Vietnam Fiber Optic Component Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1832

November 2024

85

About the Report

Vietnam Fiber Optic Component Market Overview

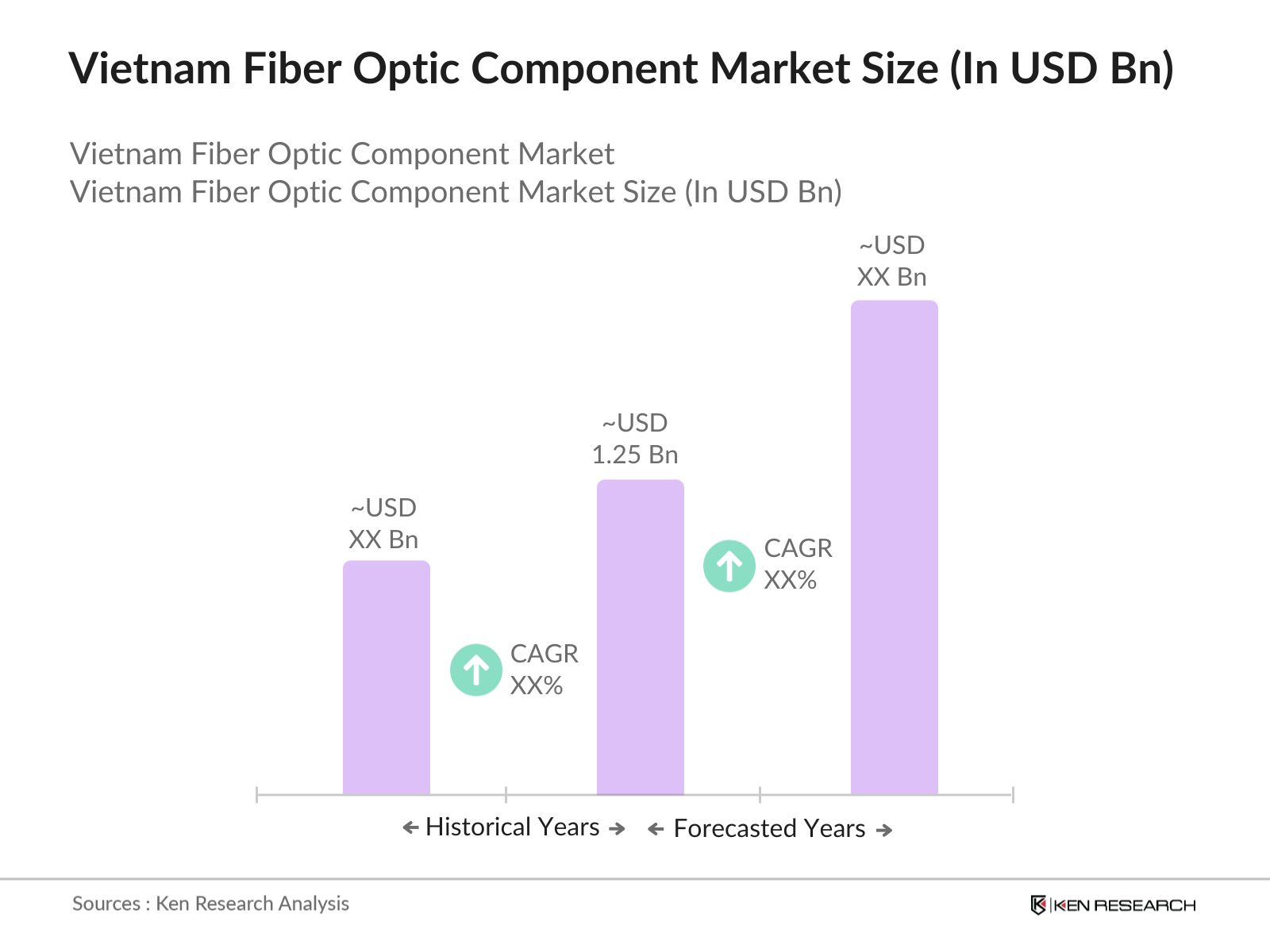

- The Vietnam fiber optic component market was valued at USD 1.25 billion in 2023, driven by increasing demand for high-speed internet, expansion of telecommunication infrastructure, and government initiatives to boost digital transformation. The growth of 5G networks and fiber-to-the-home (FTTH) deployments has contributed to the market expansion. Government policies promoting the development of smart cities and digital economy initiatives are further propelling the market.

