Vietnam Industrial Automation Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD3460

October 2024

94

About the Report

Vietnam Industrial Automation Market Overview

- The Vietnam Industrial Automation Market is valued at USD 2.5 billion, driven by increasing adoption of Industry 4.0 technologies and the rise in smart factory investments across key sectors such as manufacturing, electronics, and automotive. Automation solutions, including robotics, sensors, and control systems, are fueling productivity and operational efficiency. Government incentives supporting technological advancements further augment this market's growth trajectory, as the country positions itself as a regional manufacturing hub.

- Hanoi, Ho Chi Minh City, and Bac Ninh lead this market due to their strong industrial bases, favorable government policies, and proximity to major ports, which facilitate international trade. These cities are home to many multinational corporations and large-scale manufacturing plants, particularly in the automotive and electronics sectors. The rapid industrialization in these regions, coupled with infrastructure advancements and foreign direct investment, underpins their dominance in this market.

- The Vietnamese government supports industrial automation through clear standards, financial incentives, and prioritization of high-tech products. Among 99 prioritized high-tech items, 20 come from automation, with the Ministry of Science and Technology leading the development of these technologies. Additionally, public-private partnerships and automation-friendly policies aim to promote the adoption of advanced technologies across industries like electronics and manufacturing, positioning Vietnam as a key player in the global automation landscape.

