Vietnam Health Supplement Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9267

November 2024

98

About the Report

Vietnam Health Supplement Market Overview

- The Vietnam Health Supplement market is valued at USD 650 billion, based on a five-year historical analysis. This growth is driven by increasing consumer awareness regarding personal health, rising disposable incomes, and a growing aging population. Moreover, the market has seen a boost due to the widespread adoption of supplements during the COVID-19 pandemic, where health consciousness became a top priority among Vietnamese consumers. Government campaigns promoting health and wellness, along with favorable regulations, have further spurred this market's expansion.

- Dominant cities in the Vietnam Health Supplement market include Ho Chi Minh City and Hanoi. These cities dominate due to their higher levels of disposable income, urbanization, and access to a wide variety of supplement products through modern trade channels. Additionally, the population in these areas is more health-conscious, actively seeking products that enhance well-being, such as vitamins, minerals, and herbal supplements, contributing to the market's dominance in these regions.

- In 2024, the Vietnamese government continued to enforce the Food Safety and Standards Act (FSSA) to regulate the health supplement market. All supplement manufacturers are required to comply with stringent safety regulations, including quality control measures, ingredient transparency, and labeling accuracy. Violations can result in severe penalties, including product recalls and financial fines. According to the Ministry of Health, more than 200 supplements failed to meet FSSA standards in 2023 and were subsequently removed from the market. This strict regulatory framework ensures consumer safety but also raises entry barriers for new market players.