- Major players in the Vietnam fiber optic component market include FPT Telecom, Viettel Group, VNPT, Huawei Technologies, and ZTE Corporation. These companies dominate the market with their advanced product offerings, extensive distribution networks, and strategic partnerships to enhance technology adoption in the country.

- Cities like Ho Chi Minh City, Hanoi, and Da Nang lead in market share, reflecting their strategic importance in the nation's digital infrastructure development. These cities are hubs for technological innovation and broadband adoption, driving the fiber optic component market forward. The market is predominantly concentrated in these urban centers due to the growing demand for high-speed connectivity and smart city projects.

- By the end of 2022, VNPT, Vietnam Military Telecoms Co., and FPT Telecom collectively reached over 18 million fiber customers. This important milestone reflects the rapid expansion of fiber optic networks in Vietnam, driven by these major ISPs to enhance broadband penetration and support the country's digital economy goals.

Vietnam Fiber Optic Component Market Segmentation

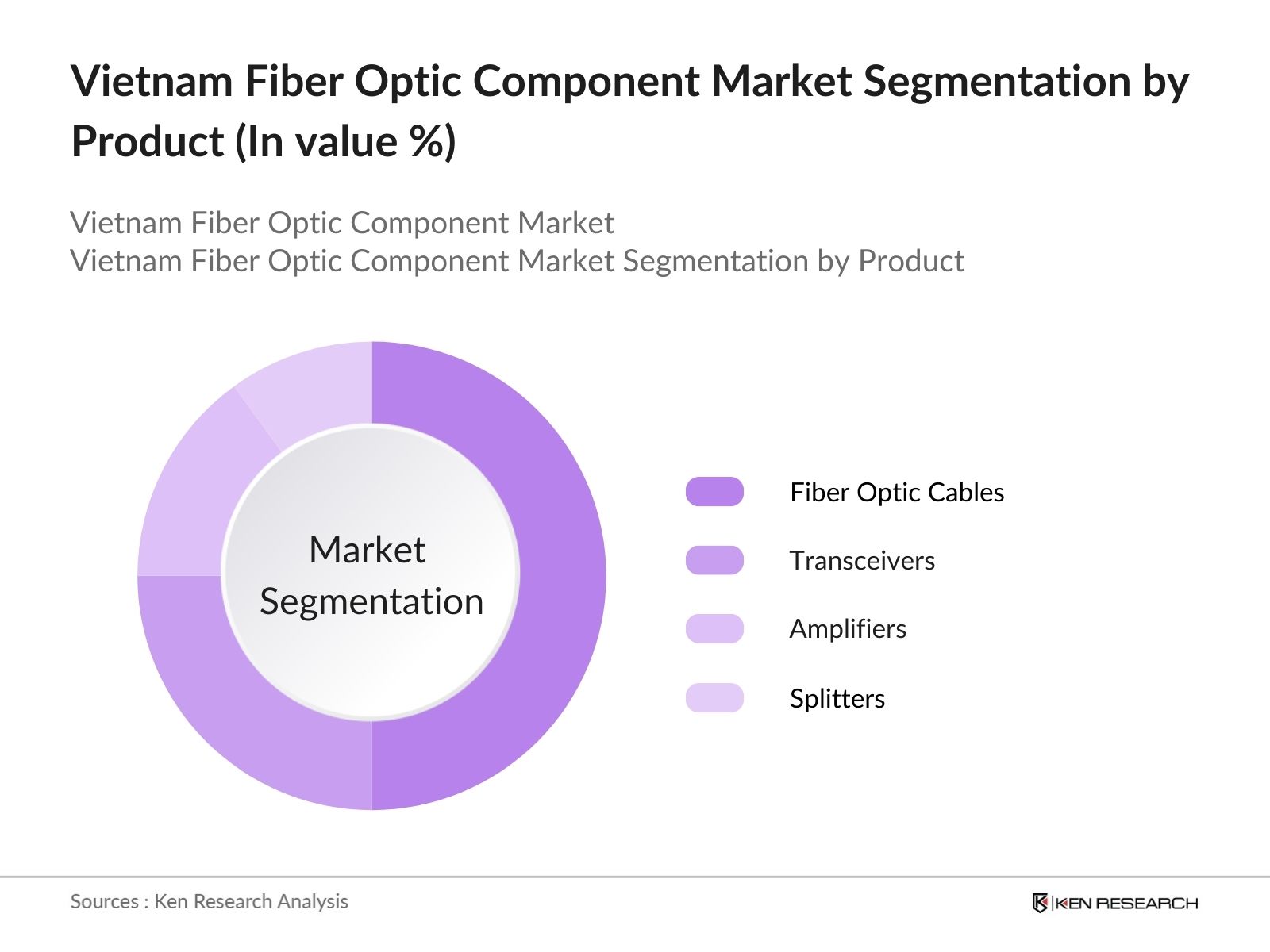

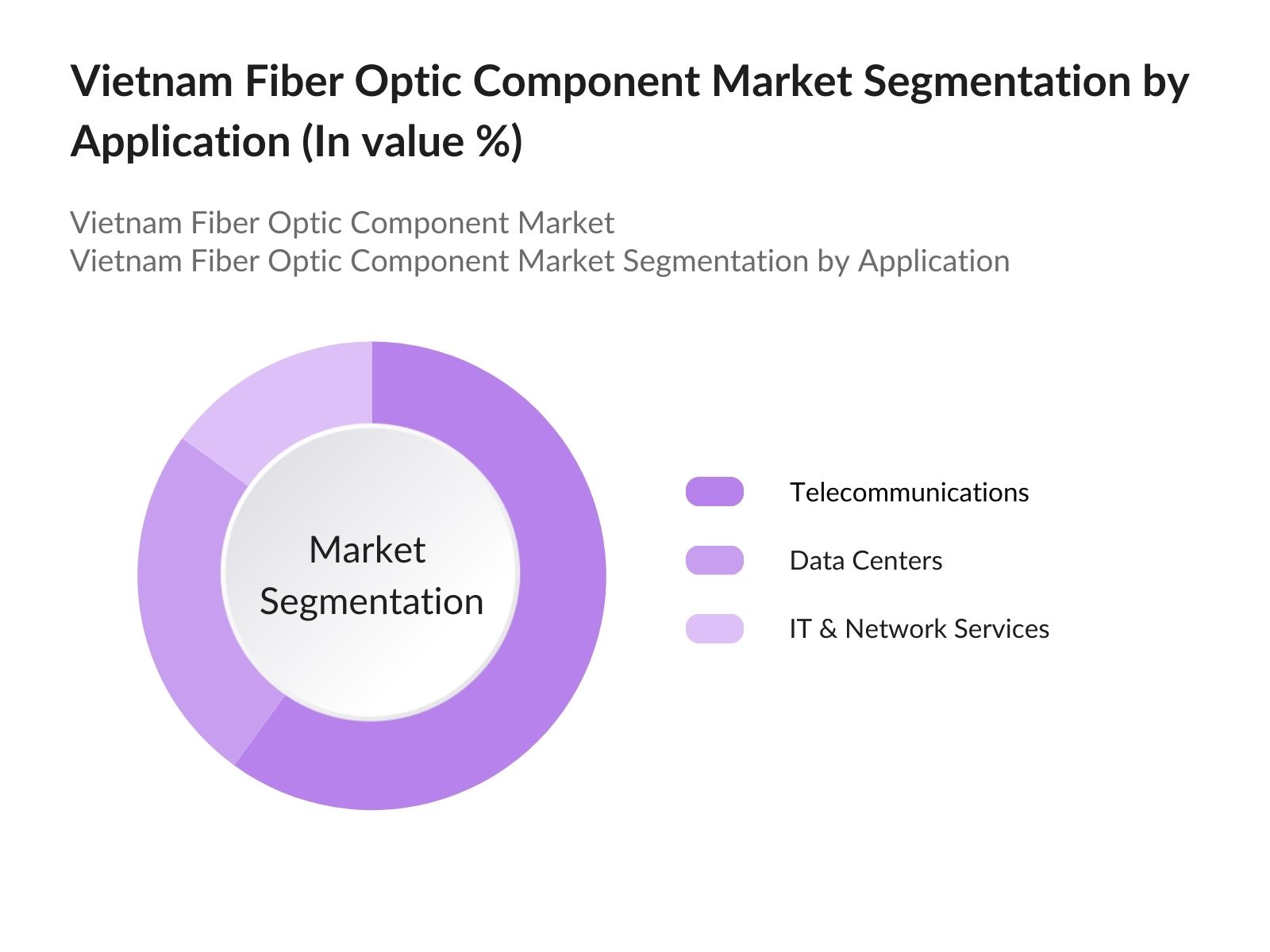

The Vietnam fiber optic component market is segmented by product type, application, and region.

