Vietnam Frozen Food Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD2654

December 2024

84

About the Report

Vietnam Frozen Food Market Overview

- The Vietnam Frozen Food market is valued at USD 1.7 billion, based on a five-year historical analysis, driven by the increasing demand for convenience foods. Urbanization and a fast-paced lifestyle have led consumers to rely more on ready-to-eat frozen products, particularly in urban centers like Ho Chi Minh City and Hanoi. The expansion of cold chain infrastructure has also allowed companies to increase the distribution of frozen goods, ensuring higher product quality and availability across regions. Reliable data from Vietnams Ministry of Industry and Trade suggests that the market is growing rapidly due to consumer trends and infrastructural advancements.

- Ho Chi Minh City and Hanoi dominate the Vietnam Frozen Food market, primarily due to their large populations, developed retail infrastructure, and higher disposable incomes. These cities also benefit from better logistics networks, including advanced cold storage systems, which facilitate a smoother supply chain for frozen foods. Furthermore, the rapid development of online food delivery services and an increasing preference for convenience meals contribute to the dominance of these metropolitan areas.

- In 2023, the Ministry of Health updated its guidelines for the import of frozen food products, mandating that all frozen goods entering Vietnam must meet the Hazard Analysis Critical Control Point (HACCP) standards. This regulatory framework has led to a 10% increase in rejected shipments due to non-compliance with these stricter safety guidelines, according to the Ministry of Health

