Vietnam Elderly Care Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD4145

December 2024

91

About the Report

Vietnam Elderly Care Market Overview

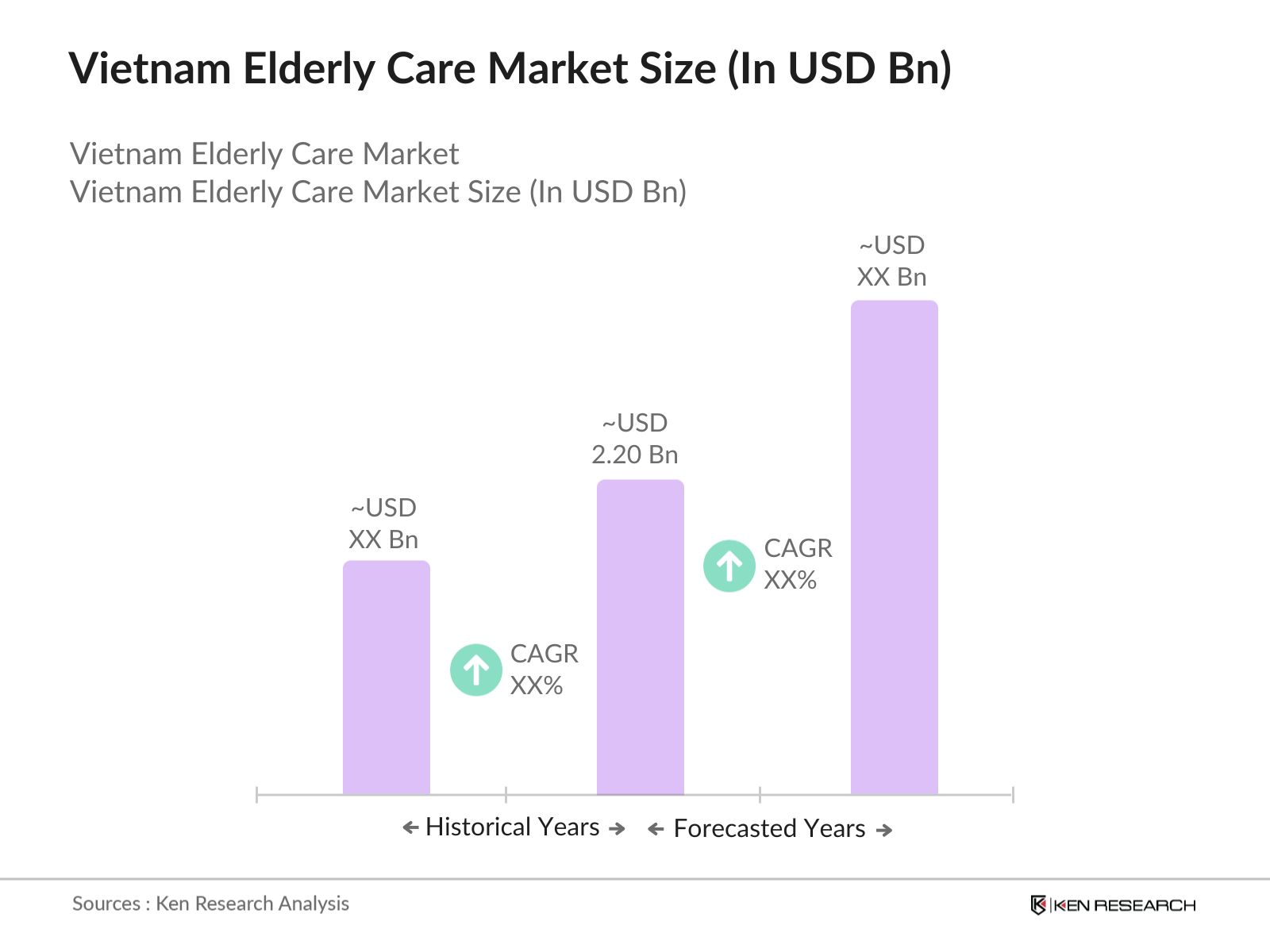

- The Vietnam Elderly Care Market is witnessing substantial growth, currently valued at USD 2.20 Bn, fueled by the rising elderly population, improved healthcare infrastructure, and increasing government support for elderly care initiatives. As of 2024, Vietnams population aged 60 and above exceeded 11.5 million, accounting for nearly 12% of the total population. This demographic shift is driving the demand for both home-based and facility-based elderly care services. The market includes a range of services such as assisted living, nursing homes, geriatric care management, and rehabilitation services.

