Vietnam Male Grooming Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD7429

December 2024

91

About the Report

Vietnam Male Grooming Market Overview

- The Vietnam Male Grooming Market is valued at USD 200 million, with steady growth driven by rising disposable incomes, a shift in cultural perceptions around male grooming, and the influence of social media in promoting grooming products. Grooming habits among Vietnamese men are evolving rapidly, reflecting a broader trend in the region as more men integrate skincare, haircare, and fragrance products into their daily routines, leading to consistent growth.

- Urban centers such as Hanoi and Ho Chi Minh City drive market dominance due to higher income levels, a trend toward urbanization, and greater access to premium grooming products. These cities showcase a growing interest in personal care among male consumers, who are influenced by global trends and digital advertising, which are more prevalent in urbanized areas.

- The Vietnamese Ministry of Health oversees the regulation of cosmetic products, including those in the male grooming segment. All cosmetic products must be registered with the Ministry before being marketed. This process involves submitting detailed product information, including ingredients, manufacturing processes, and safety data. The Ministry evaluates these submissions to ensure compliance with national standards. Non-compliance can result in penalties or market withdrawal.

Vietnam Male Grooming Market Segmentation

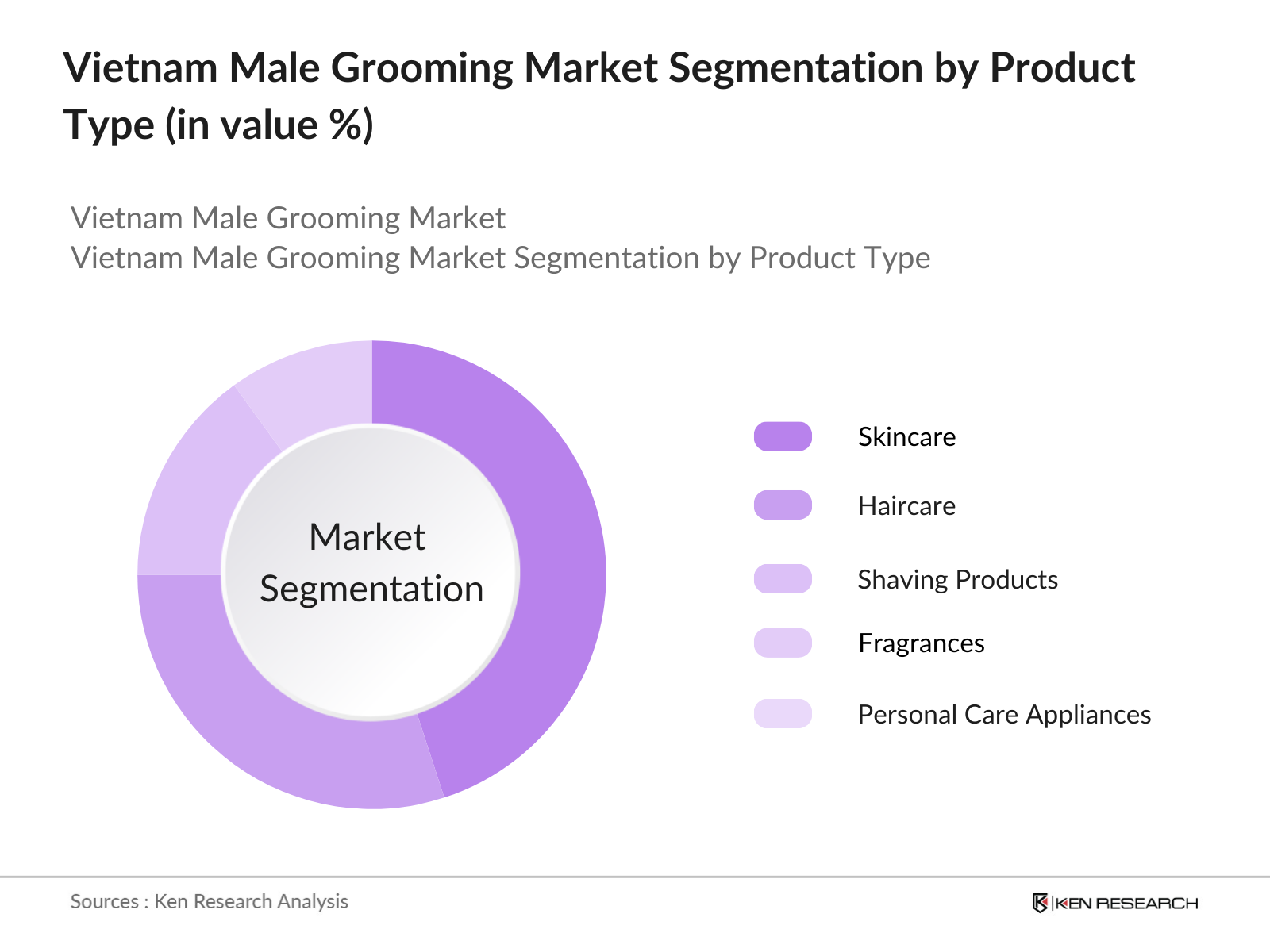

- By Product Type: The Vietnam Male Grooming Market is segmented by product type into Skincare, Haircare, Shaving Products, Fragrances, and Personal Care Appliances. Currently, skincare products, particularly moisturizers and sunscreens, hold a dominant share within this segmentation. This dominance is attributed to increasing awareness about skincare benefits and the influence of global brands offering products suited for various skin types.

