Vietnam Intelligent Transportation Systems (ITS) Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7119

December 2024

82

About the Report

Vietnam Intelligent Transportation Systems (ITS) Market Overview

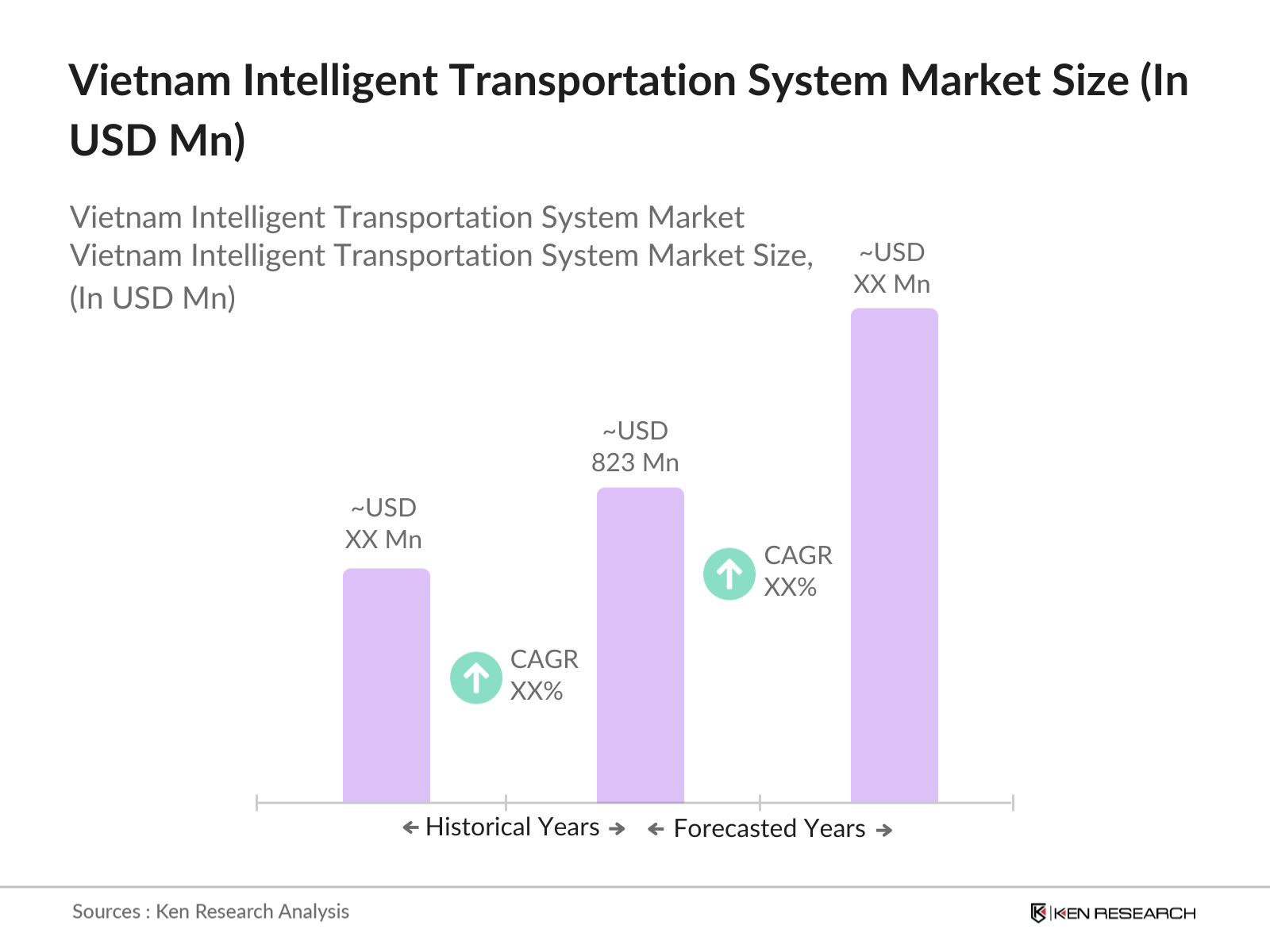

- The Vietnam Intelligent Transportation Systems (ITS) Market, is valued at USD 823 million based on a five-year historical analysis, driven by a combination of urbanization, government initiatives, and growing adoption of technology. The growth of ITS in Vietnam is propelled by significant investments in infrastructure projects, especially in urban centers such as Hanoi and Ho Chi Minh City, where the traffic congestion problem is severe.

