Vietnam HVAC Control Systems Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1109

December 2024

91

About the Report

Vietnam HVAC Control Systems Market Overview

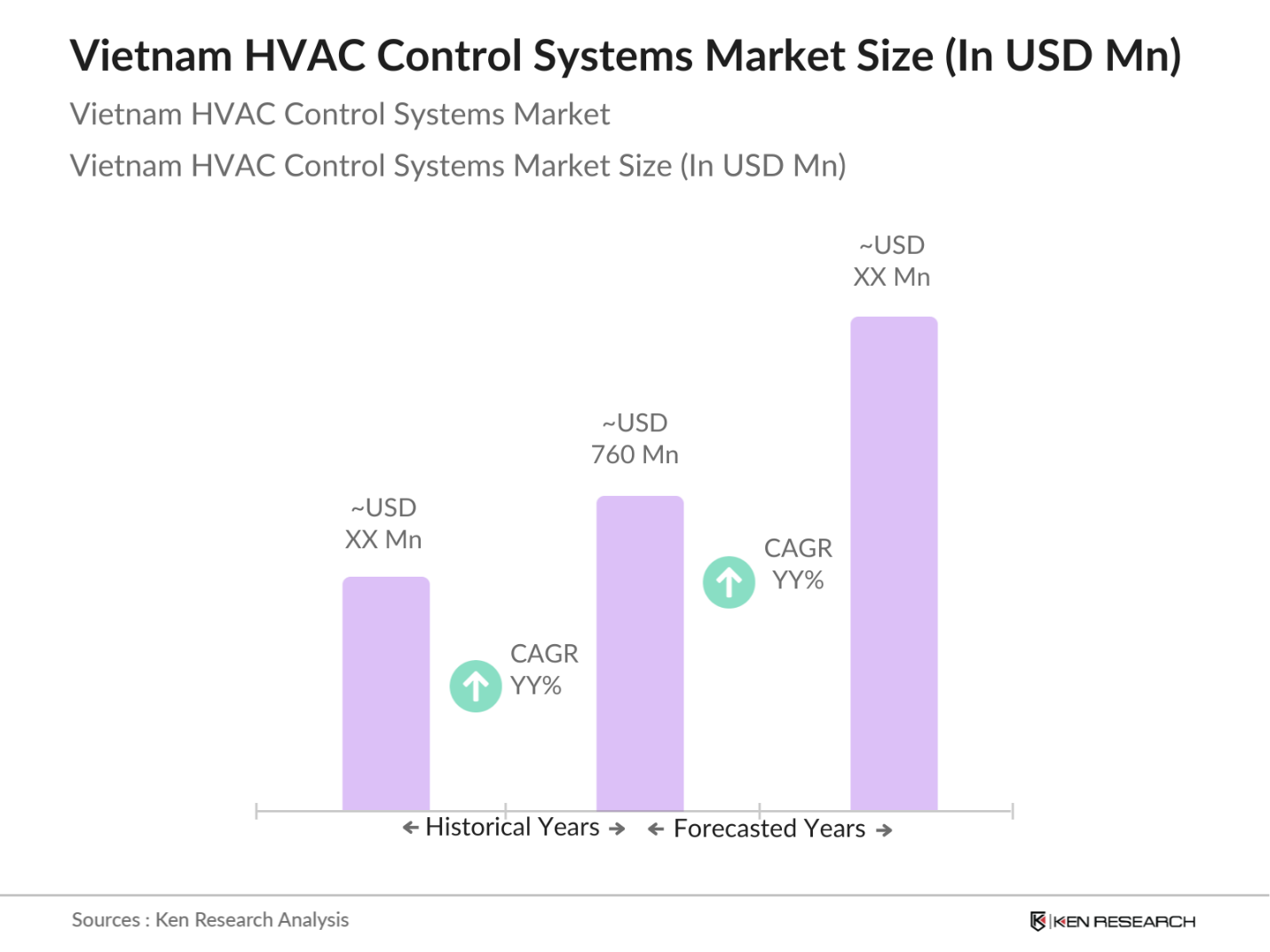

- The Vietnam HVAC Control Systems Market has experienced significant growth, this is reflected in the market valuation reaching USD 760 million in 2023. The primary drivers of this market expansion include rapid urbanization, increased construction activities, and heightened awareness of energy efficiency.

- Major players in the Vietnam HVAC market includeJohnson Controls, Siemens, Honeywell International Inc., Schneider Electric and Daikin Industries. These companies have established their dominance through a combination of technological innovation, comprehensive product portfolios, and robust distribution networks.

