Vietnam Insecticide Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2242

November 2024

91

About the Report

Vietnam Insecticide Market Overview

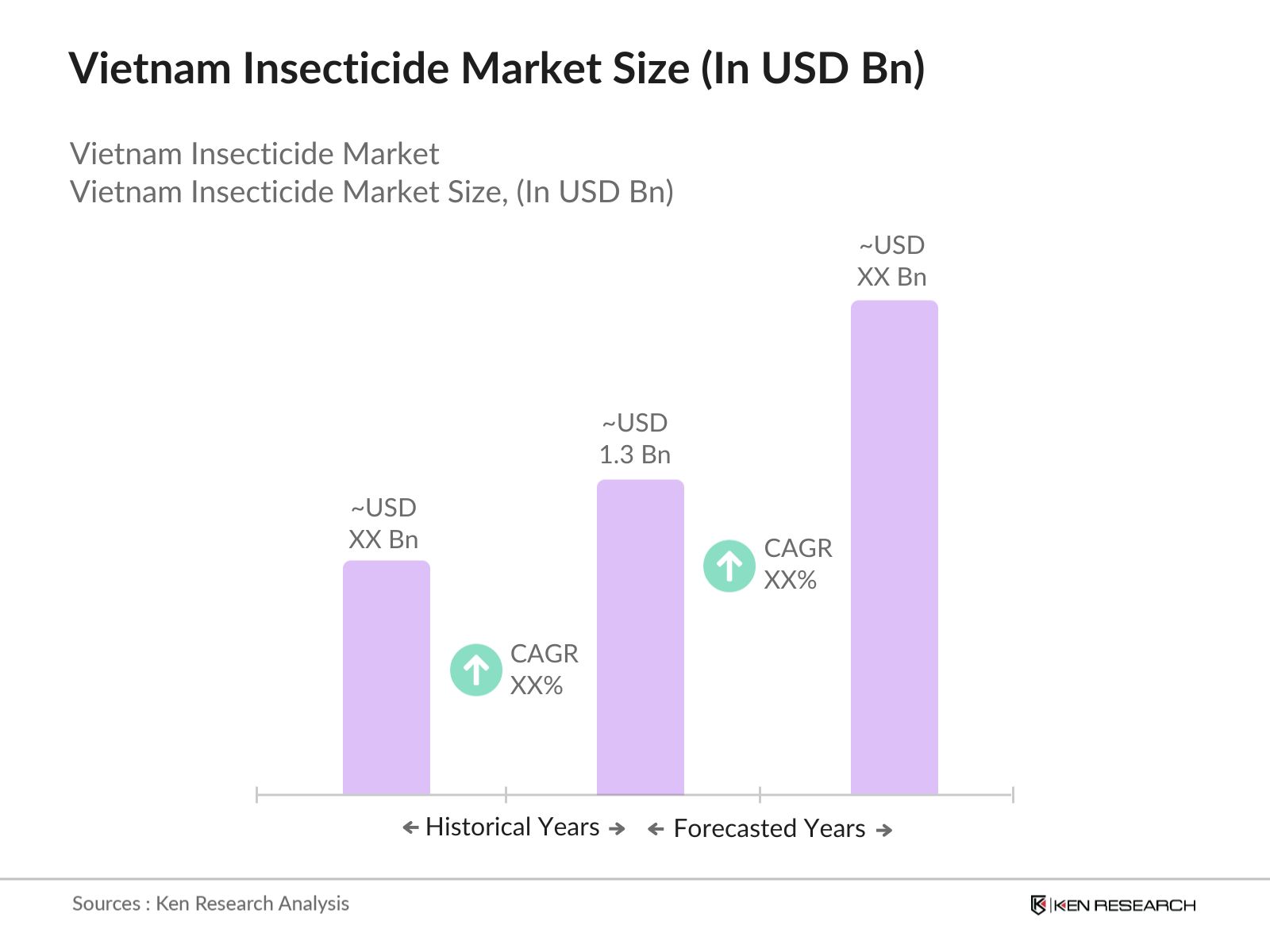

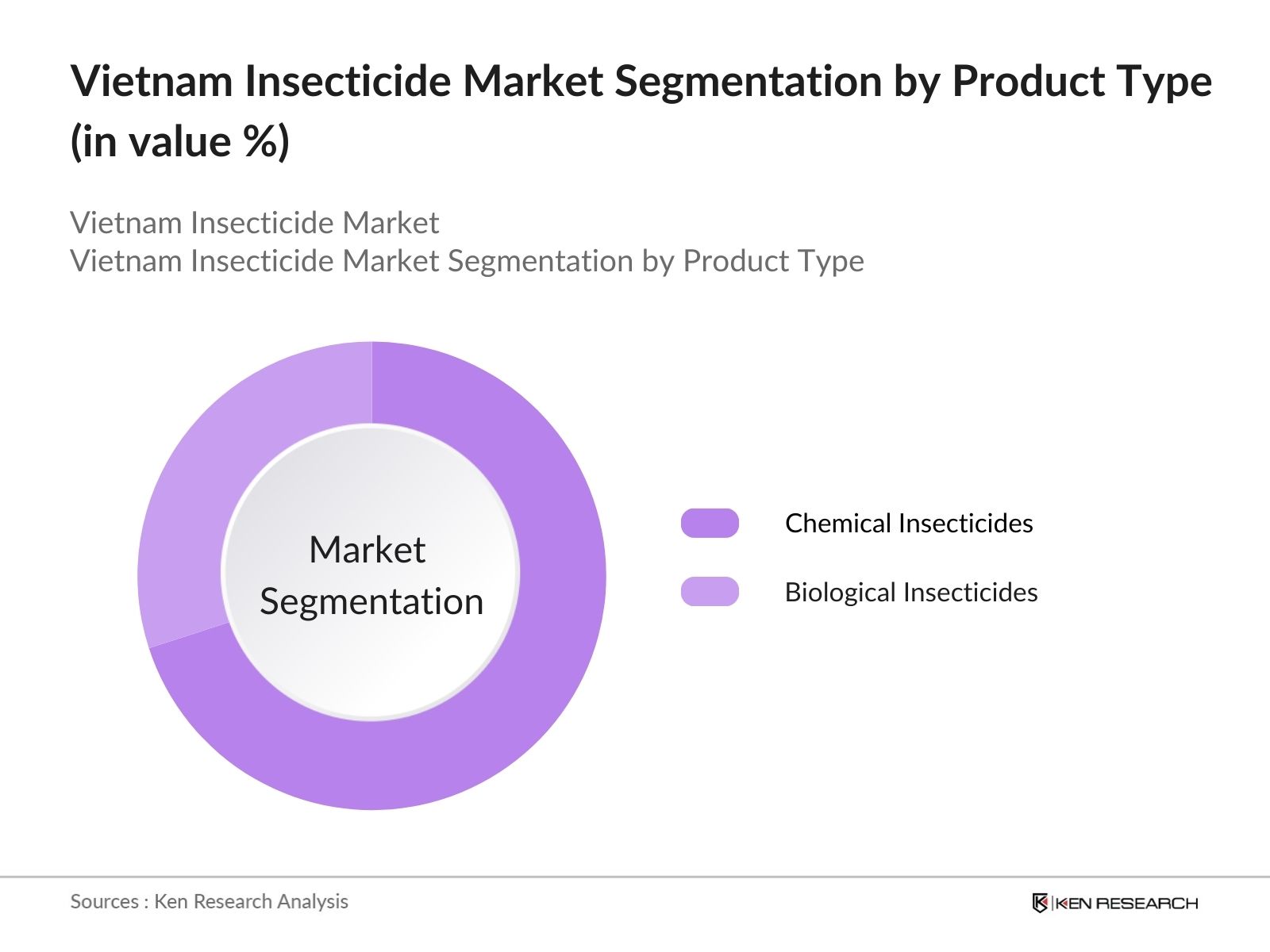

- The Vietnam Insecticide Market was valued at USD 1.3 billion in 2023, influenced by the rising demand for crop protection due to the countrys robust agricultural sector, increasing pest infestations, and a growing focus on enhancing agricultural productivity. The market is segmented into chemical insecticides, biological insecticides, and others, with chemical insecticides holding the largest share due to their effectiveness and widespread usage.

- Major players in the Vietnam Insecticide Market include Syngenta AG, Bayer CropScience, BASF SE, FMC Corporation, and Dow AgroSciences. These companies are known for their comprehensive product offerings and advancements in insecticide formulations. Syngenta AG leads the market with its innovative solutions, including its widely used insecticide brands like Karate and Actara, recognized for their efficacy in pest control.

- In 2023, Vietnams key agricultural regions such as the Mekong Delta, Red River Delta, and Central Highlands experienced significant pest issues, driving the demand for insecticides. The Mekong Delta, in particular, is a major rice-growing area where insecticide use is critical for protecting crops from pests and diseases.

- In 2023, BASF SE launched a new line of eco-friendly insecticides under its Pest Management Solutions portfolio, aimed at reducing environmental impact while maintaining high effectiveness. This launch highlights the ongoing shift towards more sustainable pest control solutions in the Vietnamese insecticide market, aligning with global trends towards environmental responsibility.

