Vietnam In-Vitro Diagnostics (IVD) Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3711

December 2024

95

About the Report

Vietnam In-Vitro Diagnostics Market Overview

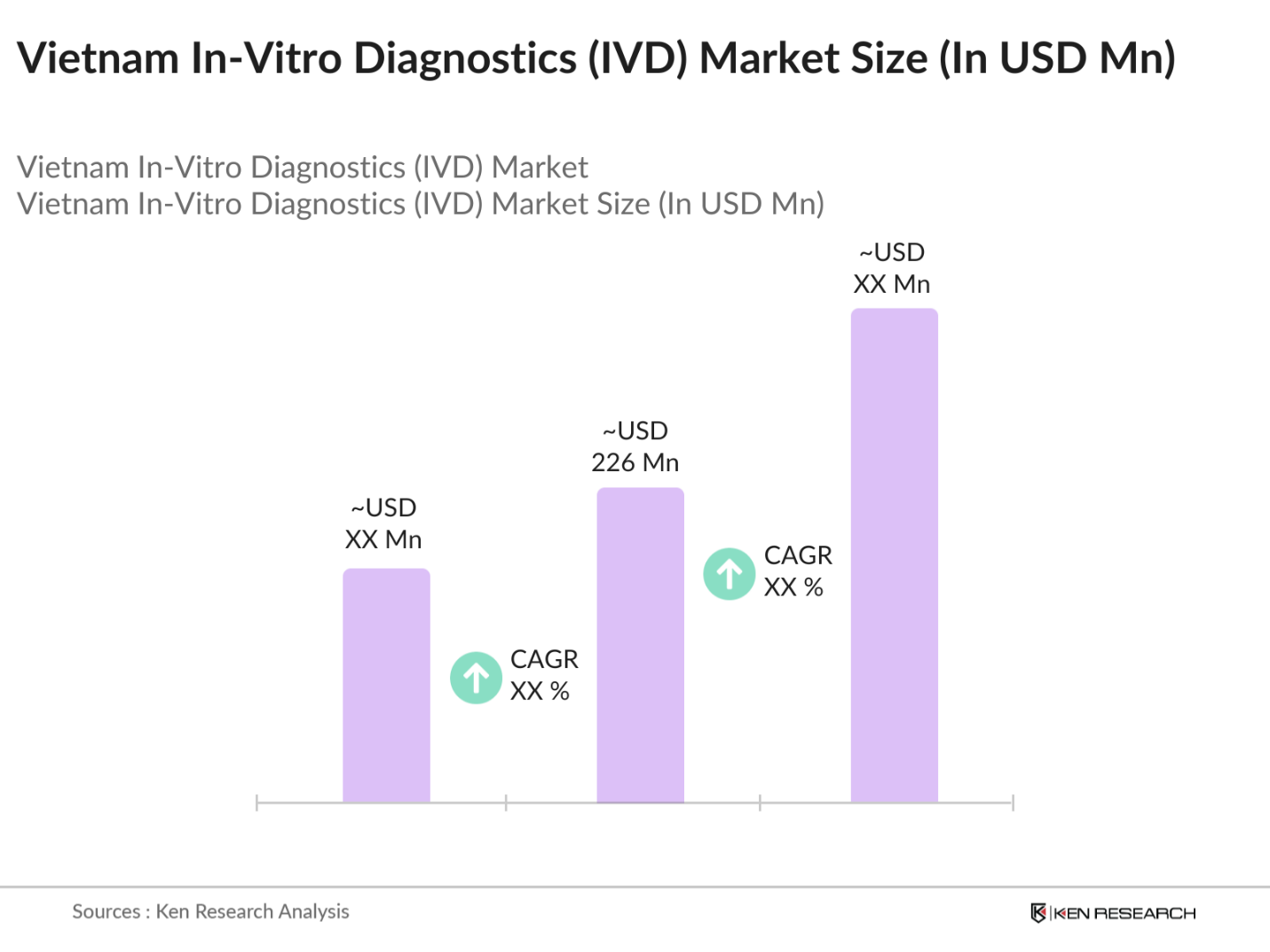

- The Vietnam In-Vitro Diagnostics (IVD) market is valued at USD 226 million, based on a five-year historical analysis. This market is primarily driven by an increasing burden of chronic diseases, including diabetes, cardiovascular diseases, and cancer, necessitating more frequent and advanced diagnostic solutions. Key drivers also include government initiatives to enhance healthcare infrastructure, and the growing adoption of point-of-care testing and molecular diagnostics techniques for early disease detection and management. These factors are fueling demand across hospitals, diagnostics laboratories, and research institutes, creating a robust outlook for the markets growth trajectory.

