Vietnam Interactive Kiosk Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD3842

October 2024

100

About the Report

Vietnam Interactive Kiosk Market Overview

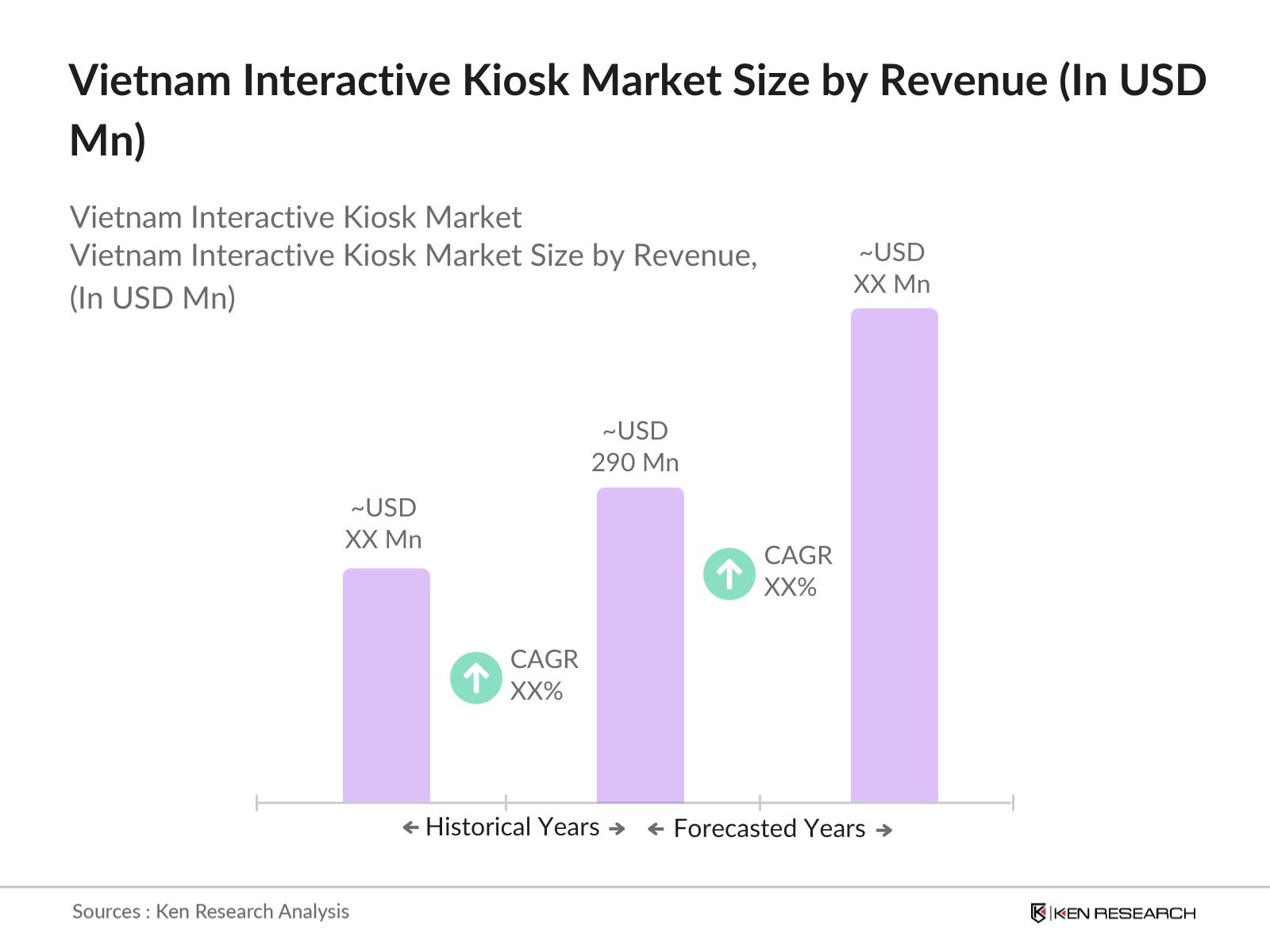

- The Vietnam interactive kiosk market size by revenue USD 290 million, based on a five-year historical analysis. This market is driven by the rapid digital transformation initiatives in Vietnam, especially in the retail, banking, and transportation sectors. The increasing adoption of self-service kiosks in these industries has enhanced customer engagement, reduced service time, and improved operational efficiency, leading to steady growth in demand for interactive kiosks. Government support for smart city projects further propels the demand for these kiosks, particularly in urban areas.

- Hanoi and Ho Chi Minh City dominate the Vietnam interactive kiosk market due to their advanced infrastructure, high urbanization rates, and stronger consumer purchasing power. These cities have higher adoption rates of interactive kiosks across retail and transport hubs. The local government’s investment in smart city development has also contributed to their dominance, creating a favorable environment for technological advancements in public services and retail sectors.

- Vietnam’s Digital Economy Strategy aims to develop a robust digital infrastructure, with interactive kiosks playing a significant role. By 2023, the Vietnamese government had invested $3 billion in digital infrastructure, including the deployment of kiosks in public spaces to offer services such as healthcare, banking, and public information. These investments are part of Vietnam’s broader goal to accelerate its digital economy, which is expected to account for 20% of the national GDP by 2025.

