Vietnam Fitness Trackers Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3004

December 2024

89

About the Report

Vietnam Fitness Trackers Market Overview

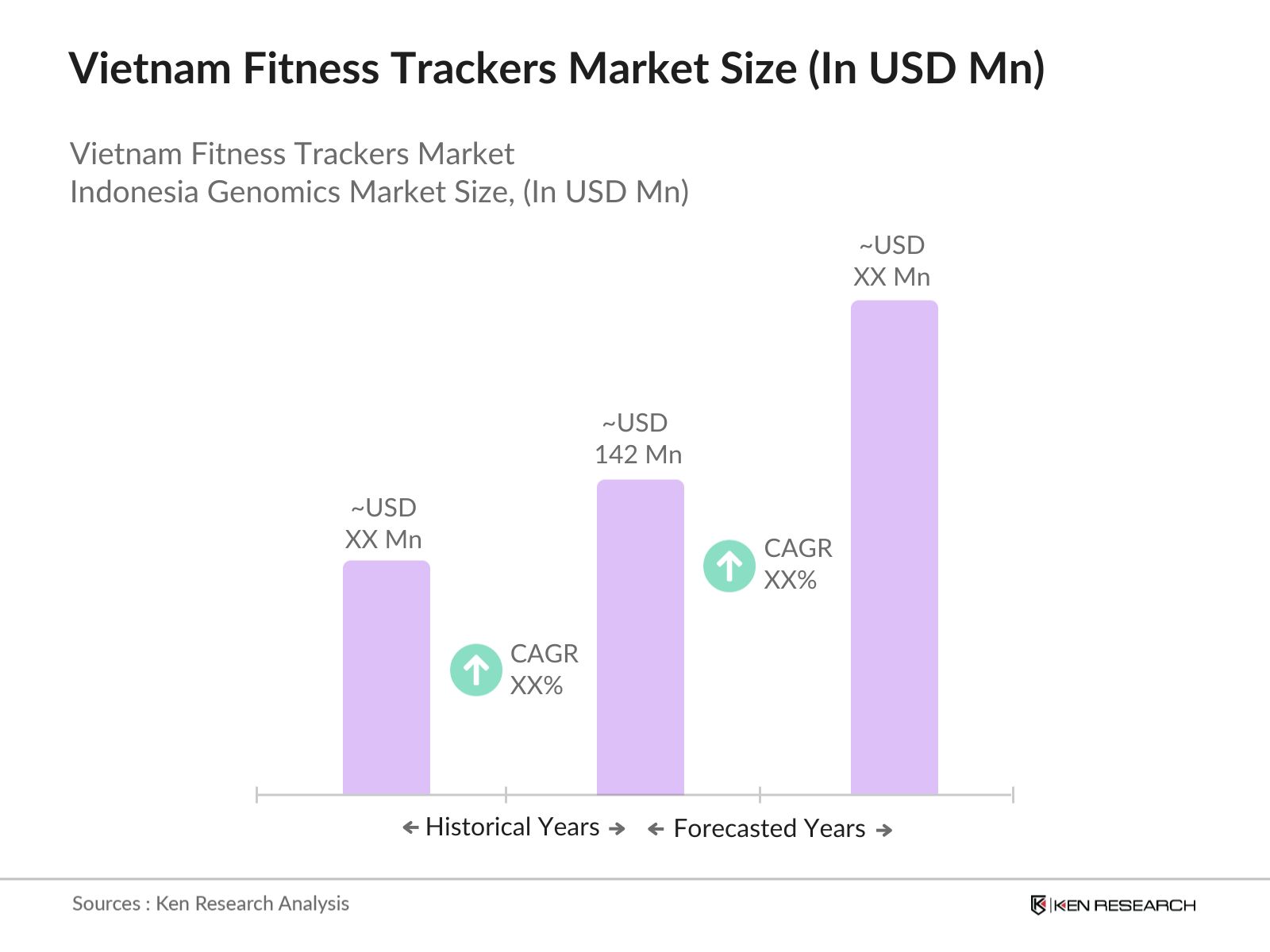

- The Vietnam fitness trackers market is valued at USD 142 million, driven by the increasing adoption of wearable technology and the rising health consciousness among the population. The market's growth is supported by a five-year historical analysis, showing a steady increase in demand for health tracking devices, particularly after the pandemic, which led to a surge in consumers prioritizing health and fitness. The affordability and advancements in technology, such as enhanced sensors and longer battery life, have further fueled the demand for fitness trackers in Vietnam.

