Vietnam Light Commercial Vehicles Market Outlook to 2030

Region:Asia

Author(s):Mukul Soni

Product Code:KROD421

July 2024

100

About the Report

Vietnam Light Commercial Vehicles Market Overview

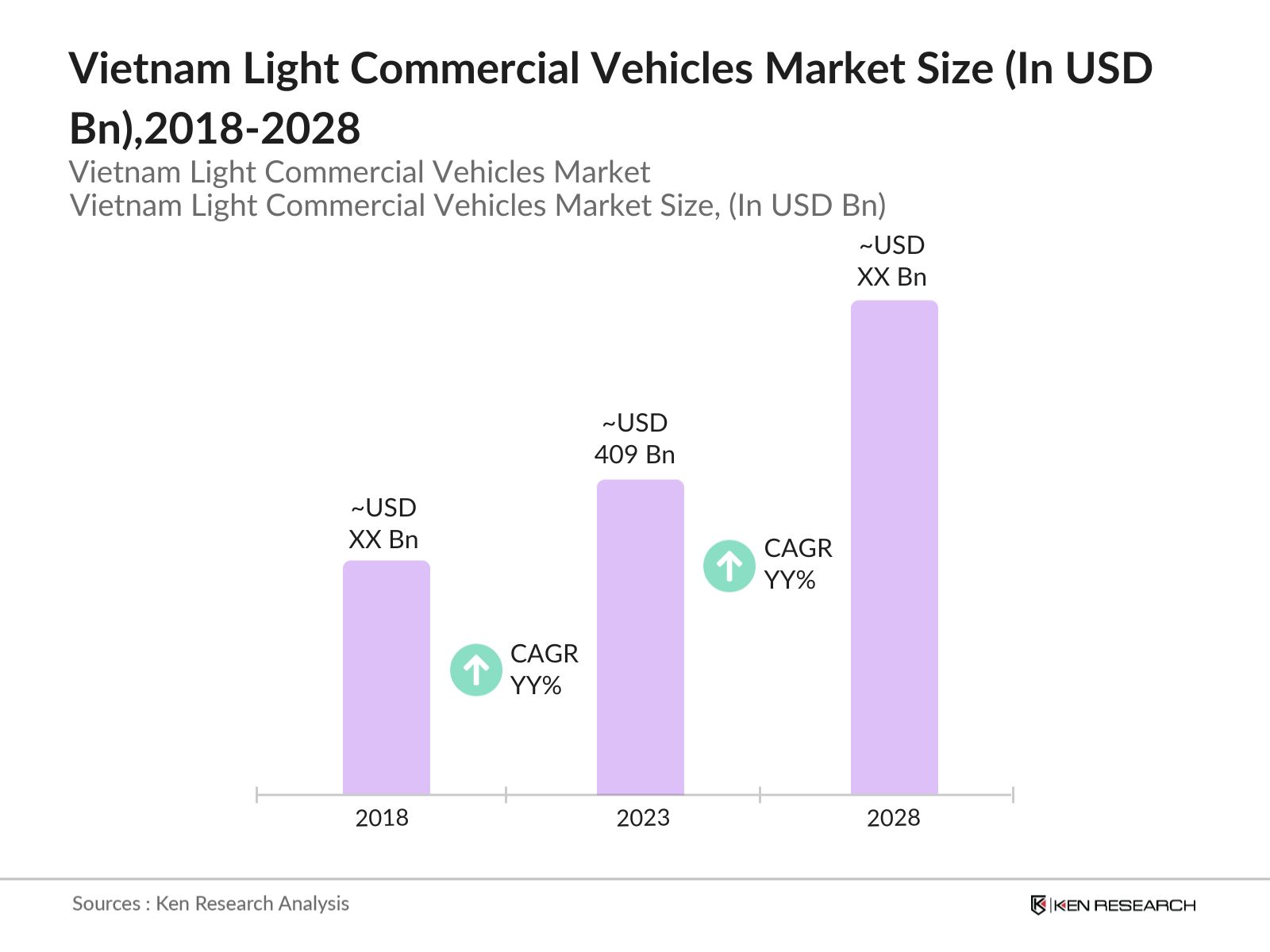

- In recent years, the Vietnam Light Commercial Vehicles market has experienced substantial growth, this is reflected by the global Light Commercial Vehicles market reached a valuation of USD 409 billion in 2023.

