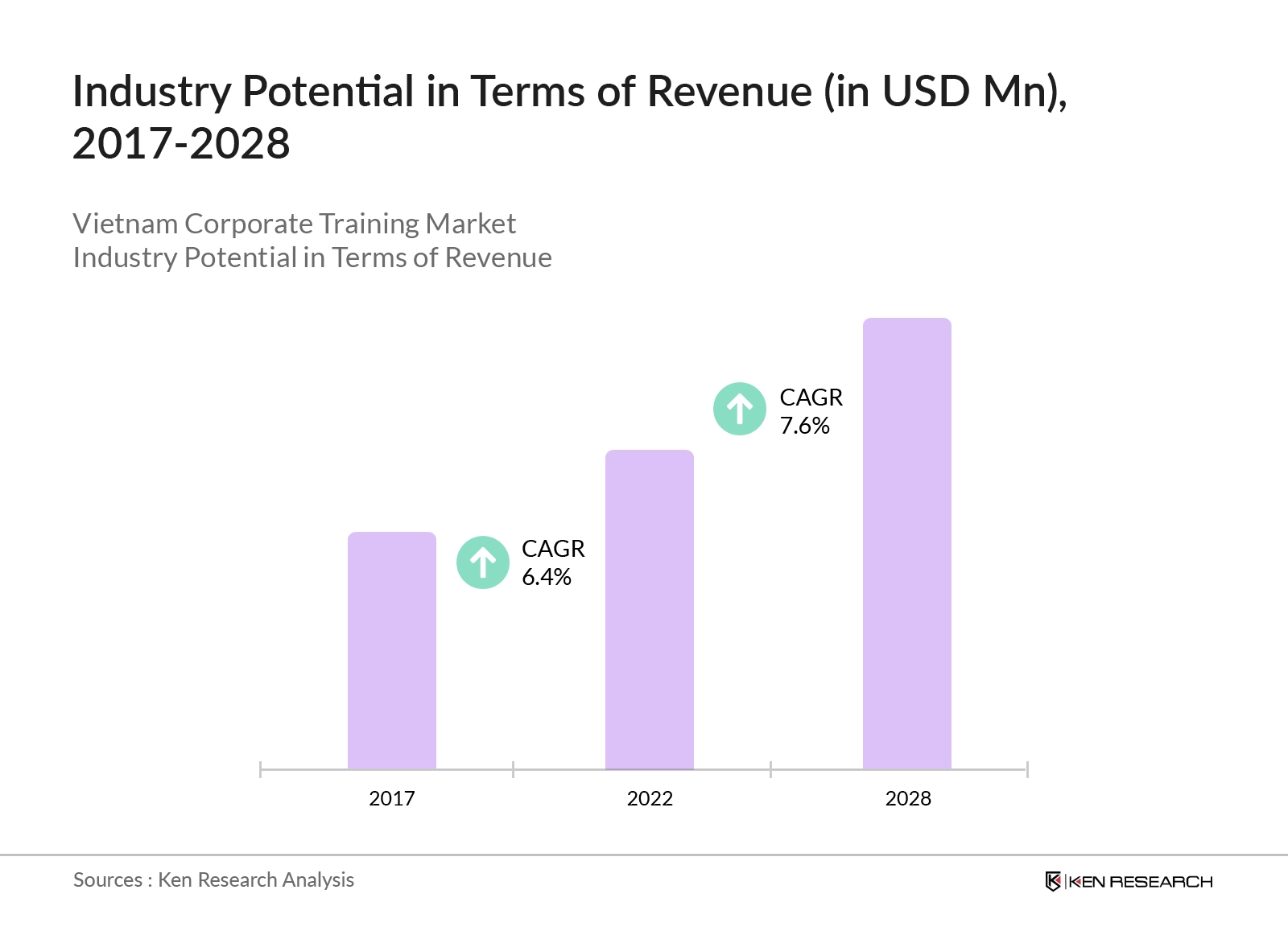

- Vietnam Corporate Training Market has grown at a CAGR of 6.4% from 2017 to 2022 with the advancement in e-learning and self-paced learning platforms

- Vietnam Corporate Training Market operates mostly via Offline mode in the form of Classroom Training, Workshops, Seminars and On-site Training

- Corporate Training Centers in Vietnam cater to a large variety of end user industries in their sector specific domain and vocational courses as well

- Vietnam Corporate Training Market is expected to grow @ CAGR of 7.6% from 2022 to 2028 and is dominated by Small and Medium Enterprises and Manufacturing Industries, especially across HCMC of the Southern region.

Key Trends by Market Segment:

By Organization Size: Out of approximately 850 thousand enterprises in the country, 96% of them are classified as small and medium-sized enterprises (SMEs), while only 4% are medium and large enterprises. Private enterprises have demonstrated consistent growth in recent years, contributing around 40% to the country's GDP and employing 85% of the national labour force. Despite their significant contributions, private enterprises exhibit the lowest productivity growth rate compared to the state economy and the foreign-invested economic sector.

