Vietnam IT Security Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD4521

December 2024

93

About the Report

Vietnam IT Security Market Overview

- The Vietnam IT security market is valued at USD 200 million, based on a five-year historical analysis. The market is driven by increasing digital transformation, rapid adoption of cloud services, and the rising threat of cyberattacks, which has prompted both private and public sectors to invest heavily in security infrastructure. Additionally, government mandates and data protection laws are encouraging enterprises to adopt IT security solutions, making Vietnam a key regional player in Southeast Asia's cybersecurity landscape.

- Ho Chi Minh City and Hanoi dominate the Vietnam IT security market. The dominance of these cities can be attributed to their role as economic hubs, housing the majority of large corporations, financial institutions, and government agencies that require advanced security infrastructure. Moreover, these cities are the primary focus of government initiatives to bolster digital security, attracting IT investments and skilled talent. This concentration of economic activity and digital transformation initiatives makes them the primary drivers of IT security growth in Vietnam.

- The Vietnamese government has enacted stringent regulations to bolster the nations IT security infrastructure. In 2024, the Ministry of Information and Communications (MIC) mandated cybersecurity standards for all governmental agencies and critical infrastructure sectors. The Cybersecurity Law of Vietnam requires organizations to store user data locally and adhere to strict data security protocols. Non-compliance can result in heavy penalties. This regulatory push is driving higher demand for cybersecurity services as organizations rush to meet compliance requirements. The enforcement of such regulations also ensures that businesses prioritize data protection and cybersecurity upgrades.

