Vietnam Household Appliance Market Outlook to 2030

Region:Asia

Author(s):Dev Chawla

Product Code:KRO025

June 2025

90

About the Report

Vietnam Household Appliance Market Overview

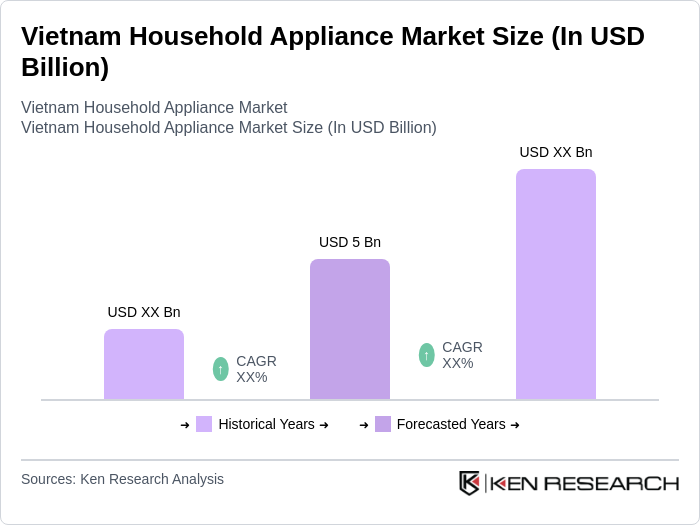

- The Vietnam Household Appliance Market was valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, urbanization, and a growing middle class that is increasingly investing in modern household appliances. The demand for energy-efficient and smart appliances has also surged, reflecting changing consumer preferences towards convenience and sustainability.

- Key cities such as Ho Chi Minh City and Hanoi dominate the market due to their large populations and rapid urban development. These urban centers are experiencing a shift in consumer behavior, with residents increasingly favoring modern appliances that enhance their quality of life. The concentration of retail outlets and e-commerce platforms in these cities further facilitates access to a wide range of household appliances.

- In 2023, the Vietnamese government implemented regulations aimed at promoting energy efficiency in household appliances. This includes mandatory energy labeling for appliances, which requires manufacturers to disclose energy consumption levels. The initiative is designed to encourage consumers to choose energy-efficient products, thereby reducing overall energy consumption and promoting sustainable practices in the household appliance sector.

Vietnam Household Appliance Market Segmentation

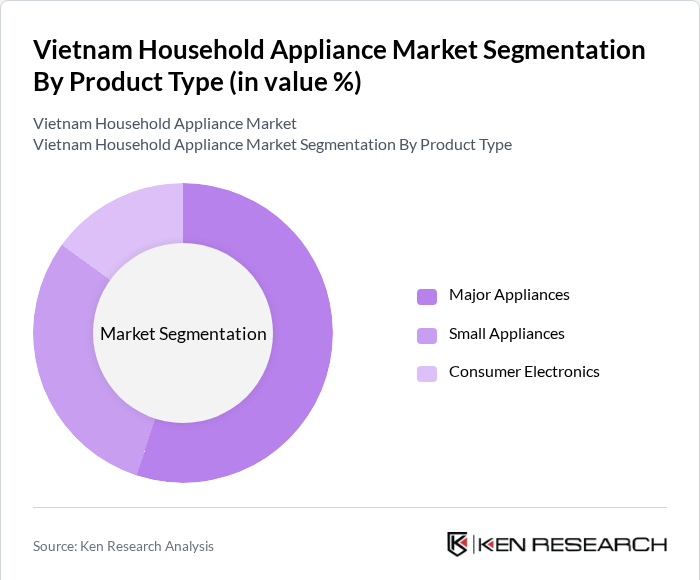

By Product Type: The household appliance market can be segmented into major categories such as major appliances, small appliances, and consumer electronics. Among these, major appliances, which include refrigerators, washing machines, and air conditioners, dominate the market. This is largely due to the increasing demand for energy-efficient and technologically advanced products that cater to the needs of modern households. Consumers are increasingly investing in high-quality major appliances that offer durability and advanced features, reflecting a trend towards long-term investments in home comfort and convenience.