Vietnam Health Supplement Market Segmentation

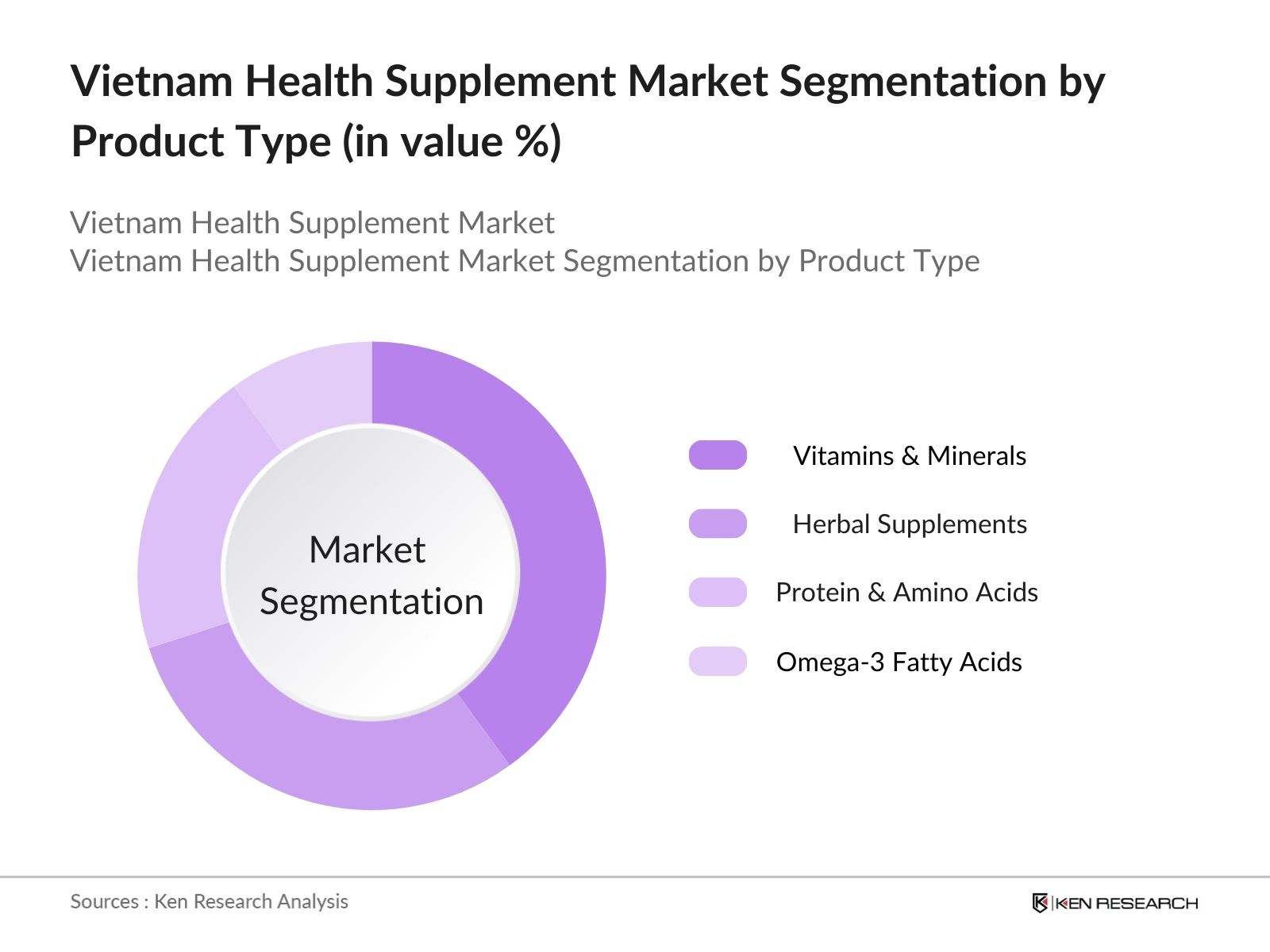

- By Product Type: The market is segmented by product type into vitamins & minerals, herbal supplements, protein & amino acids, and omega-3 fatty acids. Recently, vitamins & minerals have captured a dominant market share in Vietnam under the product type segmentation. The dominance of this segment is attributed to the increasing consumer focus on boosting immunity and overall health. With government initiatives promoting general health and wellness, this segment has experienced significant growth. Vitamins such as C and D, along with multivitamins, have become household staples, particularly after the pandemic.