- Vietnams Ministry of Construction, supported by UNDP's Global Environment Facility, implemented the "Energy Efficiency Improvement in Commercial and High-Rise Residential Buildings in Vietnam" (EECB) project, increasing demand for advanced HVAC control systems. A consultation workshop on December 15, 2023, focused on developing energy efficiency certification for existing buildings, involving the Ministry of Construction, UNDP, and various experts.

- Ho Chi Minh City's rapid urbanization and high levels of construction activity have significantly contributed to the demand for HVAC systems. The city's ongoing commercial developments are creating a strong need for advanced heating, ventilation, and air conditioning solutions. The regions focus on smart building technologies and energy efficiency has further reinforced its leading position in the market.

Vietnam HVAC Control Systems Market Segmentation

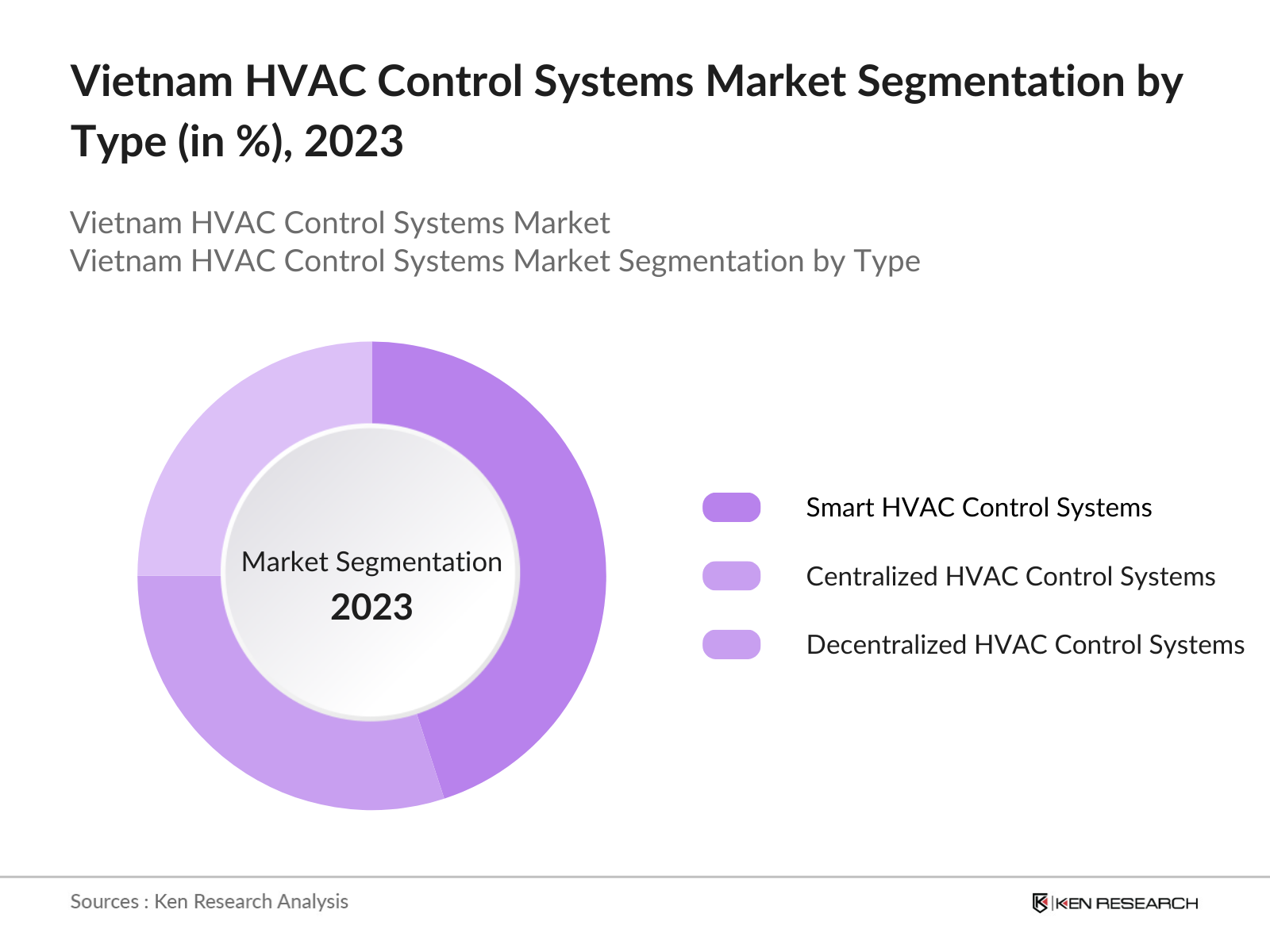

- By Type: The Vietnam HVAC Control Systems Market is segmented by type into Centralized HVAC Control Systems, Decentralized HVAC Control Systems, and Smart HVAC Control Systems. In 2023, Smart HVAC Control Systems indeed dominated the market, primarily due to the increasing adoption of smart technologies and IoT integration. These advancements provide enhanced features such as remote control and energy monitoring, which are driving consumer preference toward smart systems.