- By Product Type: The market is segmented into fiber optic cables, transceivers, amplifiers, and splitters. In 2023, fiber optic cables held the dominant market share due to their essential role in supporting high-speed data transmission and network reliability. FPT Telecom and Viettel Group are leading manufacturers in this segment, providing a range of cables equipped with advanced features for robust and scalable network infrastructure.

- By Application: The market is segmented by application into telecommunications, data centers, and IT & network services. Telecommunications dominated the market in 2023, driven by the rapid expansion of 5G networks and increasing demand for reliable and high-speed internet services. The integration of advanced fiber optic components has further enhanced network performance, contributing to the dominance of this segment.

- By Region: The market is segmented regionally into North Vietnam, South Vietnam, Central Vietnam, and the Mekong Delta. In 2023, North Vietnam dominated the market share due to its status as a key economic and technological hub, with substantial investments in digital infrastructure. South Vietnam follows, with substantial adoption driven by industrial growth and urbanization.

Vietnam Fiber Optic Component Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

FPT Telecom |

1988 |

Hanoi, Vietnam |

|

Viettel Group |

1989 |

Hanoi, Vietnam |

|

VNPT |

1995 |

Hanoi, Vietnam |

|

Huawei Technologies |

1987 |

Shenzhen, China |

|

ZTE Corporation |

