Vietnam Freight and Logistics Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD7864

November 2024

81

About the Report

Vietnam Freight and Logistics Market Overview

- The Vietnam Freight and Logistics market is valued at USD 48 billion, driven by its increasing integration into global trade and expanding infrastructure development. The market has grown substantially over a five-year historical analysis, largely due to the government's commitment to improving transport infrastructure, coupled with rising demand from e-commerce and manufacturing industries.

- Key cities such as Ho Chi Minh City, Hanoi, and Da Nang dominate the market. These cities act as significant hubs for both domestic and international freight movements due to their well-established transport infrastructure, large industrial clusters, and proximity to major ports. Ho Chi Minh City, for instance, is home to the busiest port in Vietnam, accounting for a large portion of the countrys import and export trade.

- The Vietnamese government is rolling out a comprehensive National Logistics Master Plan that aims to modernize the countrys logistics infrastructure and improve connectivity. By 2024, the government will invest $30 billion in projects such as deep-sea ports and road networks, enhancing freight mobility and reducing logistics costs by up to 10% over the next five years.

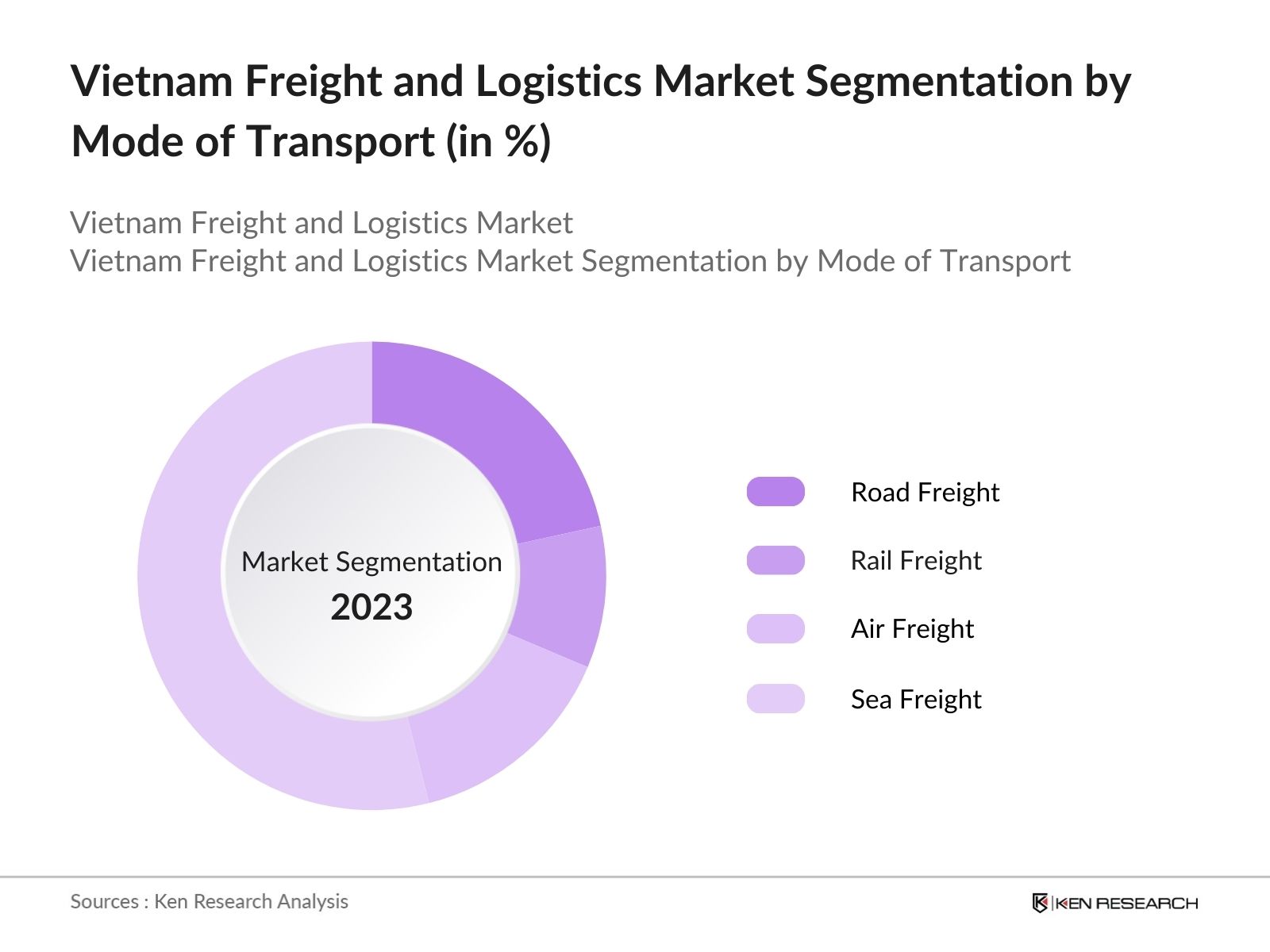

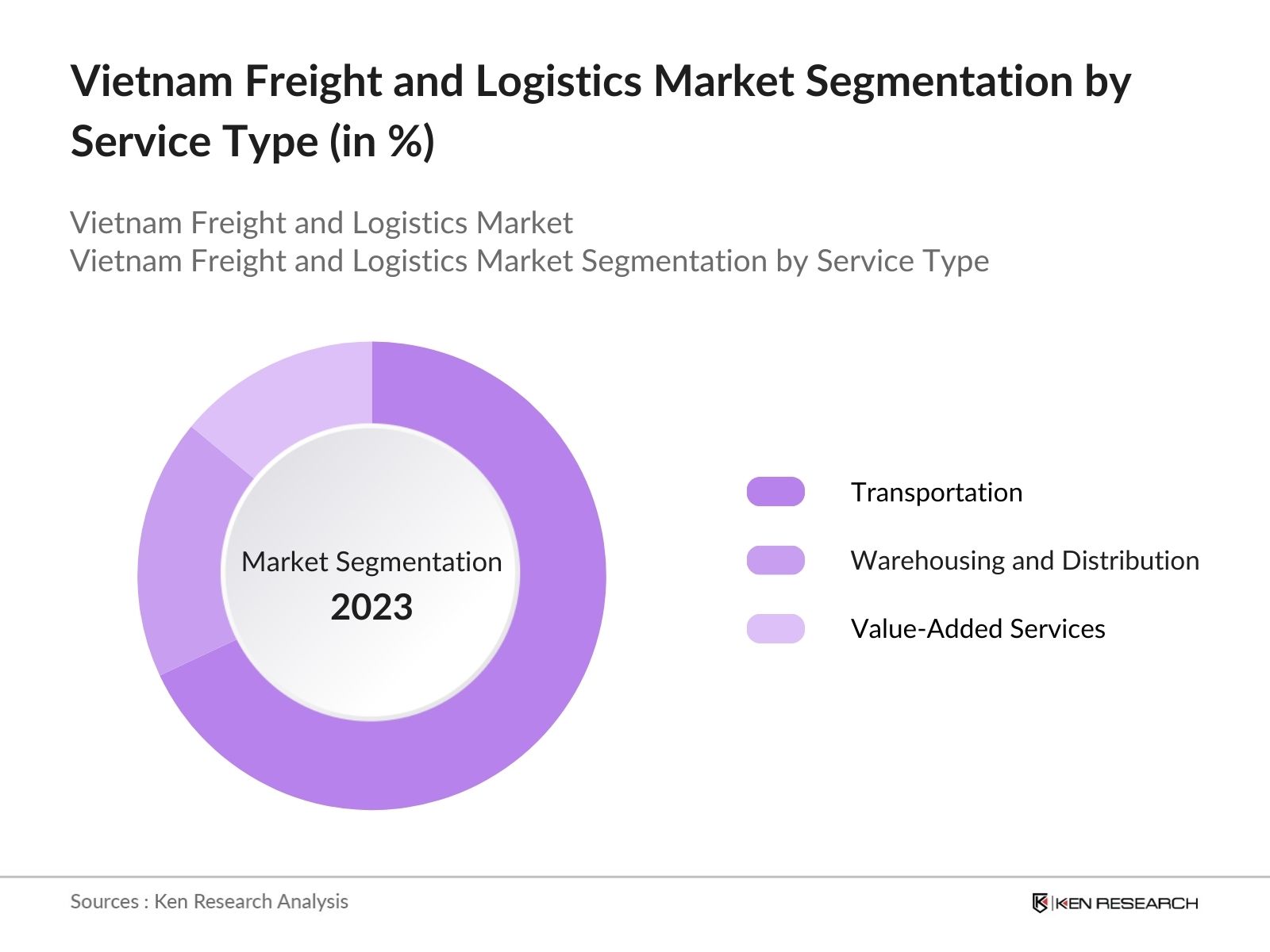

Vietnam Freight and Logistics Market Segmentation