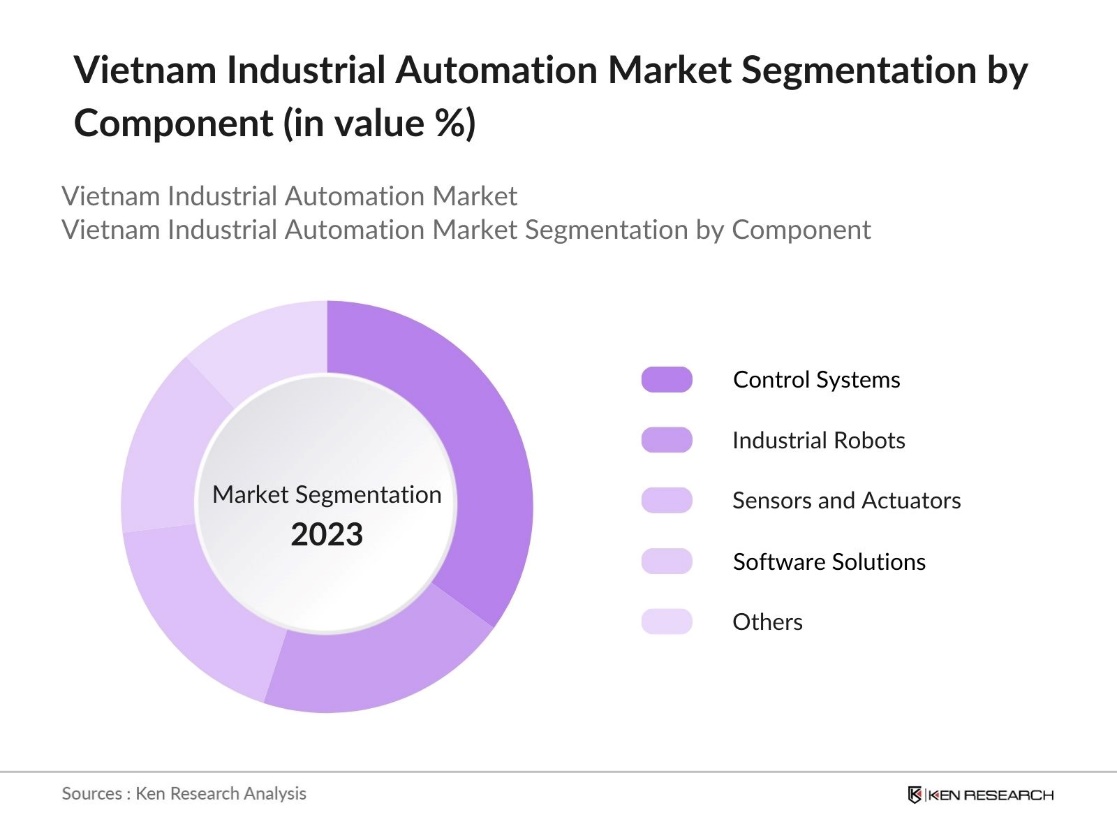

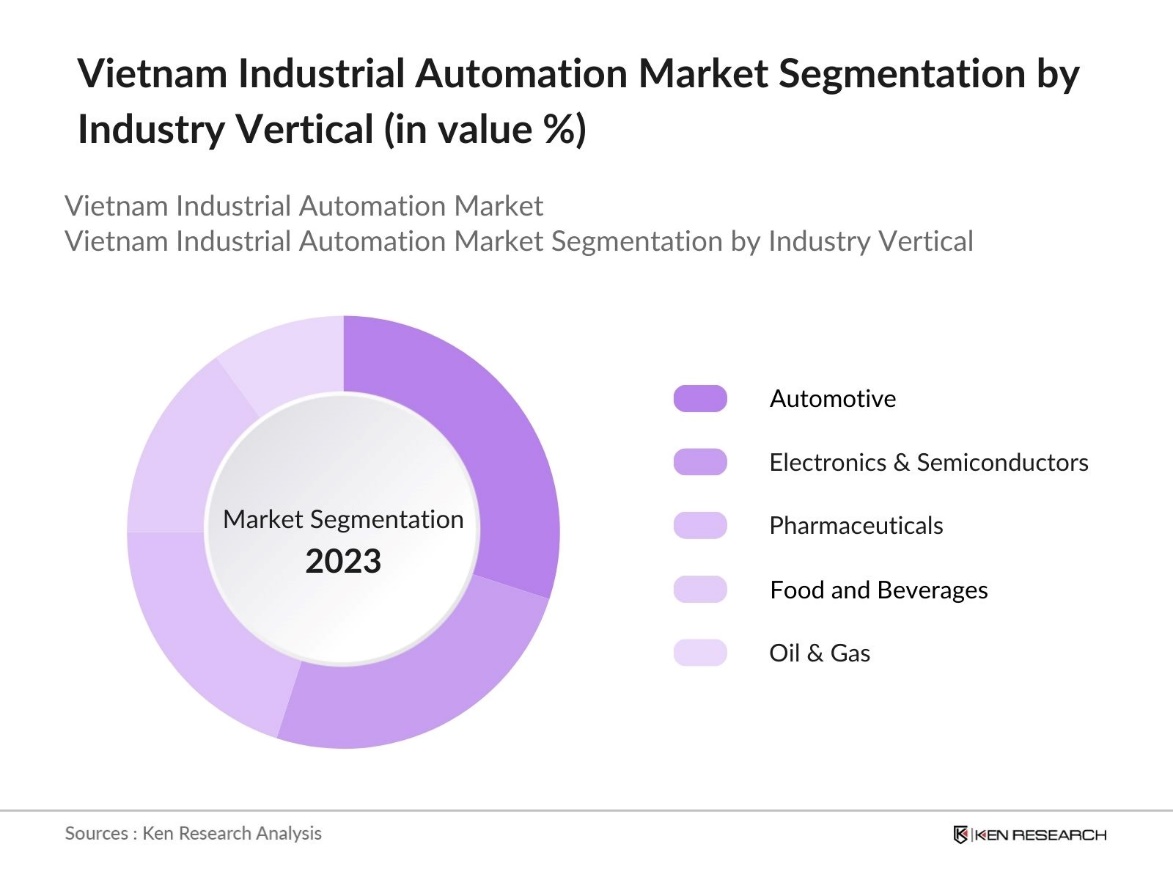

Vietnam Industrial Automation Market Segmentation

By Component: The Vietnam Industrial Automation market is segmented by component into industrial robots, control systems (PLC, SCADA, DCS), sensors and actuators, software solutions (MES, ERP), and others (networking solutions, safety systems). Recently, control systems have been dominant under this segmentation. The robust growth is due to the critical role they play in automating complex processes across diverse industries such as electronics and automotive. As manufacturers in Vietnam increasingly seek to optimize production and improve operational efficiency, demand for advanced control systems is surging.

