Vietnam Energy Management Market Outlook 2030

Region:Asia

Author(s):Shivani Mehra

Product Code:KROD8064

December 2024

99

About the Report

Vietnam Energy Management Market Overview

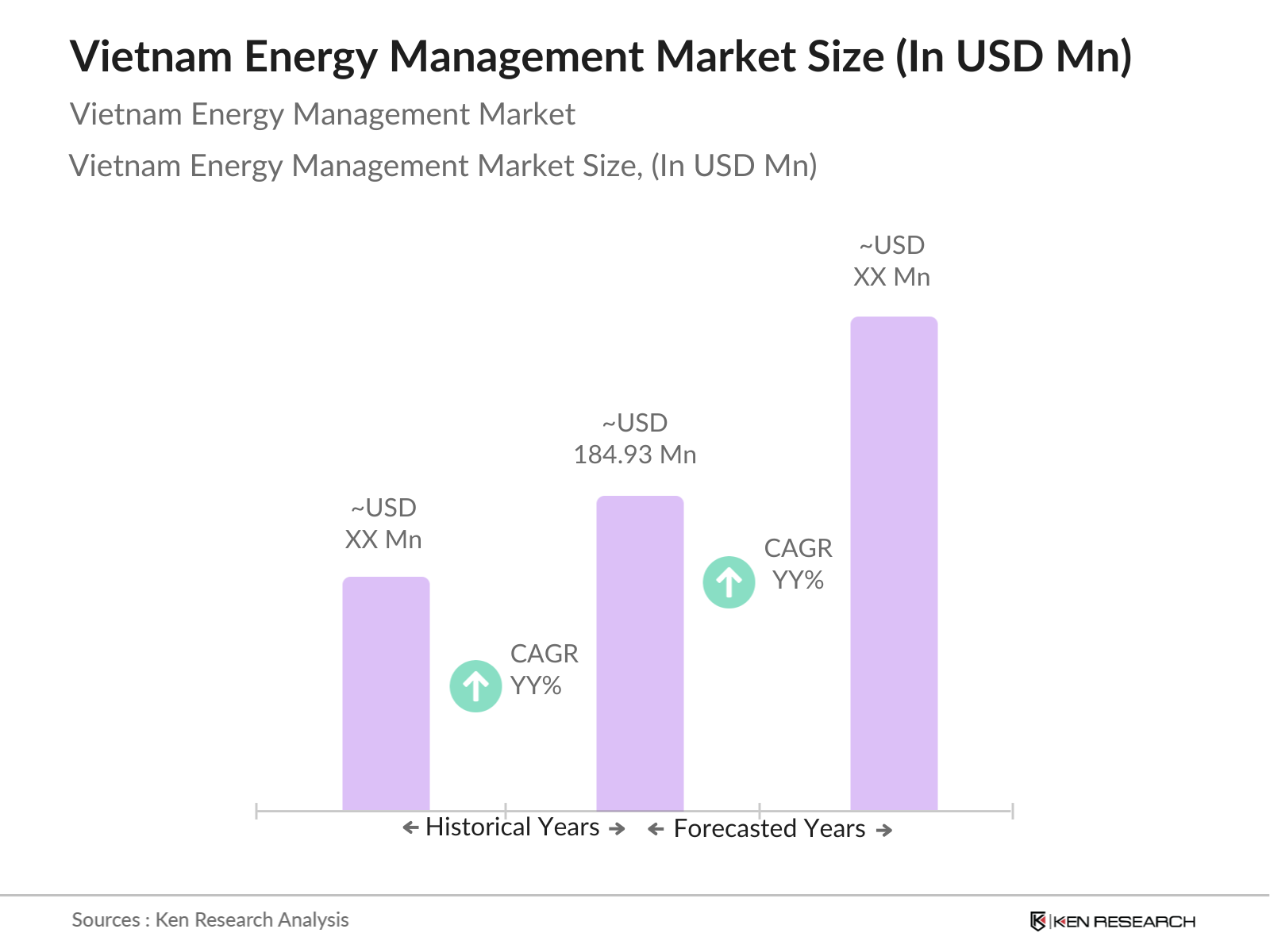

- The Vietnam Energy Management market is valued at USD 184.93 million, driven by increasing energy demands and significant government initiatives aimed at improving energy efficiency. The rapid urbanization and industrial growth in Vietnam have led to a surge in energy consumption, prompting both public and private sectors to invest heavily in energy management solutions. Government policies focusing on renewable energy adoption and energy conservation are also contributing to market growth, as organizations seek to reduce operational costs and improve sustainability.