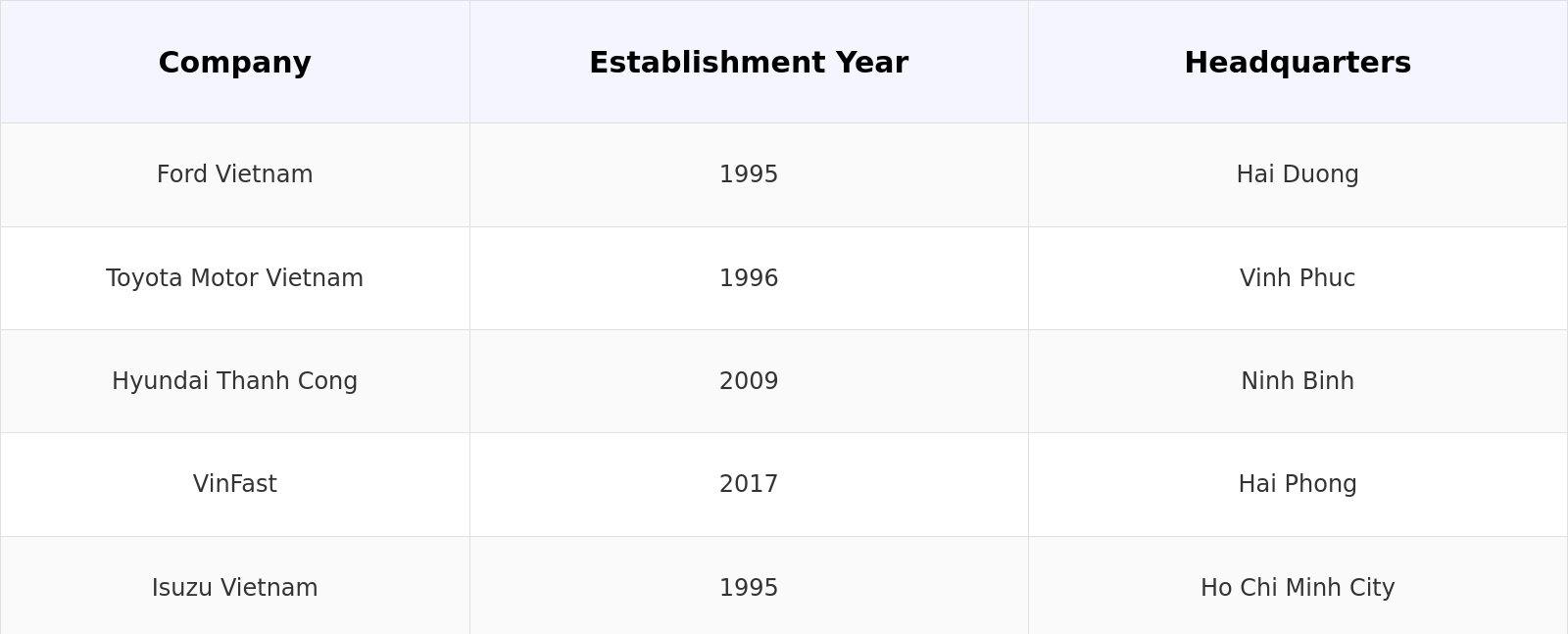

- The market features a mix of international and domestic manufacturers. Key players include Ford Vietnam, Toyota Motor Vietnam, and Hyundai Thanh Cong. Local manufacturers such as VinFast are also emerging, capitalizing on local market understanding to boost their presence.

- The South region of Vietnam is the leading area in the LCV market. The region's dominance is attributed to its higher urbanization rate, robust infrastructure, and significant presence of industrial zones which require efficient transportation solutions.

- In 2023, VinFast announced the launch of a new electric light commercial vehicle, tailored for urban deliveries. This model comes with advanced logistics support technology, aiming to capture the growing demand for eco-friendly transport solutions in Vietnamese cities.

Vietnam Light Commercial Vehicles Market Segmentation

The Vietnam Light Commercial Vehicles Market can be segmented based on several factors like by vehicle, end- user and region.