- In terms of dominance, the cities of Hanoi and Ho Chi Minh City stand out due to their rapid urbanization, higher population density, and increasing traffic congestion. These cities are actively deploying ITS to reduce congestion and enhance transportation efficiency. Additionally, government support for smart city initiatives has further strengthened the ITS deployment in these cities, making them the leading regions in adopting ITS technology in Vietnam. The availability of financial and technological resources has contributed to the success of ITS in these dominant cities.

- Vietnams environmental policies strongly influence its ITS deployment, focusing on reducing carbon emissions and adopting cleaner technologies. Decision 450/QD-TTg emphasizes the importance of modernizing public transport systems and limiting the use of private vehicles, particularly those powered by internal combustion engines. This decision is part of a broader effort to improve air quality in urban areas and reduce reliance on fossil fuels.

Vietnam Intelligent Transportation Systems (ITS) Market Segmentation

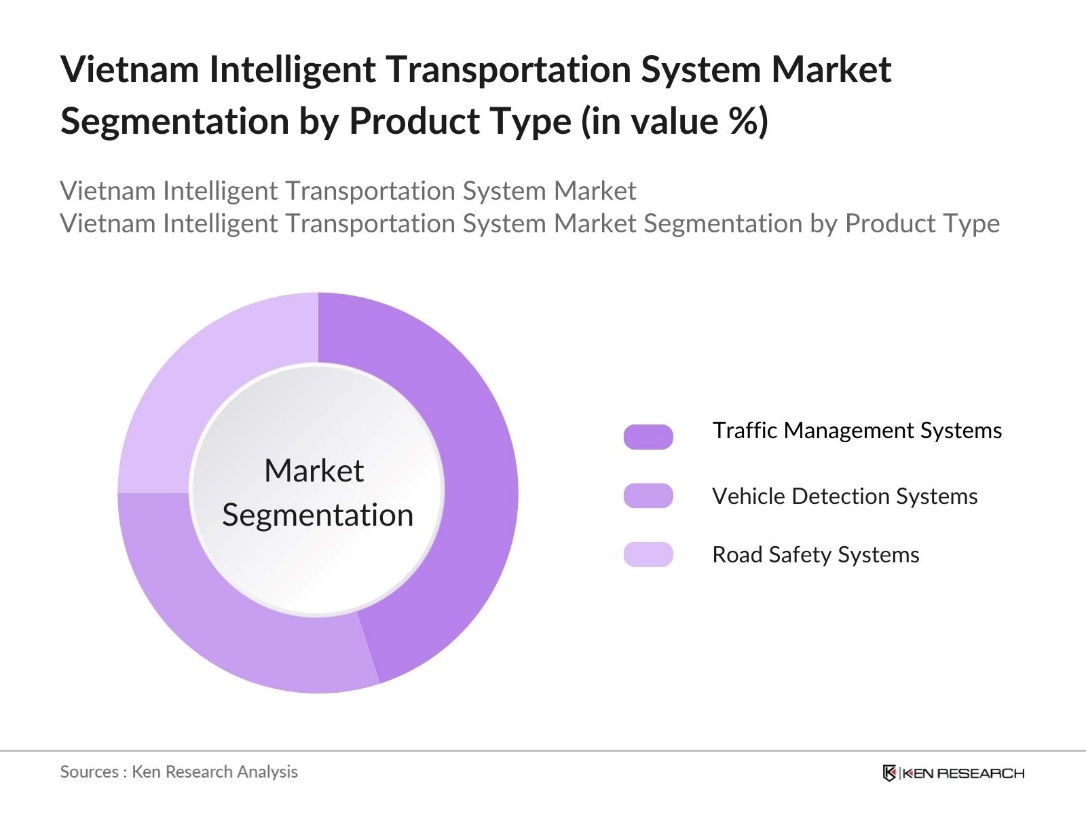

By Product Type: The Vietnam ITS market is segmented by product type into traffic management systems, vehicle detection systems, and road safety systems. Among these, traffic management systems dominate the market share due to their crucial role in mitigating traffic congestion and ensuring smooth traffic flow in urban areas. Hanoi and Ho Chi Minh City, known for their heavy traffic, have heavily invested in real-time traffic management systems, which help monitor and control traffic flow, reduce travel times, and improve road safety.

