Vietnam Dolls and Stuffed Toys Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5907

December 2024

92

About the Report

Vietnam Dolls and Stuffed Toys Market Overview

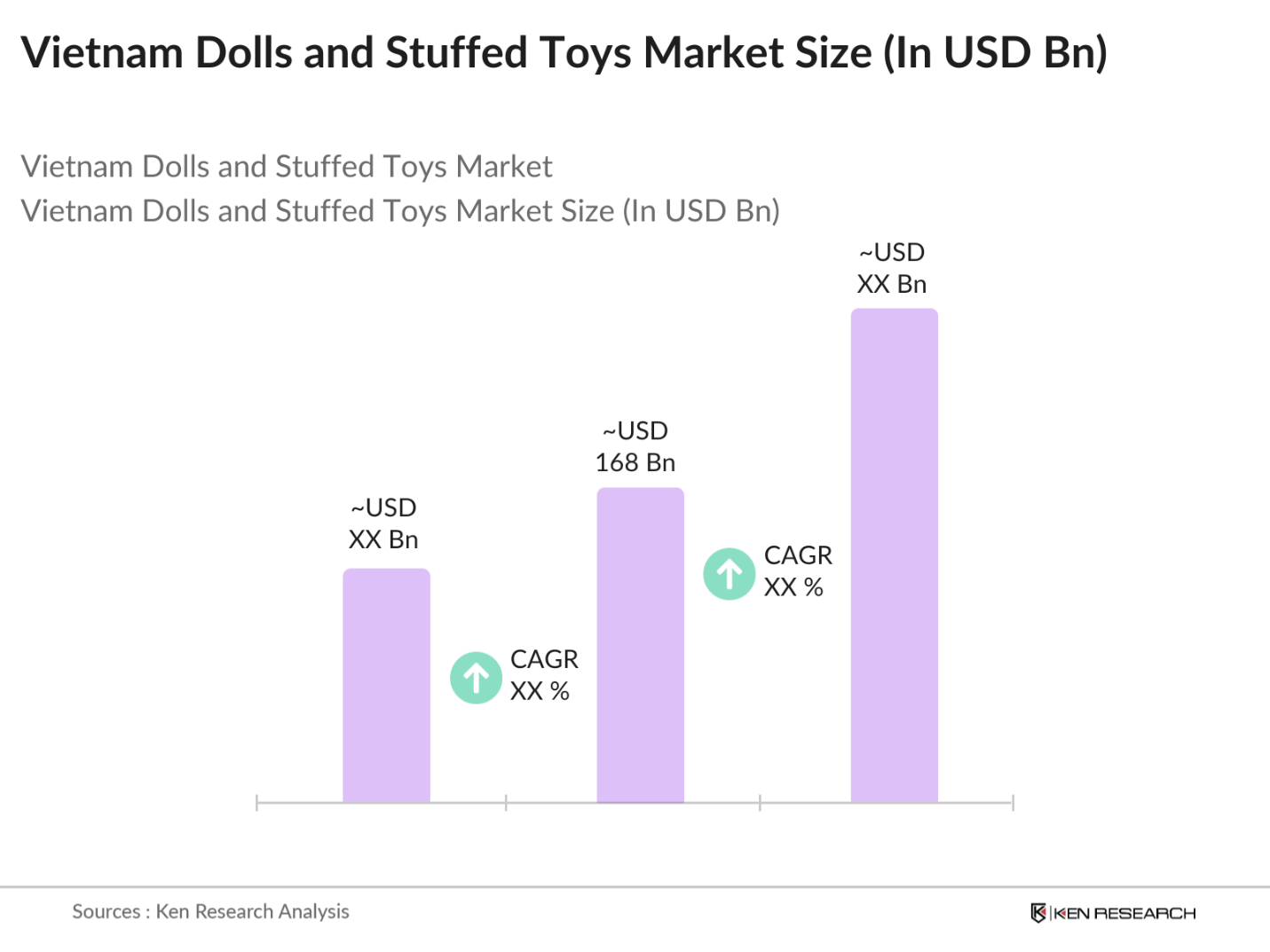

- The Vietnam Dolls and Stuffed Toys market is valued at USD 168 million, based on a five-year historical analysis. The market is driven by the rising disposable incomes of Vietnamese consumers, particularly in urban areas, and the growing influence of Western entertainment, which has created demand for character-based dolls and toys. Additionally, the increasing preference for educational and interactive toys among Vietnamese parents is a significant factor contributing to market growth.

