Vietnam Food Service Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD9302

December 2024

86

About the Report

Vietnam Food Service Market Overview

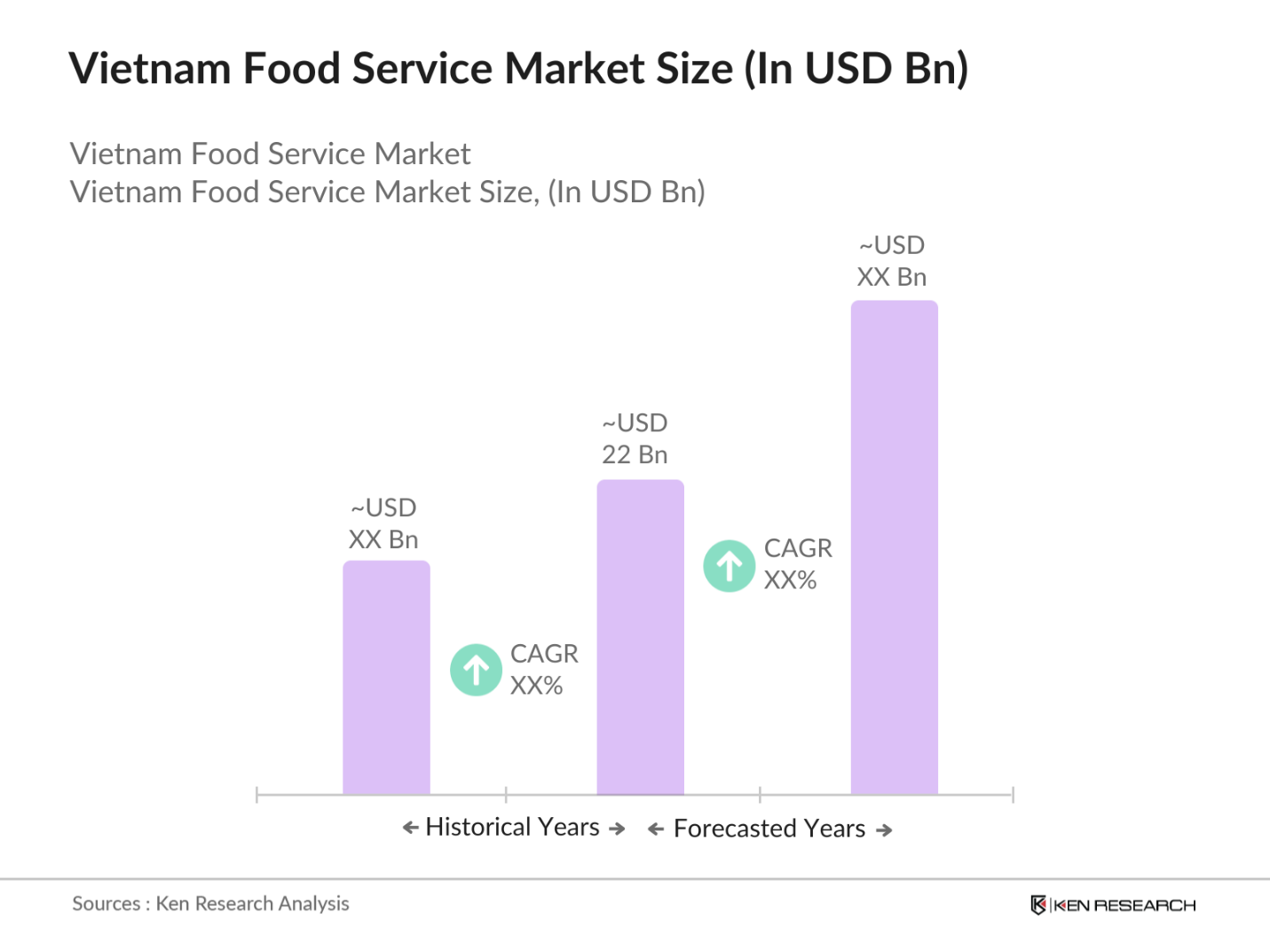

- The Vietnam food service market, valued at USD 22 billion, is experiencing steady growth due to the rise in consumer spending, urbanization, and an increase in the middle-class population. The market is driven by factors such as evolving consumer preferences towards dining out, an increase in tourism, and the rapid expansion of digital food delivery services. The government's efforts to boost tourism and improve infrastructure have also helped in attracting foreign investments into the food service sector, further boosting market size. The influx of international brands, combined with the demand for diversified cuisines, is also contributing to the markets growth.