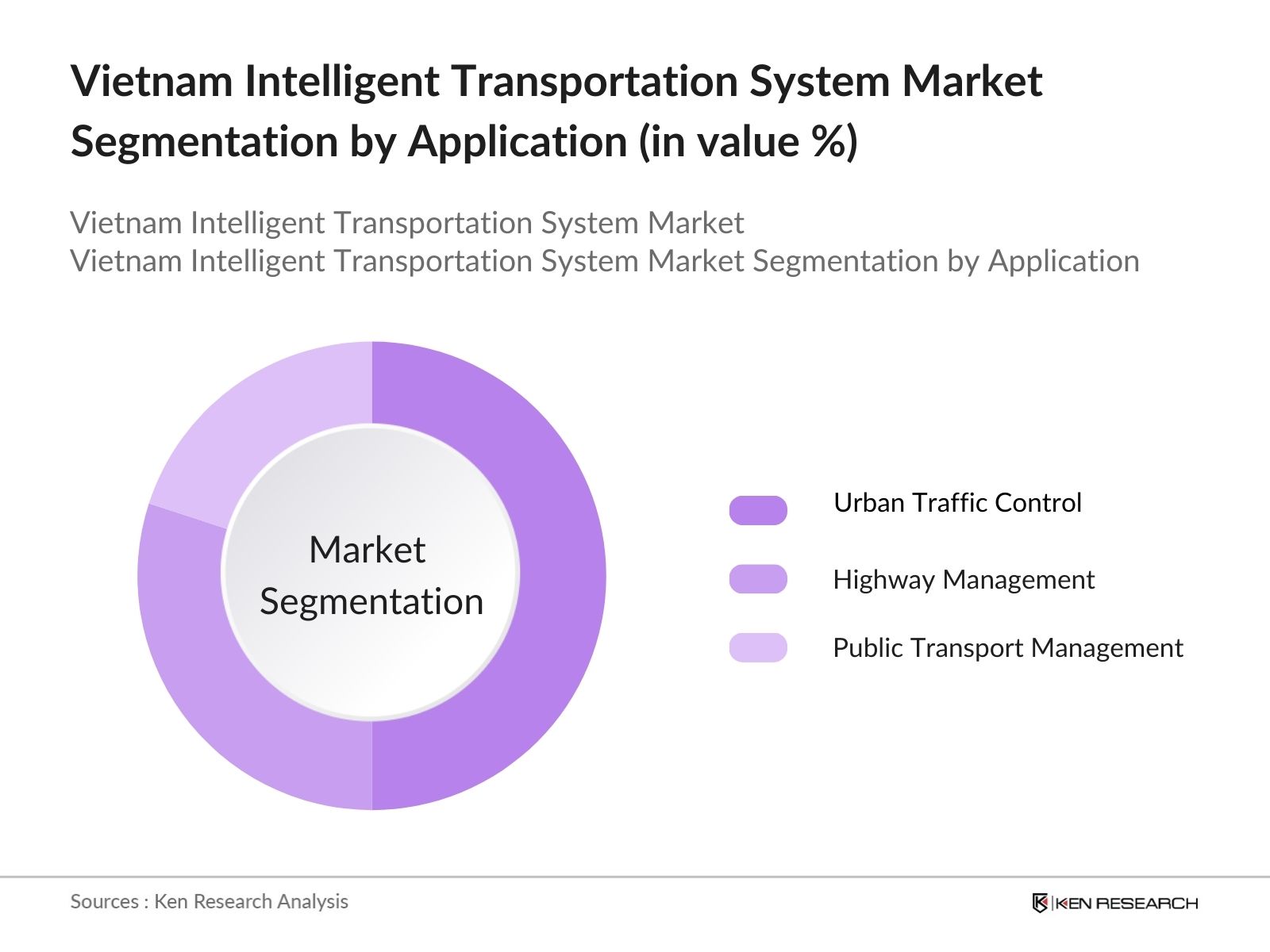

By Application: The ITS market in Vietnam is also segmented by application into urban traffic control, highway management, and public transport management. Urban traffic control holds the largest market share due to the pressing need for efficient traffic systems in densely populated cities. The implementation of ITS solutions in urban areas helps reduce traffic congestion, enhances road safety, and improves fuel efficiency. Cities like Hanoi and Ho Chi Minh have been early adopters of urban traffic control systems, which use data analytics and real-time monitoring to optimize traffic lights, reroute vehicles, and manage accidents more efficiently.