- Vietnams IVD market is primarily dominated by the southern region, particularly in cities such as Ho Chi Minh City. This dominance is due to the region's well-developed healthcare infrastructure, higher concentration of diagnostic laboratories, and the presence of a larger patient base. Furthermore, the southern region has more advanced healthcare facilities and a stronger presence of multinational companies offering IVD solutions, making it a significant contributor to the overall market growth.

- This decree outlines stringent regulations for the classification, registration, and post-market surveillance of medical devices in Vietnam. The decrees provisions require all medical devices to be registered with the Ministry of Health, and they stipulate mandatory safety and performance requirements that manufacturers must meet to ensure product quality and patient safety.

Vietnam In-Vitro Diagnostics Market Segmentation

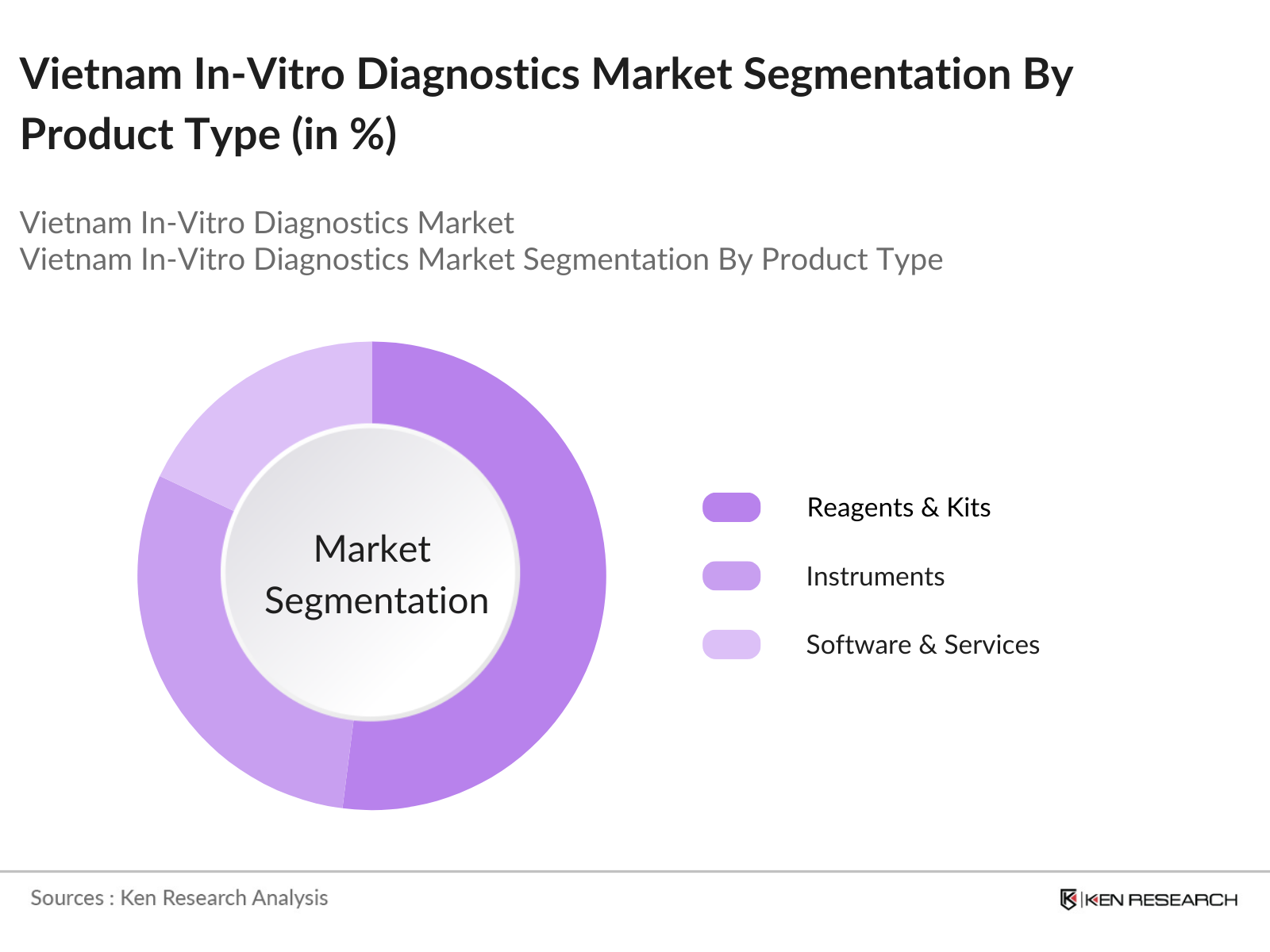

By Product Type: The Vietnam IVD market is segmented by product type into Reagents & Kits, Instruments, and Software & Services. Reagents and kits currently hold a dominant market share due to their recurring demand in diagnostic testing procedures, especially for clinical chemistry, hematology, and molecular diagnostics. The usage of reagents is essential for conducting various diagnostic tests, making them a critical consumable in clinical settings.

