Vietnam Ice Cream Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD970

July 2024

100

About the Report

Vietnam Ice Cream Market Overview

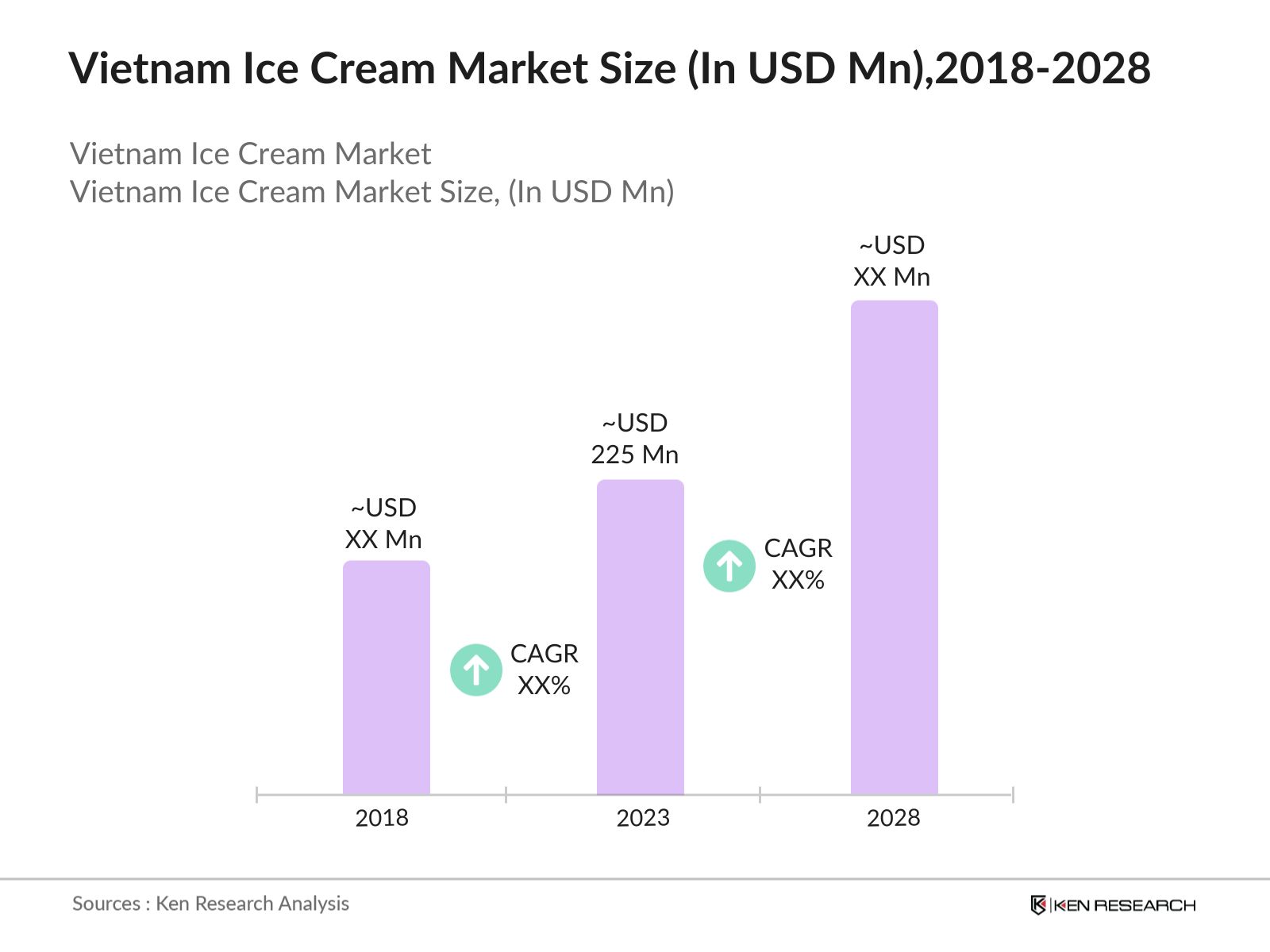

- Vietnam Ice Cream Market was valued at $225 million with a robust compound annual growth rate (CAGR). This growth is primarily driven by increasing disposable incomes, urbanization, changing consumer preferences towards Westernized food products, and the expansion of retail distribution channels.

- Key players in the Vietnam ice cream market include domestic and international brands such as Kido Group, Vinamilk, TH True Milk, Nestlé, and Unilever. These companies have established strong brand recognition and loyalty among Vietnamese consumers.