Vietnam Frozen Food Market Segmentation

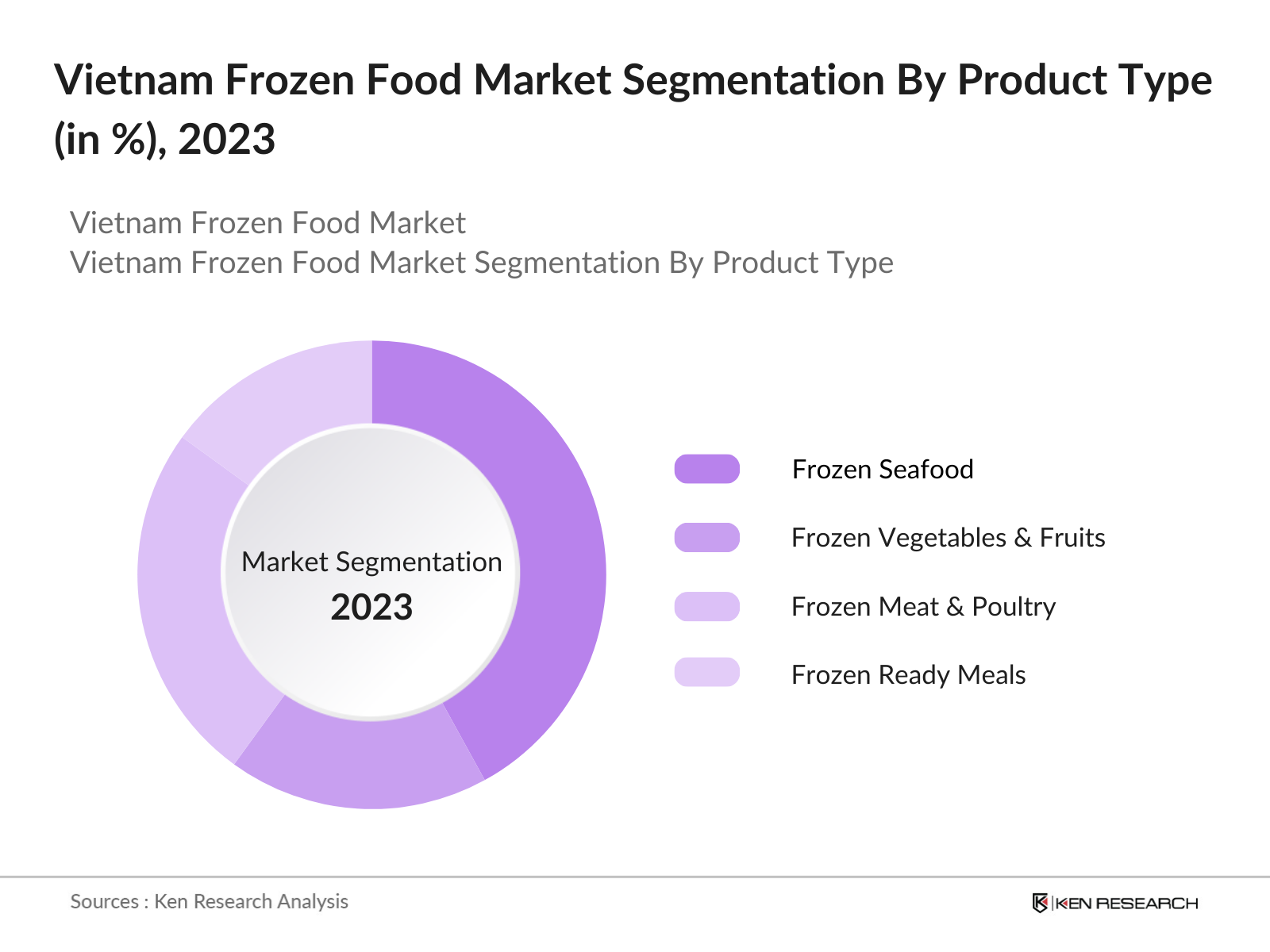

By Product Type: Vietnam's Frozen Food market is segmented by product type into frozen seafood, frozen vegetables and fruits, frozen meat and poultry, frozen ready meals, and frozen bakery products. Recently, frozen seafood has a dominant market share due to Vietnams strong seafood export industry and the increasing consumer preference for seafood-based meals. Companies like Minh Phu Seafood Corporation play a significant role in the supply chain, ensuring that the product quality remains high through stringent standards. Furthermore, the global demand for sustainable seafood has bolstered the presence of frozen seafood in the local market.