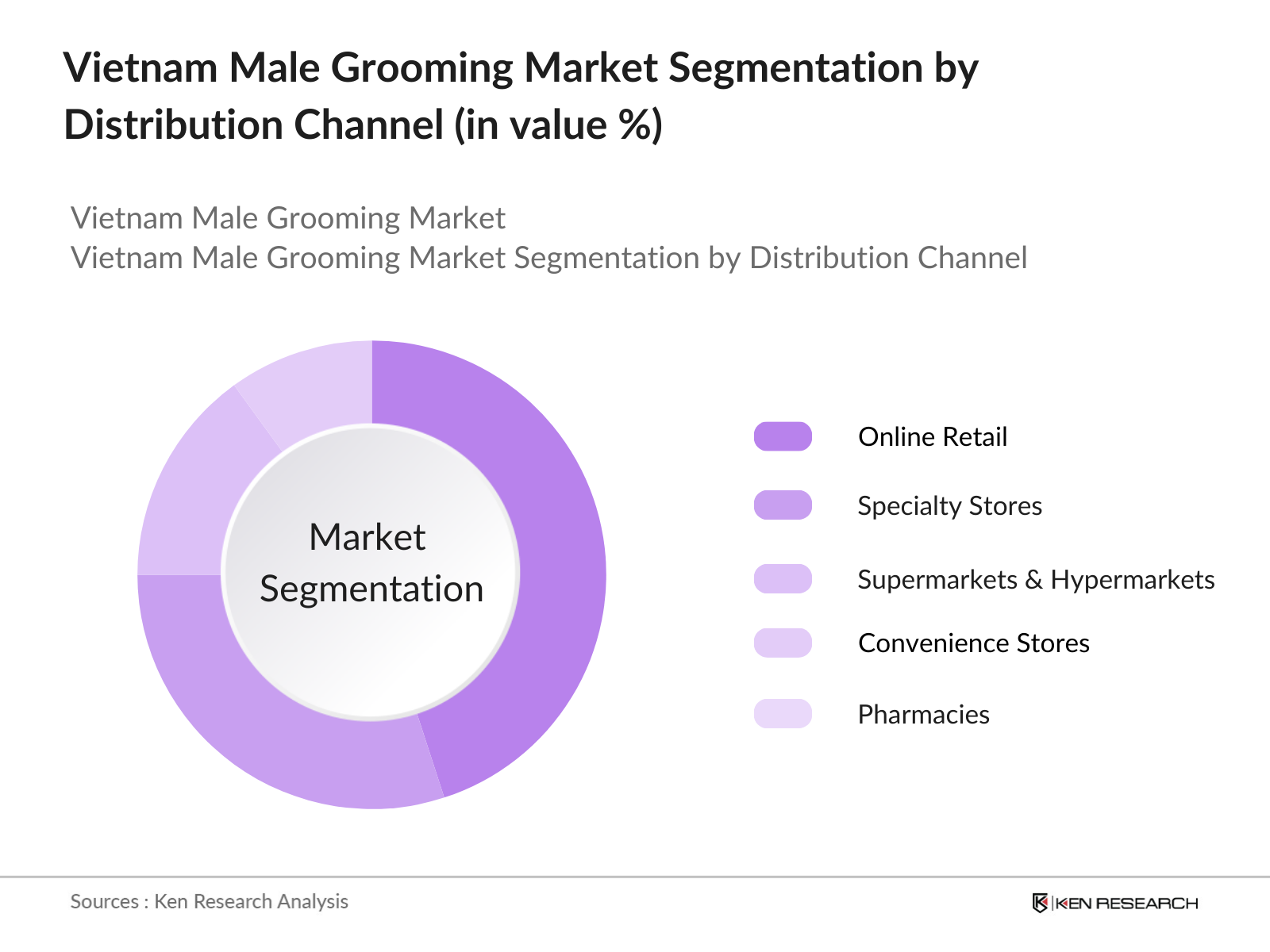

- By Distribution Channel: The market segmentation by distribution channels includes Online Retail, Specialty Stores, Supermarkets & Hypermarkets, Convenience Stores, and Pharmacies. Online retail stands out in terms of market share due to the rise of e-commerce platforms and mobile shopping convenience, especially among younger consumers who prefer the ease of digital shopping over physical stores.

Vietnam Male Grooming Competitive Landscape

The Vietnam Male Grooming Market is characterized by a mix of international and local players, each leveraging brand recognition, digital presence, and innovation to gain a competitive edge. Leading companies are investing in influencer partnerships and social media strategies to maintain strong consumer engagement.

Vietnam Male Grooming Market Analysis

Growth Drivers

- Rising Male Consumer Awareness: There is a notable increase in awareness among Vietnamese males regarding personal grooming, driven by social media and influencer marketing. In 2022, reports indicated that about 60% of males aged 18-34 actively engage with beauty and grooming content on platforms like Instagram and TikTok. This heightened awareness is translating into higher expenditures on grooming products, leading to a more competitive market landscape. This demographic shift signals a cultural change where grooming is no longer considered solely a female activity.

- Shift Towards Personal Grooming: The cultural perception of male grooming is evolving in Vietnam, with more men embracing grooming routines similar to those traditionally associated with women. As of 2023, research showed that 50% of Vietnamese males regularly use skincare products, up from 35% in previous years. This increase indicates a broader acceptance of male grooming habits and a shift toward comprehensive grooming regimens that include skincare, hair care, and personal hygiene. This trend is expected to sustain growth in the male grooming sector.

- Expansion of Retail Channels: The growth of modern retail channels, including supermarkets and e-commerce platforms, has made male grooming products more accessible to consumers. As of 2023, the e-commerce sector in Vietnam grew by 20% year-on-year, indicating a significant opportunity for male grooming brands to reach consumers through online platforms. The increased availability of products through diverse channels is expected to facilitate market penetration and attract a wider customer base.

Challenges

- High Competition and Market Saturation: The male grooming market in Vietnam is characterized by intense competition, with numerous international and local brands vying for market share. As of 2022, over 100 brands were reported to operate within the male grooming sector. This saturation leads to aggressive marketing strategies and pricing wars, making it challenging for new entrants to establish a foothold. Brands must continuously innovate and differentiate themselves to maintain competitiveness in such a crowded marketplace.