1985 |

Shenzhen, China |

- FPT Telecom: FPT plans to expand its Data Center infrastructure, aiming to inaugurate the District 9 Data Center by the end of 2024. This new facility will be one of the largest in Vietnam, featuring over 3,000 rack cabinets, as part of FPT's strategy to become the premier provider of Data Center Services in the region.

- Viettel Group: In February2023, Viettel collaboratedwith Nokia to establisha pioneeringDense Wavelength DivisionMultiplexing (DWDM) network. Thisproject utilizesNokia's advanced PSE-V optical engines, enabling the transmissionof a 600Gb/s channel.This solutionis part of Viettel's efforts toexpand its network capacityto 25.2 Tbps inthe C-band, with potentialfor further enhancement usingL-band components.

Vietnam Fiber Optic Component Market Analysis

Growth Drivers:

- Increasing Demand for High-Speed Internet: The surge in demand for high-speed internet services, driven by the growth of 5G networks and FTTH deployments, is an important growth driver in the Vietnam fiber optic component market. As of January 2023, Vietnam had 77.93 million internet users, which accounts for 79.1% of the total population. In 2024, urban areas in Vietnam have witnessed substantial investments in fiber optic networks, resulting in increased internet speeds and better connectivity. The market is expected to grow further as more regions gain access to high-speed internet.

