Vietnam Crop Protection Chemicals Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD8679

December 2024

98

About the Report

Vietnam Crop Protection Chemicals Market Overview

- The Vietnam Crop Protection Chemicals Market is valued at USD 2 billion, driven by the countrys robust agricultural sector, which is a critical contributor to its economy. The market has experienced steady growth over the past five years, primarily due to the increased need for effective crop protection solutions to address pest attacks, diseases, and improve crop yields. The sector is fueled by the demand for food security and rising agricultural exports, particularly for rice, coffee, and rubber. Advanced technologies in crop protection are also contributing to the expansion of the market.

- The Mekong Delta and Red River Delta regions dominate the Vietnam crop protection chemicals market. These regions are the agricultural hubs of Vietnam, producing most of the the country's rice, coffee, and rubber crops. The dominance of these regions is driven by favorable climatic conditions, fertile soils, and extensive agricultural activities. Furthermore, the Mekong Delta plays a critical role in rice production, which is the staple food of Vietnam and a major export product. These factors make these regions pivotal in shaping the demand for crop protection chemicals.

- The Ministry of Agriculture and Rural Development (MARD) is the primary regulatory body overseeing the use of crop protection chemicals in Vietnam. In 2022, MARD updated its guidelines on pesticide usage, emphasizing the reduction of hazardous chemicals and promoting safer alternatives such as biopesticides. The ministrys regulations also ensure that only licensed products are sold in the market, with strict penalties for violations. These guidelines are part of the governments broader efforts to ensure sustainable agricultural practices and enhance the safety of both domestic and export-oriented agricultural products.