By Region: Northern Vietnam region is home to a significant number of corporate companies, including major players in the manufacturing, biotechnology, commerce, and electronics and technology sectors. Most Vietnamese electronics manufacturers are located in northern provinces of the country, such as Bac Giang, Hai Phong, and Bac Ninh, with two-thirds of foreign electronic manufacturers having their factories in the North. The Red River Delta, which includes Hanoi, ranks second with 161,000 firms, accounting for 31.1 percent of the total number of businesses in Vietnam. However, large companies accounted for only 1.9 percent of the total, with only 10,000 large firms. The majority (98.1 percent) of the firms continue to be small, medium, and micro-enterprise.

Competitive Landscape:

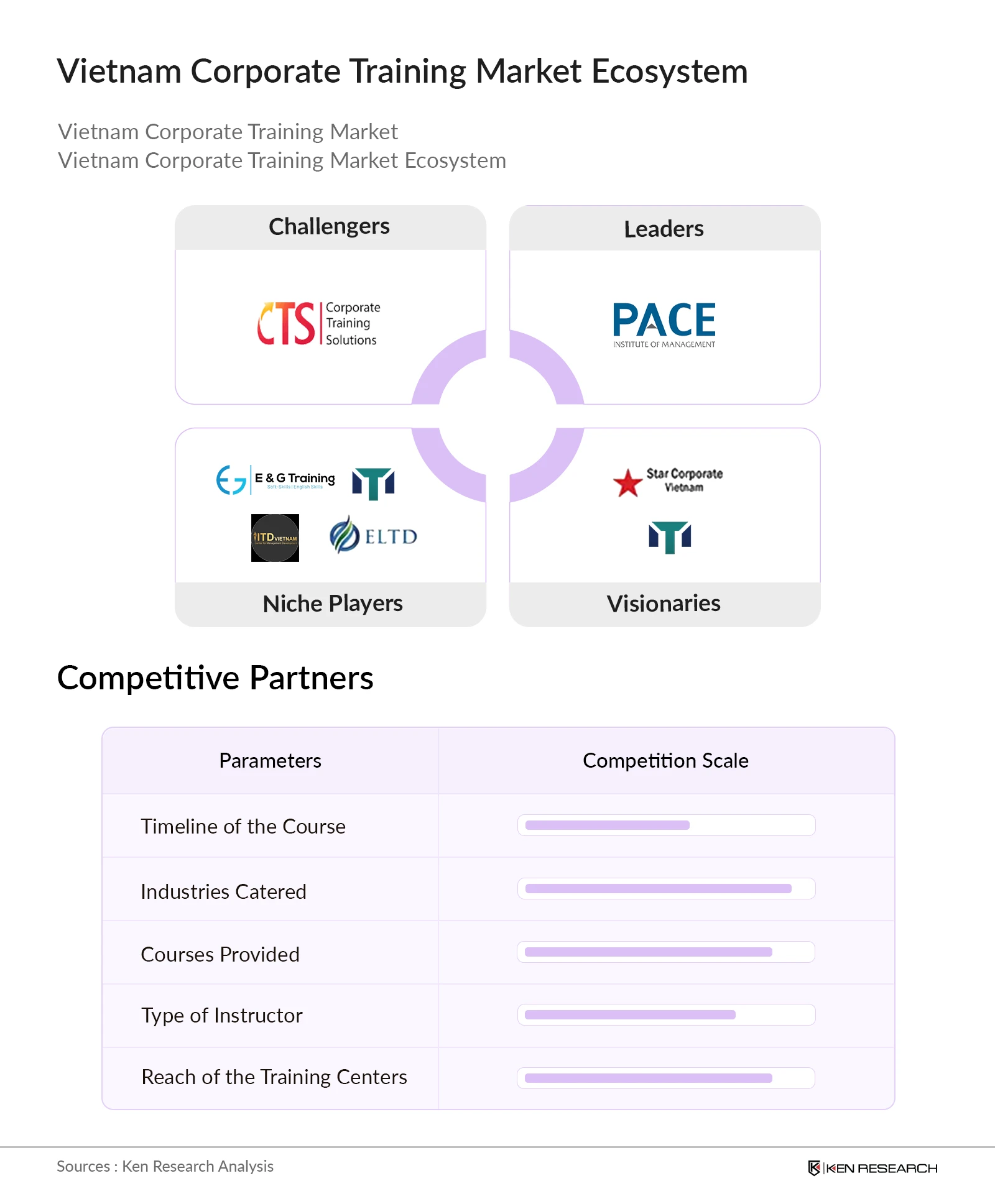

- Companies follow B2B Business Models and offer multiple products, of which Leadership and English Communication Courses are the most popular.