By Industry Vertical: The Vietnam Industrial Automation market is segmented by industry vertical into automotive, electronics and semiconductors, food and beverages, oil and gas, and pharmaceuticals. The automotive sector holds a dominant market share due to Vietnams emergence as a key manufacturing hub for global automotive players. Companies are rapidly automating their assembly lines and production processes to meet the increasing demand for both domestic and export markets. The sector's expansion is supported by government incentives aimed at fostering technological innovation.

Vietnam Industrial Automation Market Competitive Landscape

The Vietnam Industrial Automation market is dominated by key multinational players that have established strong footprints in the country through joint ventures, partnerships, and local manufacturing units. Companies such as Siemens, ABB, and Mitsubishi Electric have significantly expanded their presence, particularly in sectors such as automotive, electronics, and heavy industries. These firms leverage their expertise in automation solutions, including robotics, AI-driven systems, and control technologies, to maintain their competitive edge in the region.

|

Company |

Establishment Year |

Headquarters |

Market Focus |

Revenue (2023) |

Product Portfolio |

R&D Investment |

Local Manufacturing Presence |

Partnerships |

|

Siemens AG |

1847 |

Munich, Germany |

Industrial Automation |

$96 billion |

PLCs, SCADA, Robotics |

High |

Yes |

High |

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

Robotics and Automation |

$28 billion |

Control Systems |

High |

Yes |

High |

|

Mitsubishi Electric |

1921 |

Tokyo, Japan |

Factory Automation |

$42 billion |

Robotics, Sensors |

Medium |

Yes |

Medium |

|

Honeywell International |

1906 |

Charlotte, USA |

Automation Systems |

$36 billion |

AI-driven Solutions |

Medium |

Yes |

High |

|

Schneider Electric |

1836 |

Rueil-Malmaison, France |

Energy & Automation |

$32 billion |

Sensors, Robotics |

Medium |

Yes |

Medium |

Vietnam Industrial Automation Industry Analysis

Growth Drivers

- Increasing Foreign Direct Investments (FDI): The market has witnessed significant growth due to rising FDI inflows. In 2022, the country attracted over $21.34 billion in FDI, particularly in high-tech sectors like manufacturing and automation, according to the Ministry of Planning and Investment. The governments push to develop advanced manufacturing capabilities has made Vietnam a hub for smart manufacturing initiatives, drawing foreign investors interested in capitalizing on automation technologies.

- Shift Towards Smart Manufacturing: The shift is supported by the Ministry of Industry and Trade's 2023 report, which states that Vietnam's industrial production index increased by 1.5% year-on-year, reflecting the country's move toward digitalization and automation. The use of automation in industries like electronics, textiles, and automotive is increasing, positioning Vietnam as a future leader in smart manufacturing, driven by its low labor costs and government incentives for high-tech industrial parks.

- Adoption of Advanced Robotics and AI: The adoption of advanced robotics and AI is transforming Vietnam's industrial automation, particularly in sectors like automotive and electronics. These technologies enhance production efficiency and enable real-time decision-making through AI integration. This shift is driven by the government's efforts to boost technological capabilities, positioning Vietnam as a growing hub for smart manufacturing and process optimization.

Market Challenges

- High Initial Implementation Costs: The implementation of advanced industrial automation systems often comes with high upfront costs, posing a challenge for businesses, particularly small and medium-sized enterprises (SMEs). These initial financial demands make it difficult for companies to upgrade their systems, despite the long-term benefits automation offers. This barrier slows down the adoption of automation technologies, especially in cost-sensitive industries, where budget constraints impact the transition to modern, efficient processes.

- Lack of Skilled Labor for Advanced Automation Technologies: The shift towards automation technologies has exposed a skills gap in Vietnams workforce. A significant portion of the labor force lacks the necessary training to operate advanced automation systems such as AI-powered robotics and IIoT devices. This shortage of skilled workers hampers the effective deployment and maintenance of automation technologies, making it harder for manufacturers to fully embrace smart manufacturing. Expanding vocational training and upskilling programs is essential to address this challenge.

Vietnam Industrial Automation Market Future Outlook

The Vietnam Industrial Automation market is set to experience robust growth over the coming years, driven by rapid advancements in automation technologies and the increased adoption of smart manufacturing solutions. Key drivers include the Vietnamese governments push for digital transformation in manufacturing and significant foreign investments into automation infrastructure. As Vietnam becomes an integral player in the global supply chain, industries such as automotive, electronics, and pharmaceuticals are expected to significantly boost their automation levels, further driving the market.