- Government Support for Digital Transformation: The Vietnamese governments focus on digital transformation is another crucial driver for the fibre optic component market. As of 2023, Vietnam had 28 data centers with a total capacity of 45 MW. Initiatives like the National Digital Transformation Program aim to increase internet penetration and promote smart city projects across the country. In 2023, government policies encouraging investments in digital infrastructure played a pivotal role in the markets growth.

- Rising Adoption of Smart City Projects: The adoption of smart city projects in major cities like Ho Chi Minh City and Hanoi is driving the demand for advanced fiber optic components. About 30 cities andprovinces inVietnam haveimplemented smarturban constructionprojects, including HoChi Minh City andHanoi. These projects require robust and scalable network infrastructure, which is being facilitated by the deployment of high-quality fiber optic cables and components.

Challenges:

- Regulatory Hurdles: The market in Vietnam faces challenges due to complex regulatory requirements and lengthy approval processes. Obtaining the necessary permits for deploying fiber optic infrastructure can be time-consuming, delaying project timelines and increasing costs. Additionally, compliance with environmental regulations and land acquisition issues further complicate the deployment process, posing challenges to market players.

- Limited Availability of Skilled Labor: The market in Vietnam is constrained by a shortage of skilled labor required for the installation and maintenance of fiber optic networks. The lack of adequately trained technicians can lead to delays in network deployment and increased operational costs, hindering the markets growth potential. This gap in the workforce can lead to delays in network deployment and increased operational costs, hindering the markets growth potential.

Government Initiatives:

- National Digital Transformation Program: Launched in 2020, the National Digital Transformation Program aims to accelerate the development of digital infrastructure in Vietnam, including the expansion of fiber optic networks. The program provides financial incentives and regulatory support to companies investing in digital infrastructure, promoting the growth of the fiber optic component market. The governments commitment to this program is driving the market by creating a favorable environment for infrastructure development and technology adoption.

- Vietnam Smart Cities Project: The Vietnam Smart Cities Project, initiated in 2019, focuses on developing smart cities across the country by 2030. This project includes substantial investments in fiber optic infrastructure, driving demand for high-quality components and supporting the overall market growth. This initiative is directly contributing to the growth of the fiber optic component market by driving demand for advanced network infrastructure.

Vietnam Fiber Optic Component Market Future Outlook

The Vietnam fiber optic component market is expected to witness remarkable growth by 2028, driven by continued investments in digital infrastructure, expansion of 5G networks, and supportive government policies.

Future Market Trends:

- Expansion of FTTH Networks: By 2028, the deployment of fiber-to-the-home (FTTH) networks is expected to become widespread in Vietnam, driven by increasing demand for high-speed internet services. The continued expansion of FTTH networks will likely revolutionize the countrys digital landscape, enabling seamless connectivity and supporting the growth of the fiber optic component market.

- Adoption of Advanced Fiber Optic Technologies: The adoption of advanced fiber optic technologies, including WDM (Wavelength Division Multiplexing) and DWDM (Dense Wavelength Division Multiplexing), is anticipated to increase by 2028. These technologies will enhance network capacity and efficiency, supporting the growing demand for data transmission and connectivity.

Scope of the Report

|

By Product |

Fibre Optic Cables Transceivers Amplifiers Splitters |

|

By Application |

Telecommunications Data Centers It & Network Services |

|

By Region |

North Vietnam South Vietnam Central Vietnam Mekong Delta |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Telecommunication Companies

Fiber Optic Component Manufacturers

Internet Service Providers (ISPs)

IT and Network Service Providers

Construction and Engineering Firms

Electronics and Semiconductor Companies

Supply Chain and Logistics Companies

Banks and Financial Institutions

Venture Capitalist

Government Agencies and Regulatory Bodies (USDA and EPA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

FPT Telecom

Viettel Group

VNPT (Vietnam Posts and Telecommunications Group)

Huawei Technologies Co., Ltd.