- Ho Chi Minh City and Hanoi are the dominant cities in the Vietnam dolls and stuffed toys market. Their dominance stems from a high concentration of affluent families, larger retail markets, and higher consumer awareness of global brands. Furthermore, these cities are key hubs for toy imports and local distribution, making them the primary drivers of the market's expansion.

- Vietnam enforces strict toy safety regulations through the Ministry of Science and Technology, which updated its toy safety standards in 2022. These regulations mandate that all toys sold in the market must meet safety requirements concerning chemical composition, mechanical properties, and labeling. Toys containing hazardous substances such as lead or cadmium are strictly prohibited, with penalties for non-compliance ranging from VND 20 million to VND 50 million.

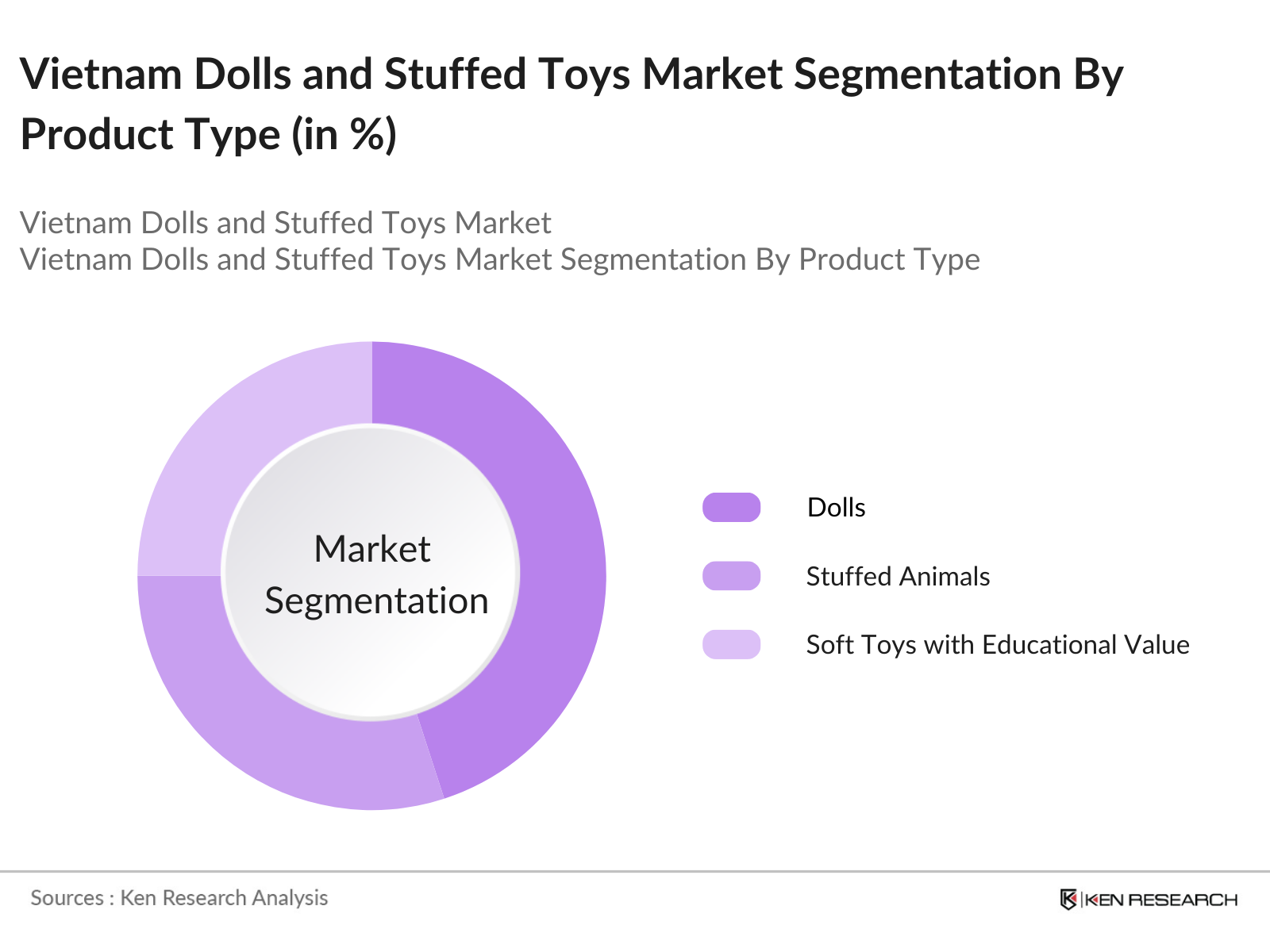

Vietnam Dolls and Stuffed Toys Market Segmentation

By Product Type: The market is segmented by product type into dolls, stuffed animals, and soft toys with educational value. Recently, dolls have dominated the product type category due to their strong appeal among younger children and their association with popular animated characters and films.