- Major cities such as Ho Chi Minh City and Hanoi dominate the Vietnam Energy Management market due to their high energy consumption levels and the presence of numerous industrial facilities. These cities are focal points for economic activity, attracting investments in energy-efficient technologies and infrastructure. The government's commitment to transforming these urban areas into smart cities further enhances their dominance in the energy management landscape, driving innovation and implementation of advanced energy solutions.

- Vietnam's National Energy Development Plans outline a comprehensive strategy for the energy sector, focusing on reducing dependence on fossil fuels and promoting renewable energy sources. The latest plan includes initiatives to significantly increase the share of renewables in the energy mix. The government has committed to investing around $18 billion to develop energy infrastructure and ensure sustainable energy availability. These initiatives reflect Vietnam's proactive approach to addressing energy challenges, fostering economic growth, and enhancing environmental sustainability. The commitment to renewables is integral to achieving a more resilient and diversified energy future.

Vietnam Energy Management Market Segmentation

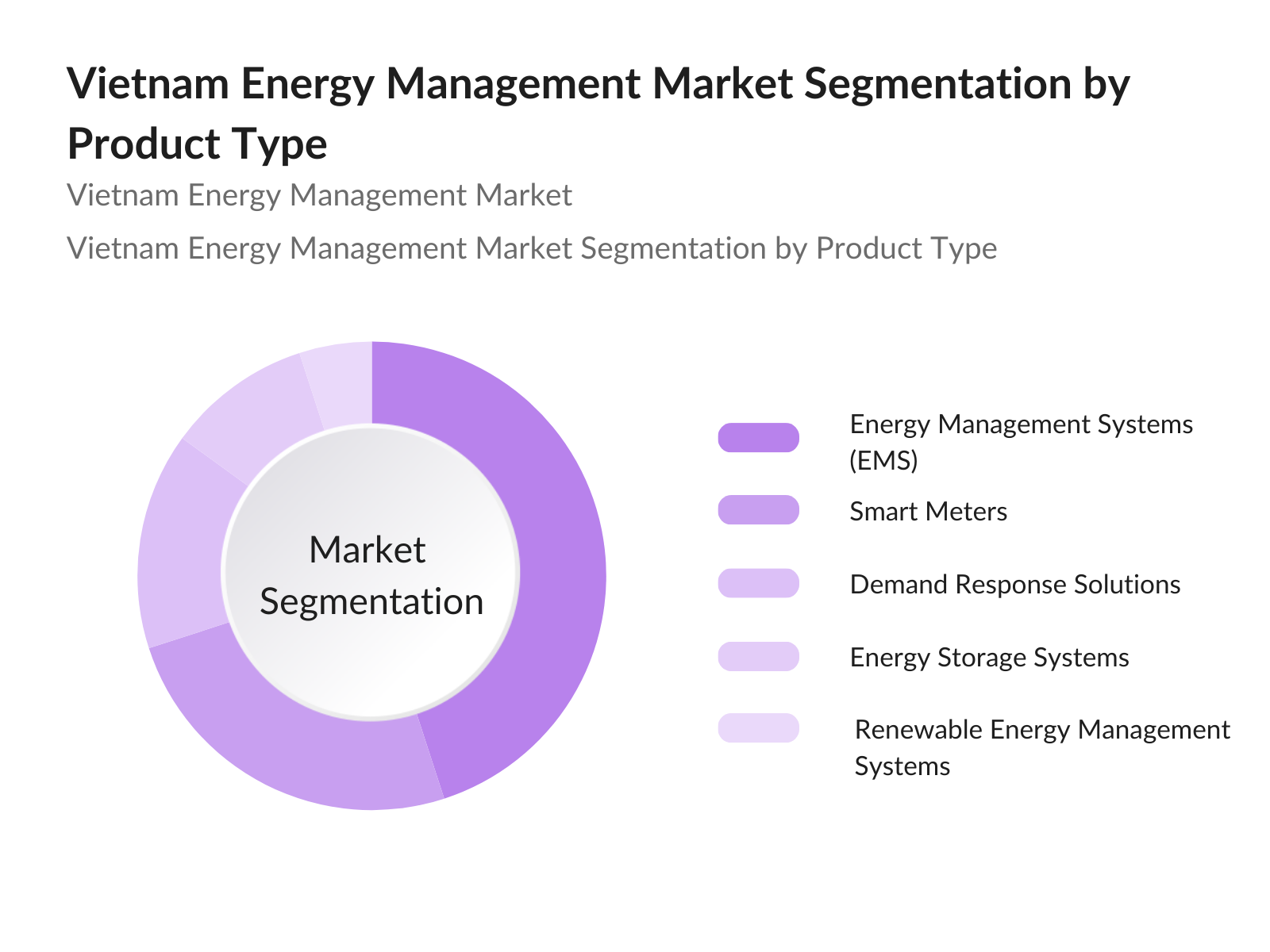