By Vehicle Type: The Vietnam light commercial vehicles market is segmented by vehicle type into pickup trucks are particularly favored for their versatility and robustness, making them ideal for diverse transportation needs across both urban and rural settings. Vans have gained popularity, especially for intra-city logistics and passenger transportation, due to their spacious interiors and adaptability. Meanwhile, mini trucks stand out in congested urban environments, where their compact size and maneuverability allow for efficient navigation and operation

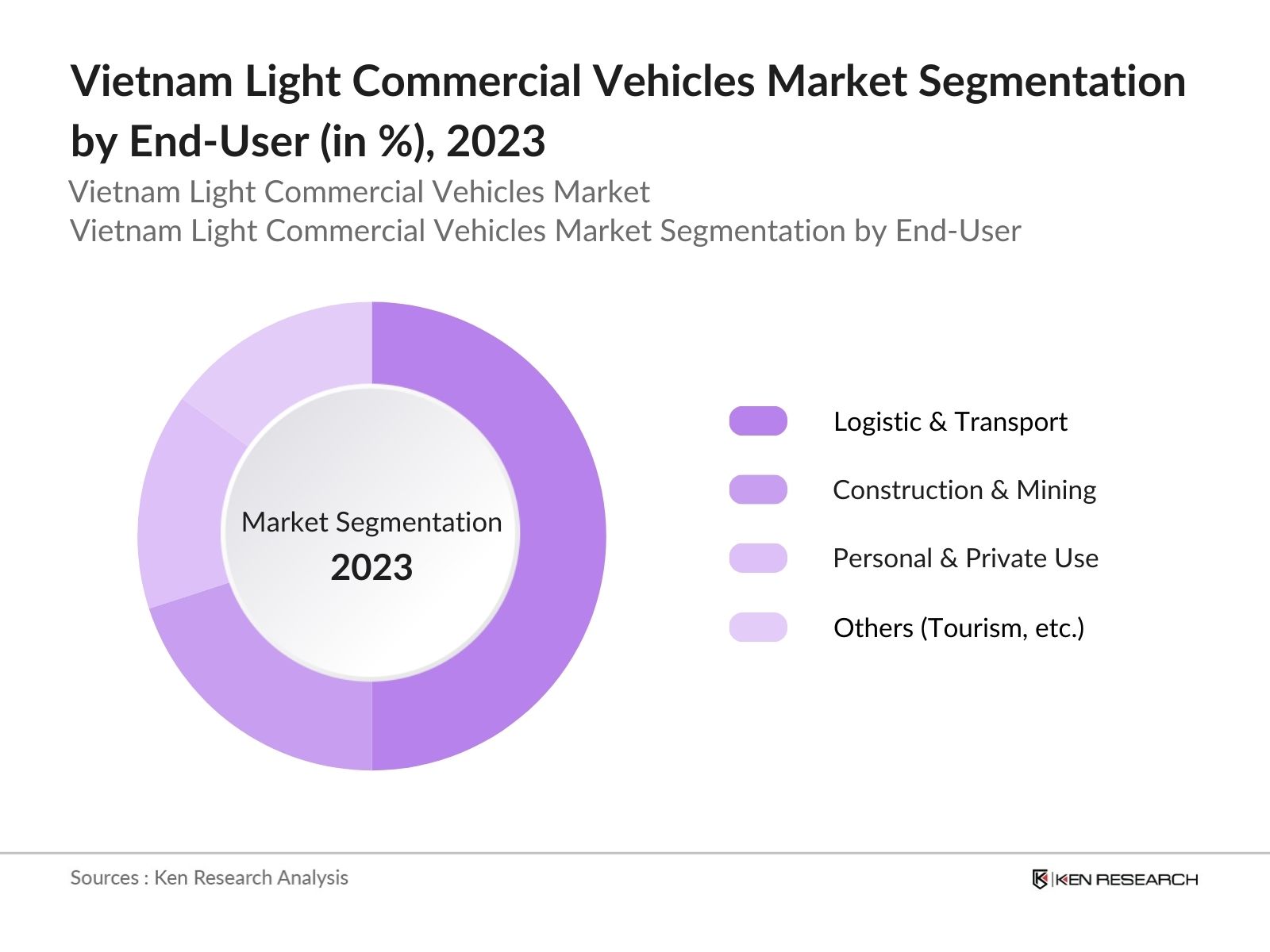

By End-User: The Vietnam light commercial vehicles market is segmented by end user type into logistics and transportation segment commands the largest share of the Vietnam Light Commercial Vehicles Market, primarily fueled by the surging e-commerce industry and the demand for effective delivery systems. Additionally, light commercial vehicles (LCVs) are indispensable in the construction sector for the transport of materials and workers, enhancing operational efficiency at construction sites.

By Region: In the Vietnam Light Commercial Vehicles Market, regional dynamics vary significantly. Hanoi in the North leads in electric vehicle, reflecting the region's progressive stance on environmental concerns and technological adoption. Conversely, Ho Chi Minh City in the South dominates the market in terms of diesel and overall vehicle sales.

