Vietnam Cryptocurrencies Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD6696

December 2024

94

About the Report

Vietnam Cryptocurrencies Market Overview

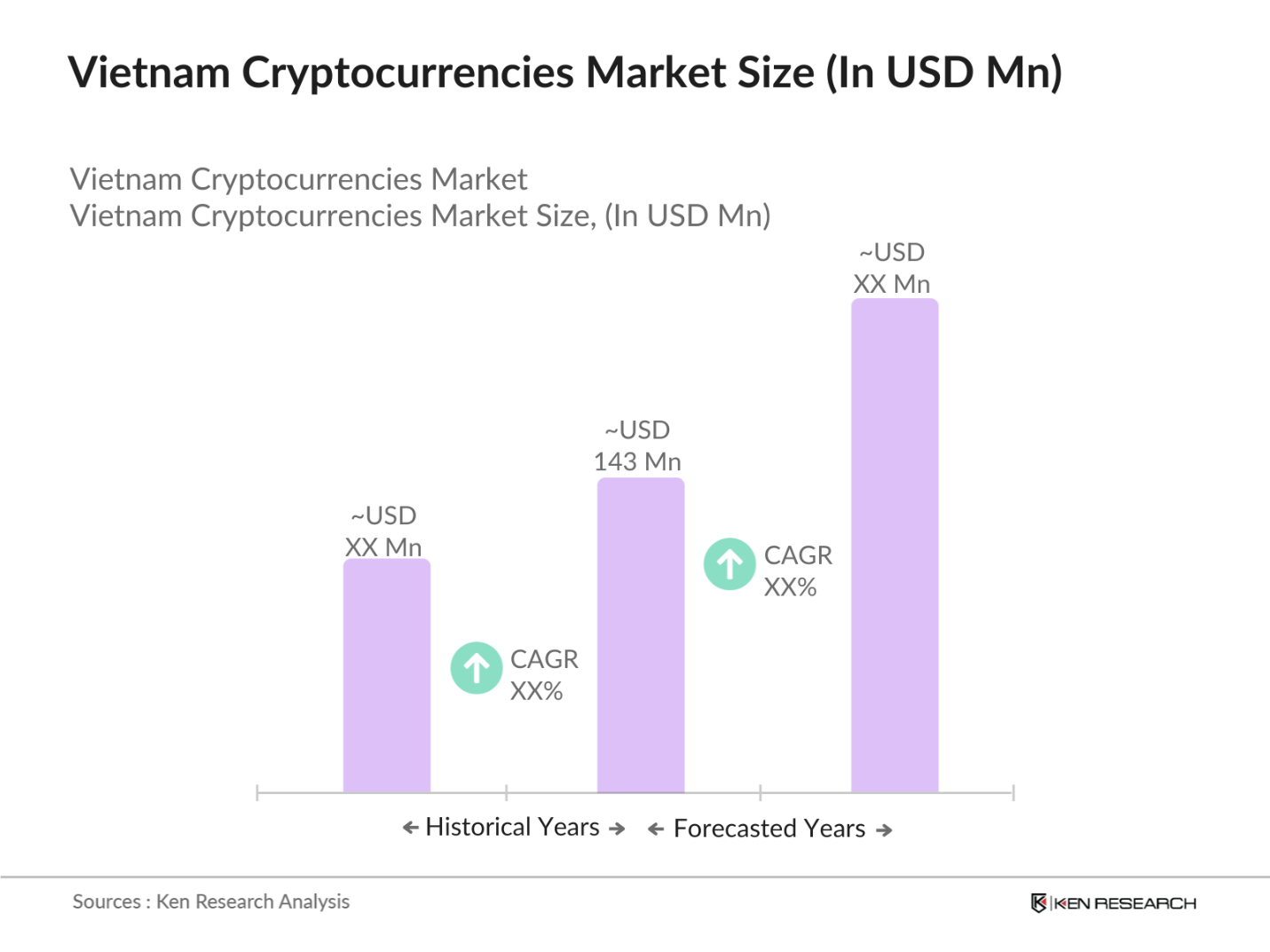

- The Vietnam cryptocurrencies market is valued at USD 143 million, based on a five-year historical analysis. The market is driven by increasing digital adoption, rising smartphone penetration, and a surge in financial technology (fintech) solutions. Cryptocurrencies offer an alternative financial solution, especially for those without access to traditional banking systems. Vietnams high remittance flows, where many citizens work overseas and send money back home, have led to increased usage of cryptocurrency as a fast and cost-effective method of transferring funds.

