Vietnam Flooring Market Outlook to 2030

Region:Asia

Author(s):Khushi Khatreja

Product Code:KROD1297

October 2024

94

About the Report

Vietnam Flooring Market Overview

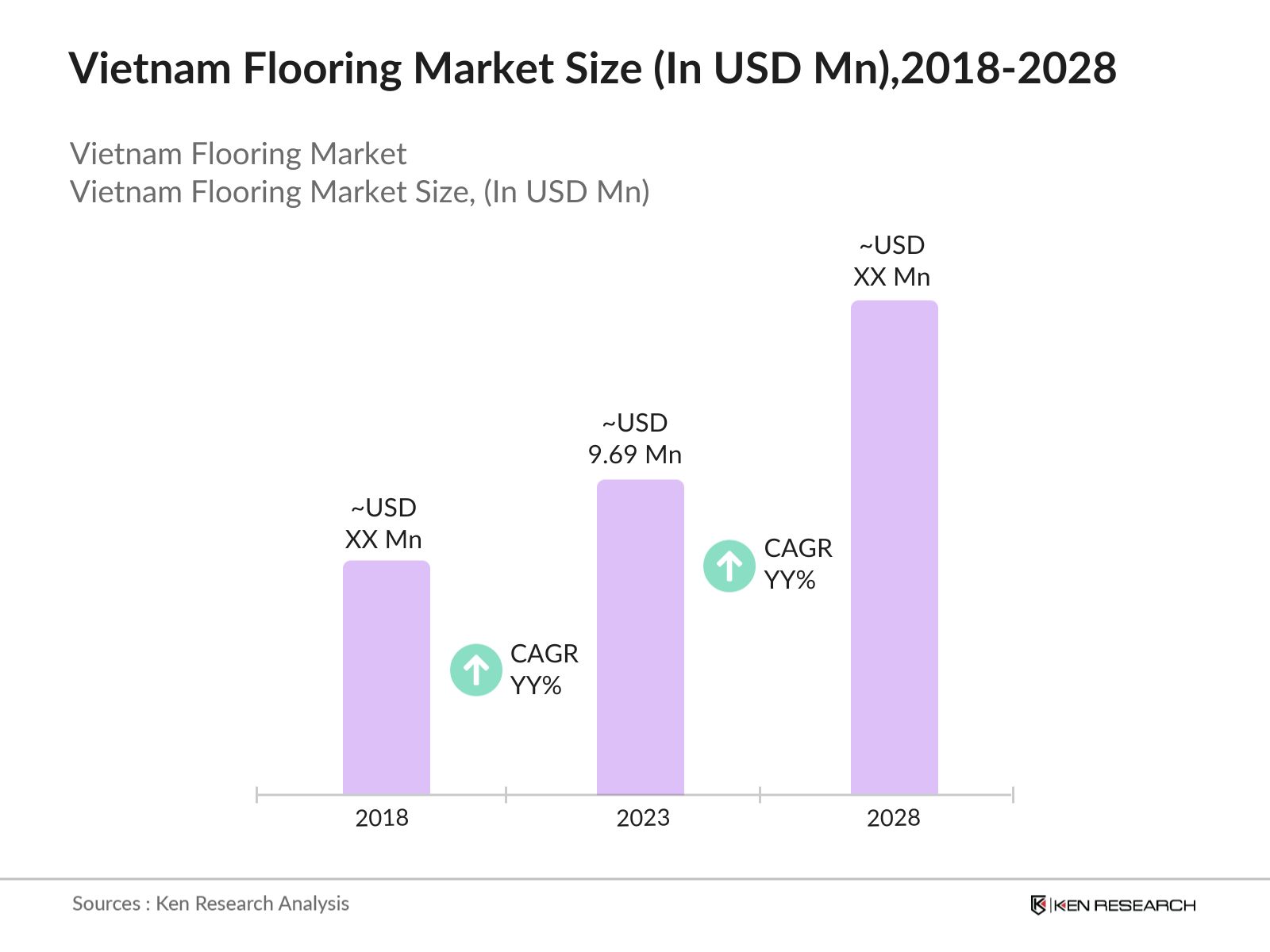

- The Vietnam Flooring Market has experienced notable growth reaching a valuation of USD 9.69million in 2023. This growth is driven primarily by the rapid urbanization and industrial growth in the country. The increasing investments in the construction sector, both residential and commercial, have significantly boosted the demand for various flooring materials.