Vietnam Interactive Kiosk Market Segmentation

-

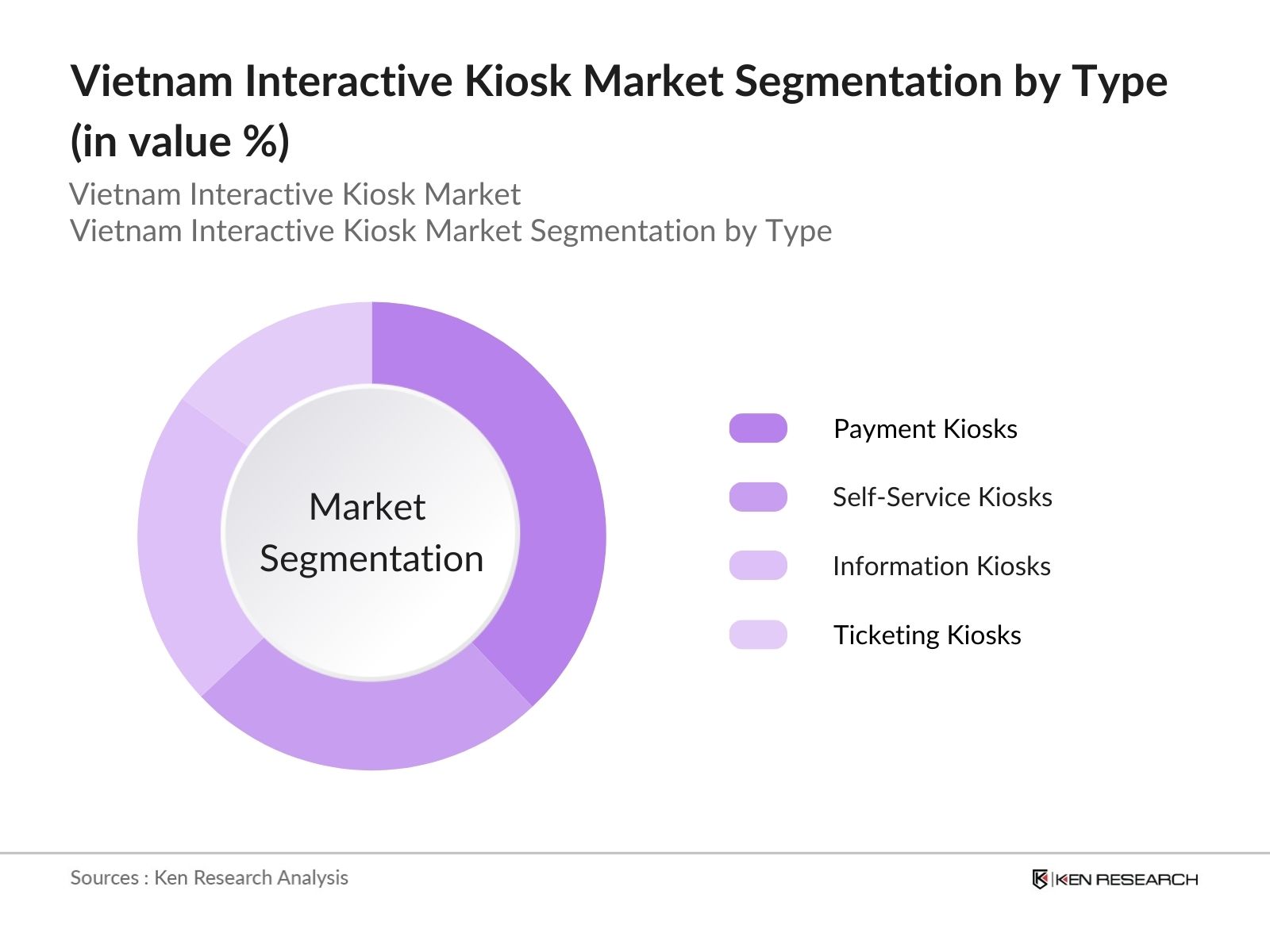

By Type: The Vietnam’s interactive kiosk market is segmented by type into information kiosks, ticketing kiosks, payment kiosks, and self-service kiosks. Among these, payment kiosks dominated the market, driven by the increasing preference for cashless transactions and digital payment methods in Vietnam. The growing penetration of e-commerce and the government’s push toward a cashless economy have led to the widespread use of payment kiosks, particularly in retail and banking sectors.