Vietnam IT Security Market Segmentation

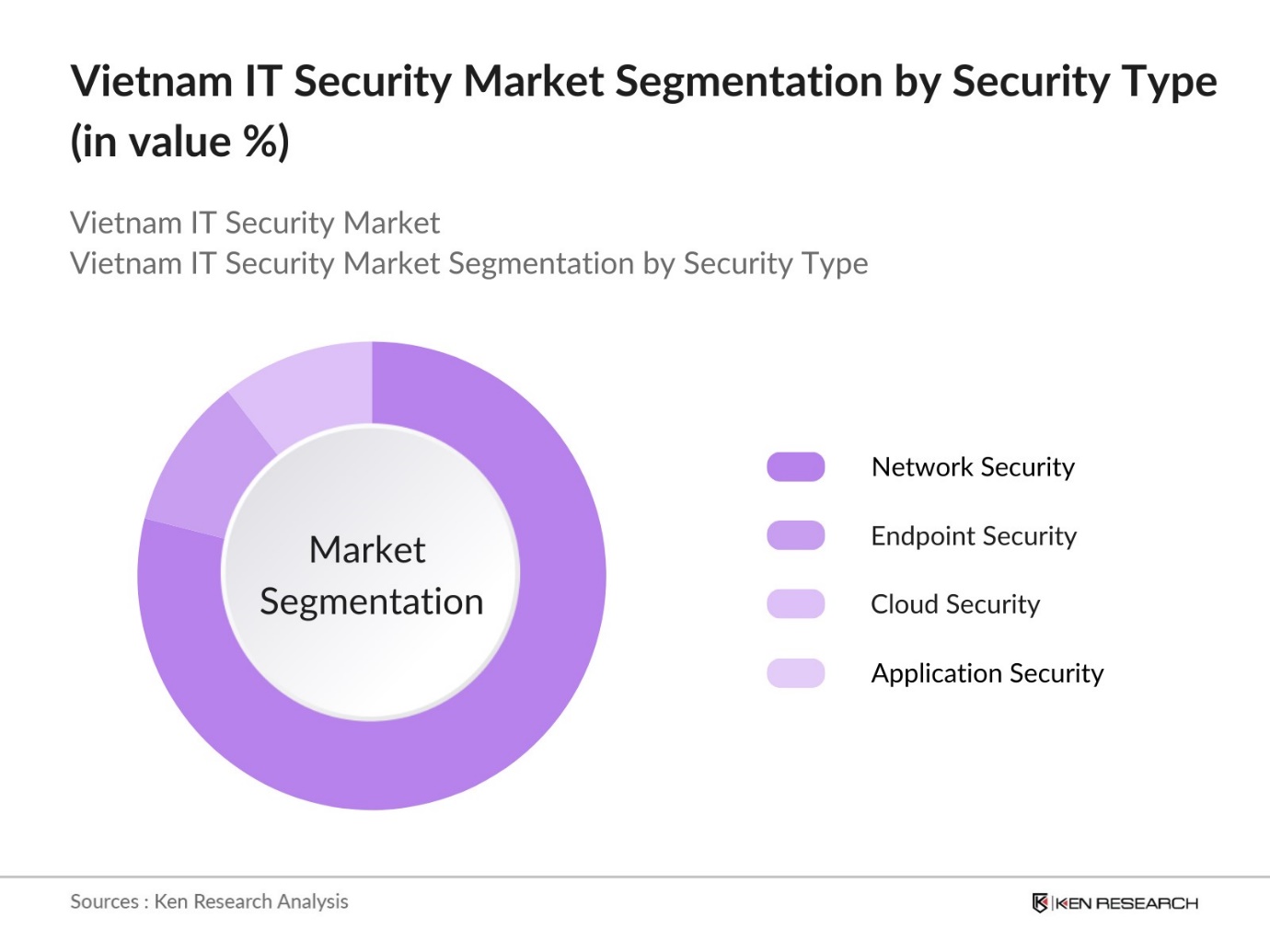

- By Security Type: Vietnam's IT security market is segmented by security type into network security, endpoint security, cloud security, application security, and data security. Network Security holds a dominant market share under the segmentation due to the increasing use of networking devices and internet traffic, which makes networks more vulnerable to cyberattacks. The surge in advanced persistent threats (APTs), phishing attacks, and malware has forced organizations to prioritize network security solutions to safeguard their data. Enterprises in industries such as banking and finance are particularly inclined toward investing in network security infrastructure, driving this segments growth.