- Major urban areas such as Ho Chi Minh City and Hanoi are leading the market, driven by their higher concentration of elderly citizens, advanced medical facilities, and a growing number of private and government-sponsored elderly care centers. These cities are also witnessing an increase in specialized care facilities catering to affluent families who seek premium care services for their elderly family members.

- The Vietnamese government has introduced various policies to improve elderly care, such as the National Action Program on Older People for 2021-2030, which aims to provide comprehensive care, including healthcare, social services, and financial support for the elderly. Additionally, the private sector has seen substantial investment in elderly care services, particularly in the form of home care services, which are gaining popularity due to the preference for in-home care among the elderly population.

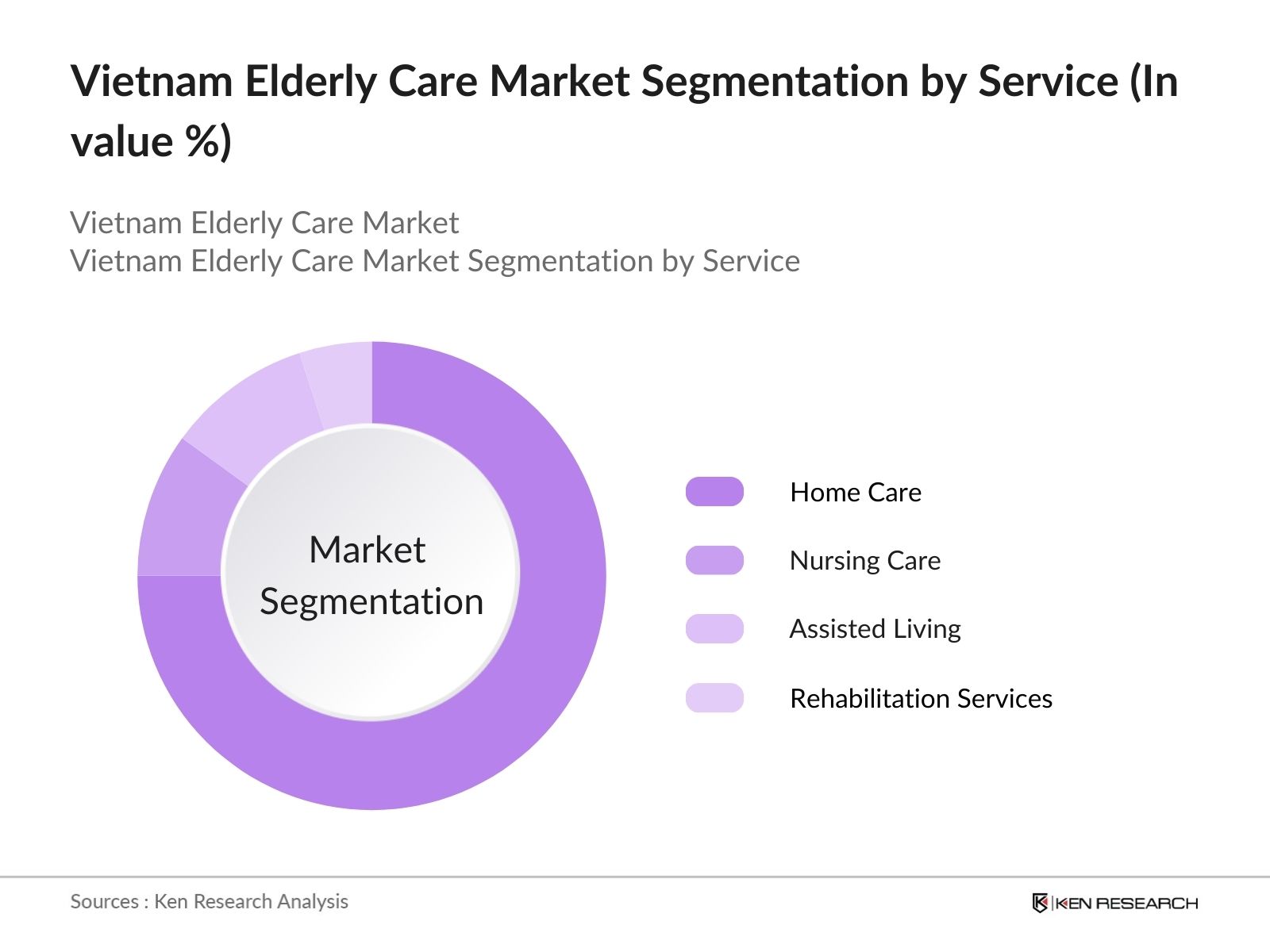

Vietnam Elderly Care Market Segmentation

- By Service Type: The market is segmented into home care, nursing care, assisted living, and rehabilitation services. Home care services hold the largest market share, driven by the preference for in-home care and affordability compared to institutional care. Nursing care is the second-largest segment, with increasing demand for professional medical attention for elderly individuals with chronic illnesses. Assisted living is emerging as a popular option for families seeking a balance between independence and professional care for their elderly relatives.