-

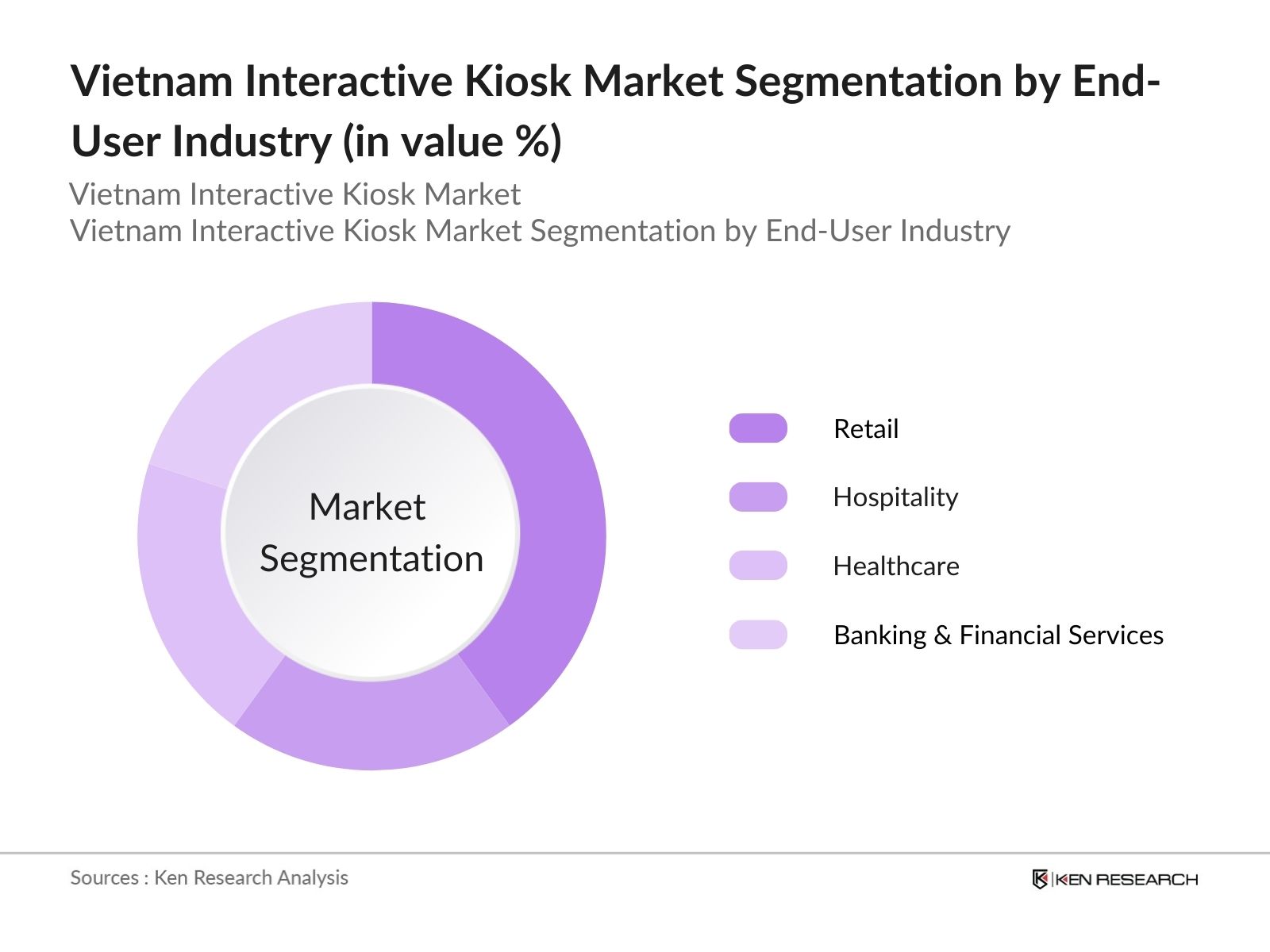

By End-User Industry: The Vietnam’s interactive kiosk market is also segmented by end-user industries, including retail, hospitality, healthcare, and banking & financial services. The retail sector dominates the market, due to the proliferation of self-service kiosks in malls and supermarkets. Interactive kiosks in the retail sector offer customers personalized shopping experiences, improving customer satisfaction and enhancing sales.

Vietnam Interactive Kiosk Market Competitive Landscape

The Vietnam interactive kiosk market is dominated by both local and international players, creating a competitive ecosystem. Major players have a strong foothold due to their technological expertise, wide distribution networks, and ability to offer customized solutions for different industries.

Table: Major Players in the Vietnam Interactive Kiosk Market

| Company | Establishment Year | Headquarters | No. of Kiosks Installed | Revenue (USD Bn) | Number of Employees | Technology Innovations | Key Industry Focus | Recent Developments | Local Presence |

|---|---|---|---|---|---|---|---|---|---|

| NCR Corporation | 1884 | USA | - | - | - | - | - | - | - |

| Diebold Nixdorf | 1859 | Germany | - | - | - | - | - | - | - |

| Glory Global Solutions | 1918 | Japan | - | - | - | - | - | - | - |

| Kiosk Information Systems | 1993 | USA | - | - | - | - | - | - | - |

| Samsung Electronics | 1969 | South Korea | - | - | - | - | - | - | - |

Vietnam Interactive Kiosk Industry Analysis

Vietnam Interactive Kiosk Market Growth Drivers

- Increased Retail and Hospitality Sectors: The retail and hospitality sectors in Vietnam have been rapidly expanding, supported by a growing urban population and a significant increase in foreign direct investments (FDI). In 2023, the Vietnamese retail sector saw a total revenue of $204 billion, while the hospitality sector experienced a strong boost due to tourism recovery. This surge in demand for modern services has increased the need for interactive kiosks, particularly in shopping malls, hotels, and airports. The interactive kiosk market benefits from these developments, allowing retailers and hoteliers to enhance customer engagement and operational efficiency.