- Hanoi and Ho Chi Minh City dominate the market due to their dense population, higher income levels, and rapid urban development. Both cities are also the most popular destinations for international tourists, leading to a surge in demand for food services, particularly in the full-service restaurant and quick service restaurant (QSR) segments. Additionally, the growth of business hubs and the presence of international franchises have further cemented their dominance in the food service market.

- Vietnams food service industry is strictly regulated by food safety and hygiene standards set by the Vietnam Food Administration (VFA). In 2023, the VFA conducted 120,000 inspections nationwide, issuing fines totaling VND 60 billion for violations of safety standards. These regulations aim to protect consumers from foodborne illnesses and ensure that food service providers maintain hygiene in their operations. Compliance with these regulations is mandatory for all food service businesses, and failure to meet standards can result in business closures or severe penalties.

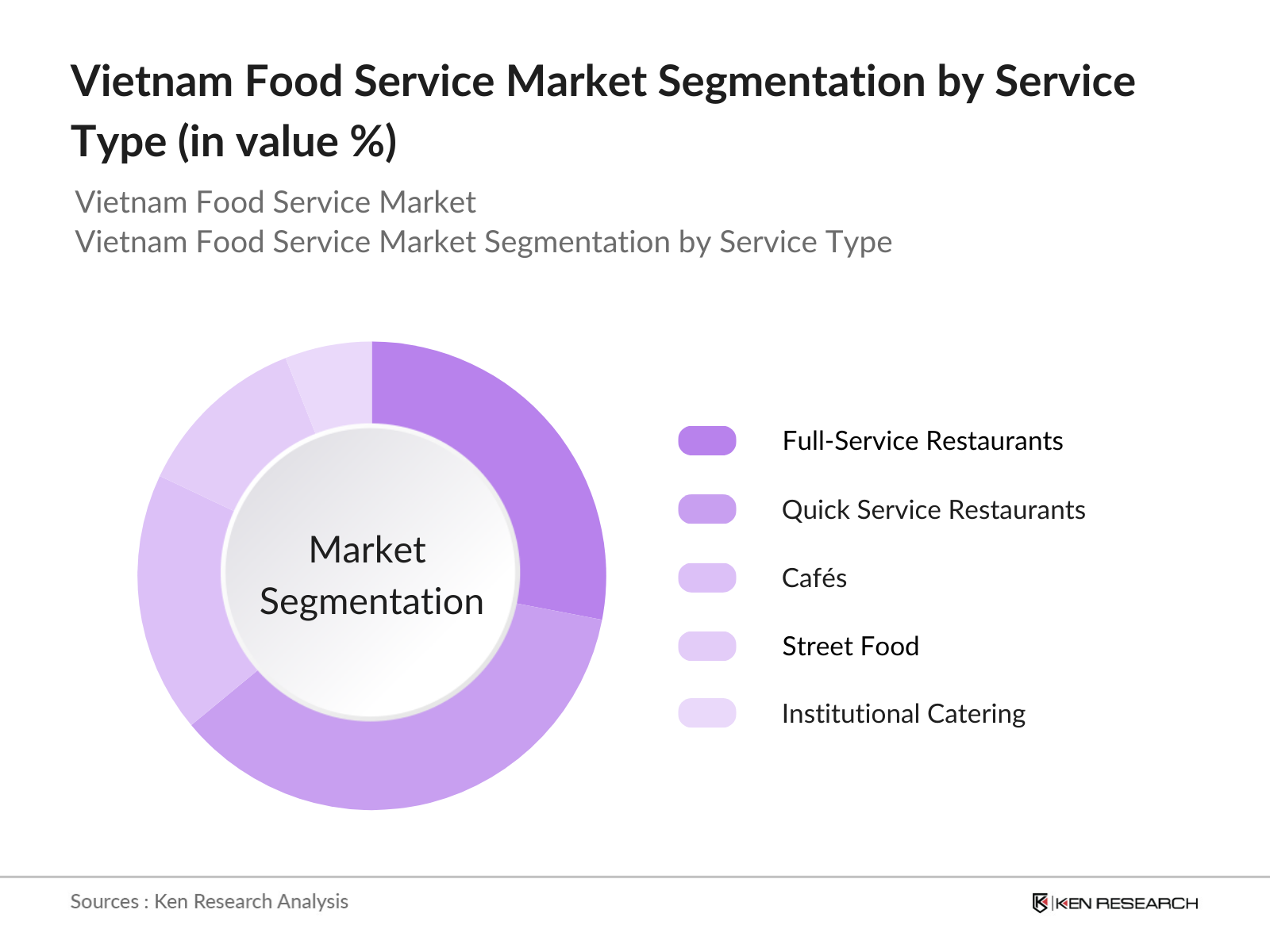

Vietnam Food Service Market Segmentation

By Service Type: The market is segmented into full-service restaurants, quick service restaurants (QSR), cafs, street food, and institutional catering. Recently, quick service restaurants (QSR) have a dominant market share within this segment. This is driven by the fast-paced lifestyles of urban residents, who prefer convenient, affordable, and quick meal options. International fast-food chains, such as KFC and McDonald's, have expanded aggressively, tapping into the growing demand for fast food, particularly among the younger population. Additionally, the expansion of food delivery apps like GrabFood and Now has increased the reach of QSRs, further boosting their dominance in the market.