Vietnam Insecticide Market Segmentation

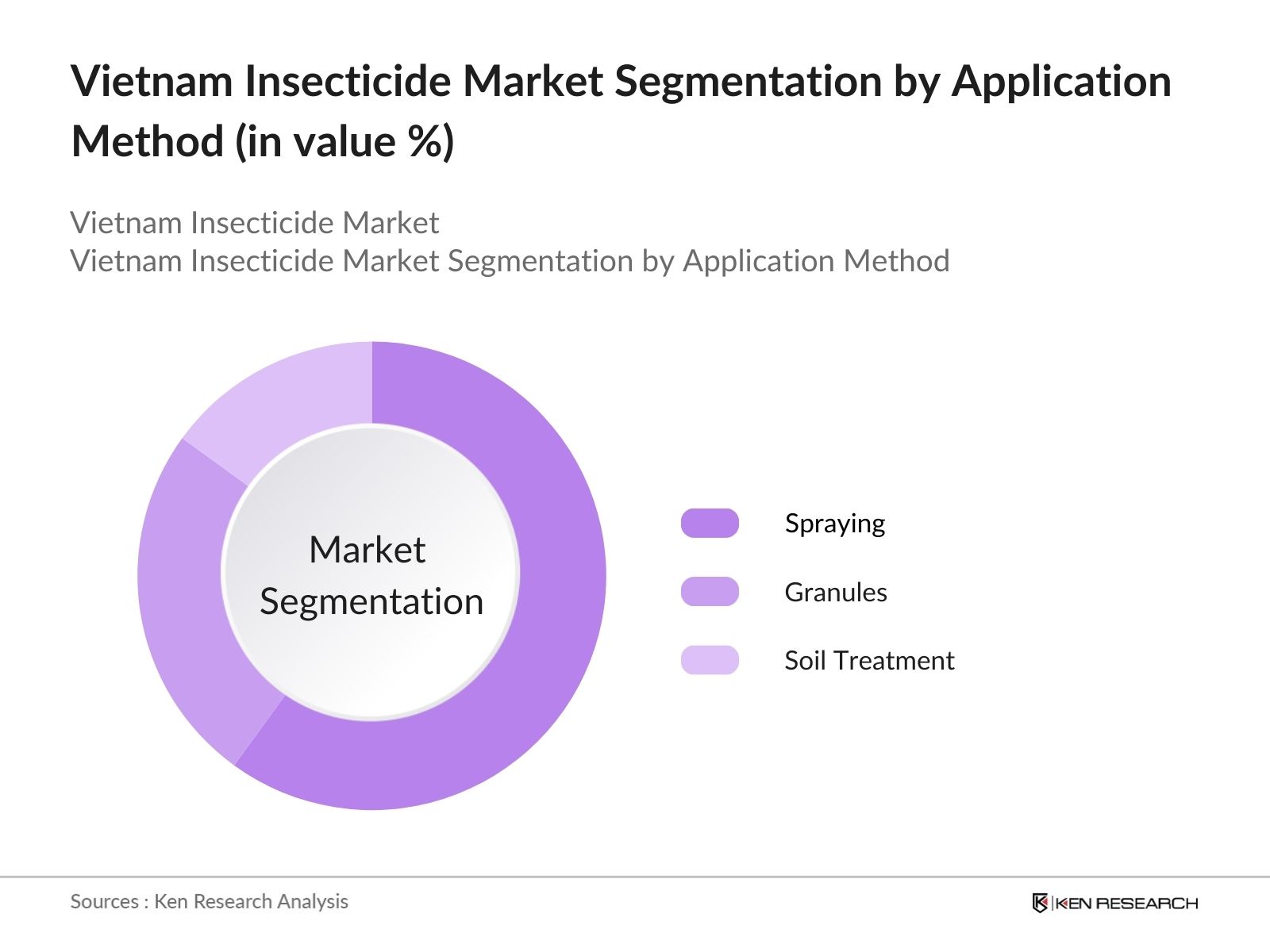

The Vietnam Insecticide Market can be segmented by product type, application method, and region:

- By Product Type: The market is divided into chemical insecticides, and biological insecticides. In 2023, chemical insecticides dominate due to their high effectiveness and extensive use in agriculture. Biological insecticides are gaining traction due to their eco-friendly nature and reduced environmental impact. The 'others' category includes newer formulations and specialized products.

- By Application Method: The market is segmented into spraying, granules, and soil treatment. In 2023, spraying remains the most common application method due to its efficiency and wide coverage. Granules are popular for targeted application, while soil treatment is growing in use for its ability to control pests at the source.

- By Region: The market is segmented into North, East, West and South Vietnam. In 2023, Southern Vietnam leads the market due to its extensive agricultural activities, particularly in rice and vegetable cultivation. Northern Vietnam also shows significant demand, driven by the region's diverse crop production.

Vietnam Insecticide Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Syngenta AG |

2000 |

Basel, Switzerland |

|

Bayer CropScience |

1863 |

Leverkusen, Germany |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

FMC Corporation |

1883 |

Philadelphia, USA |

|

Dow AgroSciences |

1897 |

Midland, USA |

- Syngenta AG: In 2023, Syngenta AG introduced a new range of advanced insecticides under its Karate brand, designed to combat emerging pest species resistant to conventional treatments. This product launch aims to address the increasing challenge of pest resistance and strengthen Syngentas market position.

- Bayer CropScience: In 2024, Bayer CropScience expanded its portfolio with a new insecticide product that integrates with digital pest management systems, providing farmers with real-time data on pest activity and effective control measures. This innovation reflects Bayers commitment to integrating technology with pest management solutions.

Vietnam Insecticide Market Analysis

Market Growth Drivers:

- Increasing Agricultural Production: Vietnam's agricultural sector has been expanding rapidly. In 2023, the total area of cultivated land was approximately 9.5 million hectares, with major crops including rice, maize, and vegetables. The rise in crop production increases the demand for effective insecticides.

- Advancements in Insecticide Technology: The development of new insecticide formulations and technologies has significantly improved pest management efficiency. In 2023, over 30 new insecticide products were introduced to the Vietnamese market, showcasing innovation in pest control methods.