Market Opportunities

- Expansion in SME Adoption of Automation: Small and medium-sized enterprises (SMEs) are increasingly adopting automation technologies, driven by government support and the need for more efficient production processes. With financial incentives available, many SMEs are investing in automation to enhance productivity and streamline operations. This growing adoption positions SMEs as essential contributors to the automation landscape, enabling them to compete more effectively in both domestic and global markets.

- Digital Transformation in Process Industries: Vietnam's process industries, such as food and beverage, chemicals, and textiles, are experiencing rapid digital transformation. The integration of technologies like IIoT and AI is optimizing production workflows, reducing downtime, and improving quality control. Supported by government initiatives and favorable policies, this shift towards digitalization is unlocking new opportunities for automation technology providers across various industries in the country.

Scope of the Report

|

Component |

Industrial Robots Control Systems Sensors and Actuators Software Solutions Others |

|

Industry Vertical |

Automotive Electronics & Semiconductors Food & Beverages Oil & Gas Pharmaceuticals |

|

Technology |

IIoT, AI & ML Cobots Cloud Computing Additive Manufacturing |

|

Enterprise Size |

Large Enterprises Small & Medium Enterprises |

|

Region |

Northern Central Southern |

Products

Key Target Audience

Manufacturing Companies

Automotive Manufacturers Companies

Electronics & Semiconductor Companies

Robotics Manufacturers

Technology Providers for Industrial Automation

Government & Regulatory Bodies (Ministry of Industry and Trade)

Venture Capital and Investment Firms

Banks and Financial Institutions

Companies

Major Players

Siemens AG

ABB Ltd.

Mitsubishi Electric Corporation

Honeywell International Inc.

Schneider Electric

Bosch Rexroth AG

Fanuc Corporation

Rockwell Automation

Omron Corporation

Emerson Electric Co.

Keyence Corporation

Delta Electronics Inc.

Yokogawa Electric Corporation

Advantech Co. Ltd.

Fuji Electric Co., Ltd.

Table of Contents

1. Vietnam Industrial Automation Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (influenced by Industry 4.0, Smart Factories, and Industrial IoT integration)

1.4 Market Segmentation Overview

2. Vietnam Industrial Automation Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (including local manufacturing expansion and automation investments)

3. Vietnam Industrial Automation Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Foreign Direct Investments (FDI)

3.1.2 Shift Towards Smart Manufacturing

3.1.3 Adoption of Advanced Robotics and AI

3.1.4 Government Support for Technological Advancements in Manufacturing

3.2 Market Challenges

3.2.1 High Initial Implementation Costs

3.2.2 Lack of Skilled Labor for Advanced Automation Technologies

3.2.3 Complex Integration with Legacy Systems

3.3 Opportunities

3.3.1 Expansion in SME Adoption of Automation

3.3.2 Digital Transformation in Process Industries

3.3.3 Investment in Smart Factory Solutions

3.4 Trends

3.4.1 Implementation of Industrial IoT (IIoT)

3.4.2 AI and Machine Learning in Predictive Maintenance

3.4.3 Adoption of 5G for Factory Automation

3.5 Government Regulations

3.5.1 National Strategy for Industry 4.0

3.5.2 Vietnam Automation Association Initiatives

3.5.3 Tax Benefits for Automation Investment

3.5.4 Public-Private Partnerships in Manufacturing Innovation

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, System Integrators, and OEMs)