- Ho Chi Minh City and Hanoi are the leading markets for fitness trackers in Vietnam. These cities dominate due to their higher urban population, increased disposable income, and a growing focus on personal health and wellness. The tech-savvy younger population in these metropolitan areas is more inclined toward purchasing wearable fitness technology, contributing to their dominance. Additionally, the increasing number of gyms, fitness centers, and corporate wellness programs in these cities drives the adoption of fitness trackers.

- Vietnam has launched several national initiatives aimed at improving health awareness and promoting physical activity. The National Health Program 2022, backed by the Ministry of Health, has set ambitious targets for reducing physical inactivity by 10% by 2025. These government-led programs create a supportive environment for the adoption of fitness trackers, as they align with national goals to improve public health outcomes.

Vietnam Fitness Trackers Market Segmentation

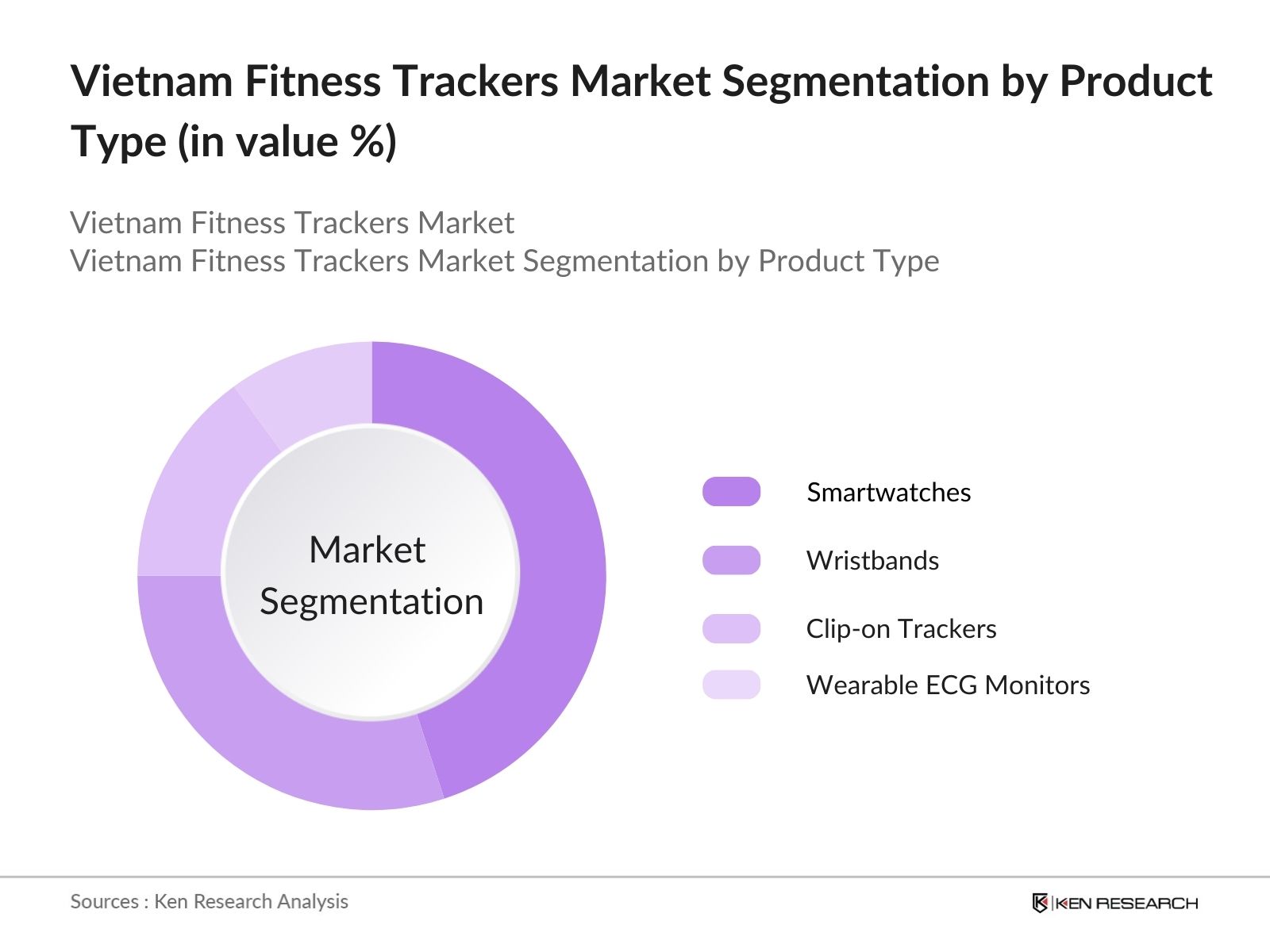

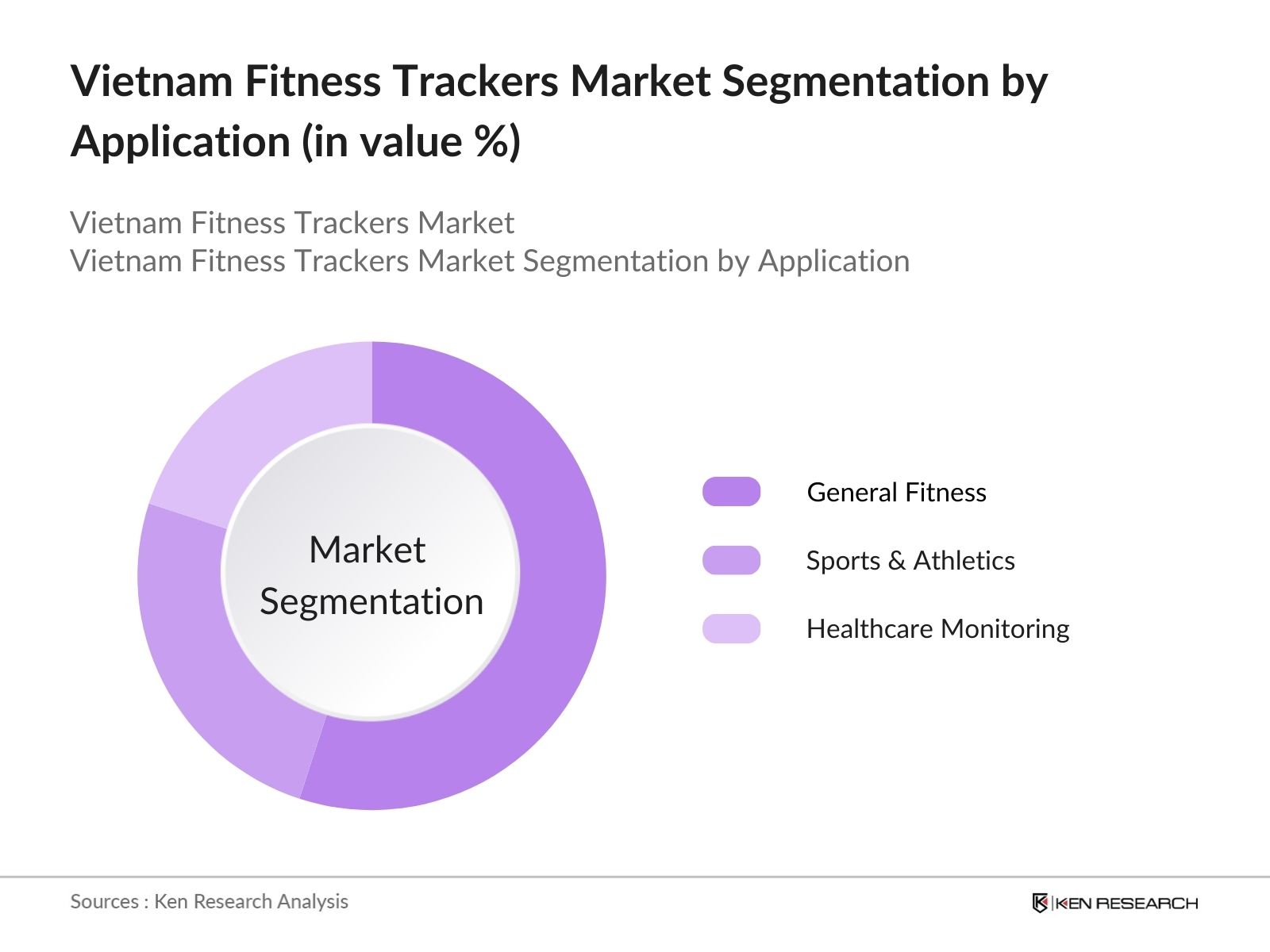

The Vietnam fitness trackers market is segmented by product type and by application.

- By Product Type: The Vietnam fitness trackers market is segmented by product type into smartwatches, wristbands, clip-on trackers, and wearable ECG monitors. Smartwatches currently dominate the market share under this segmentation, thanks to their multi-functional capabilities, which include fitness tracking, notifications, and heart monitoring. The dominance of smartwatches is also due to their brand appeal, with global players like Apple, Samsung, and Xiaomi offering feature-rich devices that cater to tech enthusiasts and health-conscious individuals alike.

