Vietnam LED Lighting Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD2406

October 2024

87

About the Report

Vietnam LED Lighting Market Overview

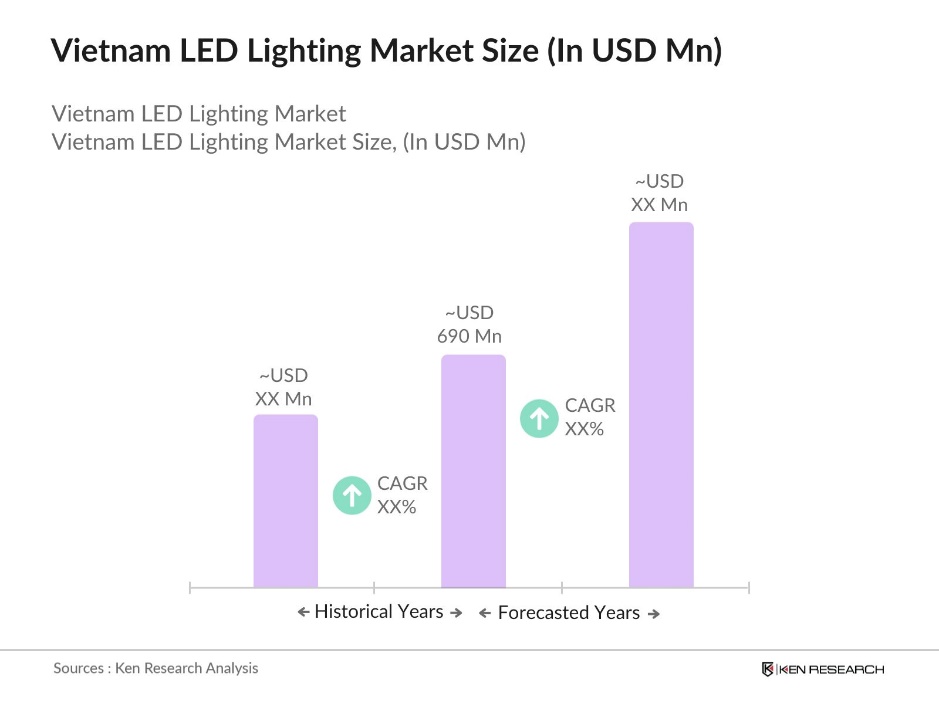

- In 2023, the Vietnam LED lighting market was valued at USD 690 million, showing consistent growth over the past few years, driven by rising demand for energy-efficient lighting solutions and favorable government policies that promote LED adoption.

- Several global and local players dominate Vietnams LED lighting market. Some of the key companies include Signify (Philips Lighting), Osram Licht AG, Rang Dong Light Source and Vacuum Flask JSC (Ralaco), and Dien Quang Light Source Company. These firms hold significant market shares due to their strong product portfolios and focus on technological advancements.

- In 2023, the Vietnamese government announced a project focused on installing 3.5 million LED streetlights across major cities to enhance public lighting efficiency and reduce energy consumption. This initiative is expected to significantly reduce the national electricity consumption by around 4 terawatt-hours annually, thereby boosting the LED lighting market.

- In 2023, Vietnams government launched the Energy Efficiency Program, which incentivizes the adoption of LED lighting in residential, commercial, and industrial sectors. This program offers financial incentives for retrofitting old lighting systems with LEDs, thereby encouraging the widespread use of energy-efficient solutions.

- Ho Chi Minh City and Hanoi are the leading cities in Vietnams LED lighting market. These cities dominate due to their large populations, extensive urban development projects, and strong focus on smart city initiatives. The increasing number of high-rise buildings and public infrastructure projects in these metropolitan areas has driven the demand for LED installations.