- Government Focus on Digitalization (Vietnam National Digital Transformation Program): Vietnam's government has been pushing for digital transformation, targeting the digital economy to account for 20% of the GDP by 2025. Under the National Digital Transformation Program, several sectors, including public services, retail, and education, are undergoing rapid digitization. In 2023, government investments in digital infrastructure reached $800 million, a critical enabler for the adoption of interactive kiosks across public and private sectors. These kiosks play a vital role in enhancing service delivery, reducing wait times, and facilitating digital payments.

- Rise in Self-Service Adoption: The self-service trend has accelerated in Vietnam, especially in urban areas, driven by consumer demand for convenience and speed. By 2023, over 40% of retail transactions in Vietnam's largest cities were processed via self-service systems, including interactive kiosks. Airports, railway stations, and large retail chains like VinMart have increasingly adopted these solutions to streamline operations and reduce labor costs. This trend is further bolstered by the rise in e-commerce, where interactive kiosks facilitate click-and-collect services, making them a crucial part of the retail landscape.

Vietnam Interactive Kiosk Market Restraints

- Cybersecurity Risks for Digital Kiosks: With the increasing adoption of digital kiosks, the risk of cybersecurity threats has become a major concern. In 2023, Vietnam reported over 12,000 cybersecurity incidents, with financial and personal data breaches being significant threats to kiosk operations. Kiosks that process payments or store user information are particularly vulnerable, leading to stricter regulations and security protocols. The need for advanced cybersecurity measures is pushing up costs for kiosk operators, making it essential to integrate secure and compliant solutions.

- Maintenance and Technical Skill Gaps: Technical maintenance of interactive kiosks remains a significant challenge, especially in rural areas. Vietnam faces a shortage of skilled technicians capable of handling regular kiosk maintenance and troubleshooting. By 2023, only 30% of kiosk installations outside major cities were supported by adequate technical infrastructure. This skill gap leads to downtime and loss of revenue for businesses that rely on kiosks for daily operations. Addressing this challenge requires investment in vocational training and technical support networks across the country.

Vietnam Interactive Kiosk Market Future Outlook

Over the next five years, the Vietnam interactive kiosk market is expected to show significant growth, driven by ongoing digitalization efforts, the expansion of smart cities, and the increasing demand for self-service solutions across industries. With technological advancements in AI and cloud computing, kiosks will become more interactive and intuitive, catering to personalized customer experiences. Additionally, the government’s efforts to modernize public infrastructure will further fuel the growth of interactive kiosks, especially in urban areas.

Market Opportunities

- Expansion of Interactive Kiosks in Rural Areas: With Vietnam’s urbanization rate reaching 40% in 2024, there is growing potential to expand interactive kiosks into rural areas. Government programs like the National Rural Development Scheme aim to bring modern infrastructure to underdeveloped regions, providing a new market for kiosk vendors. Kiosks in rural areas could improve access to government services, banking, and e-commerce platforms. The Vietnamese government allocated $1.2 billion to rural digitization efforts in 2023, creating a conducive environment for kiosk deployment in these regions.

- Integration with AI and IoT Technologies: The adoption of Artificial Intelligence (AI) and Internet of Things (IoT) in Vietnam is transforming the interactive kiosk market. In 2023, Vietnam’s AI market was valued at over $600 million, with major applications in retail, healthcare, and transportation sectors. Integrating AI into kiosks allows for personalized services, data analytics, and predictive maintenance, while IoT enables real-time connectivity and monitoring. The combination of these technologies improves the functionality of kiosks, making them a key part of Vietnam’s digital infrastructure.