- In 2023, Vinamilk has more than 60 export markets, with net revenue from export activities reaching over VND 5,000 billion, a 4.4% increase from the previous year. The company has explored two new markets in China & Philippines which has maintained good results for key markets.

Vietnam Ice Cream Current Market Analysis

- The Vietnam ice cream market significantly impacts the local economy by creating jobs and supporting ancillary industries such as dairy farming and retail. The growth of this market also fosters tourism, as ice cream is a popular treat among tourists visiting the country.

- One of the critical challenges faced by the Vietnam ice cream market is the high cost of raw materials, particularly dairy products. This price hike has put pressure on manufacturers' profit margins and led to increased product prices, potentially affecting consumer demand.

- The southern region of Vietnam, particularly Ho Chi Minh City, dominates the ice cream market. This dominance is because of the city's large population, higher income levels, and a thriving tourism industry. The presence of numerous retail outlets and modern trade channels also facilitates higher ice cream consumption in this region.

Vietnam Ice Cream Market Segmentation

The Vietnam Ice Cream Market can be segmented based on several factors:

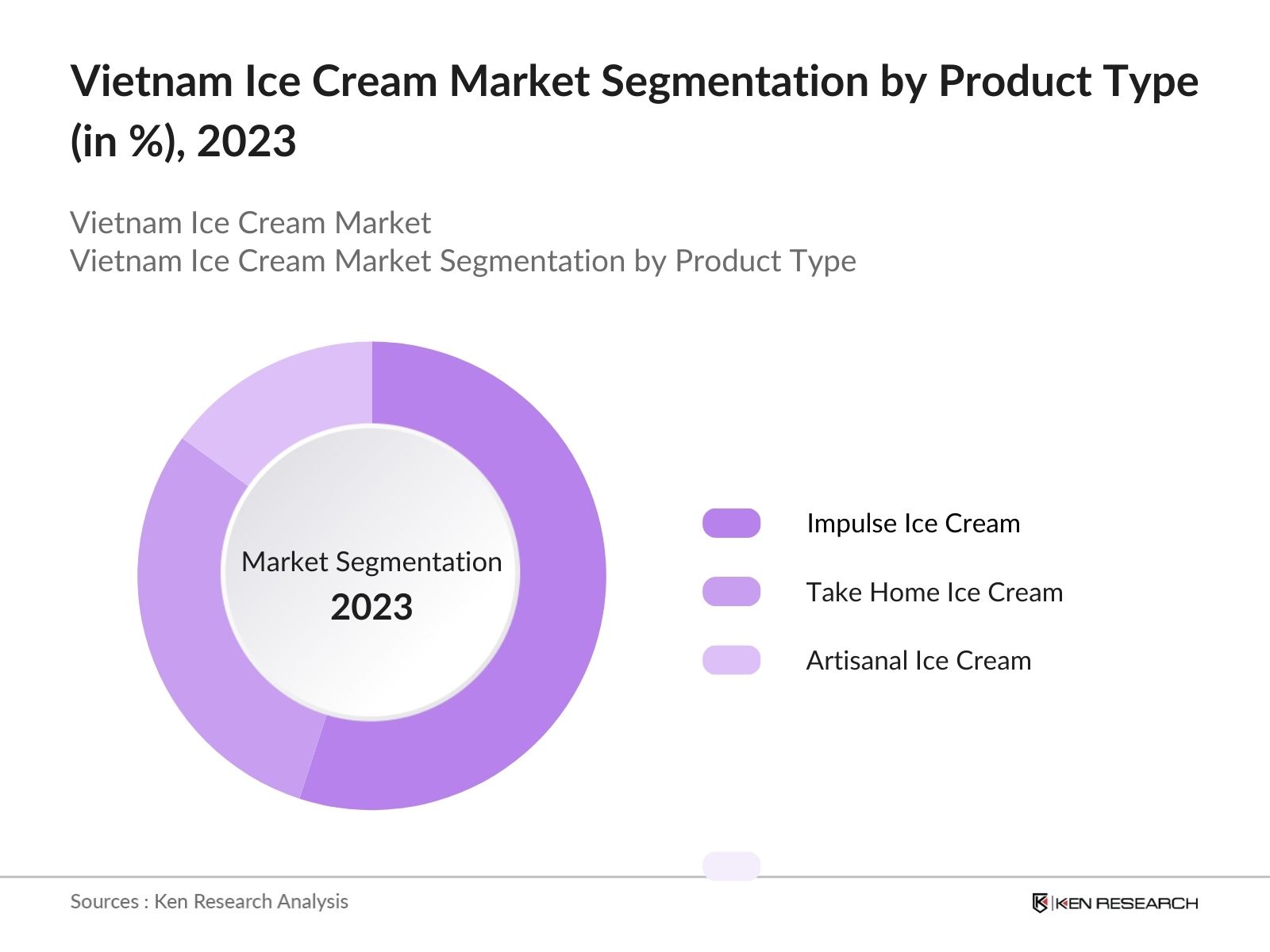

By Product Type: Vietnam Ice Cream Market is segmented by Product Type into impulse ice-cream, take-home ice-cream and artisanal ice cream. In 2023, impulse ice-cream reign as the most dominant sub-segment, holding a substantial market share driven by the growing preference for on-the-go consumption among young consumers and tourists.