- Ho Chi Minh City and Hanoi are the dominant cities in the Vietnam cryptocurrencies market due to their status as the country's financial and technological hubs. Both cities have seen significant fintech development, with increasing numbers of cryptocurrency exchanges and blockchain-related startups. Additionally, these urban areas benefit from strong internet infrastructure and high adoption of mobile payment platforms, making them ideal environments for crypto transactions and investments.

- Decentralized Finance (DeFi) has gained traction in Vietnam, with an increasing number of platforms offering financial services without intermediaries. As of 2023, the volume of transactions on DeFi platforms has surged, driven by the desire for greater financial autonomy and better yields compared to traditional finance. The Vietnamese government is supportive of this trend, as it aligns with its goals for digital transformation. A report by the International Monetary Fund indicates that the total value locked in DeFi projects is on the rise, indicating robust growth potential for the sector in Vietnam.

Vietnam Cryptocurrencies Market Segmentation

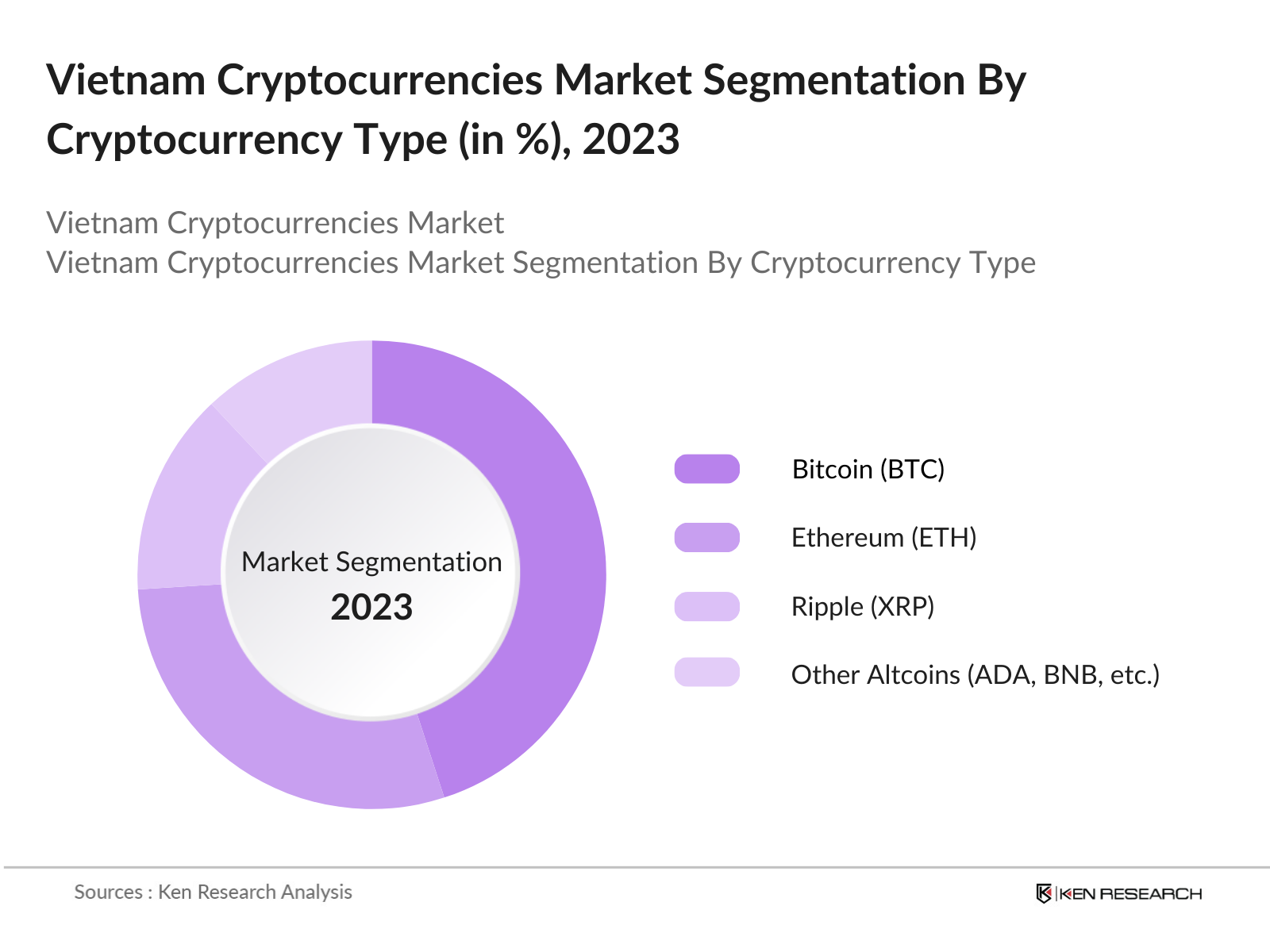

By Cryptocurrency Type: The Vietnam cryptocurrency market is segmented by cryptocurrency type into Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and other altcoins such as Cardano (ADA) and Binance Coin (BNB). Bitcoin currently holds the dominant market share due to its status as the first and most widely recognized cryptocurrency. Bitcoins appeal lies in its high liquidity and global acceptance, making it the most attractive option for both traders and investors in Vietnam. Additionally, local exchanges prioritize Bitcoin trading due to its relative stability compared to other altcoins, contributing to its leadership position in the market.