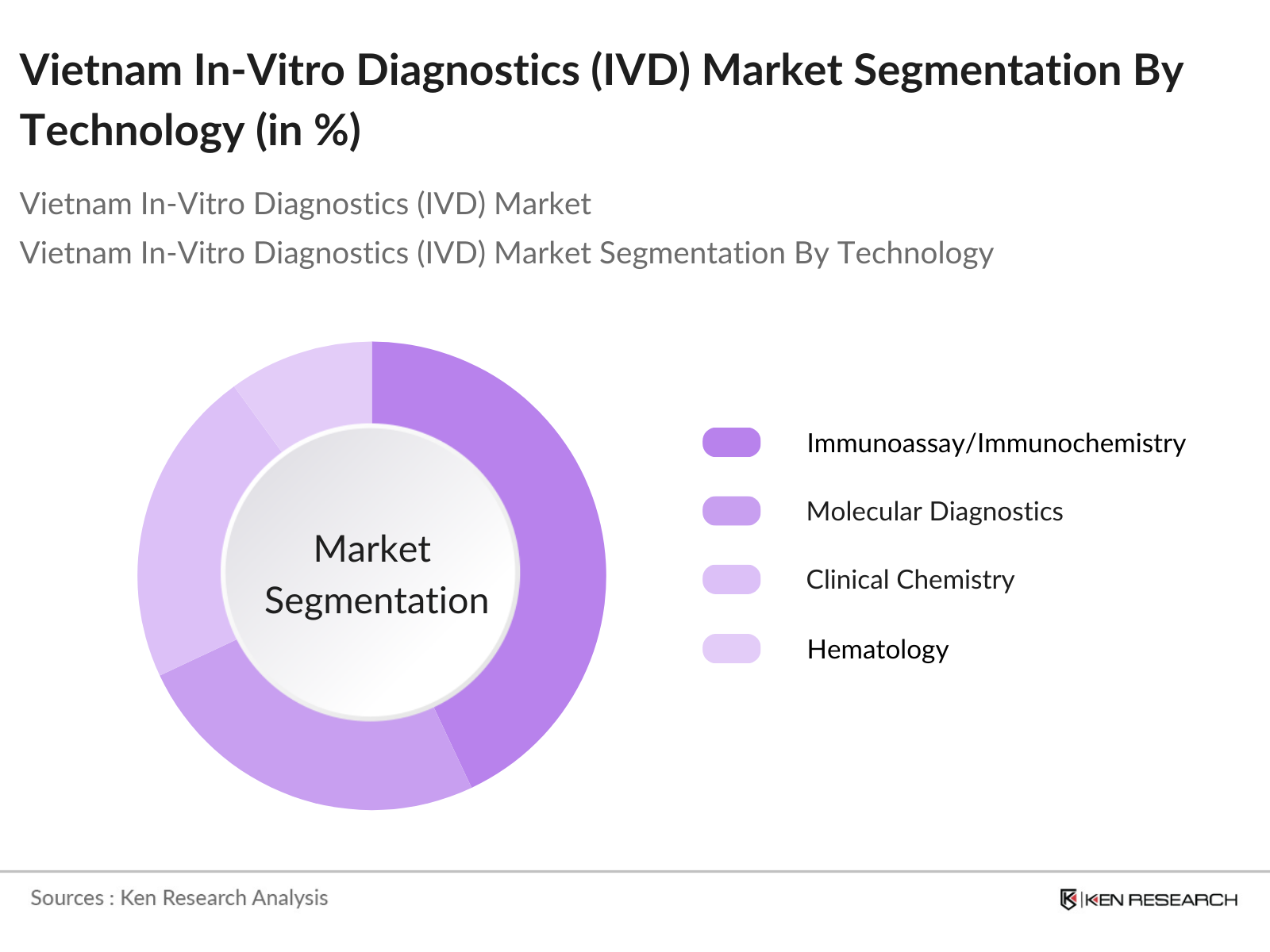

By Technology: The Vietnam IVD market is segmented by technology into Immunoassay/Immunochemistry, Molecular Diagnostics, Clinical Chemistry, Hematology, Microbiology, and Others. The molecular diagnostics segment has emerged as the fastest-growing technology due to its capability for early and precise detection of infectious and chronic diseases. Molecular diagnostics techniques such as PCR and next-generation sequencing are extensively used in cancer diagnostics, genetic testing, and infectious disease testing.

Vietnam In-Vitro Diagnostics (IVD) Market Competitive Landscape

The Vietnam IVD market is dominated by several key players, both global and local. The market is highly consolidated, with the top companies accounting for a significant share of the overall market revenue. Major players are focusing on product innovation, strategic alliances, and geographical expansion to strengthen their market positions. The Vietnam IVD market is currently led by multinational companies such as Abbott, Danaher, and Roche Diagnostics, which have established robust distribution networks and strong customer relationships.

Vietnam In-Vitro Diagnostics (IVD) Industry Analysis

Growth Drivers

- Rising Prevalence of Chronic Diseases (e.g., Diabetes, Cardiovascular Diseases, Cancer): Chronic diseases, particularly cardiovascular diseases (CVDs), are a significant health burden in Vietnam. CVDs account for approximately 31% of all deaths in the country, with over 170,000 fatalities annually. The prevalence of hypertension among adults aged 18-69 years is 18.9%, indicating a high-risk factor for heart diseases and stroke.

- Growing Geriatric Population: Vietnams population is aging rapidly. According to WHO data, the average life expectancy has increased to 73.8 years, reflecting the demographic shift toward an older population. This trend significantly impacts the prevalence of age-related diseases such as diabetes, cardiovascular conditions, and cancer, leading to increased demand for diagnostics and healthcare services tailored for the elderly.

- Technological Advancements in IVD Solutions: Technological innovations in In-Vitro Diagnostics (IVD) have enabled the adoption of advanced diagnostic solutions such as molecular diagnostics, immunoassays, and digital pathology. The integration of artificial intelligence and machine learning into diagnostic tools is enhancing the accuracy of disease detection and prognosis, which is critical for managing the high burden of non-communicable diseases (NCDs) in the country.

Market Challenges

- High Initial Investment in Advanced Diagnostics: The adoption of advanced diagnostic technologies involves significant initial investment costs, especially in terms of acquiring equipment and maintaining quality standards. In low- and middle-income settings like Vietnam, these costs pose a substantial barrier to the widespread deployment of cutting-edge IVD technologies, limiting access mainly to urban centers and high-end hospitals.