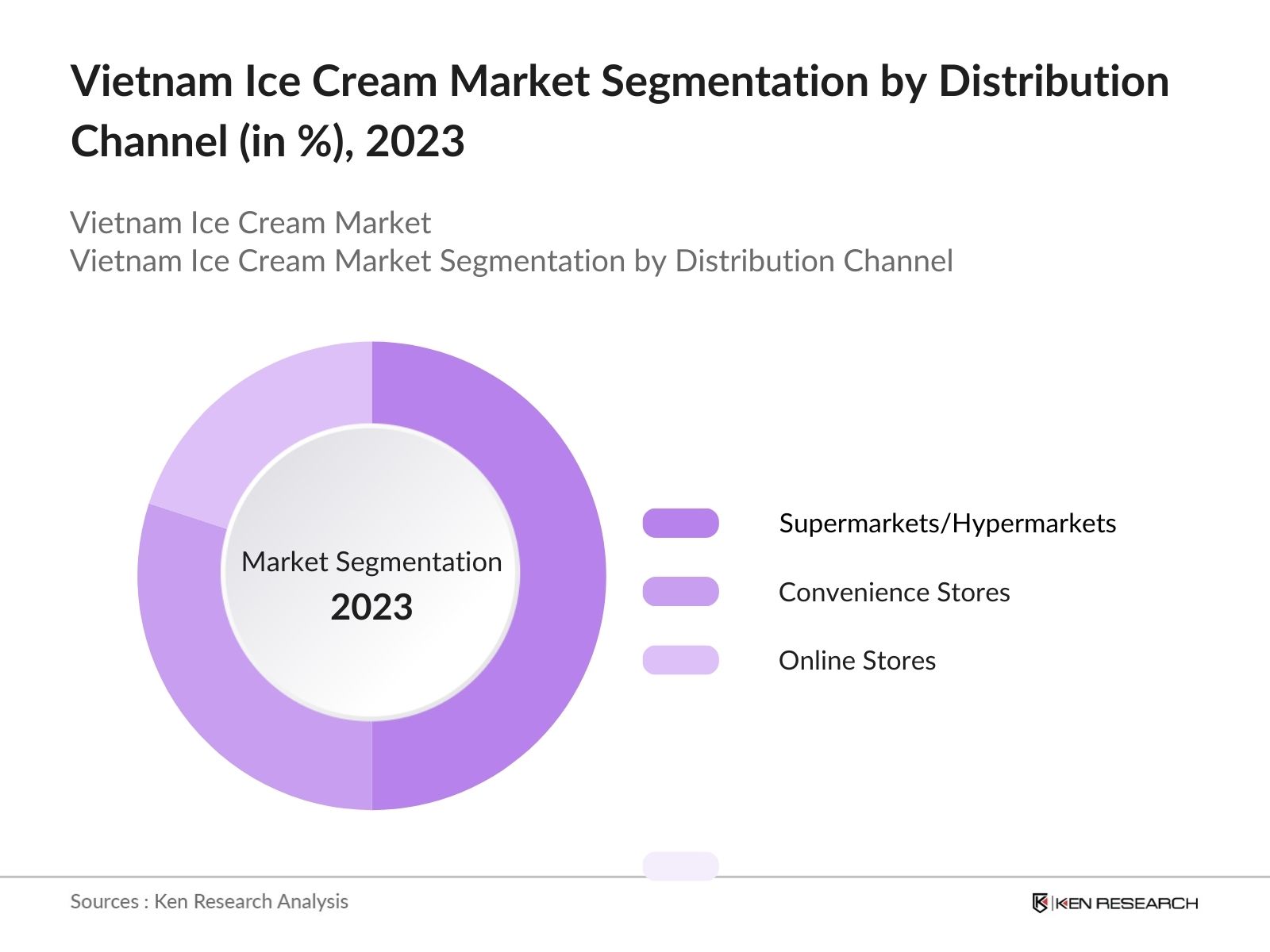

By Distribution Channel: Vietnam Ice Cream Market is segmented by Distribution Channel in Supermarkets/Hypermarkets, Convenience Stores & Online Retail. In 2023, Supermarkets/Hypermarkets emerges as the most dominant sub-segment, commanding a significant percentage of the market share, driven by extensive reach and consumer preference for purchasing ice cream along with other groceries during regular shopping trips.