- Key players in the Vietnam flooring market include names such as SCG Cement-Building Materials, An Cuong Wood Working, Dong Tam Group, and TAVICO Timber JSC. These companies dominate due to their extensive distribution networks, strong brand presence, and continuous innovations in product offerings.

- SCG Cement-Building Materials launched itsLow Carbon Super Cementin Vietnam onJune 17, 2024. This new product utilizes advanced green technologies to reduce carbon emissions by up to20%compared to traditional cement.

- Ho Chi Minh City and Hanoi dominate the Vietnam flooring market due to their rapid urbanization and higher spending capacities. Ho Chi Minh City, with its booming construction industry and significant foreign investments, leads in the demand for high-end and innovative flooring solutions.

Vietnam Flooring Market Segmentation

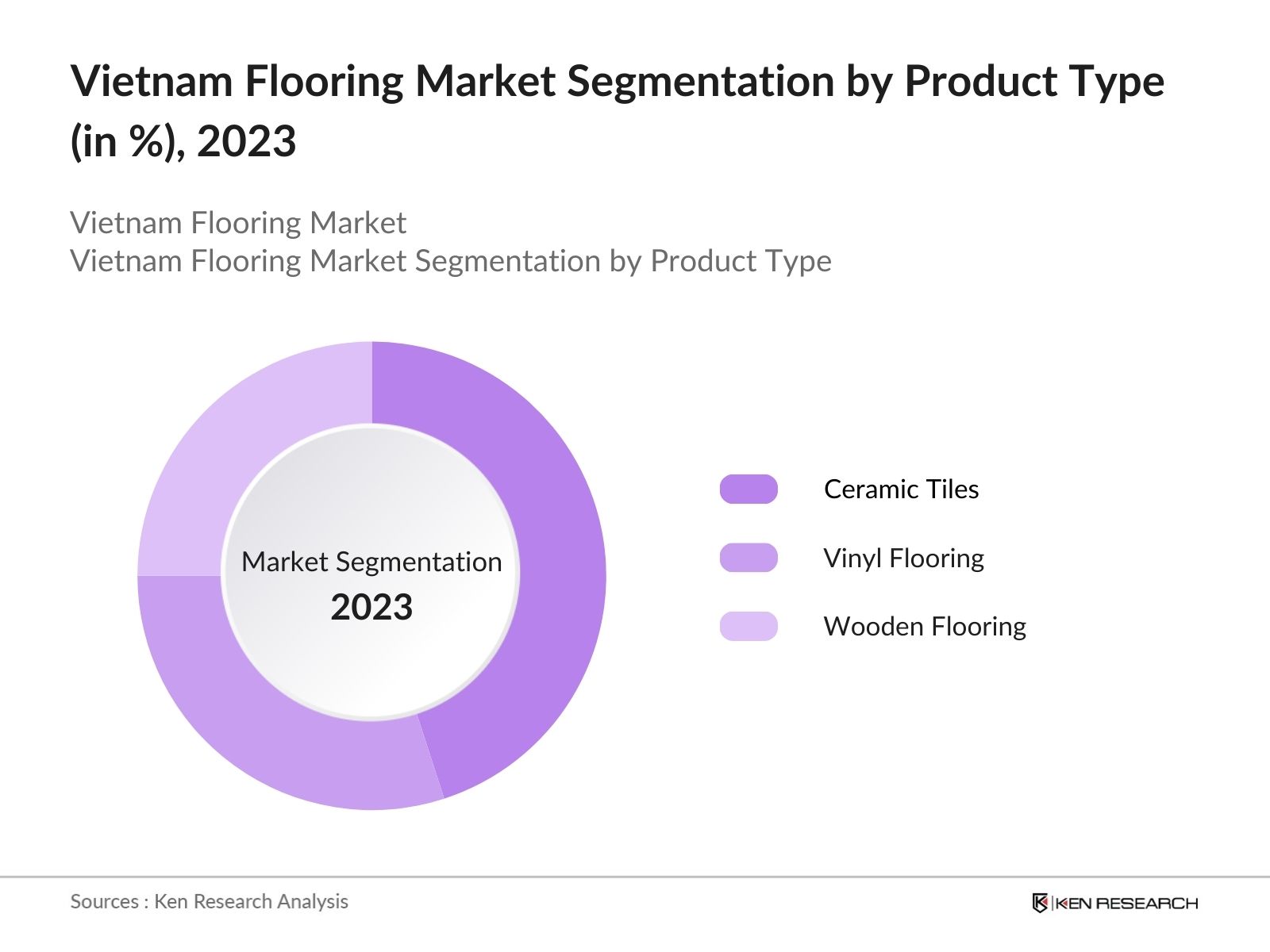

- By Product Type: Vietnam's flooring market is segmented by product type into ceramic tiles, vinyl flooring, and wooden flooring. In 2023, ceramic tiles hold the dominant market share due to their affordability, durability, and variety. Ceramic tiles are preferred in both residential and commercial spaces for their ease of maintenance and aesthetic appeal.