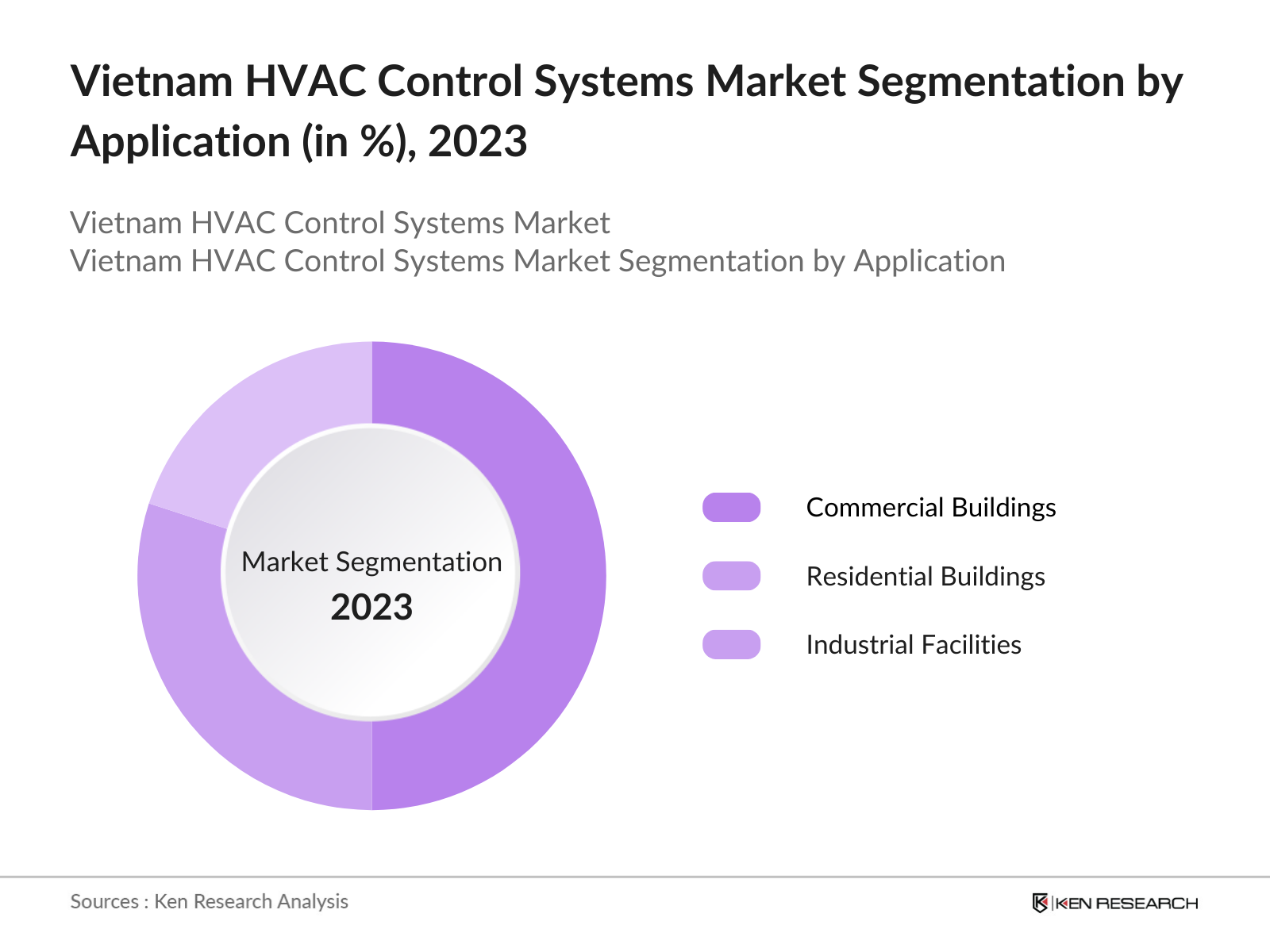

- By Application: The market is also segmented by application into Commercial Buildings, Residential Buildings, and Industrial Facilities. In 2023, Commercial Buildings indeed held the largest market share, primarily due to the high demand for advanced HVAC (Heating, Ventilation, and Air Conditioning) control systems. These systems are essential for enhancing energy efficiency and climate control in large spaces, which is a significant concern in commercial settings.