- By Application: The market is segmented by application into general fitness, sports & athletics, and healthcare monitoring. General fitness is the leading sub-segment due to its widespread adoption among consumers looking to track daily activity levels, steps, and calories burned. The affordability and accessibility of general fitness trackers make them popular across a broad demographic, especially among individuals who are new to fitness tracking.

Vietnam Fitness Trackers Market Competitive Landscape

The Vietnam fitness trackers market is dominated by a mix of global tech giants and local companies, with the top players focusing on product innovation, marketing strategies, and expanding their distribution networks. This competitive landscape is characterized by the consolidation of market share among leading players, including well-known brands like Apple and Xiaomi. These companies leverage their R&D capabilities to introduce new features such as advanced health metrics, GPS tracking, and AI-based insights, further solidifying their market presence.

|

Company Name |

Year Established |

Headquarters |

Revenue (2023) |

Product Offering |

|

Apple Inc. |

1976 |

Cupertino, USA |

||

|

Xiaomi Corporation |

2010 |

Beijing, China |

||

|

Garmin Ltd. |

1989 |

Olathe, USA |

||

|

Huawei Technologies Co. |

1987 |

Shenzhen, China |

||

|

Fitbit (Google-owned) |

2007 |

San Francisco, USA |

Vietnam Fitness Trackers Market Analysis

Market Growth Drivers