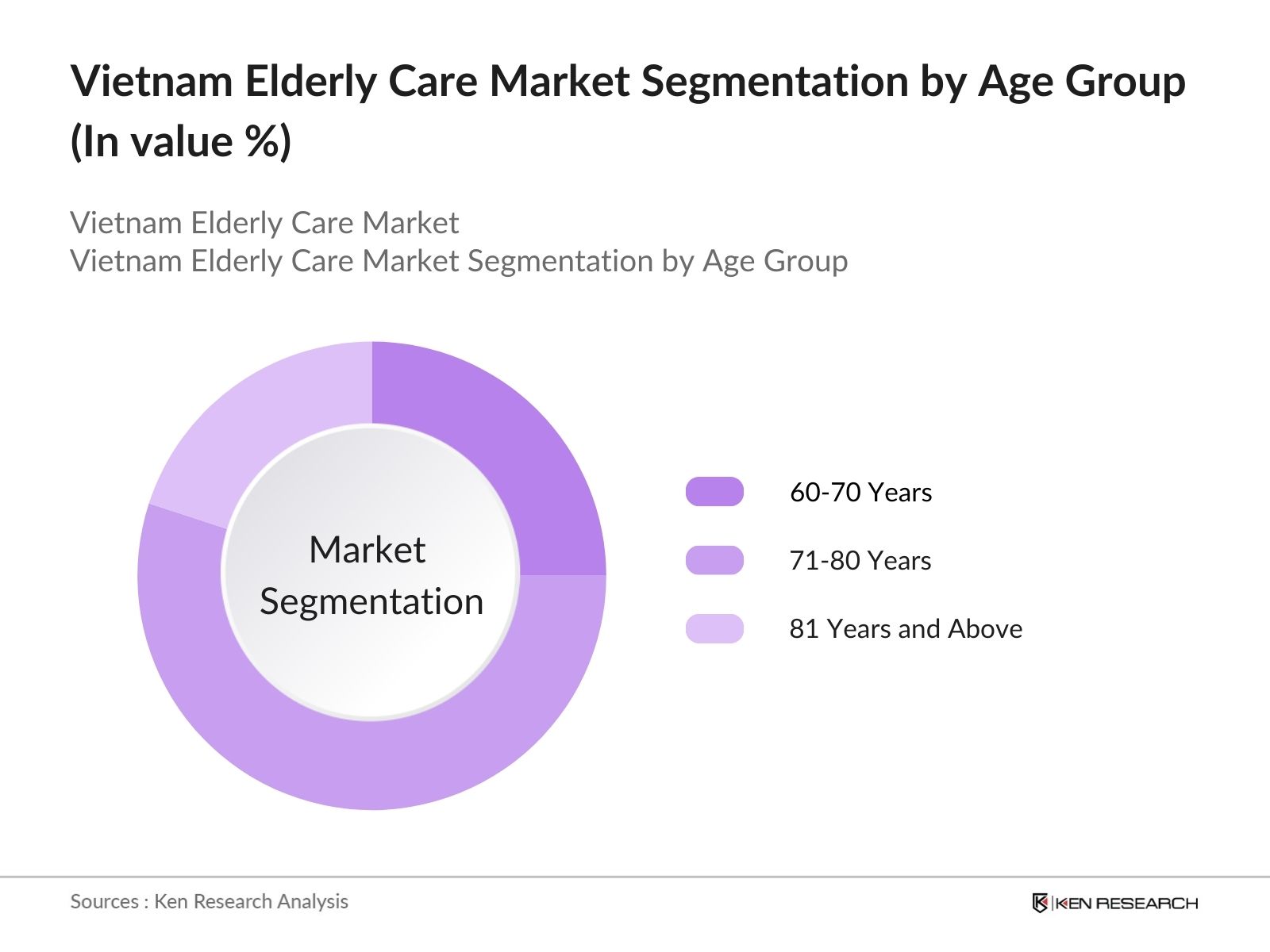

- By Age Group: The market is further segmented by age group into 60-70 years, 71-80 years, and 81 years and above. The 71-80 years age group dominates the market due to the higher prevalence of age-related health conditions requiring professional care. With a growing number of elderly individuals requiring long-term care, this age group represents the largest segment in the elderly care market. Geriatric care and specialized nursing services are particularly in demand among this age bracket.

Vietnam Elderly Care Market Competitive Landscape

The Vietnam Elderly Care Market is highly competitive, with local and international players actively participating to capture market share. Leading companies such as Vinmec International Hospital and Hoan My Medical Corporation dominate the healthcare segment, offering elderly care services through their specialized facilities. Private home care providers such as VinaHealth and Nhan Ai Homecare have also gained a strong presence in the market, providing affordable in-home care solutions.

The market is characterized by increasing investments in technology-driven elderly care services, such as telemedicine, remote health monitoring, and digital platforms for elderly care management. Companies are adopting innovative care models to meet the growing demand for personalized and accessible elderly care services.

|

Company Name |

Establishment Year |

Headquarters |

Key Services |

No. of Employees |

Revenue (USD) |

Market Reach |

Sustainability Initiatives |

R&D Investments |

Partnerships |

|

Vinmec International Hospital |

2012 |

Hanoi, Vietnam |

|||||||

|

Hoan My Medical Corporation |

1997 |

Ho Chi Minh City, Vietnam |

|||||||

|

VinaHealth |

2010 |

Ho Chi Minh City, Vietnam |

|||||||

|

Nhan Ai Homecare |

2015 |

Hanoi, Vietnam |

|||||||

|

Family Medical Practice Vietnam |

1994 |

Ho Chi Minh City, Vietnam |

Vietnam Elderly Care Market Analysis