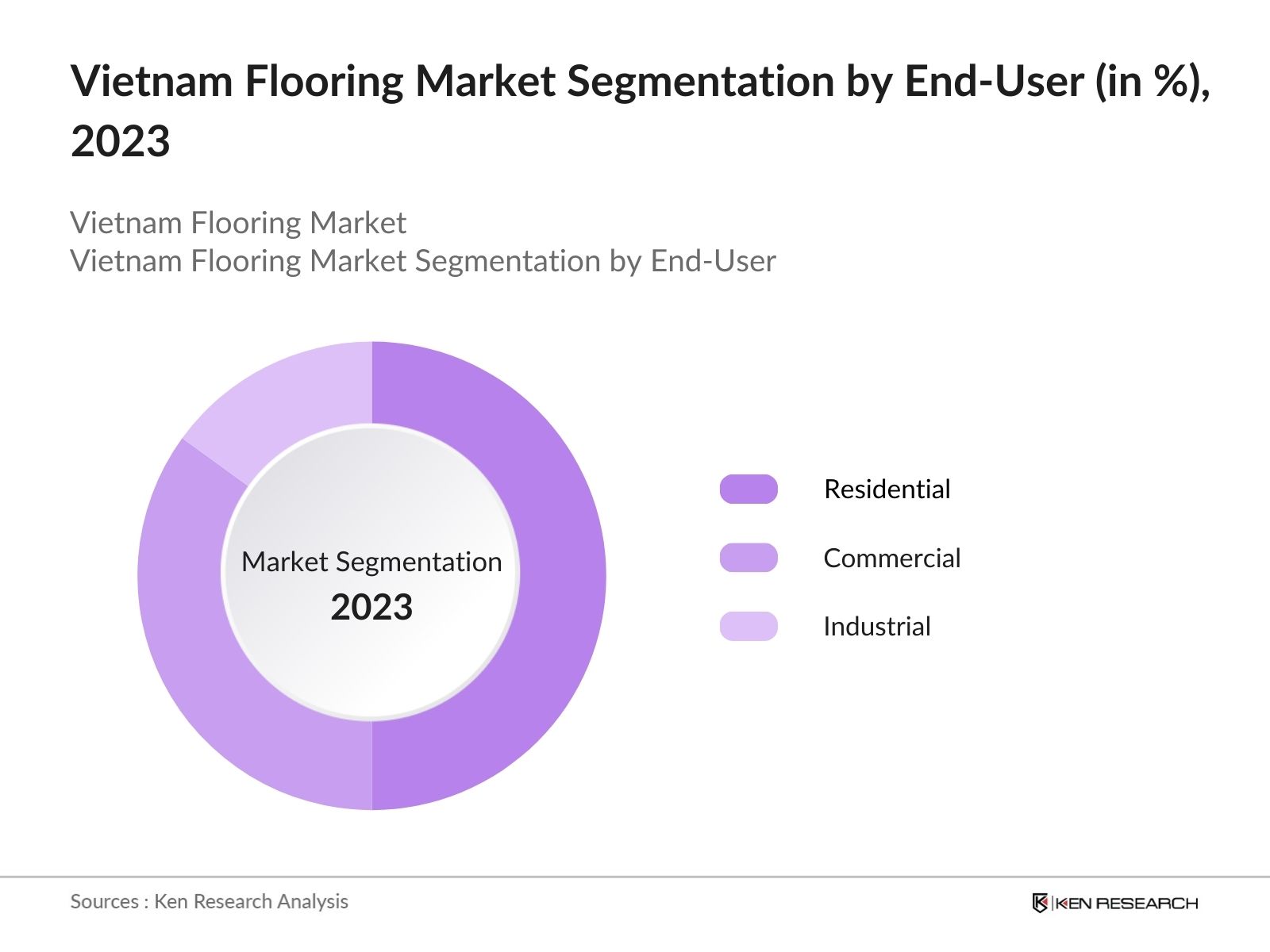

- By End-User: The market is further segmented by end-users into residential, commercial, and industrial sectors. The residential sector holds the largest market share in 2023, driven by a growing population, urbanization, and an increasing number of housing projects.

- By Region: Vietnam's flooring market is regionally segmented into North, South, East, and West. The Southern region, encompassing Ho Chi Minh City, dominates the market share in 2023 due to its economic dynamism, higher income levels, and significant construction activities.

Vietnam Flooring Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

SCG Cement-Building Materials |

1913 |

Ho Chi Minh City |

|

An Cuong Wood Working |

1994 |

Binh Duong |

|

Dong Tam Group |

1969 |

Ho Chi Minh City |

|

TAVICO Timber JSC |

2005 |

Dong Nai |

|

Hoa Binh Construction Group |

1987 |

Ho Chi Minh City |

- An Cuong Wood Working: An Cuong Wood Working introduced a new line of eco-friendly flooring products in 2023, made from sustainable materials and advanced manufacturing processes. This move is part of their strategy to capture the growing segment of environmentally conscious consumers.

- Dong Tam Group: In January 2023, Dong Tam Group announced the cancellation of its public company registration. This decision marks a pivotal moment for the company, which has been a key player in the construction materials sector, including flooring products. The cancellation may impact its market presence and investor relations moving forward.

Vietnam Flooring Industry Analysis

Vietnam Flooring Market Growth Drivers

- Housing and Smart City: The Vietnamese government is actively promoting investments in affordable housing and smart city development. As of mid-2024, there are 503 social housing projects in progress across Vietnam, with 75 completed projects providing nearly 40,000 housing units.

- Sustainable and Innovative Products: The demand for innovative and sustainable flooring materials is rising. For example, technology-integrated solutions like smart thermostats for underfloor heating and energy-generating floors are gaining popularity, with significant market growth expected in 2024.