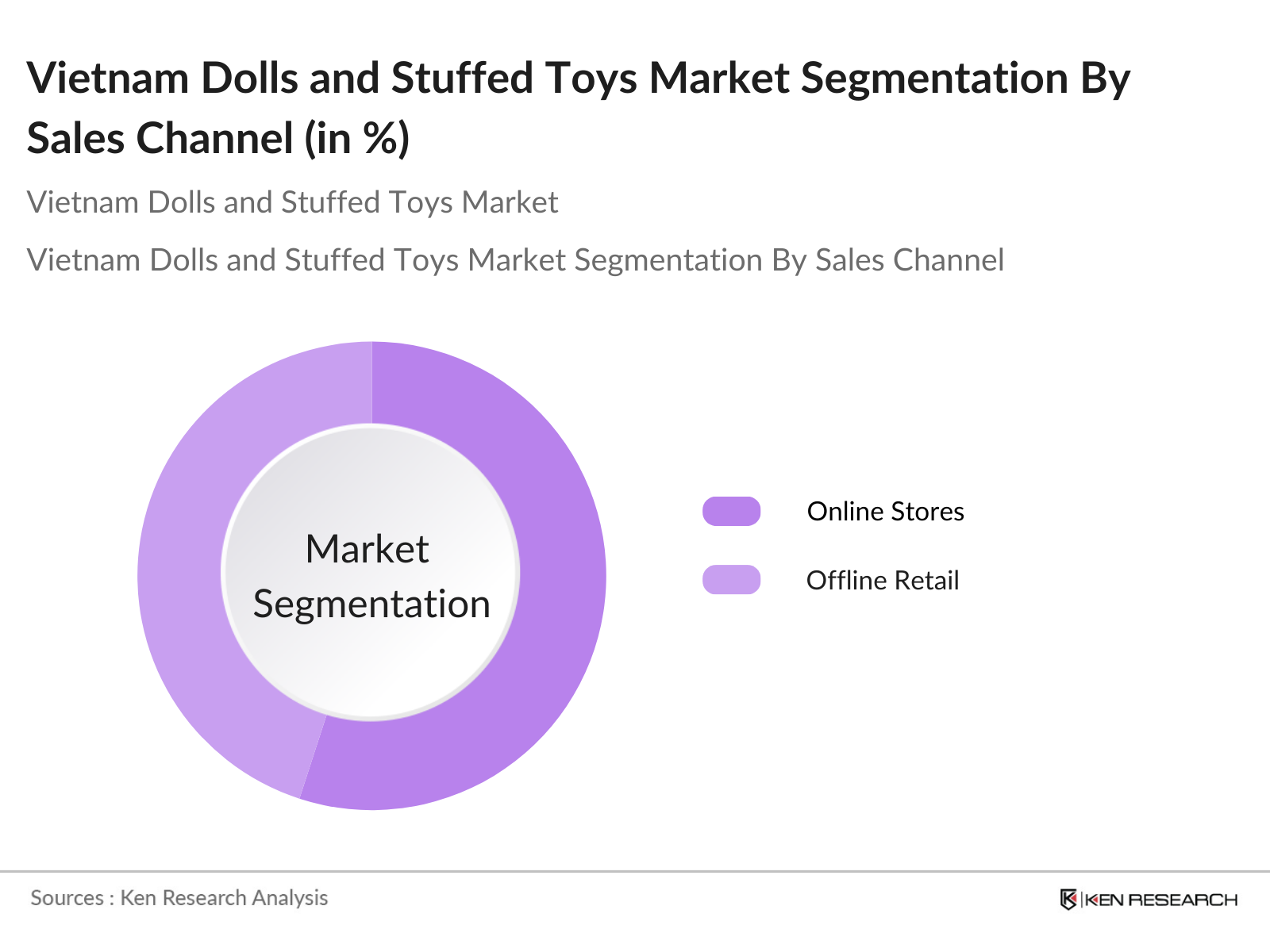

By Sales Channel: The market is also segmented by sales channel into online stores and offline retail (which includes toy stores and supermarkets). Recently, online stores have gained prominence as the dominant sales channel. This shift is primarily due to the rapid growth of e-commerce platforms in Vietnam, especially in major urban areas, where consumers appreciate the convenience, wider selection, and competitive pricing offered online.