- By Region: The market is divided into North, South, East, and West. In 2023, South region dominates the market due to rapid urbanization and high levels of commercial development, which are significant factors driving economic growth in this area. Specifically, the southern region has the largest market share in various sectors, including retail and consumer goods.

Vietnam HVAC Control Systems Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Johnson Controls |

1885 |

Milwaukee, USA |

|

Siemens |

1847 |

Munich, Germany |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

|

Schneider Electric |

1836 |

Rueil-Malmaison, France |

|

Daikin Industries |

1924 |

Osaka, Japan |

- Siemens and EVN's Ongoing Collaboration: In 2023, Siemens is enhancing its partnership with the Electricity of Vietnam (EVN) to improve the power grid's efficiency and reliability through advanced technologies. This collaboration focuses on integrating digital solutions into the HVAC control systems, aiming to optimize energy management and support Vietnam's energy transition goals. The initiative is part of Siemens' broader strategy to leverage digitalization in energy management, ensuring sustainable and efficient energy distribution across the region.

- Schneider Electric: In 2022, Schneider Electric introduced a new global offer of SE7000 Room Controllers, which headline the industry's broadest offer in this market.The new SE7000 Room Controllers are part of Schneider Electric's SpaceLogic product range and are designed to provide a comprehensive control solution for various HVAC systems.

Vietnam HVAC Control Systems Industry Analysis

Vietnam HVAC Control Systems Market Growth Drives

- Rise in Residential Construction: In 2023, Vietnam saw the construction of over 100,000 new residential units in urban areas, driven by a growing middle class and government initiatives to boost affordable housing. This surge in residential construction is leading to higher demand for HVAC control systems that offer energy efficiency and enhanced climate control.

- Boom in Retail Sector Development: The retail sector in Vietnam expanded significantly in 2023, with 500,000 square meters of new retail space added in major cities. This boom is driving the installation of advanced HVAC control systems in shopping malls and retail outlets to ensure comfortable shopping environments and reduce energy costs.

- Rapid Urbanization and Smart City Projects: Vietnam's urban population is expected to surpass 40 million by 2025, with significant growth observed in 2023. This rapid urbanization is driving the development of smart city projects across major cities, leading to increased demand for integrated HVAC control systems that enhance energy efficiency and provide real-time monitoring.

Vietnam HVAC Control Systems Market Challenges

- High Initial Investment Costs: The upfront costs associated with these systems can indeed exceed USD 10,000, which poses a significant barrier for both businesses and homeowners. This high initial investment often leads to hesitation in adopting these technologies, ultimately limiting market growth. This challenge is compounded by the perception that traditional systems are more cost-effective in the short term.

- Regulatory Compliance Issues: Compliance with local and international standards for HVAC systems can be complex and costly. As of 2024, HVAC companies are struggling to meet the stringent energy efficiency regulations set by the government. This regulatory burden can deter investment in new technologies and slow down the market's growth trajectory.

Vietnam HVAC Control Systems Market Government Initiatives

- Support for Smart City Development: The Vietnamese government is actively promoting smart city initiatives, with an investment of USD 1 billion by 2025. These initiatives include the integration of smart technologies in urban planning, which encompasses advanced HVAC control systems. As cities become smarter, the demand for integrated HVAC solutions that enhance energy management and environmental sustainability will increase.

- Green Building Standards (2010): Vietnam is adopting green building standards that require new constructions to incorporate energy-efficient HVAC systems. As of September 2021, Vietnam had 201 certified green buildings, with 132 certified under the LEED system, 48 under LOTUS, and 21 under Green Mark. This regulatory push will drive innovation and investment in the HVAC sector.

Vietnam HVAC Control Systems Market Outlook

By 2028, the Vietnam HVAC control systems market is expected to grow substantially, driven by ongoing urbanization, technological advancements, and stringent energy regulations. The focus will likely be on energy efficiency and sustainability, leading to the adoption of advanced HVAC control systems across various sectors.

Future Trends:

- Increased Adoption of IoT-Enabled HVAC Systems: The integration of IoT in HVAC systems allows for improved efficiency and performance. These systems can be monitored and controlled remotely, enabling real-time adjustments that optimize energy usage based on occupancy levels and environmental conditions. Additionally, IoT technology supports predictive maintenance, which helps in identifying potential failures before they occur, thereby minimizing downtime and extending the lifespan of HVAC equipment.