Vietnam LED Lighting Market Segmentation

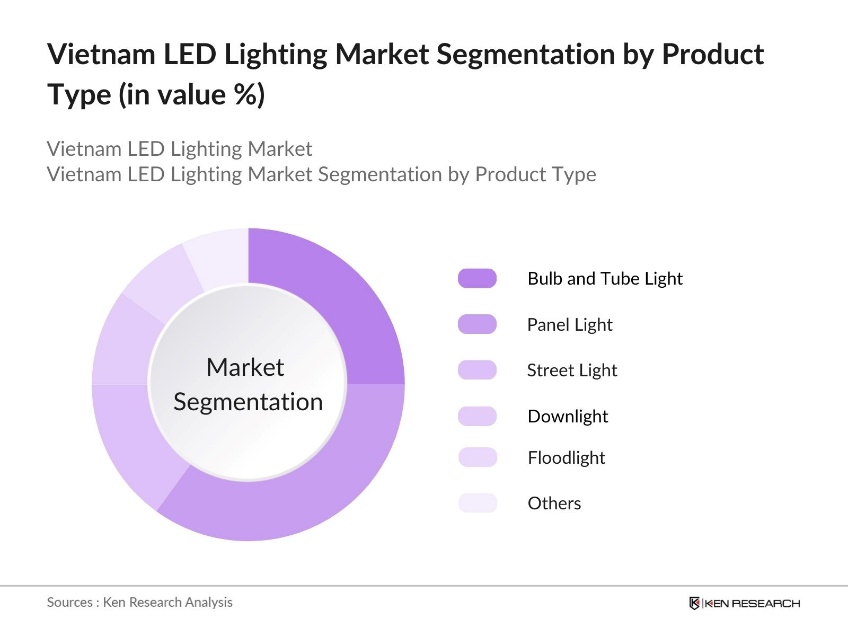

By Product Type: The Vietnam LED lighting market is segmented by product type into bulb and tube lights, panel lights, street lights, downlights, floodlights, and others. In 2023, panel lights held the dominant market share, as they are preferred for their energy efficiency and versatility in various settings, including homes, offices, and public spaces. The declining cost of LED technology and government support for energy-saving initiatives have further increased their adoption.

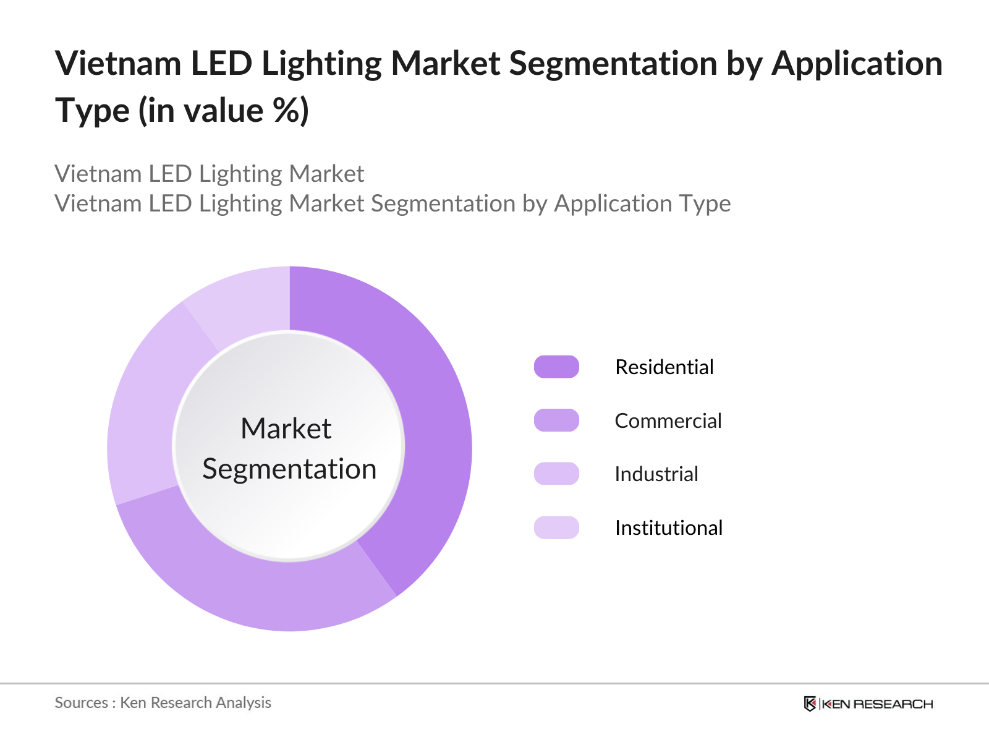

By Application: The market is categorized into residential, commercial, industrial, and institutional applications. Residential applications led the market in 2023, driven by increasing consumer demand for energy-efficient lighting. As households increasingly replace traditional incandescent bulbs with LED solutions, the residential sector remains the largest contributor to market growth.