By Mode of Transport: The market is segmented by mode of transport into road freight, rail freight, air freight, and sea freight. Among these, sea freight holds the largest share, driven by Vietnam's extensive coastline and its strategic importance for international trade. The presence of major ports such as Hai Phong and Tan Cang-Cat Lai Port in Ho Chi Minh City allows sea freight to dominate the logistics market, handling the bulk of imports and exports. Sea freight's dominance is further reinforced by increasing investments in port infrastructure to accommodate larger vessels and improve handling efficiency.

By Service Type: The market is segmented by service type into transportation, warehousing and distribution, and value-added services such as customs clearance and packaging. Transportation services dominate the market, accounting for the largest share due to the high demand for efficient and cost-effective goods movement. The rapid expansion of the e-commerce sector, manufacturing, and cross-border trade in Vietnam has accelerated the need for reliable transportation services. Companies continue to focus on expanding their fleet sizes, enhancing their supply chain capabilities, and integrating technology to optimize operations, which has further solidified transportation as the leading service type in the logistics industry.

Vietnam Freight and Logistics Market Competitive Landscape

The market is characterized by a mix of local and global players, with a few large companies dominating the market. Key players like Gemadept Corporation and Transimex Corporation lead the market due to their extensive logistics networks and investments in technology to enhance operational efficiency.

|

Company Name |

Establishment Year |

Headquarters |