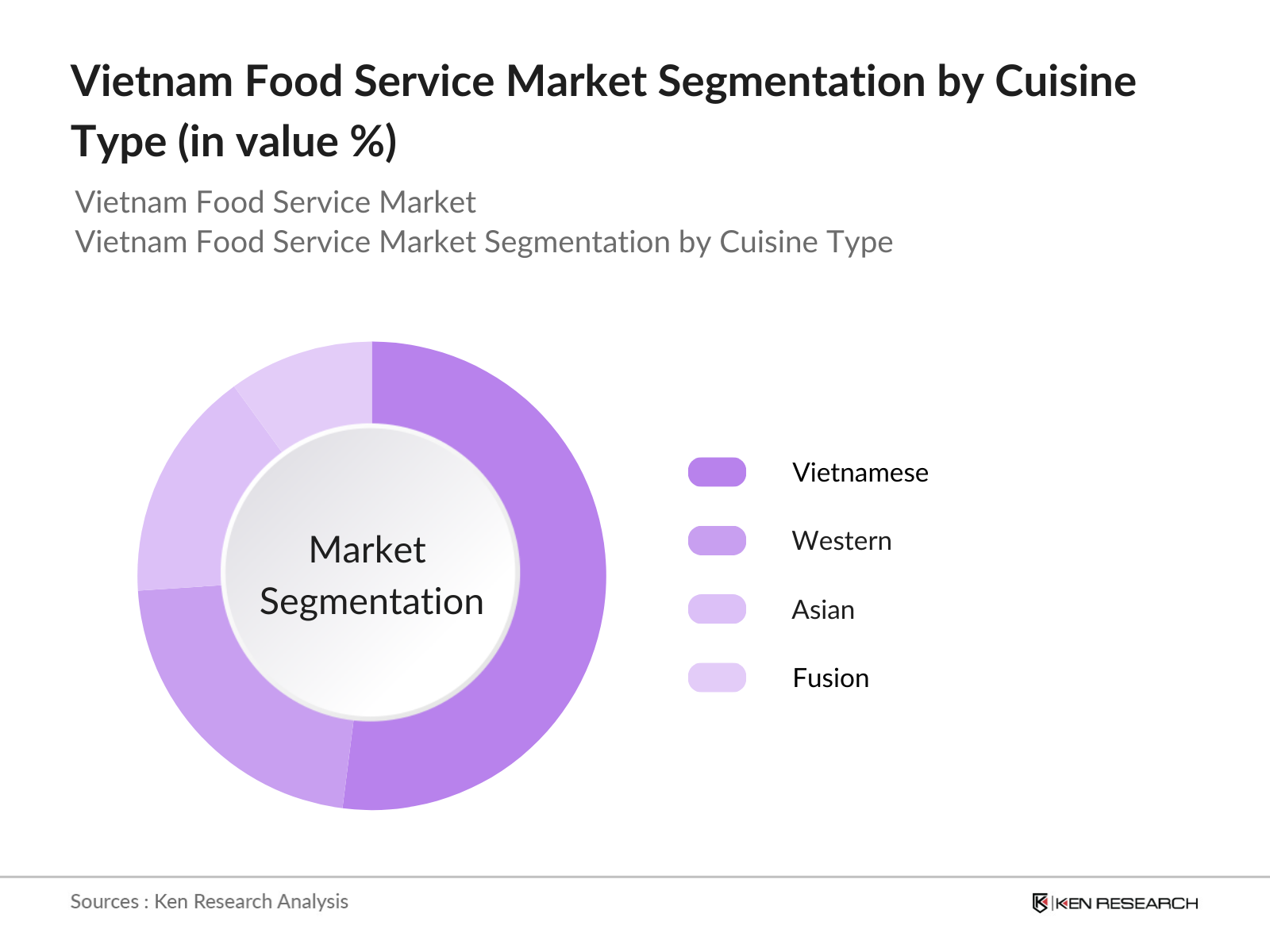

By Cuisine Type: The market is segmented by cuisine into Vietnamese, Western, Asian, and fusion cuisines. Vietnamese cuisine holds a dominant position in this segment, as it remains the primary choice for locals and tourists. The strong cultural attachment to traditional Vietnamese dishes, such as Pho and Banh Mi, combined with the affordability of local street food, ensures the high demand for Vietnamese cuisine. Moreover, the increasing focus on promoting Vietnamese cuisine globally has led to a rise in local food services catering to both domestic and international tastes.

Vietnam Food Service Market Competitive Landscape

The Vietnam food service market is dominated by a mix of local companies and international brands. Leading players such as Lotteria and Highlands Coffee have established a strong presence with their extensive network of outlets, tapping into the growing consumer demand. International chains like KFC and McDonald's are also competing aggressively by adapting their menus to suit local tastes, alongside expanding delivery services through partnerships with digital platforms like GrabFood. This competitive environment has driven market consolidation, where key players invest heavily in marketing, partnerships, and outlet expansion to maintain market share.

|

Company |

Establishment Year |

Headquarters |

Revenue |

No. of Outlets |

Market Strategy |

Delivery Integration |

Local Sourcing |

Franchise Model |

Consumer Segment Focus |

|

Lotteria |

1998 |

Ho Chi Minh City, VN |

|||||||

|

Highlands Coffee |

1999 |

Hanoi, VN |

|||||||

|

KFC |

1997 |

Louisville, USA |

|||||||

|

McDonalds |

2014 |

Chicago, USA |

|||||||

|

The Coffee House |

2014 |

Ho Chi Minh City, VN |

Vietnam Food Service Industry Analysis

Growth Drivers

- Rapid Urbanization and Rise in Disposable Income: Vietnams rapid urbanization continues to fuel growth in the food service market. In 2023, urban areas in Vietnam house approximately 38 million people, accounting for about 38% of the population. As urban dwellers earn significantly more than their rural counterparts, the General Statistics Office of Vietnam (GSO) reported that per capita disposable income for urban residents reached VND 73.9 million in 2023. This increase in disposable income directly supports higher spending on dining out and food services. The shift from home-cooked meals to convenience and leisure dining is a critical driver of market expansion.