- Regulatory Compliance: Navigating the complex landscape of regulatory compliance poses a significant challenge for brands in the male grooming sector. The Vietnamese government has implemented strict regulations regarding the safety and efficacy of cosmetic products, requiring extensive testing and certification. In 2023, nearly 30% of grooming brands reported facing difficulties in meeting these regulations, leading to increased operational costs and potential delays in product launches. Brands must invest in understanding and adhering to these regulations to ensure market entry and sustainability.

Vietnam Male Grooming Future Outlook

Over the next few years, the Vietnam Male Grooming Market is expected to witness continued growth as more consumers adopt holistic grooming routines and brands expand product lines tailored to Vietnamese skin and hair types. This growth will be bolstered by innovations in product formulations, the increasing influence of social media, and the expansion of e-commerce.

Opportunities

- Growth of E-Commerce Platforms: The surge in e-commerce adoption in Vietnam presents a lucrative opportunity for male grooming brands. With online retail sales projected to reach $23 billion by 2025, brands can leverage digital channels to increase visibility and accessibility. As more consumers prefer the convenience of online shopping, especially post-pandemic, brands can enhance their online presence through targeted marketing strategies, partnerships with e-commerce giants, and improved logistics to capitalize on this trend. This shift towards e-commerce can significantly boost sales and market penetration.

- Introduction of Natural and Organic Products: There is a growing consumer preference for natural and organic grooming products among Vietnamese males, driven by increasing health consciousness and environmental awareness. As of 2023, about 45% of male consumers indicated a willingness to pay more for products that are eco-friendly and made from natural ingredients. Brands that focus on developing and marketing organic lines can tap into this emerging segment, catering to a health-conscious demographic while differentiating themselves in a competitive market.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Product Type |

Shaving Products |

|

Skincare Products |

|

|

Hair Care Products |

|

|

Fragrances |

|

|

Deodorants |

|

|

By Distribution Channel |

Online Retail |

|

Supermarkets/Hypermarkets |

|

|

Specialty Stores |

|

|

Convenience Stores |

|

|

Drugstores/Pharmacies |

|

|

By Consumer Demographics |

Age Groups (18-24, 25-34, 35-44, 45+) |

|

Urban vs. Rural Distribution |

|

|

By Region |

Northern Vietnam |

|

Central Vietnam |

|

|

Southern Vietnam |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Health, Vietnam Standards and Quality Institute)

Personal Care Product Manufacturers

Retail Chains and Supermarkets

Online Retail Platforms

Male Grooming Salons and Spas

Packaging Suppliers

Sustainability Organizations and NGOs

Companies

Players mentioned in the report

Unilever Vietnam

Beiersdorf AG

L'Oral Group

Procter & Gamble

Shiseido Co., Ltd.

Johnson & Johnson

Kao Corporation

LG Household & Health Care

Estee Lauder Companies

Edgewell Personal Care

Marico Limited

Avon Products Inc.

Colgate-Palmolive

Lush Cosmetics

Himalaya Herbal Healthcare

Table of Contents

1. Vietnam Male Grooming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Male Grooming Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Male Grooming Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income (Per Capita Income)

3.1.2. Rising Male Consumer Awareness (Male Grooming Spending Trends)

3.1.3. Shift Towards Personal Grooming (Consumer Behavior Changes)

3.1.4. Expansion of Retail Channels (Growth in Modern Retail)

3.2. Market Challenges

3.2.1. High Competition and Market Saturation (Number of Brands)

3.2.2. Regulatory Compliance (Government Policies on Cosmetics)

3.2.3. Fluctuating Raw Material Costs (Commodity Price Trends)

3.3. Opportunities

3.3.1. Growth of E-Commerce Platforms (Online Sales Growth)

3.3.2. Introduction of Natural and Organic Products (Consumer Preferences)

3.3.3. Emergence of Male-Specific Products (Niche Market Expansion)

3.4. Trends

3.4.1. Social Media Influences on Male Grooming (Digital Marketing Impact)

3.4.2. Innovation in Product Formulations (R&D Investment Trends)

3.4.3. Increasing Popularity of Male Grooming Salons (Service Industry Growth)

3.5. Government Regulation

3.5.1. Cosmetic Product Safety Regulations (Health Standards)

3.5.2. Labeling and Packaging Compliance (Consumer Protection Laws)

3.5.3. Import and Export Regulations (Trade Policies)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Male Grooming Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Shaving Products