Fleet Size |

Technology Integration |

Revenue |

No. of Employees |

Service Coverage |

Operational Reach |

|

Gemadept Corporation |

1990 |

Ho Chi Minh City |

||||||

|

Transimex Corporation |

1983 |

Ho Chi Minh City |

||||||

|

DHL Vietnam |

1969 |

Bonn, Germany |

||||||

|

FedEx Vietnam |

1971 |

Memphis, USA |

||||||

|

Saigon Newport Corporation |

1989 |

Ho Chi Minh City |

Vietnam Freight and Logistics Market Analysis

Market Growth Drivers

- Increased Trade Agreements: Vietnam has engaged in several free trade agreements (FTAs), including the Regional Comprehensive Economic Partnership (RCEP), and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). In 2024, these agreements are expected to contribute to substantial growth in trade volumes, particularly in sectors like electronics and textiles.

- Infrastructure Development Projects: The Vietnamese government has been heavily investing in infrastructure projects to improve connectivity. In 2024, projects such as the North-South Expressway and the Long Thanh International Airport are projected to come closer to completion, boosting the capacity to handle cargo.

- Growing Manufacturing Output: Vietnam has become a global manufacturing hub, particularly for electronics and apparel. By 2024, the countrys manufacturing output is expected to reach $300 billion, with exports contributing to logistics demands. The increase in manufacturing activity will lead to an additional 1 million containers being moved through Vietnams ports each year, requiring the logistics sector to expand and improve efficiency in order to meet global standards.