- By Product Type: The Vietnam Energy Management market is segmented by product type into Energy Management Systems (EMS), Smart Meters, Demand Response Solutions, Energy Storage Systems, and Renewable Energy Management Systems. Currently, Energy Management Systems (EMS) hold a dominant market share due to their ability to provide real-time data analytics and optimization capabilities for energy consumption. Businesses increasingly rely on EMS to enhance operational efficiency, reduce costs, and comply with governmental energy regulations. As the demand for energy efficiency grows, the adoption of EMS is becoming essential for enterprises aiming to maintain competitiveness in a rapidly evolving market.

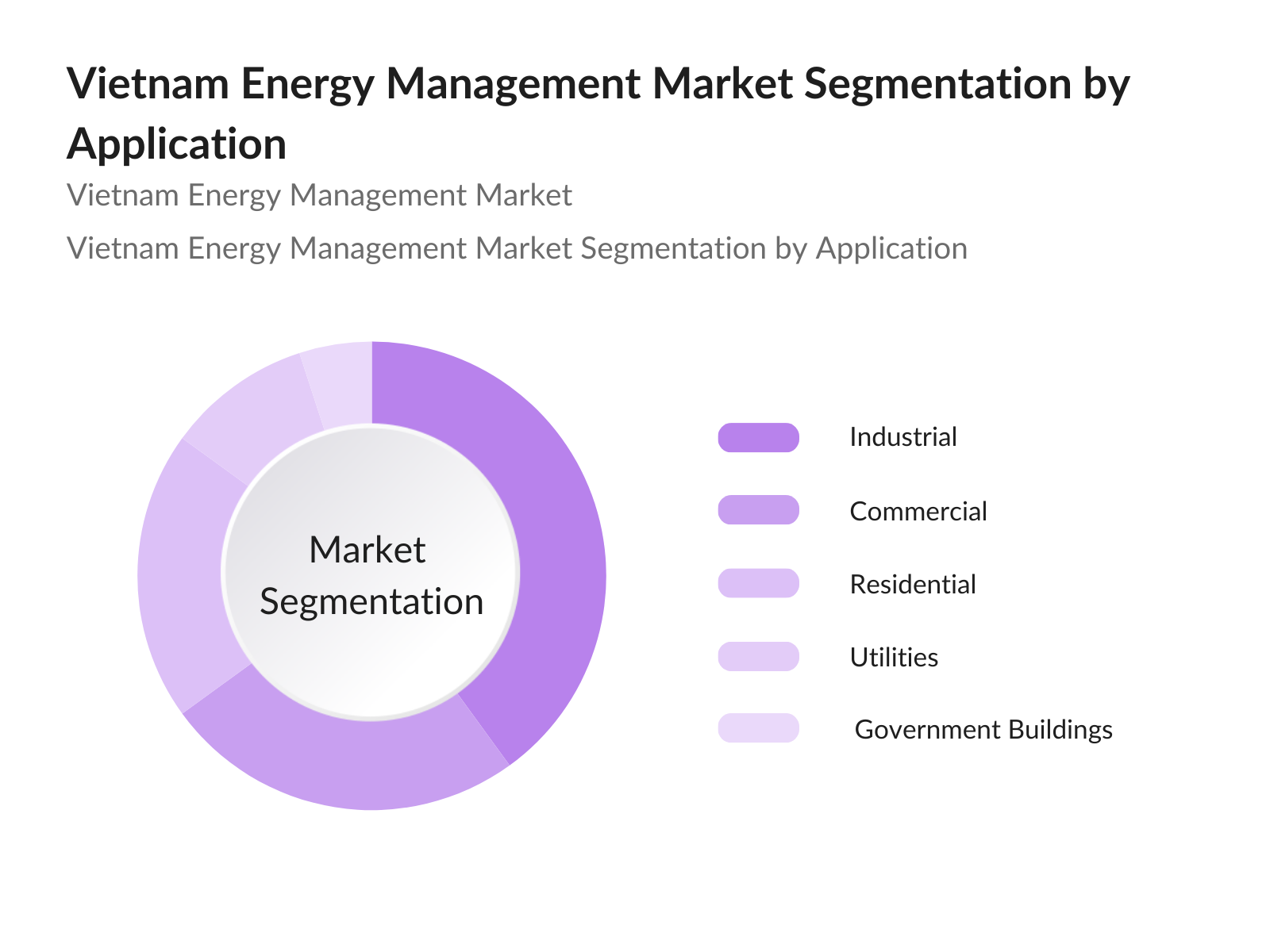

- By Application: The market is further segmented by application into Industrial, Commercial, Residential, Utilities, and Government Buildings. The industrial segment commands a significant market share due to the high energy consumption associated with manufacturing and production processes. Industries are increasingly adopting energy management solutions to optimize their energy use and enhance productivity. The focus on reducing energy costs and meeting regulatory standards is propelling the demand for energy management solutions in this sector, making it a key driver of market growth.