Vietnam Intelligent Transportation Systems (ITS) Market Competitive Landscape

The market is dominated by several local and global players, with many companies contributing to the infrastructure and technology solutions that power the country's ITS initiatives. The market shows a mix of established global technology providers and strong local players working on expanding their footprint in Vietnam.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Geographic Presence |

Product Portfolio |

Technological Capabilities |

Partnerships |

Revenue |

Market Share |

|

Siemens Vietnam |

1972 |

Hanoi |

|||||||

|

Hitachi Vietnam |

1991 |

Ho Chi Minh City |

|||||||

|

FPT Corporation |

1988 |

Hanoi |

|||||||

|

Toshiba Infrastructure Systems |

1969 |

Tokyo |

|||||||

|

IBM Vietnam |

1993 |

Ho Chi Minh City |

Vietnam Intelligent Transportation Systems (ITS) Industry Analysis

Growth Drivers

- Increasing Urban Traffic Congestion: Vietnam's rapid urbanization is leading to severe traffic congestion in cities like Hanoi and Ho Chi Minh. As of 2023, the total number of registered vehicles in India is indeed significant, with estimates suggesting around 260 million two-wheelers and approximately 50 million cars on the roads. This congestion creates a significant demand for Intelligent Transportation Systems (ITS) to manage traffic more efficiently. The increased vehicle count also reflects higher air pollution and accidents, which ITS aims to mitigate.

- Investment in Infrastructure (Smart Roads, Real-Time Traffic Monitoring): Vietnams infrastructure investments have focused heavily on smart road technologies, with US$43-65 billion allocated in 2023 for developing smart roads, real-time traffic monitoring systems, and integrated traffic management platforms. These systems help monitor traffic density, detect violations, and manage signals, providing an efficient flow of vehicles. The countrys focus on high-tech solutions reflects the urgency to modernize its aging infrastructure and cope with rising congestion.

- Government Initiatives for Smart Cities: Vietnams government is promoting smart city initiatives that integrate intelligent transportation systems (ITS) to improve urban mobility. Cities like Ho Chi Minh are incorporating ITS into public transport to enhance traffic flow and reduce congestion. These efforts aim to optimize infrastructure and create sustainable, efficient urban spaces, reflecting the governments commitment to modernizing its rapidly growing cities.

Market Challenges

- High Initial Investment Costs: The implementation of ITS in Vietnam is challenged by high initial investment requirements. Developing smart roads, installing traffic sensors, and upgrading public transportation networks require significant financial resources. While the government offers some support, the financial burden on local administrations and private entities remains substantial. This financial strain makes it difficult for smaller urban centers to adopt ITS, leading to uneven deployment across the country.

- Lack of Skilled Workforce in ITS Management: Vietnam's rapid adoption of ITS is hindered by a shortage of skilled professionals. The lack of expertise in managing advanced transportation technologies affects the efficient deployment and operation of ITS. Although efforts are being made to improve training and foster international collaborations, the shortage of qualified professionals remains a challenge for long-term ITS success.

Vietnam Intelligent Transportation Systems (ITS) Market Future Outlook

Over the next five years, the Vietnam Intelligent Transportation Systems market is expected to show significant growth driven by continued government support for smart city initiatives, increased investment in infrastructure projects, and growing consumer demand for efficient and safe transportation systems. The government's focus on reducing urban traffic congestion and improving road safety will be key factors in the markets expansion.

Market Opportunities

- Integration of Autonomous Vehicles into ITS: Vietnam is preparing to integrate autonomous vehicles into its Intelligent Transportation Systems (ITS), creating new growth opportunities. By incorporating advanced technologies, Vietnam aims to optimize traffic management and improve road safety. ITS infrastructure supports the operation of autonomous vehicles by providing real-time data on traffic conditions, laying the foundation for future transportation advancements.

- Expansion of Public-Private Partnerships (PPP): Public-Private Partnerships (PPP) are expanding in Vietnams transportation infrastructure sector, especially in ITS projects. These collaborations between the government and private stakeholders enable faster deployment of ITS technology and help distribute the financial responsibilities, making large-scale projects more achievable.

Scope of the Report

|

Product Type |

Traffic Management Systems Vehicle Detection Systems, Road Safety Systems |

|

Application |

Urban Traffic Control Highway Management Public Transport Management |

|

Technology |

Sensing and Detection Data Processing, AI and ML |

|

Deployment Type |

Cloud-Based On-Premises |

|

Region |

Hanoi Ho Chi Minh City Central Vietnam Northern Highlands |

Products

Key Target Audience

Logistics and Fleet Management Companies

Automotive Manufacturers

Telecommunications Companies

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Transport, Ministry of Construction)

Companies

Players Mentioned in the Report

Siemens Vietnam

Hitachi Vietnam

FPT Corporation

Toshiba Infrastructure Systems

IBM Vietnam

Kapsch TrafficCom AG

Thales Group

Vietnam Electronics and Informatics Corporation

NEC Vietnam

Qualcomm Vietnam

Table of Contents

1. Vietnam ITS Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (ITS Adoption Rate, Expansion of Smart Cities)

1.4. Market Segmentation Overview

2. Vietnam ITS Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Infrastructure Spending, Urbanization Rate)

2.3. Key Market Developments and Milestones

3. Vietnam ITS Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urban Traffic Congestion

3.1.2. Government Initiatives for Smart Cities

3.1.3. Investment in Infrastructure (Smart Roads, Real-Time Traffic Monitoring)

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Lack of Skilled Workforce in ITS Management

