Vietnam Handicrafts Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD7899

December 2024

86

About the Report

Vietnam Handicrafts Market Overview

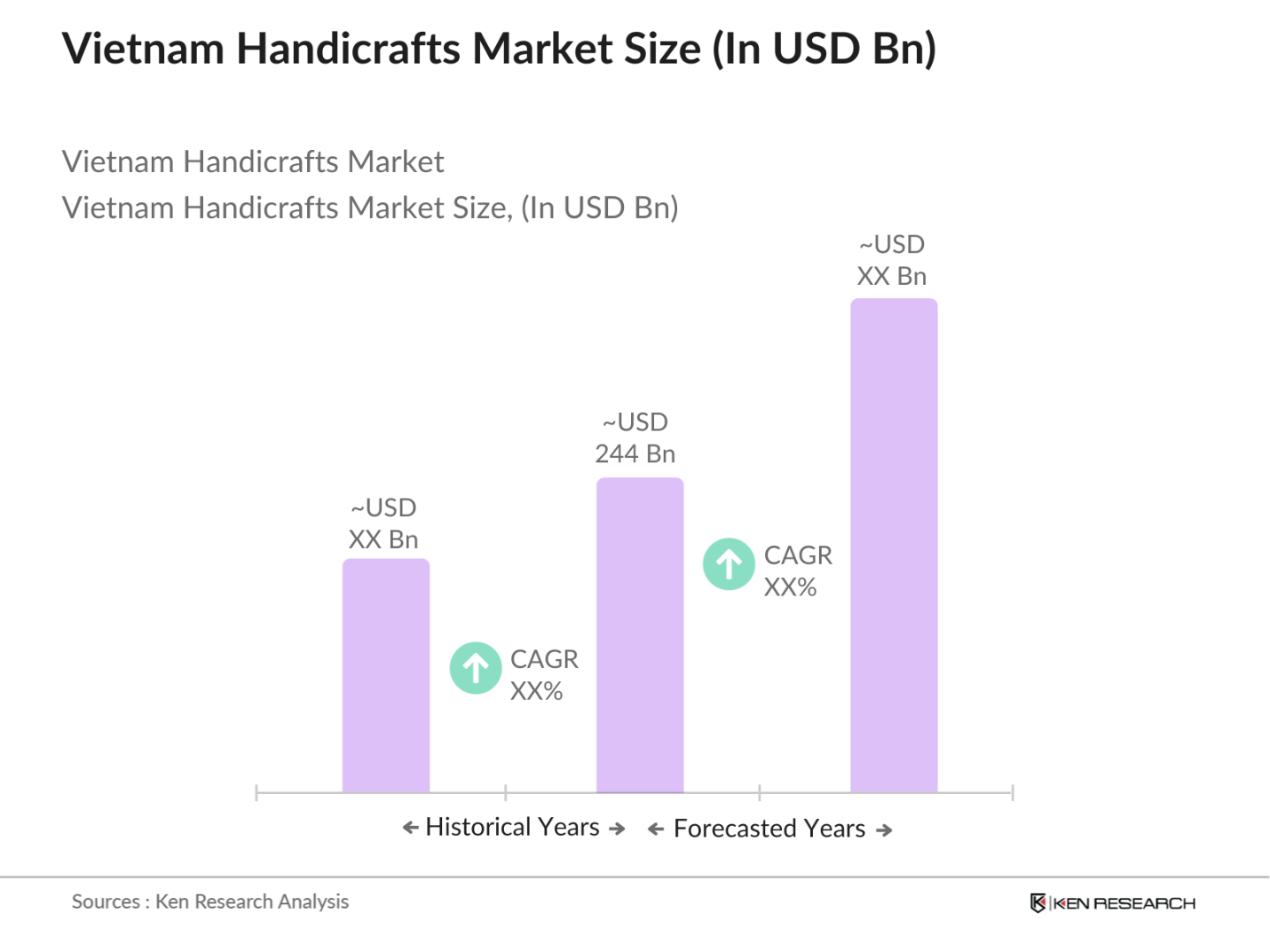

- The Vietnam Handicrafts Market is valued at USD 244 billion, driven primarily by the demand for eco-friendly and sustainable products globally. The market is rooted in the traditional craftsmanship of rural artisans, with significant contributions from small and medium enterprises (SMEs). Increasing global interest in cultural and authentic hand-made products has also played a key role in market growth. Additionally, the rise in exports, especially to markets in the United States, Japan, and the European Union, has provided strong momentum to the industry.