- Entry of International Brands: The influx of international flooring brands into the Vietnamese market is enhancing competition and expanding consumer choices, further driving market growth. The Vietnam Wood Flooring market currently has an HHI (Herfindahl-Hirschman Index) of 9284 in 2023, indicating a highly concentrated market.

Vietnam Flooring Market Challenges

- Competition from Low-Cost Imports: Domestic manufacturers in the Vietnam flooring market are grappling with intense price competition from low-cost imported flooring products. This influx of affordable alternatives from other countries poses a significant threat to local businesses, as they struggle to match the pricing strategies of their foreign counterparts.

- Evolving Consumer Tastes: The ever-changing landscape of interior design trends requires flooring manufacturers in Vietnam to consistently adapt their offerings to cater to the shifting preferences of consumers. Failing to keep up with these changes could result in a loss of market appeal and relevance for their products.

Vietnam Flooring Market Government Initiatives

- Affordable Housing Promotion: The Vietnamese government has introduced a range of initiatives to boost the construction of affordable housing. This effort has significantly increased the demand for flooring materials as various residential projects progress. In June 2023, Deputy Prime Minister Tran Hong Ha emphasized the need for policymakers to create regulations for allocating state funds to support social housing development for low-income individuals and policy beneficiaries, following a model similar to that used for official residences.

- Public Building Renovations: Government authorities are making substantial investments in renovating educational and public buildings, which is driving increased demand for a diverse range of flooring solutions. This initiative not only upgrades public infrastructure but also promotes growth in the flooring market. In June 2023, the Ministry of Education and Training revealed plans to renovate and upgrade 1,000 schools nationwide by 2025.