3.8 Porters Five Forces

3.9 Competitive Landscape

4. Vietnam Industrial Automation Market Segmentation

4.1 By Component (In Value %)

4.1.1 Industrial Robots

4.1.2 Control Systems (PLC, SCADA, DCS)

4.1.3 Sensors and Actuators

4.1.4 Software Solutions (MES, ERP)

4.1.5 Others (Networking Solutions, Safety Systems)

4.2 By Industry Vertical (In Value %)

4.2.1 Automotive

4.2.2 Electronics and Semiconductors

4.2.3 Food and Beverages

4.2.4 Oil & Gas

4.2.5 Pharmaceuticals

4.3 By Technology (In Value %)

4.3.1 Industrial Internet of Things (IIoT)

4.3.2 Artificial Intelligence & Machine Learning

4.3.3 Collaborative Robots (Cobots)

4.3.4 Cloud Computing and Big Data Analytics

4.3.5 Additive Manufacturing (3D Printing)

4.4 By Enterprise Size (In Value %)

4.4.1 Large Enterprises

4.4.2 Small & Medium Enterprises (SMEs)

4.5 By Region (In Value %)

4.5.1 Northern Vietnam (Hanoi, Bac Ninh)

4.5.2 Central Vietnam (Da Nang)

4.5.3 Southern Vietnam (Ho Chi Minh City, Binh Duong)

5. Vietnam Industrial Automation Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. ABB Ltd.

5.1.3. Schneider Electric

5.1.4. Honeywell International Inc.

5.1.5. Rockwell Automation

5.1.6. Mitsubishi Electric Corporation

5.1.7. Yokogawa Electric Corporation

5.1.8. Omron Corporation

5.1.9. FANUC Corporation

5.1.10. KUKA AG

5.1.11. Bosch Rexroth

5.1.12. Delta Electronics

5.1.13. Keyence Corporation

5.1.14. Advantech Co. Ltd.

5.1.15. Emerson Electric Co.

5.2 Cross Comparison Parameters (Revenue, Market Presence, Automation Product Portfolio, Industry Expertise, Headquarters Location, Number of Employees, R&D Investment, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Incentives

6. Vietnam Industrial Automation Market Regulatory Framework

6.1 Standards and Certification (ISO, IEC Compliance)

6.2 Automation Safety Guidelines

6.3 Compliance Requirements for Robotic Systems

6.4 Industrial Data Protection and Cybersecurity Regulations

7. Vietnam Industrial Automation Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Vietnam Industrial Automation Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Industry Vertical (In Value %)

8.3 By Technology (In Value %)

8.4 By Enterprise Size (In Value %)

8.5 By Region (In Value %)

9. Vietnam Industrial Automation Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Marketing Initiatives

9.3 White Space Opportunity Analysis

9.4 Technology Adoption Roadmap

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves creating an ecosystem map of the Vietnam Industrial Automation market, considering stakeholders such as automation solution providers, end-users, and regulatory authorities. We utilize secondary databases, proprietary data, and comprehensive desk research to identify critical market drivers.

Step 2: Market Analysis and Construction

Next, historical data on market penetration, automation adoption rates, and revenue generation is analyzed to understand the growth patterns of the Vietnam Industrial Automation market. This includes a detailed assessment of technological adoption in key sectors.

Step 3: Hypothesis Validation and Expert Consultation

We conduct in-depth interviews with industry experts through telephone consultations to validate market hypotheses. These interviews provide operational insights, which help to refine data and ensure the accuracy of our market analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing insights gathered from automation manufacturers and industry stakeholders to form a comprehensive market report. This stage ensures that the report is accurate, validated, and aligns with market dynamics.

Frequently Asked Questions

01. How big is the Vietnam Industrial Automation Market?

The Vietnam Industrial Automation Market is valued at USD 2.5 billion, driven by advancements in Industry 4.0 technologies, smart factories, and rising government support for automation initiatives.

02. What are the challenges in the Vietnam Industrial Automation Market?

Key challenges in Vietnam Industrial Automation Market include high initial setup costs, a shortage of skilled labor capable of handling advanced automation technologies, and difficulties in integrating automation with existing legacy systems in manufacturing plants.

03. Who are the major players in the Vietnam Industrial Automation Market?

Major players in Vietnam Industrial Automation Market include Siemens AG, ABB Ltd., Mitsubishi Electric Corporation, Honeywell International Inc., and Schneider Electric, among others. These companies dominate due to their strong global presence, robust product portfolios, and partnerships with local industries.

04. What are the growth drivers of the Vietnam Industrial Automation Market?

The Vietnam Industrial Automation Market is propelled by factors such as increased adoption of smart manufacturing solutions, government incentives for digital transformation, and foreign direct investments in the manufacturing sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.