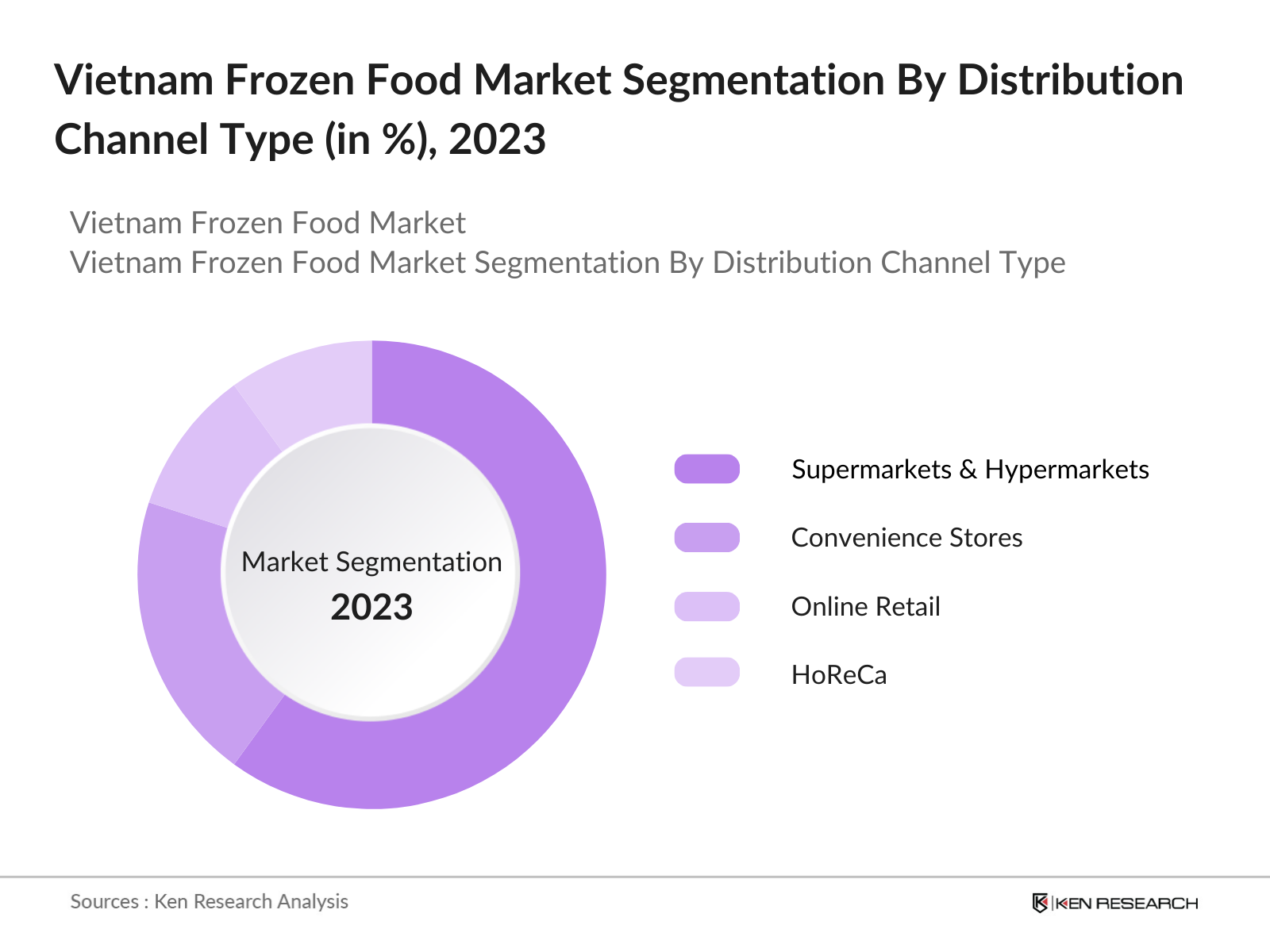

By Distribution Channel: The Vietnam Frozen Food market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online retail, and HoReCa (Hotels, Restaurants, and Catering). Supermarkets and hypermarkets have a dominant market share in this segment, primarily due to the established trust and convenience they provide to consumers. Chains like Saigon Co.op and VinMart have built large-scale freezer sections that offer a variety of frozen products, ensuring accessibility to high-quality frozen goods for everyday consumers. The convenience of purchasing frozen food in bulk from these large outlets is a key factor driving this segment's dominance.

Vietnam Frozen Food Market Competitive Landscape

The Vietnam Frozen Food market is dominated by a mix of local players like Minh Phu Seafood Corporation and Vinh Hoan Corporation, as well as international companies like CJ Foods and KIDO Foods. This market consolidation showcases the dominance of established players with robust cold chain networks, wide distribution channels, and strong relationships with local farmers and producers. The competitive landscape is also influenced by mergers, acquisitions, and strategic partnerships aimed at expanding product portfolios and market reach.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD) |

Market Share |

Key Products |

Cold Storage Facilities |

Export Capabilities |

Local Distribution Channels |

Sustainability Initiatives |

|

Minh Phu Seafood Corporation |

1992 |

Ca Mau, Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

Vinh Hoan Corporation |

1997 |

Dong Thap, Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

CJ Foods Vietnam |

2004 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

|

KIDO Foods |

1993 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

|

Saigon Co.op |

1989 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

- |

Vietnam Frozen Food Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenience Foods: With Vietnam's urbanization rate reaching 38% in 2023, the demand for convenient, ready-to-eat food options like frozen foods has surged. A growing number of dual-income households and the increasing pace of life in urban areas have led to a 30% rise in consumption of frozen food products compared to fresh options, according to Vietnam's Ministry of Industry and Trade. This trend is bolstered by the country's rising GDP per capita, which stood at $4,264 in 2023, supporting the affordability of convenience foods.

- Urbanization and Growing Middle-Class Population: Vietnam's middle-class population is projected to expand to 25 million people by 2025, up from 21 million in 2022, as reported by the World Bank. This demographic shift is driving increased spending on premium frozen food products, particularly in urban centers like Ho Chi Minh City and Hanoi, where urbanization rates are accelerating at 3.5% annually. The middle-class demand for high-quality, imported frozen foods continues to grow, particularly for products such as frozen seafood and processed meals.