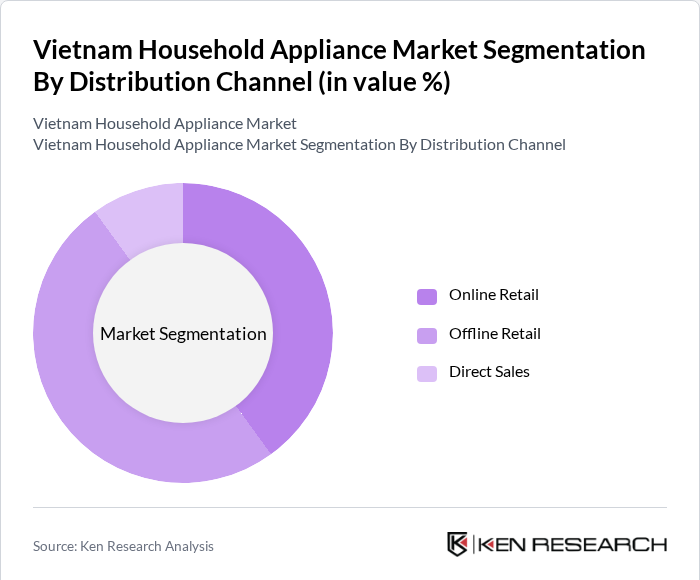

By Distribution Channel: The market can also be segmented based on distribution channels, including online retail, offline retail, and direct sales. Online retail is rapidly gaining traction, driven by the increasing penetration of the internet and the growing popularity of e-commerce platforms. Consumers are increasingly opting for the convenience of online shopping, which offers a wider selection and competitive pricing. This shift in consumer behavior is reshaping the distribution landscape, with traditional retailers adapting to include online sales strategies to meet changing consumer preferences.

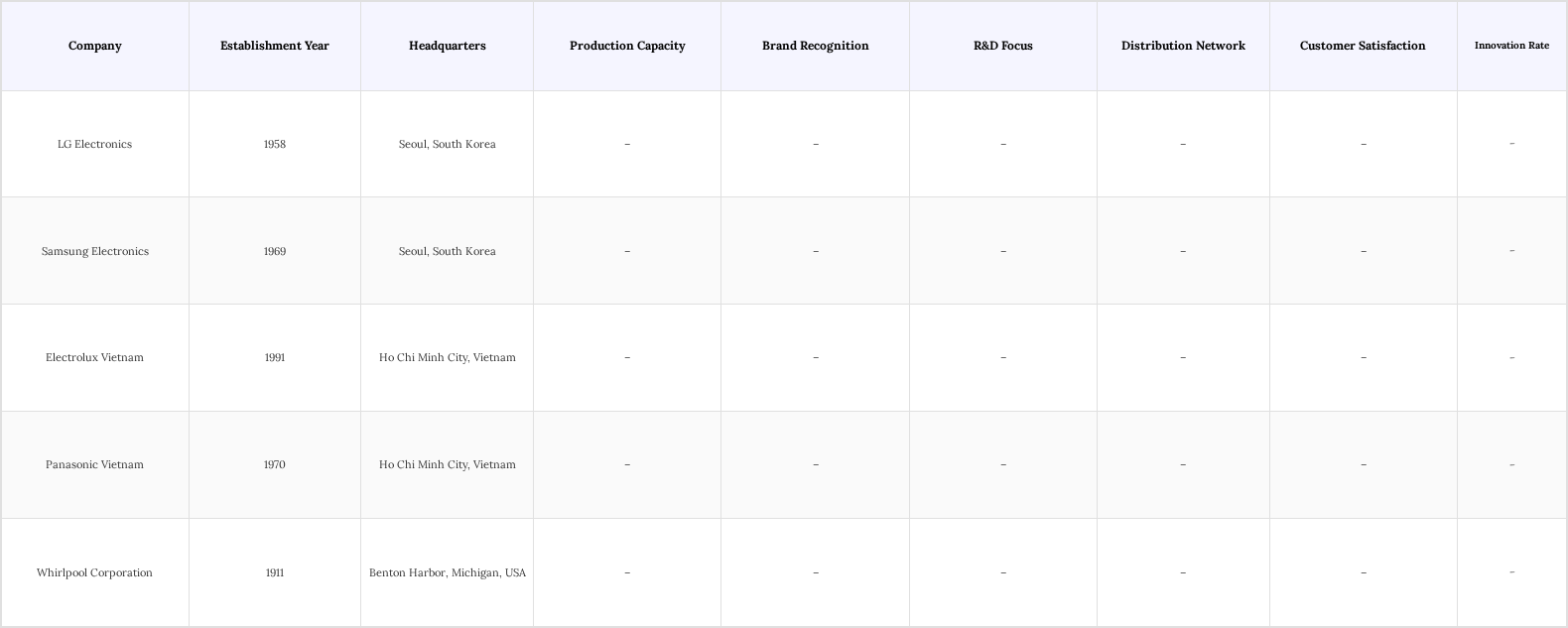

Vietnam Household Appliance Market Competitive Landscape

The Vietnam Household Appliance Market is characterized by a competitive landscape with several key players, including both local and international companies. Major players such as LG Electronics, Samsung, and local brands like Electrolux Vietnam are actively competing for market share. The market is marked by innovation, with companies focusing on energy-efficient products and smart technology integration to meet evolving consumer demands.