- Key cities and countries that dominate the Vietnam Handicrafts Market include Hanoi, Ho Chi Minh City, and traditional craft villages such as Bat Trang and Van Phuc. The reason for this dominance lies in the deep-rooted heritage and extensive expertise in handicraft production. Hanoi, for example, has a rich tradition of ceramic and silk production, while Ho Chi Minh City serves as a central hub for export activities due to its proximity to major shipping routes. These regions also benefit from skilled labor and strong government support, contributing to their continued prominence in the market.

- The Vietnamese government has introduced the Handicrafts Export Development Program (2021-2025) aimed at improving the global competitiveness of the countrys handicraft sector. The program provides training, market access assistance, and export promotion initiatives. As of 2023, over 1,000 artisans received training under this program, with a focus on improving design skills and market knowledge. The program has helped increase the number of export-ready enterprises in the sector by 15%, contributing to the strong growth of handicraft exports in recent years.

Vietnam Handicrafts Market Segmentation

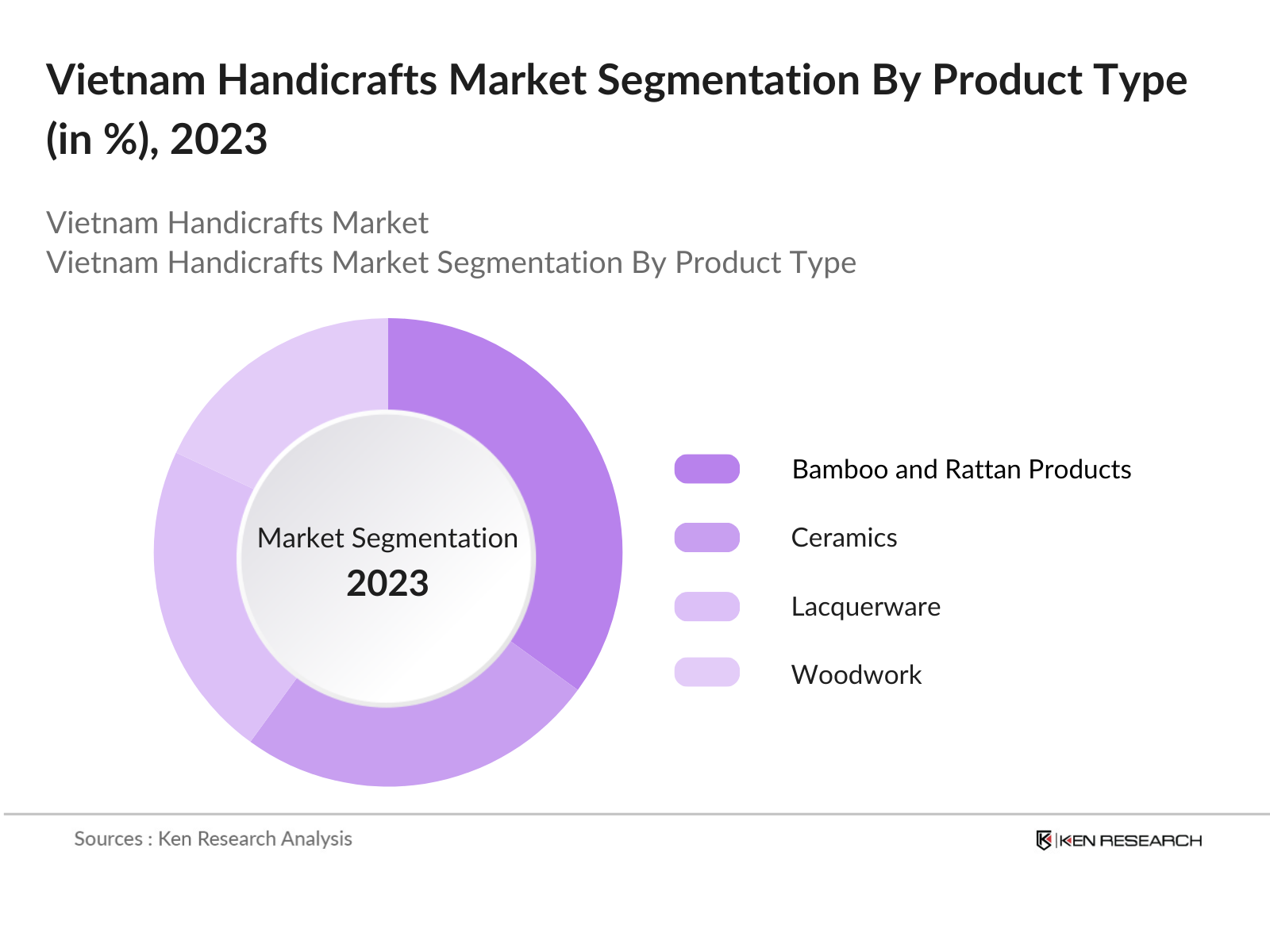

By Product Type: The Vietnam Handicrafts Market is segmented by product type into bamboo and rattan products, ceramics, lacquerware, woodwork, and textiles. Among these, bamboo and rattan products hold the dominant market share in 2023. This is largely due to their sustainable nature and increasing demand for eco-friendly home dcor and furniture. The lightweight, durable characteristics of bamboo and rattan products, combined with the versatility of design, have fueled their popularity in both domestic and international markets.