Market Challenges

- Underdeveloped Cold Chain Logistics: Vietnams cold chain logistics infrastructure is underdeveloped, limiting the transportation of perishable goods like seafood and pharmaceuticals. By 2024, the demand for cold storage is expected to rise by over 500,000 tons, but limited availability and poor connectivity pose challenges to meeting this demand, especially in remote areas.

- Traffic Congestion in Major Cities: Ho Chi Minh City and Hanoi, Vietnam's largest logistics hubs, face severe traffic congestion, which delays freight transportation. In 2024, urban freight movement is projected to increase by 7 million tons, but current road infrastructure struggles to handle this growth.

Vietnam Freight and Logistics Market Future Outlook

Over the next five years, the Vietnam Freight and Logistics industry is expected to experience growth driven by increasing international trade, the rise of the e-commerce sector, and government initiatives to enhance logistics infrastructure.

Future Market Opportunities

- Increased Investments in Automated Warehousing: Automated warehousing will become a critical investment area for logistics companies in Vietnam. By 2026, over 1,000 automated warehouses are expected to be operational, increasing inventory management efficiency and reducing manpower requirements by 15%. This shift will help logistics firms meet growing demands while optimizing operational costs.

- Development of Inland Waterways for Freight Movement: Vietnam is expected to increase its reliance on inland waterways for freight transportation as a more cost-effective and environmentally friendly alternative. By 2029, over 25 million tons of goods will be moved annually via inland waterways, reducing the pressure on congested road networks and lowering logistics costs.

Scope of the Report

|

By Mode of Transport |

Road Freight Rail Freight Air Freight Sea Freight |

|

By Service Type |

Transportation Warehousing and Distribution Value-Added Services (Customs Clearance, Packaging) |

|

By End-User Industry |

Manufacturing Retail and FMCG Healthcare and Pharmaceuticals Chemicals |

|

By Region |

North East West South |

|

By Logistics Providers |

First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Logistics Service Providers

Banks and Financial Institution

E-commerce Companies

Retail and Manufacturing Companies

Government and Regulatory Bodies (Ministry of Transport, Vietnam Logistics Association)

Investors and Venture Capitalist Firms

Private Equity Firms

Companies

Players Mentioned in the Report:

Gemadept Corporation

Transimex Corporation

Vietnam Airlines Cargo

ITL Corporation

DHL Vietnam

FedEx Vietnam

Saigon Newport Corporation

Viettel Post

Kerry Logistics Vietnam

Nippon Express Vietnam

Table of Contents

Vietnam Freight and Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Vietnam Freight and Logistics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Vietnam Freight and Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Trade Liberalization and Free Trade Agreements