4.1.2. Skincare Products

4.1.3. Hair Care Products

4.1.4. Fragrances

4.1.5. Deodorants

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets/Hypermarkets

4.2.3. Specialty Stores

4.2.4. Convenience Stores

4.2.5. Drugstores/Pharmacies

4.3. By Consumer Demographics (In Value %)

4.3.1. Age Groups (18-24, 25-34, 35-44, 45+)

4.3.2. Urban vs. Rural Distribution

4.4. By Region (In Value %)

4.4.1. Northern Vietnam

4.4.2. Central Vietnam

4.4.3. Southern Vietnam

5. Vietnam Male Grooming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever

5.1.2. Procter & Gamble

5.1.3. L'Oral

5.1.4. Beiersdorf AG

5.1.5. Shiseido

5.1.6. Henkel

5.1.7. Johnson & Johnson

5.1.8. Coty Inc.

5.1.9. Colgate-Palmolive

5.1.10. Edgewell Personal Care

5.1.11. Este Lauder Companies Inc.

5.1.12. Revlon Inc.

5.1.13. Amway

5.1.14. Kao Corporation

5.1.15. Avon Products

5.2. Cross Comparison Parameters (Revenue, Market Presence, Product Range, Brand Loyalty, Marketing Strategy, Distribution Channels, Customer Segmentation, Innovation Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Male Grooming Market Regulatory Framework

6.1. Cosmetic Product Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam Male Grooming Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Male Grooming Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Demographics (In Value %)

8.4. By Region (In Value %)

9. Vietnam Male Grooming Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the major stakeholders in the Vietnam Male Grooming Market. This step uses a combination of secondary research and proprietary databases to identify key variables impacting market dynamics, including demographic influences and product adoption trends.

Step 2: Market Analysis and Construction

This stage compiles and analyzes historical data on the male grooming sector, including the growth rates of various segments. It evaluates market penetration and segment-specific revenue generation to ensure data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses are validated through consultations with industry experts, providing insights into consumer behavior, brand strategies, and sales performance, which refine and confirm the market data.

Step 4: Research Synthesis and Final Output

The synthesis phase involves engaging with leading grooming product manufacturers to gain insights on segment performance and consumer preferences, corroborating the bottom-up approach with real-world market behavior.

Frequently Asked Questions

01. How big is the Vietnam Male Grooming Market?

The Vietnam Male Grooming Market is valued at USD 200 million, showing steady demand for skincare, haircare, and grooming appliances due to rising income levels and increased awareness of grooming.

02. What challenges does the Vietnam Male Grooming Market face?

The market faces challenges including counterfeit products, high competition, and distribution limitations in rural areas, impacting growth and product availability.

03. Who are the major players in the Vietnam Male Grooming Market?

Key players include Unilever Vietnam, L'Oral Group, Procter & Gamble, Shiseido Co., and Johnson & Johnson, each maintaining a competitive edge through strong brand presence and distribution networks.

04. What are the main growth drivers of the Vietnam Male Grooming Market?

Growth is driven by rising consumer awareness, increasing disposable income, and the influence of social media on grooming trends, especially among the urban youth.

05. What product types are most popular in the Vietnam Male Grooming Market?

Skincare products are highly popular, driven by demand for moisturizers, sunscreens, and anti-aging solutions, reflecting consumers' growing interest in skin health.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.