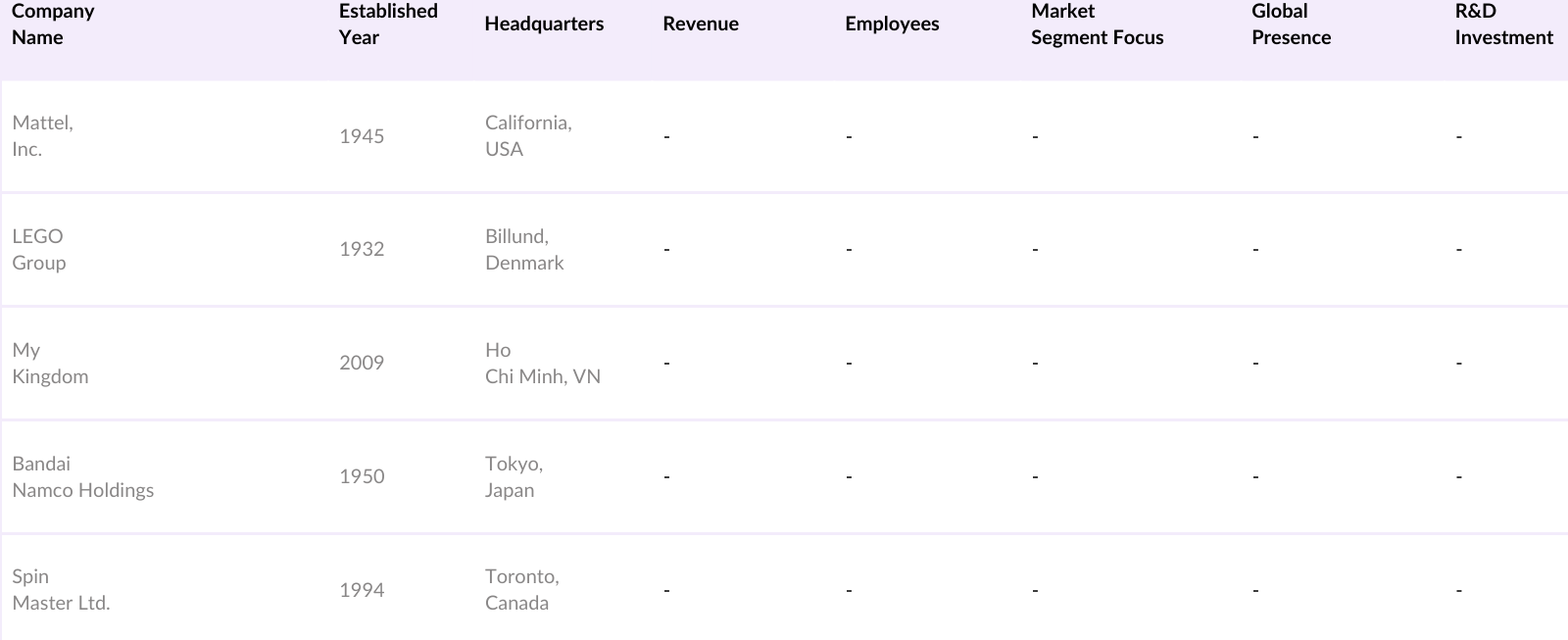

Vietnam Dolls and Stuffed Toys Market Competitive Landscape

The Vietnam Dolls and Stuffed Toys market is dominated by a mix of international and local players. This competitive landscape features major global companies that have a strong brand presence and significant market reach. Companies like Mattel, Inc. and LEGO have established themselves through consistent product innovation and wide distribution networks.

Vietnam Dolls and Stuffed Toys Industry Analysis

Growth Drivers

- Rising Disposable Income: As Vietnam continues its strong economic growth, the average disposable income per capita is projected to surpass USD 3,800 in 2024, a significant increase from previous years. This rise in disposable income directly influences consumer spending on non-essential goods, including toys. The World Bank reports that Vietnams GDP reached USD 411 billion in 2023, signaling improved economic stability and purchasing power.