By Region: Vietnam Ice Cream Market is segmented by region into North, South, East & West. In 2023, the South region dominated the market with a significant share. This region's dominance is driven by the high population density, urbanization, and strong tourism sector in the capital.

Vietnam Autonomous Vehicles Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Kido Group |

1993 |

Ho Chi Minh City |

|

Vinamilk |

1976 |

Ho Chi Minh City |

|

TH True Milk |

2009 |

Nghe An |

|

Nestlé |

1866 |

Vevey, Switzerland |

|

Unilever |

1929 |

London, UK |

- TH True Milk: Sales of TH True milk products in July 2023 reached the highest level of 8.7 billion VND and 35.8 thousand in output. The market scale of TH true milk in July 2023 also reached 8.7 billion in sales and grew 61.5% better than June 2023.

- Nestle: In 2023, Nestlé launched a new KitKat Pink strawberry cheesecake-flavored ice cream bar in Malaysia with plans for global rollout. The new product features a blend of real strawberries and creamy cheesecake, encased in the iconic KitKat wafer and chocolate coating.

- Baskin Robbins: In 2021, Baskin-Robbins had already opened 31 stores in Vietnam as part of a master franchise agreement with Vietnamese food manufacturer Blue Star Food Corp The agreement required Blue Star to open around 50 Baskin-Robbins stores in Vietnam over the next few years.

Vietnam Ice Cream Industry Analysis

Vietnam Ice Cream Market Growth Drivers:

- Introduction of Healthier Options: The introduction of healthier ice cream products, such as low-sugar and low-fat variants, has been a notable trend in the Vietnamese market. In 2023, Vinamilk, a leading dairy company, launched a new range of low-sugar ice creams. While the search results do not provide specific sales data for these healthier options, the launch indicates a growing consumer demand for more nutritious ice cream choices.

- E-commerce Growth: The rise of e-commerce platforms has facilitated the purchase of ice cream products online. In 2022 there were 57 million ecommerce users in Vietnam which demonstrates the convenience and popularity of online shopping.

- Youth Population: Vietnam’s youth population, which constitutes 20 million people of the country in 2023, is a significant consumer base for the ice cream market. This demographic is more inclined towards indulging in ice cream as a treat which drives sales.

Vietnam Ice Cream Market Challenges:

- Supply Chain Disruptions: Global supply chain disruptions led to delays and increased costs for importing essential ingredients, adding to the overall production costs for ice cream manufacturers. These challenges prompted companies like Unilever to optimize logistics and seek alternative sourcing strategies to mitigate future disruptions.

- Peak and Off-Peak Seasons: The ice cream market in Vietnam experiences significant demand fluctuations, with peak sales during summer months and a drop during winter. Manufacturers often adjust production schedules and marketing strategies to align with these seasonal patterns and consumer preferences.

- Inventory Management: Managing inventory during off-peak seasons poses a challenge. Manufacturers must balance production to avoid overstocking and potential waste during lower demand periods. This requires forecasting and strategic planning to optimize inventory levels and minimize costs while ensuring adequate supply during peak seasons.

Vietnam Ice Cream Market Government Initiatives:

- Nutritional Labeling Regulations: Effective from February 15, 2024, Vietnam has mandated comprehensive nutritional labeling on all food products. ThisCircular 29/2023/TT-BYT, requires labels to display key nutritional information, including energy, protein, carbohydrates, fat, and sodium content. Specific categories of food. This regulation aims to enhance consumer awareness and align Vietnam with international standards.

- Permissible Food Additives and Flavors: Circular 17/2023, effective from November 9, 2023, updated the list of permissible food additives, flavors, and processing aids. This update adopts the latest standards from the Codex Alimentarius and allows flavors recognized by international bodies such as JECFA and FEMA​.

Vietnam Ice Cream Future Market Outlook

By 2028, The Vietnam ice cream market is expected to continue its substantial growth. This growth will be driven by expanding retail networks, innovative product launches, and increasing consumer demand for premium and health-oriented ice cream products.