- Rising Health Awareness: The growing awareness of health and fitness in Vietnam is significantly driving demand for fitness trackers. Vietnam's healthcare spending in 2023 is projected to reach $23.6 billion, an increase from $21.9 billion in 2022, reflecting a broader focus on preventive healthcare and wellness initiatives. Government campaigns, such as the National Action Program on Health, have intensified efforts to promote physical activity among the population. With Vietnams life expectancy now at 75.6 years, the rise in chronic diseases such as hypertension and diabetes has encouraged citizens to adopt healthier lifestyles, where fitness trackers play a crucial role.

- Increasing Penetration of Wearable Technology: Vietnams wearable technology market has expanded rapidly, with over 11 million internet users added in 2023 alone, reaching a total of 76 million. This digital expansion has made it easier for consumers to adopt fitness wearables. The smartphone penetration rate in Vietnam, which exceeds 60%, is also a major enabler for fitness tracker adoption. With increased availability of affordable wearable technology, such as devices by Xiaomi and Huawei, wearable penetration is growing in urban centers like Hanoi and Ho Chi Minh City.

- Adoption of Fitness Apps: The rise in fitness apps is contributing to fitness tracker adoption in Vietnam. With over 72 million mobile connections in 2023, fitness apps have grown in popularity as users seek ways to monitor health metrics such as steps, sleep patterns, and calories burned. Local platforms like ELVN have seen increased adoption alongside global apps like Strava and Fitbit, which sync seamlessly with fitness trackers. This growing integration of apps and wearable devices supports user engagement and adoption.