By Region: Vietnam's LED lighting market is also segmented by region into north, south, east, and west. The southern region, particularly Ho Chi Minh City, accounted for the largest market share in 2023 due to its economic significance and ongoing infrastructure projects. The citys focus on upgrading public lighting and urban infrastructure makes it a key market for LED solutions.

Vietnam LED Lighting Market Competitive Landscape

|

Company Name |

Year of Establishment |

Headquarters |

|---|---|---|

|

Signify (Philips Lighting) |

1891 |

Eindhoven, Netherlands |

|

Osram Licht AG |

1919 |

Munich, Germany |

|

Rang Dong Light Source and Vacuum JSC |

1961 |

Hanoi, Vietnam |

|

Dien Quang Light Source Company |

1973 |

Ho Chi Minh City, Vietnam |

|

Cree Inc. |

1987 |

Durham, USA |

- Signify: Formerly known as Philips Lighting Group, has seen significant changes in Vietnam. After experiencing a 20% decline in net revenue in 2021, the company rebounded in 2022 with an increase of approximately 10%, equivalent to nearly 600 billion Vietnamese dong. LED lights account for 70% of the company's total sales, with a 7W LED bulb priced at 65,300 Vietnamese dong. Their after-tax profit, which was nearly 20 billion dong in 2020, grew by about 50% over the following two years.

- Rang Dong Light Source and Vacuum Flask JSC Rang Dong has increased its production capacity to 100 million LED products annually, alongside 5 million desk lamps and various lighting equipment. This expansion is part of the company's strategy to meet rising domestic and international demand for energy-efficient lighting solutions

Vietnam LED Lighting Market Analysis

Growth Drivers

- Government-Backed Energy Efficiency Programs: Vietnams Energy Efficiency Program (VNEEP), initiated by the government in 2023, aims to reduce national energy consumption by 10% by 2030. This has spurred the adoption of LED lighting, which is significantly more energy-efficient compared to conventional lighting systems. The program mandates that government buildings, public spaces, and large-scale industrial units convert to LED systems, driving up sales and installations in the sector. According to Ministry of Industry and Trade (MOIT), this shift is expected to save 10 TWh of electricity annually, directly impacting the markets growth.

- Electricity Price Hikes Encouraging LED Adoption: In 2024, Vietnam witnessed a 7.5% increase in electricity prices, a direct result of rising energy demand and strain on the countrys energy infrastructure. This price hike has led businesses and households to switch to energy-saving LED solutions, which consume 50-70% less power than traditional lighting. The Vietnam Electricity Corporation (EVN) has confirmed that the shift to LED lighting could help consumers save up to USD 1.5 billion annually by reducing electricity bills.

- Favorable Trade Policies: Vietnams favorable trade policies, including the EU-Vietnam Free Trade Agreement (EVFTA) enacted in 2020, have reduced import duties on LED components and materials. This has led to a reduction in manufacturing costs, fostering local production of LED lights and making the products more competitive. In 2024, the Vietnamese Ministry of Finance reported a major reduction in import tariffs on lighting equipment, allowing local companies to access cheaper materials and boosting the production of domestic LED lighting systems.

Challenges

- High Initial Installation Costs: Despite their long-term benefits, the upfront costs associated with LED lighting systems remain a barrier, especially for small and medium enterprises (SMEs). SMEs cited high installation and retrofitting costs as a major obstacle to adopting LED lighting technologies, despite government incentives.