Vietnam Flooring Market Future Outlook

The Vietnam flooring market is ready for significant growth, supported by favorable economic conditions, evolving consumer preferences, and strategic government initiatives aimed at enhancing infrastructure and housing development.

Future Market Trends

- Growth in Demand for Sustainable Flooring: Sustainability will continue to be a major driver in the flooring market, with an increasing preference for eco-friendly materials. By 2028, the market share of sustainable flooring materials, such as bamboo, cork, and recycled composites, will expand.

- Expansion of Modular Flooring Systems: Modular flooring systems, which offer easy installation, flexibility, and cost efficiency, are projected to see robust growth. By 2028, modular flooring will acquire a major percentage of the flooring market in Vietnam. These systems are particularly attractive for commercial spaces that require frequent reconfiguration.

Scope of the Report

|

By Product Type |

Ceramic Tiles Vinyl Flooring Wooden Flooring |

|

By End-User |

Residential Commercial Industrial |

|

By Region |

North South East West |

Products

Key Target Audience

Construction Companies

Flooring Material Suppliers

Industrial Facility Managers

Government and Regulatory Bodies (Ministry of Construction, Ministry of Industry and Trade)

Investments and Venture Capitalist Firms

Property Management Companies

Hospitality Sector Developers

Public Works Departments

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

SCG Cement-Building Materials

An Cuong Wood Working

Dong Tam Group

TAVICO Timber JSC

Hoa Binh Construction Group

Phu My Hung Corporation

Vinaconex Corporation

Vietnam Construction and Import-Export Corporation (Vinaconex)

Viglacera Corporation

Vicostone

CMC Joint Stock Company

Coteccons Construction Joint Stock Company

Hoa Sen Group

Vingroup

Tan A Dai Thanh Group

Table of Contents

1.Vietnam Flooring Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.Vietnam Flooring Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.Vietnam Flooring Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization

3.1.2. Industrial Growth

3.1.3. Construction Sector Investments

3.1.4. Technological Advancements in Flooring Materials

3.2. Restraints

3.2.1. Competition from Low-Cost Imports

3.2.2. Evolving Consumer Tastes

3.2.3. High Costs of Innovative Flooring Solutions

3.3. Opportunities

3.3.1. Expansion of Smart City Projects

3.3.2. Demand for Eco-Friendly Flooring Solutions

3.3.3. Growth in Renovation Activities

3.4. Trends

3.4.1. Sustainable and Green Flooring Materials

3.4.2. Modular Flooring Systems

3.4.3. Technological Integration in Flooring Solutions

3.5. Government Regulations

3.5.1. Affordable Housing Initiatives

3.5.2. Public Building Renovations

3.5.3. Sustainability Policies in Construction

3.5.4. Tax Incentives for Green Buildings

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4.Vietnam Flooring Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Ceramic Tiles

4.1.2. Vinyl Flooring

4.1.3. Wooden Flooring

4.2. By End-User (in Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5.Vietnam Flooring Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. SCG Cement-Building Materials

5.1.2. An Cuong Wood Working

5.1.3. Dong Tam Group

5.1.4. TAVICO Timber JSC

5.1.5. Hoa Binh Construction Group

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.Vietnam Flooring Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7.Vietnam Flooring Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8.Vietnam Flooring Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9.Vietnam Flooring Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

10.Vietnam Flooring Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on Vietnam Flooring Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Flooring industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output:

Our team will approach multiple Flooring industry companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Vietnam Flooring industry companies.

Frequently Asked Questions

01 How big is Vietnam Flooring Market?

The Vietnam Flooring Market has experienced notable growth reaching a valuation of USD 9.69million in 2023.

02 Who are the major players in the Vietnam Flooring Market?

Key players in the Vietnam flooring market include SCG Cement-Building Materials, An Cuong Wood Working, Dong Tam Group, and TAVICO Timber JSC. These companies lead due to their strong brand presence, extensive distribution networks, and continuous product innovations.

03 What are the growth drivers of Vietnam Flooring Market?

The market is propelled by increasing foreign direct investment, the booming hospitality and tourism sector, and the growth in the manufacturing sector, which drives demand for both residential and industrial flooring solutions.

04 What are the challenges in Vietnam Flooring Market?

Challenges in the Vietnam flooring market include high competition among local and international players, fluctuating raw material prices, and stringent environmental regulations that require significant investments in sustainable practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.