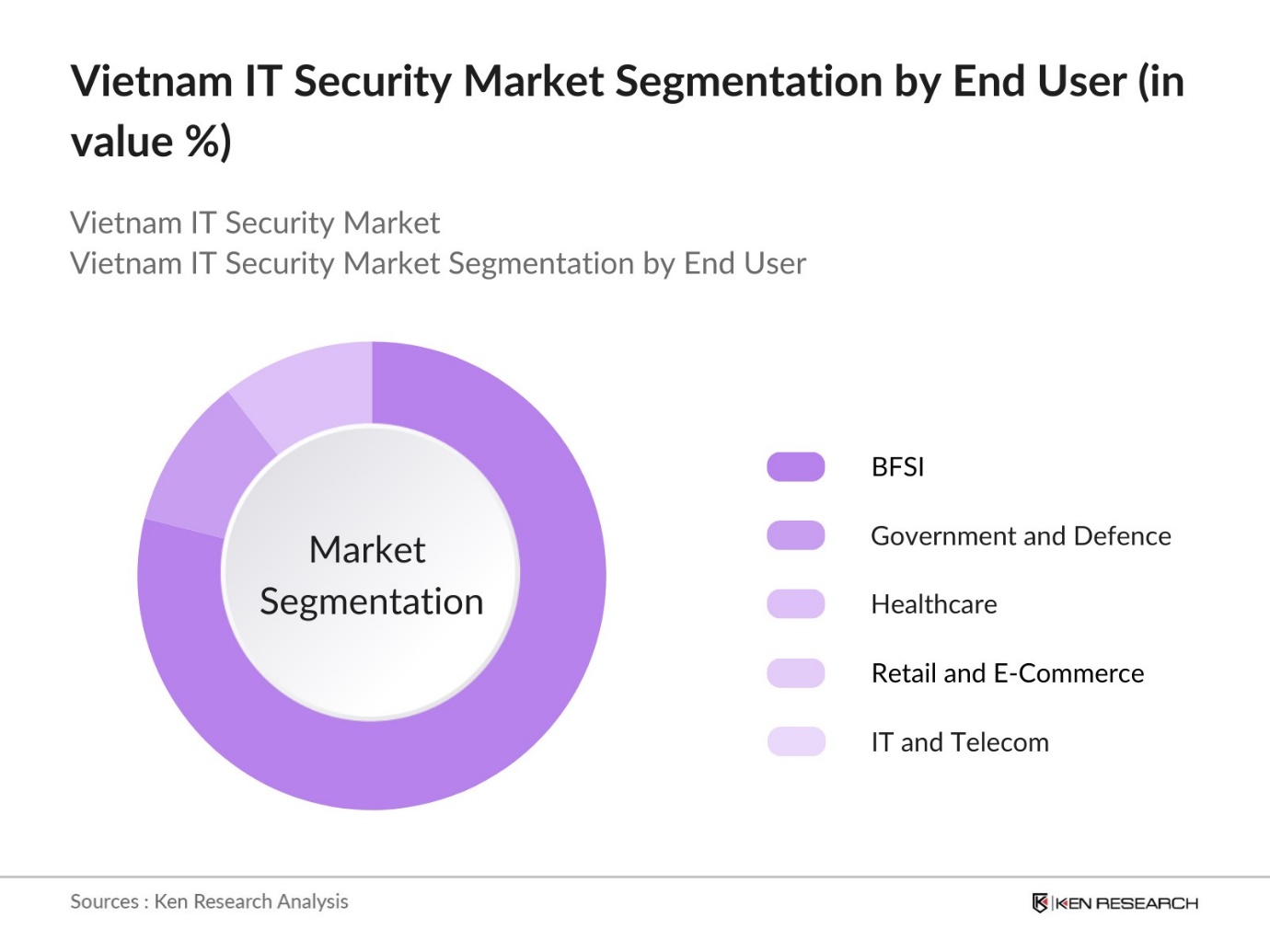

- By End User: The market is also segmented by end user into BFSI, government & defense, healthcare, retail & e-commerce, and IT & telecom. BFSI (Banking, Financial Services, and Insurance) dominates the end-user segmentation, holding the largest market share. This dominance is due to the highly sensitive nature of financial data and the growing number of cyberattacks targeting financial institutions. The BFSI sector requires stringent regulatory compliance and robust IT security frameworks, which includes multi-layered security solutions, encryption, and identity management systems. These factors drive higher investments in cybersecurity by banks and financial institutions.

Vietnam IT Security Market Competitive Landscape

The Vietnam IT security market is dominated by both domestic and international players. Local companies such as Bkav and CMC Corporation lead the market alongside global companies like Cisco and Palo Alto Networks. This mix of local expertise and global technology providers ensures a highly competitive environment, with companies focusing on innovation, partnerships, and cybersecurity education.

|

Company Name |

Established |

Headquarters |

Product Offerings |

Revenue (USD) |

R&D Investment |

Global Presence |

No. of Employees |

Partnerships |

Certifications |

|

Bkav Corporation |

1995 |

Hanoi, Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

CMC Corporation |

1993 |

Hanoi, Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

Cisco Systems |

1984 |

San Jose, USA |

- |

- |

- |

- |

- |

- |

- |

|

Palo Alto Networks |

2005 |

Santa Clara, USA |

- |

- |

- |

- |

- |

- |

- |

|

Trend Micro |

1988 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

- |

Vietnam IT Security Industry Analysis

Growth Drivers

- Rising Cybersecurity Threats: The escalating frequency and sophistication of cyberattacks in Vietnam have spurred the need for enhanced IT security solutions. According to the National Cyber Security Center (NCSC) of Vietnam, the country reported over 13,000 cyberattacks in the first half of 2024, a sharp increase from the previous year. This trend is alarming given Vietnam's rapidly expanding digital economy, which is forecasted to contribute a significant share of the nation's GDP. Cybercriminals target sectors like banking, e-commerce, and telecom due to the increased digitalization. In response, businesses are investing more heavily in security solutions, making cybersecurity a critical business requirement.

- Digital Transformation Initiatives: Vietnams digital transformation is progressing rapidly, driven by both public and private sector initiatives. In 2024, the Vietnamese government introduced the "National Digital Transformation Program," aiming to digitize key sectors such as finance, healthcare, and education by 2025. This large-scale digitization has increased the attack surface for cyber threats, pushing businesses to adopt more robust cybersecurity measures. As enterprises migrate to cloud infrastructures and adopt AI and IoT, theres a growing reliance on cybersecurity solutions that can protect these technologies. Enhanced security measures are essential to protect sensitive data and ensure the continuity of digital services.

- Growing Investments in Cloud Security: As cloud adoption rises in Vietnam, so does the investment in cloud security. Data from the Ministry of Information and Communications show that cloud-related investments in Vietnam exceeded USD 1 billion in 2024, largely driven by the need to secure cloud environments. Cloud storage and services are becoming more common as businesses shift operations online, but this transition has also exposed them to cloud-specific cyber threats. Cloud security solutions are increasingly in demand to address risks such as data breaches and account hijacking, especially in sectors handling sensitive information like healthcare and financial services.