Growth Drivers

- Rising Elderly Population: Vietnam is experiencing a rapid increase in its elderly population. By 2024, the number of people aged 60 and older is projected to reach around 13 million, up from 12.2 million in 2022. This growing demographic creates significant demand for elderly care services, which is expected to rise as Vietnam's population continues aging at one of the fastest rates in Southeast Asia. Vietnams government has recognized this shift, with plans to increase social security funds for elder care annually to accommodate growing needs.

- Private Sector Investment: Private sector investment in elderly care has surged significantly in Vietnam over recent years, reflecting a growing recognition of the economic potential within this sector. In 2023, private capital flows into geriatric hospitals, residential care facilities, and elderly care products reached all time high, marking a substantial increase compared to previous years. This growth is fueled by the increasing demand for high-quality, accessible elderly care services, driven by Vietnam's rapidly aging population. Several private companies, in collaboration with international healthcare providers and investors, are developing cutting-edge care facilities equipped with advanced medical technologies to meet the rising needs of elderly care.

- Increasing Disposable Income: Vietnams rapidly growing middle class and rising disposable income levels are fueling increased spending on healthcare services, particularly in the elderly care sector. By 2023, the average per capita income in Vietnam had risen to USD 4276, up from USD 4101 in 2022, allowing households to allocate a larger portion of their income towards premium elderly care services. This increase in disposable income has led to a notable 15% rise in household expenditure on health services for aging family members, further driving demand for specialized geriatric care, assisted living facilities, and home healthcare solutions.