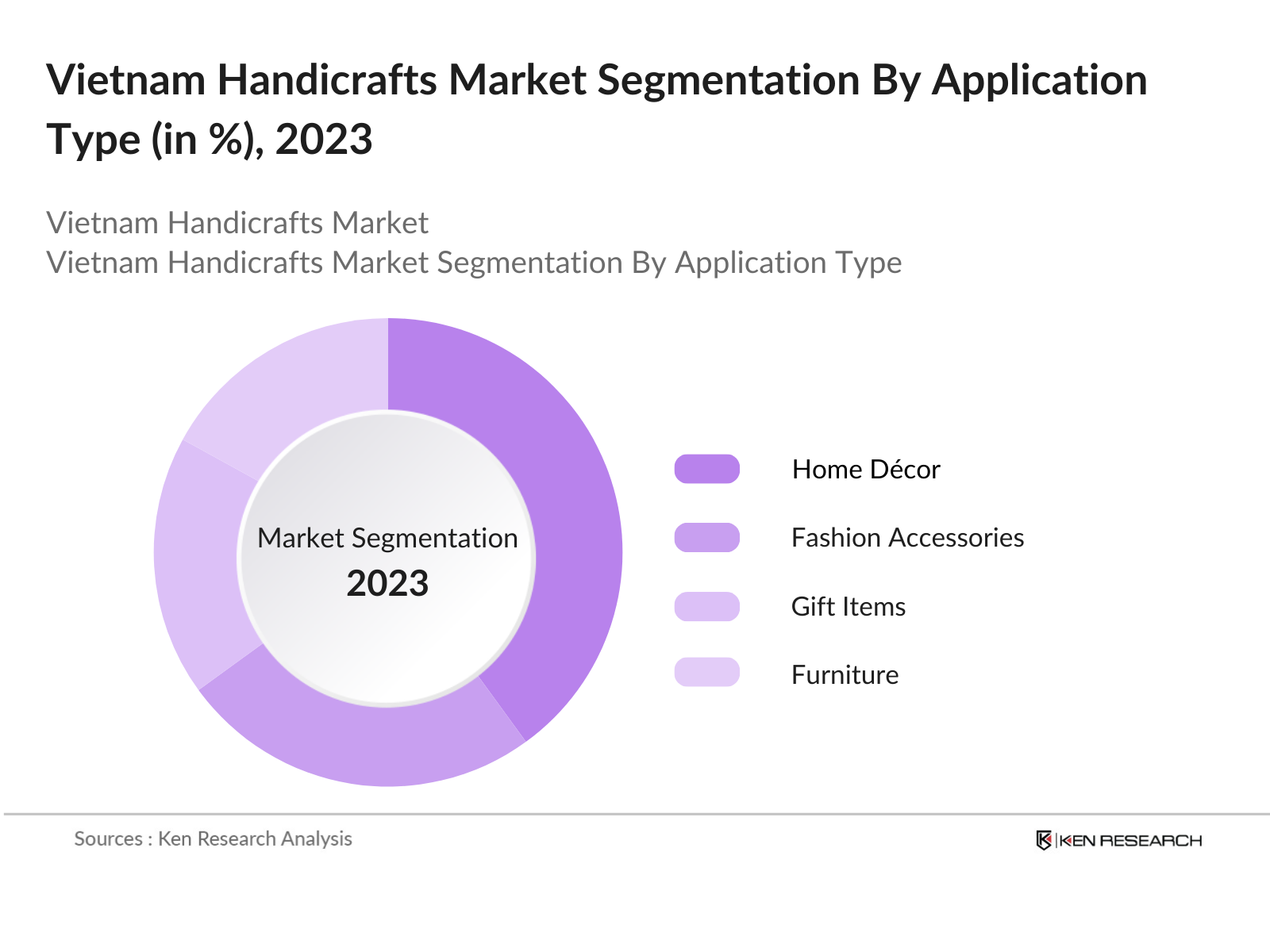

By Application: The market is also segmented by application into home dcor, fashion accessories, gift items, furniture, and religious artifacts. Home dcor emerges as the largest segment in 2023, driven by increasing consumer preference for handcrafted and personalized products. The global movement towards sustainability and the use of natural materials in interior design has bolstered demand for handmade, artisanal home dcor items such as lamps, wall hangings, and baskets.

Vietnam Handicrafts Market Competitive Landscape

The Vietnam Handicrafts Market is characterized by a mixture of small-scale artisans, cooperatives, and a few prominent players. The competitive landscape is dominated by traditional producers, along with modernized companies catering to both local and international markets. Local firms like Craft Link and Mai Handicrafts have established strong networks with international buyers, while villages such as Bat Trang and Van Phuc are known for producing ceramics and silk, respectively. This consolidation reflects the significant influence of both modern and traditional producers on the market.

|

Company |

Established |

Headquarters |

Market Reach |

No. of Artisans |

Export Value |

Product Range |

Online Presence |

Design Collaboration |

|

Craft Link |

1996 |

Hanoi |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mai Handicrafts |

1991 |

Ho Chi Minh City |

_ |

_ |

_ |

_ |

_ |

_ |

|

Bat Trang Pottery |

Historical |

Hanoi |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mekong Quilts |

2002 |

Ho Chi Minh City |

_ |

_ |

_ |

_ |

_ |

_ |

|

Van Phuc Silk Village |

Historical |

Hanoi |

_ |

_ |

_ |

_ |

_ |

_ |

Vietnam Handicrafts Industry Analysis

Growth Drivers

Growing Demand for Sustainable and Eco-friendly Products: The growing global awareness about sustainability has driven demand for eco-friendly products, including handicrafts. Vietnam's Ministry of Industry and Trade reports that the country exported 2.5 million tons of bamboo, rattan, and wooden products in 2023, highlighting strong demand for natural materials. This shift aligns with the global push for environmentally friendly alternatives to plastic and synthetic products. Vietnams exports of sustainable handicrafts increased by 15% in volume between 2022 and 2024, supported by rising international demand for ethically sourced products. Government programs like the National Green Growth Strategy (2021-2030) further drive this market segment.