Vietnam Household Appliance Market Industry Analysis

Growth Drivers

- Increasing Urbanization: Vietnam’s urban population reached 40.2% up from 37.6% in 2019, according to the World Bank, with projections to surpass 45%. This rapid urbanization is driving strong demand for household appliances as urban dwellers seek convenience and modern living standards. The number of urban households is estimated at over 10 million, significantly boosting appliance sales, especially in Ho Chi Minh City and Hanoi, where lifestyle changes are most pronounced.

- Rising Disposable Income: Vietnam’s average disposable income per capita reached USD 3,310, up 6.7% from the previous year, according to the General Statistics Office. This income growth enables consumers to invest in higher-quality household appliances, boosting premium product sales. As consumer spending rises, demand for energy-efficient and technologically advanced appliances is also increasing, further driving market growth

- Technological Advancements: The Vietnamese household appliance market is witnessing rapid technological advancements, particularly in energy efficiency and smart technology. By 2024, it is estimated that 35% of appliances sold will feature smart technology, according to industry reports. This shift is driven by consumer preferences for energy-efficient products, which can reduce utility costs. Manufacturers are increasingly investing in R&D to innovate and meet these evolving consumer demands, enhancing overall market growth.

Market Challenges

- Intense Competition: The Vietnam household appliance market is characterized by fierce competition among both local and international brands. Major players like LG and Samsung dominate the market, making it challenging for smaller companies to gain market share. The presence of numerous brands leads to price wars, which can erode profit margins. The top five companies accounted the market share, highlighting the competitive landscape that new entrants must navigate.

- Fluctuating Raw Material Prices: The household appliance industry in Vietnam faces challenges due to fluctuating raw material prices, particularly metals and plastics. In 2023, the price of steel increased, impacting production costs for manufacturers. This volatility can lead to increased prices for consumers, potentially dampening demand. Companies must develop strategies to manage these costs effectively while maintaining competitive pricing to sustain market presence.

Vietnam Household Appliance Market Future Outlook

The Vietnam household appliance market is poised for significant growth driven by ongoing urbanization, rising disposable incomes, and technological advancements. As consumers increasingly prioritize energy efficiency and smart technology, manufacturers will need to innovate continuously. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. The market is expected to adapt to changing consumer preferences, focusing on sustainability and smart home integration, which will shape future developments.

Market Opportunities

- Expansion of E-commerce: The growth of e-commerce in Vietnam presents a significant opportunity for household appliance sales. With online retail expected to grow rapidly, companies can leverage digital platforms to reach a broader audience. This shift allows for targeted marketing strategies and improved customer engagement, ultimately driving sales growth in the appliance sector.

- Demand for Smart Appliances: The increasing consumer interest in smart home technology offers a lucrative opportunity for appliance manufacturers. It is projected that smart appliances will represent 32% of total appliance sales. Companies that invest in developing IoT-enabled products can capitalize on this trend, meeting consumer demands for convenience and energy efficiency while enhancing their competitive edge in the market.

Scope of the Report

| By Product Type |

Major Appliances Small Appliances Consumer Electronics |

| By Distribution Channel |

Online Retail Offline Retail Direct Sales |

| By End User |

Residential Commercial |

| By Region |

North Vietnam Central Vietnam South Vietnam |

| By Price Range |

Low-End Mid-Range High-End |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Trade, General Department of Vietnam Customs)

Manufacturers and Producers

Distributors and Retailers

Importers and Exporters

Industry Associations (e.g., Vietnam Electronics Industries Association)

Financial Institutions

Logistics and Supply Chain Companies

Companies

Players Mentioned in the Report:

LG Electronics

Samsung Electronics

Electrolux Vietnam

Panasonic Vietnam

Whirlpool Corporation

VietHome Appliances

GreenTech Appliances

SmartLiving Solutions

EcoHome Innovations

FutureWave Electronics

Table of Contents

1. Vietnam Household Appliance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Household Appliance Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Household Appliance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Population Growth