Market Challenges

- Shortage of Skilled Caregivers: Vietnam is grappling with a significant shortage of skilled labor in the elderly care sector, a challenge that directly impacts the quality of services provided to the aging population. The demand for trained healthcare professionals specializing in geriatric care is rising sharply due to the countrys rapidly aging population, but the supply of qualified personnel is insufficient to meet the growing need. This shortage affects not only the availability of caregivers but also the quality of care offered in residential facilities and at-home care services. The gap is most noticeable in rural areas, where the need for elderly care is increasing but the availability of skilled workers remains limited.

- High Costs of Elderly Care Facilities: The cost of elderly care in Vietnam has become a growing concern, particularly for families with lower or moderate incomes. The rising expenses associated with care services, especially in urban centers, make it difficult for many families to afford quality care for their elderly members. The high costs are largely driven by inflation, increased wages for healthcare workers, and the general operational expenses of running care facilities. These financial pressures are passed on to consumers, making elderly care services less accessible to a broad segment of the population.

Vietnam Elderly Care Market Future Outlook

The Vietnam Elderly Care Market is expected to grow significantly, driven by an aging population, increasing demand for home-based care, and government initiatives aimed at improving elderly care services. The market is projected to witness the expansion of both home care and facility-based services, with the integration of digital health technologies playing a pivotal role in shaping the future of elderly care in Vietnam.

Future Market Opportunities

- Integration of Digital Health Solutions: The adoption of digital health solutions in Vietnams elderly care sector is gaining significant momentum, transforming the way care is delivered and managed. These digital platforms, including mobile health applications, allow elderly individuals and their families to manage medication schedules, book medical appointments, and monitor health conditions from the comfort of their homes. In recent years, the government has actively promoted the digitization of healthcare records, encouraging the adoption of e-health solutions that improve patient outcomes and healthcare efficiency.

- Expansion into Rural Areas: Vietnams elderly care market is witnessing substantial opportunities for growth in rural areas, where a large portion of the countrys elderly population resides. These regions, often underserved by healthcare services, are becoming the focus of both government initiatives and private sector investment aimed at improving access to elderly care. The government has launched programs to develop care facilities in rural areas, recognizing the need to address the growing demand for elderly care services outside of major cities. The expansion of infrastructure in these areas is critical, as rural regions tend to have fewer healthcare resources, and the elderly population faces challenges in accessing proper care due to geographic and financial constraints.

Scope of the Report

|

By Service Type |

Home Care Nursing Care Assisted Living Rehabilitation Services |

|

By Age Group |

60-70 Years 71-80 Years 81 Years and Above |

|

By Care Provider |

Private Providers Government-Supported Providers NGOs/Charity Organizations |

|

By Payment Model |

Out-of-Pocket Insurance Coverage Government Subsidies Private Funding |

|

By Region |

Northern Central Southern |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Ministry of Labour, Invalids and Social Affairs)

Healthcare Providers

Elderly Care Facilities

Home Care Service Providers

Insurance Companies

Technology Solution Providers

Pharmaceutical Companies

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Vinmec International Hospital

Hoan My Medical Corporation

VinaHealth

Nhan Ai Homecare

Family Medical Practice Vietnam

FV Hospital

Sunflower Nursing Care

Jio Health

Victoria Healthcare

An Binh Nursing Home

Tam Duc Nursing Home

Peaceful Life Elderly Care

Happy Senior Care Vietnam

Medcare Home Health Services

Hanoi French Hospital

Table of Contents

1. Vietnam Elderly Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Elderly Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Elderly Care Market Analysis

3.1. Growth Drivers (Rising Elderly Population, Government Policies, Private Sector Investment, Increasing Disposable Income)

3.2. Market Challenges (Skilled Labor Shortages, High Cost of Elderly Care, Infrastructure Constraints, Regional Disparities)

3.3. Opportunities (Telemedicine, Digital Health Solutions, Expansion into Rural Areas, Affordable Care Solutions)

3.4. Trends (Smart Home Care Integration, Aging Population, Specialized Geriatric Services, Technological Advancements in Care)