Future Trends

- Growth of Low-Calorie Ice Creams: The demand for low-calorie ice creams is expected to grow significantly over the next five years, driven by increasing health consciousness among consumers. This trend will prompt manufacturers to innovate with healthier ingredients and flavours, catering to a growing segment of health-conscious consumers seeking indulgent yet guilt-free treats.

- Expansion of Organic Products: The market for organic ice creams will expand. This growth will be driven by consumer preferences for natural and organic products. Manufacturers will invest in sourcing high-quality organic ingredients and obtain certifications to meet the rising demand for sustainable and healthier dessert options.

- Functional Ice Creams: Ice creams with functional ingredients like probiotics, vitamins, and minerals will gain popularity, as consumers seek additional health benefits from their indulgences. This trend reflects a growing interest in combining pleasure with wellness, driving innovation in the ice cream market towards products that offer both taste and nutritional value.

Scope of the Report

|

By Product Type |

Impulse Ice-Cream Take-Home Ice-Cream Artisanal Ice-Cream |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Automotive Manufacturers

Automotive Component Suppliers

Renewable Energy Companies

Electric Vehicle Charging Infrastructure Companies

Solar Panel Manufacturers

Logistics and Fleet Management Companies

Banks & Financial Institutions

Investors & Venture Capitalists

Government & Regulatory Bodies (Department of Energy, EPA etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Kido Group

Vinamilk

TH True Milk

Nestlé

Unilever

Bud's Ice Cream

Dairy Queen

Fanny Ice Cream

Baskin-Robbins

Swensen's

Lotte Confectionery

Baskin Robbins

Haagen-Dazs

Wall's

Celano Ice Cream

Table of Contents

1. Vietnam Ice Cream Market Overview

1.1 Vietnam Ice Cream Market Taxonomy

2. Vietnam Ice Cream Market Size (in USD Mn), 2018-2023

3. Vietnam Ice Cream Market Analysis

3.1 Vietnam Ice Cream Market Growth Drivers

3.2 Vietnam Ice Cream Market Challenges and Issues

3.3 Vietnam Ice Cream Market Trends and Development

3.4 Vietnam Ice Cream Market Government Regulation

3.5 Vietnam Ice Cream Market SWOT Analysis

3.6 Vietnam Ice Cream Market Stake Ecosystem

3.7 Vietnam Ice Cream Market Competition Ecosystem

4. Vietnam Ice Cream Market Segmentation, 2023

4.1 Vietnam Ice Cream Market Segmentation by Product Type (in value %), 2023

4.2 Vietnam Ice Cream Market Segmentation by Distribution Channel (in value %), 2023

4.3 Vietnam Ice Cream Market Segmentation by Region (in value %), 2023

5. Vietnam Ice Cream Market Competition Benchmarking

5.1 Vietnam Ice Cream Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Vietnam Ice Cream Future Market Size (in USD Mn), 2023-2028

7. Vietnam Ice Cream Future Market Segmentation, 2028

7.1 Vietnam Ice Cream Market Segmentation by Product Type (in value %), 2028

7.2 Vietnam Ice Cream Market Segmentation by Distribution Channel (in value %), 2028

7.3 Vietnam Ice Cream Market Segmentation by Region (in value %), 2028

8. Vietnam Ice Cream Market Analysts’ Recommendations

8.1 Vietnam Ice Cream Market TAM/SAM/SOM Analysis

8.2 Vietnam Ice Cream Market Customer Cohort Analysis

8.3 Vietnam Ice Cream Market Marketing Initiatives

8.4 Vietnam Ice Cream Market White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market Building:

Collating statistics on Vietnam Ice Cream Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Ice Cream Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research output:

Our team will approach multiple Vietnam Ice Cream companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Vietnam Ice Cream companies.

Frequently Asked Questions

01 How big is Vietnam Ice Cream Market?

The Vietnam Ice Cream market was valued at USD 225 million in 2023, driven by increasing disposable incomes, urbanization, changing consumer preferences, and the expansion of retail distribution channels.

02 What are challenges in Vietnam Ice Cream Market?

Challenges include high raw material costs, particularly dairy prices, seasonal demand fluctuations, regulatory compliance, and intense competition from local brands. These factors can impact profitability and market stability.

03 Who are the major players in Vietnam Ice Cream Market?

Key players in the market include Kido Group, Vinamilk, TH True Milk, Nestlé, and Unilever. These companies dominate the market due to their extensive distribution networks, strong brand recognition, and continuous product innovation.

04 What are the growth drivers of Vietnam Ice Cream Market?

The market is driven by factors such as the introduction of healthier ice cream options, expansion of retail distribution channels, innovation in product offerings, and increasing disposable income among the urban middle class and youth population.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.