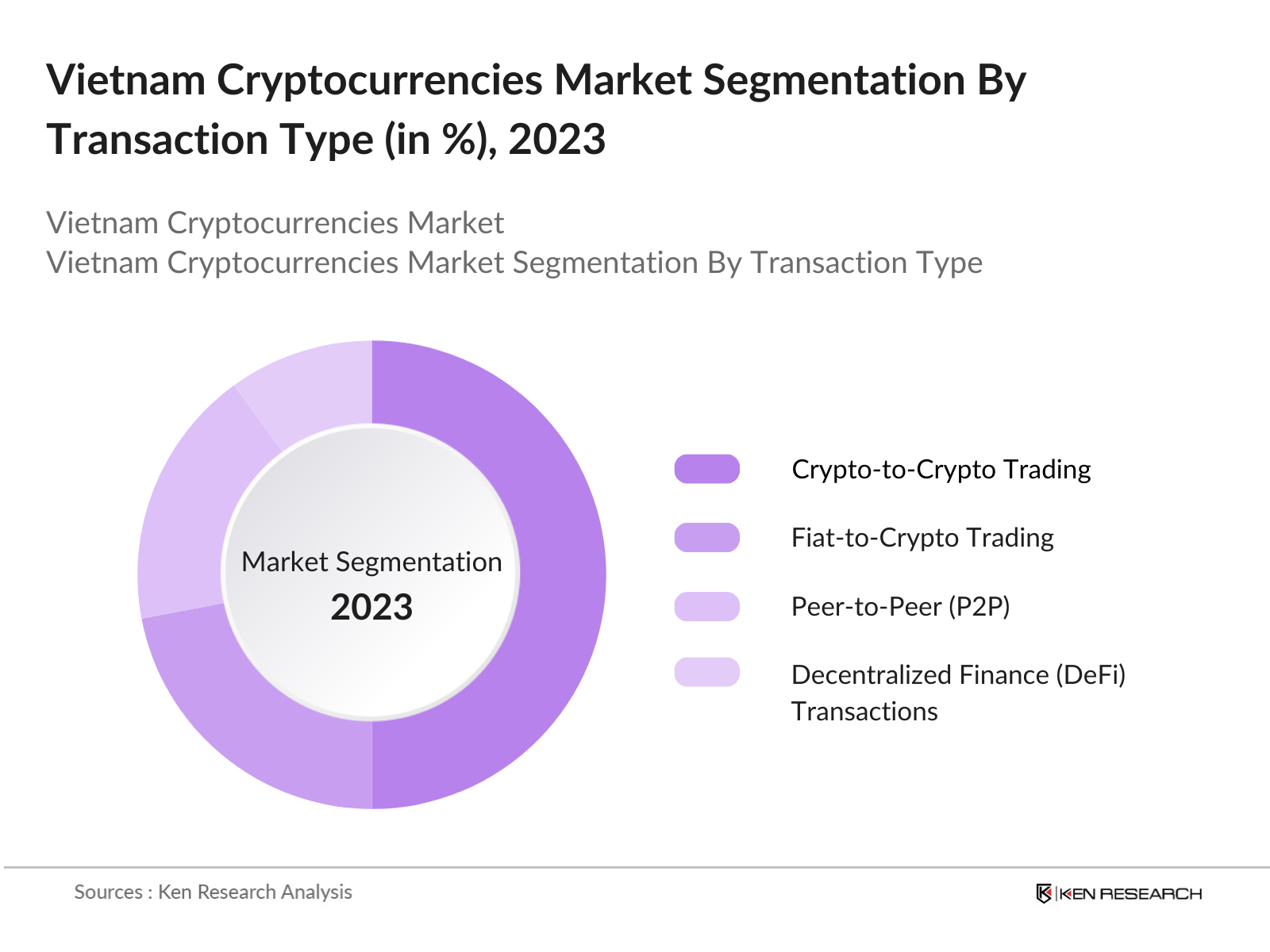

By Transaction Type: The Vietnam cryptocurrency market is also segmented by transaction type into peer-to-peer (P2P) transactions, crypto-to-crypto trading, fiat-to-crypto trading, and decentralized finance (DeFi) transactions. Crypto-to-crypto trading dominates the market due to the increasing number of Vietnamese traders leveraging various cryptocurrencies to maximize returns. Exchanges like Binance and KuCoin have established themselves as popular platforms for this type of trading. Crypto-to-crypto transactions are favored because they allow traders to hedge against volatility in specific currencies while benefiting from the liquidity of larger exchanges.

Vietnam Cryptocurrencies Market Competitive Landscape

The Vietnam cryptocurrency market is dominated by a mix of local exchanges and global platforms. The market is highly competitive with a combination of well-established global players and local startups. For example, Binance and Coinbase have significant market penetration due to their user-friendly interfaces, large cryptocurrency offerings, and security features. Local exchanges such as Remitano have also garnered a substantial user base due to their focus on the local market and ease of use for Vietnamese customers.