- Government Initiatives: The Vietnamese government has been actively promoting modern pest management practices. For instance, the introduction of subsidies and support programs for adopting advanced pest control technologies has contributed to the market's growth.

Market Challenges:

- Environmental and Health Concerns: There is growing concern about the environmental and health impacts of chemical insecticides. Issues such as pesticide residues, potential harm to non-target species, and human health risks have led to increased scrutiny and demand for safer alternatives.

- Market Fragmentation: The presence of numerous local and international competitors in the insecticide market can lead to intense competition, making it difficult for companies to maintain market share and achieve economies of scale.

- Pest Resistance: The development of resistance among pests to commonly used insecticides are a significant challenge. This resistance can reduce the effectiveness of existing products and lead to increased costs for farmers as they seek alternative solutions.

Government Initiatives:

- Vietnam's National Action Plan on Integrated Pest Management (IPM): Vietnam has set an ambitious goal of reducing the number of chemical pesticide brands registered in the country by 30%, with a strong emphasis on replacing them with bioproducts. The Netherlands, known for its extensive expertise in biological crop protection and sustainable farming methods, has emerged as a valuable partner in this endeavor.

- Pest Control Research Grants: The U.S. Department of Agricultures National Institute of Food and Agriculture (NIFA) today announced the availability of $4 million to support research and extension efforts to mitigate pest issues and increase crop protection practices for the agricultural community. This funding is made through the Crop Protection and Pest Management (CPPM) Program, administered by NIFA.

Vietnam Insecticide Market Future Market Outlook

The Vietnam Insecticide Market is expected to grow steadily, driven by advancements in pest control technologies, increasing agricultural activities, and a shift towards more sustainable pest management practices.

- Expansion of Biopesticides: The market for biopesticides is expected to grow significantly, with new biopesticide products entering the market to address the need for environmentally friendly pest control solutions. In 2023, the global biopesticides market was valued at approximately USD 6.8 billion, with Vietnam showing increasing adoption.

- Integration of Smart Technology: The use of smart technology in pest management is on the rise. Innovations such as drone-based pest monitoring and smart sensors for real-time pest detection are anticipated to enhance the effectiveness of insecticides. The smart agriculture market, which includes such technologies, was valued at USD 12.8 billion globally in 2023.

- Growth of Precision Agriculture: Precision agriculture techniques, which use data and technology to optimize pest control, are gaining traction. This approach is expected to drive demand for targeted insecticide applications. The precision agriculture market was valued at USD 8.5 billion in 2023 and is projected to continue growing.

Scope of the Report

|

By Region |

West East North South |

|

By Application Method |

Spraying Granules Soil Treatment |

|

By Product Type |

Chemical Insecticides Biological Insecticides |

Products

Key Target Audience:

Agricultural Product Manufacturers

Pest Control Companies

Government and Regulatory Bodies (MARD, VEA, MOH, MOIT)

Research and Development Institutions

Crop Protection Specialists

Agricultural Equipment Suppliers

Environmental and Sustainability Organizations

Agribusiness Investors

Pest Management Consultants

Agricultural Cooperatives

Agrochemical Distributors

Trade Associations in Agriculture and Pest Control

University and Academic Researchers in Agricultural Sciences

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Syngenta AG

Bayer CropScience

BASF SE

FMC Corporation

Dow AgroSciences

Corteva Agriscience

Sumitomo Chemical

Mitsui Chemicals

Adama Agricultural Solutions

UPL Limited

Nufarm Limited

AMVAC Chemical Corporation

Valent BioSciences LLC

Nippon Soda Co., Ltd.