- Growth of the Retrofit Market: The retrofit market for HVAC systems is anticipated to expand as existing buildings seek to upgrade their systems for improved efficiency. By 2028, the retrofit market is expected to account for a significant share of HVAC control system sales in Vietnam. This growth will be fueled by government incentives aimed at promoting energy efficiency and the increasing awareness of energy conservation among building owners, leading to a greater focus on upgrading older systems to meet modern standards.

Scope of the Report

|

By Type |

Centralized HVAC Control Systems Decentralized HVAC Control Systems Smart HVAC Control Systems |

|

By Application |

Commercial Buildings Residential Buildings Industrial Facilities |

|

By Region |

North South East West |

Products

Key Target Audience

HVAC System Manufacturers

Building Contractors

Real Estate Developers

Facility Management Companies

Government (Ministry of Construction (MOC))

Energy Service Companies

Industrial Plant Operators

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Johnson Controls

Siemens

Honeywell International Inc.

Schneider Electric

Daikin Industries

Mitsubishi Electric

LG Electronics

ABB Ltd.

Carrier Corporation

Emerson Electric Co.

Panasonic Corporation

Fujitsu General

Samsung Electronics

Hitachi Ltd.

Trane Technologies

Table of Contents

1. Vietnam HVAC Control Systems Market Overview

1.1 Vietnam HVAC Control Systems Market Taxonomy

2. Vietnam HVAC Control Systems Market Size (in USD Mn), 2018-2023

3. Vietnam HVAC Control Systems Market Analysis

3.1 Vietnam HVAC Control Systems Market Growth Drivers

3.2 Vietnam HVAC Control Systems Market Challenges and Issues

3.3 Vietnam HVAC Control Systems Market Trends and Development

3.4 Vietnam HVAC Control Systems Market Government Regulation

3.5 Vietnam HVAC Control Systems Market SWOT Analysis

3.6 Vietnam HVAC Control Systems Market Stake Ecosystem

3.7 Vietnam HVAC Control Systems Market Competition Ecosystem

4. Vietnam HVAC Control Systems Market Segmentation, 2023

4.1 Vietnam HVAC Control Systems Market Segmentation by Type (in value %), 2023

4.2 Vietnam HVAC Control Systems Market Segmentation by Application (in value %), 2023

4.3 Vietnam HVAC Control Systems Market Segmentation by Region (in value %), 2023

5. Vietnam HVAC Control Systems Market Competition Benchmarking

5.1 Vietnam HVAC Control Systems Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Vietnam HVAC Control Systems Market Outlook Size (in USD Mn), 2023-2028

7. Vietnam HVAC Control Systems Market Outlook Segmentation, 2028

7.1 Vietnam HVAC Control Systems Market Segmentation by Type (in value %), 2028

7.2 Vietnam HVAC Control Systems Market Segmentation by Application (in value %), 2028

7.3 Vietnam HVAC Control Systems Market Segmentation by Region (in value %), 2028

8. Vietnam HVAC Control Systems Market Analysts Recommendations

8.1 Vietnam HVAC Control Systems Market TAM/SAM/SOM Analysis

8.2 Vietnam HVAC Control Systems Market Customer Cohort Analysis

8.3 Vietnam HVAC Control Systems Market Marketing Initiatives

8.4 Vietnam HVAC Control Systems Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on Vietnam HVAC Control Systems Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated Vietnam HVAC Control Systems Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple HVAC control systems companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from HVAC control systems companies.

Frequently Asked Questions

01. How big is the Vietnam HVAC Control Systems Market?

The Vietnam HVAC Control Systems Market has experienced significant growth, this is reflected in the global valuation of the HVAC Control Systems, which reached USD 760 million in 2023, reflecting robust growth driven by increasing urbanization, construction activities, and technological advancements in HVAC systems.

02. What are the challenges in the Vietnam HVAC Control Systems Market?

Challenges in the market include the high initial cost of advanced HVAC control systems, limited awareness about energy efficiency benefits, and the complexity of integrating new systems with existing infrastructure. Additionally, the market faces competition from low-cost, less advanced alternatives.

03. Who are the major players in the Vietnam HVAC Control Systems Market?

Key players in the market include Johnson Controls, Siemens, Honeywell International Inc., Schneider Electric and Daikin Industries. These companies are prominent due to their extensive product portfolios, technological innovations, and strong market presence.

04. What are the growth drivers of the Vietnam HVAC Control Systems Market?

Growth drivers in the market include the expansion of commercial construction projects, increasing investments in the manufacturing sector, the rise of smart buildings integrating IoT technologies, and the need for compliance with stricter energy efficiency regulations. These factors are significantly contributing to the market's expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.