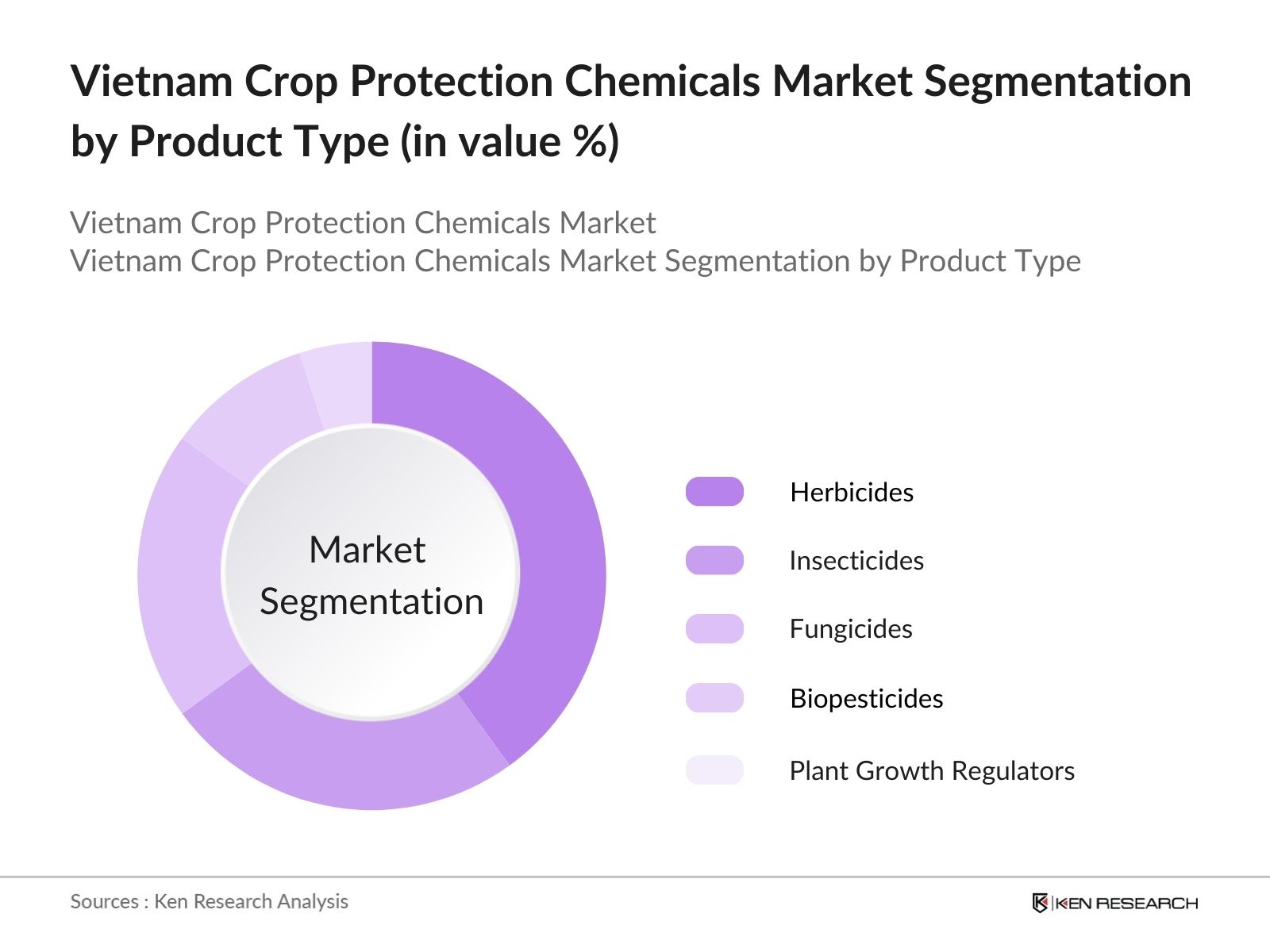

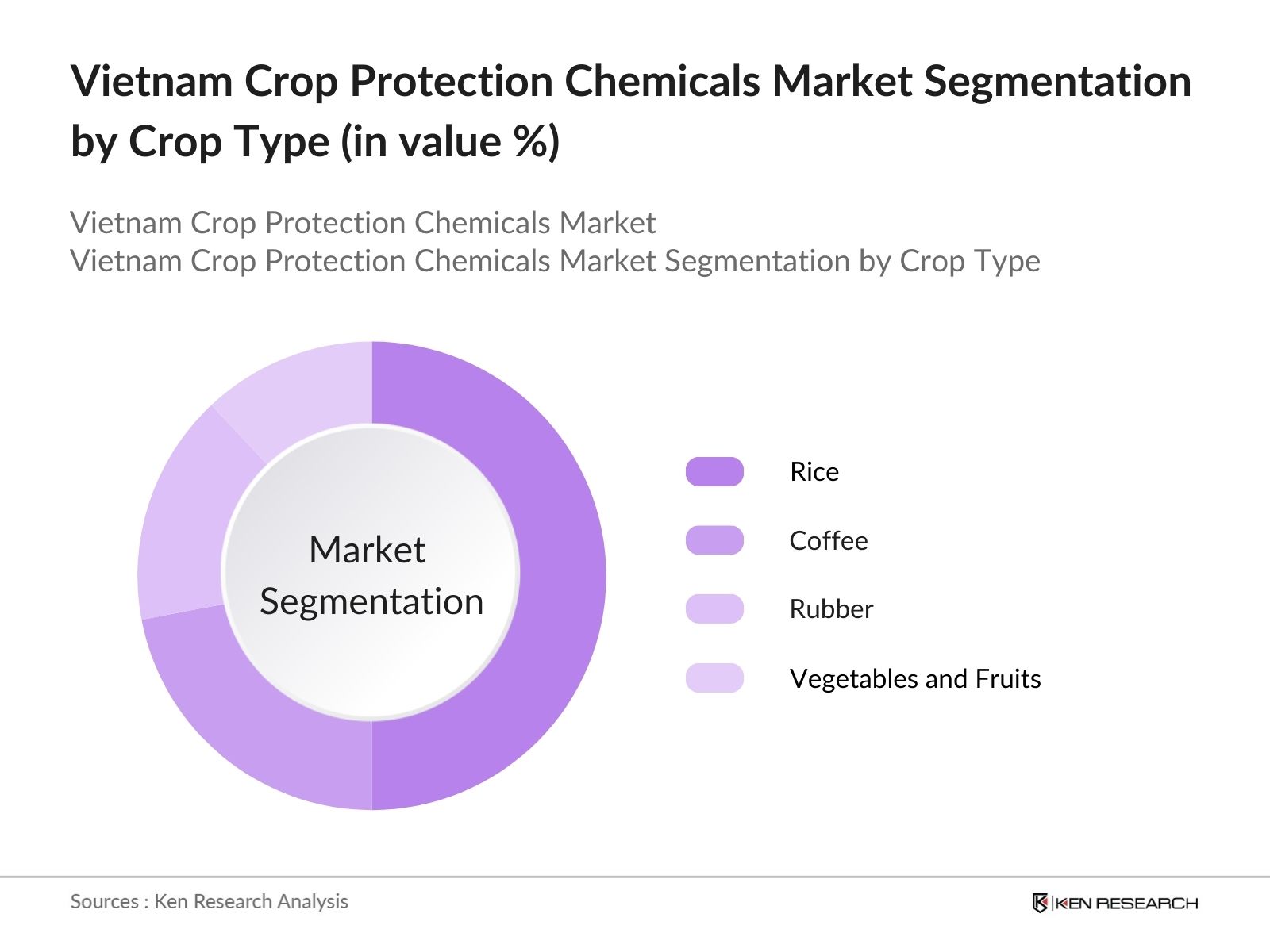

Vietnam Crop Protection Chemicals Market Segmentation

By Product Type: The market is segmented by product type into herbicides, insecticides, fungicides, biopesticides, and plant growth regulators. Herbicides currently dominate the market in this segment due to the vast paddy fields that require effective weed control for high rice production. The consistent demand for herbicides in managing the weed problem across large areas of cultivation, particularly in rice and coffee farms, has made it the leading product type in the market.

By Crop Type: The Vietnam crop protection chemicals market is segmented by crop type into rice, coffee, rubber, vegetables and fruits, and others (including cashew, pepper, and tea). Rice dominates the crop type segment, given its importance as the staple food and export product of Vietnam. The need for high productivity, better quality crops, and increasing pest and disease outbreaks has led to a high demand for crop protection chemicals in rice cultivation. The governments support for maintaining Vietnams position as one of the largest global rice exporters has also strengthened this segment.

Vietnam Crop Protection Chemicals Market Competitive Landscape

The Vietnam Crop Protection Chemicals Market is highly competitive, with a mix of local and international players. Global giants such as Bayer CropScience AG, Syngenta AG, and BASF SE dominate the market alongside local firms that cater to region-specific demands. These companies are investing heavily in research and development to introduce more effective and sustainable crop protection solutions, such as bio-based products. The market is also witnessing several mergers, acquisitions, and strategic partnerships, further consolidating the market share among the top players.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Market Share |

Distribution Network |

R&D Investment |

Sustainability Initiatives |

Product Range |

Local Partnerships |

|

Bayer CropScience AG |

1863 |

Germany |

|||||||

|

Syngenta AG |

2000 |

Switzerland |

|||||||

|

BASF SE |

1865 |

Germany |

|||||||

|

Corteva Agriscience |

2019 |

USA |

|||||||

|

Nufarm Limited |

1916 |

Australia |

Vietnam Crop Protection Chemicals Industry Analysis

Growth Drivers