- Regulatory Compliance and Certification Processes: Vietnam has strict regulatory requirements for medical devices, particularly under Decree No. 98/2021, which oversees the classification, certification, and registration of all medical devices. Meeting these compliance standards involves a detailed and time-consuming approval process, especially for Class C and D devices that require Marketing Authorization Codes (MAC). This can delay market entry and increase compliance costs for companies looking to introduce new diagnostic technologies.

Vietnam In-Vitro Diagnostics (IVD) Market Future Outlook

Over the next five years, the Vietnam In-Vitro Diagnostics (IVD) market is expected to witness steady growth, driven by rising demand for advanced diagnostic technologies, expansion of healthcare infrastructure, and an increasing geriatric population that necessitates more frequent health check-ups. Government initiatives aimed at expanding diagnostic capabilities and reducing the burden of chronic diseases will further support the market's growth trajectory. Technological advancements in areas such as point-of-care testing and molecular diagnostics will play a pivotal role in enhancing the market's value.

Market Opportunities

- Adoption of Point-of-Care Testing (POCT) Solutions: Point-of-Care Testing (POCT) solutions are gaining traction in Vietnam due to their ability to provide rapid results and improve diagnostic efficiency, particularly in decentralized healthcare settings. The adoption of POCT for diabetes and other chronic diseases in primary care facilities can help reduce the diagnostic gap and provide timely treatment interventions. The WHO's ongoing initiatives to expand diagnostic capabilities at commune-level health stations highlight the potential for increased POCT adoption in Vietnam.

- Expansion of Healthcare Infrastructure in Central and Southern Vietnam: The Vietnamese government is investing in the expansion of healthcare infrastructure, particularly in the central and southern regions. This includes establishing new hospitals, upgrading existing facilities, and increasing the number of healthcare professionals. These developments provide an opportunity for IVD companies to collaborate with healthcare institutions and support capacity building through the supply of diagnostic technologies and training.

Scope of the Report

|

Product Type |

Instruments Reagents and Kits Software and Services |

|

Technology |

Immunoassay/Immunochemistry Molecular Diagnostics Clinical Chemistry Hematology Microbiology Others |

|

Application |

Infectious Diseases Oncology Cardiology Nephrology Others |

|

End User |

Hospitals and Clinics Diagnostics Laboratories Point-of-Care Testing Centers Academic and Research Institutes |

|

Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Hospitals and Clinics

Diagnostics Laboratories

Point-of-Care Testing Centers

Government and Regulatory Bodies (Ministry of Health, Department of Medical Equipment and Construction)

Investments and Venture Capitalist Firms

Medical Device Manufacturers

Pharmaceutical Companies

Healthcare Service Providers

Companies

Players Mentioned in the Report

Abbott Laboratories

Danaher Corporation

Siemens Healthineers AG

Roche Diagnostics

Sysmex Corporation

Bio-Rad Laboratories

Thermo Fisher Scientific

Quidel Corporation

PerkinElmer Inc.

Ortho Clinical Diagnostics

Table of Contents

1. Vietnam In-Vitro Diagnostics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Impact of COVID-19 on the Vietnam IVD Market

1.6. Government Initiatives and Regulations

2. Vietnam In-Vitro Diagnostics Market Size (USD Million)

2.1. Historical Market Size

2.2. Current Market Size Analysis

2.3. Year-on-Year Growth Analysis

2.4. Key Market Developments and Milestones

3. Vietnam In-Vitro Diagnostics Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Diseases (e.g., Diabetes, Cardiovascular Diseases, Cancer)