Vietnam Light Commercial Vehicles Market Competitive Landscape

- Toyota Motor: Toyota Motor Vietnam has taken a significant step by partnering with a major Vietnamese technology company in 2024. This collaboration aims to integrate advanced GPS and logistics management software into their vehicles, enhancing the operational efficiency of their fleets. This strategic move not only improves the logistical capabilities of Toyota’s vehicles but also positions the brand as a leader in technological integration within the market.

- Ford Vietnam: Simultaneously, Ford Vietnam has made a robust response to the rising domestic demand for light commercial vehicles. In 2024, they expanded their production capacity by 30%. This expansion is particularly focused on developing models that are tailored to the specific climatic and road conditions of Vietnam, ensuring reliability and efficiency. This increase in production capacity allows Ford Vietnam to better meet the growing needs of the local market, reinforcing its commitment to the Vietnamese market.

Vietnam Light Commercial Vehicles Market Analysis

Vietnam Light Commercial Vehicles Market Growth Drivers:

- E-commerce Expansion: The explosive growth of Vietnam's e-commerce sector, which reached 35 billion transactions in 2024, has substantially increased the demand for delivery vehicles. This surge necessitates the expansion of robust fleets of light commercial vehicles to efficiently manage the logistics of delivering online purchases across the country.

- Infrastructure Development: In 2024, the Vietnamese government invested $15 billion in improving the country's infrastructure, particularly roads and transport networks. These enhancements facilitate smoother and more efficient operations for light commercial vehicles, leading to reduced vehicle maintenance costs and downtime. This investment not only supports the current needs but also prepares the infrastructure for future demand increases.

- Manufacturing Sector Growth: The manufacturing sector in Vietnam saw a 12% increase in output by volume in 2024. This growth has escalated the need for effective transportation of goods, which is critical to maintaining the supply chain and production cycles. The expansion of this sector has directly stimulated the demand for light commercial vehicles, as they are essential for transporting raw materials and finished goods across various regions, thereby supporting the broader logistics network.

Vietnam Light Commercial Vehicles Market Challenges

- Fuel Price Fluctuation: One of the primary challenges is the volatility in diesel prices, which reached a peak of USD 0.90 per liter in 2024. This high variability in fuel costs directly influences the operational expenses of commercial vehicle fleets. For fleet operators, managing these fluctuating fuel prices becomes a critical issue, as it affects budgeting and profitability.

- Electric Vehicle Infrastructure: Another major hurdle is the underdeveloped infrastructure for electric vehicles. Despite the Vietnamese government's initiatives to promote eco-friendly transportation alternatives, only about 30% of the planned electric vehicle charging stations were operational as of 2024. This insufficient infrastructure severely limits the widespread adoption of electric light commercial vehicles.

Vietnam Light Commercial Vehicles Market Government Initiatives:

- Tax Incentives for EVs: In an effort to accelerate the adoption of electric vehicles (EVs) within the commercial sector, the Vietnamese government introduced significant tax exemptions in 2024. These incentives can reduce the purchase costs of electric commercial vehicles by up to VND 50 million per vehicle. This substantial reduction in initial costs is designed to make electric vehicles more attractive to businesses, encouraging them to replace their traditional fuel-dependent fleets with cleaner, more sustainable alternatives.

- Green Transport Fund: Recognizing the need for a broader infrastructure and support system to facilitate the shift towards sustainable transportation, the government established a Green Transport Fund with an allocation of $200 million in 2024. This fund is aimed at enhancing the integration of environmentally friendly transport solutions within the commercial vehicle sectors.

Vietnam Light Commercial Vehicles Future Market Outlook

The Vietnam Light Commercial Vehicles Market is expected to grow significantly by 2028, driven by technological advancements, increased adoption of electric vehicles, and expansion of the e-commerce sector.

Future Trends:

-

- Electrification of Fleets: The shift towards electric vehicles (EVs) is a major trend shaping the future of the Vietnamese light commercial vehicle landscape. By 2029, it is projected that more than 50% of the light commercial vehicles in Vietnam will be electric. This transition is supported by robust governmental incentives that make EVs more financially viable, alongside enhancements in local manufacturing capabilities that make these vehicles more accessible and affordable.

- Integration of IoT: Another significant trend is the integration of the Internet of Things (IoT) technologies into commercial vehicles. By 2029, the use of IoT is expected to improve operational efficiency by 40%. This technology enables real-time tracking and diagnostics of vehicles, which not only enhances the management of fleets but also significantly reduces downtime and increases the reliability of service deliveries.