|

Company |

Established Year |

Headquarters |

Trading Volume |

User Base |

Market Capitalization |

No. of Cryptocurrencies Listed |

No. of Employees |

Annual Revenue |

|

Binance |

2017 |

Malta |

_ |

_ |

_ |

_ |

_ |

_ |

|

Coinbase |

2012 |

United States |

_ |

_ |

_ |

_ |

_ |

_ |

|

Remitano |

2014 |

Vietnam |

_ |

_ |

_ |

_ |

_ |

_ |

|

Kraken |

2011 |

United States |

_ |

_ |

_ |

_ |

_ |

_ |

|

KuCoin |

2017 |

Seychelles |

_ |

_ |

_ |

_ |

_ |

_ |

Vietnam Cryptocurrencies Industry Analysis

Growth Drivers

- Increase in Digital Adoption and Smartphone Penetration: Vietnam has witnessed significant digital adoption, with the number of internet users reaching approximately 70 million in 2023, which represents about 70% of the population. The country ranks high in smartphone penetration, with over 45 million smartphones in use, contributing to the growing interest in cryptocurrencies. According to the World Bank, Vietnam's digital economy is projected to reach $43 billion by 2025, driven by increased connectivity and digital literacy. This surge in digital engagement has created a conducive environment for cryptocurrency adoption, as more individuals and businesses explore digital assets as alternative financial tools.