3.1.2. Growing Geriatric Population

3.1.3. Technological Advancements in IVD Solutions

3.2. Market Challenges

3.2.1. High Initial Investment in Advanced Diagnostics

3.2.2. Regulatory Compliance and Certification Processes

3.2.3. Limited Awareness in Rural Areas

3.3. Opportunities

3.3.1. Adoption of Point-of-Care Testing (POCT) Solutions

3.3.2. Expansion of Healthcare Infrastructure in Central and Southern Vietnam

3.3.3. International Partnerships for R&D and Manufacturing

3.4. Trends

3.4.1. Increased Use of Molecular Diagnostics

3.4.2. Adoption of Digital Health and AI in Diagnostics

3.4.3. Growing Focus on Personalized Medicine

3.5. Government Regulations

3.5.1. Decree No. 98/2021 on Medical Equipment Management

3.5.2. Implementation of ASEAN Medical Device Directive (AMDD)

3.5.3. Marketing Authorization Code (MAC) Requirements for Class C and D Devices

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competition Ecosystem

3.9. Stakeholder Ecosystem and Strategic Initiatives

4. Vietnam In-Vitro Diagnostics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Instruments

4.1.2. Reagents and Kits

4.1.3. Software and Services

4.2. By Technology (In Value %)

4.2.1. Immunoassay/Immunochemistry

4.2.2. Molecular Diagnostics

4.2.3. Clinical Chemistry

4.2.4. Hematology

4.2.5. Microbiology

4.2.6. Others (Coagulation, Urinalysis)

4.3. By Application (In Value %)

4.3.1. Infectious Diseases

4.3.2. Oncology

4.3.3. Cardiology

4.3.4. Nephrology

4.3.5. Others (Autoimmune Diseases, Drug Testing)

4.4. By End User (In Value %)

4.4.1. Hospitals and Clinics

4.4.2. Diagnostics Laboratories

4.4.3. Point-of-Care Testing Centers

4.4.4. Academic and Research Institutes

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam In-Vitro Diagnostics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Danaher Corporation

5.1.3. Siemens Healthineers AG

5.1.4. Roche Diagnostics

5.1.5. Sysmex Corporation

5.1.6. Bio-Rad Laboratories

5.1.7. Becton Dickinson and Company

5.1.8. Thermo Fisher Scientific

5.1.9. Quidel Corporation

5.1.10. PerkinElmer Inc.

5.1.11. Ortho Clinical Diagnostics

5.1.12. Qiagen N.V.

5.1.13. BioMrieux S.A.

5.1.14. Hologic Inc.

5.1.15. Agilent Technologies

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Key Strategic Initiatives, R&D Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Partnerships)

5.5. Investment Analysis

5.6. Government Grants and Funding

5.7. Private Equity Investments and Venture Capital Funding

6. Vietnam In-Vitro Diagnostics Market Regulatory Framework

6.1. Regulatory Requirements for IVD Devices

6.2. Classification of IVD Devices (Class A, B, C, D)

6.3. Compliance with ASEAN Medical Device Directives (AMDD)

6.4. Certification and Licensing Processes

7. Vietnam In-Vitro Diagnostics Future Market Size (USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

7.3. Expected Developments and Innovations

8. Vietnam In-Vitro Diagnostics Market Analyst Recommendations

8.1. Market Expansion Strategies

8.2. Strategic Partnerships for Innovation

8.3. Product Differentiation and Customization

8.4. Regulatory Compliance and Risk Management

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam In-Vitro Diagnostics Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Vietnam In-Vitro Diagnostics Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple IVD manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam In-Vitro Diagnostics market.

Frequently Asked Questions

01. How big is the Vietnam In-Vitro Diagnostics Market?

The Vietnam In-Vitro Diagnostics (IVD) market is valued at USD 226 million, based on a five-year historical analysis. This market is primarily driven by an increasing burden of chronic diseases, including diabetes, cardiovascular diseases, and cancer, necessitating more frequent and advanced diagnostic solutions.

02. What are the major challenges in the Vietnam In-Vitro Diagnostics Market?

Challenges include stringent regulatory requirements under Decree No. 98/2021, high initial investment costs for advanced diagnostic equipment, and limited awareness of diagnostic solutions in rural and underserved regions.

03. Who are the major players in the Vietnam In-Vitro Diagnostics Market?

Major players include Abbott Laboratories, Danaher Corporation, Siemens Healthineers AG, Roche Diagnostics, and Sysmex Corporation, all of which have a strong presence in the Vietnam market due to their extensive product portfolios, strategic alliances, and distribution networks.

04. What are the growth drivers of the Vietnam In-Vitro Diagnostics Market?

The primary growth drivers are the rising geriatric population, the increasing burden of chronic diseases, and advancements in diagnostic technologies. The adoption of point-of-care testing and molecular diagnostics is significantly contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.