Scope of the Report

|

By Type |

Information Kiosks |

|

Ticketing Kiosks |

|

|

Payment Kiosks |

|

|

Self-Service Kiosks |

|

|

By End-User Industry |

Retail |

|

Hospitality |

|

|

Healthcare |

|

|

Banking & Financial Services |

|

|

By Technology |

Interactive Touch Screens |

|

Biometric and Touchless Sensors |

|

|

NFC and RFID-enabled Kiosks |

|

|

By Component |

Hardware (Displays, Processors, Peripherals) |

|

Software (Operating Systems, Custom Applications) |

|

|

Services (Installation, Maintenance, Consulting) |

|

|

By Region |

Hanoi |

|

Ho Chi Minh City |

|

|

Da Nang |

|

|

Other Regions |

Products

Key Target Audience

- Retail Companies

- Financial Institutions

- Hospitality Service Providers

- Healthcare Providers

- Public Transport Authorities

- Government and Regulatory Bodies (Ministry of Information and Communications, Vietnam Digital Transformation Department)

- Investments and Venture Capitalist Firms

- E-commerce Platforms

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

- NCR Corporation

- Diebold Nixdorf

- Glory Global Solutions

- Kiosk Information Systems

- Samsung Electronics

- Fujitsu

- Zivelo

- Advantech Co. Ltd.

- Olea Kiosks

- Meridian Kiosks

- REDYREF Interactive Kiosks

- IER Group

- Evoke Creative

- Shenzhen Lean Kiosk Systems

- GRGBanking

Table of Contents

1. Vietnam Interactive Kiosk Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (based on interactive kiosk installations and expansions)

1.4. Market Segmentation Overview

2. Vietnam Interactive Kiosk Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Market penetration, government programs, kiosk-specific infrastructure investments)

3. Vietnam Interactive Kiosk Market Analysis

3.1. Growth Drivers

3.1.1. Increased Retail and Hospitality Sectors

3.1.2. Government Focus on Digitalization (Vietnam National Digital Transformation Program)

3.1.3. Rise in Self-Service Adoption

3.1.4. Demand from Smart Cities Initiatives (Vietnam Smart City Development Plan)

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Cybersecurity Risks for Digital Kiosks

3.2.3. Maintenance and Technical Skill Gaps

3.3. Opportunities

3.3.1. Expansion of Interactive Kiosks in Rural Areas

3.3.2. Integration with AI and IoT Technologies

3.3.3. Payment Kiosks for Financial Inclusion

3.4. Trends

3.4.1. Emergence of Touchless Interactive Kiosks

3.4.2. Customizable and Modular Kiosk Solutions

3.4.3. Integration with QR Code and Mobile Payments

3.5. Government Regulation

3.5.1. Government Digital Economy Strategy

3.5.2. Regulations on Data Privacy for Kiosks (Vietnam Cybersecurity Law)

3.5.3. Infrastructure Support for Digitalization

3.6. SWOT Analysis (Vietnam Interactive Kiosk Industry)

3.7. Stakeholder Ecosystem (Kiosk Manufacturers, Service Providers, Government Bodies)

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Vietnam Interactive Kiosk Market Segmentation