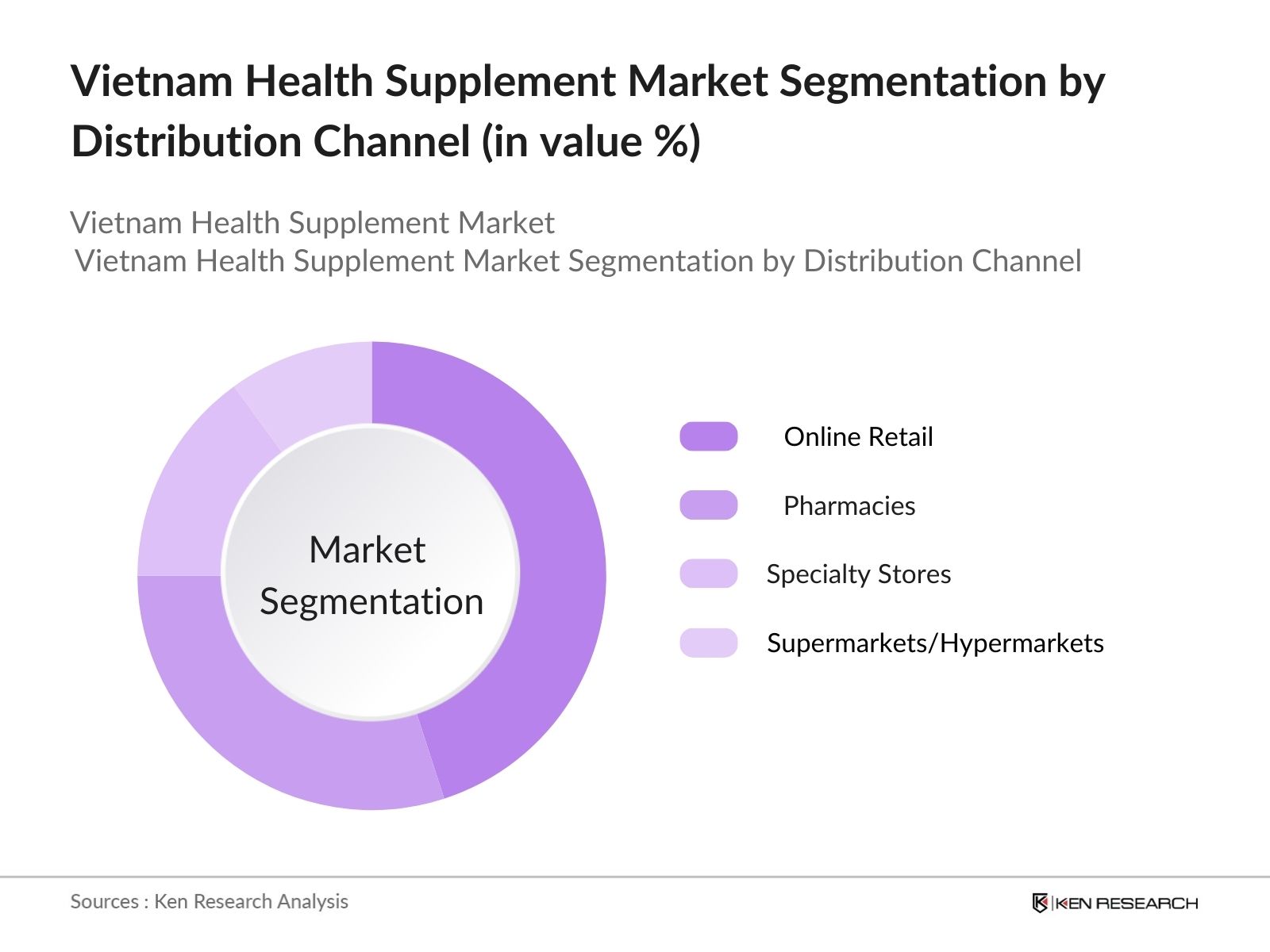

- By Distribution Channel: The market is also segmented by distribution channels, including online retail, pharmacies, specialty stores, and supermarkets/hypermarkets. Online retail holds the largest market share due to the convenience and variety it offers consumers. The digital shift in consumer buying behavior, accelerated by the pandemic, has made online platforms a preferred method for purchasing health supplements. Consumers can easily access information about the supplements, compare prices, and read customer reviews before making a purchase, leading to a surge in online sales.

Vietnam Health Supplement Market Competitive Landscape

The Vietnam Health Supplement market is dominated by several key players, both local and international. The competitive landscape is characterized by a strong focus on product innovation, marketing, and distribution. International brands such as Abbott Laboratories and Herbalife maintain a significant presence due to their established trust and global expertise. Local players like Vinamilk are also making strides by leveraging their brand strength in the domestic market, offering locally adapted products that resonate with Vietnamese consumers.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Market Presence |

R&D Investment |

Product Portfolio |

Strategic Initiatives |

Market Share (%) |

|

Abbott Laboratories |

1888 |

Illinois, USA |

|||||||

|

Herbalife Nutrition |

1980 |

Los Angeles, USA |

|||||||

|

Vinamilk |

1976 |

Ho Chi Minh, Vietnam |

|||||||

|

Amway Vietnam |

1959 |

Michigan, USA |

|||||||

|

Natures Way |

1969 |

Sydney, Australia |

Vietnam Health Supplement Industry Analysis

Growth Drivers

- Rising Health Consciousness: Vietnam has seen a marked rise in health consciousness among its population, driven by growing awareness of preventive healthcare. In 2024, the Ministry of Health reported that over 70% of urban residents regularly seek health supplements to improve their overall well-being. This shift is attributed to the increasing prevalence of lifestyle-related diseases such as diabetes and cardiovascular disorders. In addition, the demand for vitamins, minerals, and herbal supplements has surged, particularly among the working-class population, who are looking to maintain long-term health. As healthcare expenditure rises to $17 billion in 2024, health supplements are becoming an integral part of daily health routines.

- Increasing Geriatric Population: Vietnams aging population has become a significant factor in driving the health supplement market. By 2024, approximately 12 million people in Vietnam are aged 60 or older, according to the General Statistics Office of Vietnam. The geriatric population is particularly vulnerable to nutritional deficiencies, which has led to increased demand for supplements such as calcium and omega-3 fatty acids. The Ministry of Health has noted a rise in the consumption of supplements aimed at improving joint health, immunity, and energy levels among older adults. This demographic trend is expected to further boost the market, as the elderly population continues to grow.