Rise in Exports to Global Markets: Vietnam's handicrafts sector is increasingly targeting global markets, particularly in Europe, the U.S., and Japan. In 2023, the export value of Vietnamese handicrafts reached USD 3.2 billion, primarily from the U.S. and European markets. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and EU-Vietnam Free Trade Agreement (EVFTA) have removed tariffs, boosting competitiveness. The U.S. is the largest market for Vietnamese handicrafts, accounting for 35% of total exports, followed by the EU with 25%. This increase reflects both market expansion and international demand for high-quality handmade goods.

Supportive Government Policies and Trade Agreements: Vietnams government has implemented several policies and trade agreements to support its handicrafts sector. The EVFTA and CPTPP agreements have significantly reduced tariffs on Vietnamese handicrafts, increasing their appeal in foreign markets. The Vietnam Handicraft Export Development Program (2021-2025) includes training for artisans, access to new markets, and trade promotion initiatives, contributing to a 12% annual growth in handicraft exports in the first half of 2024. Vietnam's handicrafts sector also benefits from tax exemptions and favorable credit terms for SMEs, helping them scale and modernize operations.

Market Challenges

- Competition from Mass-produced Goods: Vietnams handicrafts market faces stiff competition from mass-produced goods, especially from countries like China, which can offer lower prices due to industrial-scale production. In 2023, more than 30% of domestic consumers opted for cheaper, mass-produced alternatives over handcrafted items. This trend is particularly noticeable in the urban markets, where industrial goods flood the market due to their affordability and availability. However, Vietnams handicrafts sector is trying to differentiate itself through unique designs and sustainable materials to remain competitive.