- Increasing Birth Rates: Vietnam's birth rate has remained relatively stable, with 1.8 million children born in 2023, according to government data. The consistent birth rate fuels the demand for toys, as a growing population of young children continues to drive consumption in the toys and dolls market. The General Statistics Office (GSO) of Vietnam projects that the child population under 14 will reach approximately 26 million in 2024, providing a sizable target market for toy manufacturers.

- Cultural Influence on Toy Preferences: Vietnamese cultural values place a strong emphasis on family and children's happiness, which influences spending on childrens toys. Dolls and stuffed toys are particularly popular as gifts during Tet, Vietnams Lunar New Year, a time when spending on children's goods typically increases. Toys that reflect Vietnamese traditions, or that are themed after popular cultural icons, are gaining popularity, especially with a market of over 16 million urban households that celebrate these occasions annually.

Market Challenges

- Low Penetration in Rural Areas: Despite economic growth in urban regions, rural areas of Vietnam, which house about 63% of the population, face limited access to a variety of consumer products, including dolls and stuffed toys. This challenge stems from underdeveloped retail infrastructure and lower disposable income levels, with rural households earning an average of USD 1,400 annually. This discrepancy creates a gap in the market, limiting potential growth in non-urban regions where over 50 million people reside.

- High Production Costs: Vietnams toy manufacturing industry faces rising production costs due to increased raw material prices and labor costs. The average minimum wage in Vietnam rose to approximately VND 4.68 million per month (USD 200) in 2023, impacting overall manufacturing expenses. Additionally, import tariffs on certain raw materials and components needed for toy production further increase costs. These factors contribute to higher retail prices, which can be a deterrent for price-sensitive consumers.

Vietnam Dolls and Stuffed Toys Market Future Outlook

Over the next five years, the Vietnam dolls and stuffed toys market is expected to grow significantly, driven by several factors including the rise of online retail, increased demand for licensed toys, and the expansion of eco-friendly and sustainable toy offerings. Companies are likely to continue focusing on product innovation, especially in terms of interactive and educational toys, to meet changing consumer preferences.

Market Opportunities

- Expansion of Licensing Deals (e.g., Movies, Cartoons): The demand for branded toys tied to popular movie and cartoon franchises is growing in Vietnam. Global franchises such as Disney, Marvel, and local Vietnamese animations have garnered widespread appeal. For instance, toy sales linked to the "Doraemon" franchise, one of the most popular characters in Asia, have seen significant growth in 2023.

- Growth of Sustainable and Eco-friendly Toys: In response to growing environmental awareness, eco-friendly and sustainable toys have become increasingly popular in Vietnam. In 2023, nearly 58% of urban Vietnamese consumers expressed a preference for products made from recyclable or organic materials, according to the Ministry of Natural Resources and Environment. This trend is encouraging manufacturers to focus on producing eco-friendly dolls and stuffed toys, tapping into a niche yet rapidly growing segment of the market.

Scope of the Report

|

By Product Type |

Dolls Stuffed Animals Soft Toys |

|

By Age Group |

Toddlers Preschoolers Kids |

|

By Sales Channel |

Online Stores Offline Retail |

|

By Material Type |

Synthetic Materials Organic Materials |

|

By Region |

Ho Chi Minh City Hanoi Central Vietnam Mekong Delta |

Products

Key Target Audience

Toy Manufacturers

Distributors and Retailers

Online Marketplaces

Licensing Companies

Educational Institutions (specifically focused on toy-based learning)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Trade Ministry, Consumer Protection Agency)

Eco-friendly Toy Manufacturers

Companies

Players Mentioned in the Report

Mattel, Inc.

LEGO Group

Hasbro, Inc.

Bandai Namco Holdings

Spin Master Ltd.

VTech Holdings Ltd.

Ty Inc.

Funko, Inc.

Giochi Preziosi S.p.A.

Takara Tomy Co., Ltd.

Table of Contents

1. Vietnam Dolls and Stuffed Toys Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Dolls and Stuffed Toys Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Dolls and Stuffed Toys Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Increasing Birth Rates

3.1.3. Cultural Influence on Toy Preferences

3.1.4. E-commerce Growth in Vietnam

3.2. Market Challenges

3.2.1. Low Penetration in Rural Areas

3.2.2. High Production Costs

3.2.3. Safety Concerns Related to Product Materials

3.3. Opportunities

3.3.1. Expansion of Licensing Deals (e.g., Movies, Cartoons)

3.3.2. Growth of Sustainable and Eco-friendly Toys

3.3.3. New Designs and Customization Trends

3.4. Trends

3.4.1. Increased Focus on Educational Toys

3.4.2. Adoption of Smart Toys with Interactive Features

3.4.3. Rise of Collectible Toys and Character-Based Merchandise

3.5. Government Regulations

3.5.1. Vietnam Toy Safety Regulations

3.5.2. Import Restrictions and Tariff Policies

3.5.3. Consumer Protection Laws

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Dolls and Stuffed Toys Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Dolls (Traditional, Fashion, Character-based)