3.5. Government Regulation (National Action Program on Older People, Financial Aid, Geriatric Healthcare Reforms, Public-Private Partnerships)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Threat of New Entrants, Competitive Rivalry, Threat of Substitutes)

3.9. Competition Ecosystem

4. Vietnam Elderly Care Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Home Care

4.1.2. Nursing Care

4.1.3. Assisted Living

4.1.4. Rehabilitation Services

4.2. By Age Group (In Value %)

4.2.1. 60-70 Years

4.2.2. 71-80 Years

4.2.3. 81 Years and Above

4.3. By Care Provider (In Value %)

4.3.1. Private Providers

4.3.2. Government-Supported Providers

4.3.3. NGOs/Charity Organizations

4.4. By Payment Model (In Value %)

4.4.1. Out-of-Pocket

4.4.2. Insurance Coverage

4.4.3. Government Subsidies

4.4.4. Private Funding

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

4.5.4. Rural vs. Urban Breakdown

5. Vietnam Elderly Care Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1. Vinmec International Hospital

5.1.2. Hoan My Medical Corporation

5.1.3. VinaHealth

5.1.4. Nhan Ai Homecare

5.1.5. FV Hospital

5.1.6. Family Medical Practice Vietnam

5.1.7. Hanoi French Hospital

5.1.8. Medcare Home Health Services

5.1.9. Sunflower Nursing Care

5.1.10. Jio Health

5.1.11. Victoria Healthcare

5.1.12. An Binh Nursing Home

5.1.13. Tam Duc Nursing Home

5.1.14. Peaceful Life Elderly Care

5.1.15. Happy Senior Care Vietnam

5.2 Cross Comparison Parameters (Inception Year, Revenue, Headquarters, No. of Employees, Market Reach, Key Services, Digital Health Initiatives, Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

6. Vietnam Elderly Care Market Regulatory Framework

6.1. Licensing Requirements for Elderly Care Providers

6.2. Compliance with Healthcare Standards

6.3. Certification Processes for Elderly Care Facilities

6.4. Government Initiatives to Support Elderly Care

7. Vietnam Elderly Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Elderly Care Market Analysts' Recommendations

8.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) Analysis

8.2. Customer Segmentation Strategies

8.3. Investment Opportunities

8.4. White Space Opportunity Analysis

9. Vietnam Elderly Care Future Market Segmentation

9.1. By Service Type (In Value %)

9.2. By Age Group (In Value %)

9.3. By Care Provider (In Value %)

9.4. By Payment Model (In Value %)

9.5. By Region (In Value %)

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we identify and define the critical variables impacting the Vietnam Elderly Care Market. Using a combination of desk research and proprietary databases, we map out major stakeholders and their roles within the market ecosystem. The objective is to outline the variables that influence market size, demand, and growth trends.

Step 2: Market Analysis and Construction

We analyze historical data and market penetration, focusing on service providers and the corresponding revenue streams generated from elderly care services. Special attention is given to emerging trends such as home care solutions, ensuring the reliability of growth projections.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses, developed through quantitative analysis, are validated through expert interviews with market professionals. These consultations offer critical insights into operational challenges, service adoption rates, and the evolving preferences of the elderly population.

Step 4: Research Synthesis and Final Output

The final step synthesizes all research data through bottom-up and top-down methodologies. Market size projections and segmentation details are refined through direct engagement with elderly care providers, ensuring accuracy and reliability in the final report.

Frequently Asked Questions

01. How big is the Vietnam Elderly Care Market?

The Vietnam elderly care market is valued at USD 2.20 billion, driven by the rising elderly population and increased demand for home care services.

02. What are the challenges in the Vietnam Elderly Care Market?

Challenges in the Vietnam elderly care market include skilled labor shortages, high costs of elderly care facilities, and disparities in care accessibility between rural and urban regions.

03. Who are the major players in the Vietnam Elderly Care Market?

Key players in the Vietnam elderly care market include Vinmec International Hospital, Hoan My Medical Corporation, VinaHealth, Nhan Ai Homecare, and Family Medical Practice Vietnam.

04. What are the growth drivers of the Vietnam Elderly Care Market?

The Vietnam elderly care market is propelled by an aging population, government support, increasing disposable income, and the rising demand for home care solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.