- Supply Chain Disruptions: Seasonal fluctuations in production, especially in rural craft villages, often disrupt the supply chain of Vietnams handicraft industry. For instance, raw material shortages in bamboo and rattan production were reported during the wet season of 2023, causing a 20% drop in output in certain regions. Many villages rely heavily on seasonal labor, further exacerbating these disruptions. This seasonality creates inconsistencies in supply, making it challenging for international buyers to rely on steady imports, especially during peak demand periods.

Vietnam Handicrafts Market Future Outlook

Over the next five years, the Vietnam Handicrafts Market is expected to experience significant growth due to rising international demand for sustainable and cultural products. The increase in e-commerce platforms supporting small artisans, combined with growing consumer interest in personalized and handmade items, will drive market expansion. Additionally, government initiatives aimed at promoting rural craft villages and supporting SMEs through favorable trade agreements will further bolster growth. The future landscape will likely see stronger collaborations between local artisans and global designers, enhancing the appeal of Vietnamese handicrafts in international markets.

Opportunities

- Expansion of E-commerce Platforms for Handicrafts: The digital economy offers significant opportunities for Vietnams handicrafts sector. In 2024, e-commerce sales of handicrafts increased by 18%, driven by platforms like Tiki and Lazada. Government initiatives such as the E-commerce Development Plan (2021-2025) support small-scale artisans by facilitating access to online markets. Around 50% of handicraft businesses in Vietnam now sell their products online, broadening their customer base domestically and internationally. This trend is expected to continue growing, as the number of internet users in Vietnam crossed 77 million in 2023.

- Growing Demand for Customization and Personalization: Consumers are increasingly seeking personalized and customized handicraft products, and Vietnams artisans are well-positioned to meet this demand. In 2023, more than 30% of orders for handicrafts in Vietnams key export markets were for custom-made items, according to data from the Vietnam Chamber of Commerce. This trend is particularly popular in Western markets, where consumers value unique, personalized items. The rise of direct-to-consumer (DTC) platforms has further enabled Vietnamese artisans to cater to niche markets with tailored offerings.

Scope of the Report

|

By Product Type |

Bamboo and Rattan Products Ceramics and Pottery Lacquerware Woodwork and Carvings Textiles and Embroidery |

|

By Material Type |

Natural Materials Synthetic and Recycled Materials Textile Fibers Ceramics and Clay |

|

By Application |

Home Dcor, Fashion Accessories Gift Items and Souvenirs Furniture Religious and Cultural Artifacts |

|

By End-user |

Residential Consumers Commercial Buyers Retailers Wholesalers and Exporters |

|

By Region |

Red River Delta Mekong River Delta Central Highlands Northern Midlands and Mountain Areas Southeast Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Artisanal Cooperative Companies

Exporters Industries

Interior Designing Companies

E-commerce Companies

Government Agencies (Vietnam Handicraft Export Development Program)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Trade, Vietnam Customs)

Companies

Players Mentioned in the Report

Craft Link

Mai Handicrafts

Mekong Quilts

Bat Trang Pottery Village

Van Phuc Silk Village

Hoa Binh Cooperative

Quang Nam Woodcrafts

VinaCraft

Xuan Lai Bamboo Village

Thanh Ha Pottery Village

Table of Contents

1. Vietnam Handicrafts Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Handicrafts Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Handicrafts Market Analysis