- Lack of Skilled Labor for Installation: The Vietnam Energy Efficiency and Conservation Office (VNEECO) noted in 2024 that a shortage of skilled labor for the installation and maintenance of advanced LED systems is slowing down market penetration. This labor gap has resulted in delays in government-initiated public lighting projects and private sector installations, affecting the overall market performance.

Government Initiative

- National Green Growth Strategy: In 2023, the Vietnamese government implemented the Green Growth Strategy 2021-2030, aiming to reduce greenhouse gas emissions and promote energy efficiency. This initiative mandates the use of LED lighting in all new government buildings and publicly funded infrastructure projects. The strategy is expected to reduce the countrys carbon emissions by 15% by 2030, largely driven by the shift to LED lighting.

- Public Lighting Upgradation Initiative: As part of its Smart City Initiative, Vietnams government has allocated USD 250 million for upgrading public lighting systems in major urban centers like Ho Chi Minh City and Hanoi by the end of 2025. This includes the replacement of traditional lighting with LED streetlights, which are expected to reduce energy consumption by 50% in public spaces.

Vietnam LED Lighting Market Future Outlook

The Vietnam LED Lighting Market is projected to grow exponentially by 2028. This growth will be driven by the government-backed Energy efficiency programs, electricity price hikes encouraging LED adoption and favorable trade policies.

Future Trends

- Expansion of Smart Lighting Solutions: By 2028, smart LED lighting systems will dominate the market, driven by the increasing adoption of smart home technologies. Government initiatives, such as the Smart City Program, will ensure that public lighting incorporates smart control systems, enabling remote monitoring and reducing energy consumption.

- Increased Use of Solar-Powered LED Solutions: The future of Vietnams LED lighting market will also see a significant shift toward solar-powered LED lighting, especially in rural areas. By 2028, rural lighting installations are expected to be solar-powered, driven by government efforts to reduce dependency on the national grid and promote sustainable development.

Scope of the Report

|

By Product Type |

Bulb And Tube Lights Panel Lights Street Lights Downlights Floodlights Others |

|

By Application |

Residential Commercial Industrial Institutional |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

LED Manufacturers

Energy Service Companies (ESCOs)

Building Contractors and Construction Firms

Real Estate Developers

Public Infrastructure Developers

Lighting and Electrical Distributors

Energy Efficiency Consultants

Municipal Corporations

Venture Capital Firms

Government and Regulatory Bodies (Ministry of Industry and Trade)

Companies

Players mentioned in the report:

Signify (Philips Lighting)

Osram Licht AG

Rang Dong Light Source and Vacuum Flask JSC

Dien Quang Light Source Company

Cree Inc.

Seoul Semiconductor Co. Ltd

Nichia Corporation

FSL Vietnam

Toshiba Lighting

Asled Co. Ltd

Table of Contents

1. Vietnam LED Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Key Market Developments and Milestones

2. Vietnam LED Lighting Market Size (in USD)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Revenue Breakdown by Key Segments