3.1.2. Rising Disposable Income and Consumer Spending

3.1.3. Technological Advancements in Appliance Efficiency

3.2. Market Challenges

3.2.1. Intense Competition Among Local and International Brands

3.2.2. Fluctuating Raw Material Prices

3.2.3. Regulatory Compliance and Environmental Standards

3.3. Opportunities

3.3.1. Expansion of E-commerce Platforms for Appliance Sales

3.3.2. Growing Demand for Smart Home Appliances

3.3.3. Increasing Focus on Energy-Efficient Products

3.4. Trends

3.4.1. Shift Towards Sustainable and Eco-Friendly Appliances

3.4.2. Integration of IoT in Household Appliances

3.4.3. Customization and Personalization of Products

3.5. Government Regulation

3.5.1. Energy Efficiency Standards and Labeling Requirements

3.5.2. Import Tariffs and Trade Policies Affecting Appliances

3.5.3. Safety Regulations for Electrical Appliances

3.5.4. Environmental Regulations on Waste Management

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Vietnam Household Appliance Market Segmentation

4.1. By Product Type

4.1.1. Major Appliances

4.1.2. Small Appliances

4.1.3. Consumer Electronics

4.2. By Distribution Channel

4.2.1. Online Retail

4.2.2. Offline Retail

4.2.3. Direct Sales

4.3. By End User

4.3.1. Residential

4.3.2. Commercial

4.4. By Region

4.4.1. North Vietnam

4.4.2. Central Vietnam

4.4.3. South Vietnam

4.5. By Price Range

4.5.1. Low-End

4.5.2. Mid-Range

4.5.3. High-End

5. Vietnam Household Appliance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LG Electronics

5.1.2. Samsung Electronics

5.1.3. Electrolux Vietnam

5.1.4. Panasonic Vietnam

5.1.5. Whirlpool Corporation

5.1.6. VietHome Appliances

5.1.7. GreenTech Appliances

5.1.8. SmartLiving Solutions

5.1.9. EcoHome Innovations

5.1.10. FutureWave Electronics

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Product Range and Innovation

5.2.3. Pricing Strategies

5.2.4. Distribution Network Efficiency

5.2.5. Customer Satisfaction Ratings

5.2.6. Brand Recognition and Loyalty

5.2.7. Sustainability Initiatives

5.2.8. Financial Performance Metrics

6. Vietnam Household Appliance Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam Household Appliance Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Household Appliance Market Future Market Segmentation

8.1. By Product Type

8.1.1. Major Appliances

8.1.2. Small Appliances

8.1.3. Consumer Electronics

8.2. By Distribution Channel

8.2.1. Online Retail

8.2.2. Offline Retail

8.2.3. Direct Sales

8.3. By End User

8.3.1. Residential

8.3.2. Commercial

8.4. By Region

8.4.1. North Vietnam

8.4.2. Central Vietnam

8.4.3. South Vietnam

8.5. By Price Range

8.5.1. Low-End

8.5.2. Mid-Range

8.5.3. High-End

9. Vietnam Household Appliance Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key components of the Vietnam Household Appliance Market, including consumer demographics, purchasing behavior, and technological trends. This step relies on extensive desk research, utilizing secondary data sources such as industry reports, government publications, and market surveys to identify the critical variables that shape market dynamics.

Step 2: Market Segmentation and Analysis

In this phase, we will segment the market based on product categories, consumer preferences, and regional variations. This involves analyzing historical sales data and market trends to understand the performance of different segments, which will help in forecasting future growth and identifying potential opportunities within the Vietnam Household Appliance Market.

Step 3: Stakeholder Interviews and Expert Consultation

To gain deeper insights, we will conduct interviews with key stakeholders, including manufacturers, retailers, and industry experts. These consultations will provide qualitative data that complements quantitative findings, helping to validate assumptions and refine market projections based on real-world experiences and expert opinions.

Step 4: Data Synthesis and Reporting

The final phase involves synthesizing all collected data into a coherent report that outlines market trends, forecasts, and strategic recommendations. This will include a thorough analysis of the findings from both quantitative and qualitative research, ensuring that the final output is comprehensive, actionable, and tailored to the needs of stakeholders in the Vietnam Household Appliance Market.

Frequently Asked Questions

01. How big is the Vietnam Household Appliance Market?

The Vietnam Household Appliance Market is valued at USD 5 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Vietnam Household Appliance Market?

Key challenges in the Vietnam Household Appliance Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Vietnam Household Appliance Market?

Major players in the Vietnam Household Appliance Market include LG Electronics, Samsung Electronics, Electrolux Vietnam, Panasonic Vietnam, Whirlpool Corporation, among others.

04. What are the growth drivers for the Vietnam Household Appliance Market?

The primary growth drivers for the Vietnam Household Appliance Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.