3.2.3. Regulatory Compliance Issues (Data Privacy, ITS Standards)

3.3. Opportunities

3.3.1. Integration of Autonomous Vehicles into ITS

3.3.2. Expansion of Public-Private Partnerships (PPP)

3.3.3. Increasing Usage of AI for Traffic Management

3.4. Trends

3.4.1. Adoption of IoT and AI in ITS

3.4.2. Growth of Ride-Sharing Platforms Integrating ITS

3.4.3. Increased Focus on Sustainable Transportation Systems

3.5. Government Regulations

3.5.1. National ITS Deployment Policies

3.5.2. Environmental Standards for Smart Transportation

3.5.3. Public-Private Collaboration Framework

4. Vietnam ITS Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Traffic Management Systems

4.1.2. Vehicle Detection Systems

4.1.3. Road Safety and Security Systems

4.2. By Application (In Value %)

4.2.1. Urban Traffic Control

4.2.2. Highway Traffic Management

4.2.3. Public Transport Management

4.3. By Technology (In Value %)

4.3.1. Sensing and Detection Systems

4.3.2. Data Processing and Communication Technology

4.3.3. Artificial Intelligence and Machine Learning

4.4. By Deployment Type (In Value %)

4.4.1. Cloud-Based Systems

4.4.2. On-Premises Systems

4.5. By Region (In Value %)

4.5.1. Hanoi

4.5.2. Ho Chi Minh City

4.5.3. Central Vietnam

4.5.4. Northern Highlands

5. Vietnam ITS Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens Vietnam

5.1.2. Hitachi Vietnam

5.1.3. IBM Vietnam

5.1.4. Toshiba Infrastructure Systems & Solutions

5.1.5. Kapsch TrafficCom AG

5.1.6. Vietnam Electronics and Informatics Corporation

5.1.7. FPT Corporation

5.1.8. Thales Group

5.1.9. Cubic Corporation

5.1.10. VEC E-Toll (Vietnam Expressway Corporation)

5.1.11. Aimsun Vietnam

5.1.12. Qualcomm Vietnam

5.1.13. Danfoss Vietnam

5.1.14. Advantech Vietnam

5.1.15. NEC Vietnam

5.2. Cross Comparison Parameters (Revenue, Number of Employees, Headquarters, Geographic Presence, Product Portfolio, Technological Capabilities, Partnerships, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam ITS Market Regulatory Framework

6.1. ITS Standards and Guidelines

6.2. Data Privacy Regulations for ITS

6.3. Compliance and Certification Requirements

7. Vietnam ITS Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Smart City Projects, Increased AI Usage)

8. Vietnam ITS Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Deployment Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam ITS Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of the Vietnam ITS market, identifying major stakeholders including government agencies, private technology companies, and public transport authorities. This desk research phase leverages a combination of secondary sources and proprietary databases to collect industry-level information.

Step 2: Market Analysis and Construction

In this step, we analyze historical data from the Vietnam ITS market, including market penetration levels, infrastructure investment statistics, and traffic system adoption rates. These metrics provide a foundation for assessing market trends and key growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

Interviews are conducted with industry experts from Vietnam's transportation and technology sectors to validate market data. The insights gathered from these consultations inform adjustments to the analysis and reinforce the accuracy of market estimations.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the data collected, ensuring that market figures are cross-referenced with insights from key players in the Vietnam ITS market. The resulting report provides a comprehensive and validated analysis of the markets structure, challenges, and opportunities.

Frequently Asked Questions

01. How big is the Vietnam Intelligent Transportation Systems Market?

The Vietnam ITS Market is valued at USD 823 million, driven by government initiatives aimed at reducing traffic congestion and improving transportation efficiency.

02. What are the challenges in the Vietnam ITS Market?

Challenges in the Vietnam ITS market includes high initial setup costs, lack of skilled ITS professionals, and regulatory hurdles associated with data privacy and system interoperability.

03. Who are the major players in the Vietnam ITS Market?

Major players in Vietnam ITS Market include Siemens Vietnam, Hitachi Vietnam, FPT Corporation, Toshiba Infrastructure Systems, and IBM Vietnam. These companies are dominant due to their technological expertise and strategic partnerships.

04. What are the growth drivers of the Vietnam ITS Market?

Key growth drivers in Vietnam ITS Market include the increasing demand for smart city solutions, government investment in infrastructure, and the adoption of advanced technologies like IoT and AI in traffic management systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.