- Increasing Consumer Demand for Diverse Cuisine: Vietnamese consumers are increasingly seeking diverse culinary experiences, driven by a growing middle class and a more cosmopolitan lifestyle. In 2022, the Ministry of Culture, Sports, and Tourism noted that the food and beverage sector was the third-largest segment of consumer expenditure, at VND 330 trillion annually. This growing demand for diverse, international cuisines (such as Korean, Japanese, and Western foods) reflects changing consumer preferences and is further supported by the rise of international tourism, enhancing the need for variety in food service offerings.

- Growth of Tourism and Hospitality Sector: The tourism and hospitality sector is a significant driver of Vietnam's food service industry, bolstered by the country's rebound in international tourism. In 2023, Vietnam welcomed 8.9 million international tourists, a sharp rise from the pandemic lows. This influx has translated into increased demand for food services, particularly in major cities like Ho Chi Minh City and Hanoi. With average tourist expenditure on dining reaching VND 10 million per visit, the hospitality industry's growth has created extensive opportunities for restaurants and food services, contributing to the sector's overall expansion.

Market Challenges

- High Competition in Local Market: Vietnam's food service sector is highly fragmented, with a mix of local street food vendors, family-owned restaurants, and international chains. In 2023, the Ministry of Industry and Trade reported that the country has over 540,000 registered food service businesses. This saturation, combined with consumer price sensitivity, has created a highly competitive environment. Restaurants must differentiate themselves through unique offerings or competitive pricing, which is challenging in an environment where traditional food vendors still dominate. The competition affects profit margins and market entry for new players.

- Real Estate and Rental Costs in Urban Areas: Urbanization has led to a significant rise in real estate and rental costs, particularly in major cities like Ho Chi Minh City and Hanoi. In 2023, the average rental cost for prime restaurant locations in Ho Chi Minh City was VND 1.5 million per square meter per month, according to the Vietnam Real Estate Association. These rising costs place financial pressure on food service businesses, particularly smaller, local enterprises, making it difficult to sustain profitable operations in high-demand areas. This challenge often forces businesses to relocate or operate in less desirable locations.