Scope of the Report

|

By Vehicle Type |

Vans Pickup Trucks Minibuses |

|

By End-User |

Logistic & Transport Construction & Mining Personal & Private Use |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Automobile Manufacturers

Parts and Component Suppliers

Government Transport Departments

E-commerce Companies

Logistics and Courier Companies

Large-scale Retailers

Construction Companies

Agriculture Sector Entities

Tourism Operators

Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Ford Vietnam

Toyota Motor Vietnam

Hyundai Thanh Cong

VinFast

Isuzu Vietnam

Honda Vietnam

Suzuki Vietnam

Mercedes-Benz Vietnam

BMW Vietnam

Nissan Vietnam

Mitsubishi Vietnam

Kia Vietnam

Renault Vietnam

Chevrolet Vietnam

Tata Motors Vietnam

Table of Contents

1. Vietnam Light Commercial Vehicles Market Overview

1.1 Vietnam Light Commercial Vehicles Market Taxonomy

2. Vietnam Light Commercial Vehicles Market Size (in USD Bn), 2018-2023

3. Vietnam Light Commercial Vehicles Market Analysis

3.1 Vietnam Light Commercial Vehicles Market Growth Drivers

3.2 Vietnam Light Commercial Vehicles Market Challenges and Issues

3.3 Vietnam Light Commercial Vehicles Market Trends and Development

3.4 Vietnam Light Commercial Vehicles Market Government Regulation

3.5 Vietnam Light Commercial Vehicles Market SWOT Analysis

3.6 Vietnam Light Commercial Vehicles Market Stake Ecosystem

3.7 Vietnam Light Commercial Vehicles Market Competition Ecosystem

4. Vietnam Light Commercial Vehicles Market Segmentation, 2023

4.1 Vietnam Light Commercial Vehicles Market Segmentation by Vehicle Type (in %), 2023

4.2 Vietnam Light Commercial Vehicles Market Segmentation by End-User (in %), 2023

4.3 Vietnam Light Commercial Vehicles Market Segmentation by Region (in %), 2023

5. Vietnam Light Commercial Vehicles Market Competition Benchmarking

5.1 Vietnam Light Commercial Vehicles Market Cross-Comparison (number of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Vietnam Light Commercial Vehicles Market Future Market Size (in USD Bn), 2023-2028

7. Vietnam Light Commercial Vehicles Market Future Market Segmentation, 2028

7.1 Vietnam Light Commercial Vehicles Market Segmentation by Vehicle Type (in %), 2028

7.2 Vietnam Light Commercial Vehicles Market Segmentation by End-User (in %), 2028

7.3 Vietnam Light Commercial Vehicles Market Segmentation by Region (in %), 2028

8. Vietnam Light Commercial Vehicles Market Analysts’ Recommendations

8.1 Vietnam Light Commercial Vehicles Market TAM/SAM/SOM Analysis

8.2 Vietnam Light Commercial Vehicles Market Customer Cohort Analysis

8.3 Vietnam Light Commercial Vehicles Market Marketing Initiatives

8.4 Vietnam Light Commercial Vehicles Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building:

Collating statistics on Vietnam light commercial vehicles market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam light commercial vehicles market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach automotive manufacture and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such drone manufacturing companies.

Frequently Asked Questions

01 How big is Vietnam Light Commercial Vehicles Market?

In recent years, the Vietnam Light Commercial Vehicles market has experienced substantial growth, this is reflected by the global Light Commercial Vehicles market reached a valuation of USD  409 billion in 2023.

02 What are the challenges in Vietnam Light Commercial Vehicles Market?

Challenges facing the Vietnam Light Commercial Vehicles Market include the fluctuation of fuel prices, limited electric vehicle infrastructure, stringent vehicle import regulations, and a shortage of qualified technical service providers.

03 Who are the major players in the Vietnam Light Commercial Vehicles Market?

Major players in the Vietnam Light Commercial Vehicles Market include Ford Vietnam, Toyota Motor Vietnam, Hyundai Thanh Cong, VinFast, and Isuzu Vietnam. These companies have established a strong market presence through continuous innovation and adapting to local demands.

04 What are the growth drivers of Vietnam Light Commercial Vehicles Market?

Key growth drivers for the Vietnam Light Commercial Vehicles Market include the rapid expansion of e-commerce, significant infrastructure investments by the government, growth in the manufacturing sector, and increased operations of local small and medium enterprises.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.