- These companies offer a diversified portfolio of training programs and conduct exclusive training from professionals across abroad.

- These companies specially focus on Human Resource Management Courses and plan to adopt advanced technologies in the future.

- Vietnam Corporate Training Market is Moderately Fragmented with two major market players – PACE Institute of Management and LHH.

- Pace & LHH are market leaders.

Recent Developments:

- LHH- Webinar lead by Kevin Tennant, Partner, Executive Interim Management.

- PACE- GLP- focusing on Global leadership, REINVENT- Reinventing Business &NEXTGEN

- E&G Training provided Soft Skill, Exclusive training from The British University, Negotiation Workshop at IEC Institute.

- ITD Vietnam provided Global Leadership Team Conference: Thriving Sustainability in October 2023.

Future Outlook:

- Vietnam's will expand at a CAGR of 7.6% between 2022 and 2028 owing to the rising middle class and online used car platforms

- Vietnam's Corporate Training Market will see a shift towards Virtual Classroom Room Training and a higher emphasis on Digital Skills

- Technology like Augmented & Virtual Reality and the recently developed Metaverse have the potential of completely redefining learning.

- Companies may prioritize employee well-being and mental health in their training programs involving workshops on stress management, resilience, work-life balance, and fostering a healthy work environment.

- More than 70.0% of the manufacturing firms are present in the vicinity of Ho Chi Minh, making the city a major market for Corporate Training Companies.

- Vietnam's Corporate Training Market is yet to grow at its full potential owing to the increasing number of businesses getting registered every year

Scope of the Report

|

Vietnam Corporate training Market Segmentation |

|

|

By Organization Size |

Small & Medium Large |

|

By Industry |

Manufacturing Financial Services Information Technology FMCG Retail Healthcare Pharmaceutical Public Enterprises Professional Services Others |

|

By Region |

Southern Northern Central |

|

By City |

Ho Chi Min Hanoi Danang |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Government Institutions

Investors

Distributors

Startups & Entrepreneurs

Employees & Professionals

Training Providers

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2028

Companies

Major Players Mentioned in the Report:

CTS Corporate Training Institutes

Viet Sourcing

Pace

ELTD

ITD Vietnam

Talent Net

E & G Training

Table of Contents

1. Executive Summary

1.1 Executive Summary for Vietnam Corporate Training Market - Outlook to 2028

2. Market Overview and Value Chain Analysis

2.1 Demand and Supply Side Ecosystem of Major Entities in Vietnam Corporate Training Market, 2022

2.2 Value Chain of Vietnam Corporate Training Market

3. Vietnam Corporate Training Market Sizing and Segmentation, 2022

3.1 Market Sizing, 2017-2022

3.2 Segmentation of Vietnam Corporate Training Market, 2022

4. Industry Analysis of Vietnam Corporate Training Market

4.1 Growth Drivers of Vietnam Corporate Training Market

4.2 Challenges in Vietnam Corporate Training Market

4.3 Trends in Vietnam Corporate Training Market

5. Competition Analysis of Vietnam Corporate Training Market, 2022

5.1 Cross Competition of Vietnam Corporate Training Market, 2022

5.2 Competition Scenario of Vietnam Corporate Training Market, 2022

6. Future Outlook of Vietnam Corporate Training Market, 2022-2028

6.1 Market Sizing, 2028

6.2 Market Segmentation on the basis of Revenue, 2028

6.3 Market Opportunities – TAM

7. Client-Specific Requirements

7.1 Cross Comparison for Trainers

7.2 Popular Workshop Stats

7.3 Corporate Training Centers in Vietnam that cater to FMCG Industry

8. Research Methodology

9. Disclaimer

10. Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on corporate training market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for used corporate training. we will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple corporate training channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from corporate training.

Frequently Asked Questions

01 How big is the vietnam corporate training market?

The Vietnam Corporate Training Market is valued at USD 600 Mn in 2022 and is expected to show a growth with annual CAGR of 7.6% by 2028.

02 What are the corporate elearning trends for 2023?

The major trends which are functioning in Vietnam corporate learning market are Technology like Augmented & Virtual Reality and the recently developed Metaverse which are effecting the market.

03 What are the major types of Corporate learning?

The Vietnam Corporate learning market is segmented by type into Manufacturing, Financial Services, Information, Technology, FMCG, Retail and Healthcare etc.

04 What are the major players in Vietnam Corporate learning?

The major players operating in the Vietnam Corporate learning market are Pace & LHH. Also E&G Training and ITD are responsible for key developments in the market.

05 Which is the largest distribution channel type Segment within the Vietnam Corporate training Market?

The largest share of the Vietnam Corporate training Market in 2022 was dominated by the organized sales type segment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.