- Rising Agricultural Production (Rice, Coffee, Rubber): Vietnams agricultural output continues to play a pivotal role in supporting the demand for crop protection chemicals. The country ranks among the top five global producers of rice, with 44 million tons of rice produced in 2022, according to the Ministry of Agriculture and Rural Development (MARD). Additionally, coffee production reached 1.8 million tons, contributing significantly to export revenue. Rubber production exceeded 1.2 million tons, further emphasizing the need for efficient pest management and crop protection solutions to maintain and enhance yields. The sectors demand for chemicals has increased to ensure sustainable crop production.

- Government Initiatives on Food Security: The Vietnamese government has prioritized food security through the National Food Security Program, ensuring an adequate food supply while also supporting export potential. In 2023, Vietnam allocated $1.4 billion to agricultural subsidies, with a portion focused on enhancing crop protection and ensuring farmers have access to safe and effective chemicals. Vietnam aims to boost food production by 10% by the end of 2024, which aligns with the growing need for advanced agrochemicals. The governments efforts directly support the demand for crop protection solutions in light of increasing food production demands.

- Increasing Adoption of Sustainable Agricultural Practices: Vietnam's agricultural policies are increasingly aligned with sustainability. By 2023, over 3 million hectares were designated for sustainable farming, which includes the use of environmentally friendly crop protection chemicals. This movement is driven by international trade agreements, particularly with the European Union, which requires compliance with strict sustainability standards. Vietnam's adoption of integrated pest management and organic farming practices has encouraged the use of bio-based chemicals, increasing the overall market demand for sustainable crop protection solutions.

Market Challenges

- Regulatory Constraints (Pesticide Usage Regulations, Bans on Certain Chemicals): Vietnam has implemented stringent regulations on pesticide usage, limiting the markets ability to introduce certain chemicals. As of 2023, the government has banned over 60 pesticide formulations due to their environmental and health impacts, as stated by MARD. Additionally, the regulatory process for approving new chemicals has become more complex, with approval times averaging 18 months. This regulatory environment poses a significant challenge for agrochemical companies looking to introduce new products in the Vietnamese market.