Market Challenges

- High Competition and Price Sensitivity: Vietnams fitness tracker market faces stiff competition from both international and domestic brands. Companies like Xiaomi, Samsung, and Apple are competing for market share, making the market highly price-sensitive. With an average monthly income of $340, many consumers gravitate toward budget-friendly options, limiting premium brands' ability to dominate. This price sensitivity is a challenge for brands looking to introduce higher-end features or more durable products, especially in a competitive market with affordable alternatives.

- Data Privacy Concerns: Data privacy is a growing concern among Vietnamese consumers using wearable fitness technology. The introduction of the Vietnam Cybersecurity Law in 2020 heightened scrutiny over data collection practices, particularly concerning personal health information. As fitness trackers collect sensitive biometric data, users are becoming increasingly cautious about who has access to their information. The fear of data breaches and misuse of personal health records poses a significant challenge for brands in building trust with consumers in the fitness tracker market.

Vietnam Fitness Trackers Market Future Outlook

Over the next five years, the Vietnam fitness trackers market is poised for significant growth, driven by advancements in wearable technology, increased health awareness, and rising consumer demand for devices that offer real-time health monitoring. Companies are expected to introduce more sophisticated devices with AI integration, improved battery life, and enhanced health tracking features such as oxygen saturation and stress level monitoring. The increasing trend toward personalization and connectivity with other IoT devices is likely to further accelerate market growth.

Market Opportunities

- Integration of AI and Machine Learning in Fitness Trackers: Vietnams tech sector is seeing rapid growth, with the government prioritizing digital transformation under its National Digital Transformation Program. The integration of AI and machine learning (ML) into fitness trackers presents a lucrative opportunity for wearable technology providers. AI algorithms can now deliver more personalized fitness recommendations, from adaptive workout plans to predictive health alerts. In 2023, the technology sector contributed $16 billion to the economy, highlighting the country's readiness to embrace innovative applications in wearables.

- Expansion of Smart Health Ecosystems: Vietnams healthcare system is increasingly integrating smart health solutions, which opens new opportunities for fitness tracker companies to expand into the broader smart health ecosystem. In 2023, Vietnam introduced several digital health initiatives, such as telemedicine platforms and e-health records, aimed at improving accessibility to healthcare services. Fitness trackers can play a critical role by syncing with healthcare apps, monitoring chronic conditions, and providing real-time health data to users and healthcare providers.

Scope of the Report

|

Smartwatches, Wristbands Clip-on Trackers Wearable ECG Monitors |

|

|

By Distribution Channel |

Online Stores Offline Retailers Fitness Boutiques E-commerce Giants |

|

By Application |

General Fitness Sports & Athletics Healthcare Monitoring |

|

By End-User |

Consumer Corporate Wellness Programs Healthcare Institutions |

|

By Region |

North East West South |

Products

Key Target Audience

Fitness Device Manufacturers

E-commerce Companies

Health and Fitness Clubs

Consumer Electronics Retailers

Healthcare Institutions

Corporate Wellness Programs

Banks and Financial Institutes

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Information and Communications, Vietnam Health Ministry)

Companies

Players Mention in the Report:

Garmin Ltd.

Fitbit, Inc.

Xiaomi Corporation

Samsung Electronics Co., Ltd.

Apple Inc.

Huawei Technologies Co., Ltd.

Fossil Group, Inc.

Suunto Oy

Polar Electro Oy

Amazfit (Zepp Health)

Honor (Shenzhen Zhixin New Information Technology)

Realme

Whoop, Inc.

Withings

Noise

Table of Contents

1. Vietnam Fitness Trackers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Fitness Trackers Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Fitness Trackers Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness

3.1.2. Increasing Penetration of Wearable Technology

3.1.3. Adoption of Fitness Apps

3.1.4. Growing Influence of Social Media on Fitness Trends

3.2. Market Challenges

3.2.1. High Competition and Price Sensitivity

3.2.2. Data Privacy Concerns

3.2.3. Limited Battery Life and Device Durability

3.3. Opportunities

3.3.1. Integration of AI and Machine Learning in Fitness Trackers

3.3.2. Expansion of Smart Health Ecosystems

3.3.3. Customization and Personalization of User Experience

3.4. Trends

3.4.1. Rise of Hybrid Fitness Trackers (Fashion & Functionality)

3.4.2. Increasing Popularity of Advanced Health Metrics (VO2 Max, ECG)

3.4.3. Enhanced Connectivity with IoT Devices

3.5. Government Regulations and Incentives

3.5.1. National Initiatives for Health & Fitness Awareness

3.5.2. Government-Backed Subsidies on Wearable Health Technology

3.5.3. Import Tariffs on Wearable Electronics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Consumers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Vietnam Fitness Trackers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smartwatches

4.1.2. Wristbands

4.1.3. Clip-on Trackers

4.1.4. Wearable ECG Monitors

4.2. By Application (In Value %)

4.2.1. General Fitness

4.2.2. Sports & Athletics

4.2.3. Healthcare Monitoring

4.3. By Distribution Channel (In Value %)

4.3.1. Online Stores

4.3.2. Offline Retailers

4.3.3. Fitness Boutiques

4.3.4. E-commerce Giants

4.4. By End-User (In Value %)

4.4.1. Consumer

4.4.2. Corporate Wellness Programs

4.4.3. Healthcare Institutions

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5.Vietnam Fitness Trackers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Garmin Ltd.

5.1.2. Fitbit, Inc.

5.1.3. Xiaomi Corporation

5.1.4. Samsung Electronics Co., Ltd.

5.1.5. Apple Inc.

5.1.6. Huawei Technologies Co., Ltd.

5.1.7. Fossil Group, Inc.

5.1.8. Suunto Oy

5.1.9. Polar Electro Oy

5.1.10. Amazfit (Zepp Health)

5.1.11. Honor (Shenzhen Zhixin New Information Technology)

5.1.12. Realme

5.1.13. Whoop, Inc.

5.1.14. Withings

5.1.15. Noise

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Offering, Market Share, Revenue, R&D Investments, Product Launch Frequency, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Fitness Trackers Market Regulatory Framework

6.1. Health Data Compliance

6.2. Consumer Protection Laws

6.3. Electronic Devices Certification

7. Vietnam Fitness Trackers Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Fitness Trackers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Fitness Trackers Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map was developed, outlining the main stakeholders in the Vietnam Fitness Trackers Market. This step was supported by detailed desk research using proprietary and public databases to identify the critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

This step involved gathering and analyzing historical data for the Vietnam Fitness Trackers Market. We evaluated market penetration and revenue generation, factoring in the number of users and device sales. Additionally, service quality statistics were assessed to refine the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We conducted interviews with industry experts to validate market hypotheses and gather insights on operational trends. These consultations helped to fine-tune our understanding of product segments, revenue distribution, and growth factors.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the findings, engaging with multiple fitness device manufacturers to validate sales data and consumer preferences. This ensured the analysis provided was accurate, comprehensive, and actionable for stakeholders.

Frequently Asked Questions

01. How big is the Vietnam Fitness Trackers Market?

The Vietnam fitness trackers market is valued at USD 142 million, fueled by a surge in health consciousness and the adoption of wearable technology across major cities such as Ho Chi Minh City and Hanoi.

02. What are the challenges in the Vietnam Fitness Trackers Market?

Challenges in Vietnam fitness trackers market include high competition, with a growing number of local and international brands vying for market share. Data privacy concerns and device durability also remain key obstacles to market growth.

03. Who are the major players in the Vietnam Fitness Trackers Market?

Key players in Vietnam fitness trackers market include Garmin Ltd., Fitbit, Xiaomi Corporation, Samsung, and Apple Inc., which dominate due to their extensive product offerings, brand recognition, and innovative features.

04. What are the growth drivers of the Vietnam Fitness Trackers Market?

Vietnam fitness trackers market Growth is driven by rising health awareness, increasing disposable income, and the rapid development of wearable technologies that offer advanced fitness and health monitoring capabilities.

05. What are the future trends in the Vietnam Fitness Trackers Market?

Vietnam fitness trackers market Future trends include the integration of AI, machine learning, and advanced health metrics in fitness devices. Consumers will continue to demand more personalized and sophisticated health tracking features.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.