Vietnam Energy Management Market Competitive Landscape

The Vietnam Energy Management market is characterized by the presence of a few major players, including local and international companies. This consolidation highlights the significant influence of these key companies in driving innovation and maintaining competitive advantage. The major players include Siemens AG, Schneider Electric, Honeywell International Inc., ABB Ltd., and General Electric, which collectively hold a substantial share of the market, driven by their advanced technology offerings and strong customer relationships.

Vietnam Energy Management Market Analysis

Market Growth Drivers

- Increasing Energy Demand: Vietnam's energy demand has been growing rapidly, with significant increases expected as the country continues to develop economically. The industrial sector is a major driver of this demand, consuming a substantial portion of the total electricity produced. The country is experiencing notable economic growth, with its GDP anticipated to reach around $406 billion in 2024. Urbanization and industrialization are accelerating, leading to a corresponding rise in energy requirements. This growing need underscores the urgency for enhanced energy management solutions to ensure a sustainable energy supply for both residential and industrial consumers.

- Government Initiatives and Policies: The Vietnamese government has implemented various policies to support energy development, including the National Power Development Plan 8 (PDP8), which aims to enhance the capacity and efficiency of the energy sector. The government is committed to reducing greenhouse gas emissions through its Nationally Determined Contributions (NDC). Additionally, the Energy Efficiency Law promotes energy-saving practices, emphasizing the importance of improving energy efficiency across all sectors.

- Industrial Energy Efficiency Programs: Vietnam's industrial sector is pivotal to its economy, contributing significantly to the country's GDP in 2022. To improve energy efficiency, the government has launched initiatives such as the Vietnam Energy Efficiency Program (VNEEP), which aims to enhance energy-saving practices across various industries. This program focuses on optimizing energy consumption, which is particularly important in energy-intensive sectors like textiles and cement. The implementation of advanced energy management systems is crucial for these industries, as it helps optimize operations, reduce costs, and promote sustainable energy usage, thereby supporting overall economic growth.

Market Challenges:

- High Capital Investment: Investing in energy management systems in Vietnam requires substantial capital. For instance, the development of a single solar power plant can range from $1 million to $3 million per megawatt. With the growing need for advanced technologies, the financial burden becomes considerable, particularly for small and medium-sized enterprises (SMEs), which make up a large portion of the total businesses in Vietnam. Additionally, the initial costs of energy-efficient technologies can deter widespread adoption, posing a challenge to market growth despite the long-term savings they provide. Addressing these financial barriers is essential for promoting energy efficiency in the sector.

- Technological Barriers: Vietnam faces several technological challenges that hinder advancements in energy management. Many existing systems are outdated, leading to inefficiencies in energy use and management. Additionally, there is a lack of skilled labor proficient in advanced energy technologies, which has created a knowledge gap within the workforce. The energy sector is projected to require significant upskilling to meet the demand for modern energy management practices. These technological barriers impede the transition to more efficient and sustainable energy systems, making it essential for the country to invest in workforce development and technology upgrades to enhance energy management capabilities.

Vietnam Energy Management Market Future Outlook

Over the next five years, the Vietnam Energy Management market is expected to witness substantial growth, driven by ongoing government support, technological advancements, and increasing consumer demand for sustainable energy solutions. The Vietnamese government's commitment to enhancing energy efficiency and promoting renewable energy will play a crucial role in shaping the market landscape. As more businesses prioritize sustainability and seek to lower their carbon footprints, energy management solutions will become integral to operational strategies.

Market Opportunities:

- Integration of IoT in Energy Management: The integration of Internet of Things (IoT) technology in energy management is transforming the sector in Vietnam. IoT applications enable real-time monitoring and management of energy consumption, leading to improved efficiency. The number of IoT devices in the energy sector is expected to reach 30 million by 2025, facilitating better data collection and analysis. This trend supports the implementation of smart grids and enhances the overall effectiveness of energy management systems, allowing for more responsive energy supply solutions.