- High Research and Development Costs: Developing new crop protection chemicals is an expensive endeavor, with research and development costs in Vietnams agrochemical industry rising to $2.5 billion annually, according to a 2023 MARD report. The high cost is partly due to rigorous testing and regulatory approval requirements, which make it difficult for smaller companies to compete. Additionally, multinational companies dominate the market, making it even harder for local players to keep up with R&D expenditures. This high cost creates barriers to innovation and market entry for newer, smaller firms.

Vietnam Crop Protection Chemicals Market Future Outlook

Over the next five years, the Vietnam Crop Protection Chemicals Market is expected to grow significantly due to the rising demand for higher agricultural productivity and the need for sustainable farming practices. Government policies aimed at reducing post-harvest losses, increasing crop yields, and promoting eco-friendly agricultural inputs will drive the adoption of innovative crop protection chemicals. The shift toward bio-based chemicals and integrated pest management (IPM) solutions, coupled with advanced technologies such as precision farming, is expected to shape the market's future landscape.

The markets potential will also be influenced by increasing collaborations between local and international players, further improving the availability and accessibility of advanced crop protection products. This will enhance the resilience of the agricultural sector against pests, diseases, and the unpredictable impacts of climate change.

Future Market Opportunities

- Growth in Organic Farming: Vietnam's organic farming sector is expanding rapidly, with over 250,000 hectares of certified organic farmland in 2023. This growth is driven by rising consumer demand for organic products, both domestically and internationally. The export value of organic agricultural products reached $335 million in 2023, according to MARD. This trend has opened up new opportunities for bio-based crop protection solutions, as organic farms require non-synthetic chemicals. The shift towards organic farming presents significant potential for companies offering eco-friendly and sustainable crop protection products.

- Expansion of Export Markets for Agricultural Products

Vietnam's agricultural exports surpassed $53 billion in 2023, making it one of the leading exporters of rice, coffee, and rubber globally. With new free trade agreements, such as the EU-Vietnam Free Trade Agreement (EVFTA), the country is poised to increase exports further in 2024. These agreements necessitate adherence to stricter agricultural standards, including the use of approved crop protection chemicals. The expansion of Vietnams export markets directly correlates with an increased demand for high-quality and compliant agrochemicals.

Scope of the Report

|

By Product Type |

Herbicides Insecticides Fungicides Biopesticides Plant Growth Regulators |

|

By Crop Type |

Rice, Coffee Rubber Vegetables and Fruits |

|

By Application Method |

Foliar Spray Seed Treatment Soil Treatment Post-Harvest Treatment |

|

By Origin |

Synthetic Chemicals Bio-based Chemicals |

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development, Vietnam National Pesticide Management Program)

Farmers and Agricultural Cooperatives

Agrochemical Manufacturers

Bio-based Chemical Producers

Agricultural Research Institutions

Agricultural Equipment Manufacturers

Investments and Venture Capitalist Firms

Distributors and Wholesalers of Agrochemicals

Companies

Major Players in the Vietnam Crop Protection Chemicals Market

Bayer CropScience AG

Syngenta AG

BASF SE

Corteva Agriscience

Sumitomo Chemical Co. Ltd.

Nufarm Limited

FMC Corporation

UPL Limited

Adama Agricultural Solutions

Nihon Nohyaku Co., Ltd.

Albaugh LLC

Marrone Bio Innovations

DuPont

PI Industries Ltd.

Mitsui Chemicals Agro, Inc.

Table of Contents

1. Vietnam Crop Protection Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Crop Protection Chemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Crop Protection Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Rising Agricultural Production (Rice, Coffee, Rubber)

3.1.2. Government Initiatives on Food Security

3.1.3. Increasing Adoption of Sustainable Agricultural Practices

3.1.4. Technological Advancements in Agrochemicals

3.2. Market Challenges

3.2.1. Regulatory Constraints (Pesticide Usage Regulations, Bans on Certain Chemicals)

3.2.2. High Research and Development Costs

3.2.3. Impact of Climate Change (Unpredictable Monsoons, Flooding)

3.3. Opportunities

3.3.1. Growth in Organic Farming

3.3.2. Expansion of Export Markets for Agricultural Products

3.3.3. Emerging Bio-based Crop Protection Solutions

3.4. Trends

3.4.1. Shift Towards Biopesticides and Bioherbicides

3.4.2. Precision Farming Integration

3.4.3. Partnerships between Agrochemical Companies and Tech Firms

3.5. Government Regulation

3.5.1. Ministry of Agriculture and Rural Development (MARD) Guidelines

3.5.2. Pesticide Regulation and Licensing Procedures

3.5.3. National Programs for Sustainable Agriculture (VN-SAP)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Local Distributors, Farmers, Government Bodies)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Crop Protection Chemicals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Herbicides