Market Challenges

- Lack of Skilled Cybersecurity Professionals: Vietnam is facing a significant shortage of cybersecurity professionals, with the Ministry of Information and Communications estimating a shortfall of over 500,000 skilled workers in the field in 2024. This workforce gap creates a substantial challenge for both private and public sector organizations seeking to implement advanced cybersecurity protocols. Despite the increasing demand for IT security, the supply of qualified professionals remains limited. The gap is particularly pronounced in areas requiring specialized knowledge, such as ethical hacking and cybersecurity analytics, hindering the countrys ability to mitigate and respond to sophisticated cyberattacks effectively.

- High Cost of Advanced Security Solutions: One of the key challenges in Vietnam's IT security market is the high cost of advanced security solutions. For small and medium-sized enterprises (SMEs), which make up over 96% of Vietnam's businesses, the financial burden of implementing comprehensive cybersecurity systems is considerable. These businesses often struggle to afford high-end solutions like threat intelligence platforms, endpoint detection, and zero-trust frameworks. According to Vietnams Chamber of Commerce and Industry, many companies allocate less than 1% of their IT budgets to security, limiting their ability to deploy cutting-edge solutions.

Vietnam IT Security Market Future Outlook

Over the next five years, the Vietnam IT security market is expected to show significant growth driven by continuous advancements in cloud computing, the rapid increase in the number of mobile devices, and government initiatives to tighten cybersecurity laws. Enterprises are increasingly adopting artificial intelligence (AI)-based security solutions to combat sophisticated cyberattacks. Moreover, the expanding internet user base and the government's push for digital transformation across all sectors will further propel the growth of this market.

Market Opportunities

- Growth of Managed Security Services: The managed security services sector is expanding rapidly in Vietnam, driven by the increasing complexity of cyber threats and the shortage of in-house cybersecurity expertise. In 2024, the Ministry of Information and Communications reported that the adoption of managed services increased by 20% as businesses outsourced their IT security needs. This growth is particularly strong among SMEs, which find it more cost-effective to engage third-party service providers rather than build in-house security teams. Managed security service providers (MSSPs) offer continuous monitoring, incident response, and vulnerability management, presenting a scalable and affordable solution to organizations of all sizes.

- Expanding Cyber Insurance Market: The demand for cyber insurance is rising in Vietnam as businesses seek to mitigate financial risks associated with cyberattacks. In 2024, the Vietnam Insurance Association reported a 30% increase in cyber insurance policies issued, driven by growing concerns over data breaches and ransomware attacks. Cyber insurance provides financial protection against incidents such as data breaches, legal costs, and system downtime. With the rising costs associated with data breaches, more companies are purchasing cyber insurance to protect themselves from financial ruin. The growth of the cyber insurance market represents a new opportunity for both insurers and businesses to address cybersecurity risks.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Security Type |

Network Security Endpoint Security Cloud Security Application Security Data Security |

|

By Solution Type |

Antivirus & Anti-malware Firewalls IDS SIEM IAM |

|

By Deployment Type |

On-Premise Cloud-Based |

|

By End User |

BFSI Government & Defense Healthcare Retail & E-commerce IT & Telecom |

|

By Region |

Ho Chi Minh City Hanoi Da Nang Mekong Delta Central Highlands |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Information and Communications of Vietnam, Vietnam Cybersecurity Emergency Response Team)

BFSI Institutions

IT & Telecom Companies

Healthcare Organizations

Retail & E-commerce Enterprises

Cloud Service Providers

Managed Security Service Providers (MSSPs)

Investor and Venture Capitalist Firms

Companies

Players mentioned in the report

Bkav Corporation

CMC Corporation

Viettel Group

VNPT Group

FPT Corporation

Cisco Systems

Palo Alto Networks

Kaspersky

IBM Security

Symantec

Trend Micro

McAfee

FireEye

Check Point Software Technologies

Fortinet

Table of Contents

1. Vietnam IT Security Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam IT Security Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam IT Security Market Analysis