ZTE Corporation

CommScope Holding Company, Inc.

Prysmian Group

Corning Incorporated

Fujikura Ltd.

Sumitomo Electric Industries, Ltd.

Nexans S.A.

Sterlite Technologies Ltd.

YOFC (Yangtze Optical Fibre and Cable Joint Stock Limited Company)

OFS Fitel, LLC (a Furukawa Company)

HUBER+SUHNER AG

Table of Contents

1. Vietnam Fiber Optic Component Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. Vietnam Fiber Optic Component Market Size (in USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam Fiber Optic Component Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of 5G Networks

3.1.2 Government Initiatives for Digital Transformation

3.1.3 Increasing Demand from Data Centers

3.2 Challenges

3.2.1 High Infrastructure Costs

3.2.2 Regulatory Hurdles

3.2.3 Limited Availability of Skilled Labor

3.3 Opportunities

3.3.1 Expansion of Fiber-to-the-Home (FTTH) Networks

3.3.2 Growth in Smart City Projects

3.3.3 Integration with Advanced Fiber Optic Technologies

3.4 Trends

3.4.1 Adoption of Wavelength Division Multiplexing (WDM) Technology

3.4.2 Growth of FTTH Services

3.4.3 Partnerships and Collaborations for Network Expansion

3.5 Government Initiatives

3.5.1 National Digital Transformation Program

3.5.2 Vietnam Smart Cities Initiative

3.5.3 Broadband Expansion Program

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. Vietnam Fiber Optic Component Market Segmentation, 2023

4.1 By Product Type (in Value %)

4.1.1 Fiber Optic Cables

4.1.2 Transceivers

4.1.3 Amplifiers

4.1.4 Splitters

4.2 By Application (in Value %)

4.2.1 Telecommunications

4.2.2 Data Centers

4.2.3 IT & Network Services

4.3 By Region (in Value %)

4.3.1 North Vietnam

4.3.2 South Vietnam

4.3.3 Central Vietnam

4.3.4 Mekong Delta

5. Vietnam Fiber Optic Component Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 FPT Telecom

5.1.2 Viettel Group

5.1.3 VNPT

5.1.4 Huawei Technologies Co., Ltd.

5.1.5 ZTE Corporation

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Vietnam Fiber Optic Component Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. Vietnam Fiber Optic Component Market Regulatory Framework

7.1 National Digital Transformation Program

7.2 Vietnam Smart Cities Initiative

7.3 Compliance Requirements and Certification Processes

8. Vietnam Fiber Optic Component Market Future Outlook (in USD Bn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

8.3 Future Market Segmentation

8.3.1 By Product Type (in Value %)

8.3.2 By Application (in Value %)

8.3.3 By Region (in Value %)

9. Vietnam Fiber Optic Component Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building

Collating statistics on Vietnam fiber optic component market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam fiber optic component market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential fiber optic companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from fiber optic companies.

Frequently Asked Questions

1. How big is the Vietnam Fiber Optic Component Market?

The Vietnam fiber optic component market was valued at USD 1.25 billion in 2023, driven by the expansion of 5G networks, government initiatives for digital transformation, and increasing demand from data centers.

2. What are the challenges in the Vietnam Fiber Optic Component Market?

Challenges in the Vietnam fiber optic component market include high infrastructure costs, complex regulatory requirements, and a shortage of skilled labor necessary for the installation and maintenance of fiber optic networks.

3. Who are the major players in the Vietnam Fiber Optic Component Market?

Key players in the Vietnam fiber optic component market include FPT Telecom, Viettel Group, VNPT, Huawei Technologies, and ZTE Corporation. These companies lead due to their technological advancements and strong market presence.

4. What are the growth drivers of the Vietnam Fiber Optic Component Market?

The Vietnam fiber optic component market is propelled by the expansion of 5G networks, government-led digital transformation programs, and the rising demand for high-speed internet services from both residential and business sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.