3. Vietnam LED Lighting Market Dynamics

3.1. Growth Drivers

3.1.1. Government Regulations Promoting Energy Efficiency

3.1.2. Increased Electricity Prices and Cost-Savings Focus

3.1.3. Expansion of Infrastructure and Smart City Projects

3.2. Challenges

3.2.1. High Initial Installation and Retrofitting Costs

3.2.2. Labor Shortages for Advanced Installations

3.2.3. Proliferation of Counterfeit LED Products

3.3. Opportunities

3.3.1. Expanding Use of Solar-Powered LED Solutions

3.3.2. Integration of LED Lighting in Smart City Initiatives

3.3.3. Adoption of LED Lighting in Public Infrastructure Projects

3.4. Market Trends

3.4.1. Rise of Smart LED Lighting Systems

3.4.2. Rural Electrification Boosting LED Adoption

3.4.3. Growth of Industrial LED Applications

3.5. Market Challenges

3.5.1. Supply Chain Disruptions Post-Pandemic

3.5.2. Competition from Other Energy-Efficient Lighting Solutions

3.5.3. Complex Regulatory and Compliance Barriers

4. Vietnam LED Lighting Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Bulb and Tube Light

4.1.2. Panel Light

4.1.3. Street Light

4.1.4. Downlight

4.1.5. Floodlight

4.1.6. Others

4.2. By Application (in Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Institutional

4.3. By Region (in Value %)

4.3.1. Northern Vietnam

4.3.2. Southern Vietnam

4.3.3. Eastern Vietnam

4.3.4. Western Vietnam

5. Vietnam LED Lighting Competitive Landscape

5.1. Market Share Analysis

5.2. Company Profiles and Financials

5.3. Competitive Positioning

5.4. Strategic Initiatives

5.4.1. Mergers & Acquisitions

5.4.2. Partnerships & Collaborations

5.4.3. Investment Strategies

6. Key Competitors

6.1. Signify (Philips Lighting)

6.2. Osram Licht AG

6.3. Rang Dong Light Source and Vacuum Flask JSC

6.4. Dien Quang Light Source Company

6.5. Cree Inc.

6.6. Nichia Corporation

6.7. Seoul Semiconductor Co. Ltd

6.8. FSL Vietnam

6.9. Toshiba Lighting

6.10. Asled Co. Ltd

6.11. Sharp Corporation

6.12. LG Electronics

6.13. Acuity Brands Lighting

6.14. Panasonic Corporation

6.15. Zumtobel Group

7. Vietnam LED Lighting Regulatory Framework

7.1. Energy Efficiency Standards

7.2. Government Incentives and Rebates

7.3. Compliance and Certification Requirements

7.4. Environmental Regulations and Sustainability

8. Investment Analysis in the Vietnam LED Lighting Market

8.1. Government Initiatives and Funding Programs

8.2. Foreign Direct Investment (FDI) Trends

8.3. Private Equity and Venture Capital Activity

9. Vietnam LED Lighting Market Future Outlook

9.1. Market Projections (in USD)

9.2. Key Drivers of Future Growth

9.2.1. Increase in Public Lighting Projects

9.2.2. Adoption of Energy-Saving Technologies

9.2.3. Expansion of Local Manufacturing Capacities

9.3. Strategic Recommendations for Market Players

10. Cross-Segmentation Analysis

10.1. Comparison of Regional Demand Trends

10.2. Market Share Distribution Across Product Segments

10.3. Cross-Analysis by Installation Type and End Use

11. SWOT Analysis

11.1. Strengths

11.2. Weaknesses

11.3. Opportunities

11.4. Threats

12. Vietnam LED Lighting Market Forecast

12.1. By Product Type

12.2. By Application

12.3. By Installation Type

12.4. By Region

12.5. By End Use

13. Analyst Recommendations

13.1. Expansion Opportunities in Southern Vietnam

13.2. Diversification Strategies for Manufacturers

13.3. Recommended Partnerships and Collaborations

13.4. Growth Opportunities in Solar-Powered LED Products

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Vietnam LED Lighting Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam LED Lighting Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple electronic companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from electronic companies.

Frequently Asked Questions

1. How big is Vietnam LED lighting market?

The Vietnam LED lighting market was valued at USD 690 million in 2023. This growth is driven by government initiatives to promote energy-efficient solutions, expanding public infrastructure projects, and increasing adoption of smart LED systems across urban and rural areas.

2. What are the challenges in Vietnam LED lighting market?

Key challenges include the high initial installation costs for advanced LED systems, a shortage of skilled labor for installation and maintenance, and the proliferation of counterfeit LED products that negatively impact consumer trust and market profitability.

3. Who are the major players in the Vietnam LED lighting market?

Major players include Signify (Philips Lighting), Osram Licht AG, Rang Dong Light Source and Vacuum Flask JSC, and Dien Quang Light Source Company. These companies lead the market through their innovative product portfolios, strong distribution networks, and alignment with government energy efficiency goals.

4. What are the growth drivers of Vietnam LED lighting market?

Growth drivers include government-backed energy efficiency programs, rising electricity costs encouraging energy savings, and the rapid development of infrastructure projects, particularly in urban areas. The push for smart city initiatives also accelerates the adoption of LED lighting systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.