- Expansion of Cold Chain Infrastructure: Vietnam has been investing heavily in cold chain logistics, with a 20% increase in new cold storage facilities recorded between 2022 and 2023. These investments are driven by both the public and private sectors to accommodate the expanding frozen food market. This expansion is vital as Vietnam aims to modernize its food supply chain, with 80% of cold storage capacities now meeting international standards, according to the Vietnam Logistics Business Association

Market Challenges

- High Energy Costs in Frozen Food Storage: The rising energy costs in Vietnam, particularly in urban areas, pose a significant challenge to the frozen food market. Energy prices have increased by approximately 5% annually from 2022 to 2024, reaching an average cost of 8.45 US cents per kWh in 2024, according to the Vietnam Electricity Corporation. This escalation directly impacts the operational costs of cold storage facilities, making frozen food products less competitive compared to fresh alternative.

- Consumer Perception of Frozen Foods vs Fresh Foods: Vietnamese consumers traditionally prefer fresh foods over frozen alternatives, with 65% of households still prioritizing fresh food purchases in 2023, based on a survey by the General Statistics Office of Vietnam. This consumer perception, rooted in cultural preferences, presents a barrier to market growth, particularly in rural areas where fresh produce is more accessible and affordable.

Vietnam Frozen Food Market Future Outlook

Over the next five years, the Vietnam Frozen Food market is expected to witness significant growth, driven by rising consumer demand for convenience foods and healthier frozen options. Continuous advancements in cold chain technology, along with government support for the food processing industry, are likely to further fuel market expansion. Key growth drivers will include the increasing adoption of frozen foods in the HoReCa sector, as well as the rise of e-commerce platforms offering frozen food delivery services. Furthermore, the growing trend toward plant-based frozen products is expected to create new opportunities in the market.

Opportunities

- Rise in E-commerce and Online Food Delivery Platforms: The e-commerce sector in Vietnam has been growing rapidly, with a 35% increase in online grocery sales in 2023, driven largely by the pandemic and shifting consumer behaviors. Companies such as Tiki and Shopee have expanded their frozen food categories, making frozen food products more accessible to a wider range of consumers. The growth of e-commerce has enabled manufacturers to reach previously untapped rural markets, where cold storage infrastructure may be limited.

- Growing Demand for Plant-Based and Healthy Frozen Food Options: There has been a notable rise in demand for plant-based frozen food products in Vietnam, reflecting global health trends. A 2023 survey conducted by the Vietnam Ministry of Health found that 28% of urban consumers prefer plant-based frozen meals over traditional options. The growing health consciousness among middle-class consumers is driving demand for healthier frozen alternatives, such as plant-based proteins and low-calorie meals, opening new avenues for market growth.

Scope of the Report

|

By Product Type |

Frozen Seafood Frozen Vegetables and Fruits Frozen Meat and Poultry Frozen Ready Meals Frozen Bakery Products |

|

By Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Retail HoReCa |

|

By End-User |

Household Consumers Food Service Industry |

|

By Storage Type |

Cold Storage Warehouses Retail Freezers Home Freezers |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Frozen Food Companies

Retail Chains (Saigon Co.op, VinMart)

HoReCa Industry (Hotels, Restaurants, and Catering Services)

Cold Storage Facility Companies

Logistics Companies specializing in Cold Chain Distribution

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade)

Online Retailers and E-commerce Platforms

Companies

Players Mentioned in the Report:

Minh Phu Seafood Corporation

Vinh Hoan Corporation

CJ Foods Vietnam

KIDO Foods

Saigon Co.op

GreenFeed Vietnam

Masan Group

C.P. Vietnam Corporation

Vinamilk

PAN Group

Nafoods Group

Fonterra Vietnam

Sovico Holdings

An Giang Fisheries Import and Export

Kinh Do Corporation

Table of Contents

1. Vietnam Frozen Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Frozen Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Frozen Food Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Convenience Foods

3.1.2. Urbanization and Growing Middle-Class Population

3.1.3. Expansion of Cold Chain Infrastructure

3.1.4. Technological Advancements in Food Preservation

3.2. Market Challenges

3.2.1. High Energy Costs in Frozen Food Storage (Vietnam-specific energy pricing)

3.2.2. Consumer Perception of Frozen Foods vs Fresh Foods

3.2.3. Complex Regulatory Framework for Frozen Food Imports

3.3. Opportunities

3.3.1. Rise in E-commerce and Online Food Delivery Platforms

3.3.2. Growing Demand for Plant-Based and Healthy Frozen Food Options

3.3.3. Government Initiatives to Boost Export of Processed Foods (Vietnam-specific trade policies)

3.4. Trends

3.4.1. Increasing Popularity of Frozen Seafood

3.4.2. Innovations in Sustainable Packaging for Frozen Foods

3.4.3. Expansion of Premium Frozen Food Categories (organic, gourmet)

3.5. Government Regulations

3.5.1. Food Safety Standards for Frozen Products

3.5.2. Vietnams Ministry of Health Guidelines on Frozen Food Imports

3.5.3. Vietnam Free Trade Agreements (impact on frozen food trade)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Frozen Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Frozen Seafood