- Government Initiatives for Public Health: Vietnams government has been actively promoting public health through various initiatives aimed at improving nutrition and reducing disease. The National Nutrition Strategy (2017-2025) emphasizes the importance of dietary supplements in preventing malnutrition, particularly in rural and underserved areas. In 2024, the Ministry of Health launched a campaign to encourage the use of micronutrient-rich supplements among pregnant women and children under five, contributing to an increased demand for multivitamins and fortified products. This policy support ensures a stable regulatory environment for health supplement manufacturers to thrive.

Market Challenges

- Stringent Regulatory Standards (Government Compliance): The Vietnamese health supplement market is tightly regulated, with stringent standards set by the Ministry of Health to ensure product safety and efficacy. In 2024, the government reinforced compliance with the Food Safety Law, requiring all health supplements to be registered and tested for contaminants before reaching the market. Failure to meet these requirements has led to the confiscation of substandard products, with over 2,500 supplements being removed from shelves between 2022 and 2024. These regulatory hurdles pose a significant challenge for both domestic and international players looking to enter the market.

- High Competition from Local Brands: Vietnams health supplement market is characterized by fierce competition from local brands, many of which have gained consumer trust through affordable and culturally familiar products. Brands such as Vinaga and Bao Thanh have established a strong presence by offering traditional herbal supplements that resonate with local preferences. By 2024, these domestic players controlled over 60% of the market share. This intense competition from well-established local companies makes it difficult for new entrants to gain a foothold without substantial investments in marketing and product differentiation

Vietnam Health Supplement Market Future Outlook

Over the next five years, the Vietnam Health Supplement market is expected to show steady growth driven by increasing consumer demand for immunity-boosting products, government health initiatives, and the expansion of online retail platforms. The rise in chronic diseases, along with the aging population, will further fuel demand for health supplements aimed at enhancing overall well-being. Manufacturers are also likely to explore sustainable and natural supplements to cater to the growing demand for eco-friendly and organic products.

Future Market Opportunities

- Expansion into Rural Markets: Rural areas represent a significant untapped market for health supplements in Vietnam. As of 2024, nearly 65% of Vietnams population lives in rural regions, according to the General Statistics Office. Despite lower income levels, there is growing awareness of health supplements, particularly for nutritional support in children and pregnant women. Government health initiatives, such as the "Healthy Village" program, are expected to raise the demand for affordable supplements. Companies that can offer cost-effective solutions tailored to the needs of rural populations will be well-positioned to capitalize on this growth opportunity.

- Technological Innovations in Supplement Production: Innovations in supplement production technology are creating new opportunities in the Vietnamese health supplement market. Companies are investing in advanced formulations, such as slow-release capsules and bio-enhanced ingredients, to improve the efficacy of their products. By 2024, local manufacturers had begun adopting nanotechnology to enhance the absorption of key nutrients like curcumin and omega-3 fatty acids. These technological advancements not only improve product quality but also enable companies to offer more specialized, high-value supplements that cater to specific health concerns.

Scope of the Report

|

Vitamins & Minerals Herbal Supplements Protein & Amino Acids Omega-3 Fatty Acids |

|||

|

By Distribution Channel |

Online Retail Pharmacies Specialty Stores Supermarkets/Hypermarkets |

||

|

By Application |

General Health Digestive Health Bone & Joint Health Immunity |

||

|

By End-User |

|

||

|

By Region |

North East West South |

Products

Key Target Audience

Pharmaceutical Companies

Dietary Supplement Manufacturers

Healthcare Providers

Online Retail Platforms

Pharmacies

Banks and Financial Institutes

Investment and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Health, Vietnam Food Administration)

Wellness Centers and Fitness Clubs

Companies

Players Mentions in the Report

Abbott Laboratories

Herbalife Nutrition

Vinamilk

Amway Vietnam

Natures Way

DHC Corporation

Blackmores

Nutrilite

Pharmacity

Mega Lifesciences

GNC Vietnam

Lifeline Supplements

TH True Milk

Unicity Vietnam

Vinh Hao Mineral Water

Table of Contents

1. Vietnam Health Supplement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Health Supplement Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Health Supplement Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Increasing Geriatric Population