4.1. By Type (In Value %)

4.1.1. Information Kiosks

4.1.2. Ticketing Kiosks

4.1.3. Payment Kiosks

4.1.4. Self-Service Kiosks

4.2. By End-User Industry (In Value %)

4.2.1. Retail

4.2.2. Hospitality

4.2.3. Healthcare

4.2.4. Banking & Financial Services

4.3. By Technology (In Value %)

4.3.1. Interactive Touch Screens

4.3.2. Biometric and Touchless Sensors

4.3.3. NFC and RFID-enabled Kiosks

4.4. By Component (In Value %)

4.4.1. Hardware (Displays, Processors, Peripherals)

4.4.2. Software (Operating Systems, Custom Applications)

4.4.3. Services (Installation, Maintenance, Consulting)

4.5. By Region (In Value %)

4.5.1. Hanoi

4.5.2. Ho Chi Minh City

4.5.3. Da Nang

4.5.4. Other Regions

5. Vietnam Interactive Kiosk Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. NCR Corporation

5.1.2. Diebold Nixdorf

5.1.3. Glory Global Solutions

5.1.4. Kiosk Information Systems

5.1.5. GRGBanking

5.1.6. Fujitsu

5.1.7. Samsung Electronics

5.1.8. Zivelo

5.1.9. Advantech Co. Ltd.

5.1.10. Olea Kiosks

5.1.11. Meridian Kiosks

5.1.12. REDYREF Interactive Kiosks

5.1.13. IER Group

5.1.14. Evoke Creative

5.1.15. Shenzhen Lean Kiosk Systems

5.2. Cross Comparison Parameters (No. of Employees, Installed Units, Market Share %, Innovations Introduced, Revenue)

5.3. Market Share Analysis (Segment-specific, Technology-specific)

5.4. Strategic Initiatives (M&A, Partnerships, Product Launches)

5.5. Investment Analysis

5.6. Venture Capital Funding (Kiosk Innovations, Startups)

5.7. Private Equity Investments

6. Vietnam Interactive Kiosk Market Regulatory Framework

6.1. Digital Kiosk Licensing Requirements

6.2. Data Security and Compliance (Vietnam Personal Data Protection Law)

6.3. National Regulations on Public Digital Infrastructure

7. Vietnam Interactive Kiosk Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Interactive Kiosk Future Market Segmentation

8.1. By Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

9. Vietnam Interactive Kiosk Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Targeted Promotions, Branding)

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the Vietnam interactive kiosk market. Extensive desk research is conducted, leveraging both secondary sources and proprietary databases to capture relevant industry insights. The primary focus is identifying key variables influencing market trends, such as technological advancements and government policies.

Step 2: Market Analysis and Construction

This phase involves compiling historical data, focusing on the adoption rates of interactive kiosks across industries. Factors such as market penetration, kiosk functionality, and user experience are analyzed. Service quality metrics are also evaluated to estimate the overall market value with accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on the data collected and are validated through expert interviews via CATI (computer-assisted telephone interviews). These experts are industry practitioners from key segments like retail and banking, providing insights on market developments and trends.

Step 4: Research Synthesis and Final Output

This final phase synthesizes data from the bottom-up approach and direct interviews with key market players. The output is validated to ensure a comprehensive understanding of the Vietnam interactive kiosk market, covering critical aspects such as market segmentation, growth drivers, and competitive landscape.

Frequently Asked Questions

1. How big is the Vietnam Interactive Kiosk Market?

The Vietnam interactive kiosk market size by revenue USD 290 million, driven by increasing digital transformation initiatives, especially in the retail, banking, and transportation sectors.

2. What are the challenges in the Vietnam Interactive Kiosk Market?

Challenges in the Vietnam interactive kiosk market include the high initial investment costs associated with kiosk infrastructure, cybersecurity concerns, and a lack of technical expertise for kiosk maintenance.

3. Who are the major players in the Vietnam Interactive Kiosk Market?

Key players in the Vietnam interactive kiosk market include NCR Corporation, Diebold Nixdorf, Glory Global Solutions, Samsung Electronics, and Kiosk Information Systems, which dominate due to their technological capabilities and strong market presence.

4. What are the growth drivers of the Vietnam Interactive Kiosk Market?

The Vietnam interactive kiosk market is driven by digitalization efforts, the growing demand for self-service solutions, and government initiatives supporting smart city projects and digital payments.

|

By Type |

Market Share (2023) |

|

Information Kiosks |

22% |

|

Ticketing Kiosks |

15% |

|

Payment Kiosks |

38% |

|

Self-Service Kiosks |

25% |

|

By End-User Industry |

Market Share (2023) |

|

Retail |

40% |

|

Hospitality |

20% |

|

Healthcare |

20% |

|

Banking & Financial Services |

20% |

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.