Platform Specialty Products Corporation

Table of Contents

1. Vietnam Insecticide Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Insecticide Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Insecticide Market Analysis

3.1. Market Growth Drivers

3.1.1. Increasing Agricultural Production

3.1.2. Advancements in Insecticide Technology

3.1.3. Government Initiatives

3.2. Market Challenges

3.2.1. Environmental and Health Concerns

3.2.2. Market Fragmentation

3.2.3. Pest Resistance

3.3. Market Opportunities

3.3.1. Growth of Biopesticides

3.3.2. Integration of Smart Technology

3.3.3. Growth of Precision Agriculture

3.4. Future Market Trends

3.4.1. Expansion of Biopesticides

3.4.2. Integration of Smart Technology

3.4.3. Growth of Precision Agriculture

3.4.4. Increased Focus on Sustainable Practices

3.4.5. Development of Eco-friendly Formulations

3.4.6. Rise in Organic Farming

3.4.7. Adoption of Integrated Pest Management (IPM) Programs

3.4.8. Enhanced Regulatory Standards

3.4.9. Growth in Agricultural Technology Investments

3.4.10. Increased Collaboration between Industry and Research Institutions

3.5. Government Initiatives

3.5.1. Vietnam's National Action Plan on Integrated Pest Management (IPM)

3.5.2. Pest Control Research Grants

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Vietnam Insecticide Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Chemical Insecticides

4.1.2. Biological Insecticides

4.1.3. Others

4.2. By Application Method (in Value %)

4.2.1. Spraying

4.2.2. Granules

4.2.3. Soil Treatment

4.3. By Region (in Value %)

4.3.1. North Vietnam

4.3.2. East Vietnam

4.3.3. West Vietnam

4.3.4. South Vietnam

5. Vietnam Insecticide Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Syngenta AG

5.1.2. Bayer CropScience

5.1.3. BASF SE

5.1.4. FMC Corporation

5.1.5. Dow AgroSciences

5.1.6. Corteva Agriscience

5.1.7. Sumitomo Chemical

5.1.8. Mitsui Chemicals

5.1.9. Adama Agricultural Solutions

5.1.10. UPL Limited

5.1.11. Nufarm Limited

5.1.12. AMVAC Chemical Corporation

5.1.13. Valent BioSciences LLC

5.1.14. Nippon Soda Co., Ltd.

5.1.15. Platform Specialty Products Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Vietnam Insecticide Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Vietnam Insecticide Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Vietnam Insecticide Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Vietnam Insecticide Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application Method (in Value %)

9.3. By Region (in Value %)

10. Vietnam Insecticide Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and trends in insecticide usage. We also assess regulatory impacts and market dynamics specific to the Vietnamese insecticide market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (chemical insecticides, biological insecticides, and others), and the distribution of application methods (spraying, granules, soil treatment). We also analyze market share and revenue generated by leading brands, emerging trends in pest management, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading insecticide manufacturers, distributors, and agricultural professionals. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and market dynamics.

Step 4: Research Output

Our team interacts with insecticide manufacturers, agricultural experts, pest control specialists, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and sales trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the Vietnam Insecticide Market?

In 2023, the Vietnam Insecticide Market was valued at approximately USD 1.3 billion. The market's growth is driven by the need for effective crop protection solutions due to rising pest infestations and advancements in pest control technologies.

02. What are the challenges in the Vietnam Insecticide Market?

Challenges in the Vietnam Insecticide Market include environmental and health concerns related to chemical insecticides, regulatory hurdles for product safety and environmental impact, and the issue of pest resistance. There is a growing demand for safer, more sustainable pest management solutions.

03. Who are the major players in the Vietnam Insecticide Market?

Major players in the Vietnam Insecticide Market include Syngenta AG, Bayer CropScience, BASF SE, FMC Corporation, and Dow AgroSciences. These companies lead the market with their innovative products and comprehensive pest management solutions.

04. What are the growth drivers of the Vietnam Insecticide Market?

Key growth drivers include increasing agricultural production, rising pest infestations, and advancements in insecticide technology. The demand for more effective and eco-friendly pest control solutions also contributes to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.