3.1. Growth Drivers

3.1.1. Growing Demand for Sustainable and Eco-friendly Products

3.1.2. Rise in Exports to Global Markets

3.1.3. Supportive Government Policies and Trade Agreements

3.1.4. Increasing Popularity of Handcrafted and Ethnic Products

3.2. Market Challenges

3.2.1. Competition from Mass-produced Goods

3.2.2. Supply Chain Disruptions (Seasonal Production Fluctuations)

3.2.3. Lack of Technological Integration in Production

3.3. Opportunities

3.3.1. Expansion of E-commerce Platforms for Handicrafts

3.3.2. Growing Demand for Customization and Personalization

3.3.3. Increasing Domestic Tourism and Demand for Souvenirs

3.4. Trends

3.4.1. Adoption of Sustainable and Recyclable Materials

3.4.2. Collaboration with Global Designers

3.4.3. Use of Digital Marketing by Local Artisans

3.5. Government Regulation

3.5.1. Vietnam Handicrafts Export Development Program

3.5.2. Tax Incentives for Small and Medium Enterprises (SMEs)

3.5.3. Policies Supporting Rural Craft Villages

3.6. SWOT Analysis

3.7. Stake Ecosystem (Craft Villages, Artisans, Exporters, E-commerce Platforms)

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of Substitutes

3.8.4. Threat of New Entrants

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

4. Vietnam Handicrafts Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bamboo and Rattan Products

4.1.2. Ceramics and Pottery

4.1.3. Lacquerware

4.1.4. Woodwork and Carvings

4.1.5. Textiles and Embroidery

4.2. By Material Type (In Value %)

4.2.1. Natural Materials (Bamboo, Rattan, Wood)

4.2.2. Synthetic and Recycled Materials

4.2.3. Textile Fibers

4.2.4. Ceramics and Clay

4.3. By Application (In Value %)

4.3.1. Home Dcor

4.3.2. Fashion Accessories

4.3.3. Gift Items and Souvenirs

4.3.4. Furniture

4.3.5. Religious and Cultural Artifacts

4.4. By End-user (In Value %)

4.4.1. Residential Consumers

4.4.2. Commercial Buyers (Hotels, Restaurants)

4.4.3. Retailers (Specialty Stores, E-commerce)

4.4.4. Wholesalers and Exporters

4.5. By Region (In Value %)

4.5.1. Red River Delta

4.5.2. Mekong River Delta

4.5.3. Central Highlands

4.5.4. Northern Midlands and Mountain Areas

4.5.5. Southeast Vietnam

5. Vietnam Handicrafts Market Competitive Analysis 5.1 Detailed Profiles of Major Companies

5.1.1. Craft Link

5.1.2. Mekong Quilts

5.1.3. Mai Handicrafts

5.1.4. Van Phuc Silk Village

5.1.5. Quang Nam Woodcrafts

5.1.6. Hoa Binh Cooperative

5.1.7. VinaCraft

5.1.8. Phu Vinh Rattan Village

5.1.9. Xuan Lai Bamboo Village

5.1.10. Thanh Ha Pottery Village

5.1.11. Minh Long Ceramics

5.1.12. Bat Trang Pottery Village

5.1.13. Dong Ho Painting Village

5.1.14. Chuong Conical Hat Village

5.1.15. Tay Tuu Flower Village

5.2 Cross Comparison Parameters (Number of Artisans, Product Range, Export Markets, Production Capacity, Revenue, Export Value, Design Collaboration, Online Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Vietnam Handicrafts Market Regulatory Framework

6.1. Trade Policies and Agreements (ASEAN, EU-Vietnam Free Trade Agreement)

6.2. Environmental Regulations for Sustainable Crafting

6.3. Certification Processes (Fair Trade, Eco-labels)

7. Vietnam Handicrafts Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Handicrafts Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Application (In Value %)

8.4. By End-user (In Value %)

8.5. By Region (In Value %)

9. Vietnam Handicrafts Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping out all relevant stakeholders in the Vietnam Handicrafts Market. Using comprehensive desk research, we analyze the key variables such as production capacities, export volumes, and artisan demographics, essential to understanding the market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on gathering historical data from various sources to assess market penetration, exports, and growth drivers. Data on consumer preferences and production quality will also be reviewed to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses, generated from secondary research, will be validated through interviews with industry experts, including artisans, exporters, and government bodies. These interviews will help refine market insights and ensure data reliability.

Step 4: Research Synthesis and Final Output

The final phase involves integrating insights from manufacturers, exporters, and e-commerce platforms. This bottom-up approach will be combined with quantitative data, ensuring a detailed and verified analysis of the Vietnam Handicrafts Market.

Frequently Asked Questions

01. How big is the Vietnam Handicrafts Market?

The Vietnam Handicrafts Market is valued at USD 244 billion, driven by growing exports and increased consumer interest in eco-friendly and culturally significant products.

02. What are the challenges in the Vietnam Handicrafts Market?

Challenges include competition from mass-produced goods, seasonal production constraints, and the lack of technological integration in many rural craft villages, affecting scalability.

03. Who are the major players in the Vietnam Handicrafts Market?

Key players include Craft Link, Mai Handicrafts, Bat Trang Pottery Village, Mekong Quilts, and Van Phuc Silk Village. These companies dominate due to their strong international partnerships and skilled craftsmanship.

04. What are the growth drivers of the Vietnam Handicrafts Market?

Growth drivers include rising international demand for sustainable, handmade products, government support for rural craft villages, and the expansion of e-commerce platforms supporting artisans.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.