Vietnam Food Service Market Future Outlook

Over the next five years, the Vietnam food service market is expected to continue its upward trajectory, driven by increasing consumer disposable income, a growing middle-class population, and the rising popularity of food delivery services. The expansion of digital platforms and partnerships between food service outlets and delivery apps will further enhance the market's growth potential. Additionally, the demand for healthy and organic food, along with international cuisines, is projected to shape future market trends. The government's continued efforts to promote tourism and improve infrastructure will also attract more foreign investments, contributing to the development of Vietnams food service industry.

Future Market Opportunities

- Penetration of Digital Food Delivery Platforms: Vietnam has experienced a significant rise in the adoption of digital food delivery platforms, driven by the growing use of smartphones and internet penetration. By 2023, over 47 million people in Vietnam used food delivery apps such as GrabFood and Baemin, according to the Ministry of Information and Communications. This shift offers a lucrative opportunity for restaurants to expand their customer base beyond physical locations, particularly as online food delivery revenue has seen consistent growth in urban areas. Restaurants are increasingly integrating with these platforms to boost sales and reach.

- Rise in Demand for Healthy and Organic Food: With growing awareness of health and wellness, the demand for healthy and organic food options is increasing. The Vietnam Organic Agriculture Association reported that sales of organic food products in Vietnam reached VND 23 trillion in 2023. Restaurants and food service providers are capitalizing on this trend by offering healthier menu options, including vegetarian, vegan, and organic dishes. This shift aligns with global trends and provides food businesses in Vietnam an opportunity to differentiate themselves and meet evolving consumer demands for nutritious and sustainable food choices.

Scope of the Report

|

By Service Type |

Full-Service Restaurants Quick Service Restaurants Cafs Street Food Catering |

|

By Cuisine Type |

Vietnamese Western Asian Fusion |

|

By End-User |

Residential Corporate Tourists |

|

By Region |

Hanoi Ho Chi Minh City Da Nang Mekong Delta |

|

By Channel |

Dine-In Takeaway Delivery |

Products

Key Target Audience

Food & Beverage Manufacturers

Restaurant Chains and Food Service Providers

International Franchisors

Real Estate Developers

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade)

Food Delivery Platform Operators

Investor and Venture Capitalist Firms

Equipment Suppliers for Food Service Industry

Companies

Major Players

Lotteria

Highlands Coffee

Golden Gate Restaurant Group

KFC Vietnam

Pizza 4Ps

The Coffee House

Jollibee Foods Corporation

Starbucks Vietnam

McDonald's Vietnam

Hoang Yen Group

BBQ Chicken

Baskin Robbins Vietnam

Pho24

Domino's Pizza Vietnam

Wrap & Roll

Table of Contents

1. Vietnam Food Service Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Growth Rate

1.5. Market Segmentation Overview

2. Vietnam Food Service Market Size (In USD Bn)

2.1. Historical Market Size (Revenue, Number of Outlets, Market Growth)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Expansions, Partnerships, Market Entry)

3. Vietnam Food Service Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Urbanization and Rise in Disposable Income

3.1.2. Increasing Consumer Demand for Diverse Cuisine

3.1.3. Growth of Tourism and Hospitality Sector

3.1.4. Expansion of International Brands in Vietnam

3.2. Market Challenges

3.2.1. High Competition in Local Market

3.2.2. Real Estate and Rental Costs in Urban Areas

3.2.3. Supply Chain and Logistics Constraints

3.3. Opportunities

3.3.1. Penetration of Digital Food Delivery Platforms

3.3.2. Rise in Demand for Healthy and Organic Food

3.3.3. Franchise Opportunities for International Brands

3.3.4. Growth of Coffee Chains and Beverage Markets

3.4. Trends

3.4.1. Increased Consumer Focus on Sustainable and Locally Sourced Food

3.4.2. Growth of Quick Service Restaurants (QSR)

3.4.3. Integration of Technology and Automation in Food Services

3.4.4. Rise of Cloud Kitchens and Ghost Restaurants

3.5. Government Regulations

3.5.1. Food Safety and Hygiene Standards (Vietnam Food Administration)

3.5.2. Licensing and Franchise Regulations (Ministry of Industry and Trade)

3.5.3. Labor Law and Wage Policies (Ministry of Labor, Invalids, and Social Affairs)

3.5.4. Environmental Policies on Packaging and Waste Management

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Distributors, Delivery Platforms)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Food Service Market Segmentation