- Government Initiatives for Blockchain and Crypto Legalization: The Vietnamese government has shown a proactive approach towards blockchain technology and cryptocurrencies, culminating in the Ministry of Finance's proposal to regulate digital assets. The government is expected to establish a legal framework for cryptocurrencies by 2025, supporting their use in various sectors. As part of its digital transformation strategy, Vietnam aims to foster innovation, with the digital economy projected to contribute 20% to GDP by 2025. These initiatives signal a positive regulatory environment that encourages investment and participation in the cryptocurrency market.

- Rising Remittance Flows in Cryptocurrencies: Vietnam is one of the top countries for remittances, receiving approximately $18 billion in remittances in 2022. An increasing portion of these remittances is being transferred in cryptocurrencies, driven by the desire for lower transaction fees and faster processing times. A report from the World Bank indicates that remittance flows to Vietnam are projected to grow as the global adoption of cryptocurrencies rises. This trend not only enhances financial inclusion but also boosts local economies as more individuals leverage digital currencies for cross-border transactions.

Market Challenges

- Regulatory Uncertainty: One of the most significant challenges facing the Vietnamese cryptocurrency market is regulatory uncertainty. Despite the government's efforts to draft laws regarding digital currencies, the lack of a clear legal framework continues to deter investments. According to a report by the World Bank, Vietnam's regulatory environment ranks low in terms of clarity and transparency, which has implications for businesses and investors looking to enter the market. The absence of standardized licensing procedures further complicates the situation, leading to a cautious approach from potential market participants.

- Limited Access to Cryptocurrency Exchanges for Retail Investors: Access to cryptocurrency exchanges remains limited for retail investors in Vietnam, with only a handful of exchanges operating legally. A survey by the State Bank of Vietnam revealed that nearly 60% of potential investors face challenges in finding reliable platforms for trading cryptocurrencies. This lack of access inhibits participation from a broader audience, thereby stifling market growth. Enhancing the accessibility of exchanges and establishing clear regulations could facilitate greater engagement from retail investors, ultimately fostering a more robust cryptocurrency ecosystem.

Vietnam Cryptocurrencies Market Future Outlook

Over the next five years, the Vietnam cryptocurrency market is expected to show significant growth driven by increasing adoption of decentralized finance (DeFi), the rise of non-fungible tokens (NFTs), and further regulatory clarity. The government is actively working on creating a legal framework for cryptocurrencies, which could lead to broader adoption across various industries, from finance to supply chain management. Additionally, growing interest in blockchain applications for remittances and digital payments will likely contribute to the expansion of the market.

Opportunities

- Development of Central Bank Digital Currency (CBDC) in Vietnam: The Vietnamese government is actively exploring the development of a Central Bank Digital Currency (CBDC), which presents significant opportunities for the cryptocurrency market. As of 2023, the State Bank of Vietnam is conducting pilot projects to assess the feasibility of a digital currency, aiming to enhance transaction efficiency and reduce costs in the financial system. The potential launch of a CBDC could integrate the benefits of cryptocurrencies into the mainstream economy, fostering wider acceptance and usage among the population. This strategic move is anticipated to position Vietnam as a leader in the digital currency landscape in Southeast Asia.

- Cross-border Payment Solutions and Crypto Remittance Market Expansion: The demand for efficient cross-border payment solutions is rising, particularly for remittances, where cryptocurrencies can significantly reduce transaction costs. In 2022, Vietnam ranked among the top remittance-receiving countries globally, and the World Bank anticipates continued growth in remittance flows. The integration of cryptocurrencies into these transactions offers a faster and more cost-effective alternative, providing opportunities for financial institutions and startups to develop innovative solutions that cater to this burgeoning market. As global remittance practices evolve, Vietnam stands to benefit from increased participation in the crypto remittance space.