- Digital Transformation in Energy Sector: Digital transformation is reshaping Vietnam's energy sector, with a significant emphasis on data analytics and automation. Many energy companies in Vietnam are investing in digital technologies to enhance operational efficiency. The adoption of big data analytics, artificial intelligence (AI), and machine learning in energy management is becoming increasingly common, enabling companies to optimize resource allocation and improve decision-making processes.

Scope of the Report

|

By Product Type |

Energy Management Systems (EMS) |

|

By Application |

Industrial |

|

By Technology |

Cloud-based Solutions |

|

By End-User |

Energy Producers |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Trade, Ministry of Natural Resources and Environment)

Utility Companies

Industrial Corporations

Commercial Property Owners

Renewable Energy Developers

Energy Service Companies (ESCOs)

Environmental NGOs

Companies

Players Mentioned in the report

Siemens AG

Schneider Electric

Honeywell International Inc.

ABB Ltd.

General Electric

Rockwell Automation

Johnson Controls

Mitsubishi Electric

Emerson Electric Co.

Cisco Systems, Inc.

Panasonic Corporation

Eaton Corporation

Siemens Gamesa Renewable Energy

Tetra Tech, Inc.

Wrtsil Corporation

Table of Contents

1. Vietnam Energy Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Energy Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Energy Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Energy Demand

3.1.2. Government Initiatives and Policies

3.1.3. Rise of Renewable Energy Sources

3.1.4. Industrial Energy Efficiency Programs

3.2. Market Challenges

3.2.1. High Capital Investment

3.2.2. Technological Barriers

3.2.3. Regulatory Compliance Issues

3.3. Opportunities

3.3.1. Smart Grid Technology Adoption

3.3.2. Energy Storage Solutions

3.3.3. Public-Private Partnerships

3.4. Trends

3.4.1. Integration of IoT in Energy Management

3.4.2. Focus on Sustainability and Carbon Neutrality

3.4.3. Digital Transformation in Energy Sector

3.5. Government Regulation

3.5.1. National Energy Development Plans

3.5.2. Incentives for Renewable Energy Projects

3.5.3. Energy Conservation Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Energy Management Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Energy Management Systems (EMS)

4.1.2. Smart Meters

4.1.3. Demand Response Solutions

4.1.4. Energy Storage Systems

4.1.5. Renewable Energy Management Systems

4.2. By Application (In Value %)

4.2.1. Industrial

4.2.2. Commercial

4.2.3. Residential

4.2.4. Utilities

4.2.5. Government Buildings

4.3. By Technology (In Value %)

4.3.1. Cloud-based Solutions

4.3.2. On-premise Solutions

4.3.3. Hybrid Solutions

4.4. By End-user (In Value %)

4.4.1. Energy Producers

4.4.2. Energy Consumers

4.4.3. Energy Service Companies

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Southern Vietnam

4.5.3. Central Vietnam

5. Vietnam Energy Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. Schneider Electric

5.1.3. Honeywell International Inc.

5.1.4. ABB Ltd.

5.1.5. General Electric

5.1.6. Rockwell Automation

5.1.7. Johnson Controls

5.1.8. Mitsubishi Electric

5.1.9. Emerson Electric Co.

5.1.10. Yokogawa Electric Corporation

5.1.11. Cisco Systems, Inc.

5.1.12. Panasonic Corporation

5.1.13. Eaton Corporation

5.1.14. Siemens Gamesa Renewable Energy

5.1.15. Tetra Tech, Inc.

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Innovation Index, Geographic Reach, Customer Base, Revenue Growth Rate, R&D Investment, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Energy Management Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam Energy Management Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Energy Management Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-user (In Value %)

8.5. By Region (In Value %)

9. Vietnam Energy Management Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Energy Management market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam Energy Management market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple energy management solution providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Energy Management market.

Frequently Asked Questions

01. How big is the Vietnam Energy Management market?

The Vietnam Energy Management market is valued at USD 184.93 million, driven by increasing energy demands and significant government initiatives aimed at improving energy efficiency.

02. What are the challenges in the Vietnam Energy Management market?

Challenges in the Vietnam Energy Management market include high capital investment for implementing advanced technologies and regulatory compliance issues that can hinder market entry for new players.

03. Who are the major players in the Vietnam Energy Management market?

Key players in the market include Siemens AG, Schneider Electric, Honeywell International Inc., ABB Ltd., and General Electric. These companies dominate due to their advanced technology offerings and strong customer relationships.

04. What are the growth drivers of the Vietnam Energy Management market?

The market is propelled by increasing energy demands, government support for renewable energy initiatives, and the need for energy efficiency across various sectors, including industrial and commercial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.