4.1.2. Insecticides

4.1.3. Fungicides

4.1.4. Biopesticides

4.1.5. Plant Growth Regulators

4.2. By Crop Type (In Value %)

4.2.1. Rice

4.2.2. Coffee

4.2.3. Rubber

4.2.4. Vegetables and Fruits

4.2.5. Others (Cashew, Pepper, Tea)

4.3. By Application Method (In Value %)

4.3.1. Foliar Spray

4.3.2. Seed Treatment

4.3.3. Soil Treatment

4.3.4. Post-Harvest Treatment

4.4. By Origin (In Value %)

4.4.1. Synthetic Chemicals

4.4.2. Bio-based Chemicals

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Vietnam Crop Protection Chemicals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Syngenta AG

5.1.2. Bayer CropScience AG

5.1.3. BASF SE

5.1.4. Corteva Agriscience

5.1.5. Sumitomo Chemical Co. Ltd.

5.1.6. Nufarm Limited

5.1.7. FMC Corporation

5.1.8. UPL Limited

5.1.9. Adama Agricultural Solutions

5.1.10. Nihon Nohyaku Co., Ltd.

5.1.11. Albaugh LLC

5.1.12. Marrone Bio Innovations

5.1.13. DuPont

5.1.14. PI Industries Ltd.

5.1.15. Mitsui Chemicals Agro, Inc.

5.2. Cross Comparison Parameters (Market Share, Innovation Index, Production Volume, Sustainability Initiatives, Pricing Strategy, Distribution Network, Local Presence, Growth Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Support

5.8. Private Equity Investments

6. Vietnam Crop Protection Chemicals Market Regulatory Framework

6.1. National Regulations and Guidelines for Pesticides

6.2. Import and Export Regulations (Chemical Imports and Exports)

6.3. Certification Requirements for Crop Protection Products

6.4. Compliance with International Agricultural Standards (GAP, HACCP, Codex)

7. Vietnam Crop Protection Chemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Crop Protection Chemicals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Crop Type (In Value %)

8.3. By Application Method (In Value %)

8.4. By Origin (In Value %)

8.5. By Region (In Value %)

9. Vietnam Crop Protection Chemicals Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Insights and Segmentation Analysis

9.3. Strategic Marketing and Business Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Crop Protection Chemicals Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Vietnam Crop Protection Chemicals Market. This includes assessing market penetration, the ratio of manufacturers to distributors, and revenue generation. An evaluation of product quality statistics is conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts. These consultations provide valuable operational and financial insights directly from practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engagement with major crop protection chemical manufacturers to acquire detailed insights into product segments, sales performance, and other pertinent factors. This interaction verifies and complements the statistics derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the market.

Frequently Asked Questions

01. How big is the Vietnam Crop Protection Chemicals Market?

The Vietnam Crop Protection Chemicals Market is valued at USD 2 billion. This growth is driven by the rising demand for crop protection products to combat pest infestations and improve agricultural productivity.

02. What are the major challenges in the Vietnam Crop Protection Chemicals Market?

Major challenges include stringent government regulations on chemical usage, the rising costs of research and development, and the increasing need for sustainable and bio-based products to reduce environmental impact.

03. Who are the major players in the Vietnam Crop Protection Chemicals Market?

Key players in the market include Bayer CropScience AG, Syngenta AG, BASF SE, Corteva Agriscience, and Nufarm Limited. These companies dominate due to their global presence, extensive product portfolios, and strong distribution networks.

04. What drives the growth of the Vietnam Crop Protection Chemicals Market?

The market is driven by factors such as rising agricultural production, increasing pest and disease outbreaks, government initiatives for food security, and the growing adoption of sustainable farming practices.

05. What trends are shaping the Vietnam Crop Protection Chemicals Market?

Notable trends include the shift toward bio-based crop protection solutions, increasing use of precision farming techniques, and collaborations between local and international chemical manufacturers to promote innovation and sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.