Scope of the Report

|

By Cryptocurrency Type |

Bitcoin Ethereum Ripple Litecoin Altcoins |

|

By Transaction Type |

P2P Crypto-to-Crypto Fiat-to-Crypto, DeFi |

|

By Platform |

Centralized Exchanges Decentralized Exchanges Mobile Wallets Custodial Wallets |

|

By Application |

Payments Investment Smart Contracts Supply Chain Management |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investments and venture capital firms

Government and regulatory bodies (State Bank of Vietnam, Ministry of Information and Communications)

Cryptocurrency exchange companies

Payment gateway companies

Financial institutions and banks

Technology companies involved in blockchain solutions

Retail cryptocurrency investing Companies

Companies

Players Mentioned in The Report

Binance

Coinbase

Remitano

Kraken

KuCoin

Bitfinex

Huobi

Crypto.com

Paxful

Gate.io

Luno

OKEx

FTX

Upbit

Blockchain.com

Table of Contents

1. Vietnam Cryptocurrencies Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Growth Rate and Volume Analysis (Market Penetration, Transaction Volume, Market Capitalization)

1.4. Market Segmentation Overview

2. Vietnam Cryptocurrencies Market Size (In USD Bn)

2.1. Historical Market Size (Transaction Volume, User Base)

2.2. Year-on-Year Growth Analysis (Trading Activity, Wallet Creation, Blockchain Adoption)

2.3. Key Market Developments and Milestones (Regulatory Updates, Major Partnerships, Key Project Launches)

3. Vietnam Cryptocurrencies Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Digital Adoption and Smartphone Penetration

3.1.2. Government Initiatives for Blockchain and Crypto Legalization

3.1.3. Rising Remittance Flows in Cryptocurrencies

3.1.4. Financial Inclusion via Cryptocurrencies in Unbanked Sectors

3.2. Market Challenges

3.2.1. Regulatory Uncertainty (Licensing, Legal Framework)

3.2.2. Limited Access to Cryptocurrency Exchanges for Retail Investors

3.2.3. High Market Volatility

3.2.4. Security Risks (Hacking, Cyber Threats)

3.3. Opportunities

3.3.1. Development of Central Bank Digital Currency (CBDC) in Vietnam

3.3.2. Cross-border Payment Solutions and Crypto Remittance Market Expansion

3.3.3. Investment Opportunities for Startups in Blockchain and Decentralized Finance (DeFi)

3.4. Trends

3.4.1. Growth in Decentralized Finance (DeFi) Solutions

3.4.2. Adoption of Stablecoins for Daily Transactions

3.4.3. Increased Interest in Non-Fungible Tokens (NFTs)

3.4.4. Integration of Cryptocurrencies into Traditional Payment Gateways

3.5. Government Regulations

3.5.1. Vietnams Draft Laws for Cryptocurrencies

3.5.2. Licensing Procedures for Crypto Exchanges and Wallet Providers

3.5.3. Taxation Policies for Cryptocurrency Traders and Investors

3.5.4. Collaboration with International Organizations on Crypto Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Exchanges, Wallet Providers, Blockchain Developers, Investors)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Key Players, Crypto Exchange Platforms, Blockchain Startups)

4. Vietnam Cryptocurrencies Market Segmentation

4.1. By Cryptocurrency Type (In Value %) 4.1.1. Bitcoin (BTC)

4.1.2. Ethereum (ETH)

4.1.3. Ripple (XRP)

4.1.4. Litecoin (LTC)

4.1.5. Other Altcoins (ADA, DOT, BNB)

4.2. By Transaction Type (In Value %) 4.2.1. Peer-to-Peer (P2P)

4.2.2. Crypto-to-Crypto Trading

4.2.3. Fiat-to-Crypto Trading

4.2.4. Decentralized Finance (DeFi) Transactions

4.3. By Platform (In Value %) 4.3.1. Centralized Exchange Platforms

4.3.2. Decentralized Exchange Platforms

4.3.3. Mobile Wallet Platforms

4.3.4. Custodial vs. Non-Custodial Wallet Platforms

4.4. By Application (In Value %) 4.4.1. Payments and Remittances

4.4.2. Investment and Trading

4.4.3. Smart Contracts

4.4.4. Supply Chain Management (Blockchain-based Applications)

4.5. By Region (In Value %) 4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Cryptocurrencies Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Binance