4.1. By Service Type (In Value and Volume %)

4.1.1. Full-Service Restaurants

4.1.2. Quick Service Restaurants (QSR)

4.1.3. Cafs and Coffee Chains

4.1.4. Street Food and Hawkers

4.1.5. Institutional Catering (Schools, Hospitals, Corporations)

4.2. By Cuisine Type (In Value %)

4.2.1. Local Vietnamese Cuisine

4.2.2. Western Cuisine

4.2.3. Asian (Korean, Japanese, Chinese)

4.2.4. Fusion Cuisine

4.3. By End-User (In Volume %)

4.3.1. Residential Consumers

4.3.2. Corporate and Institutional Buyers

4.3.3. Tourists

4.4. By Region (In Value %)

4.4.1. Hanoi

4.4.2. Ho Chi Minh City

4.4.3. Da Nang

4.4.4. Mekong Delta

4.5. By Channel (In Value and Volume %)

4.5.1. Dine-In

4.5.2. Takeaway

4.5.3. Delivery (Food Apps, In-House Delivery Services)

5. Vietnam Food Service Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lotteria

5.1.2. Highlands Coffee

5.1.3. Golden Gate Restaurant Group

5.1.4. KFC Vietnam

5.1.5. Pizza 4Ps

5.1.6. The Coffee House

5.1.7. Jollibee Foods Corporation

5.1.8. Starbucks Vietnam

5.1.9. McDonald's Vietnam

5.1.10. Hoang Yen Group

5.1.11. BBQ Chicken

5.1.12. Baskin Robbins Vietnam

5.1.13. Pho24

5.1.14. Domino's Pizza Vietnam

5.1.15. Wrap & Roll

5.2. Cross Comparison Parameters (No. of Outlets, Revenue, Market Share, Employee Base, Expansion Plans, Ownership Type, Brand Strategy, Consumer Demographics)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Franchising, M&A, New Product Launches)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding in Food Service Industry

5.8. Government Grants and Subsidies

6. Vietnam Food Service Market Regulatory Framework

6.1. Food and Beverage Standards (Ministry of Health)

6.2. Compliance Requirements for International Brands

6.3. Certification Processes (ISO, HACCP)

7. Vietnam Food Service Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Rising Middle-Class Population, Expanding Digital Ecosystem, Franchising Opportunities)

8. Vietnam Food Service Future Market Segmentation

8.1. By Service Type (In Value and Volume %)

8.2. By Cuisine Type (In Value %)

8.3. By Region (In Value %)

8.4. By Channel (In Value and Volume %)

9. Vietnam Food Service Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis (Emerging Consumer Trends, Untapped Regional Markets)

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping out the Vietnam Food Service market's ecosystem, identifying key stakeholders such as restaurant chains, delivery platforms, and franchisors. Desk research combined with proprietary databases provided the foundation for defining the variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data on market size, outlet expansion, and consumer preferences were analyzed to construct an accurate representation of the market. Additionally, service quality and delivery efficiency statistics were factored into revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with food service industry experts, market hypotheses were tested and validated. These consultations offered critical insights into operational strategies, consumer trends, and market challenges.

Step 4: Research Synthesis and Final Output

Direct interaction with food service operators provided detailed insights into product performance, customer satisfaction, and strategic plans. These inputs were used to refine the bottom-up analysis, ensuring the reliability of market projections.

Frequently Asked Questions

01 How big is the Vietnam Food Service Market?

The Vietnam food service market is valued at USD 22 billion, driven by rising disposable incomes, urbanization, and increased tourism.

02 What are the challenges in the Vietnam Food Service Market?

Challenges in the Vietnam food service market include high competition, supply chain inefficiencies, and rising real estate costs in urban centers like Ho Chi Minh City and Hanoi.

03 Who are the major players in the Vietnam Food Service Market?

Key players in the Vietnam food service market include Lotteria, Highlands Coffee, KFC Vietnam, McDonald's Vietnam, and The Coffee House, which dominate the market through strategic expansion and delivery partnerships.

04 What are the growth drivers of the Vietnam Food Service Market?

Growth drivers in the Vietnam food service market include the rise in consumer spending on dining, the expansion of delivery services, and the increasing demand for diverse and international cuisines.

05 Which cities dominate the Vietnam Food Service Market?

Ho Chi Minh City and Hanoi dominate the Vietnam food service market due to their high population densities, strong tourism industries, and the presence of numerous international food chains.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.