3.1.3. Government Initiatives for Public Health

3.1.4. Expansion of E-commerce Platforms

3.2. Market Challenges

3.2.1. Stringent Regulatory Standards (Government Compliance)

3.2.2. High Competition from Local Brands

3.2.3. Price Sensitivity of Consumers

3.3. Opportunities

3.3.1. Expansion into Rural Markets

3.3.2. Technological Innovations in Supplement Production

3.3.3. Increasing Investment in R&D

3.4. Trends

3.4.1. Organic and Natural Supplements (Consumer Preferences)

3.4.2. Personalized Supplements (Technological Advancements)

3.4.3. Online Direct-to-Consumer Sales Channels

3.5. Government Regulation

3.5.1. Food Safety and Standards Act (FSSA) Compliance

3.5.2. Supplement Labeling Requirements

3.5.3. Import Tariffs and Trade Regulations

3.5.4. National Nutritional Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Health Supplement Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vitamins & Minerals

4.1.2. Herbal Supplements

4.1.3. Protein & Amino Acids

4.1.4. Omega-3 Fatty Acids

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Pharmacies

4.2.3. Specialty Stores

4.2.4. Supermarkets/Hypermarkets

4.3. By Application (In Value %)

4.3.1. General Health

4.3.2. Digestive Health

4.3.3. Bone & Joint Health

4.3.4. Immunity

4.4. By End-User (In Value %)

4.4.1. Adults

4.4.2. Pregnant Women

4.4.3. Children

4.4.4. Elderly Population

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. Vietnam Health Supplement Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Amway Vietnam

5.1.3. Herbalife Nutrition

5.1.4. Unicity Vietnam

5.1.5. DHC Corporation

5.1.6. Natures Way

5.1.7. Blackmores

5.1.8. Nutrilite

5.1.9. Pharmacity

5.1.10. Mega Lifesciences

5.1.11. GNC Vietnam

5.1.12. Lifeline Supplements

5.1.13. Vinamilk

5.1.14. TH True Milk

5.1.15. Vinh Hao Mineral Water

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Inception Year, Market Presence, R&D Investments, Market Share, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Health Supplement Market Regulatory Framework

6.1. Food Safety Certifications

6.2. Licensing and Approvals

6.3. Supplement Ingredient Compliance

6.4. Import/Export Regulations

7. Vietnam Health Supplement Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Health Supplement Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Health Supplement Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Preferences Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem for the Vietnam Health Supplement Market. This step includes desk research using secondary and proprietary databases to understand the industry's overall structure. The main goal here is to identify the key variables, such as consumer behavior, market dynamics, and government regulations that influence market trends.

Step 2: Market Analysis and Construction

In this step, historical data related to the Vietnam Health Supplement Market is collected and analyzed. This involves evaluating sales data, product penetration rates, and consumer preferences. We also look at the overall revenue generation and how these factors impact the market structure.

Step 3: Hypothesis Validation and Expert Consultation

To ensure accuracy, the hypotheses developed from initial data are validated through interviews with industry experts and stakeholders. This process involves direct consultations to gather financial insights and operational data that are critical to understanding the market.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing all the collected data into a comprehensive report. This includes direct consultations with key market players to refine the statistical models and ensure the data represents an accurate picture of the Vietnam Health Supplement Market.

Frequently Asked Questions

01. How big is the Vietnam Health Supplement Market?

The Vietnam Health Supplement market is valued at USD 650 billion, driven by increasing consumer awareness, a rising aging population, and growing disposable income levels.

02. What are the challenges in the Vietnam Health Supplement Market?

Challenges in Vietnam Health Supplement market include stringent regulatory standards, competition from local brands, and price sensitivity among consumers, which can limit market expansion.

03. Who are the major players in the Vietnam Health Supplement Market?

Key players in the Vietnam Health Supplement market include Abbott Laboratories, Herbalife Nutrition, Vinamilk, Amway Vietnam, and Natures Way. These companies dominate due to their strong distribution networks, brand presence, and wide product portfolios.

04. What are the growth drivers of the Vietnam Health Supplement Market?

Growth drivers in Vietnam Health Supplement market include rising health consciousness among consumers, government initiatives to promote wellness, and the increasing adoption of e-commerce as a major distribution channel.

05. Which regions dominate the Vietnam Health Supplement Market?

Ho Chi Minh City and Hanoi dominate the Vietnam Health Supplement market due to their urbanization, higher disposable incomes, and a more health-conscious population. Additionally, these regions benefit from better access to various distribution channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.