3.1. Growth Drivers

3.1.1. Rising Cybersecurity Threats (cyber threats landscape)

3.1.2. Government IT Security Mandates (regulatory standards)

3.1.3. Digital Transformation Initiatives (technology adoption)

3.1.4. Growing Investments in Cloud Security (investment flow)

3.2. Market Challenges

3.2.1. Lack of Skilled Cybersecurity Professionals (workforce gap)

3.2.2. High Cost of Advanced Security Solutions (cost burden)

3.2.3. Complex IT Infrastructure (system complexity)

3.3. Opportunities

3.3.1. Growth of Managed Security Services (managed services)

3.3.2. Expanding Cyber Insurance Market (risk management)

3.3.3. Rising Adoption of Zero-Trust Security Models (security framework)

3.4. Trends

3.4.1. Artificial Intelligence in Cybersecurity (AI adoption)

3.4.2. Cloud-Based Security Solutions (cloud security)

3.4.3. Increased Focus on Endpoint Security (endpoint solutions)

3.5. Government Regulation

3.5.1. Data Protection Law (legal compliance)

3.5.2. Cybersecurity Law (cyber defense framework)

3.5.3. GDPR-Like Data Privacy Regulations (data protection)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (key market players and roles)

3.8. Porters Five Forces (competitive landscape)

3.9. Competition Ecosystem (competitive dynamics)

4. Vietnam IT Security Market Segmentation

4.1. By Security Type (In Value %)

4.1.1. Network Security

4.1.2. Endpoint Security

4.1.3. Cloud Security

4.1.4. Application Security

4.1.5. Data Security

4.2. By Solution Type (In Value %)

4.2.1. Antivirus & Anti-malware

4.2.2. Firewalls

4.2.3. Intrusion Detection Systems (IDS)

4.2.4. Security Information and Event Management (SIEM)

4.2.5. Identity and Access Management (IAM)

4.3. By Deployment Type (In Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.4. By End User (In Value %)

4.4.1. BFSI

4.4.2. Government & Defense

4.4.3. Healthcare

4.4.4. Retail & E-commerce

4.4.5. IT & Telecom

4.5. By Region (In Value %)

4.5.1. Ho Chi Minh City

4.5.2. Hanoi

4.5.3. Da Nang

4.5.4. Mekong Delta

4.5.5. Central Highlands

5. Vietnam IT Security Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Bkav Corporation

5.1.2. CMC Corporation

5.1.3. Viettel Group

5.1.4. VNPT Group

5.1.5. FPT Corporation

5.1.6. Kaspersky

5.1.7. Palo Alto Networks

5.1.8. Cisco Systems

5.1.9. Trend Micro

5.1.10. McAfee

5.1.11. Check Point Software Technologies

5.1.12. IBM Security

5.1.13. Symantec

5.1.14. FireEye

5.1.15. Fortinet

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Global Presence, Partnerships, Number of Employees, Client Base, Certifications, Service Offerings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Private Equity Funding

5.8. Cybersecurity R&D Investments

6. Vietnam IT Security Market Regulatory Framework

6.1. Compliance Requirements (data protection standards)

6.2. Certification Processes (ISO/IEC 27001)

6.3. Cybersecurity Certification Programs

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping all stakeholders in the Vietnam IT security market, including enterprises, service providers, and regulatory bodies. A combination of secondary research and proprietary databases will be used to identify critical market variables.

Step 2: Market Analysis and Construction

Historical data for market penetration, IT security spending, and revenue generation is collected and analyzed to form a comprehensive understanding of the market dynamics. Service quality is also examined through industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with IT security experts and decision-makers within key companies are conducted to validate the research findings. These consultations will also provide insights into market strategies and operational challenges.

Step 4: Research Synthesis and Final Output

A detailed engagement with market leaders, such as IT security vendors and integrators, ensures that final data outputs are corroborated through a bottom-up approach, ensuring an accurate and comprehensive market report.

Frequently Asked Questions

01. How big is the Vietnam IT Security Market?

The Vietnam IT security market is valued at approximately USD 300 million, driven by the increasing number of cyber threats and the expansion of cloud services.

02. What are the challenges in the Vietnam IT Security Market?

Challenges include the lack of skilled cybersecurity professionals, high costs associated with advanced security solutions, and the complex IT infrastructure in organizations.

03. Who are the major players in the Vietnam IT Security Market?

Key players include Bkav Corporation, CMC Corporation, Cisco Systems, Palo Alto Networks, and Trend Micro. These companies dominate due to their extensive service portfolios and strong partnerships.

04. What are the growth drivers of the Vietnam IT Security Market?

The market is driven by government mandates, increased digitization across sectors, the growing adoption of cloud computing, and rising cybersecurity threats.

05. How are government regulations affecting the Vietnam IT Security Market?

Government regulations, such as data protection laws and cybersecurity requirements, have pushed organizations to adopt advanced IT security measures, contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.