3.1.2. Infrastructure Investments

3.1.3. Rising E-commerce Demand

3.1.4. Government Support for Logistics and Transportation Development

3.2. Market Challenges

3.2.1. Fragmented Supply Chain

3.2.2. High Operational Costs

3.2.3. Regulatory Bottlenecks

3.2.4. Limited Skilled Workforce

3.3. Opportunities

3.3.1. Integration of Digital Solutions in Freight Management

3.3.2. Expansion of Cold Chain Logistics

3.3.3. Increasing Investment in Green Logistics

3.3.4. Cross-Border Trade Expansion

3.4. Trends

3.4.1. Automation in Warehousing and Transportation

3.4.2. Expansion of Last-Mile Delivery Services

3.4.3. Integration of Blockchain for Transparency

3.4.4. Rising Focus on Sustainable Logistics

3.5. Government Regulation

3.5.1. National Logistics Development Plan

3.5.2. Regulatory Reforms in Trade Facilitation

3.5.3. Public-Private Partnerships for Infrastructure Development

3.5.4. Compliance to ASEAN Trade Facilitation Framework

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

Vietnam Freight and Logistics Market Segmentation

4.1. By Mode of Transport (In Value %)

4.1.1. Road Freight

4.1.2. Rail Freight

4.1.3. Air Freight

4.1.4. Sea Freight

4.2. By Service Type (In Value %)

4.2.1. Transportation

4.2.2. Warehousing and Distribution

4.2.3. Value-Added Services (Customs Clearance, Packaging)

4.3. By End-User Industry (In Value %)

4.3.1. Manufacturing

4.3.2. Retail and FMCG

4.3.3. Healthcare and Pharmaceuticals

4.3.4. Chemicals

4.4. By Region (In Value %)

4.4.1. North

4.4.2. West

4.4.3. South

4.4.4. East

4.5. By Logistics Providers (In Value %)

4.5.1. First-Party Logistics (1PL)

4.5.2. Second-Party Logistics (2PL)

4.5.3. Third-Party Logistics (3PL)

4.5.4. Fourth-Party Logistics (4PL)

Vietnam Freight and Logistics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Gemadept Corporation

5.1.2. Vietnam Airlines Cargo

5.1.3. Transimex Corporation

5.1.4. ITL Corporation

5.1.5. Saigon Newport Corporation

5.1.6. DHL Vietnam

5.1.7. FedEx Vietnam

5.1.8. Viettel Post

5.1.9. Kerry Logistics Vietnam

5.1.10. Nippon Express Vietnam

5.1.11. DB Schenker Vietnam

5.1.12. Yusen Logistics Vietnam

5.1.13. Kuehne + Nagel Vietnam

5.1.14. APL Logistics Vietnam

5.1.15. CJ Logistics Vietnam

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Share, Fleet Size, Operational Reach, Technological Integration, Service Offerings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Vietnam Freight and Logistics Market Regulatory Framework

6.1. Trade and Customs Regulations

6.2. Environmental Standards for Logistics Operations

6.3. Certification Processes for Freight and Logistics Providers

Vietnam Freight and Logistics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Vietnam Freight and Logistics Future Market Segmentation

8.1. By Mode of Transport (In Value %)

8.2. By Service Type (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Logistics Providers (In Value %)

Vietnam Freight and Logistics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the entire Vietnam Freight and Logistics ecosystem, identifying key stakeholders such as logistics service providers, freight forwarders, and government bodies. Extensive secondary research was conducted to gather information on market drivers, challenges, and trends, helping to identify the critical variables impacting the market.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data, such as market size and transportation demand, for a comprehensive understanding of the market landscape. The assessment of different modes of transport, service types, and logistics providers was crucial to construct an accurate picture of the market's current state.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed based on historical data and trends and validated through expert consultations with industry professionals. These interviews provided insights into operational and financial dynamics, which further enriched the research findings and improved data accuracy.

Step 4: Research Synthesis and Final Output

The final phase integrated insights from leading logistics companies, which were cross-verified through multiple approaches. This allowed for the creation of a comprehensive market report that encompasses both quantitative and qualitative insights into the Vietnam Freight and Logistics market.

Frequently Asked Questions

How big is the Vietnam Freight and Logistics Market?

The Vietnam Freight and Logistics market is valued at USD 48 billion, driven by increasing infrastructure investments, booming e-commerce, and its strategic role in international trade routes.

What are the challenges in the Vietnam Freight and Logistics Market?

Challenges in the Vietnam Freight and Logistics market include a fragmented supply chain, high operational costs, regulatory hurdles, and a lack of skilled workforce, which continue to hamper the industry's overall efficiency.

Who are the major players in the Vietnam Freight and Logistics Market?

Key players in the Vietnam Freight and Logistics market include Gemadept Corporation, Transimex Corporation, DHL Vietnam, FedEx Vietnam, and ITL Corporation, all of which dominate due to their extensive networks and technological integration.

What are the growth drivers of the Vietnam Freight and Logistics Market?

Growth drivers in the Vietnam Freight and Logistics market include trade liberalization, infrastructure investments, rising e-commerce demand, and government support for logistics and transportation infrastructure.

What is the future outlook for the Vietnam Freight and Logistics Market?

The Vietnam Freight and Logistics market is expected to experience growth, driven by enhanced port facilities, the expansion of road and rail networks, and the adoption of new technologies to optimize supply chains.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.