5.1.2. Coinbase

5.1.3. Huobi

5.1.4. FTX

5.1.5. KuCoin

5.1.6. Kraken

5.1.7. Gate.io

5.1.8. Paxful

5.1.9. Remitano

5.1.10. Crypto.com

5.1.11. OKEx

5.1.12. Bitfinex

5.1.13. Upbit

5.1.14. Luno

5.1.15. Blockchain.com

5.2. Cross Comparison Parameters (Market Penetration, Transaction Fees, User Base, Trading Volume, No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis (In Percentage by Trading Volume and User Base)

5.4. Strategic Initiatives (Partnerships, Marketing Campaigns)

5.5. Mergers and Acquisitions in the Market

5.6. Investment Analysis (Crypto Venture Funds, ICOs, IEOs)

5.7. Venture Capital and Private Equity Funding in Blockchain Companies

6. Vietnam Cryptocurrencies Market Regulatory Framework

6.1. Cryptocurrency Compliance Requirements

6.2. Licensing and Regulatory Framework for Crypto Exchanges

6.3. Anti-Money Laundering (AML) and Know Your Customer (KYC) Guidelines

6.4. Taxation Policies for Cryptocurrency Investments

7. Vietnam Cryptocurrencies Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Transaction Volume, User Base)

7.2. Key Factors Driving Future Market Growth (Regulatory Changes, Institutional Adoption)

8. Vietnam Cryptocurrencies Future Market Segmentation

8.1. By Cryptocurrency Type (In Value %)

8.2. By Transaction Type (In Value %)

8.3. By Platform (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Vietnam Cryptocurrencies Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Trader Profiles, Investor Demographics)

9.3. Marketing Initiatives (User Acquisition, Crypto Adoption Campaigns)

9.4. White Space Opportunity Analysis (Underserved Regions, Market Niches)

Research Methodology

Step 1: Identification of Key Variables

In this phase, we map out the stakeholder ecosystem of the Vietnam cryptocurrency market. Key variables include transaction volume, regulatory factors, and adoption rates. Primary and secondary research sources are used to build a comprehensive dataset.

Step 2: Market Analysis and Construction

We compile and analyze historical data related to cryptocurrency trading volumes, transaction types, and user base growth. The analysis focuses on understanding the market dynamics that contribute to revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated using industry expert consultations, including interviews with stakeholders from cryptocurrency exchanges, regulators, and blockchain developers. This helps in refining market projections and verifying our data.

Step 4: Research Synthesis and Final Output

The final report is compiled with detailed insights gathered from both qualitative and quantitative sources. Multiple rounds of validation ensure that the data is both accurate and reflective of the current market landscape.

Frequently Asked Questions

01. How big is the Vietnam Cryptocurrencies Market?

The Vietnam cryptocurrencies market was valued at USD 143 million, driven by rapid digital adoption, growing fintech solutions, and increasing remittance flows.

02. What are the challenges in the Vietnam Cryptocurrencies Market?

Challenges include regulatory uncertainty, security risks, and limited access to cryptocurrency trading platforms for retail investors.

03. Who are the major players in the Vietnam Cryptocurrencies Market?

Major players in the market include Binance, Coinbase, Remitano, Kraken, and KuCoin, dominating due to their large user bases and liquidity.

04. What are the growth drivers of the Vietnam Cryptocurrencies Market?

Growth is propelled by increasing smartphone penetration, rising remittances, and government efforts to establish a legal framework for cryptocurrencies.

05. What trends are shaping the Vietnam Cryptocurrencies Market?

Key trends include the rise of decentralized finance (DeFi), the growing popularity of NFTs, and the integration of cryptocurrencies into traditional financial services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.