4.1.2. Stuffed Animals (Animal-based, Fictional Characters)

4.1.3. Soft Toys with Educational Value

4.2. By Age Group (in Value %)

4.2.1. Toddlers (0-3 Years)

4.2.2. Preschoolers (4-7 Years)

4.2.3. Kids (8-12 Years)

4.3. By Sales Channel (in Value %)

4.3.1. Online Stores

4.3.2. Offline Retail (Toy Stores, Supermarkets)

4.4. By Material Type (in Value %)

4.4.1. Synthetic Materials

4.4.2. Organic/Eco-friendly Materials

4.5. By Region (in Value %)

4.5.1. Ho Chi Minh City

4.5.2. Hanoi

4.5.3. Central Vietnam

4.5.4. Mekong Delta

5. Vietnam Dolls and Stuffed Toys Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LEGO Group

5.1.2. Mattel, Inc.

5.1.3. Hasbro, Inc.

5.1.4. Simba Dickie Group

5.1.5. Bandai Namco Holdings Inc.

5.1.6. Spin Master Ltd.

5.1.7. Ty Inc.

5.1.8. VTech Holdings Ltd.

5.1.9. Takara Tomy Co., Ltd.

5.1.10. Giochi Preziosi S.p.A.

5.1.11. Green Toys Inc.

5.1.12. Funko, Inc.

5.1.13. Alpha Group Co., Ltd.

5.1.14. Sanrio Co., Ltd.

5.1.15. My Kingdom

5.2. Cross Comparison Parameters (Product Range, Target Age Group, Regional Presence, Revenue Contribution)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Dolls and Stuffed Toys Market Regulatory Framework

6.1. Toy Safety Certification Processes

6.2. Compliance Requirements

6.3. Import Regulations

7. Vietnam Dolls and Stuffed Toys Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Dolls and Stuffed Toys Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Age Group (in Value %)

8.3. By Sales Channel (in Value %)

8.4. By Material Type (in Value %)

8.5. By Region (in Value %)

9. Vietnam Dolls and Stuffed Toys Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified key variables such as market drivers, consumer preferences, and regulatory requirements that shape the Vietnam Dolls and Stuffed Toys market. Extensive desk research using industry reports, market databases, and government publications was conducted to map out the ecosystem of the market.

Step 2: Market Analysis and Construction

Historical data on sales, consumer demographics, and product preferences were compiled. We also analyzed key retail and distribution channels to determine the penetration rate of various product categories within the Vietnam dolls and stuffed toys market.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding future market trends and challenges were validated through interviews with industry professionals, including manufacturers, distributors, and regulatory experts. These consultations provided essential insights to fine-tune our market data.

Step 4: Research Synthesis and Final Output

In this final step, we synthesized data from manufacturers and suppliers to validate our findings. Our analysis was further verified by cross-checking sales and production volumes with industry reports to ensure accuracy in market projections.

Frequently Asked Questions

01. How big is the Vietnam Dolls and Stuffed Toys Market?

The Vietnam Dolls and Stuffed Toys market is currently valued at USD 168 million, based on a five-year historical analysis. The market is driven by the rising disposable incomes of Vietnamese consumers, particularly in urban areas, and the growing influence of Western entertainment, which has created demand for character-based dolls and toys.

02. What are the challenges in the Vietnam Dolls and Stuffed Toys Market?

The primary challenges include high production costs, especially for eco-friendly materials, and the slow penetration of modern retail channels in rural areas. Additionally, regulatory compliance adds complexity for international manufacturers.

03. Who are the major players in the Vietnam Dolls and Stuffed Toys Market?

Key players in this market include Mattel, Inc., LEGO Group, My Kingdom, Bandai Namco Holdings, and Spin Master Ltd. These companies have established themselves through their innovative product lines and strong distribution networks.

04. What are the growth drivers of the Vietnam Dolls and Stuffed Toys Market?

Growth drivers include the increasing adoption of online shopping, a rise in demand for licensed and educational toys, and a growing consumer base of young children in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.