4.1.2. Frozen Vegetables and Fruits

4.1.3. Frozen Meat and Poultry

4.1.4. Frozen Ready Meals

4.1.5. Frozen Bakery Products

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. HoReCa (Hotels, Restaurants, and Catering)

4.3. By End-User (In Value %)

4.3.1. Household Consumers

4.3.2. Food Service Industry

4.4. By Storage Type (In Value %)

4.4.1. Cold Storage Warehouses

4.4.2. Retail Freezers

4.4.3. Home Freezers

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Frozen Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Minh Phu Seafood Corporation

5.1.2. Vinh Hoan Corporation

5.1.3. Masan Group

5.1.4. CJ Foods Vietnam

5.1.5. GreenFeed Vietnam

5.1.6. KIDO Foods

5.1.7. Saigon Co.op

5.1.8. An Giang Fisheries Import and Export

5.1.9. C.P. Vietnam Corporation

5.1.10. Vinamilk

5.1.11. PAN Group

5.1.12. Kinh Do Corporation

5.1.13. Nafoods Group

5.1.14. Fonterra Vietnam

5.1.15. Sovico Holdings

5.2 Cross Comparison Parameters (Revenue, Market Share, No. of Employees, Distribution Networks, Export Volume, Supply Chain Partnerships, Innovation in Cold Storage, Product Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Incentives

5.8 Private Equity Investments

6. Vietnam Frozen Food Market Regulatory Framework

6.1. Food Safety and Quality Certifications (Vietnam-specific food safety certification bodies)

6.2. Import and Export Regulations (Vietnams trade agreements for frozen food products)

6.3. Licensing and Compliance Requirements

7. Vietnam Frozen Food Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Frozen Food Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Storage Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Frozen Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and mapping all the stakeholders within the Vietnam Frozen Food market. Comprehensive desk research is conducted using secondary databases, market reports, and company filings. This step helps to identify the critical variables driving market dynamics, including consumer behavior, supply chain infrastructure, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data related to frozen food production, consumption, and trade within Vietnam is analyzed. Key indicators such as revenue generation and market penetration rates are calculated. Additionally, the cold chain infrastructure is assessed to understand its impact on the market.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed, focusing on market trends, growth drivers, and challenges. These hypotheses are validated through consultations with experts in frozen food production, distribution, and retail. Insights gathered through interviews help fine-tune market estimations.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research findings into a coherent and validated market analysis. The output includes detailed market insights on product segments, sales performance, and emerging trends, providing an accurate picture of the Vietnam Frozen Food market.

Frequently Asked Questions

01. How big is the Vietnam Frozen Food market?

The Vietnam Frozen Food market is valued at USD 1.7 billion, with its growth driven by urbanization, increasing consumer demand for convenience, and an expanding cold chain infrastructure.

02. What are the challenges in the Vietnam Frozen Food market?

The market faces challenges such as high energy costs for cold storage, regulatory complexities for frozen food imports, and consumer skepticism regarding the freshness of frozen products.

03. Who are the major players in the Vietnam Frozen Food market?

Key players include Minh Phu Seafood Corporation, Vinh Hoan Corporation, CJ Foods Vietnam, and KIDO Foods. These companies lead the market through extensive cold storage facilities, strong distribution networks, and a focus on quality.

04. What are the growth drivers of the Vietnam Frozen Food market?

The market's growth is driven by urbanization, the rise of e-commerce platforms for food delivery, and advancements in cold chain logistics that allow wider distribution of frozen products.

05. What is the future outlook for the Vietnam Frozen Food market?

The market is poised for significant growth, supported by rising consumer demand for convenience foods, technological advancements in cold storage, and expanding online food delivery platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.